Bitcoin Halving 2025

The Bitcoin halving, a pre-programmed event in the Bitcoin protocol, is set to occur in 2025, marking a significant moment in the cryptocurrency’s history. This event, which reduces the rate at which new Bitcoins are created, has historically been associated with periods of price appreciation. Understanding the mechanics of the halving and its potential impact is crucial for navigating the evolving cryptocurrency landscape.

Bitcoin Halving Mechanics and Historical Price Impact

The Bitcoin halving occurs approximately every four years, or every 210,000 blocks mined. The core mechanic involves cutting the block reward, the amount of Bitcoin miners receive for successfully adding a block of transactions to the blockchain, in half. This directly impacts the rate of Bitcoin inflation. Historically, the halvings in 2012, 2016, and 2020 were followed by substantial price increases, although the timing and magnitude of these increases varied. While correlation doesn’t equal causation, the reduced supply coupled with sustained or increased demand is often cited as a contributing factor to price appreciation. The impact is complex, influenced by various market forces beyond the halving itself.

Projected Bitcoin Supply After the 2025 Halving

After the 2025 halving, the block reward will be reduced to 3.125 BTC per block. This will further decrease the rate at which new Bitcoins enter circulation. The total supply of Bitcoin is capped at 21 million. While the exact circulating supply at the time of the halving is difficult to predict with absolute certainty due to lost or inaccessible coins, it is expected to be very close to its maximum supply. The halving will significantly slow down the addition of new coins to the circulating supply.

Comparison of Past Halving Cycles and Predictions for 2025

Analyzing past halving cycles reveals distinct patterns, yet each event unfolds within a unique macroeconomic and market context. The 2012 halving saw a relatively modest price increase, followed by a significant bull run in the subsequent years. The 2016 halving was similarly followed by a period of price growth, though the timing and intensity differed from the previous cycle. The 2020 halving, amidst growing institutional adoption and global economic uncertainty, resulted in a substantial price surge. Predicting the outcome of the 2025 halving is challenging; however, many analysts expect a similar pattern, although the precise impact on price remains speculative. Several factors, including regulatory changes, macroeconomic conditions, and overall market sentiment, will play a crucial role.

Timeline of Significant Events Leading Up to the 2025 Halving

The period leading up to the 2025 halving will likely witness increased market speculation and volatility. Key events to watch include: the continued development of Bitcoin’s underlying technology; changes in regulatory frameworks impacting cryptocurrencies globally; the evolution of institutional investment strategies concerning Bitcoin; and shifts in overall market sentiment. These factors, along with macroeconomic conditions, will significantly influence the price of Bitcoin in the lead-up to and following the halving.

Key Metrics Across Past and Projected Halvings

| Halving Year | Block Reward (BTC) | Approximate Circulating Supply (BTC) | Price at Halving (USD – approximate) |

|---|---|---|---|

| 2012 | 25 | 10,500,000 | 13 |

| 2016 | 12.5 | 15,500,000 | 650 |

| 2020 | 6.25 | 18,000,000 | 9,000 |

| 2025 (Projected) | 3.125 | ~19,000,000 | (Prediction Varies Widely) |

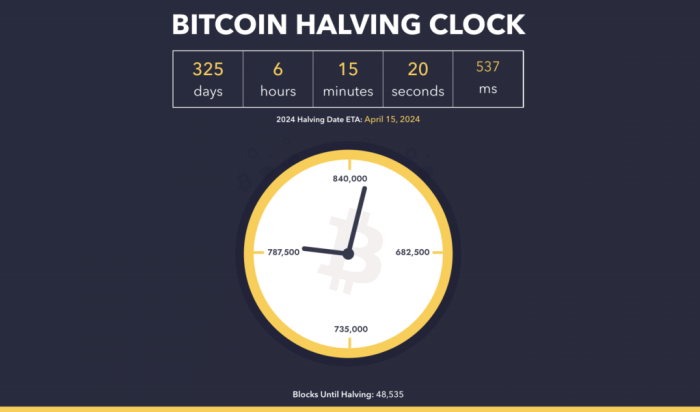

The “Reloj” (Clock) Factor

The countdown to a Bitcoin halving event significantly impacts market sentiment, driving investor behavior and influencing price volatility. The “Reloj,” or clock, visually representing the time until the next halving, becomes a focal point, shaping expectations and triggering specific market reactions. Understanding this psychological element is crucial for navigating the often turbulent period surrounding the event.

The anticipation surrounding a Bitcoin halving creates a unique market dynamic. As the halving date approaches, the decreasing supply of newly mined Bitcoin fuels a narrative of scarcity. This narrative, amplified by media coverage and online discussions, often leads to increased trading volume and price fluctuations. The closer the halving gets, the more pronounced these effects become, culminating in a period of heightened volatility in the days and weeks immediately preceding the event.

Anticipation’s Effect on Trading Volume and Price Volatility

The psychological impact of the halving countdown is undeniable. Investors, driven by FOMO (fear of missing out) and speculation, often increase their trading activity. This increased trading volume, coupled with the inherent uncertainty surrounding the event’s actual impact, leads to amplified price swings. Prices can experience significant upward movements as investors bet on post-halving price appreciation. Conversely, periods of uncertainty and profit-taking can lead to price corrections. The interplay between these factors contributes to a volatile market environment. For example, the halving in 2020 saw a significant price increase in the months leading up to the event, followed by a period of consolidation and then a subsequent bull run.

Potential Market Reactions to Different Scenarios, Halving Bitcoin 2025 Reloj

Several scenarios can unfold leading up to and following a Bitcoin halving. A positive scenario might involve sustained price appreciation in anticipation of the halving, followed by a further price increase post-halving due to reduced supply. A more neutral scenario could see prices remaining relatively stable, with the halving’s impact being less pronounced in the short term. A negative scenario might involve a price drop leading up to the halving due to profit-taking or a bearish market sentiment, potentially followed by a period of prolonged consolidation or even further price decline. The 2012 halving saw a relatively muted price reaction in the immediate aftermath, while the 2016 halving saw a more gradual price increase following the event.

Historical Market Reactions to Previous Halving Events

Historically, Bitcoin halvings have been associated with periods of significant price volatility. The first halving in 2012 saw a gradual price increase in the following months. The second halving in 2016 was followed by a period of consolidation before a significant bull run began. The third halving in 2020 was preceded by a period of price appreciation and followed by a substantial bull market. While these historical events provide some insight, it’s important to remember that each halving occurs within a unique macroeconomic and market context, making direct comparisons challenging.

Typical Market Sentiment Curve Around a Bitcoin Halving

Imagine a graph. The x-axis represents time, stretching from several months before the halving to several months after. The y-axis represents market sentiment, ranging from extremely bearish (negative values) to extremely bullish (positive values). Initially, sentiment might be relatively neutral or even slightly bearish. As the halving approaches, sentiment gradually becomes more bullish, peaking shortly before the event. Immediately after the halving, there might be a slight dip in sentiment as investors take profits or wait to see the market’s immediate reaction. However, if the halving is followed by positive price action, sentiment will likely recover and continue its upward trajectory. If the price action is negative, sentiment may remain subdued or even turn bearish. The overall shape of the curve resembles a slightly asymmetrical bell curve, skewed towards the bullish side, with the peak occurring just before the halving.

Economic and Geopolitical Influences on Bitcoin’s Price

Bitcoin’s price, while driven by its inherent characteristics as a decentralized digital currency, is significantly influenced by broader economic and geopolitical forces. Understanding these external factors is crucial for navigating the volatility inherent in the cryptocurrency market and for making informed predictions about its future trajectory. The interplay between macroeconomic conditions, global events, and regulatory landscapes profoundly shapes Bitcoin’s price action.

Macroeconomic Factors and Bitcoin’s Price

Macroeconomic factors, such as inflation, interest rates, and recessionary fears, exert considerable influence on Bitcoin’s price. High inflation, for example, often leads investors to seek alternative stores of value, potentially driving demand for Bitcoin. Conversely, rising interest rates can make holding Bitcoin less attractive, as investors might shift towards higher-yielding assets. Recessionary fears, similarly, can lead to increased demand for safe-haven assets, which could either boost or diminish Bitcoin’s appeal depending on its perceived risk profile at that time. The 2022 bear market, for instance, saw Bitcoin’s price decline alongside broader market downturns fueled by rising interest rates and fears of a global recession.

Geopolitical Events and Bitcoin’s Price

Global geopolitical events can significantly impact Bitcoin’s price due to their influence on investor sentiment and market stability. Major conflicts, political instability, or significant shifts in global power dynamics can create uncertainty, pushing investors towards safe havens like Bitcoin or away from riskier assets. The Russian invasion of Ukraine in 2022, for example, initially saw a surge in Bitcoin’s price as investors sought refuge from the uncertainty. Conversely, periods of geopolitical stability can lead to decreased demand for Bitcoin as investors feel more confident in traditional markets.

Bitcoin’s Performance During Economic Uncertainty and Stability

Bitcoin has demonstrated varied performance during periods of economic uncertainty and stability. During times of economic instability, Bitcoin has often served as a hedge against inflation and traditional market volatility, leading to price increases. However, during periods of economic stability, Bitcoin’s price can be more susceptible to speculative trading and market sentiment, resulting in increased volatility. The 2008 financial crisis, for example, saw a significant rise in Bitcoin’s adoption as an alternative financial system, while periods of economic growth have sometimes seen Bitcoin’s price fluctuate more dramatically.

Regulatory Developments and Bitcoin Adoption

Regulatory developments in different countries play a crucial role in shaping Bitcoin’s adoption and price. Favorable regulations can boost investor confidence and increase institutional investment, driving up the price. Conversely, restrictive regulations can stifle adoption and negatively impact the price. The varying regulatory approaches across jurisdictions highlight the complexity of navigating the legal landscape for Bitcoin, significantly influencing its global appeal and market value. For instance, El Salvador’s adoption of Bitcoin as legal tender initially boosted the price, while China’s crackdown on cryptocurrency mining led to a significant price correction.

Potential Economic and Geopolitical Events Impacting Bitcoin in 2025

Predicting the future is inherently challenging, but several potential economic and geopolitical events could significantly impact Bitcoin’s price in 2025. These include: a potential global recession, further interest rate hikes by central banks, escalation of geopolitical tensions, significant changes in cryptocurrency regulation in major economies, and the emergence of competing cryptocurrencies or blockchain technologies. The extent of their impact will depend on their severity and the market’s overall response. The potential for a major technological breakthrough in blockchain technology, for example, could dramatically reshape the landscape, while a prolonged global recession might trigger a flight to safety, boosting Bitcoin’s value as a store of value.

Technological Developments and Bitcoin’s Future

Bitcoin’s technological trajectory will significantly impact its price and adoption rate following the 2025 halving. Ongoing developments and debates surrounding scalability, energy consumption, and competition from alternative cryptocurrencies will shape its long-term viability. The interplay between these factors will determine whether Bitcoin can maintain its position as a leading digital asset.

Halving Bitcoin 2025 Reloj – Technological advancements are crucial for Bitcoin’s continued relevance and growth. Improvements in existing infrastructure and the introduction of new technologies will directly affect transaction speeds, costs, and overall usability, influencing both investor confidence and user adoption.

Understanding the Halving Bitcoin 2025 Reloj requires knowing the precise date of the next halving. To clarify this crucial element, you should check out this resource: When Is Bitcoin Halving 2025. This date significantly impacts the Halving Bitcoin 2025 Reloj, influencing predictions and market analyses surrounding the event. Therefore, precise timing is key to understanding the implications.

Lightning Network Enhancements and Taproot Upgrades

The Lightning Network, a layer-two scaling solution, aims to significantly increase Bitcoin’s transaction throughput. Improvements in its routing algorithms, channel management, and user interface could lead to wider adoption and a subsequent increase in Bitcoin’s price. Similarly, the Taproot upgrade, which enhanced Bitcoin’s scripting capabilities and improved privacy, has already had a positive impact. Further development and integration of Taproot could further boost transaction efficiency and attract more users and developers. The success of these upgrades hinges on widespread adoption and seamless integration within existing Bitcoin infrastructure. A hypothetical scenario: widespread adoption of the Lightning Network could drastically reduce transaction fees, making Bitcoin more competitive with traditional payment systems, potentially driving up demand.

Bitcoin’s Scalability and Energy Consumption

Bitcoin’s scalability remains a subject of ongoing debate. While the Lightning Network offers a potential solution, concerns persist about the network’s ability to handle a massive surge in transactions. Similarly, Bitcoin’s energy consumption is a significant concern, particularly in the context of environmental sustainability. The transition to more sustainable energy sources for Bitcoin mining, along with the development of more energy-efficient mining hardware, are crucial for addressing these concerns. For example, a shift towards renewable energy sources for mining operations could significantly reduce Bitcoin’s carbon footprint, potentially improving its public image and attracting environmentally conscious investors.

Bitcoin’s Technological Strengths and Weaknesses Compared to Alternatives

Bitcoin’s key strengths lie in its decentralized nature, robust security, and established track record. Its first-mover advantage and established brand recognition provide a significant competitive edge. However, weaknesses include its relatively slow transaction speeds compared to some alternative cryptocurrencies and its high energy consumption. Alternative cryptocurrencies often offer faster transaction speeds and lower energy consumption, but frequently lack the same level of decentralization, security, and market maturity as Bitcoin. For instance, Ethereum, while offering smart contract functionality, has faced scalability challenges in the past. This comparison highlights Bitcoin’s strengths in security and decentralization but acknowledges its limitations in speed and energy efficiency.

Potential Risks and Challenges to Bitcoin’s Long-Term Viability

Several risks and challenges threaten Bitcoin’s long-term viability. These include regulatory uncertainty, potential quantum computing threats to its cryptographic security, and competition from alternative cryptocurrencies with superior technological features. Furthermore, the concentration of Bitcoin mining power in specific geographic regions poses a risk to its decentralization. A successful attack on the Bitcoin network, though unlikely given its current security, could severely damage investor confidence and its price.

Technological Advancements’ Impact on Bitcoin’s Price Trajectory Post-2025 Halving

Technological advancements could significantly influence Bitcoin’s price trajectory after the 2025 halving. Successful implementation of scaling solutions like the Lightning Network could lead to increased adoption and price appreciation. Conversely, a failure to address scalability and energy consumption concerns could negatively impact its price. The overall effect will depend on the interplay between technological progress, regulatory developments, and broader macroeconomic conditions. For example, a successful scaling solution combined with positive regulatory developments could trigger a substantial price increase following the halving, similar to past halving cycles, but with the magnitude potentially influenced by the technological advancements.

Investing and Trading Strategies Around the Halving: Halving Bitcoin 2025 Reloj

The Bitcoin halving, a significant event reducing the rate of new Bitcoin creation, historically precedes periods of price appreciation. However, predicting the exact market reaction remains challenging, necessitating a nuanced approach to investment and trading strategies. Investors should carefully consider their risk tolerance and time horizon before deploying capital.

Long-Term Holding Strategy

This strategy, often referred to as “HODLing,” involves buying Bitcoin and holding it for an extended period, typically years, regardless of short-term price fluctuations. The core principle is based on the belief in Bitcoin’s long-term value proposition as a decentralized, scarce digital asset. The halving is viewed as a catalyst for increased scarcity and potential future price appreciation.

Risks and Rewards of Long-Term Holding

The primary reward is the potential for significant returns if Bitcoin’s price appreciates over the long term. However, the risks include the possibility of prolonged periods of price stagnation or even decline, potentially leading to significant losses if the investment is not diversified. The volatility of Bitcoin’s price also presents a considerable risk for long-term holders. The 2018 bear market, following the 2016 halving, serves as a cautionary example, where prices fell sharply despite the halving event.

Short-Term Trading Strategy

Short-term trading involves attempting to profit from short-term price fluctuations. Traders often use technical analysis and indicators to identify buying and selling opportunities around the halving event, aiming to capitalize on the anticipated volatility. This approach requires a high level of market understanding and risk tolerance.

Risks and Rewards of Short-Term Trading

Short-term trading offers the potential for quick profits, but carries significantly higher risk. The rapid price swings characteristic of Bitcoin can lead to substantial losses if trades are not timed correctly. The market’s reaction to the halving can be unpredictable, making accurate predictions challenging. Unsuccessful short-term trading strategies during past halvings have resulted in significant losses for many traders.

Trading Indicators and Their Application

Various technical indicators are employed to predict Bitcoin price movements. These include moving averages (e.g., 50-day, 200-day), relative strength index (RSI), and volume analysis. While these indicators can provide insights into potential price trends, they are not foolproof and should be used in conjunction with other forms of analysis. For instance, the RSI might suggest an overbought or oversold condition, indicating a potential price reversal, but this is not guaranteed. The efficacy of these indicators is also dependent on market conditions and can vary significantly.

Examples of Successful and Unsuccessful Strategies

Successful strategies during past halvings often involved a combination of long-term holding and strategic buying during periods of price dips. Conversely, unsuccessful strategies frequently involved leveraging high amounts of borrowed funds to amplify short-term gains, leading to significant losses when the market moved against the trader’s position. Overly aggressive short-term trading based solely on technical indicators without considering broader market conditions has also proven to be a high-risk strategy.

Hypothetical Portfolio Allocation Strategy

A hypothetical portfolio allocation strategy for investors considering Bitcoin exposure before and after the halving might involve a diversified approach. For example, a moderately risk-tolerant investor could allocate 10% of their portfolio to Bitcoin before the halving, increasing it to 15% after the halving if the price remains stable or appreciates. The remaining portfolio could be invested in other asset classes like stocks, bonds, and real estate to mitigate overall risk. This allocation should be adjusted based on individual risk tolerance and financial goals. It is crucial to remember that this is a hypothetical example, and the actual allocation should be determined based on individual circumstances and professional financial advice.

Frequently Asked Questions (FAQs)

This section addresses common questions surrounding the Bitcoin halving, its impact on price, and the associated investment considerations. Understanding these aspects is crucial for navigating the complexities of the cryptocurrency market, particularly in anticipation of the upcoming halving event.

Bitcoin Halving Explained

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created. This occurs approximately every four years, or every 210,000 blocks mined. The halving mechanism cuts the block reward in half, meaning miners receive fewer Bitcoins for verifying transactions and adding new blocks to the blockchain. This process directly impacts Bitcoin’s inflation rate, gradually decreasing the supply of new Bitcoins entering circulation. The initial block reward was 50 BTC, and it has been halved three times already, currently standing at 6.25 BTC per block.

Timing of the Next Bitcoin Halving

The next Bitcoin halving is projected to occur in the spring of 2025. The precise date depends on the rate of block creation, which can fluctuate slightly. However, based on historical data and current mining rates, a date sometime between April and June 2025 is widely anticipated within the Bitcoin community.

The Halving’s Impact on Bitcoin’s Price

Historically, Bitcoin’s price has shown a tendency to increase following previous halving events. This is attributed to the reduced supply of new Bitcoins entering the market, potentially creating a scenario of increased scarcity and driving up demand. However, it’s crucial to note that other factors, such as overall market sentiment, regulatory changes, and technological advancements, also significantly influence Bitcoin’s price. The 2012 and 2016 halvings were followed by substantial price increases, although the timeframes varied. Predicting the exact price impact of the 2025 halving remains speculative, as numerous unpredictable variables are at play.

Investing in Bitcoin Before the Halving

Investing in Bitcoin before a halving presents both significant potential rewards and considerable risks. The potential reward stems from the historical price increases observed after previous halvings, driven by the anticipation of reduced supply. However, the cryptocurrency market is highly volatile, and investing before the halving carries substantial risk. The price could decline before the halving, leading to losses. Furthermore, the historical correlation between halvings and price increases isn’t a guarantee of future performance. Thorough research, risk assessment, and diversification are essential before making any investment decisions.

Potential Risks Associated with Investing in Bitcoin

Investing in Bitcoin, like any other asset class, involves inherent risks. Market volatility is a primary concern; Bitcoin’s price can fluctuate dramatically in short periods. Regulatory uncertainty also poses a risk, as governments worldwide are still developing their approaches to regulating cryptocurrencies. Security risks, such as hacking and theft from exchanges or personal wallets, are also relevant considerations. Finally, technological risks, including potential vulnerabilities in the Bitcoin protocol, could impact the value of the cryptocurrency. Mitigating these risks involves diversifying investments, using secure storage methods for Bitcoin, and staying informed about regulatory developments and technological advancements.

Understanding the Halving Bitcoin 2025 Reloj requires examining the broader context of Bitcoin’s reward halving mechanism. For a detailed analysis of this crucial event, including its potential impact on price and mining, refer to this comprehensive resource on the Bitcoin 2025 Halving. Returning to the Halving Bitcoin 2025 Reloj, this knowledge helps us better predict its effects on the overall Bitcoin ecosystem and its future trajectory.

The anticipation surrounding the Bitcoin Halving 2025 Reloj is palpable, with many speculating on its market impact. A key question on everyone’s mind is precisely when this event will occur, and to find out the exact time, you can consult this helpful resource: What Time Is The Bitcoin Halving 2025. Understanding the precise timing is crucial for strategizing around the Halving Bitcoin 2025 Reloj and its potential consequences.

The anticipation surrounding the Bitcoin Halving 2025 Reloj is palpable, with many speculating on its market impact. A key question on everyone’s mind is precisely when this event will occur, and to find out the exact time, you can consult this helpful resource: What Time Is The Bitcoin Halving 2025. Understanding the precise timing is crucial for strategizing around the Halving Bitcoin 2025 Reloj and its potential consequences.

The anticipation surrounding the Bitcoin Halving 2025 Reloj is palpable, with many speculating on its market impact. A key question on everyone’s mind is precisely when this event will occur, and to find out the exact time, you can consult this helpful resource: What Time Is The Bitcoin Halving 2025. Understanding the precise timing is crucial for strategizing around the Halving Bitcoin 2025 Reloj and its potential consequences.

The anticipation surrounding the Bitcoin Halving 2025 Reloj is palpable, with many speculating on its market impact. A key question on everyone’s mind is precisely when this event will occur, and to find out the exact time, you can consult this helpful resource: What Time Is The Bitcoin Halving 2025. Understanding the precise timing is crucial for strategizing around the Halving Bitcoin 2025 Reloj and its potential consequences.