Bitcoin Halving 2025: Halving Date Bitcoin 2025

The Bitcoin halving, a pre-programmed event reducing the rate at which new Bitcoins are mined, is a significant occurrence in the cryptocurrency’s lifecycle. This reduction in supply, coupled with generally increasing demand, historically has led to significant price appreciation in the months and years following the event. The 2025 halving, anticipated around April, is generating considerable speculation within the crypto community.

Bitcoin Halving Mechanics and Historical Impact

The Bitcoin halving mechanism is embedded within the Bitcoin protocol. Every 210,000 blocks mined, approximately every four years, the reward paid to Bitcoin miners for verifying transactions is cut in half. This halving reduces the inflation rate of Bitcoin, making it a potentially deflationary asset in the long term. Historically, each halving has been followed by a period of significant price increase, although the timing and magnitude of these increases have varied. The reduced supply creates scarcity, a fundamental economic principle that often drives up prices, particularly for assets with growing demand.

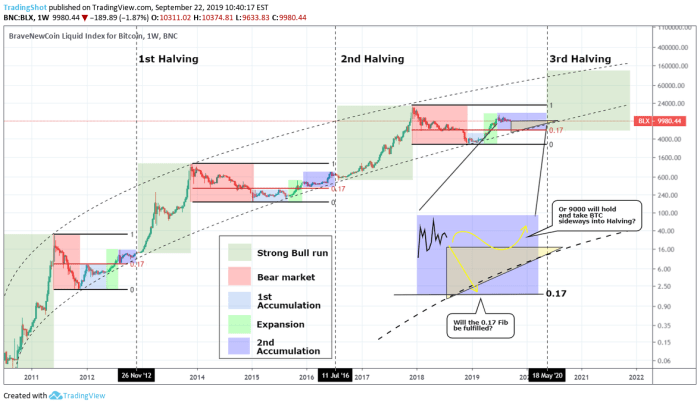

Timeline of Past Bitcoin Halvings and Subsequent Price Movements

The first Bitcoin halving occurred in November 2012, reducing the block reward from 50 BTC to 25 BTC. The price, then around $13, saw a gradual increase over the following years, eventually reaching a high of over $1,100 by late 2013. The second halving happened in July 2016, cutting the reward to 12.5 BTC. This was followed by a substantial price surge, reaching almost $20,000 by December 2017. The third halving, in May 2020, reduced the reward to 6.25 BTC. While the price did increase following this halving, the rise was less dramatic than in previous cycles, reaching approximately $69,000 in late 2021 before experiencing a significant correction.

Analyst Predictions for the 2025 Halving, Halving Date Bitcoin 2025

Prominent cryptocurrency analysts offer varying predictions for the 2025 halving’s impact. Some believe the halving will trigger another significant bull market, citing the historical precedent and the potential for increased institutional adoption of Bitcoin. Others are more cautious, pointing to macroeconomic factors, regulatory uncertainty, and the potential for increased competition from other cryptocurrencies as factors that could mitigate the price impact. PlanB, a well-known on-chain analyst, has historically used the Stock-to-Flow model to predict Bitcoin’s price, although his predictions haven’t always been perfectly accurate. However, his work continues to influence market sentiment. It is crucial to remember that these are predictions, not guarantees, and the actual price movement will depend on a complex interplay of factors.

Comparison of Bitcoin Halvings

| Halving Date | Block Reward Before | Block Reward After | Approximate Price Before Halving (USD) |

|---|---|---|---|

| November 2012 | 50 BTC | 25 BTC | ~$13 |

| July 2016 | 25 BTC | 12.5 BTC | ~$650 |

| May 2020 | 12.5 BTC | 6.25 BTC | ~$9,000 |

| ~April 2025 (Projected) | 6.25 BTC | 3.125 BTC | (To be determined) |

Market Impact and Price Predictions

The Bitcoin halving, scheduled for 2025, is a significant event anticipated to impact the cryptocurrency’s price. This reduction in the rate of new Bitcoin entering circulation historically has led to periods of price appreciation, though the extent of this impact varies considerably depending on various market factors. Understanding the potential short-term and long-term effects, along with analyzing different price prediction models, is crucial for navigating this period of market uncertainty.

Short-Term and Long-Term Price Effects

The halving’s immediate effect on Bitcoin’s price is often characterized by increased volatility. In the short term (months following the event), we might see a surge in price driven by anticipation and speculation. However, this initial surge may be followed by a period of consolidation or even a temporary price correction as the market digests the event and adjusts to the new supply dynamics. The long-term effect is generally considered to be bullish, with a gradual upward trend in price expected as the scarcity of Bitcoin becomes more pronounced over time. The historical precedent of previous halvings supports this long-term bullish outlook, although past performance is not necessarily indicative of future results. External factors such as regulatory changes, macroeconomic conditions, and overall market sentiment will significantly influence the actual price trajectory.

Price Prediction Models and Estimations

Various models attempt to predict Bitcoin’s price after the 2025 halving. Stock-to-flow (S2F) models, for example, focus on the relationship between Bitcoin’s supply and its price. These models often generate high price predictions based on historical trends and the diminishing supply post-halving. However, it’s important to note that these models often oversimplify the complexity of the market and fail to account for unforeseen events. Other models incorporate factors like adoption rates, network effects, and macroeconomic indicators to arrive at more nuanced predictions. For instance, some analysts incorporate on-chain metrics such as transaction volume and active addresses to refine their price projections. These more sophisticated models tend to provide a range of potential outcomes rather than a single point prediction.

Bullish and Bearish Market Sentiments

The 2025 halving has generated a diverse range of market sentiments. Bullish investors point to the historical precedent of price increases following previous halvings, the inherent scarcity of Bitcoin, and the increasing institutional adoption as reasons for expecting significant price appreciation. They often cite the limited supply of 21 million Bitcoin as a key driver of long-term price growth. Conversely, bearish sentiments highlight the potential for regulatory uncertainty, macroeconomic headwinds, and the possibility of a broader cryptocurrency market downturn. Skeptics argue that past halving cycles do not guarantee future price increases and emphasize the volatility inherent in the cryptocurrency market. The prevailing sentiment will significantly impact the actual price movement post-halving.

Visual Representation of Price Prediction Scenarios

Consider this text-based illustration of potential price scenarios:

Scenario 1 (Bullish): A sharp price increase immediately following the halving, followed by a period of consolidation and then a gradual, sustained upward trend reaching prices significantly higher than pre-halving levels. This could be visualized as a steep upward curve, followed by a gentler incline. For example, a move from $30,000 to $100,000 within a year or two, followed by further growth.

Scenario 2 (Neutral): A moderate price increase initially, followed by a period of sideways trading and then a more gradual upward trend. This could be depicted as a less steep incline, with some periods of flat movement. A potential example would be a move from $30,000 to $50,000 over a two-year period.

Scenario 3 (Bearish): A temporary price increase followed by a significant correction, leading to prices remaining relatively flat or even declining below pre-halving levels. This would be visualized as a short upward spike followed by a sharp downward trend, potentially settling below the starting point. For example, a temporary spike to $40,000 followed by a drop to $20,000.

It is important to remember that these are simplified scenarios, and the actual price movement is likely to be more complex and influenced by numerous unpredictable factors.

The Bitcoin halving in 2025 is a significant event for the cryptocurrency, reducing the rate of new Bitcoin creation. Understanding this event is crucial, and for a comprehensive explanation, I recommend checking out this helpful resource: Que Es El Halving Bitcoin 2025. This resource will give you a solid grasp of the mechanics behind the halving and its potential impact on the Bitcoin price leading up to and following the Halving Date Bitcoin 2025.

The Bitcoin halving in 2025 is a significant event for the cryptocurrency, reducing the rate of new Bitcoin creation. Understanding this event is crucial, and for a comprehensive explanation, I recommend checking out this helpful resource: Que Es El Halving Bitcoin 2025. This resource will give you a solid grasp of the mechanics behind the halving and its potential impact on the Bitcoin price leading up to and following the Halving Date Bitcoin 2025.

The Bitcoin halving in 2025 is a significant event for the cryptocurrency, reducing the rate of new Bitcoin creation. Understanding this event is crucial, and for a comprehensive explanation, I recommend checking out this helpful resource: Que Es El Halving Bitcoin 2025. This resource will give you a solid grasp of the mechanics behind the halving and its potential impact on the Bitcoin price leading up to and following the Halving Date Bitcoin 2025.

The Bitcoin halving in 2025 is a significant event for the cryptocurrency, reducing the rate of new Bitcoin creation. Understanding this event is crucial, and for a comprehensive explanation, I recommend checking out this helpful resource: Que Es El Halving Bitcoin 2025. This resource will give you a solid grasp of the mechanics behind the halving and its potential impact on the Bitcoin price leading up to and following the Halving Date Bitcoin 2025.

The Bitcoin halving in 2025 is a significant event for the cryptocurrency, reducing the rate of new Bitcoin creation. Understanding this event is crucial, and for a comprehensive explanation, I recommend checking out this helpful resource: Que Es El Halving Bitcoin 2025. This resource will give you a solid grasp of the mechanics behind the halving and its potential impact on the Bitcoin price leading up to and following the Halving Date Bitcoin 2025.

The Bitcoin halving in 2025 is a significant event for the cryptocurrency, reducing the rate of new Bitcoin creation. Understanding this event is crucial, and for a comprehensive explanation, I recommend checking out this helpful resource: Que Es El Halving Bitcoin 2025. This resource will give you a solid grasp of the mechanics behind the halving and its potential impact on the Bitcoin price leading up to and following the Halving Date Bitcoin 2025.