Bitcoin’s Price Prediction for 2025: How Much Is Bitcoin Worth In 2025

Predicting Bitcoin’s price in 2025 is inherently speculative, given the cryptocurrency’s volatile nature and the influence of numerous interconnected factors. However, by analyzing historical trends, technological developments, regulatory landscapes, and macroeconomic conditions, we can explore potential price scenarios. This analysis will not offer a definitive answer but rather a range of possibilities based on current understanding.

Factors Influencing Bitcoin’s Price in 2025

Several key factors will likely shape Bitcoin’s price trajectory in 2025. Technological advancements, such as the scalability improvements in the Lightning Network and the development of layer-2 solutions, could significantly increase Bitcoin’s transaction speed and reduce fees, potentially boosting adoption and price. Conversely, the emergence of competing cryptocurrencies with superior technology could negatively impact Bitcoin’s dominance and price. Regulatory changes, both positive (e.g., clearer regulatory frameworks fostering institutional investment) and negative (e.g., outright bans or excessive restrictions), will also play a crucial role. Finally, market sentiment, driven by news events, media coverage, and overall investor confidence, will continue to be a significant driver of price volatility.

Comparison of Bitcoin Price Prediction Models

Various models attempt to predict Bitcoin’s price, each with strengths and weaknesses. Simple price prediction models, often based on historical price trends and extrapolations, are easy to understand but lack the sophistication to account for unforeseen events. More complex models, incorporating factors like adoption rates, network effects, and macroeconomic indicators, provide more nuanced predictions but rely on assumptions that may not hold true. For instance, some models use stock-to-flow analysis, which correlates Bitcoin’s scarcity with its price, but this model’s accuracy has been debated, particularly as the mining rate adjusts over time. Ultimately, no single model offers a foolproof prediction.

Impact of Macroeconomic Factors

Macroeconomic factors, such as inflation and interest rates, will significantly influence Bitcoin’s value. High inflation could drive investors towards Bitcoin as a hedge against inflation, potentially increasing its demand and price. Conversely, rising interest rates might reduce investment in riskier assets like Bitcoin, leading to price declines. Global economic uncertainty and geopolitical events will also play a crucial role, potentially increasing Bitcoin’s appeal as a safe haven asset during periods of instability. For example, the global economic downturn in 2022 demonstrated a negative correlation between Bitcoin’s price and traditional markets.

Potential Price Scenarios for Bitcoin in 2025, How Much Is Bitcoin Worth In 2025

Several scenarios are plausible for Bitcoin’s price in 2025. A bullish scenario envisions widespread institutional adoption, positive regulatory developments, and continued technological improvements, potentially pushing the price significantly higher, perhaps to levels exceeding $100,000 or even more. A neutral scenario suggests a consolidation period, with price fluctuations around current levels, reflecting a balance between positive and negative influences. A bearish scenario, characterized by negative regulatory actions, technological setbacks, or a prolonged economic downturn, could result in a substantial price decline. The probability of each scenario depends on the interplay of the aforementioned factors.

Expert Bitcoin Price Predictions for 2025

| Expert | Prediction | Methodology | Source |

|---|---|---|---|

| Analyst A (Example) | $150,000 | Stock-to-flow analysis with adjustments for adoption rate | Research Report, Date |

| Analyst B (Example) | $75,000 | Macroeconomic model incorporating inflation and interest rates | Financial News Article, Date |

| Analyst C (Example) | $50,000 | Technical analysis based on historical price patterns | Trading Platform Blog, Date |

| Analyst D (Example) | $100,000+ | Combination of on-chain metrics and adoption forecasts | Cryptocurrency News Website, Date |

Factors Affecting Bitcoin’s Future Value

Predicting Bitcoin’s price in 2025 requires considering a complex interplay of technological advancements, regulatory landscapes, institutional involvement, and market sentiment. These factors are not independent; they influence each other, creating a dynamic and often unpredictable market.

Technological Developments

Technological improvements are crucial for Bitcoin’s scalability, efficiency, and overall usability. Increased adoption hinges on addressing current limitations such as transaction fees and processing speeds. Significant advancements in layer-2 scaling solutions, like the Lightning Network, could drastically reduce transaction costs and increase throughput. This would make Bitcoin more practical for everyday transactions, potentially boosting its value as demand increases. Furthermore, improvements in privacy-enhancing technologies could attract a wider range of users concerned about transaction transparency. For example, advancements in privacy coins like Mimblewimble could offer a more private alternative to the existing Bitcoin blockchain.

Regulatory Frameworks

Government regulations play a pivotal role in shaping Bitcoin’s trajectory. Supportive regulatory frameworks, such as those establishing clear guidelines for cryptocurrency exchanges and tax treatments, could foster institutional investment and mainstream adoption, thereby increasing Bitcoin’s price. Conversely, overly restrictive or unclear regulations could stifle innovation and adoption, potentially depressing its value. The example of China’s crackdown on cryptocurrency mining in 2021 illustrates the significant impact of regulatory decisions on Bitcoin’s price. Conversely, the relatively clear regulatory framework in El Salvador, where Bitcoin is legal tender, shows how government acceptance can impact market sentiment and price.

Institutional Investment and Adoption

The entry of institutional investors, such as hedge funds and corporations, into the Bitcoin market has been a significant driver of price increases in the past. Increased institutional adoption signals growing confidence in Bitcoin’s long-term viability and potential as a store of value. Further institutional investment in 2025 could lead to significant price appreciation, especially if large-scale adoption by pension funds or sovereign wealth funds occurs. MicroStrategy’s significant Bitcoin holdings serve as a prominent example of this trend.

Market Speculation and Sentiment

Market sentiment and speculation are powerful forces that can drive significant price volatility. Positive news, such as technological breakthroughs or positive regulatory developments, can trigger buying frenzies and price surges. Conversely, negative news, like security breaches or regulatory crackdowns, can lead to sell-offs and price declines. Predicting shifts in sentiment is challenging, but by 2025, a greater level of maturity in the cryptocurrency market could lead to less extreme volatility, although significant price swings are still likely based on news and events. The 2021 Bitcoin bull run, followed by a significant correction in 2022, exemplifies this volatility driven by market sentiment.

Interplay of Factors

Imagine a three-dimensional graph. The X-axis represents technological advancements (e.g., a scale from slow transaction speeds to near-instantaneous transactions). The Y-axis represents regulatory environment (e.g., a scale from highly restrictive to highly supportive). The Z-axis represents market sentiment (e.g., a scale from extremely bearish to extremely bullish). Bitcoin’s price is represented by a point within this three-dimensional space. As technological advancements improve (X-axis moves to the right), regulatory frameworks become more supportive (Y-axis moves upwards), and market sentiment turns bullish (Z-axis moves upwards), the point representing Bitcoin’s price moves upwards, indicating a price increase. Conversely, negative movements along any of these axes would result in a lower price. The interplay of these factors creates a dynamic and complex relationship determining Bitcoin’s price. For instance, significant technological advancement could offset negative regulatory news, potentially resulting in a stable or even rising price, depending on the overall market sentiment.

Bitcoin’s Role in the Global Financial Landscape

Bitcoin’s potential influence on the global financial system in 2025 is a topic of considerable debate. Its decentralized nature and underlying blockchain technology challenge traditional financial structures, prompting discussions about its role as a store of value, medium of exchange, and unit of account. Understanding its position relative to established assets like gold, stocks, and bonds is crucial to assessing its overall impact.

Bitcoin’s position as a store of value, medium of exchange, and unit of account in 2025 will depend heavily on factors like regulatory clarity, technological advancements, and widespread adoption. While its volatility remains a significant hurdle to widespread acceptance as a medium of exchange for everyday transactions, its scarcity and increasing recognition as a hedge against inflation contribute to its appeal as a store of value. Its role as a unit of account, however, remains limited due to its price fluctuations and lack of widespread acceptance in pricing goods and services.

Bitcoin Compared to Traditional Assets

Bitcoin’s characteristics differ significantly from traditional assets. Gold, a traditional store of value, is physically tangible and has a long history of acceptance. Stocks represent ownership in companies and offer potential for capital appreciation, while bonds represent loans to governments or corporations and offer fixed income streams. Bitcoin, on the other hand, is a digital asset with a limited supply, making it comparable to gold in its scarcity. However, unlike gold, its value is entirely driven by market sentiment and speculative trading. Its volatility makes it a risky investment compared to the relative stability (though not complete lack of risk) of bonds or the diversified portfolio potential of stocks. For example, a comparison of Bitcoin’s price fluctuations over the past five years to the performance of a diversified stock index fund would clearly illustrate this difference in volatility.

Impact of Bitcoin Adoption on the Traditional Financial System

Increasing Bitcoin adoption could significantly impact the traditional financial system. The potential for disintermediation – removing intermediaries like banks and payment processors – is a major consideration. This could lead to reduced transaction costs and increased financial inclusion for those lacking access to traditional banking services. However, it also poses challenges to existing financial institutions and regulatory frameworks. The potential for money laundering and illicit activities associated with cryptocurrencies also remains a significant concern, requiring robust regulatory measures to mitigate risks. A hypothetical scenario where a significant portion of global transactions shifted to Bitcoin could illustrate the scale of this potential disruption.

Risks Associated with Bitcoin Investment

Investing in Bitcoin carries substantial risks. Its price volatility is notorious, with significant price swings occurring frequently. Regulatory uncertainty is another major risk, as governments worldwide are still grappling with how to regulate cryptocurrencies. The lack of intrinsic value and reliance on market sentiment makes Bitcoin vulnerable to speculative bubbles and market crashes. Furthermore, the risk of losing access to your Bitcoin due to hacking, loss of private keys, or exchange failures should not be overlooked. For example, the collapse of Mt. Gox, a major Bitcoin exchange, serves as a stark reminder of these risks.

Benefits and Drawbacks of Increased Bitcoin Adoption

The increased adoption of Bitcoin presents both significant benefits and drawbacks for the global financial system.

- Benefits: Increased financial inclusion, reduced transaction costs, enhanced transparency (through blockchain technology), potential for innovation in financial services.

- Drawbacks: Volatility and price instability, regulatory uncertainty and potential for misuse, environmental concerns related to energy consumption for Bitcoin mining, potential for market manipulation and fraud.

Investing in Bitcoin

Investing in Bitcoin presents a unique opportunity with substantial potential rewards, but also significant risks. Understanding the various investment methods, their associated risks, and implementing a robust risk assessment framework are crucial for navigating this volatile market. This section details different approaches to Bitcoin investment, compares their risk profiles, and provides a practical guide for beginners.

Bitcoin Investment Methods

Several avenues exist for investing in Bitcoin, each carrying its own set of advantages and disadvantages. Choosing the right method depends on your risk tolerance, investment goals, and technical expertise.

- Direct Purchase: This involves buying Bitcoin directly from an exchange or a peer-to-peer platform. It offers the greatest potential for returns but also carries the highest risk due to price volatility and security concerns. Direct ownership provides complete control over your assets.

- Exchange-Traded Funds (ETFs): Bitcoin ETFs, where available, allow investors to gain exposure to Bitcoin’s price movements without directly holding the cryptocurrency. They offer diversification and regulatory oversight, but may not reflect the full price movement of Bitcoin itself due to management fees and other factors.

- Derivatives: Derivatives, such as futures and options contracts, allow investors to speculate on Bitcoin’s price movements without actually owning the underlying asset. These instruments are complex and carry a high degree of risk, but they can be used for hedging or leveraging potential gains. However, inexperienced investors should approach derivatives with extreme caution.

Risk and Reward Comparison

The risk-reward profile varies significantly across Bitcoin investment strategies.

| Investment Method | Risk | Reward |

|---|---|---|

| Direct Purchase | High (volatility, security risks) | High (potential for significant gains) |

| ETFs | Medium (market risk, management fees) | Medium (potential for gains, diversification) |

| Derivatives | Very High (complex, leverage) | Very High (potential for large gains and losses) |

Bitcoin Investment Risk Assessment Framework

A comprehensive risk assessment should consider several key factors:

- Volatility: Bitcoin’s price is notoriously volatile, experiencing significant swings in short periods. This volatility represents a major risk, especially for short-term investors.

- Market Liquidity: While Bitcoin’s market has grown considerably, liquidity can still be an issue, especially during periods of high volatility. This can make it difficult to buy or sell Bitcoin quickly at a desired price.

- Regulatory Changes: Government regulations surrounding Bitcoin are constantly evolving. Changes in regulatory frameworks can significantly impact Bitcoin’s price and accessibility.

- Security Risks: Storing Bitcoin securely requires careful consideration. Losses due to hacking, theft, or loss of private keys are a significant risk.

Safe and Secure Bitcoin Investment: A Beginner’s Guide

Investing in Bitcoin safely requires careful planning and execution.

- Research and Education: Thoroughly understand Bitcoin, its technology, and the risks involved before investing.

- Choose a Reputable Exchange: Select a regulated and secure cryptocurrency exchange with a strong reputation.

- Secure Storage: Use a secure hardware wallet or a reputable software wallet to store your Bitcoin offline whenever possible.

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Diversify your investments across different asset classes.

- Start Small: Begin with a small investment amount to gain experience and manage risk.

- Regularly Review Your Investments: Monitor your portfolio and adjust your strategy as needed based on market conditions and your risk tolerance.

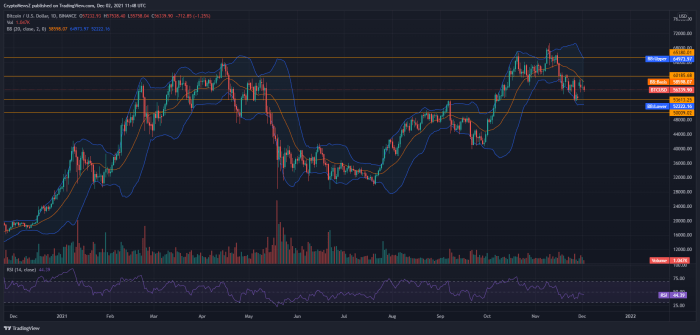

Examples of Bitcoin Price Fluctuations

Bitcoin’s history is marked by dramatic price swings. For example, in late 2017, Bitcoin’s price surged to nearly $20,000, only to crash significantly in the following year. More recently, the price has experienced considerable volatility, influenced by factors like macroeconomic conditions, regulatory announcements, and market sentiment. These fluctuations highlight the importance of a well-defined risk management strategy and a long-term perspective when investing in Bitcoin. Analyzing past price movements can provide valuable insights, but it’s crucial to remember that past performance is not indicative of future results.

Frequently Asked Questions about Bitcoin’s Future Value

Predicting the future price of Bitcoin is inherently speculative, but analyzing various factors allows for informed estimations of potential price ranges and associated risks. Understanding these factors is crucial for anyone considering investing in Bitcoin or other cryptocurrencies. The following sections address common questions surrounding Bitcoin’s future value and the implications for investors.

Bitcoin’s Most Likely Price Range in 2025

Predicting a precise Bitcoin price for 2025 is impossible. However, considering past price cycles, technological advancements, regulatory developments, and adoption rates, analysts have proposed a wide range of potential outcomes. Some optimistic predictions suggest prices exceeding $100,000, while more conservative estimates place the price somewhere between $50,000 and $75,000. These projections are heavily influenced by the overall market sentiment, macroeconomic conditions, and the continued development and adoption of Bitcoin as a store of value and a medium of exchange. It’s important to remember that these are just estimates, and the actual price could be significantly higher or lower. For example, the 2017 bull run saw Bitcoin reach nearly $20,000, only to experience a significant correction. Similarly, the 2021 bull run saw a peak above $60,000, followed by a considerable downturn. Past performance is not indicative of future results.

Biggest Risks Associated with Investing in Bitcoin

Investing in Bitcoin carries significant risks. Volatility is a primary concern; Bitcoin’s price can fluctuate dramatically in short periods, leading to substantial gains or losses. Regulatory uncertainty also poses a risk, as governments worldwide are still developing their approaches to regulating cryptocurrencies. This could lead to changes in tax laws, trading restrictions, or even outright bans, impacting Bitcoin’s value. Furthermore, the decentralized nature of Bitcoin, while a strength for some, also means there is a lack of central authority to protect investors in case of fraud or hacking. Security breaches on exchanges or the loss of private keys can result in irreversible loss of funds. Finally, the relatively young age of Bitcoin and the cryptocurrency market as a whole introduces an inherent level of uncertainty and risk compared to more established asset classes. It is advisable to only invest what you can afford to lose.

Government Regulations’ Effect on Bitcoin’s Price

Government regulations will undoubtedly influence Bitcoin’s price. Favorable regulations, such as clear tax guidelines and robust investor protection frameworks, could boost investor confidence and drive up the price. Conversely, restrictive regulations, including outright bans or heavy taxation, could significantly depress the price. The impact of regulations will vary depending on the jurisdiction and the specific nature of the regulations. For example, China’s ban on cryptocurrency trading in 2021 led to a noticeable drop in Bitcoin’s price. In contrast, the increasing acceptance of Bitcoin by some governments, such as El Salvador’s adoption as legal tender, has been seen by some as a positive development for the cryptocurrency’s future. The evolving regulatory landscape remains a crucial factor to monitor.

Bitcoin as a Good Long-Term Investment

Whether Bitcoin is a good long-term investment depends on individual risk tolerance and investment goals. Its decentralized nature and limited supply are often cited as reasons for its potential long-term value appreciation. However, the significant volatility and regulatory uncertainty inherent in the cryptocurrency market make it a high-risk investment. A long-term perspective is crucial, as short-term fluctuations are to be expected. Diversification across different asset classes is also recommended to mitigate risk. Comparing Bitcoin’s potential long-term growth to more traditional investments like stocks or bonds requires careful consideration of the different risk profiles and potential returns. There is no guarantee of long-term profitability.

Alternative Cryptocurrencies to Consider

Numerous alternative cryptocurrencies exist, each with its unique features, risks, and potential. Ethereum, for instance, is a prominent platform for decentralized applications (dApps) and smart contracts, offering different investment opportunities. Other cryptocurrencies, such as Solana or Cardano, focus on scalability and improved transaction speeds compared to Bitcoin. However, it’s crucial to conduct thorough research before investing in any cryptocurrency. The cryptocurrency market is highly volatile and speculative, and alternative cryptocurrencies often carry even higher risks than Bitcoin. Each cryptocurrency has its own technological specifications, community support, and potential use cases, all of which influence its value and potential for growth. Investing in alternative cryptocurrencies should only be done after careful consideration of their individual characteristics and associated risks.

How Much Is Bitcoin Worth In 2025 – Predicting the value of Bitcoin in 2025 is inherently speculative, depending heavily on various market factors. A key element to consider is the potential for a significant bull run, as discussed in this insightful article on the Bitcoin Price 2025 Bull Run. Therefore, understanding the dynamics of such a run is crucial for any estimation of Bitcoin’s worth by 2025.

Ultimately, the actual price remains uncertain.

Predicting the value of Bitcoin in 2025 is challenging, with various factors influencing its price. Understanding the trajectory of related cryptocurrencies can offer some insight; for example, checking the projected value of altcoins like Bitcoin Cash provides a comparative perspective. To explore potential future trends, you might find the analysis at Bitcoin Cash Price 2025 helpful when considering the broader cryptocurrency market and its impact on Bitcoin’s worth in 2025.

Ultimately, Bitcoin’s value will depend on numerous market forces.

Predicting how much Bitcoin will be worth in 2025 is challenging, depending heavily on various market factors. A key data point to consider when forming such a prediction is the price in a specific month, for example, checking the projected Bitcoin Price April 2025 can offer some insight. Ultimately, the value of Bitcoin in 2025 will depend on a confluence of technological advancements, regulatory changes, and overall market sentiment.

Predicting the value of Bitcoin in 2025 is inherently speculative, but various models offer insights. To understand potential price trajectories, consider exploring resources dedicated to forecasting, such as the detailed analysis provided by Bitcoin Bx Price Prediction 2025. Ultimately, the worth of Bitcoin in 2025 will depend on a multitude of factors influencing market sentiment and adoption.

Predicting the value of Bitcoin in 2025 is challenging, with various factors influencing its price. To gain some insight into potential price fluctuations, you might find it helpful to check out resources that focus on this, such as this website dedicated to analyzing the Bitcoin Price Dollar 2025. Ultimately, however, the question of how much Bitcoin will be worth in 2025 remains speculative and depends on market forces.