Bitcoin Halving 2025

The Bitcoin halving, a pre-programmed event reducing the rate at which new Bitcoins are created, is anticipated in 2025. This event has historically been associated with significant shifts in Bitcoin’s price and market sentiment, making it a crucial factor in understanding the future trajectory of the cryptocurrency. Understanding past halvings and their influence allows for a more informed assessment of potential outcomes in 2025.

Historical Impact of Bitcoin Halvings

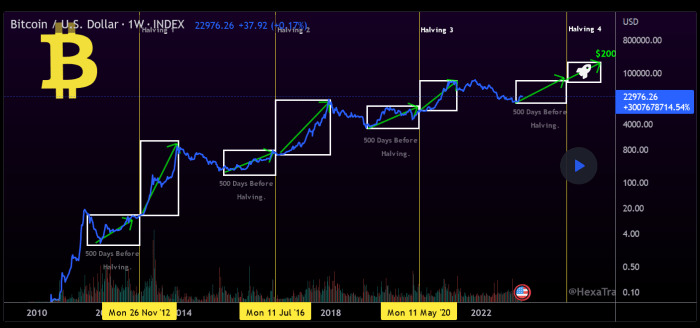

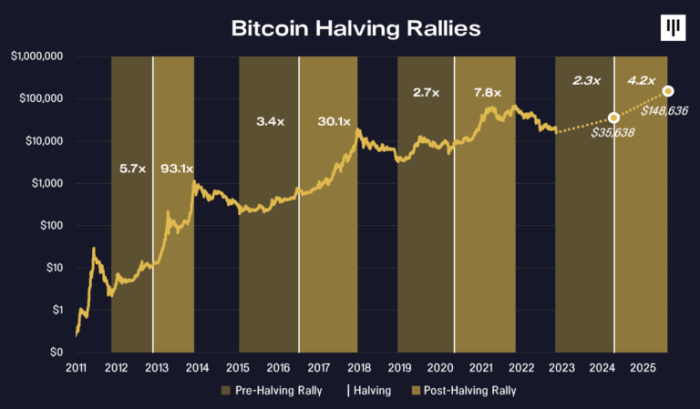

Previous Bitcoin halvings have demonstrated a consistent pattern of increased price volatility and, generally, a long-term upward trend following the event. The first halving in 2012 saw a relatively modest price increase, largely due to the nascent nature of the cryptocurrency market at the time. The second halving in 2016 witnessed a more pronounced price surge, leading to significant gains in the following year. The third halving in 2020 also resulted in a substantial price increase, though this was followed by a period of considerable market correction. This historical data suggests a correlation between halvings and price appreciation, though the magnitude and duration of these increases vary considerably depending on broader market conditions.

Economic Factors Influencing Bitcoin Price in 2025

Several economic factors could influence Bitcoin’s price leading up to and after the 2025 halving. Macroeconomic conditions, such as inflation rates, interest rate policies implemented by central banks globally, and overall economic growth will undoubtedly play a role. The regulatory landscape surrounding cryptocurrencies, both domestically and internationally, will also be a significant factor. Furthermore, the adoption rate of Bitcoin by institutional investors and mainstream consumers will heavily influence its price. Finally, the level of competition from alternative cryptocurrencies and the overall health of the broader cryptocurrency market will all contribute to shaping the price of Bitcoin. For instance, the 2020 halving coincided with a period of increased institutional interest in Bitcoin, potentially contributing to the subsequent price surge.

Comparison of Market Conditions Across Halvings

The market conditions surrounding each Bitcoin halving have been significantly different. The first halving occurred during a period of relatively low market awareness and trading volume. The second halving coincided with growing institutional interest and increasing regulatory clarity in some jurisdictions. The third halving took place during a period of increased mainstream awareness and adoption, alongside a broader bull market in the cryptocurrency sector. The anticipated market conditions in 2025 are likely to be influenced by the maturation of the cryptocurrency market, increased regulatory scrutiny, and the ongoing evolution of the financial technology landscape. These factors could result in a response to the 2025 halving that differs from previous events.

Bitcoin’s Inflation Rate Reduction After the 2025 Halving

The 2025 halving will reduce the block reward for Bitcoin miners from 6.25 BTC to 3.125 BTC. This represents a 50% reduction in the rate at which new Bitcoins enter circulation. This decrease in the rate of inflation is expected to create scarcity, potentially driving up the price due to increased demand in a limited supply environment. This effect is based on the fundamental economic principle of supply and demand, where reduced supply, ceteris paribus, can lead to increased prices, especially in a market with continued demand. The magnitude of this effect, however, remains uncertain and subject to various market forces.

Key Metrics Before and After Previous Halvings

| Halving Date | Block Reward (Before) | Circulating Supply (Before) | Price (Before – Approximate USD) | Price (After – Approximate USD) |

|---|---|---|---|---|

| November 2012 | 50 BTC | 10,500,000 BTC | $13 | ~$100 (over time) |

| July 2016 | 25 BTC | 15,750,000 BTC | ~$650 | ~$20,000 (over time) |

| May 2020 | 12.5 BTC | 18,375,000 BTC | ~$9,000 | ~$65,000 (over time) |

The Halving’s Effect on Bitcoin Mining

The Bitcoin halving, scheduled for 2025, represents a significant event for the Bitcoin mining ecosystem. This event, occurring approximately every four years, reduces the block reward miners receive for successfully adding new transactions to the blockchain. This reduction directly impacts the profitability of mining operations and forces miners to adapt their strategies for survival and continued participation in the network.

Impact on Miners’ Profitability

The halving cuts the Bitcoin block reward in half. This means miners will receive significantly less Bitcoin for their computational efforts. Profitability hinges on the interplay between the block reward (in Bitcoin), the price of Bitcoin in fiat currency, electricity costs, and the mining hardware’s efficiency. A lower block reward, all else being equal, directly translates to reduced profitability. Miners will need to carefully analyze their operational costs to determine if they can remain profitable after the halving. For example, if the Bitcoin price remains stable, miners with high electricity costs or less efficient hardware may find themselves operating at a loss and be forced to shut down or upgrade.

Miner Adaptation Strategies

Faced with decreased profitability, miners will likely pursue several strategies to maintain operations. These could include upgrading to more energy-efficient mining hardware (ASICs), negotiating lower electricity rates with providers, diversifying revenue streams (e.g., offering hosting services), or consolidating operations to achieve economies of scale. Some miners may choose to relocate their operations to regions with lower energy costs, further emphasizing the importance of energy price in mining profitability. Others might explore alternative consensus mechanisms or explore other cryptocurrencies with more lucrative rewards.

Energy Consumption Implications

Bitcoin mining is energy-intensive. The total energy consumption fluctuates based on the hashrate (the computational power dedicated to mining), the efficiency of mining hardware, and the electricity prices in different mining locations. Before a halving, the network’s hashrate tends to increase as miners compete for the existing block reward. After the halving, the hashrate might initially decline as less profitable miners exit the network. However, this decline is usually temporary. As the Bitcoin price adjusts and mining hardware efficiency improves, the hashrate often recovers and continues to grow. The overall energy consumption depends on this dynamic interplay. The energy consumed before a halving can be significantly higher than after, due to increased competition, but the long-term impact is less clear-cut and depends on multiple factors.

Hashrate and Mining Difficulty Adjustments

Historically, Bitcoin’s hashrate has increased significantly in the period leading up to each halving, as miners anticipate the reduced reward and aim to secure their share of the remaining blocks. Following the halving, the hashrate may initially drop, but it typically recovers and continues its upward trend. Mining difficulty, which adjusts to maintain a consistent block generation time (approximately 10 minutes), also follows a similar pattern. It increases before the halving due to the rising hashrate and then adjusts downward after the halving, as the hashrate might temporarily decrease before resuming its growth. For instance, the 2020 halving saw a significant hashrate increase leading up to the event, followed by a temporary dip and subsequent recovery.

Potential Consequences of Decreased Mining Activity

A significant decrease in mining activity, while less likely in the long run, could have several negative consequences.

- Reduced network security: Fewer miners mean a weaker network, potentially making it more vulnerable to 51% attacks.

- Increased transaction fees: A less active network could lead to congestion and higher transaction fees.

- Slower block confirmation times: The time it takes for transactions to be confirmed could increase.

- Negative impact on Bitcoin’s price: Reduced network security and slower transaction times could negatively affect investor confidence and the price of Bitcoin.

Investor Sentiment and Market Predictions: Halving Bitcoin Date 2025

The 2025 Bitcoin halving is a significant event anticipated to impact investor sentiment and market predictions significantly. The reduced supply of newly mined Bitcoin, coupled with existing demand, is expected to influence price movements, although the extent of this influence remains a subject of ongoing debate among experts. Understanding the interplay between psychological factors and investment strategies is crucial for navigating this period.

Expert Opinions on Expected Price Movement

Many experts believe the halving will be a bullish catalyst for Bitcoin’s price. PlanB, a well-known on-chain analyst, has historically used stock-to-flow models to predict Bitcoin’s price, suggesting a potential price surge following the halving. However, other analysts, such as those at Arcane Research, offer more cautious predictions, emphasizing the impact of macroeconomic factors and regulatory uncertainty on the cryptocurrency market. These varying perspectives highlight the inherent uncertainty in predicting Bitcoin’s price, even with the predictability of the halving event itself. For example, while some predict a price increase to $100,000 or more, others suggest a more modest rise, or even a temporary price dip before a later surge. The actual price movement will likely depend on a complex interplay of factors beyond the halving itself.

Psychological Factors Influencing Investor Behavior

The anticipation surrounding the halving creates a potent psychological environment for investors. FOMO (Fear Of Missing Out) often drives investors to purchase Bitcoin in the lead-up to the event, potentially inflating the price. Conversely, fear and uncertainty can lead to selling pressure, particularly if broader market conditions are unfavorable. The “hodl” (hold on for dear life) mentality, a common sentiment within the Bitcoin community, encourages long-term investment, potentially mitigating short-term price volatility. This psychological tug-of-war between greed and fear significantly influences the overall market sentiment and price action. Past halving events have shown periods of both significant price increases and subsequent corrections, demonstrating the complexity of this psychological interplay.

Investment Strategies in Anticipation of the Halving

Investors employ various strategies to capitalize on the anticipated halving. Dollar-cost averaging (DCA), a strategy involving consistent investments regardless of price fluctuations, is a popular approach to mitigate risk. Some investors opt for a more aggressive approach, accumulating Bitcoin before the halving in anticipation of a price surge. Others might choose to diversify their portfolios, allocating a portion of their investments to Bitcoin and other assets to reduce overall risk. The optimal strategy depends on individual risk tolerance and investment goals. For example, a risk-averse investor might prefer DCA, while a more aggressive investor might choose to invest a larger sum before the halving, acknowledging the higher risk involved.

Potential Risks and Opportunities

Investing in Bitcoin before and after the halving presents both significant opportunities and considerable risks. The potential for substantial price appreciation is a major draw, but the cryptocurrency market is inherently volatile, susceptible to regulatory changes, market manipulation, and unexpected technological developments. The halving itself doesn’t guarantee price increases; other market forces could outweigh its impact. Opportunities exist for both short-term and long-term investors, but careful risk assessment is crucial. For instance, the risk of a market crash unrelated to the halving could significantly impact investments, regardless of the halving’s effects.

Comparison of Bullish and Bearish Predictions

Bullish predictions for the post-halving period often cite the reduced Bitcoin supply as the primary driver of price appreciation, pointing to historical precedent. They often predict a significant price increase, potentially exceeding previous highs. Bearish predictions, however, emphasize the influence of macroeconomic factors, regulatory uncertainty, and the potential for a market correction following the price surge leading up to the halving. They might suggest a more modest price increase or even a period of stagnation or decline after the halving. The reality will likely fall somewhere between these extremes, highlighting the importance of diversification and risk management. For example, a bullish prediction might forecast a price of $200,000 within a year of the halving, while a bearish prediction might suggest a price range of $50,000 to $75,000.

Long-Term Implications of the 2025 Halving

The 2025 Bitcoin halving, reducing the block reward for miners by half, is anticipated to have profound and lasting consequences on Bitcoin’s trajectory. While short-term market volatility is expected, the long-term implications are far-reaching, impacting adoption, its role as a store of value, and the broader cryptocurrency landscape. Understanding these long-term effects is crucial for both investors and those interested in Bitcoin’s future.

The reduced supply of newly mined Bitcoin post-halving is expected to create a significant deflationary pressure. This scarcity, coupled with growing adoption and institutional interest, could further solidify Bitcoin’s position as a digital gold, a hedge against inflation, and a valuable store of value. This increased scarcity will likely increase the demand, driving the price upwards if other factors remain constant. However, other macroeconomic factors and market sentiment will play a critical role in the actual price movements.

Bitcoin’s Adoption and Use Cases

The halving’s impact on Bitcoin’s adoption is multifaceted. Decreased inflation could incentivize wider adoption as a medium of exchange and store of value, especially in regions with volatile fiat currencies. Increased price appreciation (a potential outcome) could attract new investors and businesses, leading to the development of more Bitcoin-related services and applications. Conversely, a price drop could hinder adoption, making it less attractive to both individuals and businesses. The long-term effect depends heavily on the interplay of these factors. We might see increased usage in peer-to-peer transactions and decentralized finance (DeFi) applications, driven by the increased value and scarcity of Bitcoin.

Bitcoin’s Position as a Store of Value and Competition, Halving Bitcoin Date 2025

The halving could significantly strengthen Bitcoin’s position as a store of value. The reduced supply and potential price appreciation could make it more attractive compared to traditional assets like gold and real estate, particularly in times of economic uncertainty. However, its competition with other cryptocurrencies and digital assets will remain intense. Altcoins might experience periods of increased relative value, depending on their own technological advancements and market positioning. The competition will likely depend on technological innovation, regulatory developments, and market sentiment. For example, if another cryptocurrency develops a significantly more efficient or scalable technology, it could draw investment away from Bitcoin.

Impact on the Overall Cryptocurrency Market

The 2025 halving’s influence on the broader cryptocurrency market is likely to be significant but complex. While Bitcoin’s price movements can often affect the entire market (a phenomenon known as the “Bitcoin effect”), the impact isn’t uniform. Altcoins, often correlated with Bitcoin, might experience price fluctuations mirroring Bitcoin’s trajectory. However, altcoins with unique value propositions or technological advantages might decouple from Bitcoin’s price, showing independent growth or decline. The overall market capitalization of cryptocurrencies could increase or decrease, depending on the net effect of the halving on investor sentiment and market dynamics.

Potential Milestones Post-Halving

The following timeline illustrates potential milestones in Bitcoin’s development after the 2025 halving. These are speculative and depend on various factors, including technological advancements, regulatory changes, and overall market sentiment.

| Year | Potential Milestone |

|---|---|

| 2025-2026 | Increased institutional investment and adoption, leading to higher prices and market capitalization. |

| 2027-2028 | Development and wider adoption of Bitcoin-based decentralized finance (DeFi) applications and services. |

| 2029-2030 | Increased regulatory clarity in major markets, leading to greater mainstream adoption and reduced volatility. |

Summary of Long-Term Significance

The 2025 Bitcoin halving is a significant event with the potential to reshape the cryptocurrency landscape. Its long-term implications extend beyond short-term price fluctuations, impacting Bitcoin’s adoption, its competitive position, and the overall cryptocurrency market. While the future remains uncertain, understanding the potential consequences of this halving is crucial for navigating the evolving world of digital assets.