Bitcoin Halving 2025

The Bitcoin halving is a significant event in the cryptocurrency’s lifecycle, programmed into its code to reduce the rate at which new Bitcoins are created. This process, occurring approximately every four years, fundamentally alters the supply dynamics of Bitcoin and has historically been correlated with periods of price appreciation. Understanding the mechanics and potential impact of the 2025 halving is crucial for anyone involved in the cryptocurrency market.

Bitcoin Halving Mechanics and Historical Impact, Halving Bitcoin 2025

The Bitcoin halving mechanism reduces the reward miners receive for validating transactions and adding new blocks to the blockchain by half. Initially, the reward was 50 BTC per block. After the first halving in 2012, it dropped to 25 BTC, then to 12.5 BTC in 2016, and currently stands at 6.25 BTC. Each halving effectively slows down the rate of Bitcoin inflation. Historically, halvings have been followed by periods of increased Bitcoin price, though the magnitude and duration of these price increases have varied. The 2012 and 2016 halvings were both followed by substantial price rallies, though other market factors undoubtedly played a role. It’s important to remember correlation does not equal causation; while historical data suggests a positive relationship, future price movements are not guaranteed.

Bitcoin Halving 2025: Date and Specifics

The 2025 Bitcoin halving is anticipated to occur around April 2025. This is an estimated date based on the block generation time, which can fluctuate slightly. The specific block height at which the halving occurs is predetermined by the Bitcoin protocol. Once this block is mined, the reward for miners will decrease from 6.25 BTC to 3.125 BTC per block. This reduction in the rate of new Bitcoin entering circulation is the core event of the halving.

Anticipated Effects on Supply and Demand

The 2025 halving is expected to impact Bitcoin’s supply and demand dynamics. The reduction in the rate of new Bitcoin creation will decrease the inflation rate, potentially leading to increased scarcity. If demand remains constant or increases, this scarcity could exert upward pressure on the price. Conversely, if demand weakens, the price impact might be less pronounced or even negative. The interplay of various market factors, including regulatory changes, macroeconomic conditions, and overall investor sentiment, will ultimately determine the actual price effect. For example, the 2020 halving coincided with a period of increasing institutional adoption and broader market interest, contributing to a significant price increase. However, the 2012 and 2016 halvings saw different market conditions and subsequent price movements.

Price Predictions and Market Sentiment

The 2025 Bitcoin halving is a significant event anticipated to impact Bitcoin’s price, generating considerable discussion and speculation regarding its potential effects on the cryptocurrency market. Analyzing various prediction models and understanding the prevailing market sentiment is crucial for navigating this period of uncertainty. This analysis will examine different approaches to price prediction, the current market mood, and the influence of macroeconomic factors.

Predicting Bitcoin’s price after any event, let alone a halving, is inherently challenging due to the asset’s volatility and the complexity of the factors influencing its value. However, various models attempt to forecast future prices, each with its strengths and limitations.

Price Prediction Models

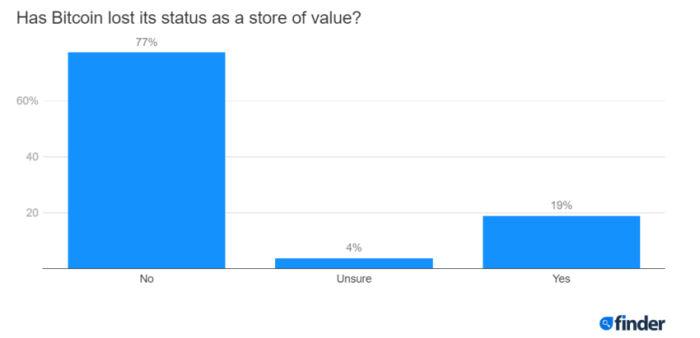

Several methodologies exist for predicting Bitcoin’s price following the 2025 halving. These models range from simple extrapolations of historical price movements to complex quantitative analyses incorporating on-chain metrics, macroeconomic indicators, and even sentiment analysis. One common approach involves analyzing past halving cycles and extrapolating price trends. For example, observing the price increases following the 2012 and 2016 halvings might inform predictions for 2025. However, this method assumes past performance will repeat, neglecting the influence of evolving market conditions and technological advancements. Other models incorporate on-chain data such as transaction volume, mining difficulty, and the number of active addresses, aiming to gauge network activity and its correlation with price. Sophisticated quantitative models might combine these factors with macroeconomic indicators such as inflation rates and interest rates, recognizing their potential impact on Bitcoin’s perceived value as a store of value or hedge against inflation. These models often rely on complex statistical techniques and require significant computational power. It’s crucial to remember that no model is perfect; each carries inherent uncertainties and limitations.

Market Sentiment Analysis

The prevailing market sentiment surrounding the 2025 halving is largely optimistic, with many anticipating a significant price increase. This sentiment is fueled by the historical correlation between halvings and subsequent price rallies. However, this optimism isn’t universally shared. Some analysts caution against overly bullish predictions, citing the potential for regulatory uncertainty, macroeconomic instability, or simply market corrections to dampen any price surge. The sentiment is reflected in the discourse within the cryptocurrency community, with discussions ranging from highly speculative price targets to more cautious assessments of the market’s overall health. Social media sentiment analysis tools, while not perfect predictors, offer insights into the prevailing mood and can indicate potential shifts in investor behavior. For example, a sudden surge in negative sentiment might foreshadow a price correction, while sustained positive sentiment could indicate continued investment and price growth.

Macroeconomic Factors and Bitcoin Price

Macroeconomic factors play a significant role in influencing Bitcoin’s price, and their impact will likely be amplified following the 2025 halving. Factors such as inflation, interest rates, and geopolitical events can significantly influence investor behavior and capital flows into cryptocurrencies. For instance, periods of high inflation might drive investors towards Bitcoin as a hedge against inflation, potentially increasing demand and price. Conversely, rising interest rates might reduce investment in riskier assets like Bitcoin, leading to a price decline. Geopolitical instability can also trigger capital flight into safe-haven assets, potentially impacting Bitcoin’s price, depending on whether it’s viewed as a safe haven or a risky investment during times of uncertainty. The interplay between these macroeconomic forces and the halving’s impact on Bitcoin’s supply is complex and difficult to predict with certainty. Consider the 2022 bear market, which was heavily influenced by rising interest rates and global economic uncertainty, despite the previous halving. This highlights the importance of considering macroeconomic context when evaluating Bitcoin price predictions.

Mining and Hashrate Implications

The 2025 Bitcoin halving, reducing the block reward by half, will significantly impact Bitcoin mining profitability and the network’s hashrate. This event will trigger a cascade of adjustments within the mining ecosystem, influencing both the short-term and long-term health and security of the Bitcoin network. Understanding these implications is crucial for assessing the future of Bitcoin.

The halving directly cuts the primary revenue stream for miners. This reduction in block rewards will likely lead to decreased profitability, forcing miners to re-evaluate their operations. The extent of this impact will depend on factors such as the Bitcoin price, electricity costs, and the efficiency of mining hardware. A sustained low Bitcoin price after the halving could cause a significant drop in mining profitability, potentially leading to a decline in the network’s hashrate.

Miner Responses to Reduced Profitability

Miners will employ various strategies to adapt to lower profitability. Some may choose to shut down less efficient mining operations, focusing resources on their most profitable machines. Others may seek to optimize their energy consumption, exploring cheaper electricity sources or implementing more energy-efficient mining techniques. The adjustment of mining difficulty, an inherent mechanism of the Bitcoin protocol, will also play a role. As profitability decreases, less powerful miners will be forced out, leading to a natural increase in the average computational power of remaining miners. This process ultimately adjusts the mining difficulty, ensuring the block generation time remains consistent, approximately ten minutes. This difficulty adjustment is a crucial element in maintaining the network’s security and stability. Additionally, some miners may explore alternative revenue streams, such as offering services like Bitcoin node operation or participating in Lightning Network transactions.

Impact on Hashrate

The halving’s impact on the hashrate is a complex interplay of various factors. While reduced profitability may initially lead to a decrease in the hashrate, the long-term effect is less predictable. The hashrate is a measure of the total computational power dedicated to securing the Bitcoin network. A substantial drop in hashrate could theoretically compromise network security, making it vulnerable to attacks. However, historical data from previous halvings suggests that the hashrate typically recovers and even surpasses previous levels over time, driven by factors such as technological advancements in mining hardware and the anticipation of future price appreciation. For instance, the 2020 halving initially caused a minor hashrate dip, followed by a significant increase in subsequent months. This pattern suggests a resilience within the mining ecosystem to adapt to these cyclical events.

Long-Term Implications for Decentralization and Security

The halving’s long-term effects on decentralization and security are intertwined. A significant drop in hashrate could potentially concentrate mining power in the hands of a few large-scale operations, potentially threatening decentralization. Conversely, if smaller miners are forced out, this could lead to a more centralized network, potentially making it more vulnerable to attacks from entities with significant computing resources. However, technological advancements in mining hardware and software could mitigate this risk by lowering the barrier to entry for smaller miners, thereby promoting a more distributed network. Ultimately, the balance between these competing forces will determine the long-term impact of the halving on the decentralization and security of the Bitcoin network. The successful adaptation of miners to reduced profitability, coupled with technological advancements, could result in a more robust and secure network, even after a temporary decrease in hashrate.

Impact on Bitcoin Adoption and Usage

The 2025 Bitcoin halving, reducing the rate of new Bitcoin creation, is anticipated to significantly influence Bitcoin’s adoption and usage as both a payment method and a store of value. The resulting scarcity could drive price appreciation, potentially making it less attractive for everyday transactions but more appealing as a long-term investment. However, other factors, including technological advancements and regulatory changes, will play crucial roles in shaping the overall impact.

The halving’s effect on Bitcoin’s adoption hinges on a complex interplay of economic incentives and practical usability. Increased price volatility following a halving, while potentially beneficial for long-term holders, could deter merchants from accepting Bitcoin due to the risk of price fluctuations impacting their profit margins. Conversely, a sustained price increase could attract new users seeking to capitalize on its perceived value appreciation, leading to increased adoption as a store of value.

Bitcoin as a Payment Method

The halving’s impact on Bitcoin’s use as a payment method is multifaceted. While higher prices might reduce its appeal for everyday transactions due to transaction fees and price volatility, the potential for increased price appreciation could encourage the development and adoption of second-layer scaling solutions like the Lightning Network. The Lightning Network, a faster and cheaper payment system built on top of Bitcoin, could alleviate the limitations of on-chain transactions, making Bitcoin more viable for everyday payments. The success of this approach will depend on its widespread adoption by merchants and users, requiring user-friendly interfaces and robust security measures. For example, if a major e-commerce platform integrates Lightning Network payments seamlessly, we could see a surge in Bitcoin usage for online purchases. Conversely, a lack of widespread merchant adoption would likely limit its use as a mainstream payment method.

Growth of Bitcoin’s Lightning Network and Other Scaling Solutions

The halving could act as a catalyst for the growth of the Lightning Network and other scaling solutions. As Bitcoin’s value potentially increases, the cost of on-chain transactions (in terms of both fees and network congestion) could become prohibitive for many users. This would drive demand for faster, cheaper alternatives like the Lightning Network, encouraging developers to improve its functionality and accessibility. Successful integration of these solutions into existing payment platforms could significantly increase the usability and adoption of Bitcoin as a daily payment method. For instance, if a significant portion of microtransactions shifts to the Lightning Network, it could demonstrate the effectiveness of this scaling solution and attract further investment and development.

Role of Institutional Investors and Regulatory Developments

Institutional investors and regulatory frameworks will play a significant role in shaping Bitcoin’s future after the halving. Increased institutional investment, driven by the perceived scarcity and potential for price appreciation, could lead to greater market stability and liquidity, making Bitcoin a more attractive asset for both institutional and retail investors. Conversely, negative regulatory developments could stifle adoption, particularly in jurisdictions with strict cryptocurrency regulations. For example, clear and favorable regulatory frameworks in major economies could encourage institutional adoption and boost confidence in Bitcoin’s long-term prospects, while restrictive regulations could limit its growth and widespread adoption. The interplay between these factors will determine the overall trajectory of Bitcoin’s adoption and usage following the 2025 halving.

Risks and Uncertainties: Halving Bitcoin 2025

Predicting the precise outcome of the 2025 Bitcoin halving is inherently challenging due to the complex interplay of factors influencing Bitcoin’s price and market adoption. While historical data offers some guidance, the cryptocurrency market is highly volatile and susceptible to unforeseen events that can significantly alter the trajectory of Bitcoin’s price and overall adoption. Numerous variables beyond the halving itself contribute to the uncertainty, making definitive predictions extremely difficult.

The inherent volatility of the cryptocurrency market presents a significant risk. Past halvings have been followed by periods of both substantial price increases and significant corrections. For example, the 2016 halving led to a substantial price surge, but the 2020 halving was followed by a period of relative stagnation before a major bull run. This variability makes predicting the post-2025 halving price movement highly speculative. External factors, such as macroeconomic conditions, regulatory changes, technological advancements within the crypto space, and even geopolitical events, can significantly influence Bitcoin’s price regardless of the halving’s impact.

Regulatory Uncertainty

Regulatory landscapes surrounding cryptocurrencies vary widely across jurisdictions. Changes in regulations, whether supportive or restrictive, can dramatically impact Bitcoin’s price and adoption. A sudden crackdown in a major market could trigger a significant price drop, while favorable regulations could fuel substantial growth. The uncertainty surrounding future regulatory actions makes accurate predictions challenging. For instance, a potential ban on Bitcoin trading in a large economy could negatively affect the price, while the adoption of Bitcoin as a legal tender in another could have the opposite effect.

Macroeconomic Factors

Global macroeconomic conditions, such as inflation, interest rates, and recessionary pressures, significantly influence investor sentiment towards risk assets, including Bitcoin. A period of high inflation might drive investors towards Bitcoin as a hedge against inflation, increasing demand and potentially pushing the price higher. Conversely, a global recession could lead to risk aversion, causing investors to sell off Bitcoin and other volatile assets, leading to a price decline. The unpredictable nature of macroeconomic trends makes it difficult to forecast their impact on Bitcoin’s price following the halving. The 2008 financial crisis, for example, showed how macroeconomic instability can impact even established financial markets, and the cryptocurrency market is not immune.

Technological Developments

Technological advancements, both within the Bitcoin ecosystem and in competing cryptocurrencies, could influence Bitcoin’s price and market share. The emergence of a more efficient or scalable blockchain technology could potentially draw investors away from Bitcoin, affecting its price. Conversely, significant upgrades to the Bitcoin protocol, such as the Lightning Network’s expansion, could enhance its usability and adoption, leading to price appreciation. The continuous evolution of blockchain technology introduces an element of unpredictability into the post-halving scenario. For example, the development of Layer-2 scaling solutions has already had a positive impact on Bitcoin’s transaction speeds and costs, but the full long-term impact is still uncertain.

Market Sentiment and Speculation

Market sentiment, driven by news events, social media trends, and investor psychology, plays a crucial role in determining Bitcoin’s price. Positive news and widespread adoption could lead to a price surge, while negative news or a loss of investor confidence could trigger a significant sell-off. The unpredictable nature of market sentiment makes it difficult to accurately forecast Bitcoin’s price trajectory following the halving. The meme-driven price fluctuations of Dogecoin, for instance, illustrate how market sentiment, independent of fundamental factors, can drastically influence cryptocurrency prices.

Historical Context and Comparisons

Analyzing the price movements of Bitcoin following previous halving events provides valuable insight into potential future trends. While past performance is not indicative of future results, understanding the factors that influenced price changes in the past can help contextualize expectations for the 2025 halving. This analysis will compare and contrast the price action following the 2012, 2016, and 2020 halvings, highlighting key similarities and differences.

The price movements of Bitcoin following each halving have been significantly different, influenced by a complex interplay of factors including macroeconomic conditions, regulatory developments, technological advancements, and market sentiment. While a consistent pattern of price increases following each halving has been observed, the timing and magnitude of these increases have varied considerably. A detailed examination of these variations is crucial for a nuanced understanding of the potential impact of the 2025 halving.

Price Movements Following Previous Halvings

The 2012 halving saw a relatively gradual price increase in the months following the event, reaching a peak approximately one year later. The 2016 halving was followed by a more pronounced and sustained price surge, culminating in a significant bull market. The 2020 halving also resulted in a substantial price increase, although this was followed by a period of consolidation and subsequent volatility. A visual representation would show three distinct lines representing the Bitcoin price over time, each starting at a respective halving event. The 2012 line would show a gentle upward slope, the 2016 line a steeper, more sustained incline, and the 2020 line a sharp rise followed by fluctuations. The y-axis would represent the Bitcoin price in USD, and the x-axis would represent time in months post-halving.

Factors Influencing Post-Halving Price

Several interconnected factors significantly impacted Bitcoin’s price after each halving. These include the reduction in new Bitcoin supply (the primary driver), changes in miner profitability and hash rate, overall market sentiment and adoption rates, and macroeconomic conditions (like inflation or economic downturns). For example, the 2016 halving coincided with growing institutional interest and increased media coverage, contributing to the subsequent bull run. Conversely, the 2020 halving occurred during a period of global uncertainty and economic disruption, leading to a more volatile price trajectory. This illustrates how external factors can interact with the halving’s inherent supply-side impact.

Comparative Analysis of Key Metrics

To effectively compare the three previous halvings, we can visualize key metrics before, during, and after each event. A table could effectively represent this information:

| Metric | 2012 Halving (Pre/During/Post) | 2016 Halving (Pre/During/Post) | 2020 Halving (Pre/During/Post) |

|———————-|———————————|———————————|———————————|

| Bitcoin Price (USD) | [Low/Mid/High price ranges] | [Low/Mid/High price ranges] | [Low/Mid/High price ranges] |

| Hashrate (TH/s) | [Low/Mid/High values] | [Low/Mid/High values] | [Low/Mid/High values] |

| Mining Difficulty | [Low/Mid/High values] | [Low/Mid/High values] | [Low/Mid/High values] |

| Market Capitalization| [Low/Mid/High values] | [Low/Mid/High values] | [Low/Mid/High values] |

| Daily Trading Volume | [Low/Mid/High values] | [Low/Mid/High values] | [Low/Mid/High values] |

This table would show the ranges of each metric before, during, and after each halving, allowing for a direct comparison of their relative changes and the overall market conditions. Note that precise numerical data would need to be inserted into the table for a complete analysis. The table itself would provide a clear visual comparison of these key metrics across the three halving events.

Frequently Asked Questions (FAQs)

This section addresses some common queries regarding the upcoming Bitcoin halving in 2025, providing clarity on its mechanics, potential impacts, and associated risks. Understanding these aspects is crucial for navigating the evolving cryptocurrency landscape.

Bitcoin Halving Explained

A Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created (mined) by half. This occurs approximately every four years, or every 210,000 blocks mined. The halving mechanism is designed to control inflation and maintain the scarcity of Bitcoin. Essentially, it slows down the supply of new Bitcoin entering circulation.

The Halving’s Effect on Bitcoin’s Price

Historically, Bitcoin halvings have been followed by periods of significant price appreciation. The reduced supply of new Bitcoin, coupled with continued or increased demand, often leads to upward pressure on the price. However, this is not a guaranteed outcome. The relationship is complex and influenced by many other factors, including overall market sentiment, regulatory changes, technological advancements, and macroeconomic conditions. For example, the 2012 and 2016 halvings were followed by substantial price increases, but the market dynamics and external influences were quite different in each instance. Predicting the price impact of the 2025 halving with certainty is impossible.

Potential Risks Associated with the 2025 Halving

While halvings are often associated with price increases, the 2025 halving also presents potential risks. A significant risk is the possibility of a price correction or even a bear market, regardless of the halving. Market sentiment can be volatile, and unforeseen events, such as a major regulatory crackdown or a significant security breach, could negatively impact the price. Furthermore, the anticipation of the halving might lead to inflated prices in the lead-up to the event, potentially creating a bubble that could burst afterward. Finally, the mining industry could experience challenges due to reduced block rewards, potentially leading to consolidation and decreased network security if miners are forced to shut down due to decreased profitability.

Expected Date of the 2025 Bitcoin Halving

The exact date of the 2025 Bitcoin halving is difficult to pinpoint precisely until the block count reaches the threshold. However, based on the current block generation rate, the halving is expected to occur sometime in the spring or early summer of 2025. The precise date will depend on the actual time it takes to mine the 210,000 blocks leading up to the event. Slight variations are normal due to fluctuations in the Bitcoin network’s hashrate.

Creating a Table Summarizing Key Information

A concise table effectively presents key dates and anticipated impacts surrounding the 2025 Bitcoin halving. This allows for a quick overview of the timeline and potential consequences. The following table provides a structured summary of significant events and their expected effects on the Bitcoin ecosystem.

Bitcoin Halving Timeline and Anticipated Outcomes

| Date | Event | Anticipated Market Impact | Anticipated Mining Impact |

|---|---|---|---|

| March 2024 (estimated) | Start of the 2025 Halving Countdown | Increased speculation and volatility, potential price increase in anticipation of the halving. | Miners begin adjusting strategies in anticipation of reduced block rewards. |

| May 2024 (estimated) | Increased Media Coverage and Public Awareness | Further price volatility driven by increased public attention and speculation. | Hashrate may experience minor fluctuations due to market sentiment. |

| March-April 2025 (estimated) | Bitcoin Halving Event | Significant price volatility expected, potentially a sharp increase in price due to reduced supply. This could be similar to the post-halving price increases observed in 2012 and 2016, although the magnitude is always uncertain. | Mining profitability decreases significantly, potentially leading to some miners shutting down operations or consolidating. The hashrate could temporarily decline before stabilizing. |

| Post-Halving (2025-2026) | Market Adjustment and Stabilization | Price will likely stabilize after initial volatility. The long-term impact will depend on several factors, including broader macroeconomic conditions and overall adoption. | Hashrate will likely stabilize at a new level, potentially lower than before the halving, depending on the efficiency of remaining miners and the price of Bitcoin. |