Bitcoin Halving

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created. This occurs approximately every four years, significantly impacting the inflation rate of the cryptocurrency and, historically, its market price. Understanding this mechanism is crucial to grasping Bitcoin’s long-term economic model.

Bitcoin Halving Mechanism and Impact on Supply

The Bitcoin halving mechanism is embedded within the Bitcoin code. Every 210,000 blocks mined, the reward given to miners for successfully adding a new block to the blockchain is cut in half. Initially, the reward was 50 BTC per block. After the first halving, it became 25 BTC, then 12.5 BTC, and currently stands at 6.25 BTC. This halving process continues until all 21 million Bitcoins are mined, projected to occur around the year 2140. The halving directly impacts Bitcoin’s supply by slowing down the rate of new Bitcoin creation, making it a deflationary asset in the long run. This controlled scarcity is a key element of Bitcoin’s design philosophy.

Historical Bitcoin Halvings and Price Effects, How Long Does Bitcoin Halving Last In 2025

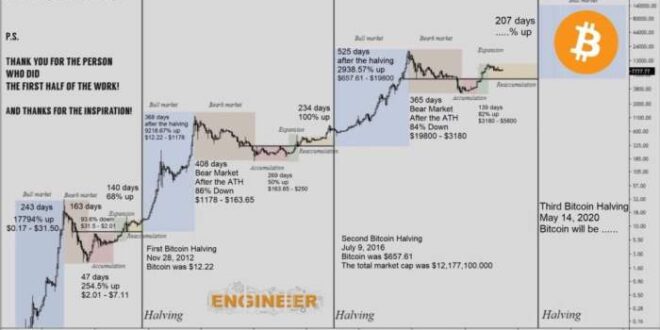

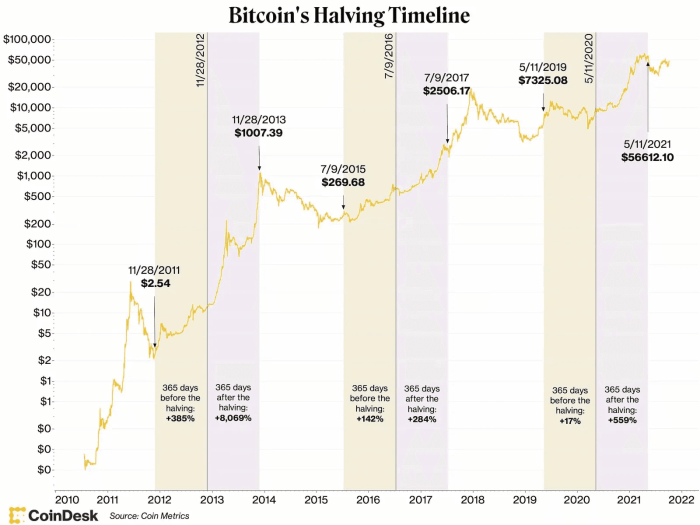

Bitcoin has undergone three previous halvings: in November 2012, July 2016, and May 2020. Following each halving, the price of Bitcoin experienced a significant increase in the months and years that followed. While correlation doesn’t equal causation, the reduced supply coupled with increasing demand has historically resulted in price appreciation. The 2012 halving saw a gradual price increase, while the 2016 halving preceded a substantial bull run. The 2020 halving, amidst a growing adoption rate and institutional interest, also led to a remarkable price surge. It is important to note that other market factors beyond the halving also contribute to price fluctuations.

Economic Principles Behind Bitcoin Halving

The Bitcoin halving is based on the principles of supply and demand. By reducing the rate of new Bitcoin creation, the halving aims to create scarcity, a fundamental economic principle driving asset value. As demand for Bitcoin continues to grow, a reduced supply can exert upward pressure on the price. This mechanism mimics the behavior of precious metals like gold, where limited supply contributes to their value. The predictable nature of the halving also provides transparency and stability, making Bitcoin a potentially attractive store of value.

Bitcoin Halving Schedule Calculation

The Bitcoin halving schedule is determined by a simple mathematical formula:

Block Reward / 2 (every 210,000 blocks)

The number of blocks mined is directly related to the time it takes to mine them, which is influenced by the computational power of the Bitcoin network (hash rate). While the target block time is approximately 10 minutes, it can fluctuate slightly, leading to minor variations in the exact timing of halvings. The formula ensures a predictable and consistent reduction in the block reward, maintaining the long-term supply schedule embedded within the Bitcoin protocol.

The 2025 Bitcoin Halving: How Long Does Bitcoin Halving Last In 2025

The Bitcoin halving, a pre-programmed event reducing the rate of newly minted Bitcoin, is anticipated to occur in 2025. This event, occurring approximately every four years, significantly impacts the cryptocurrency’s supply and demand dynamics, historically leading to periods of price volatility and market shifts. Understanding the projected date and potential consequences of the 2025 halving is crucial for anyone involved in the Bitcoin ecosystem.

Projected Date and Significance of the 2025 Halving

While the precise date is dependent on the Bitcoin network’s block time, which can fluctuate slightly, the 2025 Bitcoin halving is projected to occur sometime in the Spring or early Summer. The significance lies in the halving’s effect on Bitcoin’s inflation rate. With fewer newly mined coins entering circulation, the scarcity of Bitcoin increases, potentially driving up its value. This has been observed in previous halving events, although the magnitude of the price impact varies. The event itself serves as a significant catalyst for market speculation and investment activity.

Impact on Bitcoin’s Price and Volatility

The 2025 halving is expected to influence Bitcoin’s price, although predicting the exact extent of the impact remains challenging. Historically, halvings have been followed by periods of increased price volatility. The 2012 and 2016 halvings were followed by significant price increases, albeit after some initial periods of consolidation or even minor price dips. However, it’s important to note that various macroeconomic factors and market sentiment also play a substantial role in determining Bitcoin’s price. The 2020 halving, for example, saw a substantial price increase later in the year, but the overall market context, including factors such as institutional adoption and regulatory developments, significantly influenced the price trajectory. Therefore, while the halving is a significant factor, it is not the sole determinant of price movement.

Impact on the Mining Landscape

The halving directly affects Bitcoin miners’ profitability. With the reward for mining a block halved, miners’ revenue decreases unless the price of Bitcoin rises proportionally. This can lead to increased competition among miners, potentially forcing less efficient or smaller operations to shut down or consolidate. The halving could also stimulate innovation in mining technology, with miners seeking more efficient and cost-effective ways to operate. This could lead to a more centralized mining landscape if only the largest and most technologically advanced miners can remain profitable. The increased difficulty in mining post-halving could also increase the computational power required, potentially increasing energy consumption.

Comparison with Previous Halvings

Comparing the 2025 halving with previous events reveals some similarities and differences. All previous halvings resulted in a decrease in the rate of new Bitcoin entering circulation, a core element consistently impacting the market. However, the post-halving price movements have varied in timing and magnitude. The 2012 halving saw a more gradual price increase, while the 2016 and 2020 halvings experienced more pronounced price increases, but at different times following the halving event. This variation highlights the complex interplay of factors beyond the halving itself that influence Bitcoin’s price, including regulatory changes, market sentiment, and overall macroeconomic conditions. Analyzing these past events provides valuable context but doesn’t guarantee a predictable outcome for the 2025 halving.

Duration of the Halving Event

The Bitcoin halving is often misunderstood as a period of time, but it’s actually a single event. It’s a specific point in time when the block reward for Bitcoin miners is cut in half. Understanding this distinction is crucial to grasping its impact on the cryptocurrency’s ecosystem.

The halving’s immediate effect is a reduction in the rate at which new Bitcoins are created. This directly impacts the miners’ profitability, as they receive fewer Bitcoins for verifying transactions and adding new blocks to the blockchain. The long-term consequences, however, are far more complex and debated within the cryptocurrency community.

Immediate Effects on Block Rewards

The halving instantaneously reduces the Bitcoin reward miners receive for successfully mining a block. Before the halving, miners earn a certain number of Bitcoins per block (e.g., 6.25 BTC before the 2024 halving). Immediately after the halving, this reward is halved (e.g., to 3.125 BTC). This immediate change affects the profitability of mining operations, potentially leading to adjustments in mining difficulty or hash rate. Some miners may choose to shut down less-efficient operations, while others may seek more efficient hardware or energy sources to remain profitable.

Long-Term Effects on Bitcoin Supply and Price

The halving’s impact on Bitcoin’s long-term supply and price is a subject of ongoing discussion and speculation. The reduction in newly minted Bitcoins creates a deflationary pressure on the currency’s supply. Historically, Bitcoin halvings have been followed by periods of price appreciation, although this isn’t guaranteed. The belief is that decreased supply, coupled with continued demand, can drive up the price. However, other market factors, such as regulatory changes, macroeconomic conditions, and overall investor sentiment, also play significant roles in determining Bitcoin’s price. The 2012 and 2016 halvings, for example, were followed by substantial price increases, but this correlation doesn’t guarantee a similar outcome in 2024 or 2028.

Summary of Key Changes During and After the Halving

| Aspect | Before Halving | During Halving | After Halving |

|---|---|---|---|

| Block Reward | 6.25 BTC (example, prior to 2024 halving) | Instantaneous change | 3.125 BTC (example, post 2024 halving) |

| Bitcoin Supply Inflation Rate | Relatively higher | No change in existing supply | Significantly lower |

| Miner Profitability | Potentially higher | Immediately reduced | Potentially adjusted based on market conditions |

| Bitcoin Price | Variable | Potentially volatile | Potentially influenced by decreased supply and market demand |

How Long Does Bitcoin Halving Last In 2025 – The Bitcoin halving event itself is instantaneous; it’s the subsequent impact on Bitcoin’s inflation rate that unfolds over time. Understanding this impact is crucial, especially considering the upcoming event. For more details on this specific halving, check out this informative resource on the Bitcoin April 2025 Halving. Ultimately, the duration of the *effects* of the halving are felt over many years, influencing Bitcoin’s price and supply dynamics.

The Bitcoin halving event itself is instantaneous; it’s the impact that unfolds over time. To understand the long-term consequences, pinpointing the exact date is crucial. For a precise understanding of when this significant event occurs, check out the projected date on this resource: Bitcoin Halving Date April 2025. After the halving, the reduced block reward affects Bitcoin’s inflation rate, a process that plays out over many months and years.

The Bitcoin halving event itself is instantaneous; it’s the impact that unfolds over time. To understand the long-term consequences, pinpointing the exact date is crucial. For a precise understanding of when this significant event occurs, check out the projected date on this resource: Bitcoin Halving Date April 2025. After the halving, the reduced block reward affects Bitcoin’s inflation rate, a process that plays out over many months and years.

The Bitcoin halving event itself is instantaneous; it’s the impact that unfolds over time. To understand the long-term consequences, pinpointing the exact date is crucial. For a precise understanding of when this significant event occurs, check out the projected date on this resource: Bitcoin Halving Date April 2025. After the halving, the reduced block reward affects Bitcoin’s inflation rate, a process that plays out over many months and years.

The Bitcoin halving event itself is instantaneous; it’s the impact that unfolds over time. To understand the long-term consequences, pinpointing the exact date is crucial. For a precise understanding of when this significant event occurs, check out the projected date on this resource: Bitcoin Halving Date April 2025. After the halving, the reduced block reward affects Bitcoin’s inflation rate, a process that plays out over many months and years.