Bitcoin Halving 2025

The Bitcoin halving, a programmed event occurring approximately every four years, is a significant event in the cryptocurrency’s lifecycle. It reduces the rate at which new Bitcoins are created, impacting supply and potentially influencing price and market sentiment. The 2025 halving, expected around April-May, is anticipated to generate considerable market activity, mirroring past trends.

Bitcoin Halving History and Price Impact

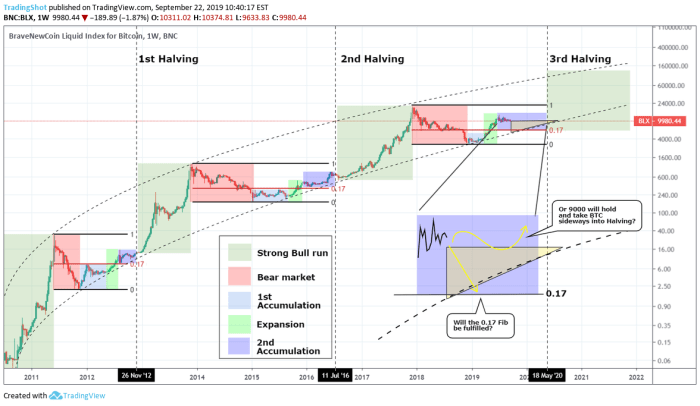

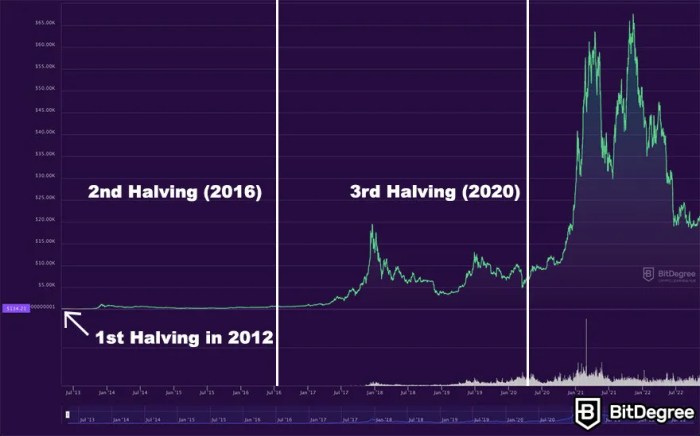

Previous Bitcoin halvings have demonstrably affected the price. The first halving in November 2012 saw the block reward decrease from 50 BTC to 25 BTC. While the immediate price impact wasn’t dramatic, it preceded a significant bull run in 2013. Similarly, the second halving in July 2016, reducing the reward to 12.5 BTC, was followed by a substantial price increase leading up to the 2017 bull market. The third halving in May 2020, lowering the reward to 6.25 BTC, was followed by a period of price consolidation before a significant price surge in late 2020 and early 2021. These historical trends suggest a correlation between halvings and subsequent price appreciation, though this is not guaranteed and other market factors play a significant role.

Supply Reduction from the 2025 Halving

The 2025 halving will reduce the block reward from 6.25 BTC to 3.125 BTC. This represents a 50% reduction in the rate of new Bitcoin creation. This decrease in the supply of newly mined Bitcoin is a key factor anticipated to influence the market. The reduced supply, coupled with potentially increasing demand, could theoretically lead to upward pressure on the price, similar to what has been observed in previous cycles. However, it’s crucial to remember that this is a theoretical impact and the actual outcome will depend on a multitude of market factors.

Comparison of Market Conditions Leading to Previous Halvings

Leading up to the previous halvings, the market experienced varying conditions. Prior to the 2012 halving, Bitcoin was still a relatively nascent technology, with limited adoption and understanding. The 2016 halving occurred after a period of price consolidation following the 2014-2015 bear market. The 2020 halving took place amidst a global pandemic and significant macroeconomic uncertainty. Currently, the market faces high inflation, rising interest rates, and geopolitical instability. Comparing these different contexts highlights the complexity of predicting the 2025 halving’s impact, as market sentiment and external factors are significant variables.

Timeline of Significant Events Around the 2025 Halving

Predicting precise events is inherently speculative, but a likely timeline might include:

Increased media coverage and market speculation in the months leading up to the halving.

A period of price volatility around the actual halving date itself.

Potential shifts in market sentiment based on the price action following the halving.

Continued development and adoption of Bitcoin and related technologies.

The longer-term impact will unfold over months or even years following the halving, influenced by various market forces.

Predicting the Bitcoin Price After the 2025 Halving: Date For Bitcoin Halving 2025

Predicting the price of Bitcoin after the 2025 halving is a complex undertaking, fraught with uncertainty. Numerous factors influence Bitcoin’s price, making accurate predictions exceptionally challenging. While historical data offers some insights, extrapolating past performance to future price movements is inherently risky. This section explores various prediction models, their limitations, and the influence of macroeconomic factors.

Price Prediction Models and Their Limitations

Several models attempt to forecast Bitcoin’s price. Stock-to-flow (S2F) models, for example, correlate Bitcoin’s price with its scarcity, based on the halving events reducing the rate of new Bitcoin creation. However, these models often oversimplify the market’s complexities, neglecting factors like adoption rates, regulatory changes, and overall market sentiment. Other models incorporate technical analysis, examining price charts and indicators to identify potential trends. These methods are subjective and can vary significantly depending on the analyst’s interpretation. Ultimately, no single model consistently provides accurate predictions. The inherent volatility of the cryptocurrency market renders any prediction inherently uncertain. For instance, while the S2F model accurately predicted price increases following previous halvings, it failed to account for the significant price drops experienced in 2022, demonstrating the limitations of relying on a single predictive model.

Historical Data Analysis and Potential Indicators

Analyzing historical Bitcoin price movements after previous halvings can offer clues. Generally, a period of price appreciation has followed past halvings, driven by the decreased supply of newly minted Bitcoin. However, the magnitude and duration of these price increases have varied significantly. Factors such as the broader macroeconomic environment, regulatory developments, and technological advancements have all played crucial roles. Examining the correlation between Bitcoin’s price and other market indicators, such as the S&P 500 or gold prices, can also provide valuable insights. For example, a strong correlation between Bitcoin and the tech sector could suggest a potential impact from broader market trends.

Expert Opinions and Their Reasoning, Date For Bitcoin Halving 2025

Expert opinions on Bitcoin’s post-halving price range widely. Some analysts predict substantial price increases, citing the reduced supply as a primary driver. Others express more cautious optimism, highlighting the potential impact of macroeconomic headwinds or regulatory uncertainty. The reasoning behind these diverse predictions often stems from different assumptions about the future adoption rate of Bitcoin, the overall state of the global economy, and the degree of regulatory intervention. For instance, some experts might anticipate increased institutional adoption, leading to higher prices, while others might foresee a period of consolidation or even a price decline due to external factors. The diversity of expert opinions underscores the uncertainty inherent in predicting Bitcoin’s future price.

Impact of Macroeconomic Factors

Macroeconomic factors significantly influence Bitcoin’s price. Inflation, interest rates, and global economic growth all play a role. During periods of high inflation, Bitcoin may be viewed as a hedge against inflation, potentially driving up its price. Conversely, rising interest rates can reduce investor appetite for riskier assets like Bitcoin, leading to price declines. Recessions or significant geopolitical events can also trigger market volatility and affect Bitcoin’s price. For example, the 2022 bear market was partly attributed to rising inflation and interest rate hikes by central banks globally, impacting investor sentiment towards risk assets. Therefore, understanding the broader macroeconomic landscape is crucial for assessing Bitcoin’s potential price trajectory post-halving.

Mining and the 2025 Halving

The Bitcoin halving event, scheduled for 2025, will significantly impact Bitcoin mining profitability and the broader mining landscape. This reduction in the block reward, from 6.25 BTC to 3.125 BTC, will directly affect miners’ revenue streams, forcing adaptations and potentially reshaping the industry’s geographic distribution and technological focus.

The halving’s primary impact is a reduction in miner revenue per block. This decrease necessitates a careful analysis of operational costs, including electricity prices, hardware maintenance, and other overhead expenses. Miners will need to evaluate their profitability margins and potentially adjust their operations accordingly. The impact will vary considerably depending on the efficiency of individual mining operations and their access to low-cost energy.

Bitcoin Mining Profitability After the Halving

The immediate effect of the halving will be a decrease in Bitcoin mining profitability for many operations. Miners with high operational costs, especially those relying on expensive electricity, may find it increasingly difficult to remain profitable. This could lead to some miners shutting down their operations, selling off their hardware, or seeking more efficient and cost-effective solutions. Conversely, miners with access to cheap, renewable energy sources, such as hydroelectric power or geothermal energy, may be better positioned to weather the halving and maintain profitability. For example, miners in regions with abundant hydroelectric power, like parts of China and Scandinavia, could gain a competitive edge. Others may focus on more efficient hardware or explore innovative strategies like mining pools to distribute costs and risks.

Mining Difficulty Adjustment

Following the halving, the Bitcoin network’s mining difficulty will inevitably adjust. This automatic adjustment mechanism ensures that the block generation time remains relatively consistent (approximately 10 minutes). Since the halving reduces the reward for successfully mining a block, the difficulty will decrease to compensate for the reduced reward, maintaining the overall network security and transaction processing speed. The extent of this difficulty adjustment will depend on the hashrate (the total computational power dedicated to mining) before and after the halving. A significant drop in hashrate might result in a more substantial difficulty adjustment. Conversely, a resilient hashrate might lead to a smaller adjustment.

Geographic Distribution of Bitcoin Mining

The halving could significantly influence the geographic distribution of Bitcoin mining. Regions with favorable regulatory environments, low energy costs, and access to skilled labor will likely attract more mining operations. Conversely, areas with strict regulations or high energy prices might see a decline in mining activity. This shift could lead to a concentration of mining power in specific regions, potentially raising concerns about network centralization. For instance, if China were to re-enter the market with favorable policies, it could dramatically alter the global mining landscape. Conversely, increased regulation in other regions might push mining operations to more decentralized locations.

Technological Advancements Impacting Mining Efficiency

Technological advancements play a crucial role in maintaining and improving Bitcoin mining profitability. The development of more energy-efficient ASICs (Application-Specific Integrated Circuits), specialized hardware designed for Bitcoin mining, is essential. Innovations in cooling technologies and power management systems could also improve efficiency. Furthermore, advancements in renewable energy sources, such as solar and wind power, could make mining more sustainable and cost-effective in certain locations. The adoption of these technologies will be critical for miners to offset the reduced block rewards and remain competitive in the post-halving environment. For example, the development of next-generation ASICs with significantly improved hash rate per watt could significantly impact the profitability of mining operations.

Date For Bitcoin Halving 2025 – Pinpointing the exact date for the Bitcoin Halving 2025 requires careful consideration of block times. However, understanding the broader context of the event is crucial; for a detailed overview, check out this comprehensive resource on the Bitcoin Halving Event 2025. This knowledge helps refine predictions surrounding the precise date for the Bitcoin Halving 2025, ultimately impacting market speculation.

Pinpointing the exact date for the Bitcoin halving in 2025 requires careful consideration of block times. However, once that date is established, speculation naturally turns to price predictions. For insightful analysis on potential price movements, check out this resource on Bitcoin 2025 Halving Price Prediction. Ultimately, the date of the halving itself remains the key catalyst for the anticipated market fluctuations.

Pinpointing the exact date for the Bitcoin halving in 2025 requires careful consideration of block generation times. However, knowing the precise date isn’t enough; you also need to know the time. To find out, check this resource: What Time Is The Bitcoin Halving 2025. This information, combined with estimations of block creation, will help you narrow down the date for the 2025 Bitcoin halving more accurately.

Pinpointing the exact date for the Bitcoin halving in 2025 requires careful consideration of block times, but it’s generally anticipated to occur around April. Naturally, this leads to speculation about the subsequent price action, a topic explored in detail at Bitcoin Price After Halving 2025. Understanding potential price movements after the halving is crucial for anyone considering the date itself and its market implications.

Pinpointing the exact date for the Bitcoin halving in 2025 requires careful consideration of block times. However, it’s also worth noting the significance of other halvings, such as the upcoming Bitcoin Cash Halving 2025 , which may indirectly influence Bitcoin’s market dynamics. Understanding these related events provides a more comprehensive perspective when predicting the Bitcoin halving date.

Pinpointing the exact date for the Bitcoin Halving in 2025 requires careful consideration of block times. However, a visual representation can be incredibly helpful; for a clear depiction, check out this comprehensive Bitcoin Halving Chart 2025 which provides a projected timeline. Using this chart, you can then better estimate the precise date for the Bitcoin Halving 2025 event.