Investing and Trading Strategies Around the 2025 Halving: Kapan Halving Bitcoin 2025

The Bitcoin halving, a significant event occurring approximately every four years, reduces the rate at which new Bitcoins are mined. Historically, this has led to periods of increased price volatility and potential for both substantial gains and losses. Understanding various investment approaches and their associated risks is crucial for navigating the market around the 2025 halving.

Long-Term Holding Strategy

This strategy involves buying Bitcoin and holding it for an extended period, regardless of short-term price fluctuations. The rationale is that the halving’s reduced supply will eventually lead to increased demand and higher prices over the long term. The risk lies in the potential for prolonged periods of price stagnation or even decline before any significant price appreciation occurs. Successful long-term holders have demonstrated patience and a conviction in Bitcoin’s underlying value proposition. For example, investors who purchased Bitcoin in its early years and held through various market cycles have experienced enormous returns. Conversely, those who panicked and sold during periods of price decline missed out on substantial gains.

Short-Term Trading Strategy

Short-term trading aims to profit from short-term price movements. Traders attempt to buy low and sell high, often leveraging technical analysis and market sentiment to time their entries and exits. This strategy offers the potential for quick profits but carries significantly higher risk. The volatility around a halving event creates opportunities for short-term gains, but also increases the chance of substantial losses if market predictions prove inaccurate. Successful short-term traders possess strong analytical skills, risk management discipline, and the ability to adapt to rapidly changing market conditions. Conversely, those lacking these skills can quickly lose capital.

Dollar-Cost Averaging Strategy

Dollar-cost averaging (DCA) involves investing a fixed amount of money at regular intervals, regardless of the price. This strategy mitigates the risk of investing a lump sum at a market peak. While DCA may not yield the highest potential returns in a consistently bullish market, it reduces the impact of volatility and provides a disciplined approach to accumulating Bitcoin over time. This approach is particularly useful for investors who are less confident in timing the market and prefer a more risk-averse approach. The success of DCA depends on the long-term outlook for Bitcoin and the investor’s ability to consistently invest.

Risk Management in Bitcoin Investing

Effective risk management is paramount in Bitcoin investing, especially around major events like halvings. This includes diversification of assets (not putting all your eggs in one basket), setting stop-loss orders to limit potential losses, and only investing capital you can afford to lose. Understanding your own risk tolerance and avoiding emotional decision-making are also crucial elements. Failing to manage risk adequately can lead to significant financial losses.

Examples of Successful and Unsuccessful Investment Strategies During Past Halvings

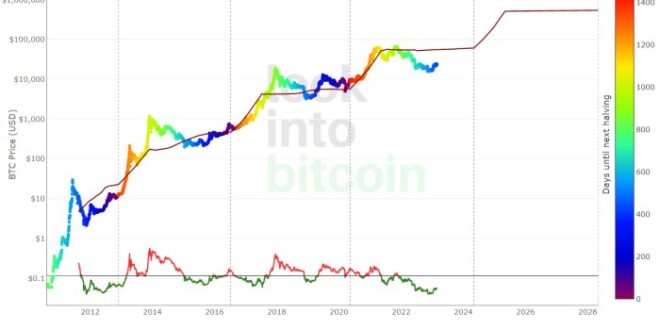

The 2012 and 2016 halvings provide valuable case studies. Investors who held Bitcoin through these events, particularly those employing a long-term holding strategy, witnessed substantial price increases in the subsequent periods. Conversely, those who engaged in short-term speculation without proper risk management often experienced significant losses due to price volatility. Analyzing these past events offers insights into the potential outcomes of different strategies surrounding the 2025 halving.

Comparison of Bitcoin Investment Strategies

| Strategy | Pros | Cons |

|---|---|---|

| Long-Term Holding | Potential for high returns, low transaction costs | Requires patience, risk of prolonged price stagnation or decline |

| Short-Term Trading | Potential for quick profits, flexibility | High risk, requires significant expertise and market timing skills |

| Dollar-Cost Averaging | Reduces risk of market timing, disciplined approach | May not maximize returns in a consistently bullish market |

Frequently Asked Questions (FAQ) about Bitcoin Halving 2025

This section addresses common queries regarding the upcoming Bitcoin halving event in 2025, providing clarity on its mechanics, potential impact, and associated risks. Understanding these aspects is crucial for informed decision-making in the cryptocurrency market.

Bitcoin Halving Mechanism, Kapan Halving Bitcoin 2025

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created (mined) by 50%. This occurs approximately every four years, or every 210,000 blocks mined. The reward given to miners for successfully adding a block to the blockchain is halved. Initially, the reward was 50 BTC per block. After the first halving, it became 25 BTC, then 12.5 BTC, and currently stands at 6.25 BTC. The next halving will reduce this reward to 3.125 BTC. This controlled inflation mechanism is designed to limit the total number of Bitcoins to 21 million.

Bitcoin Halving Date in 2025

While the exact date and time are dependent on the block mining rate, which can fluctuate slightly, the estimated date for the next Bitcoin halving is sometime in early to mid-April 2025. Pinpointing the precise moment requires monitoring the blockchain’s progress in real-time, as the exact block number (690,000) triggering the halving approaches.

Impact of Halving on Bitcoin’s Price

Historically, Bitcoin’s price has tended to increase in the period following a halving event. This is largely attributed to the reduced supply of newly mined Bitcoins, potentially increasing scarcity and driving up demand. For example, the halvings in 2012 and 2016 were followed by significant price rallies, though the timing and magnitude of these rallies varied. However, it’s crucial to remember that many other factors influence Bitcoin’s price, including market sentiment, regulatory changes, and overall economic conditions. The price increase after a halving is not guaranteed and past performance is not indicative of future results.

Considerations for Buying Bitcoin Before the 2025 Halving

Arguments for buying Bitcoin before the 2025 halving often center on the historical price increases following previous halvings and the anticipation of increased scarcity. The expectation is that reduced supply, combined with sustained or increased demand, will lead to price appreciation. Conversely, arguments against pre-halving purchases highlight the inherent volatility of the cryptocurrency market. The price could fall significantly before the halving, negating any potential gains from the halving itself. Furthermore, the market may already be pricing in the expected halving effect, meaning the actual price increase might be less dramatic than anticipated. The timing of buying is always crucial and highly speculative.

Risks of Investing Around the Halving

Investing in Bitcoin around a halving event carries significant risks. Market volatility is amplified during periods of high anticipation and uncertainty. Unexpected regulatory changes or negative news events could trigger sharp price drops, regardless of the halving. Furthermore, the potential for manipulation or market bubbles should always be considered. Risk mitigation strategies include diversifying your investment portfolio, conducting thorough due diligence, and only investing an amount of capital you can afford to lose. A gradual investment strategy, rather than a lump-sum investment, can also help to reduce risk.

Determining the precise date for the Bitcoin halving in 2025 requires careful consideration of the blockchain’s block generation time. To find out more about this important event, you can consult a reliable resource such as this page detailing the Next Bitcoin Halving Date 2025. Understanding this date is crucial for predicting potential market shifts related to Kapan Halving Bitcoin 2025 and its impact on the cryptocurrency’s value.

Therefore, keeping an eye on this date is beneficial for investors.

Predicting the exact date of the Bitcoin halving in 2025 requires careful consideration of the blockchain’s block generation times. However, understanding the potential impact on price is crucial; for insights into this, check out this analysis on Bitcoin Price At Halving 2025. Ultimately, pinpointing the *kapan* (when) of the halving depends on the network’s consistent performance leading up to that event.

Determining the exact date for the Bitcoin halving in 2025, or “Kapan Halving Bitcoin 2025” as it’s known in Indonesian, requires careful consideration of the blockchain’s block generation times. To find precise predictions and analysis, a helpful resource is available: When Is Bitcoin Halving Date 2025. Understanding this date is crucial for predicting potential market impacts related to “Kapan Halving Bitcoin 2025”.

Determining the exact date for the Bitcoin halving in 2025 requires careful consideration of the blockchain’s schedule. Many are focusing on April 2025 as the likely month, and you can find more detailed information about this prediction at Bitcoin April 2025 Halving. Ultimately, pinpointing the precise day of the Bitcoin 2025 halving depends on the final block confirmation time leading up to the event.

Determining the exact date for the Bitcoin halving in 2025 requires careful consideration of the blockchain’s schedule. Many are focusing on April 2025 as the likely month, and you can find more detailed information about this prediction at Bitcoin April 2025 Halving. Ultimately, pinpointing the precise day of the Bitcoin 2025 halving depends on the final block confirmation time leading up to the event.

Determining the exact date for the Bitcoin halving in 2025 requires careful consideration of the blockchain’s schedule. Many are focusing on April 2025 as the likely month, and you can find more detailed information about this prediction at Bitcoin April 2025 Halving. Ultimately, pinpointing the precise day of the Bitcoin 2025 halving depends on the final block confirmation time leading up to the event.