Bitcoin Halving and Market Volatility

The Bitcoin halving, an event that reduces the rate at which new Bitcoins are created, has historically been associated with significant price volatility in the cryptocurrency market. Understanding this volatility is crucial for investors navigating the period surrounding the halving. This section will explore the historical impact of halvings, the factors influencing price fluctuations, and the associated risks and opportunities.

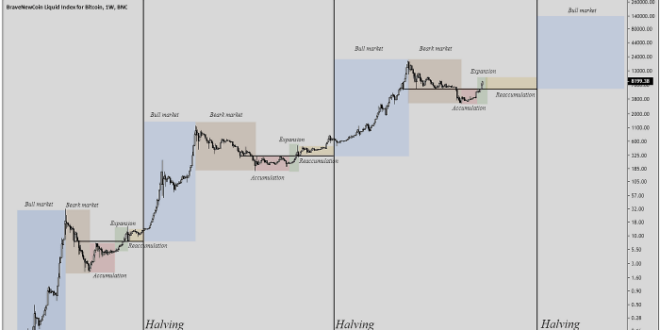

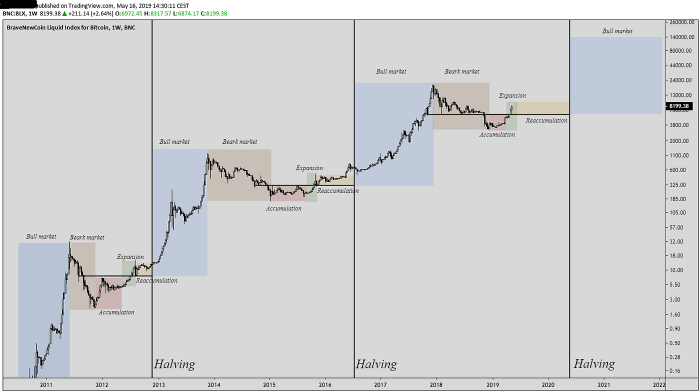

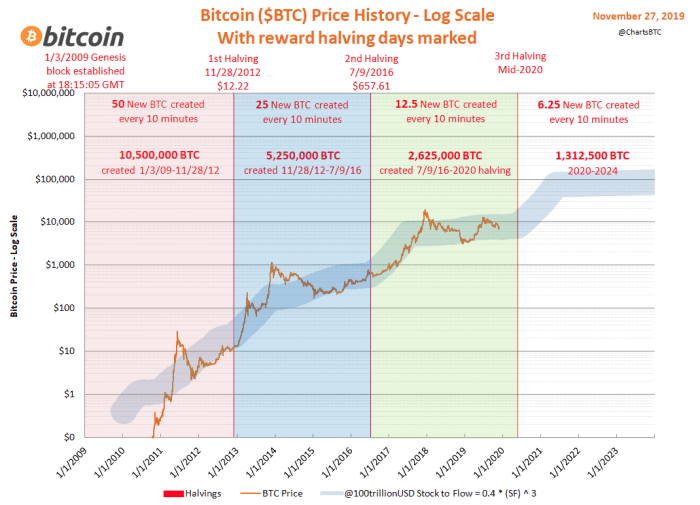

Historical Price Volatility Around Bitcoin Halvings

Past halvings have demonstrably impacted Bitcoin’s price. Analyzing these events reveals patterns of price movement before, during, and after the halving events. A timeline illustrating these price movements provides valuable context for understanding potential future behavior.

| Halving Date | Price Before Halving (approx.) | Price Around Halving (approx.) | Price After Halving (approx.) | Notable Market Events |

|---|---|---|---|---|

| November 28, 2012 | ~$13 | ~$12 – $14 | ~$100+ (within a year) | Relatively low trading volume, early stage of Bitcoin adoption. |

| July 9, 2016 | ~$650 | ~$650 – $700 | ~$20,000+ (within 2 years) | Increased institutional interest, growing mainstream awareness. |

| May 11, 2020 | ~$8,700 | ~$8,000 – $9,000 | ~$64,000+ (within a year) | Increased institutional investment, DeFi boom, growing adoption. |

Note: These prices are approximate and represent general trends. Precise figures vary depending on the exchange and data source.

Factors Influencing Bitcoin Price Volatility Around Halvings

Several factors contribute to the heightened volatility around Bitcoin halvings. These factors interact in complex ways, making precise prediction difficult.

The reduced supply of newly mined Bitcoin is a primary driver. This decreased supply, coupled with relatively stable or increasing demand, can create upward price pressure. However, other market forces, including macroeconomic conditions, regulatory changes, and overall investor sentiment, also play significant roles. For example, the 2020 halving coincided with increased institutional investment and the rise of decentralized finance (DeFi), which contributed to the significant price surge following the event.

Market Sentiment and News Events Impacting Price

Market sentiment surrounding the halving is a powerful force. Positive news and anticipation can drive prices up, while negative news or uncertainty can lead to price drops. Media coverage, analyst predictions, and social media discussions all contribute to the overall sentiment. Significant news events unrelated to Bitcoin, such as global economic downturns or geopolitical instability, can also exert a considerable impact on Bitcoin’s price, particularly during periods of already heightened volatility.

Risks and Opportunities Associated with Investing Around the Halving

Investing in Bitcoin around a halving presents both significant risks and opportunities. The potential for substantial price appreciation is a major draw, but the increased volatility also means the possibility of significant losses.

The risk of a “buy the rumor, sell the news” scenario exists. This refers to the possibility that the price might rise significantly in anticipation of the halving, only to decline after the event as investors take profits. Conversely, the reduced supply could lead to a sustained price increase over the longer term. Diversification, careful risk management, and a long-term investment horizon are crucial considerations for navigating these risks and maximizing potential opportunities.

Preparing for the Bitcoin Halving 2025

The Bitcoin halving, scheduled for 2025, is a significant event that historically has preceded periods of increased price volatility. Understanding this volatility and implementing sound investment strategies are crucial for navigating the market successfully. This section Artikels practical steps investors can take to prepare for this event.

Strategies for Navigating Market Volatility

The Bitcoin halving’s impact on price is not guaranteed, and market reactions vary. However, historical data suggests a potential surge in price following the halving, although this is often followed by corrections. Therefore, a measured approach is essential. Investors should consider dollar-cost averaging (DCA), a strategy that involves investing a fixed amount of money at regular intervals, regardless of price fluctuations. This mitigates the risk of investing a large sum at a market peak. Another approach is to utilize limit orders, setting predetermined buy and sell prices to manage risk and capitalize on potential price movements. Finally, actively monitoring market sentiment and news related to Bitcoin and the broader cryptocurrency market is crucial for informed decision-making.

Risk Management and Portfolio Diversification

Risk management is paramount in any investment, especially in the volatile cryptocurrency market. Diversification is a key component of effective risk management. Investors should not allocate their entire investment portfolio to Bitcoin alone. Diversifying into other asset classes, such as stocks, bonds, or real estate, can help mitigate potential losses should the Bitcoin price decline. Furthermore, within the cryptocurrency space itself, diversification across different cryptocurrencies can reduce overall portfolio risk. For instance, an investor could allocate a portion of their portfolio to altcoins, but careful research and due diligence are essential before investing in any altcoin.

Assessing the Reliability of Bitcoin Price Predictions

Numerous sources offer Bitcoin price predictions, ranging from optimistic forecasts to bearish outlooks. However, it’s crucial to approach these predictions with a healthy dose of skepticism. Many predictions lack a sound methodological basis and are often driven by speculation rather than rigorous analysis. Reliable price predictions typically consider factors such as the halving’s impact on supply, adoption rates, regulatory developments, and macroeconomic conditions. It is wise to focus on understanding the underlying fundamentals of Bitcoin and the factors influencing its price, rather than relying solely on speculative price targets. For example, while some predict a surge to $100,000 after the halving, others suggest a more modest increase, or even a price decrease, based on differing economic scenarios.

Potential Impact of Regulatory Changes

Regulatory developments can significantly impact Bitcoin’s price and market stability. Increased regulatory scrutiny or restrictive measures could lead to price declines, while supportive regulations could potentially boost its value. For instance, the implementation of clear regulatory frameworks in major economies could increase investor confidence and attract institutional investment, potentially driving price appreciation. Conversely, a crackdown on cryptocurrency exchanges or stricter Know Your Customer (KYC) regulations might lead to decreased liquidity and price volatility. Staying informed about regulatory changes and their potential consequences is crucial for informed investment decisions.

Checklist for Preparing for the 2025 Halving

Before the 2025 halving, investors should take the following steps:

- Review and adjust your investment strategy, considering risk tolerance and diversification.

- Develop a clear plan for managing potential market volatility, including DCA or limit orders.

- Research and understand the factors that could influence Bitcoin’s price after the halving.

- Stay informed about regulatory developments and their potential impact on the cryptocurrency market.

- Monitor market sentiment and news related to Bitcoin and the broader cryptocurrency landscape.

- Regularly review and rebalance your portfolio to maintain your desired asset allocation.

Beyond the Price

The Bitcoin halving in 2025, while often discussed through the lens of price volatility, holds far-reaching implications that extend beyond short-term market fluctuations. Understanding these long-term consequences is crucial for navigating the evolving landscape of Bitcoin and its role in the global financial system. The reduced supply of newly mined Bitcoin will undoubtedly impact its adoption, value proposition, and position within the broader cryptocurrency ecosystem.

Dia Do Halving Bitcoin 2025 – The halving event fundamentally alters the dynamics of Bitcoin’s supply and demand. The decreased rate of new Bitcoin entering circulation will likely increase scarcity, potentially driving up its value over time. However, this effect is intertwined with numerous other factors, including macroeconomic conditions, regulatory developments, and technological advancements within the cryptocurrency space.

Understanding Dia Do Halving Bitcoin 2025 requires grasping the global implications of the event. This significant date marks another Bitcoin halving, impacting the cryptocurrency’s inflation rate and potentially its value. For a detailed analysis of this pivotal moment, refer to the comprehensive resource on Bitcoin Halving Day 2025 , which provides valuable insights. Ultimately, understanding this event is crucial for navigating the future of Dia Do Halving Bitcoin 2025 and its consequences.

Bitcoin’s Role as a Store of Value

The halving contributes to Bitcoin’s narrative as a deflationary asset, a characteristic often cited as a key advantage over traditional fiat currencies prone to inflation. This deflationary pressure, coupled with Bitcoin’s limited supply of 21 million coins, could enhance its appeal as a long-term store of value, particularly during periods of economic uncertainty. Historically, halving events have been followed by periods of increased Bitcoin price appreciation, although this is not guaranteed. The 2012 and 2016 halvings, for instance, were followed by significant price increases, bolstering the argument for its store-of-value potential. However, external factors such as regulatory changes or market sentiment could significantly influence the actual outcome.

Bitcoin’s Influence on the Cryptocurrency Market, Dia Do Halving Bitcoin 2025

Bitcoin’s dominance within the cryptocurrency market is undeniable. The halving event is likely to impact the broader crypto landscape. A significant increase in Bitcoin’s price could trigger a positive sentiment ripple effect, potentially boosting the value of other cryptocurrencies. Conversely, a negative response could lead to a broader market correction. The halving’s influence will depend heavily on how the market perceives the event and its impact on Bitcoin’s long-term prospects. The correlation between Bitcoin’s price and altcoin performance varies over time, making precise predictions challenging.

Bitcoin’s Long-Term Growth Potential Compared to Other Asset Classes

Comparing Bitcoin’s long-term growth potential to established asset classes like gold, real estate, or stocks requires a nuanced approach. While gold has historically served as a hedge against inflation, Bitcoin offers a potentially higher growth trajectory due to its technological underpinnings and adoption rate. However, Bitcoin’s volatility remains a significant factor, making it a riskier investment compared to more established assets. Its growth potential is also tied to its continued adoption as a payment method, store of value, and investment asset. The long-term growth of Bitcoin, compared to gold, for example, is highly speculative and depends on numerous economic and technological factors.

Technological Advancements and Bitcoin’s Future Value

Technological advancements, such as the Lightning Network for faster and cheaper transactions, could significantly enhance Bitcoin’s usability and adoption. Improvements in scalability and privacy features could also boost its appeal to a wider range of users and investors. Conversely, the emergence of competing technologies or unforeseen vulnerabilities could negatively impact Bitcoin’s value. The development and adoption of layer-2 scaling solutions, like the Lightning Network, are examples of technological advancements that could positively impact Bitcoin’s future value by addressing its scalability limitations.

Bitcoin Network Security Post-Halving

The halving reduces the reward for Bitcoin miners, potentially impacting the security of the network. A decrease in mining profitability could lead to a consolidation of mining power among larger players, potentially raising concerns about network centralization. However, the Bitcoin network’s inherent design and the continued economic incentive for miners to secure the blockchain are likely to mitigate this risk. The network’s security is fundamentally dependent on the continued participation of miners, who are incentivized by transaction fees and the potential for future price appreciation. A decline in mining profitability could lead to a more concentrated mining landscape, requiring ongoing monitoring of network security.

Frequently Asked Questions about Bitcoin Halving 2025: Dia Do Halving Bitcoin 2025

The Bitcoin halving is a significant event in the cryptocurrency’s lifecycle, impacting its supply and potentially its price. Understanding this event is crucial for anyone interested in Bitcoin’s future. This section addresses common questions surrounding the 2025 halving.

Bitcoin Halving Explained

The Bitcoin halving is a programmed event that reduces the rate at which new Bitcoins are created. Approximately every four years, the reward miners receive for verifying transactions on the Bitcoin blockchain is cut in half. This process is designed to control inflation and maintain the scarcity of Bitcoin. Initially, miners received 50 BTC per block. After the first halving, this dropped to 25 BTC, then to 12.5 BTC, and the next halving in 2025 will reduce it to 6.25 BTC per block.

The Next Bitcoin Halving Date

The next Bitcoin halving is projected to occur around April 2025. The exact date depends on the block time, which can fluctuate slightly. However, the timeframe remains relatively certain due to the predictable nature of Bitcoin’s blockchain.

Bitcoin Halving’s Impact on Price

Historically, Bitcoin’s price has shown a tendency to increase in the period following a halving. The 2012 and 2016 halvings were followed by significant price rallies, though the timing and magnitude of these rallies varied. This price increase is often attributed to the reduced supply of newly mined Bitcoin, increasing its scarcity and potentially driving demand. However, it’s crucial to remember that numerous other factors influence Bitcoin’s price, including market sentiment, regulatory changes, and macroeconomic conditions. Therefore, while historical trends suggest a potential positive impact, it’s not a guaranteed outcome. For example, the 2012 halving led to a price increase from roughly $10 to over $1,000 within the following year. The 2016 halving saw a more gradual increase, eventually reaching nearly $20,000 by late 2017.

Investing in Bitcoin Before the Halving: Risk and Reward

Investing in Bitcoin before a halving presents both significant risks and potential rewards. The risk stems from the inherent volatility of the cryptocurrency market. Price movements can be dramatic and unpredictable, influenced by various factors beyond the halving itself. However, the potential reward lies in the possibility of capital appreciation if the historical trend of post-halving price increases continues. Investors should carefully assess their risk tolerance and only invest what they can afford to lose. Diversification across various asset classes is also a crucial risk management strategy.

Long-Term Implications of the Halving

The long-term implications of the Bitcoin halving extend beyond price fluctuations. The reduced supply of new Bitcoin contributes to its deflationary nature, potentially increasing its value as a store of value over time. This, in turn, could further enhance Bitcoin’s adoption as a digital gold and increase its appeal to both individual investors and institutional players. However, the ultimate impact on Bitcoin’s adoption and value will depend on a confluence of factors, including technological advancements, regulatory developments, and overall market acceptance. For instance, increased adoption could lead to a higher demand and consequently, a higher price, even without considering the halving effect. Conversely, negative regulatory changes could overshadow the halving’s positive influence.

Illustrative Data

Understanding the historical impact of Bitcoin halvings requires examining past events. The data below illustrates the halving events, the resulting changes in block rewards, and the subsequent price movements. While correlation doesn’t equal causation, analyzing this data provides valuable context for considering the potential effects of the 2025 halving. Remember that Bitcoin’s price is influenced by numerous factors beyond just halving events.

The table below presents a summary of past Bitcoin halvings, including the block reward before and after each event, and the approximate Bitcoin price one year prior and one year post-halving. Note that these price figures are approximations and can vary depending on the specific data source and timeframe used.

Bitcoin Halving History Data

| Halving Date | Block Reward Before | Block Reward After | Price 1 Year Before | Price 1 Year After |

|---|---|---|---|---|

| November 28, 2012 | 50 BTC | 25 BTC | ~$13 | ~$120 |

| July 9, 2016 | 25 BTC | 12.5 BTC | ~$650 | ~$4,000+ |

| May 11, 2020 | 12.5 BTC | 6.25 BTC | ~$8,700 | ~$50,000+ |

It’s crucial to remember that these price changes are complex and influenced by a wide array of macroeconomic factors, technological advancements, regulatory changes, and market sentiment. While halvings historically have preceded significant price increases, they are not the sole driver of Bitcoin’s price action. The observed price increases after each halving may be partly attributed to the reduced supply of newly mined Bitcoin, but other factors undoubtedly play a major role.

Visual Representation of Market Sentiment

Understanding the shifts in market sentiment surrounding Bitcoin halvings is crucial for navigating the volatility. A visual representation can effectively communicate the typical patterns observed in the lead-up to and aftermath of these events. This depiction focuses on the general trends, acknowledging that each halving presents unique nuances.

A line graph would be the most suitable visual. The X-axis would represent time, spanning several months before and after a halving event. The Y-axis would represent a composite sentiment score, derived from a combination of metrics such as social media sentiment analysis, Google Trends data for Bitcoin-related searches, and the overall market capitalization of Bitcoin. The scale of the Y-axis could range from -1 (extremely bearish) to +1 (extremely bullish), with 0 representing neutral sentiment.

Pre-Halving Sentiment

The line on the graph would generally show a gradual increase in bullish sentiment in the months leading up to the halving. This upward trend reflects the anticipation of reduced supply and its potential impact on price. However, the slope of the line would likely not be consistently steep; there might be periods of slight dips or corrections reflecting market uncertainty or profit-taking. These dips would be temporary, with the overall trend remaining upward. The anticipation surrounding the halving would likely overshadow short-term price fluctuations.

Post-Halving Sentiment

Immediately following the halving, the graph would show a period of high volatility. The line could initially surge upwards reflecting immediate bullish reactions, but it could quickly dip as investors who bought at higher prices might start selling to secure profits. This would create a period of uncertainty reflected by a fluctuating line, often showing a temporary bearish dip. However, over the longer term (months after the event), the graph would typically show a slow, upward climb as the reduced supply begins to impact price, leading to a gradual return to a bullish sentiment. The overall long-term trend after the halving would usually be positive, although the timeline for this positive trend to materialize can vary considerably.

Comparison Across Halvings

To enhance the visualization, multiple lines could be overlaid on the graph, each representing a different Bitcoin halving event. This would allow for a direct comparison of sentiment shifts across different halving cycles. This comparison would highlight similarities and differences in the timing and magnitude of sentiment changes, offering valuable insights into the predictability (or lack thereof) of market reactions. Color-coding each line by halving year would aid in readability and comprehension.

The Bitcoin halving in 2025, Dia Do Halving Bitcoin 2025, is a significant event for the cryptocurrency’s future. Understanding its impact requires looking ahead to the next reduction in Bitcoin’s block reward, which you can learn more about by visiting this resource on the Next Bitcoin Halving After 2025. This forward-looking perspective helps contextualize the long-term implications of the 2025 halving for Dia Do Halving Bitcoin 2025 and beyond.

The Bitcoin halving in 2025, or “Dia Do Halving Bitcoin 2025,” is a significant event for the cryptocurrency’s future. Understanding the mechanics behind this reduction in Bitcoin’s block reward is crucial, and for a deeper dive into the specifics, you can check out this excellent resource on the Halving De Bitcoin 2025. This analysis will help you better grasp the potential implications of Dia Do Halving Bitcoin 2025 on the overall market.

The anticipation surrounding Dia Do Halving Bitcoin 2025 is palpable within the crypto community. Understanding the implications of this event requires a comprehensive understanding of the halving cycle, and for further insights into the specifics, you might find the resource on Bitcoin Halving 2025 Daye beneficial. This resource provides valuable context for appreciating the significance of Dia Do Halving Bitcoin 2025 and its potential market effects.

The anticipation surrounding Dia Do Halving Bitcoin 2025 is palpable, with many speculating on its market impact. A key event leading up to this is the Bitcoin reward halving, scheduled for April 2025, as detailed in this insightful article: Bitcoin April 2025 Halving. Understanding this halving is crucial for predicting the potential consequences for Dia Do Halving Bitcoin 2025 and its subsequent effects on the cryptocurrency market.

The halving’s impact will undoubtedly shape the narrative surrounding Dia Do Halving Bitcoin 2025.

The Bitcoin halving in 2025, or “Dia Do Halving Bitcoin 2025” as it might be called in some regions, is a significant event for the cryptocurrency. Understanding its potential impact requires considering various factors, including the projected price changes. To explore this further, you might find this resource helpful: What Is The Price Prediction For Bitcoin Halving 2025.

Ultimately, the price prediction will influence how investors approach Dia Do Halving Bitcoin 2025 and its aftermath.