Bitcoin Halving 2025: Halving 2025 Bitcoin

The Bitcoin halving, a pre-programmed event reducing the rate of newly mined Bitcoin by half, is anticipated in 2025. This event has historically been associated with significant shifts in Bitcoin’s price and market sentiment, making it a crucial factor for investors and analysts alike. Understanding the historical impact, potential economic influences, and a comparison to previous halvings is vital for assessing its likely effect in 2025.

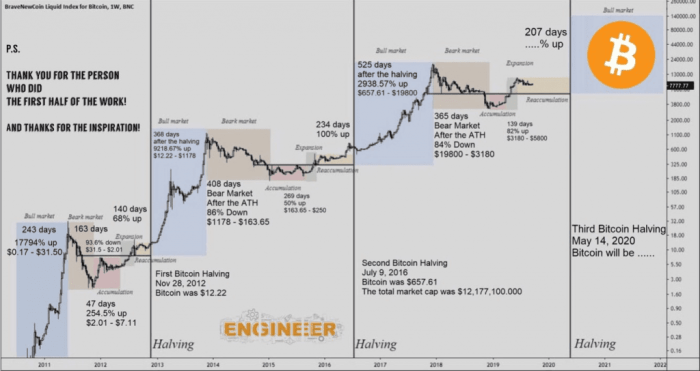

Historical Impact of Previous Halvings

The previous Bitcoin halvings, in 2012, 2016, and 2020, each demonstrated a distinct impact on price and market sentiment. While the immediate post-halving price movements have varied, a consistent trend emerges over the longer term: a gradual price increase following the event. The 2012 halving saw a subsequent price surge, though the market was still relatively nascent. The 2016 halving preceded a significant bull run, and the 2020 halving, occurring during a period of increasing institutional adoption, contributed to another notable price appreciation. However, it’s crucial to note that numerous other factors, including regulatory changes, technological advancements, and macroeconomic conditions, also played significant roles in these price movements. Attributing price changes solely to the halving would be an oversimplification.

Economic Factors Influencing the 2025 Halving

Several economic factors could influence the 2025 halving’s impact. Global macroeconomic conditions, particularly inflation rates and interest rate policies by central banks, will significantly impact investor sentiment and risk appetite towards Bitcoin. The regulatory landscape surrounding cryptocurrencies in major jurisdictions will also play a crucial role. Increased institutional adoption, the maturation of the Bitcoin ecosystem, and the development of new Bitcoin-related financial instruments could further affect the market’s response to the halving. The overall state of the global economy, including any potential recessions or periods of economic uncertainty, will also likely influence investor behavior and Bitcoin’s price.

Comparison of Market Conditions Leading Up to Previous Halvings

The market conditions leading up to the 2025 halving differ significantly from previous events. The cryptocurrency market is now far more mature and regulated than it was in 2012, 2016, or even 2020. Institutional investment in Bitcoin has grown substantially, representing a new dynamic not seen in previous cycles. The overall market capitalization of cryptocurrencies is also vastly larger. This increased maturity and institutional involvement could lead to a more measured and less volatile response to the halving compared to past cycles, although this is not guaranteed.

Potential Short-Term and Long-Term Price Implications

The short-term price impact of the 2025 halving is difficult to predict with certainty. Some analysts anticipate a short-term price increase driven by anticipation and speculation. However, this could be followed by a period of consolidation or even a temporary price correction as the market absorbs the reduced supply. The long-term price implications are more likely to be positive, given the historical precedent and the reduced inflation rate resulting from the halving. However, the magnitude of this long-term price appreciation will heavily depend on the aforementioned economic factors and overall market sentiment. For example, a global economic downturn could significantly dampen the positive impact of the halving.

Timeline of Key Events Surrounding the 2025 Halving, Halving 2025 Bitcoin

The following timeline illustrates key events expected to influence the 2025 Bitcoin halving:

Halving 2025 Bitcoin – A year before the halving (2024): Increased market speculation begins, potentially driving price increases.

Six months before the halving (Mid-2024): Major market players start adjusting their strategies in anticipation of the event.

One month before the halving (Early 2025): Volatility increases as the halving date approaches.

Bitcoin Halving (2025): The block reward is halved, potentially triggering short-term price volatility.

Six months after the halving (Late 2025): The market begins to assess the long-term impact of the halving on price and supply.

One year after the halving (2026): The long-term effects of the halving on price and market sentiment become more apparent.