Factors Influencing BTC Price in 2025: Btc Price Prediction December 2025

Predicting the price of Bitcoin in 2025 is inherently speculative, but analyzing key influencing factors provides a framework for informed consideration. Several macroeconomic, technological, and geopolitical elements will likely play significant roles in shaping Bitcoin’s trajectory.

Macroeconomic Conditions and Bitcoin Price

Global macroeconomic conditions, specifically inflation and interest rates, exert considerable influence on Bitcoin’s price. High inflation often drives investors towards alternative assets like Bitcoin, perceived as a hedge against inflation. Conversely, rising interest rates can make holding Bitcoin less attractive, as investors might shift towards higher-yielding bonds or other interest-bearing assets. For example, the 2022 Bitcoin price downturn correlated with aggressive interest rate hikes by central banks globally. The interplay between inflation and interest rate policies will significantly impact Bitcoin’s appeal as an investment vehicle in 2025.

Institutional Adoption and Large-Scale Investments

The increasing involvement of institutional investors, such as hedge funds and corporations, significantly impacts Bitcoin’s price. Large-scale investments inject liquidity into the market and often signal confidence in Bitcoin’s long-term potential. Grayscale Bitcoin Trust’s substantial holdings, for instance, demonstrate this institutional interest. Continued institutional adoption, coupled with further regulatory clarity, could propel Bitcoin’s price upwards in 2025.

Technological Upgrades and Price Volatility

Technological advancements within the Bitcoin ecosystem, particularly the Lightning Network, influence price volatility. The Lightning Network aims to improve Bitcoin’s scalability and transaction speed, potentially addressing some limitations that currently affect its usability for everyday transactions. Successful implementation and widespread adoption of such upgrades could reduce volatility by increasing Bitcoin’s utility and adoption rate. Conversely, significant technological setbacks or security vulnerabilities could lead to temporary price drops.

Geopolitical Events and Bitcoin’s Value

Geopolitical events, such as international conflicts, economic sanctions, or regulatory changes in major economies, can significantly impact Bitcoin’s price. Periods of global uncertainty often see increased demand for Bitcoin as a safe haven asset. For example, the Russian invasion of Ukraine in 2022 led to a surge in Bitcoin trading volume in some regions, reflecting its potential as a tool for circumventing financial sanctions or preserving wealth during times of instability. The unpredictable nature of geopolitical events makes assessing their precise impact challenging, but their potential influence on Bitcoin’s value in 2025 is undeniable.

Emerging Cryptocurrencies and Blockchain Technologies

The emergence of new cryptocurrencies and blockchain technologies could affect Bitcoin’s dominance and, consequently, its price. Competition from altcoins offering potentially superior features or functionalities could divert investment away from Bitcoin. However, Bitcoin’s first-mover advantage, established network effect, and brand recognition might mitigate this risk. The long-term impact of this competition remains uncertain, requiring careful monitoring of the broader cryptocurrency landscape.

Price Prediction Models and Approaches

Predicting the price of Bitcoin, a volatile asset influenced by numerous factors, requires employing diverse analytical methods. Accuracy remains elusive, but understanding the strengths and weaknesses of various approaches helps in forming a more informed perspective. This section explores three primary models: technical analysis, fundamental analysis, and machine learning.

Technical Analysis

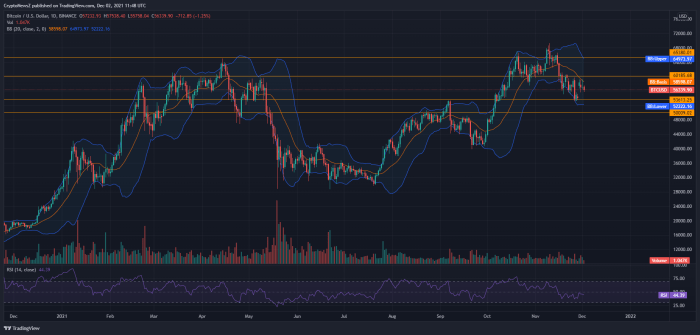

Technical analysis focuses on historical price and volume data to identify patterns and predict future price movements. It uses various indicators, such as moving averages, relative strength index (RSI), and candlestick patterns, to assess momentum, support and resistance levels, and potential trend reversals. For example, a rising 200-day moving average might suggest a bullish trend, while a bearish divergence between price and RSI could indicate a potential price correction.

Strengths of technical analysis include its relative simplicity and the wide availability of charting tools. Weaknesses lie in its subjectivity – different analysts may interpret the same chart differently – and its inability to account for fundamental factors affecting the underlying asset. Technical analysis excels at identifying short-term price movements but struggles with long-term predictions.

Fundamental Analysis, Btc Price Prediction December 2025

Fundamental analysis assesses the intrinsic value of Bitcoin by considering factors such as adoption rates, regulatory changes, technological advancements, and macroeconomic conditions. This approach aims to determine whether the current price reflects the asset’s true value. For example, widespread institutional adoption could drive up demand and price, while stringent regulations could negatively impact growth.

Fundamental analysis provides a long-term perspective, offering insights into the underlying forces driving Bitcoin’s price. However, it’s challenging to accurately quantify the impact of various factors, and predictions can be subjective and influenced by differing interpretations of available data. Moreover, unforeseen events can significantly impact price regardless of fundamental strength.

Machine Learning

Machine learning models utilize algorithms to identify patterns and relationships in large datasets, including historical price data, news sentiment, social media activity, and other relevant factors. These models can be trained to predict future price movements with varying degrees of accuracy. However, the accuracy depends heavily on the quality and quantity of data used, and the model’s ability to adapt to changing market conditions.

The strength of machine learning lies in its ability to analyze vast amounts of data and identify complex relationships that might be missed by human analysts. Weaknesses include the “black box” nature of some models, making it difficult to understand the reasoning behind predictions. Overfitting to historical data is another significant concern, leading to inaccurate predictions when market conditions change.

Hypothetical Scenario: Combining Factors

Imagine a scenario where positive fundamental news (e.g., widespread institutional adoption) coincides with bullish technical indicators (e.g., a breakout above a key resistance level). This confluence of positive signals could lead to a significant price surge. Conversely, negative news (e.g., increased regulatory scrutiny) combined with bearish technical indicators (e.g., a death cross) could trigger a substantial price decline. The interplay of these factors, and their relative weight, will determine the final price movement.

Price Prediction Comparison Table

| Model Name | Prediction Range (December 2025) | Underlying Assumptions | Strengths/Weaknesses |

|---|---|---|---|

| Technical Analysis (Conservative) | $50,000 – $75,000 | Continued market volatility, cyclical price patterns | Strengths: Identifies short-term trends; Weaknesses: Subjective, ignores fundamentals |

| Technical Analysis (Bullish) | $100,000 – $150,000 | Strong sustained upward trend, continued institutional adoption | Strengths: Identifies momentum; Weaknesses: Prone to overestimation in volatile markets |

| Fundamental Analysis (Conservative) | $40,000 – $60,000 | Moderate adoption growth, potential regulatory headwinds | Strengths: Long-term perspective; Weaknesses: Difficult to quantify factors, subjective |

| Fundamental Analysis (Bullish) | $70,000 – $100,000 | High adoption rates, positive regulatory environment, technological advancements | Strengths: Considers long-term drivers; Weaknesses: Sensitive to unforeseen events |

| Machine Learning (Average) | $60,000 – $90,000 | Based on historical data and various predictive factors | Strengths: Analyzes large datasets; Weaknesses: Black box nature, potential for overfitting |

Potential Price Scenarios for December 2025

Predicting the price of Bitcoin in December 2025 involves considerable uncertainty, given the volatile nature of the cryptocurrency market. However, by analyzing current trends, technological advancements, and macroeconomic factors, we can Artikel three plausible price scenarios: bullish, bearish, and neutral. These scenarios are not mutually exclusive and the actual price could fall anywhere between these extremes, or even outside them entirely.

Bullish Scenario: Bitcoin Surges to New Heights

This scenario envisions a significant price increase for Bitcoin by December 2025, potentially exceeding $200,000. This surge would be driven by several converging factors. Widespread institutional adoption, fueled by continued regulatory clarity and the maturation of Bitcoin as an asset class, would be a key driver. Technological advancements, such as the scaling solutions improving transaction speeds and reducing fees, would also enhance Bitcoin’s utility and attract further investment. Furthermore, macroeconomic instability, such as persistent inflation or geopolitical uncertainty, could push investors towards Bitcoin as a safe haven asset, further boosting demand. This bullish scenario would likely see a ripple effect across the broader cryptocurrency market, with altcoins experiencing significant price appreciation as well. The increased market capitalization of Bitcoin would boost overall investor confidence and liquidity within the crypto space. A comparable example could be the 2017 bull run, where a confluence of factors led to a dramatic increase in Bitcoin’s price, though the sustainability of such rapid growth remains a question.

Bearish Scenario: Bitcoin Experiences a Significant Price Correction

In a bearish scenario, Bitcoin’s price could fall considerably below its current value by December 2025, potentially dropping to levels below $30,000. Several factors could contribute to this outcome. Increased regulatory scrutiny, leading to stricter regulations or outright bans in major markets, could dampen investor enthusiasm and reduce demand. A major security breach or a series of high-profile hacks could erode trust in the Bitcoin network, leading to a sell-off. Furthermore, a global economic recession could cause investors to liquidate their holdings across all asset classes, including cryptocurrencies. This bearish scenario would have a severe impact on the broader cryptocurrency market, leading to a widespread price decline across most altcoins. Investor confidence would plummet, and many smaller projects could fail due to lack of funding and market liquidity. The 2018 crypto winter serves as a stark reminder of the potential for significant price corrections in the cryptocurrency market.

Neutral Scenario: Bitcoin Consolidates and Experiences Moderate Growth

This scenario anticipates a period of consolidation for Bitcoin, with moderate price growth by December 2025, potentially reaching a price range between $50,000 and $100,000. This would be characterized by a balance between bullish and bearish factors. While there may be some regulatory hurdles and macroeconomic uncertainties, these would be offset by continued institutional adoption and technological improvements. The overall market sentiment would be relatively stable, with neither widespread euphoria nor panic selling. This neutral scenario would likely result in moderate growth for the broader cryptocurrency market, with some altcoins performing better than others based on their individual merits and adoption rates. The market would experience periods of volatility, but overall, it would be a period of relatively stable growth and maturation for the industry. This scenario resembles the relatively stable growth seen in other established asset classes over extended periods.

Risks and Uncertainties

Predicting the price of Bitcoin, or any cryptocurrency for that matter, is inherently risky. Numerous factors influence its value, many of which are unpredictable and beyond the control of even the most sophisticated forecasting models. Understanding these risks is crucial for anyone considering investing in Bitcoin, particularly for long-term predictions like those extending to December 2025.

The inherent volatility of the cryptocurrency market presents a significant challenge to accurate price prediction. Unlike more established asset classes, Bitcoin’s relatively short history and lack of regulation contribute to its price swings. These swings can be dramatic, with significant gains and losses occurring in short periods. This makes relying on historical data alone, a common component of many predictive models, unreliable for long-term forecasting.

Limitations of Predictive Models

Bitcoin price prediction models, whether they employ technical analysis, fundamental analysis, or machine learning algorithms, all have significant limitations. Technical analysis, for example, relies on historical price and volume data to identify patterns and predict future movements. However, the cryptocurrency market is prone to sudden shifts driven by news events, regulatory changes, or even social media trends – factors not easily incorporated into technical analysis. Fundamental analysis, which considers factors like adoption rates, network effects, and regulatory developments, can also be flawed due to the evolving nature of the cryptocurrency landscape and the difficulty in accurately quantifying these factors. Machine learning models, while potentially powerful, are only as good as the data they are trained on, and the historical data available for Bitcoin may not adequately represent future market conditions. For example, a model trained on data from the 2017 bull run might not accurately predict behavior during a period of regulatory uncertainty.

Market Manipulation and Regulatory Uncertainty

The cryptocurrency market is susceptible to manipulation, especially given its relatively decentralized nature and the lack of robust regulatory oversight in many jurisdictions. Large holders, or “whales,” can influence price movements through coordinated buying or selling, creating artificial price spikes or drops. Furthermore, regulatory uncertainty poses a significant risk. Changes in government policies regarding cryptocurrency taxation, trading, or even outright bans can drastically impact Bitcoin’s price. The contrasting regulatory approaches adopted by different countries illustrate this risk; a positive regulatory shift in one major market could trigger a price surge, while a negative development in another could lead to a sharp decline. The example of China’s crackdown on cryptocurrency mining in 2021 demonstrates the potential for regulatory actions to significantly impact Bitcoin’s price.

Technological Risks and Security Concerns

Technological advancements within the Bitcoin network itself, or the emergence of competing cryptocurrencies, could influence its price. For instance, successful implementation of scaling solutions to improve transaction speeds and reduce fees could positively affect Bitcoin’s price, while the rise of alternative cryptocurrencies with superior features could lead to a decline in Bitcoin’s market share and price. Security vulnerabilities within the Bitcoin network or exchanges are also a significant concern. A major security breach, such as a large-scale hacking incident, could severely damage investor confidence and negatively impact the price.

Importance of Diversification and Risk Management

Given the inherent risks and uncertainties associated with Bitcoin price predictions, diversification is crucial for any investment strategy. Investing solely in Bitcoin exposes investors to significant risk, as its price can be highly volatile. A diversified portfolio that includes other asset classes, such as stocks, bonds, and real estate, can help mitigate the impact of potential losses in the cryptocurrency market. Furthermore, proper risk management strategies, such as setting stop-loss orders and only investing what one can afford to lose, are essential for navigating the unpredictable nature of the Bitcoin market. Investing a fixed percentage of one’s portfolio in Bitcoin, rather than a fixed amount, is another approach to risk management that adjusts to market fluctuations.

Frequently Asked Questions (FAQ)

This section addresses common questions regarding Bitcoin’s price prediction for December 2025 and the associated risks and opportunities. It’s crucial to remember that all predictions are inherently uncertain, and the cryptocurrency market is particularly volatile.

Bitcoin’s Most Likely Price in December 2025

Predicting the exact price of Bitcoin in December 2025 is impossible. Numerous factors, including regulatory changes, technological advancements, and macroeconomic conditions, will significantly influence its value. While various models suggest potential price ranges, it’s more realistic to consider a range of possibilities rather than a single definitive number. For example, some models might suggest a price between $100,000 and $200,000, while others might project a more conservative or even more optimistic outcome. The actual price will depend on the interplay of these complex and often unpredictable variables.

Biggest Risks to Bitcoin’s Price

Several significant risks could negatively impact Bitcoin’s price. Stringent government regulations, aiming to curb illicit activities or protect investors, could limit Bitcoin’s adoption and potentially suppress its price. Market manipulation, through coordinated buying or selling, can create artificial price swings, leading to significant losses for investors. Furthermore, the inherent volatility of the cryptocurrency market, amplified by speculative trading and news events, contributes to substantial price fluctuations. Finally, security breaches and technological vulnerabilities within the Bitcoin ecosystem could erode investor confidence and negatively impact its value. The collapse of major cryptocurrency exchanges or significant hacks could also trigger widespread panic selling and a sharp price decline.

Should You Invest in Bitcoin Based on These Predictions?

Investing in Bitcoin, or any cryptocurrency, involves substantial risk. The predictions presented are based on various models and analyses, but they are not guarantees of future performance. The cryptocurrency market is highly speculative, and prices can fluctuate dramatically in short periods. Before investing, you should carefully consider your risk tolerance, financial goals, and thoroughly research the asset. It’s advisable to consult with a qualified financial advisor before making any investment decisions. Remember, you should only invest money you can afford to lose completely.

Alternative Uses of Bitcoin Besides Investing

Beyond its role as an investment asset, Bitcoin has potential applications as a payment system and a store of value. As a payment system, Bitcoin offers the possibility of fast, low-cost, and borderless transactions, bypassing traditional financial intermediaries. However, its widespread adoption as a payment method is still limited by factors such as price volatility and scalability challenges. As a store of value, Bitcoin aims to function as a hedge against inflation and currency devaluation. Its limited supply of 21 million coins contributes to this narrative, but its price volatility significantly challenges its reliability as a stable store of value compared to traditional assets like gold or government bonds. The actual adoption of Bitcoin for these purposes remains dependent on technological advancements, regulatory frameworks, and widespread user acceptance.

Disclaimer and Conclusion Summary

Predicting the price of Bitcoin, or any cryptocurrency for that matter, is inherently speculative. While we’ve explored various factors and models, it’s crucial to remember that the cryptocurrency market is exceptionally volatile and influenced by numerous unpredictable events. This analysis provides a potential range of outcomes, but should not be interpreted as a definitive forecast.

The following points summarize the key findings of this Bitcoin price prediction for December 2025, emphasizing the inherent uncertainties involved in such projections. It is essential to approach these predictions with a healthy dose of skepticism and understand the limitations of any predictive model.

Key Takeaways and Uncertainties

- Bitcoin’s price in December 2025 is highly uncertain and depends on a complex interplay of factors, including regulatory changes, technological advancements, macroeconomic conditions, and market sentiment. No single factor can definitively determine the price.

- While various price prediction models offer potential scenarios, ranging from significantly bullish to bearish, these models are based on assumptions that may or may not hold true in the future. Unforeseen events can dramatically alter the trajectory.

- Past performance is not indicative of future results. Bitcoin’s historical price volatility serves as a reminder of the inherent risks associated with investing in cryptocurrencies. The price has experienced significant swings in the past, and similar volatility is expected in the future.

- The adoption rate of Bitcoin by institutional and retail investors will significantly influence its price. Increased adoption could drive prices higher, while decreased adoption could lead to price declines. Predicting adoption rates with certainty is extremely difficult.

- Technological developments, such as the scaling solutions for Bitcoin and the emergence of competing cryptocurrencies, will also play a role in determining the future price. These factors are difficult to predict accurately.

Disclaimer

This analysis is for informational purposes only and does not constitute financial advice. Investing in Bitcoin or any cryptocurrency involves significant risk, including the potential for complete loss of capital. Before making any investment decisions, conduct thorough research and consult with a qualified financial advisor. The information presented here should not be the sole basis for your investment decisions.