Mining and the 2025 Halving

The Bitcoin halving, scheduled for 2025, is a significant event that will dramatically alter the economics of Bitcoin mining. This event, which occurs approximately every four years, reduces the reward miners receive for successfully adding new blocks to the blockchain by half. This reduction in block rewards directly impacts miners’ profitability and necessitates adjustments to their operations.

The halving’s effect on miner profitability is straightforward: reduced block rewards mean less revenue per block mined. To maintain profitability, miners must either reduce their operating costs or increase their hashing power to secure a larger share of the reduced block rewards. This often leads to a period of consolidation within the mining industry, with less efficient miners forced to shut down operations or upgrade their equipment. The resulting decrease in the number of active miners can, in turn, impact the security and stability of the Bitcoin network, although this effect is typically mitigated by the increased efficiency and scale of the remaining miners.

Miner Profitability and Responses After Previous Halvings

The 2012, 2016, and 2020 halvings provide valuable insights into the industry’s response to reduced block rewards. Following each halving, there was an initial period of decreased profitability, leading to some miners exiting the market. However, the price of Bitcoin often increased in the aftermath of these events, offsetting the reduced block rewards and ultimately leading to increased overall mining profitability. This price increase is attributed to a combination of factors, including reduced supply and increased demand. For example, after the 2020 halving, the price of Bitcoin experienced a significant surge, demonstrating the resilience of the market and the potential for increased profitability despite the reduced reward. Miners adapted by improving their efficiency, consolidating operations, and focusing on lower energy costs.

Shifts in Mining Hardware and Energy Consumption

Halvings often accelerate innovation in mining hardware. The need to maintain profitability under reduced rewards drives the development of more energy-efficient and powerful ASICs (Application-Specific Integrated Circuits). The competition to secure the next block encourages miners to constantly seek out the most efficient hardware, leading to a cyclical process of upgrading and replacing older, less efficient equipment. This continuous improvement in hardware efficiency can partially offset the impact of reduced block rewards. However, this also implies a continuous need for significant energy consumption, even if the energy usage per unit of hash rate is decreasing.

Environmental Implications of Bitcoin Mining

The environmental impact of Bitcoin mining is a complex and often debated topic. The energy consumption of the Bitcoin network is substantial, primarily due to the computational power required for mining. The halving, while not directly reducing the total energy consumption, can indirectly influence it. The exit of less efficient miners after a halving might lead to a slight reduction in overall energy usage. However, this is often offset by the increased hashing power of the remaining miners who upgrade their equipment or invest in more efficient technologies. The long-term sustainability of Bitcoin mining hinges on the adoption of renewable energy sources and further advancements in hardware efficiency to reduce the overall environmental footprint. The industry is increasingly recognizing the need for sustainable practices, with many large mining operations exploring and implementing renewable energy solutions. The shift towards sustainable energy is crucial for the long-term viability and environmental responsibility of Bitcoin mining.

Investor Sentiment and Market Behavior

The Bitcoin halving, a pre-programmed event reducing the rate of new Bitcoin creation, significantly impacts investor sentiment and subsequent market behavior. The anticipation leading up to the event, coupled with the actual halving itself, often creates periods of heightened volatility and speculation. Understanding these psychological and market dynamics is crucial for navigating the investment landscape surrounding this significant event.

The psychological impact of the halving is multifaceted. The reduced supply of newly mined Bitcoin often fuels a narrative of scarcity, potentially driving up demand and price. This narrative is amplified by the belief among many investors that the halving is a historically significant bullish catalyst. Conversely, some investors view the halving with skepticism, believing that the market has already priced in the anticipated effects or that other macroeconomic factors will outweigh the impact of the halving. This divergence in opinion often leads to significant price swings.

Past Investor Behavior Around Bitcoin Halvings, Fecha Halving Bitcoin 2025

Past Bitcoin halvings have exhibited a range of investor behaviors. The 2012 halving saw a relatively subdued market reaction, followed by a significant price increase in the subsequent year. The 2016 halving led to a more pronounced price surge, though it wasn’t immediate. The 2020 halving also resulted in a notable price increase, albeit after a period of consolidation and price fluctuations. These diverse reactions highlight the complexity of predicting market behavior, even with a known event like the halving. While historical data suggests a potential positive correlation between halvings and price appreciation, it’s crucial to recognize that other factors, including regulatory changes, macroeconomic conditions, and overall market sentiment, play significant roles.

Potential Investment Strategies Considering the Halving

Several investment strategies might be considered in the context of the 2025 halving. Long-term investors might view the halving as an opportunity to accumulate Bitcoin at potentially lower prices before a predicted price increase. This strategy relies on the belief that the scarcity driven by the halving will outweigh other market pressures. Short-term traders might attempt to profit from the volatility surrounding the halving, using technical analysis to identify potential entry and exit points. However, this strategy carries a higher risk due to the potential for sharp price swings. Dollar-cost averaging, a strategy of investing a fixed amount of money at regular intervals, can help mitigate the risk associated with market volatility. This approach reduces the impact of buying at peak prices. Diversification across different asset classes is also a crucial aspect of risk management.

Halving’s Effect on Different Investor Groups

The Bitcoin halving impacts different investor groups differently. Long-term holders (HODLers) often remain unaffected by short-term price fluctuations, focusing on the long-term value proposition of Bitcoin. They may view the halving as a positive development, reinforcing their conviction in Bitcoin’s long-term potential. Short-term traders, on the other hand, are more sensitive to price fluctuations and may engage in more frequent buying and selling around the halving. Their strategies are heavily influenced by technical analysis and short-term market trends. Institutional investors, with their greater resources and risk tolerance, may adopt different strategies, potentially using the halving as an opportunity to increase their Bitcoin holdings or implement sophisticated hedging strategies. Retail investors, with often limited resources, may be more influenced by market sentiment and news, potentially leading to impulsive buying or selling decisions.

Regulatory Landscape and its Influence

The 2025 Bitcoin halving, while a significant on-chain event, will unfold within a complex and evolving regulatory environment. Government actions worldwide will significantly influence Bitcoin’s price and adoption trajectory, potentially amplifying or dampening the halving’s effects. Understanding this interplay is crucial for navigating the market effectively.

The impact of regulatory changes on the Bitcoin halving is multifaceted. Increased regulatory scrutiny could suppress price volatility in the short term by reducing speculative trading, while conversely, a more permissive environment might encourage greater investment and price appreciation. However, overly restrictive regulations could hinder innovation and adoption, ultimately negatively impacting Bitcoin’s long-term growth potential. The halving itself, by reducing the rate of new Bitcoin issuance, could trigger increased institutional interest, potentially attracting regulatory attention and shaping future policy decisions.

Regulatory Environments Across Jurisdictions

Bitcoin’s regulatory status varies significantly across different countries. Some jurisdictions, such as El Salvador, have embraced Bitcoin as legal tender, creating a favorable environment for adoption and potentially boosting its value. In contrast, others maintain strict prohibitions on Bitcoin trading or usage, limiting its accessibility and potential growth. Many countries fall somewhere in between, with varying degrees of regulation that influence the ease of access, taxation, and overall legal standing of Bitcoin within their borders. These differences create a complex global landscape, affecting both the flow of capital into Bitcoin and its overall market stability. For instance, the regulatory clarity (or lack thereof) in the United States directly impacts institutional investment decisions and consequently, the price of Bitcoin. Meanwhile, the relatively relaxed regulations in some parts of Europe attract different types of investors and businesses.

Challenges and Opportunities for Bitcoin Adoption

Regulatory uncertainty presents a significant challenge to Bitcoin adoption. Clear and consistent regulations are needed to encourage institutional investment and protect consumers from fraud. Conversely, overly burdensome or inconsistent regulations can stifle innovation and limit accessibility, hindering broader adoption. Opportunities arise when regulatory frameworks promote transparency, protect investor rights, and provide a level playing field for businesses operating within the Bitcoin ecosystem. For example, the development of clear tax guidelines can encourage participation from businesses and high-net-worth individuals. Similarly, well-defined KYC/AML (Know Your Customer/Anti-Money Laundering) procedures can increase investor confidence and reduce the risk of illicit activities, thereby attracting institutional investment.

Scenario Analysis of Regulatory Outcomes

Several scenarios can be envisioned concerning the interplay between regulation and the 2025 halving. In a scenario of increased global regulatory clarity and harmonization, the halving could lead to a sustained increase in Bitcoin’s price, driven by increased institutional investment and broader adoption. This would be akin to the gradual acceptance of the internet in the 1990s, leading to a period of growth and stabilization. Conversely, a scenario of increased regulatory crackdowns in major markets could result in short-term price volatility and potentially a longer-term negative impact on adoption, mirroring the dot-com bubble burst. A third scenario involves a fragmented regulatory landscape, where different jurisdictions adopt vastly different approaches, creating market uncertainty and potentially limiting the overall impact of the halving. This would be similar to the current state of global financial regulation, where various jurisdictions have different banking standards. The eventual outcome will depend on the specific actions taken by governments worldwide and the adaptability of the Bitcoin ecosystem to these changes.

The 2025 Halving and the Broader Crypto Market

The Bitcoin halving, a significant event in the cryptocurrency world, doesn’t exist in a vacuum. Its impact extends far beyond Bitcoin itself, influencing the broader crypto market and the performance of altcoins. Understanding these ripple effects is crucial for investors navigating the evolving landscape. This section explores the historical relationship between Bitcoin and altcoins around previous halvings, analyzes potential opportunities and risks for altcoin investors in 2025, and suggests a diversification strategy.

Ripple Effects on Other Cryptocurrencies

Historically, Bitcoin halvings have often been followed by periods of increased volatility across the entire cryptocurrency market. While Bitcoin’s price typically sees a surge leading up to and following the event, this price action doesn’t always translate directly to altcoins. Sometimes altcoins experience a “bull run” mirroring Bitcoin’s gains, other times they lag behind or even experience price declines. The extent of the correlation between Bitcoin and altcoins varies considerably depending on market sentiment, macroeconomic factors, and the specific characteristics of each altcoin. For example, the 2016 halving saw a significant increase in the price of Bitcoin, followed by a rally in many altcoins, while the 2020 halving showed a more complex pattern with altcoins exhibiting varying degrees of correlation with Bitcoin’s price.

Market Correlations Before and After Past Halvings

Analyzing historical data reveals a complex relationship between Bitcoin and altcoin price movements around halving events. Prior to a halving, we often see a period of anticipation and speculation, which can lead to increased price volatility in both Bitcoin and altcoins. Post-halving, the correlation between Bitcoin and altcoins can either strengthen or weaken, depending on various factors such as the overall market sentiment, regulatory developments, and the adoption of specific altcoins. For instance, during the period immediately following the 2012 halving, many altcoins experienced significant price increases, demonstrating a strong positive correlation with Bitcoin. However, the correlation wasn’t as pronounced following the 2016 and 2020 halvings, indicating a shift in market dynamics. The correlation coefficients calculated from historical data can vary considerably depending on the time window considered and the specific altcoins analyzed. This highlights the need for a nuanced understanding of market behavior.

Opportunities and Risks for Altcoin Investors

The 2025 halving presents both opportunities and risks for altcoin investors. On the one hand, the increased attention and potential price appreciation of Bitcoin could spill over into the altcoin market, creating opportunities for substantial gains. However, this also carries significant risks. The altcoin market is notoriously volatile, and a sudden downturn in Bitcoin’s price could trigger a sharp correction in altcoin values. Moreover, the increased competition within the altcoin space, coupled with potential regulatory uncertainty, adds another layer of complexity. Investors need to carefully assess the fundamentals of each altcoin, including its technology, team, and market adoption, before making any investment decisions. For example, altcoins with strong fundamentals and real-world applications might be less susceptible to market downturns than those lacking clear utility or driven primarily by hype.

Diversifying Cryptocurrency Holdings

A diversified portfolio is crucial for mitigating risk during periods of market uncertainty, especially around events like the 2025 halving. A balanced approach could involve allocating a portion of your portfolio to Bitcoin, recognizing its established market dominance and relative stability, while also diversifying into a selection of altcoins with strong fundamentals and potential for growth. This diversification should not only consider the potential for price appreciation but also take into account factors such as market capitalization, technology, and risk tolerance. For instance, one could allocate 50% to Bitcoin, 25% to established altcoins with a proven track record (like Ethereum or Solana), and 25% to promising newer projects, carefully vetting each investment. The specific allocation will depend on individual risk tolerance and investment goals. It’s important to remember that diversification doesn’t eliminate risk, but it can significantly reduce its impact.

Frequently Asked Questions about the Bitcoin Halving in 2025

The Bitcoin halving is a significant event in the cryptocurrency world, occurring approximately every four years. It’s a programmed reduction in the rate at which new Bitcoins are created, impacting the supply and potentially influencing the price. Understanding this event is crucial for anyone involved in or considering investing in Bitcoin.

Bitcoin Halving Explained

A Bitcoin halving is a pre-programmed event in the Bitcoin protocol that cuts the reward given to Bitcoin miners in half for successfully verifying and adding new blocks of transactions to the blockchain. This happens roughly every 210,000 blocks, which translates to approximately four years. The halving mechanism is designed to control Bitcoin’s inflation rate and maintain its scarcity over time. The initial reward was 50 BTC per block; after the first halving, it became 25 BTC, then 12.5 BTC, and the next halving in 2025 will reduce it to 6.25 BTC.

The Halving’s Effect on Bitcoin’s Price

Historically, Bitcoin halvings have been followed by periods of significant price increases. The first halving in 2012 saw a gradual price rise over the following year. The second halving in 2016 was followed by a substantial price surge in 2017. However, it’s crucial to note that correlation doesn’t equal causation. Other market factors, such as increased adoption, regulatory changes, and macroeconomic conditions, also significantly influence Bitcoin’s price. Predicting the exact impact of the 2025 halving is impossible; some analysts anticipate a price surge, while others suggest a more muted response or even a temporary price dip before a subsequent rise, mirroring the patterns seen after previous halvings. The price movement depends on a confluence of factors, not solely the halving itself. For example, the 2020 halving was followed by a significant price increase in 2021, but that increase was also influenced by factors like increased institutional investment and growing mainstream adoption.

Timing of the 2025 Bitcoin Halving

While the exact date isn’t precisely known until the block count reaches 700,000, estimations based on current block times place the 2025 Bitcoin halving sometime in the first half of the year. It’s a dynamic event that depends on the ongoing rate of block generation, which can fluctuate slightly. Precise prediction is challenging, but it’s expected to occur within a narrow timeframe around the middle of the year.

Investing in Bitcoin Before or After the Halving

Investing in Bitcoin, like any other asset, carries inherent risks. The halving is a significant event, but it’s not a guaranteed predictor of future price movements. Investing before the halving could potentially lead to higher returns if the historical trend of price increases following halvings repeats. However, there’s a risk of price correction or stagnation if market sentiment turns negative. Investing after the halving might seem less risky as some price increase is expected, but you would miss out on potential gains had you invested earlier. Thorough research, risk assessment, and a long-term investment strategy are crucial, regardless of the halving. Consider diversification and only invest what you can afford to lose. The decision to invest before or after the halving is highly personal and depends on individual risk tolerance and investment goals.

Illustrative Data Representation (Table)

Analyzing historical Bitcoin halving events provides valuable insights into potential market reactions. The table below summarizes key data points from previous halvings, allowing for a comparative analysis of the block reward reduction’s impact on Bitcoin’s price. It’s crucial to remember that past performance is not indicative of future results, and many other factors influence Bitcoin’s price.

Fecha Halving Bitcoin 2025 – The data presented represents a simplified view. Numerous economic and geopolitical events also affect Bitcoin’s price trajectory, making precise predictions challenging. While this table offers a helpful historical overview, it’s vital to consider the broader context when interpreting the data.

Bitcoin Halving Statistics

| Date | Block Reward Before Halving (BTC) | Block Reward After Halving (BTC) | Bitcoin Price 1 Year Before Halving (USD) | Bitcoin Price 1 Year After Halving (USD) |

|---|---|---|---|---|

| November 28, 2012 | 50 | 25 | 13.45 | 123.82 |

| July 9, 2016 | 25 | 12.5 | 650.39 | 4,356.66 |

| May 11, 2020 | 12.5 | 6.25 | 8,705.81 | 9,044.91 |

Illustrative Data Representation (Visual): Fecha Halving Bitcoin 2025

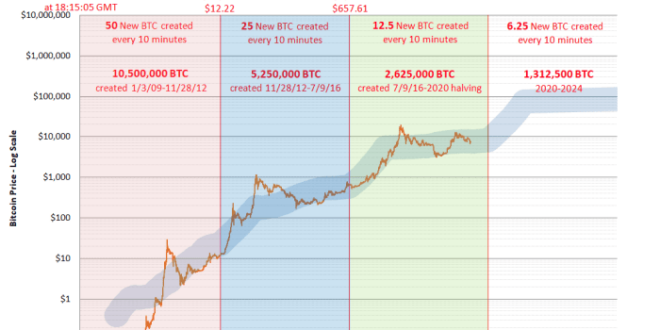

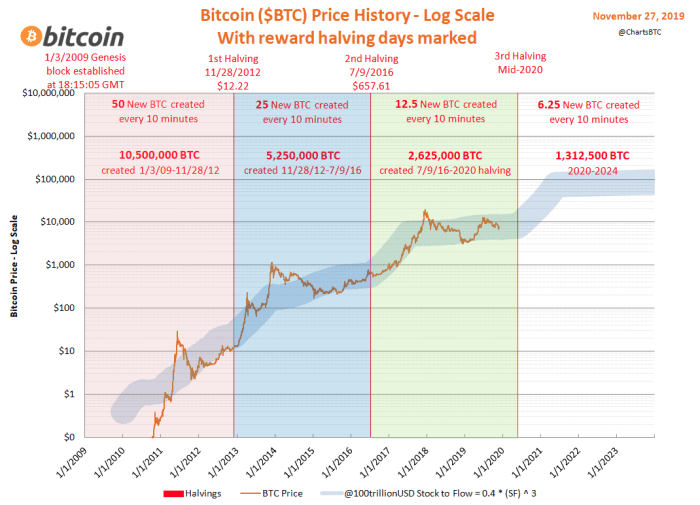

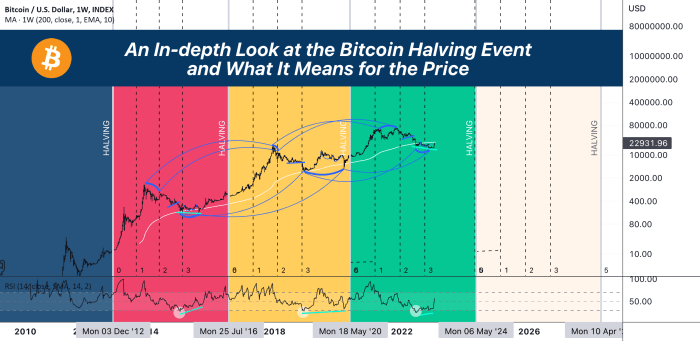

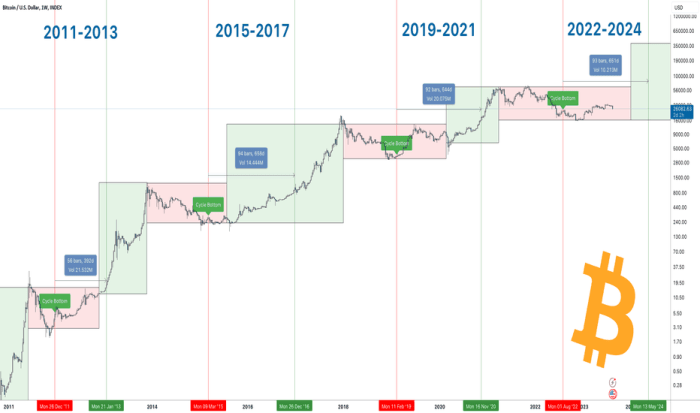

A visual representation of the historical relationship between Bitcoin halvings and subsequent price movements offers valuable insights into potential market reactions to the 2025 halving. While correlation doesn’t equal causation, analyzing past trends can inform expectations, albeit with the crucial understanding that future performance is not guaranteed. The following description details a graph depicting this relationship.

The graph would display Bitcoin’s price (on the y-axis, represented in USD) against time (on the x-axis, measured in years). Each halving event would be clearly marked on the x-axis with a vertical line. The price data would encompass the period from Bitcoin’s inception to the present day, allowing for a comprehensive view of historical performance around halving events. A legend would differentiate Bitcoin’s price line from the vertical lines representing halving events.

Bitcoin Halving Events and Price Movements

The graph would likely show a characteristic pattern. Prior to each halving, the price might exhibit a period of relative stability or even a slight decline, followed by a significant price increase in the months and years following the event. This increase could be attributed to the reduced supply of newly mined Bitcoin, potentially increasing its scarcity and driving demand. The post-halving price surge wouldn’t necessarily be immediate or uniform; it might involve periods of volatility and consolidation before reaching a new peak. The magnitude of the price increase following each halving may vary, reflecting the influence of other market factors beyond the halving itself, such as overall economic conditions, regulatory changes, and investor sentiment. For instance, the price increase following the 2012 halving was significantly less dramatic than the one following the 2016 halving, highlighting the influence of external market dynamics. The graph would visually demonstrate these variations, illustrating the complexity of the relationship between halving events and price movements. The overall shape of the graph would be a series of upward trending segments punctuated by periods of price consolidation or even correction, each segment generally starting near a halving event. The graph would serve as a powerful visual tool to highlight the historical correlation, emphasizing that past performance is not indicative of future results.