Major Cryptocurrencies in 2025

Predicting the future of cryptocurrency is inherently speculative, but by analyzing current trends, technological advancements, and market sentiment, we can formulate plausible price trajectories for major cryptocurrencies in 2025. These predictions are based on a combination of technical analysis, fundamental analysis, and consideration of macroeconomic factors. It’s crucial to remember that these are estimates, and actual prices may differ significantly.

Bitcoin’s Price Trajectory in 2025

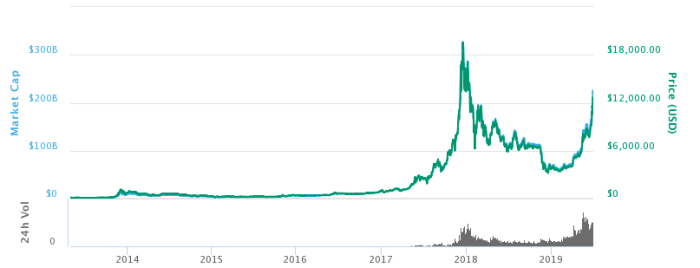

Bitcoin’s price is heavily influenced by its halving events, which reduce the rate of new Bitcoin creation. The next halving is expected to occur in 2024, potentially leading to increased scarcity and price appreciation. Furthermore, increased institutional adoption and growing recognition as a store of value could drive demand. However, regulatory uncertainty and macroeconomic factors could exert downward pressure. Considering these opposing forces, a price range between $100,000 and $200,000 by 2025 is a reasonable, albeit speculative, projection. This range is supported by historical price action following previous halvings and the increasing adoption by institutional investors. For example, the 2016 halving was followed by a significant price increase in 2017.

Ethereum’s Projected Price

Ethereum’s price is intricately linked to the growth of the decentralized finance (DeFi) ecosystem and the success of its scalability upgrades, such as the transition to proof-of-stake (PoS) and layer-2 solutions. The shift to PoS has already significantly reduced transaction fees and energy consumption. Continued improvements in scalability and the expansion of DeFi applications could propel Ethereum’s price considerably higher. A price range of $5,000 to $10,000 by 2025 is possible, contingent upon continued technological advancement and widespread DeFi adoption. The success of projects built on Ethereum, such as decentralized exchanges and lending platforms, will significantly influence its price.

Solana, Cardano, and Ripple Price Comparisons

Solana, Cardano, and Ripple represent different approaches to blockchain technology and offer distinct advantages. Solana prioritizes speed and scalability, Cardano focuses on academic rigor and sustainability, and Ripple emphasizes its use in cross-border payments. Their price movements are likely to be influenced by their respective technological advancements, adoption rates, and regulatory developments. Solana’s price could be highly volatile, reflecting its rapid growth and potential for disruption. Cardano’s price is expected to be more moderate, driven by its gradual rollout of features and focus on long-term development. Ripple’s price will be heavily influenced by the outcome of its ongoing legal battle with the SEC in the United States. Predicting precise price ranges for these cryptocurrencies is challenging due to their inherent volatility and susceptibility to market sentiment.

Projected Cryptocurrency Comparison (2025)

| Cryptocurrency | Projected Growth (from 2023) | Projected Market Capitalization (USD Trillion) | Technological Advancements |

|---|---|---|---|

| Bitcoin | 5x – 10x | 5-10 | Improved Lightning Network adoption, increased institutional usage |

| Ethereum | 3x – 5x | 2-4 | Successful scaling solutions, continued DeFi growth |

| Solana | 2x – 5x (High Volatility) | 0.5-1.5 | Further scalability improvements, expanded ecosystem |

| Cardano | 2x – 4x | 0.5-1 | Continued smart contract development, improved decentralization |

| Ripple (XRP) | 1x – 3x (Dependent on legal outcome) | 0.2-0.6 | Enhanced cross-border payment solutions (pending legal resolution) |

Factors Influencing Crypto Prices: Crypto 2025 Price Prediction

Predicting cryptocurrency prices in 2025 requires considering a complex interplay of factors. These factors range from broad macroeconomic trends to specific technological advancements and regulatory decisions. Understanding these influences is crucial for navigating the volatile crypto market.

Macroeconomic factors significantly impact cryptocurrency valuations. Fluctuations in these factors can trigger significant shifts in investor sentiment and market behavior.

Macroeconomic Influences on Crypto Prices

Inflation and interest rate adjustments by central banks globally directly affect the attractiveness of cryptocurrencies as an investment. High inflation often drives investors towards assets perceived as hedges against inflation, potentially boosting crypto demand. Conversely, rising interest rates can make traditional investments more appealing, potentially diverting capital away from the crypto market. For example, the aggressive interest rate hikes by the Federal Reserve in 2022 led to a significant downturn in the crypto market as investors shifted funds to higher-yielding bonds and other traditional assets. The correlation between inflation rates (measured by CPI) and Bitcoin’s price is not always direct, but periods of high inflation have historically been associated with increased volatility and sometimes higher prices for Bitcoin.

Geopolitical Events and Global Economic Trends

Geopolitical instability and global economic downturns can severely impact cryptocurrency prices. Events like wars, political upheavals, or significant economic crises often lead to increased uncertainty, prompting investors to move towards safer assets, including cryptocurrencies, or away from riskier ones, depending on the specific event and its perceived impact. For example, the Russian invasion of Ukraine in 2022 initially saw some investors seeking refuge in cryptocurrencies, while the subsequent global economic uncertainty caused a broader market downturn. Similarly, global economic slowdowns or recessions can reduce investor risk appetite, leading to a decline in cryptocurrency values.

Technological Advancements and Crypto Values

Technological innovations within the blockchain ecosystem play a crucial role in shaping cryptocurrency prices. Advancements such as layer-2 scaling solutions (like Polygon and Arbitrum) aim to improve transaction speeds and reduce fees, enhancing the usability and scalability of cryptocurrencies. These improvements can attract more users and institutional investors, driving up demand and potentially increasing prices. Similarly, breakthroughs in consensus mechanisms (e.g., advancements in proof-of-stake) can enhance the efficiency and environmental sustainability of blockchains, further impacting investor sentiment and market valuation. The development of new, more efficient blockchains could also potentially disrupt existing cryptocurrencies.

Regulatory Frameworks and Government Policies

Government regulations and policies significantly influence cryptocurrency markets. Clear and supportive regulatory frameworks can foster investor confidence and attract institutional investment, potentially driving up prices. Conversely, overly restrictive or unclear regulations can create uncertainty and discourage investment, leading to price declines. The regulatory landscape varies considerably across countries, with some jurisdictions embracing cryptocurrencies while others maintain a more cautious or even hostile stance. Examples include the varying levels of regulatory clarity and acceptance of cryptocurrencies in countries like the US, El Salvador, and China, which have significantly influenced investor behavior and market dynamics. The evolving regulatory environment is a major factor impacting long-term price predictions.

Market Sentiment and Investor Behavior

Predicting cryptocurrency prices in 2025 requires a nuanced understanding of market sentiment and investor behavior. These factors, often intertwined and difficult to quantify, can significantly influence price movements, potentially leading to substantial deviations from purely technical analyses. Understanding the interplay of institutional and retail investors is crucial for forming a realistic prediction.

Current market sentiment towards cryptocurrencies is complex and dynamic. While periods of intense enthusiasm and rapid price increases have occurred, there have also been significant corrections and periods of uncertainty driven by regulatory concerns, technological developments, and macroeconomic factors. This volatility makes accurate prediction challenging, as sentiment can shift rapidly based on news events or market trends. For instance, a major regulatory announcement could trigger a widespread sell-off, regardless of underlying technological advancements. Conversely, a successful technological upgrade or widespread adoption by a major corporation could lead to a surge in prices.

Institutional Investor Influence

Institutional investors, such as hedge funds, investment banks, and asset management firms, are increasingly participating in the cryptocurrency market. Their involvement brings significant capital and sophisticated trading strategies. Their actions tend to have a more pronounced and sustained impact on prices compared to individual retail investors. For example, a large institutional purchase of Bitcoin could create significant buying pressure, pushing the price upward. Conversely, a mass liquidation of holdings could trigger a sharp price decline. The strategic decisions of these large players are often based on long-term investment horizons and fundamental analysis, influencing market trends over extended periods. Their growing participation suggests increased market maturity and stability, although sudden shifts in their strategies can still cause volatility.

Retail Investor Behavior and Market Speculation, Crypto 2025 Price Prediction

Retail investors, comprising individual traders and crypto enthusiasts, significantly influence cryptocurrency price volatility through their often emotional and speculative behavior. FOMO (fear of missing out) and fear-driven selling can amplify price swings. Market speculation, driven by social media trends, news cycles, and influencer opinions, can create speculative bubbles and sudden price corrections. For example, a viral tweet from a prominent figure endorsing a specific cryptocurrency could trigger a massive price surge, often followed by a sharp correction as speculative investors take profits. The influence of retail investors is often amplified by the use of leverage and margin trading, which can exacerbate both upward and downward price movements.

Scenario: Divergent Investor Behaviors and Price Outcomes

Consider two contrasting scenarios for 2025:

Scenario 1: A positive regulatory landscape emerges globally, fostering increased institutional adoption. Simultaneously, retail investor sentiment remains optimistic, driven by successful blockchain applications and widespread adoption in the mainstream economy. In this scenario, the combined buying pressure from both institutional and retail investors could drive cryptocurrency prices significantly higher, potentially exceeding even the most optimistic predictions. Bitcoin, for example, could potentially reach prices significantly above its previous all-time high.

Scenario 2: Regulatory uncertainty persists, leading to cautious institutional investment and limited participation. Negative news events or a broader macroeconomic downturn trigger fear and uncertainty among retail investors, resulting in widespread selling. In this case, cryptocurrency prices could experience a prolonged bear market, with prices significantly lower than current levels. The value of Bitcoin, for instance, might drop considerably, mirroring past bear market corrections.

These scenarios highlight the importance of considering not only technological advancements and market fundamentals but also the unpredictable nature of investor sentiment and behavior when forecasting cryptocurrency prices.

Alternative Perspectives on Crypto Price Predictions

Predicting cryptocurrency prices is notoriously difficult, with various methodologies yielding vastly different outcomes. Understanding the limitations and biases inherent in these approaches is crucial for navigating the volatile crypto market. This section explores contrasting methodologies and expert opinions, highlighting the range of potential future scenarios for cryptocurrencies in 2025.

Predicting future cryptocurrency prices involves a complex interplay of technical analysis, fundamental analysis, and sentiment analysis. Each approach carries its own strengths and weaknesses, leading to a diverse spectrum of predictions.

Comparison of Crypto Price Prediction Methodologies

Different models employ distinct approaches. Technical analysis relies on historical price and volume data to identify patterns and predict future price movements. This method is often criticized for its susceptibility to self-fulfilling prophecies and its inability to account for external factors. Fundamental analysis, on the other hand, considers factors like technological advancements, regulatory changes, and market adoption rates. While more holistic, this approach struggles with accurately quantifying the impact of these qualitative factors. Finally, sentiment analysis gauges market sentiment through social media activity and news coverage. While offering insights into investor psychology, it is prone to manipulation and may not accurately reflect the overall market.

Limitations and Biases of Prediction Models

All prediction models are inherently limited by their reliance on past data and assumptions about future events. Technical analysis, for example, assumes that past patterns will repeat, which is not always the case in the rapidly evolving crypto market. Fundamental analysis can be biased by the analyst’s own preconceived notions and interpretations of market data. Sentiment analysis can be easily skewed by coordinated campaigns to manipulate public opinion. Furthermore, unforeseen events like regulatory crackdowns or technological breakthroughs can render any prediction obsolete. For instance, the unexpected collapse of FTX in 2022 significantly impacted the market and rendered many previous predictions inaccurate.

Differing Expert Opinions and Predictions for 2025

Expert opinions on the crypto market in 2025 vary widely. Some analysts, holding a bullish outlook, predict continued growth driven by increasing institutional adoption and the development of new decentralized applications (dApps). They point to the potential for Bitcoin to reach prices well above $100,000, citing factors like increasing scarcity and growing institutional demand. Conversely, bearish analysts foresee a market correction or even a prolonged bear market due to regulatory uncertainty, macroeconomic factors, and the inherent volatility of cryptocurrencies. They may cite historical trends and potential risks associated with the speculative nature of crypto investments. For example, some predict a scenario where Bitcoin’s price falls significantly below its current value, due to widespread adoption of alternative financial technologies or increased regulatory scrutiny.

Alternative Viewpoints: Bullish and Bearish Scenarios

A bullish scenario envisions a maturing crypto market characterized by widespread adoption, robust infrastructure, and integration with traditional financial systems. This would likely lead to higher prices for major cryptocurrencies. Conversely, a bearish scenario anticipates a period of consolidation or decline, potentially driven by regulatory challenges, security breaches, or a general loss of investor confidence. This could result in lower prices and decreased market capitalization. The divergence in these perspectives highlights the inherent uncertainty and risk associated with cryptocurrency investments. It’s important to consider multiple viewpoints before making any investment decisions.

Illustrative Examples of Price Prediction Scenarios

Predicting cryptocurrency prices is inherently speculative, influenced by a complex interplay of technological advancements, regulatory changes, and market sentiment. The following scenarios illustrate potential price movements in 2025, highlighting the factors contributing to each outcome. It is crucial to remember that these are illustrative examples and not financial advice.

Bullish Scenario: Exponential Growth

This scenario envisions a surge in cryptocurrency adoption driven by widespread institutional investment, successful implementation of Layer-2 scaling solutions, and the development of compelling decentralized applications (dApps) with real-world utility. Increased regulatory clarity in key jurisdictions, coupled with a global economic shift favoring digital assets, could further fuel this growth. Bitcoin could potentially reach prices exceeding $100,000, with altcoins experiencing even more significant percentage gains. The DeFi sector would boom, attracting substantial capital flows, and the NFT market would see a resurgence in activity, with innovative use cases emerging beyond mere digital collectibles. This scenario would lead to a significant increase in the overall market capitalization, benefiting most cryptocurrency projects, particularly those with strong fundamentals and innovative technology. The increased value would attract more investors, further fueling the upward trajectory.

Bearish Scenario: Market Correction and Stagnation

A bearish scenario could unfold if regulatory crackdowns significantly stifle innovation and adoption. A major security breach impacting a prominent cryptocurrency exchange or a significant negative event within the crypto space could trigger a widespread loss of investor confidence. This, combined with a broader macroeconomic downturn impacting investor risk appetite, could lead to a prolonged bear market. Bitcoin’s price might fall below $20,000, while many altcoins could experience even steeper declines, with some potentially becoming practically worthless. The DeFi and NFT sectors would suffer considerably, with liquidity drying up and project valuations plummeting. Investor participation would significantly decrease, and the overall market capitalization would contract substantially. This scenario could also see a renewed focus on traditional financial assets as investors seek safer havens. The impact would be particularly harsh on smaller, less established projects lacking robust fundamentals.

Neutral Scenario: Consolidation and Gradual Growth

This scenario assumes a period of market consolidation, with moderate growth punctuated by periods of volatility. Regulatory uncertainty persists, but no major negative events occur to trigger a significant market crash. Adoption continues at a steady pace, driven by ongoing technological improvements and increased institutional interest, but without the explosive growth seen in the bullish scenario. Bitcoin might trade within a range of $30,000 to $60,000, with altcoins experiencing varied performance depending on their individual fundamentals and adoption rates. The DeFi and NFT markets would show moderate growth, with innovative projects continuing to emerge but without the hyper-growth seen in a bullish market. This scenario represents a more realistic and sustainable growth trajectory, with less dramatic price swings and a more gradual increase in market capitalization. Investors would likely adopt a more cautious approach, focusing on projects with proven track records and strong community support.

Frequently Asked Questions (FAQs)

Predicting cryptocurrency prices is inherently complex, involving numerous interconnected factors. Understanding these factors and the inherent limitations of prediction is crucial for informed investment decisions. This section addresses common questions regarding cryptocurrency price prediction, risk management, and investment strategies.

Factors Influencing Cryptocurrency Price Predictions

Several key factors contribute to the difficulty of accurately predicting cryptocurrency prices. Market sentiment, driven by news, social media trends, and overall investor confidence, significantly impacts price volatility. Technological advancements, such as the development of new blockchain protocols or improved scalability solutions, can influence the adoption and value of specific cryptocurrencies. Regulatory frameworks, both at national and international levels, play a critical role in shaping market dynamics and investor behavior. Finally, macroeconomic conditions, including inflation rates, interest rates, and global economic growth, can influence investor appetite for riskier assets like cryptocurrencies. For example, a period of high inflation might drive investors towards cryptocurrencies as a hedge against inflation, increasing demand and potentially driving up prices. Conversely, a global recession could lead to decreased investor confidence and lower prices.

Reliability of Cryptocurrency Price Predictions

Cryptocurrency price predictions are inherently unreliable due to the market’s extreme volatility and unpredictable nature. Numerous factors beyond the control of analysts contribute to price fluctuations, making long-term forecasting exceptionally challenging. While technical analysis and fundamental analysis can offer insights, they cannot definitively predict future price movements. Consider the Bitcoin price in 2017; many predictions failed to anticipate the dramatic price surge and subsequent crash. This illustrates the limitations of relying solely on predictions. It’s crucial to remember that any prediction carries significant uncertainty and should be treated with caution.

Risks and Rewards of Cryptocurrency Investment in 2025

Investing in cryptocurrencies in 2025 presents both substantial potential rewards and significant risks. The potential for high returns is a major draw, with the possibility of significant capital appreciation. However, the market’s volatility exposes investors to substantial losses. The decentralized nature of cryptocurrencies means that there is less regulatory oversight compared to traditional financial markets, leading to greater uncertainty. Furthermore, the cryptocurrency market is susceptible to hacking, scams, and market manipulation, all of which can lead to significant financial losses. Thorough research, understanding your risk tolerance, and diversifying your portfolio are crucial for mitigating potential losses.

Strategies for Mitigating Risks in Cryptocurrency Investments

Several strategies can help mitigate the risks associated with cryptocurrency investments. Diversification across different cryptocurrencies and asset classes is a fundamental risk management technique. This reduces the impact of any single cryptocurrency’s price decline on your overall portfolio. Dollar-cost averaging, a strategy of investing a fixed amount of money at regular intervals regardless of price, helps to reduce the impact of market volatility. Setting stop-loss orders, which automatically sell your cryptocurrency if the price falls below a predetermined level, can limit potential losses. Finally, staying informed about market trends, regulatory changes, and technological advancements is crucial for making informed investment decisions. By implementing these strategies, investors can improve their chances of navigating the volatile cryptocurrency market successfully.