Bitcoin Halving 2025: Halving Bitcoin 2025 Que Es

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created. This occurs approximately every four years, and it’s designed to control inflation and maintain the scarcity of Bitcoin. The 2025 halving will be the fourth in Bitcoin’s history, and it’s anticipated to have a significant impact on the cryptocurrency’s price and overall market dynamics.

Bitcoin Halving Explained

The Bitcoin halving cuts the reward given to Bitcoin miners for verifying transactions and adding new blocks to the blockchain in half. This directly impacts the supply of new Bitcoins entering circulation. While demand remains relatively constant or potentially increases due to factors like adoption and investor sentiment, a reduced supply often leads to upward pressure on price, based on fundamental economic principles of supply and demand. This doesn’t guarantee a price increase, but it significantly influences market dynamics.

Historical Impact of Bitcoin Halvings on Price Volatility

Previous Bitcoin halvings have been followed by periods of significant price volatility. While the price doesn’t always immediately surge after a halving, a noticeable trend of increased price action is observed over the following months and years. This volatility is attributed to a combination of factors, including the reduced supply of newly minted Bitcoin, anticipation surrounding the event, and overall market sentiment. The increased uncertainty can lead to both sharp price increases and corrections.

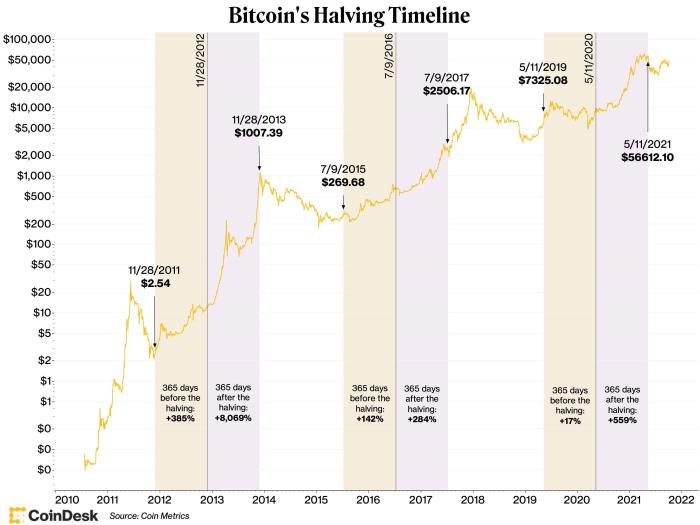

Timeline of Past Halvings and Subsequent Price Movements

Halving Bitcoin 2025 Que Es – The following table illustrates the timing of past halvings and approximate price movements in the subsequent period. Note that these are simplified representations and actual price movements are complex and influenced by numerous market factors.

Understanding the “Halving Bitcoin 2025 Que Es” requires grasping the mechanics of Bitcoin’s reward reduction. Essentially, it’s a programmed event where the reward for mining new blocks is cut in half. To keep track of the countdown to this significant event, you can use a helpful resource like the Bitcoin Halving Clock 2025. This clock provides a real-time view of the time remaining until the halving, further clarifying the implications of “Halving Bitcoin 2025 Que Es” on Bitcoin’s future.

| Halving Date | Approximate Bitcoin Price Before Halving (USD) | Approximate Bitcoin Price 1 Year After Halving (USD) | Approximate Bitcoin Price 2 Years After Halving (USD) |

|---|---|---|---|

| November 2012 | ~12 | ~100 | ~1000 |

| July 2016 | ~650 | ~1000 | ~10000 |

| May 2020 | ~8700 | ~12000 | ~60000 |

Comparison of the 2025 Halving with Previous Events

While past halvings offer valuable insights, it’s crucial to remember that the cryptocurrency market is constantly evolving. Factors such as regulatory changes, technological advancements, and macroeconomic conditions can significantly influence Bitcoin’s price. The 2025 halving is expected to be different from previous events due to the increased institutional adoption of Bitcoin and a higher level of market maturity. The impact might be less dramatic than some previous halvings, or it might be amplified by other market forces. Predicting the precise outcome is impossible. However, the fundamental principle of reduced supply influencing price remains a key factor.

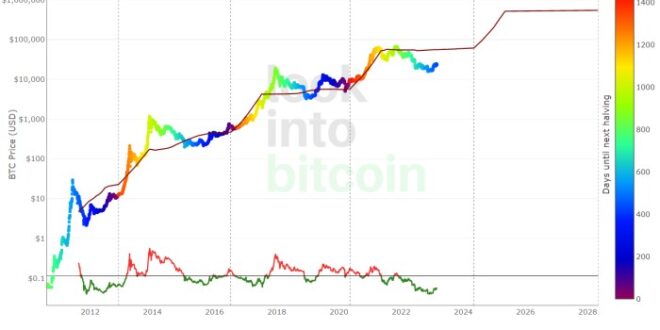

Visual Representation of Historical Price Trends, Halving Bitcoin 2025 Que Es

Imagine a line graph with the x-axis representing time (years since halving) and the y-axis representing Bitcoin price in USD. Three distinct lines would represent the price movements after each halving. Each line would initially show a period of relative stability or even slight decline immediately after the halving, followed by a period of significant price increase. The rate and magnitude of increase would vary between the lines, reflecting the differing market conditions following each event. The graph would clearly illustrate the general upward trend in Bitcoin’s price in the years following each halving, while also highlighting the volatility inherent in the cryptocurrency market.

Understanding the Bitcoin halving in 2025 involves grasping its core mechanism: the reduction of newly mined Bitcoin. To fully comprehend this event, knowing the precise date is crucial; you can find this information by checking the dedicated resource on the Halving Bitcoin 2025 Date. This date is vital for predicting potential market impacts resulting from the decreased supply of new Bitcoins entering circulation, and thus its effect on the overall Bitcoin economy.

Understanding Bitcoin’s Supply and Demand Dynamics

Bitcoin’s price, a notoriously volatile asset, is significantly influenced by its inherent scarcity and the dynamics of supply and demand. The upcoming 2025 halving, reducing the rate of newly mined Bitcoin, is a key event expected to impact these dynamics, but it’s not the only factor at play. Understanding these complexities is crucial for navigating the Bitcoin market.

Bitcoin Halving and Scarcity

The halving mechanism, programmed into Bitcoin’s core code, cuts the reward given to miners for verifying transactions by half approximately every four years. This directly impacts the rate at which new Bitcoin enters circulation. The fixed supply of 21 million Bitcoin, combined with the halving, creates a deflationary pressure, theoretically increasing scarcity over time. Each halving event historically has been followed by a period of increased price appreciation, although the timing and magnitude of these price movements vary. The reduction in supply, coupled with consistent demand, puts upward pressure on the price. The 2012 and 2016 halvings, for example, were followed by significant bull markets, showcasing the potential impact of this programmed scarcity.

Miner Rewards and the Bitcoin Ecosystem

Miner rewards are crucial to the Bitcoin ecosystem’s security and functionality. Miners, using powerful computers, solve complex cryptographic puzzles to validate transactions and add them to the blockchain. They are compensated for this work with newly minted Bitcoin and transaction fees. The halving reduces the reward portion, incentivizing miners to rely more on transaction fees to remain profitable. This mechanism indirectly affects transaction fees; if the block reward is significantly reduced and the demand remains high, transaction fees may increase, potentially creating a bottleneck or impacting the efficiency of the network. Conversely, lower demand could lead to lower transaction fees, offsetting the impact of the reduced block reward.

Factors Influencing Bitcoin’s Price Beyond the Halving

While the halving is a significant event, numerous other factors influence Bitcoin’s price. These include macroeconomic conditions (e.g., inflation, interest rates, global economic uncertainty), regulatory developments (e.g., government policies, legal frameworks concerning cryptocurrencies), technological advancements (e.g., scalability solutions, new applications), and overall market sentiment and investor behavior. For example, periods of high inflation often see increased interest in Bitcoin as a hedge against inflation, while negative regulatory news can lead to price drops. Technological innovations, such as the Lightning Network, aim to improve Bitcoin’s scalability and transaction speed, potentially impacting its adoption and price.

Market Sentiment and Investor Behavior

Market sentiment, encompassing the overall feeling of optimism or pessimism among investors, plays a substantial role in price fluctuations. Fear, uncertainty, and doubt (FUD) can lead to sell-offs, while positive news and increased adoption can drive prices higher. Investor behavior, influenced by factors like speculation, herd mentality, and risk appetite, further contributes to volatility. For instance, a sudden influx of institutional investors can significantly boost prices, while a wave of panic selling can trigger sharp declines. News coverage and social media trends also heavily influence sentiment and can create self-fulfilling prophecies.

Comparison of Bitcoin’s Supply with Other Assets

| Asset | Supply | Supply Dynamics | Inflationary/Deflationary |

|---|---|---|---|

| Bitcoin | 21 million (fixed) | Halving every four years | Deflationary |

| Gold | Finite, but not precisely known | New gold is mined, but at a decreasing rate | Mildly deflationary |

| US Dollar | Unlimited | Controlled by the Federal Reserve | Inflationary |

| Ethereum | No fixed limit | Variable inflation rate | Inflationary |

Predicting the Impact of the 2025 Halving

Predicting the price of Bitcoin after the 2025 halving is a complex undertaking, fraught with uncertainty. While the halving itself is a predictable event – reducing the rate of new Bitcoin entering circulation – its impact on price is far from guaranteed, influenced by a confluence of factors beyond the purely technical. This section explores potential price movements, the influence of macroeconomic conditions, differing expert opinions, inherent risks, and summarizes various price predictions.

A Hypothetical Price Movement Scenario

One plausible scenario involves a gradual price increase leading up to the halving, driven by anticipation. Following the halving, we might see a period of consolidation, as the market absorbs the reduced supply. This could be followed by a more significant price surge, potentially driven by increased scarcity and renewed investor interest. However, a sudden, sharp price increase immediately after the halving is less likely, given the market’s inherent volatility. The magnitude of any price movement would depend heavily on the overall market sentiment and macroeconomic environment at the time. For example, if global economic conditions are favorable, investor confidence might be high, leading to a more pronounced price increase. Conversely, a period of global economic uncertainty could dampen the impact of the halving. This scenario is based on past halving cycles, but it’s crucial to remember that past performance is not indicative of future results.

Macroeconomic Factors Influencing Bitcoin’s Price

Macroeconomic factors play a significant role in shaping Bitcoin’s price. Inflationary pressures, for instance, could drive investors towards Bitcoin as a hedge against inflation, boosting demand and consequently price. Conversely, rising interest rates, which often accompany efforts to curb inflation, might divert investment away from riskier assets like Bitcoin, potentially depressing its price. Geopolitical events, regulatory changes, and overall global economic growth or recession also significantly impact investor sentiment and, therefore, Bitcoin’s price. The 2022 bear market, for instance, was significantly influenced by rising inflation and interest rate hikes by central banks globally.

Comparison of Expert Opinions and Predictions

Experts hold diverse opinions on the 2025 halving’s impact. Some analysts, pointing to past halving cycles, predict a substantial price increase. Others are more cautious, highlighting the influence of macroeconomic factors and the potential for unforeseen events to disrupt any predictable pattern. For instance, PlanB, known for his stock-to-flow model, has historically made bullish predictions about Bitcoin’s price, although his previous forecasts haven’t always aligned perfectly with reality. Conversely, some analysts argue that the stock-to-flow model’s predictive power is limited, particularly in the face of evolving market dynamics and regulatory interventions. The divergence in expert opinions underscores the inherent uncertainty surrounding price predictions.

Risks and Uncertainties in Predicting Bitcoin’s Price

Predicting Bitcoin’s price is inherently risky. The cryptocurrency market is notoriously volatile, influenced by unpredictable factors such as regulatory changes, technological advancements, security breaches, and market manipulation. Furthermore, the relatively young age of Bitcoin means there’s limited historical data to draw robust conclusions from. Past halving cycles provide some insights, but they are not necessarily reliable predictors of future performance. Unexpected events, such as a major technological breakthrough or a significant regulatory crackdown, could significantly alter the price trajectory.

Summary of Price Predictions

| Analyst/Source | Predicted Price (USD) after Halving | Date of Prediction | Basis of Prediction |

|---|---|---|---|

| PlanB (Stock-to-Flow Model – Note: Past performance is not indicative of future results) | (This data is dynamic and changes frequently. Refer to current market analysis for up-to-date predictions from PlanB and other sources) | (This data is dynamic and changes frequently. Refer to current market analysis for up-to-date predictions from PlanB and other sources) | Stock-to-Flow Model |

| (Insert Analyst 2) | (Insert Predicted Price) | (Insert Date) | (Insert Basis) |

| (Insert Analyst 3) | (Insert Predicted Price) | (Insert Date) | (Insert Basis) |

The Role of Miners in the Halving Event

The Bitcoin halving, a programmed event reducing the block reward paid to miners, significantly impacts the economics of Bitcoin mining and, consequently, the network’s overall security and stability. Understanding the miners’ role during and after a halving is crucial to predicting the future trajectory of Bitcoin’s price and network health.

The halving directly affects miner profitability by reducing their income. Before the halving, miners receive a certain amount of Bitcoin for successfully adding a block to the blockchain. After the halving, this reward is cut in half. This reduction necessitates miners to adapt their operations to maintain profitability, influencing their behavior and decisions regarding mining operations. The consequences of this shift ripple throughout the Bitcoin ecosystem.

Miner Profitability and the Halving

The halving’s impact on miner profitability is immediate and significant. The reduced block reward means less Bitcoin earned per block mined. To maintain profitability, miners must either increase their efficiency (reducing costs per Bitcoin mined) or see an increase in Bitcoin’s price. If the Bitcoin price remains stagnant or declines following a halving, many miners may find their operations unsustainable, leading to a potential decrease in mining activity. This is because operating costs, including electricity, hardware maintenance, and cooling, remain relatively constant regardless of the block reward. The profitability equation for miners simplifies to: Profit = (Block Reward * Bitcoin Price) – Operating Costs. A reduction in the block reward directly impacts the profit margin.

Impact on Mining Hash Rate and Network Security

The mining hash rate, a measure of the total computational power dedicated to securing the Bitcoin network, is directly tied to miner profitability. A decrease in profitability often leads to a reduction in the hash rate as less profitable miners shut down their operations. This reduced hash rate can make the network more vulnerable to attacks, such as 51% attacks, where a malicious actor controls more than half of the network’s hash rate and could potentially manipulate the blockchain. However, historically, Bitcoin’s price has often increased following halving events, offsetting the reduced block reward and often leading to an increase in the hash rate as new, more efficient miners enter the market.

Miner Strategies in Response to Reduced Block Rewards

Miners employ several strategies to navigate the challenges presented by reduced block rewards. These strategies include: upgrading to more energy-efficient hardware, consolidating mining operations to benefit from economies of scale, diversifying revenue streams (such as offering hosting services), and focusing on regions with lower electricity costs. Some miners may also choose to temporarily halt operations, waiting for the Bitcoin price to increase to a level that makes mining profitable again. The decision to continue or cease operations is highly dependent on individual miners’ operational costs and risk tolerance.

Past Miner Responses to Halving Events

The previous halving events in 2012, 2016, and 2020 provide valuable insights. While the immediate impact was often a temporary dip in the hash rate, the price of Bitcoin typically increased following these events, eventually leading to a recovery and even an increase in the hash rate as more miners entered the market or existing miners upgraded their equipment. The 2020 halving, for example, saw a significant price increase in the months following the event, mitigating the impact of the reduced block reward.

Potential Consequences of Decreased Miner Profitability

The potential consequences of decreased miner profitability are multifaceted and interconnected.

- Reduced Hash Rate: Leading to increased vulnerability to attacks.

- Increased Transaction Fees: As miners prioritize more profitable transactions.

- Network Instability: Potential for longer block times and confirmation delays.

- Consolidation of Mining Power: Fewer, larger mining operations dominating the network.

- Increased Centralization: A potential shift away from a decentralized network.

- Market Volatility: Fluctuations in Bitcoin’s price due to market uncertainty.

Investing and Trading Strategies around the Halving

The Bitcoin halving, a predictable event reducing the rate of new Bitcoin creation, often influences market dynamics. Understanding these dynamics is crucial for developing effective investment and trading strategies. While past halvings have shown price increases following the event, it’s important to remember that past performance is not indicative of future results. A range of strategies, each with inherent risks and rewards, can be employed.

Bitcoin Investment Strategies Overview

Several approaches exist for investing in Bitcoin, each catering to different risk tolerances and time horizons. These strategies range from simple buy-and-hold approaches to more complex leveraged trading. Careful consideration of individual financial goals and risk appetite is paramount before selecting a strategy. The following Artikels some common methods.

Risk and Reward in Bitcoin Investment

Bitcoin’s volatility is a defining characteristic, presenting both substantial opportunities for profit and significant risks of loss. The potential for high returns attracts many investors, but the cryptocurrency market’s susceptibility to dramatic price swings necessitates a thorough understanding of risk management techniques. Factors such as regulatory changes, technological advancements, and market sentiment can all drastically affect Bitcoin’s price. For example, the 2017 bull market saw Bitcoin prices surge dramatically, only to experience a significant correction in the following years. This illustrates the inherent volatility and the importance of careful consideration before investing.

Long-Term versus Short-Term Trading Strategies

Long-term strategies, often involving a “buy-and-hold” approach, focus on accumulating Bitcoin over an extended period and weathering market fluctuations. This approach aims to benefit from the anticipated long-term growth potential of Bitcoin. Short-term trading, conversely, involves frequent buying and selling to capitalize on short-term price movements. This approach requires more active market monitoring and a higher tolerance for risk due to the potential for rapid price changes. For instance, a long-term investor might buy and hold Bitcoin for several years, regardless of short-term price fluctuations, while a short-term trader might engage in day trading, aiming to profit from minor price discrepancies within a single day.

Risk Management in Bitcoin Trading

Effective risk management is crucial for mitigating potential losses in Bitcoin trading. This includes diversifying investments across different asset classes, avoiding over-leveraging, and setting stop-loss orders to limit potential losses. Diversification reduces the impact of a single investment’s underperformance on the overall portfolio. Over-leveraging magnifies both profits and losses, increasing the risk of significant financial setbacks. Stop-loss orders automatically sell Bitcoin when the price falls to a predetermined level, helping to limit potential losses. For example, an investor might allocate only a portion of their portfolio to Bitcoin, invest in other assets, and set stop-loss orders to minimize potential losses during market downturns.

Potential Investment Strategies: Advantages and Disadvantages

| Strategy | Advantages | Disadvantages |

|---|---|---|

| Buy and Hold | Simplicity, potential for long-term growth, reduced transaction costs. | Requires patience, exposure to significant price volatility, missed opportunities for short-term gains. |

| Dollar-Cost Averaging (DCA) | Reduces risk associated with market timing, mitigates the impact of price volatility. | May not maximize returns if the price consistently rises. |

| Short-Term Trading | Potential for quick profits, flexibility to adapt to market changes. | High risk, requires significant market knowledge and time commitment, potential for substantial losses. |

| Leveraged Trading | Amplified potential returns. | Significantly increased risk of substantial losses, requires sophisticated understanding of market dynamics. |

Frequently Asked Questions (FAQs) about the 2025 Bitcoin Halving

The Bitcoin halving is a significant event in the cryptocurrency’s lifecycle, impacting its supply and potentially its price. Understanding this event is crucial for anyone interested in Bitcoin, whether as an investor or simply as a curious observer. This section addresses some of the most frequently asked questions surrounding the 2025 halving.

The Bitcoin Halving Process

The Bitcoin halving is a programmed event that reduces the rate at which new Bitcoins are created. Every 210,000 blocks mined, approximately every four years, the reward miners receive for verifying transactions is cut in half. This built-in mechanism controls Bitcoin’s inflation and ensures a finite supply of 21 million coins. For example, the reward started at 50 BTC per block and has been halved three times already, currently standing at 6.25 BTC. The 2025 halving will reduce this to 3.125 BTC per block.

The Timing of the Next Bitcoin Halving

While the exact date is dependent on the time it takes to mine blocks (which can fluctuate slightly), the next Bitcoin halving is expected to occur sometime in the Spring of 2025. Precise prediction requires monitoring the blockchain’s block generation rate in the months leading up to the event.

The Halving’s Effect on Bitcoin Price

Historically, Bitcoin’s price has seen significant increases in the periods following previous halvings. This is largely attributed to the reduced supply of new Bitcoins entering the market, potentially increasing scarcity and demand. However, it’s important to note that other market factors, such as regulatory changes, macroeconomic conditions, and overall investor sentiment, also play a crucial role in price determination. The price impact is not guaranteed and past performance is not indicative of future results. For instance, the 2012 and 2016 halvings were followed by substantial price rallies, though the market conditions surrounding each event were vastly different.

The Risks and Rewards of Investing in Bitcoin

Investing in Bitcoin, like any other investment, carries inherent risks. The cryptocurrency market is highly volatile, subject to significant price swings. Regulatory uncertainty, security breaches, and technological advancements can all impact Bitcoin’s value. However, the potential rewards can be substantial for those willing to accept the risk. Bitcoin’s limited supply and growing adoption as a store of value and medium of exchange are factors that contribute to its potential long-term growth. Diversification of investment portfolios is crucial to mitigate risk.

The Long-Term Implications of the Halving

The long-term implications of the halving are complex and multifaceted. The reduced inflation rate contributes to Bitcoin’s scarcity, potentially making it more valuable over time. This, in turn, could attract further institutional and individual investment, leading to increased adoption and network effects. However, unpredictable factors like technological disruptions and shifts in market sentiment could influence the long-term trajectory. The halving acts as a significant catalyst within a larger ecosystem of technological, economic, and social forces.

Understanding the “Halving Bitcoin 2025 Que Es” requires grasping the core concept of Bitcoin halving. Essentially, it refers to the scheduled reduction in Bitcoin’s block reward. To fully comprehend this event, you should consult a comprehensive resource, such as this detailed explanation of the Halving Bitcoin 2025 event. This understanding is key to projecting Bitcoin’s future price and overall market behavior after the “Halving Bitcoin 2025 Que Es” takes place.

Understanding the “Halving Bitcoin 2025 Que Es” requires grasping the core mechanics of Bitcoin’s reward system. Essentially, it refers to the scheduled reduction in Bitcoin’s block reward, an event that significantly impacts its supply. For a deeper dive into this pivotal event, check out this comprehensive resource on the 2025 Bitcoin Halving , which explains its potential effects on price and mining profitability.

Ultimately, understanding the 2025 halving is crucial to forecasting the future of Halving Bitcoin 2025 Que Es.

Understanding the Bitcoin halving in 2025 involves knowing what it is: a programmed reduction in Bitcoin’s block reward. To accurately predict its impact, determining the precise date is crucial; you can find that information by checking this resource: Cuando Es El Halving De Bitcoin 2025. This date significantly influences market speculation surrounding the Halving Bitcoin 2025 Que Es phenomenon and its potential effects on Bitcoin’s price.

Understanding the Bitcoin Halving 2025 Que Es involves grasping the event’s impact on Bitcoin’s supply. This halving, reducing the rate of new Bitcoin creation, is often followed by price increases. To explore potential price movements, you can check out this insightful resource on Bitcoin Halving 2025 Price Prediction , which helps contextualize the expected market reaction to the reduced supply.

Ultimately, understanding these predictions helps clarify what the Bitcoin Halving 2025 Que Es truly signifies for investors.