Bitcoin Halving 2025

The Bitcoin halving, scheduled for sometime in 2025, is a significant event in the cryptocurrency’s lifecycle. This event, programmed into Bitcoin’s code, reduces the rate at which new Bitcoins are created, effectively halving the reward miners receive for validating transactions on the blockchain. This reduction in the supply of newly minted Bitcoin is expected to have a considerable impact on its price and market dynamics.

Significance of the 2025 Bitcoin Halving

The halving’s significance stems from its impact on Bitcoin’s inflation rate. By reducing the supply of new Bitcoins entering circulation, the halving theoretically decreases inflation and potentially increases scarcity, factors which can influence price appreciation. This is based on fundamental economic principles of supply and demand. The halving is a pre-programmed, predictable event, unlike many other market forces, adding a degree of certainty to the long-term outlook for Bitcoin, although price movements remain unpredictable in the short term.

Predicted Impact on Bitcoin’s Price and Volatility

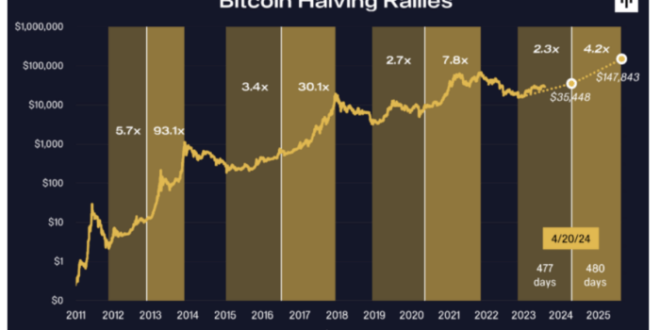

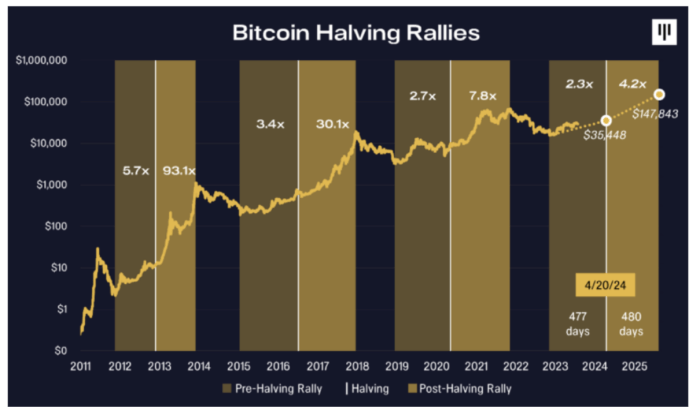

Predicting the exact impact of a halving on Bitcoin’s price is impossible. However, historically, halvings have been followed by periods of significant price appreciation. The reduced supply often creates upward pressure on price, especially if demand remains strong or increases. However, it’s crucial to note that the price movement is not immediate and is often influenced by other macroeconomic factors, market sentiment, and regulatory changes. Increased volatility is also a common occurrence surrounding and following a halving event, as investors speculate on the future price. For example, the halving in 2012 was followed by a significant bull run, while the 2016 halving led to a more gradual price increase. The 2020 halving saw a significant price surge later that year.

Historical Overview of Previous Bitcoin Halvings

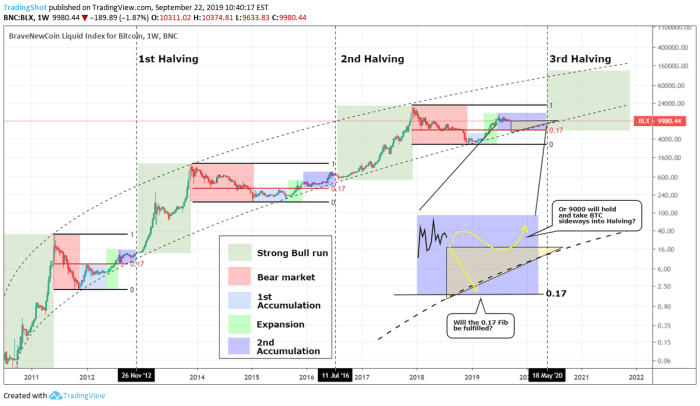

Bitcoin has undergone three previous halvings: in November 2012, July 2016, and May 2020. Each halving saw a different market response, highlighting the complexity of predicting future price movements. The 2012 halving coincided with increased awareness and adoption of Bitcoin, leading to a substantial price surge over the following year. The 2016 halving saw a more gradual price increase, influenced by various market factors beyond the halving itself. The 2020 halving was followed by a significant bull run that lasted into 2021, although other factors such as institutional investment and increased DeFi activity played significant roles. These varied outcomes underscore the importance of considering multiple factors influencing Bitcoin’s price beyond the halving itself.

Comparison of Market Conditions Leading Up to the 2025 Halving

The market conditions leading up to the 2025 halving are noticeably different from previous halvings. The cryptocurrency market is significantly more mature and regulated than it was in 2012, 2016, or even 2020. Institutional investment in Bitcoin has increased substantially, and regulatory scrutiny is greater. These factors, alongside global macroeconomic conditions, including inflation and interest rates, will play a significant role in shaping the price movement after the 2025 halving. The level of overall market sentiment, both within the crypto space and in traditional financial markets, will also be a key determinant. It’s important to consider that a significant market downturn before the halving could impact the post-halving price movement differently than a period of relative stability.

Potential Scenarios for Bitcoin’s Price After the 2025 Halving

Several scenarios are possible following the 2025 halving. A continuation of the current upward trend, fueled by increased scarcity and sustained demand, could lead to significant price appreciation. Conversely, a prolonged bear market, potentially influenced by macroeconomic factors or regulatory uncertainty, could dampen the price impact of the halving. A more moderate scenario could involve a gradual price increase, mirroring the pattern observed after the 2016 halving. Each scenario presents unique opportunities and risks for investors, underscoring the need for careful risk assessment and diversification. The level of regulatory clarity, global economic conditions, and overall market sentiment will heavily influence which scenario plays out.

The Halving’s Effect on Bitcoin Mining: Cuando Es El Halving De Bitcoin 2025

The Bitcoin halving, a pre-programmed event reducing the block reward miners receive by half, significantly impacts the profitability and landscape of Bitcoin mining. Understanding these effects is crucial for assessing the future of the network and its sustainability. The 2025 halving, in particular, will present unique challenges and opportunities for miners worldwide.

Impact on Mining Profitability

The halving directly reduces the revenue miners generate per block mined. Before the halving, miners receive a certain number of Bitcoins for successfully adding a block to the blockchain. After the halving, this reward is cut in half. This immediately affects profitability, as operating costs (electricity, hardware maintenance, and infrastructure) remain largely unchanged. Consequently, miners with higher operating costs may find it increasingly difficult to maintain profitability. This can lead to some miners shutting down their operations, or at least scaling back significantly. The profitability equation hinges on the relationship between the Bitcoin price, mining difficulty, and operational costs. A rise in Bitcoin’s price can partially offset the reduced block reward, while an increase in mining difficulty (which increases competition and energy consumption) further reduces profitability.

Changes in the Mining Landscape

The halving often triggers a reshuffling of the mining landscape. Less profitable operations are forced to exit, leading to a consolidation of the industry. Larger, more efficient mining operations, often those with access to cheaper electricity or more advanced technology, tend to survive and even thrive. This consolidation can lead to increased centralization of mining power, potentially raising concerns about network security and decentralization. The halving can also spur innovation in mining technology, as miners seek ways to improve efficiency and reduce costs to remain competitive. This might involve adopting more energy-efficient hardware or exploring alternative energy sources.

Miner Adaptation Strategies

Miners employ various strategies to adapt to the reduced rewards. One common approach is to improve operational efficiency. This involves optimizing hardware, negotiating lower electricity rates, or improving cooling systems to reduce energy consumption. Diversification into other cryptocurrencies with potentially higher rewards can also be a strategy, although this comes with its own set of risks and challenges. Some miners may also focus on increasing their hash rate to maintain their share of the block rewards in a more competitive environment. Finally, some miners might explore alternative revenue streams, such as offering hosting services to other miners or engaging in staking activities for other cryptocurrencies.

Environmental Impact of Bitcoin Mining

The environmental impact of Bitcoin mining is a significant concern, particularly given the energy intensity of the process. The halving, while not directly addressing the environmental issue, can indirectly influence it. A reduction in the number of active miners due to decreased profitability could lead to a decrease in overall energy consumption. However, this effect is likely to be moderated by the continuing adoption of more energy-efficient hardware and the exploration of renewable energy sources by some miners. The long-term environmental impact will depend on the interplay of these factors and the overall growth of the Bitcoin network. It’s important to note that the environmental impact is not solely determined by the halving, but also by broader technological advancements and regulatory changes.

Mining Profitability Before and After the 2025 Halving

| Metric | Before Halving (Estimate) | After Halving (Estimate) | Change |

|---|---|---|---|

| Block Reward (BTC) | 6.25 | 3.125 | -50% |

| Electricity Cost (USD/kWh) | 0.10 | 0.10 (Assumed Constant) | 0% |

| Hashrate (TH/s) | 300 (Example) | 350 (Example – Increased Competition) | +16.7% |

| Mining Difficulty | (Variable, depends on hashrate) | (Variable, likely to increase) | Likely Increase |

Bitcoin’s Supply and Demand Dynamics

The Bitcoin halving, a programmed event reducing the rate of new Bitcoin creation, significantly impacts the cryptocurrency’s supply and demand dynamics. Understanding this interplay is crucial for predicting potential price movements and assessing the overall health of the Bitcoin ecosystem. The reduced supply acts as a deflationary pressure, potentially driving up demand and price, but the actual effect is complex and influenced by various other factors.

The relationship between Bitcoin’s reduced supply and its potential impact on demand is not always straightforward. While a decrease in supply generally leads to increased value in traditional economics, the cryptocurrency market is susceptible to intense volatility driven by speculation and investor sentiment. A halving creates a scarcity narrative, which can attract new investors and encourage existing holders to HODL (hold on for dear life), further reducing supply available for trading. However, this effect can be counteracted by negative market sentiment, regulatory uncertainty, or competing investment opportunities.

Investor Sentiment’s Role in Shaping Bitcoin’s Price

Investor sentiment plays a dominant role in shaping Bitcoin’s price following a halving. Positive sentiment, fueled by anticipation of scarcity and potential price appreciation, can lead to a price surge. Conversely, negative sentiment, driven by macroeconomic factors, regulatory concerns, or general market downturns, can mitigate or even negate the positive impact of reduced supply. The 2012 and 2016 halvings saw differing market reactions; while the 2012 halving was followed by a period of relatively slow price growth, the 2016 halving preceded a significant bull run. This difference highlights the unpredictable nature of investor behavior and the influence of external factors.

Timeline of Key Events Surrounding Past Halvings, Cuando Es El Halving De Bitcoin 2025

Understanding the historical context of past halvings provides valuable insights into potential future price movements. The following timeline Artikels key events surrounding the previous halvings:

Cuando Es El Halving De Bitcoin 2025 – Prior to 2012 Halving: Bitcoin was still relatively new, with limited adoption and a small market cap. The price was relatively low.

2012 Halving: The first halving occurred. Price movement following this event was relatively muted compared to later halvings.

Post-2012 Halving: Gradual price increases occurred, but significant volatility remained.

Prior to 2016 Halving: Bitcoin’s adoption increased significantly, with growing institutional and public interest. The price experienced considerable growth leading up to the halving.

2016 Halving: The second halving took place. This was followed by a prolonged bull market.

Post-2016 Halving: A significant bull run began, leading to a substantial price increase. This period also saw increased regulatory scrutiny and market manipulation concerns.

Prior to 2020 Halving: Bitcoin’s price had experienced significant volatility in the preceding years, but was approaching a new all-time high leading up to the halving.

2020 Halving: The third halving occurred. The price increase following this event was significant, although it was later followed by a correction.

Post-2020 Halving: A period of price growth followed, culminating in a new all-time high, followed by a significant market correction.

Macroeconomic Factors’ Influence on Bitcoin’s Price Post-2025 Halving

Macroeconomic factors, such as inflation rates, interest rates, and global economic growth, can significantly influence Bitcoin’s price after the 2025 halving. For example, high inflation could drive investors towards Bitcoin as a hedge against inflation, increasing demand. Conversely, rising interest rates might divert investment capital away from riskier assets like Bitcoin towards more stable, interest-bearing instruments. Global economic uncertainty could also increase demand for Bitcoin as a safe haven asset. The strength of the US dollar also plays a role, with a strong dollar potentially putting downward pressure on Bitcoin’s price.

Hypothetical Scenario: Interplay of Supply, Demand, and Price

Let’s consider a hypothetical scenario. Assume the 2025 halving occurs in a period of moderate global economic growth, with relatively low inflation and stable interest rates. Further assume that investor sentiment is generally positive due to increased institutional adoption and technological advancements within the Bitcoin ecosystem. In this scenario, the reduced supply from the halving, combined with positive investor sentiment and moderate macroeconomic conditions, could lead to a gradual but sustained increase in Bitcoin’s price over the 12-18 months following the halving. However, unforeseen events, such as a major regulatory crackdown or a significant market crash in traditional financial markets, could significantly alter this outcome. The price increase might not be as dramatic as seen after the 2016 halving, reflecting a more mature and less speculative market.

Impact on the Cryptocurrency Market

The Bitcoin halving, a significant event in the Bitcoin lifecycle, doesn’t exist in a vacuum. Its effects ripple outwards, profoundly impacting the broader cryptocurrency market. Understanding these ramifications is crucial for investors and market participants alike. The reduced supply of newly mined Bitcoin often leads to price fluctuations, impacting other cryptocurrencies and the overall market capitalization.

The halving’s influence on the cryptocurrency market is multifaceted and complex, depending on various factors including market sentiment, overall economic conditions, and the adoption rate of Bitcoin itself. While historical data offers valuable insights, predicting the exact outcome remains challenging due to the inherent volatility of the crypto market.

Bitcoin Halving’s Effect on Other Cryptocurrencies

The relationship between Bitcoin and altcoins (alternative cryptocurrencies) is often described as inverse. When Bitcoin’s price rises significantly following a halving, investors may shift their focus and capital from altcoins into Bitcoin, leading to a potential downturn in altcoin prices. This is sometimes referred to as a “Bitcoin dominance” increase. Conversely, if Bitcoin’s price increase is less dramatic than anticipated, or if it experiences a correction, altcoins might see increased investment, potentially leading to an altcoin season. The 2012 and 2016 halvings provided some evidence of this dynamic, although the market conditions surrounding each event were unique.

Increased Bitcoin Adoption Following a Halving

A Bitcoin halving can potentially accelerate Bitcoin adoption. The reduced supply, coupled with sustained or increased demand, can drive up the price, making Bitcoin a more attractive investment. This increased price visibility often attracts new investors and businesses, leading to wider acceptance and usage of Bitcoin as a store of value, a payment method, or a hedge against inflation. The narrative around scarcity can significantly influence market sentiment and adoption rates. For example, the growing interest in Bitcoin as a safe haven asset could be further fueled by a halving.

Halving’s Effect on Overall Cryptocurrency Market Capitalization

The overall cryptocurrency market capitalization is heavily influenced by Bitcoin’s market dominance. Since Bitcoin accounts for a large portion of the total market cap, its price movements significantly impact the overall figure. A Bitcoin halving-induced price surge can lead to a general increase in the total market cap, as other cryptocurrencies may also benefit from the positive market sentiment. However, as previously discussed, this effect isn’t guaranteed and can be counteracted by a shift in investor focus solely towards Bitcoin. The 2020 halving, for instance, saw a period of significant growth in the overall market cap, though this was influenced by numerous factors beyond just the halving itself.

Potential for Altcoin Season Following a Bitcoin Halving

An “altcoin season” typically refers to a period where altcoins outperform Bitcoin. While a Bitcoin halving often leads to an initial surge in Bitcoin’s price, this doesn’t necessarily preclude an altcoin season later. After the initial Bitcoin price rally, investors might start looking for alternative investment opportunities with higher potential returns, leading to increased interest in altcoins. This dynamic is speculative and depends heavily on several factors, including the overall market sentiment and the specific performance of individual altcoins. The post-halving market is often characterized by heightened volatility, creating both opportunities and risks for altcoin investors.

Ripple Effects Across the Broader Crypto Market

The following points illustrate the potential ripple effects of a Bitcoin halving across the broader cryptocurrency market:

- Increased volatility in both Bitcoin and altcoin prices.

- Potential shifts in investor sentiment and portfolio allocations.

- Changes in Bitcoin mining profitability and hash rate.

- Impact on the development and adoption of alternative consensus mechanisms.

- Influence on regulatory discussions and policy decisions concerning cryptocurrencies.

- Increased media attention and public awareness of Bitcoin and cryptocurrencies in general.