Bitcoin Halving 2025

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created. This occurs approximately every four years, halving the reward given to Bitcoin miners for verifying transactions and adding new blocks to the blockchain. This mechanism is designed to control inflation and maintain the scarcity of Bitcoin over time.

Bitcoin Halving: Historical Impact

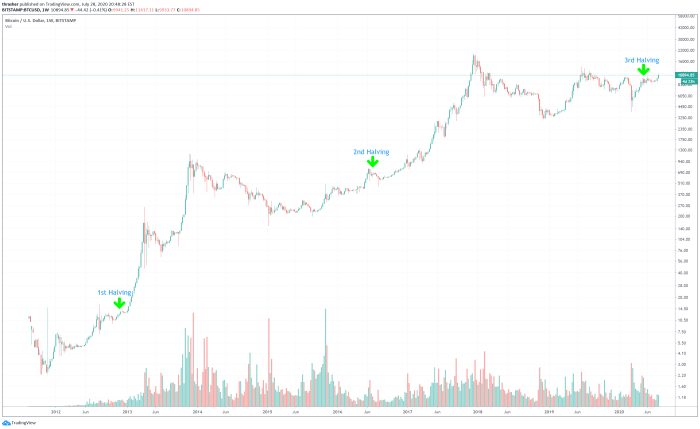

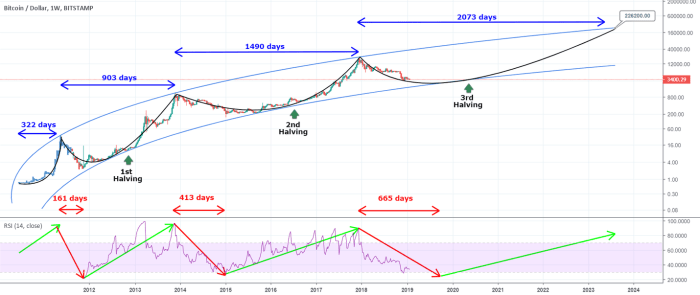

Previous Bitcoin halvings have demonstrably impacted both price and market sentiment. The first halving in November 2012 saw the block reward decrease from 50 BTC to 25 BTC. While not immediately resulting in a dramatic price surge, it coincided with a period of gradual price appreciation leading up to the next halving. The second halving in July 2016 reduced the reward to 12.5 BTC, followed by a significant price increase that began several months later and culminated in the bull market of late 2017. Similarly, the third halving in May 2020, reducing the reward to 6.25 BTC, preceded a substantial price rally that peaked in late 2021. While correlation doesn’t equal causation, these events suggest a strong link between halvings and subsequent price increases, although the timing and magnitude of the price movements have varied considerably. The impact is often attributed to the reduced supply of new Bitcoins entering the market, increasing scarcity and potentially driving up demand.

Bitcoin Halving 2025: Date and Technical Aspects

The 2025 Bitcoin halving is anticipated to occur in the Spring of 2025, although the precise date depends on the block time consistency. The technical aspect involves a reduction of the block reward from 6.25 BTC to 3.125 BTC. This means miners will receive half the amount of newly minted Bitcoin for each successfully mined block. This programmed event is automatically implemented within the Bitcoin protocol, requiring no external intervention or consensus vote. The halving is a fundamental part of Bitcoin’s deflationary monetary policy.

Bitcoin Halving 2025: Expected Effects Compared to Previous Halvings

Predicting the exact impact of the 2025 halving is challenging, as numerous factors beyond the halving itself influence Bitcoin’s price. However, based on previous halvings, a similar pattern of increased scarcity and potential price appreciation is anticipated. The magnitude of the price increase, however, is uncertain and could be influenced by factors such as overall macroeconomic conditions, regulatory developments, technological advancements, and the prevailing market sentiment. Unlike previous halvings, the 2025 event occurs in a market that has significantly matured since 2012, 2016, and 2020, with higher levels of institutional adoption and a broader range of market participants. This increased sophistication might lead to different market reactions compared to previous cycles. For example, the anticipation of the halving might be already priced into the market leading to a less dramatic price surge post-halving. Alternatively, if significant adoption increases in the months prior to the halving, we might see a more pronounced price surge. It’s important to remember that these are possibilities, not certainties.

Predicting Bitcoin’s Price After the 2025 Halving: Halving Bitcoin 2025 Data

Predicting the price of Bitcoin, especially after a halving event, is a complex undertaking. Numerous factors interact in unpredictable ways, making precise forecasting nearly impossible. However, various models and historical data can offer insights into potential price movements. This section explores some common approaches and their limitations.

Price Prediction Methodologies

Several methodologies attempt to forecast Bitcoin’s price. These range from simple statistical analyses of past price movements to sophisticated econometric models incorporating macroeconomic indicators and network metrics. One common approach involves analyzing historical price trends after previous halvings, searching for patterns that might repeat. Another involves using technical analysis, which examines price charts and trading volume to identify potential support and resistance levels. Finally, some analysts incorporate fundamental analysis, considering factors such as the scarcity of Bitcoin, adoption rates, and regulatory developments. However, it’s crucial to remember that past performance is not indicative of future results, and no model can perfectly capture the volatility inherent in the cryptocurrency market.

Examples of Historical Price Predictions and Their Accuracy

Many analysts offered price predictions before previous halvings. For example, before the 2020 halving, predictions ranged wildly, from a few thousand dollars to tens of thousands. While Bitcoin did experience a significant price surge following the 2020 halving, reaching an all-time high of nearly $69,000, the accuracy of specific predictions varied significantly. Similarly, predictions surrounding the 2016 halving showed a wide range of accuracy. Some analysts correctly anticipated an upward trend, while others missed the mark entirely. The inherent volatility and external factors impacting the market often render even the most sophisticated predictions inaccurate.

Factors Influencing Bitcoin’s Price After the 2025 Halving

Several factors could significantly influence Bitcoin’s price following the 2025 halving. Macroeconomic conditions, such as inflation rates, interest rates, and global economic growth, will likely play a crucial role. Regulatory changes, both positive and negative, in various jurisdictions could also dramatically impact investor sentiment and price. Technological advancements, such as the development of layer-2 scaling solutions or improvements in Bitcoin’s underlying technology, could also contribute to price appreciation. Furthermore, the overall adoption rate of Bitcoin by institutional and individual investors will be a major driver. Finally, geopolitical events and unexpected market shocks can introduce significant volatility.

Hypothetical Price Scenario

Considering a scenario where macroeconomic conditions remain relatively stable, regulatory environments become more favorable for cryptocurrencies, and technological advancements continue to improve Bitcoin’s scalability and efficiency, a significant price increase after the 2025 halving is plausible. Under these optimistic assumptions, a price range of $100,000 to $200,000 by the end of 2026 is conceivable. However, a pessimistic scenario involving a global recession, stricter regulations, or a major security breach could lead to a significantly lower price, potentially even below the pre-halving level. This illustrates the wide range of possibilities and the inherent uncertainty in any price prediction.

Mining and the 2025 Halving

The Bitcoin halving, scheduled for 2025, is a significant event that will drastically alter the economics of Bitcoin mining. This event, occurring approximately every four years, reduces the block reward miners receive for successfully adding new transactions to the blockchain by half. Understanding the implications of this reduction is crucial for predicting the future of the Bitcoin network.

The halving directly impacts Bitcoin mining profitability by decreasing the primary revenue stream for miners. With fewer Bitcoins awarded per block, miners must rely more heavily on transaction fees to cover their operational costs. This reduction can lead to a decrease in the overall hash rate, as less profitable miners may choose to shut down their operations. The hash rate, a measure of the total computational power dedicated to securing the Bitcoin network, is a critical indicator of network security and resilience. A significant drop in the hash rate could potentially compromise the network’s security, making it more vulnerable to attacks.

Impact on Decentralization

The halving’s effect on decentralization is complex and multifaceted. While a reduction in the hash rate could potentially lead to greater centralization (with larger, more efficient mining operations dominating), it could also incentivize innovation in mining technology and energy efficiency. Miners might seek more sustainable and cost-effective ways to operate, potentially broadening the geographical distribution of mining activities and leading to a more decentralized network. The outcome depends on various factors, including the adoption of more efficient mining hardware, the price of Bitcoin, and the regulatory environment in different regions. For example, a significant drop in the hash rate might cause smaller miners to consolidate, leading to fewer, larger players. However, advancements in hardware or a rise in Bitcoin’s price could offset this effect.

Miner Adaptation Strategies

Facing reduced block rewards, miners will likely adopt several strategies to maintain profitability. These strategies include: upgrading to more energy-efficient hardware, optimizing mining operations to reduce electricity costs, diversifying revenue streams through services like node operation or custodial services, and potentially forming mining pools to share resources and risks. The adoption of renewable energy sources could also become more prevalent as miners seek to reduce operational expenses and improve their environmental footprint. For instance, a miner might switch from older ASICs to newer, more efficient models, or explore locations with lower electricity costs.

Bitcoin Mining Profitability: Before and After Halving

The following table compares the profitability of Bitcoin mining before and after the halving, considering different electricity costs and hardware efficiency. Profitability is highly dependent on these factors, as well as the price of Bitcoin. The figures are illustrative and based on simplified calculations; actual profitability may vary significantly.

| Electricity Cost ($/kWh) | Hardware Efficiency (TH/J) | Profit/day (USD) – Before Halving (Block Reward: 6.25 BTC) | Profit/day (USD) – After Halving (Block Reward: 3.125 BTC) |

|---|---|---|---|

| 0.10 | 0.30 | $150 | $75 |

| 0.15 | 0.25 | $100 | $50 |

| 0.20 | 0.20 | $50 | $25 |

| 0.05 | 0.40 | $200 | $100 |

Investor Sentiment and Market Behavior

Investor sentiment surrounding Bitcoin halving events is a complex interplay of anticipation, speculation, and market forces. Historically, the period leading up to a halving is often characterized by increasing optimism, fueled by the expectation of reduced supply and potential price appreciation. However, the post-halving period can be more unpredictable, with sentiment shifting based on actual market performance and broader macroeconomic conditions.

The anticipation of scarcity, driven by the halving’s reduction in newly mined Bitcoin, tends to boost investor confidence. This is often reflected in increased trading volume and price volatility in the months preceding the event. However, it’s crucial to understand that this heightened optimism isn’t always a guarantee of immediate price surges. The actual impact on price depends on numerous factors, including overall market conditions, regulatory developments, and the adoption rate of Bitcoin.

Investor Sentiment Before and After Halving Events

Investor sentiment typically exhibits a cyclical pattern around Bitcoin halvings. In the months leading up to the event, a wave of bullish sentiment often takes hold, with many investors expecting a price increase. This is driven by the anticipation of reduced supply, creating a potential scarcity effect. Following the halving, the market reaction can be varied. Sometimes, a significant price increase follows, confirming the bullish sentiment. Other times, the price may consolidate or even experience a temporary dip before resuming its upward trajectory. The delay in price appreciation is often attributed to the time it takes for the market to fully absorb the impact of reduced supply and for the narrative of scarcity to fully permeate the market. This period of uncertainty can lead to significant volatility and shifts in investor sentiment.

Risks and Opportunities for Investors

Historically, Bitcoin halvings have presented both substantial risks and opportunities for investors. The potential for significant price appreciation following a halving is a major draw for many investors. However, the market’s reaction is not guaranteed, and the price could remain stagnant or even decline in the short term. For example, the halving in 2016 saw a gradual price increase over the following year, while the 2020 halving was followed by a period of consolidation before a substantial price surge. Therefore, investors need to carefully consider their risk tolerance and investment horizon. Short-term traders may experience significant losses if the price does not move as anticipated, while long-term holders are generally better positioned to weather short-term price fluctuations.

Behavior of Different Investor Groups

Long-term holders (HODLers) tend to be less affected by short-term price volatility. Their strategy relies on the long-term value proposition of Bitcoin, and they are less likely to panic sell during market downturns. In contrast, short-term traders are more susceptible to market sentiment swings and are often quick to react to price changes. They may capitalize on short-term price fluctuations but also risk substantial losses if the market moves against their predictions. The contrasting approaches highlight the importance of aligning investment strategies with individual risk tolerance and time horizons.

Timeline of Previous Halvings and Market Reactions, Halving Bitcoin 2025 Data

The following timeline illustrates key events and market reactions around previous Bitcoin halvings:

| Halving Date | Pre-Halving Sentiment | Post-Halving Market Reaction (Short-Term) | Post-Halving Market Reaction (Long-Term) |

|---|---|---|---|

| November 28, 2012 | Generally bullish, but relatively low market awareness. | Gradual price increase. | Significant price appreciation over the following years. |

| July 9, 2016 | Increasingly bullish sentiment, growing market awareness. | Consolidation followed by gradual price increase. | Sustained price growth. |

| May 11, 2020 | Strong bullish sentiment, high market awareness. | Initial consolidation, followed by significant price appreciation. | Significant price appreciation, although with periods of volatility. |