Bitcoin Halving 2025

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created. This occurs approximately every four years, cutting the block reward in half. This mechanism is designed to control inflation and maintain Bitcoin’s scarcity. Understanding the historical impact of past halvings is crucial for anticipating the potential effects of the 2025 event.

Bitcoin Halving: Event Description and Historical Impact

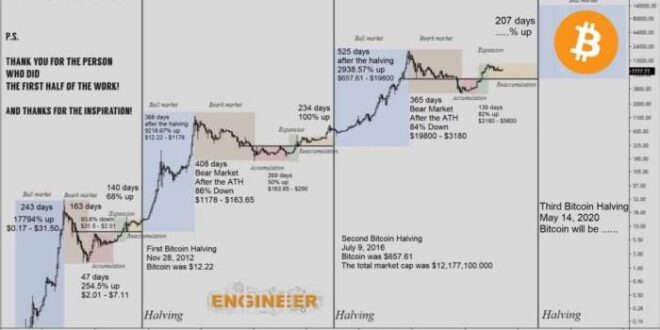

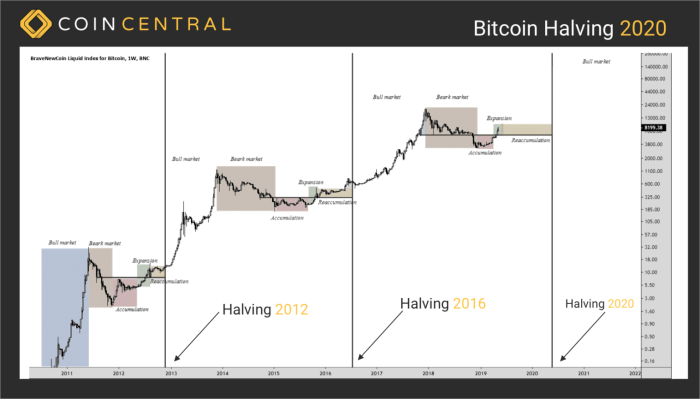

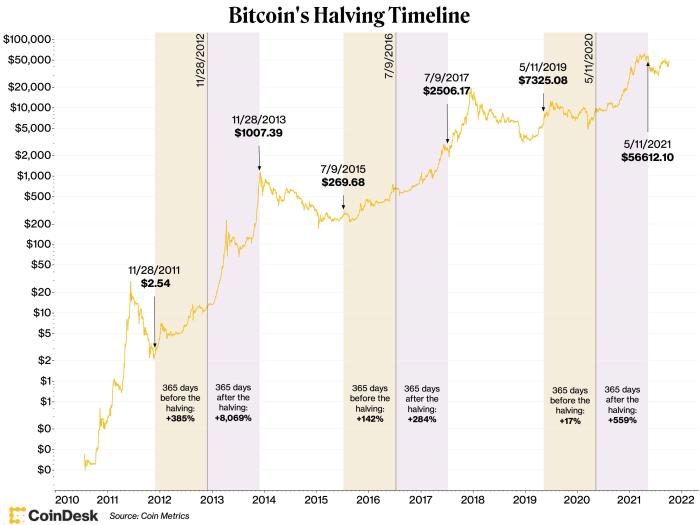

The Bitcoin halving significantly impacts the rate of Bitcoin inflation. Each halving reduces the newly minted Bitcoin supply by 50%, thereby decreasing the inflation rate. Historically, halvings have been followed by periods of increased Bitcoin price volatility, often leading to substantial price appreciation. The 2012 halving saw a price increase from around $12 to over $1,000 within a couple of years. Similarly, the 2016 halving preceded a significant price surge, though the timing and magnitude of the price increase vary. The exact reasons behind this correlation are complex and debated, but the reduced supply, coupled with increased demand, plays a significant role.

Anticipated Effects of the 2025 Halving on Supply and Demand

The 2025 halving will reduce the block reward from 6.25 BTC to 3.125 BTC. This will further decrease the rate of new Bitcoin entering circulation. Assuming consistent or increasing demand, this reduced supply should exert upward pressure on the price. However, several factors could influence the outcome, including macroeconomic conditions, regulatory developments, and overall market sentiment. The decreased supply alone doesn’t guarantee a price increase; it merely creates a foundation for potential price appreciation if demand remains strong or increases.

Potential Price Scenarios Following the 2025 Halving

Following the 2025 halving, several price scenarios are possible. A bullish scenario could see a significant price increase, potentially mirroring or exceeding the price increases observed after previous halvings. This would be driven by a combination of reduced supply, increased institutional and retail investor interest, and potentially a positive macroeconomic environment. Conversely, a bearish scenario could see a relatively muted price response or even a price decline. This could be due to factors such as a general cryptocurrency market downturn, increased regulatory scrutiny, or a lack of significant new demand. A more neutral scenario could involve a gradual price increase over an extended period.

Comparison of the 2025 Halving to Previous Halving Events

While the mechanism remains consistent, each halving occurs within a unique macroeconomic and market context. The 2012 halving happened in a relatively nascent cryptocurrency market with limited institutional involvement. The 2016 halving saw increased institutional interest but still lacked the widespread adoption seen today. The 2020 halving took place during a period of growing institutional investment and broader market awareness. The 2025 halving will likely occur in a more mature market with a larger and more diverse investor base, leading to potentially different price dynamics than previously observed. Predicting the exact outcome is challenging due to the numerous interacting factors at play.

Timeline of Key Events Surrounding the 2025 Halving

The following table Artikels key events leading up to and following the anticipated 2025 halving. Note that these dates are estimates and subject to change.

| Date | Event | Significance | Predicted Impact |

|---|---|---|---|

| Q3 2024 | Increased Speculation | Market anticipation builds ahead of the halving. | Potential price increase due to accumulating bullish sentiment. |

| March 2025 (approx.) | Bitcoin Halving | Block reward reduced by 50%. | Reduced inflation rate, potential catalyst for price appreciation. |

| Q2-Q3 2025 | Post-Halving Price Volatility | Market adjusts to the reduced supply. | Potential significant price swings, both bullish and bearish. |

| 2025-2026 | Gradual Price Adjustment | Market finds a new equilibrium. | Price stabilization, potential long-term price appreciation depending on market conditions. |

Factors Influencing Bitcoin’s Price After the Halving

The Bitcoin halving, a programmed event reducing the rate of new Bitcoin creation, historically precedes periods of significant price volatility. Predicting the precise impact on Bitcoin’s price post-halving is inherently complex, dependent on a confluence of interconnected factors. Understanding these factors is crucial for navigating the market’s potential reactions.

Macroeconomic Factors

Macroeconomic conditions significantly influence Bitcoin’s price. High inflation, for instance, can drive investors towards Bitcoin as a hedge against inflation, increasing demand and potentially pushing the price upwards. Conversely, rising interest rates, making traditional investments more attractive, could lead to decreased Bitcoin investment and price suppression. Regulatory changes, both positive (e.g., clear regulatory frameworks) and negative (e.g., outright bans), can also drastically alter investor sentiment and, consequently, the price. The 2021 China mining ban, for example, initially caused a significant price drop.

Bitcoin Adoption and Institutional Investment

Widespread Bitcoin adoption among individuals and businesses is a key driver of price appreciation. Increased usage, driven by factors like merchant acceptance and government recognition, increases demand and strengthens the underlying value proposition. Simultaneously, institutional investment, such as that from large corporations and investment funds, brings significant capital into the market, influencing price trends. The entry of firms like MicroStrategy and Tesla into the Bitcoin market has demonstrably impacted price movements in the past.

Technological Advancements and Network Upgrades

Technological advancements and successful network upgrades can positively influence Bitcoin’s price. Improvements in scalability, security, and transaction speed enhance Bitcoin’s functionality and appeal to a wider range of users. The implementation of the Lightning Network, for instance, aimed at improving transaction speeds and reducing fees, is an example of such a positive development that can indirectly impact price through improved usability. Conversely, failures or security breaches could severely damage confidence and negatively affect the price.

Market Sentiment and Media Coverage

Market sentiment, the overall feeling of investors towards Bitcoin, plays a crucial role in price volatility. Periods of optimism often lead to price increases, while fear and uncertainty can trigger sharp declines. Media coverage significantly influences market sentiment. Positive news stories can generate excitement and buying pressure, whereas negative reports can fuel selling and price drops. The constant news cycle surrounding Bitcoin, filled with both bullish and bearish narratives, directly impacts the short-term price fluctuations.

Historical Impact of Previous Halvings

Historically, Bitcoin halvings have been followed by periods of significant price appreciation. The halvings of 2012 and 2016, for example, were followed by substantial price rallies, although the timing and magnitude varied. However, it’s important to note that other factors also contributed to these price increases, and it’s inaccurate to attribute the entire price movement solely to the halving event. The market conditions surrounding each halving are unique and influence the outcome. It’s crucial to consider these contextual factors when analyzing historical data.

Understanding Bitcoin’s Supply Dynamics

Bitcoin’s inherent scarcity is a key driver of its value proposition. Unlike fiat currencies, which central banks can print at will, Bitcoin has a predetermined maximum supply, making it a deflationary asset with potentially significant long-term implications. This fixed supply, coupled with its halving mechanism, creates a unique and predictable supply dynamic unlike any other asset class.

Bitcoin’s Fixed Supply and its Implications for Long-Term Value

Bitcoin’s total supply is capped at 21 million coins. This fixed supply creates scarcity, a fundamental economic principle where limited availability drives up value. As demand for Bitcoin increases, and the supply remains constant, the price is theoretically expected to rise. This contrasts sharply with inflationary assets like fiat currencies, where increased supply can erode purchasing power over time. The scarcity of Bitcoin is often cited as a key reason why investors believe its value will continue to appreciate in the long term. Historical price action, particularly after previous halvings, seems to support this theory, although future price movements are, of course, uncertain.

The Halving Mechanism and its Impact on New Bitcoin Creation

The Bitcoin halving is a programmed event that occurs approximately every four years. During a halving, the reward miners receive for verifying transactions on the Bitcoin blockchain is cut in half. This mechanism directly controls the rate at which new Bitcoins enter circulation. For example, the initial block reward was 50 BTC, reduced to 25 BTC after the first halving, then to 12.5 BTC, and currently sits at 6.25 BTC. Each halving effectively slows down the rate of Bitcoin inflation, further contributing to its scarcity and potentially increasing its value. The predictable nature of the halving allows for anticipation and speculation within the market, often leading to price volatility in the periods leading up to and following the event.

Distribution of Bitcoin Across Different Holders

Bitcoin’s distribution is not uniform. A significant portion is held by long-term holders (often referred to as “hodlers”), who are less likely to sell their Bitcoin in response to short-term price fluctuations. Exchanges also hold a substantial amount, representing Bitcoin held by traders and those who actively participate in buying and selling. Institutions, including large investment firms and corporations, have also been increasingly accumulating Bitcoin, viewing it as a potential hedge against inflation and a diversification tool within their portfolios. Understanding this distribution is crucial for analyzing market dynamics, as the behavior of these different holder groups can significantly influence price movements.

Relationship Between Bitcoin’s Supply and Demand

The relationship between Bitcoin’s supply and demand can be illustrated graphically.

Cuando Es El Halving Bitcoin 2025 – Imagine a graph with “Price of Bitcoin (USD)” on the vertical axis and “Quantity of Bitcoin (in millions)” on the horizontal axis. The supply curve would be a vertical line at 21 million, representing the fixed total supply. The demand curve would slope downwards, reflecting the typical inverse relationship between price and quantity demanded. As the price of Bitcoin increases, the quantity demanded generally decreases, and vice-versa. The intersection of the supply and demand curves determines the market equilibrium price. After a halving, the demand curve might shift to the right (increase in demand), leading to a new equilibrium point at a higher price, assuming the supply curve remains unchanged. This illustrates how the halving mechanism, by influencing the rate of new Bitcoin entering circulation, impacts the market equilibrium and consequently the price.

Determining the exact date for the Cuando Es El Halving Bitcoin 2025 requires careful consideration of the Bitcoin blockchain’s programmed schedule. This leads us to the widely anticipated event, as detailed on this informative resource: Bitcoin April 2025 Halving. Understanding this event is key to predicting the long-term impact on Bitcoin’s value and the answer to Cuando Es El Halving Bitcoin 2025.

Comparison of Bitcoin’s Supply Dynamics with Other Cryptocurrencies or Assets

The following table compares Bitcoin’s supply dynamics with other prominent cryptocurrencies and traditional assets:

| Cryptocurrency | Total Supply | Halving Mechanism | Current Circulation |

|---|---|---|---|

| Bitcoin (BTC) | 21,000,000 | Yes, approximately every 4 years | ~19,500,000 (as of October 26, 2023 – this number is approximate and constantly changing) |

| Ethereum (ETH) | No fixed limit (but issuance rate is decreasing) | No | ~120,000,000 (as of October 26, 2023 – this number is approximate and constantly changing) |

| Gold (XAU) | Unknown, but estimated to be in the hundreds of millions of ounces | No | N/A (constantly mined and recycled) |

| US Dollar (USD) | Unlimited | No | N/A (constantly printed and destroyed) |

The Role of Miners in the Halving

Bitcoin miners are the backbone of the network’s security and operational efficiency. They dedicate significant computational power to solving complex cryptographic puzzles, validating transactions, and adding new blocks to the blockchain. This process, known as mining, ensures the integrity and immutability of the Bitcoin ledger. The halving event, which cuts the block reward in half, significantly impacts their profitability and operational strategies.

Miners’ Profitability and Operational Impacts After a Halving

The halving directly reduces the primary source of revenue for Bitcoin miners: the block reward. This decrease necessitates adjustments to maintain profitability. Before the halving, miners earn a certain amount of Bitcoin for each block they successfully mine. After the halving, this reward is halved, meaning miners need to either reduce their operational costs or increase their hashing power to maintain similar revenue levels. This can lead to a period of consolidation within the mining industry, with less profitable operations shutting down, while larger, more efficient operations potentially expanding. The price of Bitcoin plays a crucial role; if the price rises sufficiently after a halving, the reduced reward per block might still result in comparable or even higher profitability due to the increased value of the Bitcoin earned. Conversely, a price drop could exacerbate the profitability challenges faced by miners. Historically, we’ve seen periods of both price increases and decreases following halvings, making the outcome uncertain.

Miner Adaptation Strategies

In response to reduced block rewards, miners employ various strategies to maintain profitability. These include optimizing their hardware and software to improve energy efficiency, negotiating lower electricity costs, and diversifying revenue streams through services like transaction fee processing. Some miners might also consolidate operations, merging with other entities to benefit from economies of scale. Furthermore, miners might choose to invest in more energy-efficient mining hardware to offset the reduced block reward. The adoption of more efficient equipment, like ASICs (Application-Specific Integrated Circuits) with lower power consumption, is a common strategy to maintain profitability. Ultimately, the ability to adapt and innovate will be crucial for miners to survive and thrive in the post-halving environment.

Mining Difficulty and the Halving

The Bitcoin network adjusts its mining difficulty approximately every two weeks to maintain a consistent block generation time of roughly 10 minutes. This automatic adjustment mechanism ensures the network’s security and stability regardless of the overall hashing power. Following a halving, the initial impact on mining difficulty is typically minimal. However, if a significant portion of miners become unprofitable and cease operations, the network’s total hashing power will decrease, leading to a reduction in mining difficulty. This reduction makes it easier for the remaining miners to find blocks and maintain a stable block generation time. Conversely, if new miners enter the network or existing miners increase their hashing power, the difficulty will adjust upwards to maintain the target block time. This dynamic interplay between the halving, miner profitability, and mining difficulty ensures the long-term stability and security of the Bitcoin network.

Economic Incentives for Miner Participation

Miners participate in the Bitcoin network primarily driven by economic incentives. The most prominent incentive is the block reward, which provides a direct financial return for their computational efforts. However, miners also earn transaction fees, which are paid by users to prioritize their transactions within a block. These fees become increasingly important as the block reward diminishes over time. The security of the network itself is another crucial incentive; a secure network maintains the value of Bitcoin, benefiting all participants, including miners. The expectation of future Bitcoin price appreciation also motivates miners to continue their operations, as the value of their earned Bitcoin increases over time. This combination of direct financial rewards, transaction fees, and the long-term value proposition of Bitcoin creates a robust incentive structure that encourages miner participation and ensures the network’s continued security and operation.

Frequently Asked Questions about the Bitcoin Halving in 2025: Cuando Es El Halving Bitcoin 2025

The Bitcoin halving, a significant event in the cryptocurrency’s lifecycle, occurs approximately every four years. This event reduces the rate at which new Bitcoins are created, impacting its supply and potentially its price. The following sections address common questions surrounding the 2025 halving.

The Precise Date of the Bitcoin Halving in 2025

While the exact date is dependent on the time it takes to mine blocks, the Bitcoin halving in 2025 is expected to occur around April 2025. The calculation involves monitoring the block creation time, which averages around 10 minutes. The halving occurs after approximately 210,000 blocks are mined since the previous halving. Therefore, by tracking the block height and the average block time, a precise date can be estimated closer to the event. Slight variations are possible due to fluctuations in network hashrate.

The Expected Block Reward After the Halving

Following the 2025 halving, the block reward for Bitcoin miners will be reduced to 6.25 BTC. This is half of the 12.5 BTC reward currently in place. The halving mechanism is hardcoded into the Bitcoin protocol, ensuring a predictable and consistent reduction in the rate of new Bitcoin creation over time. This reduction is fundamental to Bitcoin’s deflationary nature.

The Halving’s Impact on Bitcoin’s Scarcity, Cuando Es El Halving Bitcoin 2025

The halving directly impacts Bitcoin’s scarcity by reducing the rate of new coin issuance. This controlled reduction in supply, combined with a potentially increasing demand, is often cited as a reason for price appreciation after previous halvings. The long-term implication is a gradual approach towards the hard-coded maximum supply of 21 million Bitcoins, making each Bitcoin inherently more valuable as the available supply diminishes. This is analogous to a precious metal like gold, where scarcity drives value.

Potential Risks Associated with the Halving

While halvings are generally anticipated positively, potential risks exist. A significant drop in the price of Bitcoin before the halving could reduce miner profitability, potentially leading to a decrease in the network’s hashrate. This could temporarily affect transaction processing speeds and network security. Furthermore, unforeseen market events or regulatory changes could overshadow the halving’s anticipated effects on the price. The impact of the halving is not guaranteed and depends on various market factors.

Reliable Sources of Information about the Bitcoin Halving

Reliable information on the Bitcoin halving can be found through several sources. The official Bitcoin Core website provides technical specifications and updates on the protocol. Reputable cryptocurrency news outlets, such as CoinDesk and Cointelegraph, offer analyses and commentary from industry experts. Finally, blockchain explorers, like Blockchain.com, provide real-time data on block creation and network statistics, allowing for independent verification of the halving’s progress. These sources offer a mix of technical detail and market analysis, ensuring a well-rounded understanding.

Determining the exact date for the Cuando Es El Halving Bitcoin 2025 event requires understanding the Bitcoin halving schedule. To find out precisely when this significant reduction in Bitcoin’s block reward will occur in 2025, you can consult this helpful resource: When In 2025 Is The Next Bitcoin Halving?. This information is crucial for anyone interested in the future trajectory of Bitcoin’s value and its implications for Cuando Es El Halving Bitcoin 2025.

Understanding “Cuando Es El Halving Bitcoin 2025” requires knowing the precise date of the Bitcoin halving. To clarify this, you might find the answer by checking this resource: When Was The Bitcoin Halving In 2025. This information is crucial for predicting future Bitcoin price movements and understanding the impact of the halving on the “Cuando Es El Halving Bitcoin 2025” question itself.

Determining the precise date for the Bitcoin halving in 2025, or “Cuando Es El Halving Bitcoin 2025,” requires a reliable resource. For a clear and constantly updated answer, check out the helpful Bitcoin Halving Clock 2025 which provides a countdown. Using this tool helps you stay informed about the upcoming halving and its potential impact on the Bitcoin market, providing a clearer understanding of “Cuando Es El Halving Bitcoin 2025”.

The question “Cuando Es El Halving Bitcoin 2025?” translates to “When is the Bitcoin halving in 2025?” Predicting the precise date requires careful analysis of the Bitcoin blockchain, but current projections suggest it’s likely to happen in April. For a more detailed explanation and confirmation, you can check this resource: Bitcoin Halving Is Expected To Occur In April 2025.

Therefore, based on this information, the answer to “Cuando Es El Halving Bitcoin 2025?” is likely April 2025.

Determining the precise date for the Cuando Es El Halving Bitcoin 2025 event requires careful consideration of the Bitcoin blockchain’s mechanics. Understanding this crucial event is simplified by resources like this helpful guide on When Bitcoin Halving 2025 , which clarifies the timing based on block generation. Ultimately, pinpointing the exact date for Cuando Es El Halving Bitcoin 2025 hinges on the consistent creation of new blocks within the Bitcoin network.