Bitcoin Halving 2025: Halving Bitcoin 2025 Precio

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created. This occurs approximately every four years, and significantly impacts the overall supply of Bitcoin entering circulation. Historically, these halving events have been followed by periods of increased price volatility and, in some cases, substantial price appreciation. Understanding this mechanism is crucial for navigating the cryptocurrency market.

The Bitcoin halving mechanism is built into the Bitcoin code. Every 210,000 blocks mined, the reward given to miners for securing the network is cut in half. Initially, the reward was 50 BTC per block. After the first halving, it became 25 BTC, then 12.5 BTC, and currently stands at 6.25 BTC. The 2025 halving will reduce this reward to 3.125 BTC per block.

Bitcoin Halving 2025 Date and Supply Reduction

The expected date for the 2025 Bitcoin halving is sometime in the spring or early summer. Pinpointing the exact date is difficult as it depends on the rate at which miners solve complex cryptographic puzzles to add new blocks to the blockchain. However, based on historical block times, a reasonable estimate can be made. This halving will result in a 50% reduction in the rate of new Bitcoin entering circulation. This reduction in supply, coupled with potentially sustained or increased demand, is a key factor influencing price predictions. The halving events of 2012 and 2016 were followed by significant price increases, although the extent and timing of price movements are not guaranteed to repeat. The market’s reaction will depend on various factors including macroeconomic conditions, regulatory changes, and overall investor sentiment.

Historical Analysis of Bitcoin Halvings and Price

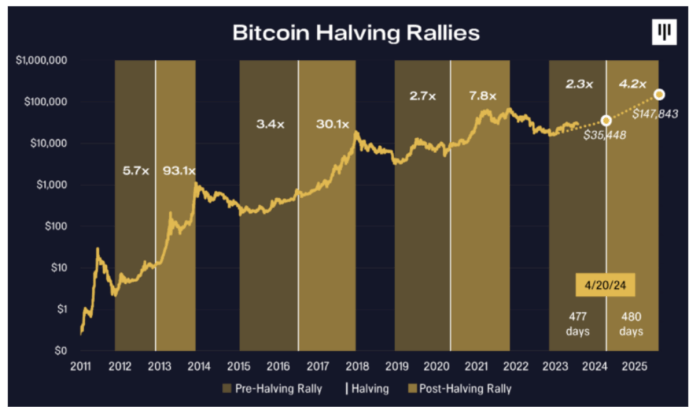

Bitcoin’s price has demonstrated a fascinating correlation with its halving events, periods where the rate of newly mined Bitcoin is cut in half. Analyzing these past events provides valuable insight into potential future price movements, though it’s crucial to remember that past performance is not indicative of future results. Numerous other factors influence Bitcoin’s price, making predictions complex.

The reduction in the supply of newly minted Bitcoin, a core element of the halving mechanism, has historically been followed by periods of price appreciation. However, the timing and magnitude of these price increases have varied significantly. Understanding the nuances of these variations requires a detailed examination of each halving event and the broader market context surrounding them.

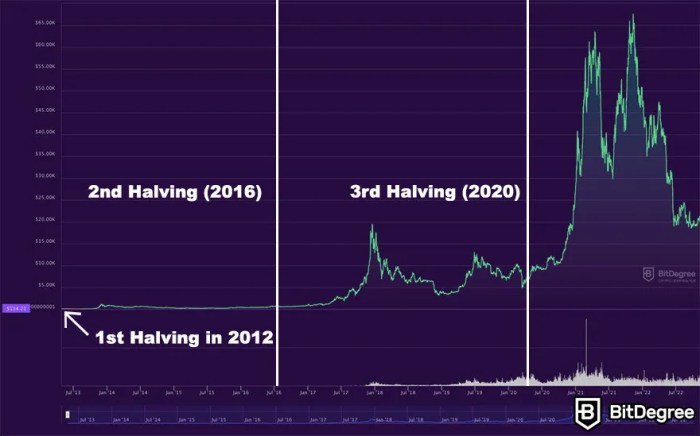

Bitcoin Halving Events and Subsequent Price Movements

The Bitcoin halving occurs approximately every four years, reducing the block reward miners receive for validating transactions. This controlled inflation mechanism is designed to limit the total supply of Bitcoin to 21 million coins. Following the first halving in November 2012, Bitcoin’s price experienced a significant increase, although the overall market was still relatively small. The second halving in July 2016 was followed by a substantial price rally, culminating in the 2017 bull market. The third halving in May 2020 also saw a subsequent price increase, albeit with more volatility and a longer timeframe before reaching peak prices. Comparing these events reveals differing timelines and price magnitudes, highlighting the complexity of predicting future outcomes.

Factors Influencing Bitcoin Price Before, During, and After Halvings

Several factors beyond the halving itself significantly impact Bitcoin’s price. Before a halving, anticipation can drive price increases as investors speculate on future scarcity. During the halving, the price may fluctuate depending on overall market sentiment and news events. After the halving, the reduced supply can contribute to price appreciation, but this effect can be influenced by factors such as regulatory changes, macroeconomic conditions, and adoption rates. For example, the 2017 bull market was fueled not only by the 2016 halving but also by increased mainstream media attention and institutional investment. Conversely, macroeconomic factors like the 2022 bear market significantly impacted Bitcoin’s price, regardless of the previous halving.

Correlation Between Halving Events and Long-Term Price Trends

While a clear correlation exists between Bitcoin halvings and subsequent price increases, it’s crucial to avoid oversimplification. The halving acts as a catalyst, reducing the supply of new Bitcoin, but it’s not the sole determinant of price. Long-term price trends are influenced by a multitude of factors, including technological advancements, regulatory developments, adoption by businesses and institutions, and overall market sentiment. It is more accurate to describe the halving as a contributing factor to long-term price appreciation rather than a direct cause. The long-term upward trend of Bitcoin’s price since its inception suggests a fundamental value proposition, though short-term price volatility remains a characteristic feature.

Predicting Bitcoin’s Price After the 2025 Halving

Predicting Bitcoin’s price after the 2025 halving is inherently speculative, as numerous factors beyond the halving itself influence market dynamics. However, by analyzing historical trends, considering macroeconomic conditions, and applying various modeling techniques, we can develop plausible price scenarios. This analysis will not provide a definitive answer but rather a range of possibilities based on different assumptions.

The impact of a Bitcoin halving on price is not always immediate or directly proportional. While the reduction in new Bitcoin supply is a significant factor, it interacts with other market forces, such as investor sentiment, regulatory changes, and overall economic health. Historical data shows a general upward trend following previous halvings, but the magnitude and timing of price increases have varied significantly. Therefore, any prediction must account for this inherent uncertainty.

Model for Predicting Bitcoin’s Price

Several models can be used to predict Bitcoin’s price, each with its limitations. One approach is to utilize a stock-to-flow (S2F) model, which relates the existing supply of Bitcoin to its newly mined supply. This model, while popular, has shown limitations in accurately predicting prices beyond a certain point, particularly in light of unexpected market events. Other models incorporate factors like on-chain metrics (transaction volume, active addresses), market sentiment indicators (Google Trends, social media analysis), and macroeconomic data (inflation rates, interest rates). A more robust model might combine these elements using techniques like time series analysis or machine learning. For example, a model might use past halving data to create a baseline, then adjust based on current macroeconomic indicators and on-chain activity. However, even the most sophisticated model cannot perfectly predict the future due to the inherent volatility of the cryptocurrency market.

Potential Price Scenarios Post-Halving

The following table Artikels three potential scenarios for Bitcoin’s price after the 2025 halving, ranging from optimistic to pessimistic. These scenarios are based on a combination of historical data, technical analysis, and macroeconomic considerations. It’s crucial to remember that these are just possibilities, and the actual price could fall outside this range.

| Scenario | Price Prediction (USD) by end of 2026 | Supporting Rationale |

|---|---|---|

| Optimistic | $200,000 – $300,000 | Strong institutional adoption, continued global macroeconomic uncertainty driving safe-haven demand, positive regulatory developments, and significant growth in the overall cryptocurrency market. This scenario assumes a strong positive response to the halving, mirroring or exceeding the price increases seen after previous halvings, combined with significant broader market growth. This would align with previous halving cycles where price surges were observed, though the magnitude is a key point of uncertainty. |

| Neutral | $100,000 – $150,000 | Moderate institutional adoption, relatively stable macroeconomic conditions, and a mixed regulatory landscape. This scenario assumes a more measured response to the halving, with price increases driven primarily by the reduction in supply, but tempered by potential market corrections or lack of substantial external growth catalysts. This scenario reflects a more conservative projection, acknowledging the possibility of periods of consolidation or sideways price movement. |

| Pessimistic | $50,000 – $80,000 | Weak institutional adoption, negative regulatory developments, a global economic downturn, and a general lack of investor confidence in cryptocurrencies. This scenario assumes negative macroeconomic conditions negatively impacting risk assets, alongside regulatory uncertainty potentially leading to reduced market participation. This scenario incorporates the possibility of a significant market correction, similar to previous bear markets in the cryptocurrency space, potentially offsetting the positive effects of the halving. |

Factors Influencing Bitcoin’s Price Beyond the Halving

The Bitcoin halving event, while significantly impacting the supply of new Bitcoin, is not the sole determinant of its price. Numerous other factors, both internal and external to the cryptocurrency ecosystem, play crucial roles in shaping Bitcoin’s value in the years following a halving. Understanding these interconnected elements is vital for a comprehensive price prediction.

Macroeconomic factors exert a considerable influence on Bitcoin’s price, often acting as a counterweight to the halving’s supply-side effects.

Macroeconomic Influences on Bitcoin Price

Global economic conditions significantly impact Bitcoin’s price. Periods of high inflation, for example, can drive investors towards Bitcoin as a hedge against currency devaluation. The perceived scarcity of Bitcoin, with a fixed supply of 21 million coins, makes it an attractive alternative to assets that are susceptible to inflationary pressures. Conversely, during economic recessions, investors may liquidate their Bitcoin holdings to cover losses in other investments, leading to price drops. The 2022 bear market, coinciding with rising inflation and interest rates, serves as a recent example of this correlation. Furthermore, changes in monetary policy by central banks, such as interest rate hikes or quantitative easing, can indirectly influence investor sentiment towards Bitcoin and its perceived risk-reward profile.

Regulatory Developments and Institutional Adoption

Government regulations and institutional investment significantly impact Bitcoin’s price trajectory. Favorable regulatory frameworks, such as clear guidelines for cryptocurrency trading and taxation, can foster investor confidence and attract institutional capital. Conversely, restrictive or unclear regulations can create uncertainty and potentially suppress price growth. The increasing adoption of Bitcoin by institutional investors, including large corporations and financial institutions, adds legitimacy and further drives demand. Examples include MicroStrategy’s substantial Bitcoin holdings or Tesla’s initial adoption and subsequent divestment, demonstrating the impact of institutional decisions on market sentiment and price volatility. These actions, however, are not always predictable and can drastically shift the market.

Technological Advancements and Network Upgrades

Technological improvements and network upgrades within the Bitcoin ecosystem also influence its value. Developments such as the Lightning Network, which aims to improve transaction speed and scalability, can enhance Bitcoin’s usability and potentially increase demand. Conversely, any significant security vulnerabilities or scaling challenges could negatively impact investor confidence and the price. The successful implementation of major upgrades, demonstrating the network’s resilience and adaptability, generally strengthens investor confidence and positively affects the price. Conversely, any major technical setbacks or controversies could lead to a negative market reaction.

Bitcoin Halving and Market Sentiment

Bitcoin halving events are significant occurrences in the cryptocurrency world, triggering considerable shifts in market sentiment. The anticipation surrounding these events, coupled with their historical impact on Bitcoin’s price, creates a volatile and often unpredictable market environment. Understanding the typical sentiment and its key indicators is crucial for navigating this period.

The typical market sentiment surrounding Bitcoin halvings is characterized by a complex interplay of excitement, anticipation, and speculation. In the lead-up to a halving, the narrative often centers around the reduced supply of newly mined Bitcoin, leading many to believe that scarcity will drive up the price. This positive sentiment is often amplified by social media discussions and bullish predictions from analysts and influencers. However, this period isn’t solely defined by optimism; fear of missing out (FOMO) and the potential for a price correction also play significant roles. After the halving, the market reaction can vary widely, depending on broader macroeconomic factors and the overall state of the crypto market.

Key Indicators of Market Sentiment, Halving Bitcoin 2025 Precio

Market sentiment around Bitcoin halvings isn’t just a feeling; it’s measurable through several key indicators. Analyzing these indicators provides a more objective understanding of investor behavior and expectations.

- Social Media Trends: Platforms like Twitter, Reddit, and Telegram become hubs for Bitcoin discussions during halving periods. Analyzing the sentiment expressed in these discussions – the ratio of positive to negative comments, the frequency of mentions, and the overall tone – can offer insights into the prevailing market mood. For example, a surge in positive tweets and forum posts about Bitcoin’s scarcity could suggest a bullish sentiment. Conversely, a rise in negative commentary and concerns about regulatory hurdles might signal a bearish outlook.

- Trading Volume: A significant increase in trading volume leading up to a halving often indicates heightened interest and speculation. This increased activity can be a sign of both bullish and bearish sentiment, depending on the context. High volume coupled with rising prices suggests bullish sentiment, while high volume accompanied by falling prices might point towards a bearish trend. For instance, a sudden spike in trading volume with a simultaneous drop in Bitcoin’s price could indicate panic selling.

- Google Trends Data: Analyzing search trends for “Bitcoin halving” or related terms can reveal the level of public interest and awareness surrounding the event. A significant increase in search volume suggests heightened public attention and anticipation, which can influence market sentiment and price movements.

Impact of Market Sentiment on Bitcoin Price

Market sentiment exerts a powerful influence on Bitcoin’s price, both before and after a halving. The anticipatory hype leading up to the event can drive prices higher, as investors position themselves for anticipated gains. However, this can also create a bubble, leading to a price correction after the halving if the anticipated price surge doesn’t materialize.

The impact of market sentiment is not solely determined by the halving itself, but also by the confluence of other factors, such as regulatory developments, macroeconomic conditions, and technological advancements.

After the halving, the price reaction is often dependent on whether the initial price surge was justified by underlying market fundamentals or driven primarily by speculation. If the post-halving price action reflects a sustainable increase driven by genuine demand, it can signify a positive long-term outlook. Conversely, a sharp price decline after the halving might indicate a correction from an overinflated market driven by speculation. The 2016 halving saw a period of consolidation followed by a significant price increase, while the 2020 halving experienced a more gradual price appreciation. These different outcomes highlight the complex interplay between market sentiment and broader market forces.

Predicting the Bitcoin price after the 2025 halving is challenging, with various factors influencing the outcome. To effectively reach potential investors interested in this market prediction, a robust marketing strategy is crucial, and setting up a Google Ads Account could be a smart move. This allows targeted advertising to those actively searching for information on “Halving Bitcoin 2025 Precio,” maximizing reach and potential returns.

Ultimately, understanding market trends and implementing a well-structured campaign are key to success in this volatile space.