Investor Sentiment and Market Speculation

The Bitcoin halving, a pre-programmed event reducing the rate of new Bitcoin creation, significantly influences investor sentiment and market speculation. The anticipation surrounding this event often leads to periods of heightened volatility and price fluctuations, driven by a complex interplay of factors including supply and demand dynamics, network security considerations, and broader macroeconomic conditions. Understanding these dynamics is crucial for navigating the market effectively during and after a halving.

Investor behavior leading up to and following a halving event typically exhibits a pattern of increasing optimism followed by a period of price adjustment. In the months leading up to the event, anticipation often fuels a price rally as investors accumulate Bitcoin in expectation of scarcity-driven price increases. Following the halving, the market may experience a period of consolidation or even a price correction, as investors assess the actual impact of the reduced supply on market dynamics. This post-halving period can be characterized by uncertainty and volatility as the market adjusts to the new reality.

Increased Volatility Around the 2025 Halving

The potential for increased volatility around the 2025 halving is significant. Historical data suggests that halving events have been followed by substantial price movements, though the magnitude and direction of these movements have varied. Several factors contribute to this potential volatility. Firstly, the reduced issuance rate directly impacts the supply of Bitcoin, potentially creating upward pressure on price. Secondly, the increased media attention and investor speculation surrounding the halving can amplify existing market sentiment, leading to amplified price swings. Finally, external macroeconomic factors, such as inflation or regulatory changes, can interact with the halving’s impact, creating further uncertainty and volatility. For example, the 2021 halving coincided with a period of increased institutional adoption and broader cryptocurrency market enthusiasm, contributing to a substantial price surge. However, the 2016 halving saw a more gradual price increase, influenced by the then-developing market conditions.

Key Factors Influencing Investor Sentiment

Several key factors influence investor sentiment regarding Bitcoin halvings. These include the perceived scarcity of Bitcoin, the anticipated increase in its value due to reduced supply, and the overall state of the cryptocurrency market. Furthermore, macroeconomic conditions, such as inflation and interest rates, play a crucial role. Regulatory developments and the adoption of Bitcoin by institutional investors also significantly influence market sentiment. For instance, positive regulatory developments or large institutional investments can boost confidence and drive prices upward, while negative news or regulatory uncertainty can lead to price corrections. The narrative surrounding Bitcoin’s role as a hedge against inflation also plays a significant role in investor sentiment, often driving demand during periods of economic instability.

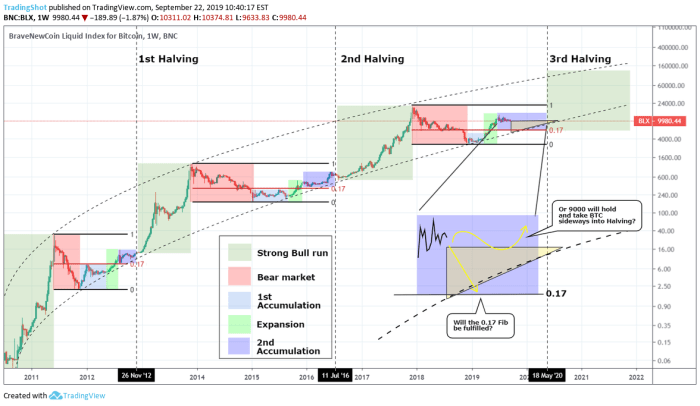

Timeline of Significant Events Surrounding Previous Halvings and Their Market Impact, Halving De Bitcoin 2025

The following timeline summarizes the key events surrounding previous Bitcoin halvings and their subsequent market impact:

| Halving Date | Market Impact (Simplified) | Significant Concurrent Events |

|---|---|---|

| November 28, 2012 | Gradual price increase following the halving. | Early adoption, limited institutional involvement. |

| July 9, 2016 | Moderate price increase, relatively slow compared to later halvings. | Growing awareness, increasing regulatory scrutiny in some regions. |

| May 11, 2020 | Significant price increase leading up to and following the halving. | Increased institutional investment, growing mainstream media attention. |

Long-Term Implications of the 2025 Halving: Halving De Bitcoin 2025

The 2025 Bitcoin halving, a programmed reduction in the rate of new Bitcoin creation, is anticipated to have significant long-term implications for the cryptocurrency’s trajectory. Understanding these potential effects is crucial for investors and stakeholders alike, as it impacts Bitcoin’s future value proposition and its position within the broader financial landscape. The reduced supply, combined with continued demand, is expected to create a dynamic interplay influencing adoption rates, its role as a store of value, and its competitive position against traditional assets.

Bitcoin Adoption and the Halving

The halving mechanism inherently creates scarcity, a key driver of value in any asset class. Historically, previous halvings have been followed by periods of increased price appreciation, potentially attracting new investors and driving greater adoption. This increased interest could lead to wider merchant acceptance, further integration into financial systems, and the development of innovative Bitcoin-based applications. However, the extent of this adoption will depend on various factors including regulatory clarity, technological advancements, and overall macroeconomic conditions. A successful integration into existing financial infrastructure, coupled with user-friendly applications, will be key to mass adoption.

Bitcoin as a Store of Value: A Post-Halving Perspective

Bitcoin’s potential as a store of value hinges on its scarcity, security, and decentralization. The halving reinforces its scarcity by reducing the supply of new Bitcoins entering the market. This, in conjunction with its inherent security features and decentralized nature, makes it an attractive alternative to traditional assets, particularly during periods of economic uncertainty. However, its volatility remains a significant factor, and its long-term stability as a store of value needs continued observation and analysis against inflation rates and the performance of other established safe-haven assets like gold. Comparing its performance during periods of high inflation against gold’s historical performance will provide a clearer picture of its suitability as a long-term store of value.

Bitcoin’s Long-Term Prospects Compared to Other Assets

Comparing Bitcoin’s long-term prospects to other established assets, such as gold or government bonds, requires a nuanced approach. While gold has historically served as a hedge against inflation, its supply is not as strictly controlled as Bitcoin’s. Government bonds, on the other hand, offer relative stability but are subject to the creditworthiness of the issuing government and inflation. Bitcoin, with its limited supply and decentralized nature, presents a unique alternative, potentially appealing to investors seeking diversification beyond traditional asset classes. The long-term success of Bitcoin will depend on its ability to maintain its security, overcome regulatory hurdles, and demonstrate its utility beyond speculation.

Visual Representation of Bitcoin’s Price Trajectory After Past Halvings

Imagine a graph. The X-axis represents time, showing the dates of past Bitcoin halvings. The Y-axis represents the price of Bitcoin in USD. Before each halving, the price might show a relatively stable, or even slightly declining, trend. Then, after each halving, a significant upward price surge is typically observed, although the extent and duration vary. The graph would visually demonstrate a pattern of price increases following each halving, although it’s important to note that this doesn’t guarantee future price movements. This is a simplification; actual price movements are far more complex and influenced by various market forces. For instance, the halving in 2012 was followed by a period of relatively slow price growth, while the 2016 halving was followed by a much more dramatic price surge. The 2020 halving exhibited a similar pattern, but with significant volatility along the way.

Alternative Perspectives and Unforeseen Consequences

The 2025 Bitcoin halving, while widely anticipated to trigger a price increase, isn’t a guaranteed outcome. Several alternative perspectives exist, and unforeseen circumstances could significantly alter the predicted trajectory. Understanding these possibilities is crucial for a comprehensive assessment of the halving’s impact.

Predicting Bitcoin’s price is notoriously difficult, and the halving’s effect is just one piece of a complex puzzle. Many factors beyond the reduction in new Bitcoin supply could influence its price, potentially overriding the expected bullish effect.

Regulatory Scrutiny and its Impact

Increased regulatory scrutiny from governments worldwide could significantly dampen the positive effects of the halving. Stringent regulations on cryptocurrency exchanges, trading, or even ownership could reduce demand and limit price appreciation. For example, a complete ban on Bitcoin trading in a major economy like China could drastically alter market dynamics, regardless of the halving. Conversely, clear and supportive regulatory frameworks in other jurisdictions could foster growth and potentially mitigate the halving’s impact. The interplay between regulatory environments and market forces will be critical.

Technological Advancements and Competition

The emergence of competing cryptocurrencies with superior technology or more attractive features could divert investor interest away from Bitcoin. Improvements in scalability, transaction speeds, or energy efficiency in alternative blockchain networks might make them more appealing, reducing the relative value of Bitcoin even in the face of a halving. For instance, a significant breakthrough in Layer-2 scaling solutions for Ethereum could attract investors who are currently hesitant due to Bitcoin’s limitations.

Macroeconomic Factors and Global Events

Global macroeconomic events, such as recessions, geopolitical instability, or major shifts in monetary policy, could significantly outweigh the impact of the halving. A global financial crisis, for example, could trigger a sell-off across all asset classes, including Bitcoin, irrespective of its reduced supply. Similarly, unexpected inflationary pressures or significant changes in interest rates could influence investor behavior and potentially overshadow the halving’s influence on Bitcoin’s price. The halving operates within a larger economic context, and its influence is not isolated.

Unforeseen Technological Disruptions

Unexpected technological disruptions or security vulnerabilities within the Bitcoin network itself could undermine confidence and negatively impact the price. A major security breach, a significant software bug, or the discovery of a previously unknown weakness in the cryptographic underpinnings of Bitcoin could trigger a dramatic price drop. Such events could easily overshadow the effects of the halving, creating a volatile and unpredictable market. The history of technology is replete with unexpected vulnerabilities, highlighting the importance of considering such possibilities.

Frequently Asked Questions (FAQ)

The Bitcoin halving is a significant event in the cryptocurrency world, impacting both its price and overall market dynamics. Understanding this event is crucial for anyone invested in or considering investing in Bitcoin. This section addresses some frequently asked questions to provide clarity and context.

Bitcoin Halving Explained

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created (mined) by half. This occurs approximately every four years, or every 210,000 blocks mined. The halving mechanism is designed to control Bitcoin’s inflation rate and maintain its scarcity over time. Essentially, it’s a built-in deflationary pressure.

Timing of the Next Halving

The next Bitcoin halving is expected to occur in 2025, around April. The exact date will depend on the time it takes to mine the 210,000 blocks. While we can estimate based on historical mining rates, unforeseen factors like changes in network hash rate could slightly alter the timing.

Halving’s Impact on Bitcoin Price

Historically, Bitcoin’s price has tended to increase in the period following a halving. This is largely attributed to the reduced supply of new Bitcoins entering the market, potentially creating upward pressure on demand. However, it’s important to note that this is not guaranteed. Other market factors, such as overall economic conditions, regulatory changes, and investor sentiment, also play significant roles in price fluctuations. For example, the 2012 and 2016 halvings were followed by significant price increases, but the market context was different then. Predicting the future impact of the 2025 halving solely based on past performance is unreliable.

Risks of Investing Around the Halving

Investing in Bitcoin around a halving carries inherent risks. The price volatility associated with Bitcoin is significantly amplified during periods of anticipation and immediate aftermath of the event. Market manipulation, unexpected regulatory changes, and overall economic downturns can all negatively impact the price regardless of the halving. Furthermore, the “buy the dip” strategy, often employed around halvings, carries the risk of purchasing at a local or even a global peak before a significant correction. The 2021 halving, for example, was followed by a significant price increase but also by a substantial correction later in the year.

Alternative Investment Strategies

Given the inherent risks, diversifying investments is crucial. Alternative strategies could include investing in other cryptocurrencies (altcoins), traditional assets like stocks and bonds, or even real estate. The specific strategy should depend on individual risk tolerance and financial goals. It’s advisable to consult with a financial advisor before making any significant investment decisions, especially in volatile markets like cryptocurrency.

Illustrative Table: Historical Halving Data

Understanding the historical impact of Bitcoin halvings is crucial for informed speculation about the 2025 event. The following table presents key data points from previous halvings, offering a glimpse into potential trends, though it’s important to remember that past performance is not indicative of future results. Market conditions and broader economic factors significantly influence Bitcoin’s price.

The table below summarizes the key data points from the three previous Bitcoin halvings. Note that price changes are approximate and represent the price movement in the period following the halving. Various factors contribute to price volatility, making precise attribution to the halving alone challenging.

Historical Bitcoin Halving Data

| Date | Block Height (approx.) | Block Reward Before (BTC) | Block Reward After (BTC) | Approximate Price Change (Post-Halving, 12-18 Months) |

|---|---|---|---|---|

| November 28, 2012 | 210,000 | 50 | 25 | Significant increase (several hundred percent) |

| July 9, 2016 | 420,000 | 25 | 12.5 | Substantial increase (several hundred percent) |

| May 11, 2020 | 630,000 | 12.5 | 6.25 | Significant increase (several hundred percent) |