Meta’s AI Initiatives and Bitcoin Price Predictions for 2025

Meta’s substantial investments in artificial intelligence, particularly in areas like natural language processing and machine learning, could significantly influence the accuracy and sophistication of Bitcoin price prediction models by 2025. While Meta isn’t currently publicly focused on cryptocurrency price prediction, its existing AI infrastructure and future developments hold potential implications for this volatile market.

Meta’s AI Investments in Relevant Technologies

Meta’s AI research spans various domains, including computer vision, which could be used to analyze market trends visualized through charts and graphs. Their advancements in natural language processing could help sift through vast amounts of online text data – news articles, social media posts, and forum discussions – to gauge market sentiment. This sentiment analysis, combined with quantitative data, could refine prediction models. Furthermore, their work on reinforcement learning could potentially be adapted to create AI agents that learn optimal trading strategies within the Bitcoin market. These investments, while not directly targeted at cryptocurrency, provide a strong foundation for future applications in financial markets.

Influence of Meta’s AI on Bitcoin Price Prediction Models

Improved AI algorithms could significantly enhance the accuracy of Bitcoin price prediction models. Currently, many models rely on historical data and technical indicators. Meta’s AI could integrate additional data sources, such as social media sentiment and news analysis, leading to more nuanced and accurate predictions. For example, an AI could identify subtle shifts in online conversation that precede price movements, providing an earlier warning system for traders. The combination of quantitative and qualitative data processed by advanced AI could lead to predictions with a higher degree of confidence, though uncertainty will always remain inherent in cryptocurrency markets.

Impact of Meta’s AI on Bitcoin Trading Strategies and Market Sentiment

Meta’s AI advancements could influence trading strategies by providing more sophisticated tools for risk management and opportunity identification. High-frequency trading algorithms, powered by Meta’s AI, could execute trades at optimal times, capitalizing on even minor price fluctuations. However, the widespread adoption of such AI-driven trading strategies could also increase market volatility. If a significant portion of the market relies on similar AI predictions, a cascade effect could occur, where predictions themselves influence price movements, creating a self-fulfilling prophecy. This could lead to amplified swings in Bitcoin’s price.

Comparison of Meta’s AI Capabilities with Other Tech Companies

Compared to other tech giants like Google and Microsoft, Meta’s current public focus on AI applications in the financial sector is less pronounced. Google and Microsoft have already made strides in developing AI-powered financial tools and algorithms. However, Meta’s vast user base and data collection capabilities offer a unique advantage. Access to a massive amount of social media data could provide an unparalleled resource for sentiment analysis and prediction models. The potential for Meta’s AI to surpass its competitors lies in its ability to leverage this unique data advantage.

Hypothetical Scenario: Meta’s AI Significantly Impacts Bitcoin Price in 2025

Imagine a scenario where Meta releases a sophisticated AI-powered trading platform that accurately predicts significant Bitcoin price movements a few hours in advance. This platform, initially accessible to a limited number of institutional investors, achieves remarkable success. As news of its accuracy spreads, market sentiment shifts dramatically. Large-scale institutional adoption leads to a significant price surge as investors attempt to capitalize on the AI’s predictions. However, this could also attract regulatory scrutiny and potentially lead to market manipulation concerns, triggering a subsequent correction. This hypothetical scenario illustrates the potential for both significant gains and risks associated with the widespread adoption of Meta’s AI in the cryptocurrency market.

Factors Influencing Bitcoin’s Price in 2025 Beyond Meta’s AI

Predicting Bitcoin’s price is inherently complex, involving a confluence of factors extending far beyond the influence of any single technological advancement, including Meta’s AI initiatives. While AI could potentially impact Bitcoin’s adoption and transactional efficiency, a broader perspective encompassing macroeconomic conditions, regulatory landscapes, and technological developments within the broader cryptocurrency ecosystem is crucial for a comprehensive assessment.

Macroeconomic Factors and Bitcoin’s Value

Global macroeconomic conditions significantly influence Bitcoin’s price. High inflation, for instance, can drive investors towards Bitcoin as a hedge against inflation, potentially increasing demand and pushing the price upwards. Conversely, rising interest rates, often implemented to combat inflation, can make holding Bitcoin less attractive compared to interest-bearing assets, potentially leading to a price decrease. Similarly, strong global economic growth might divert investment away from riskier assets like Bitcoin towards more stable, traditional markets. The interconnectedness of these factors makes predicting their cumulative impact on Bitcoin’s price challenging but undeniably crucial. For example, the 2022 inflationary environment saw increased Bitcoin investment, while subsequent interest rate hikes led to a significant market correction.

Regulatory Changes and Government Policies

Government regulations and policies play a pivotal role in shaping the cryptocurrency market. Favorable regulatory frameworks, such as those promoting clarity and fostering innovation, can boost investor confidence and increase Bitcoin adoption, leading to price appreciation. Conversely, stringent regulations or outright bans can severely limit Bitcoin’s accessibility and usage, negatively impacting its price. The ongoing regulatory debates and evolving stances across different jurisdictions highlight the uncertainty and potential volatility inherent in this aspect. For example, the relatively positive regulatory environment in El Salvador, which adopted Bitcoin as legal tender, contrasts sharply with the stricter regulatory approaches seen in other countries, demonstrating the significant impact of government policies on market dynamics.

Technological Advancements in Blockchain and Cryptocurrency

Technological advancements within the broader blockchain and cryptocurrency space can influence Bitcoin’s price both directly and indirectly. Improvements in scalability, transaction speed, and security of competing cryptocurrencies could potentially divert investment away from Bitcoin. Conversely, innovations enhancing Bitcoin’s own functionality, such as the Lightning Network for faster transactions, could enhance its appeal and increase its price. The emergence of new consensus mechanisms or advancements in smart contract technology could also shift the landscape, impacting Bitcoin’s relative position within the broader cryptocurrency market. The ongoing development of layer-2 solutions is a prime example of technological advancements that could potentially impact Bitcoin’s long-term competitiveness.

Adoption Rates and Mainstream Acceptance

The extent of Bitcoin’s adoption and mainstream acceptance is a key determinant of its future price. Wider acceptance by institutional investors, businesses, and individuals will likely drive increased demand, pushing prices higher. Factors such as user-friendliness, ease of access, and the development of robust payment infrastructure are crucial for driving broader adoption. Conversely, limited adoption or negative perceptions fueled by security concerns or lack of understanding could hinder price growth. The growing number of companies accepting Bitcoin as payment, although still relatively small compared to traditional payment methods, represents a gradual increase in mainstream acceptance, signaling a potential upward trend in the long run.

Comparative Impact: Meta’s AI vs. Other Factors

While Meta’s AI initiatives might contribute to increased efficiency and accessibility within the cryptocurrency space, their potential impact on Bitcoin’s price in 2025 is likely to be less significant compared to the broader macroeconomic, regulatory, and technological forces described above. The macroeconomic environment and regulatory decisions will set the overall tone for the market, while technological advancements will shape the competitive landscape. Meta’s AI, while potentially beneficial, is one piece of a much larger and more complex puzzle. Its influence will be felt within the context of these other, more dominant forces.

Speculative Scenarios

Predicting the price of Bitcoin in 2025 is inherently speculative, relying on numerous interconnected factors. While Meta’s AI initiatives could play a role, the cryptocurrency market’s volatility makes precise forecasting impossible. The following scenarios explore potential price trajectories, considering both optimistic and pessimistic outlooks.

High Bitcoin Price Scenario: A Bull Market Run

This scenario envisions a surge in Bitcoin’s price, driven by several converging factors. Widespread adoption of Bitcoin as a legitimate store of value and medium of exchange could significantly increase demand. Imagine a future where major corporations and institutions, spurred by inflation concerns and regulatory clarity, significantly increase their Bitcoin holdings. Simultaneously, emerging markets could experience a surge in Bitcoin adoption, fueled by a lack of trust in traditional financial systems. Technological advancements, such as layer-2 scaling solutions and improved privacy features, could enhance Bitcoin’s usability and attract a wider range of users. Meta’s AI could contribute to this scenario by improving the efficiency and security of Bitcoin transactions, potentially leading to increased user confidence. This confluence of positive factors could propel Bitcoin’s price to significantly higher levels. For example, if global adoption accelerates and institutional investment continues to grow at the current rate, a price exceeding $200,000 is conceivable, perhaps even reaching $300,000 by 2025.

Low Bitcoin Price Scenario: A Bear Market Descent

A low Bitcoin price scenario in 2025 hinges on several negative influences. Increased regulatory scrutiny, leading to tighter controls and potentially even bans in key markets, could severely dampen investor enthusiasm. A major security breach affecting the Bitcoin network, compromising its integrity, could erode trust and cause a sharp price decline. Furthermore, a prolonged global economic recession, characterized by high inflation and unemployment, might cause investors to flee riskier assets like Bitcoin in favor of safer havens. A significant technological disruption, rendering Bitcoin obsolete or less efficient than competing cryptocurrencies, could also contribute to a price downturn. In this pessimistic scenario, Bitcoin’s price might fall below $10,000, perhaps even dipping below $5,000, mirroring the bear market conditions of previous years, but on a larger scale. Meta’s AI, in this context, would have limited influence, potentially even contributing to negative sentiment if a major AI-related security flaw is discovered within the Bitcoin ecosystem.

Moderate Bitcoin Price Scenario: A Balanced Outlook

This scenario acknowledges both the potential upsides and downsides of Bitcoin’s future. While significant adoption gains are anticipated, they are balanced by potential regulatory headwinds and ongoing market volatility. Institutional investment continues, but at a more moderate pace than in the high-price scenario. Technological improvements enhance Bitcoin’s functionality, but they do not completely resolve scalability or privacy concerns. Global economic conditions remain uncertain, with moderate growth offsetting potential recessionary pressures. Meta’s AI plays a neutral role, neither significantly boosting nor hindering Bitcoin’s price trajectory. Under this moderate scenario, Bitcoin’s price could range between $30,000 and $70,000 by 2025, reflecting a steady, but not spectacular, growth trajectory. This aligns with historical growth patterns, albeit with increased volatility.

| Scenario | Price Range (USD) | Key Factors | Meta AI Influence |

|---|---|---|---|

| High Price | $200,000 – $300,000+ | Widespread adoption, strong institutional investment, technological advancements, positive regulatory environment | Improved transaction efficiency and security, increased user confidence |

| Low Price | Below $10,000 | Increased regulation, security breaches, global recession, technological disruption | Limited influence, potential negative impact from AI-related security flaws |

| Moderate Price | $30,000 – $70,000 | Balanced adoption, moderate institutional investment, ongoing technological improvements, uncertain economic conditions | Neutral influence, neither significantly boosting nor hindering price |

The Role of Social Media Sentiment and Meta’s Influence: Meta Ai Bitcoin Price 2025

Social media sentiment has demonstrably influenced Bitcoin’s price, creating a complex interplay between online chatter and market volatility. Meta’s vast network of platforms, particularly Facebook and Instagram, plays a significant role in shaping this sentiment, given their immense user base and reach. Understanding this dynamic is crucial for comprehending Bitcoin’s future price movements.

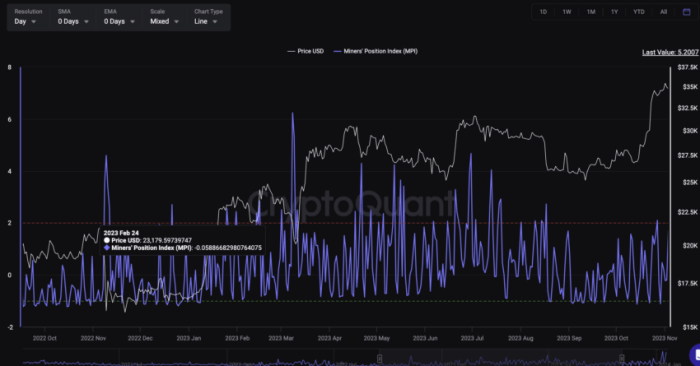

The historical correlation between social media sentiment and Bitcoin price fluctuations is well-documented. Positive sentiment, often expressed through enthusiastic posts and discussions, tends to coincide with price increases, while negative sentiment, marked by fear, uncertainty, and doubt (FUD), often precedes price drops. This correlation isn’t always direct or perfectly predictable, as numerous other factors influence Bitcoin’s price, but the link is undeniable.

Meta’s Platforms and Bitcoin Sentiment Amplification

Meta’s platforms, with their billions of users, can significantly amplify both positive and negative Bitcoin-related sentiment. A viral post or a trending hashtag can rapidly spread information and influence the perception of Bitcoin, leading to either a surge in buying or a wave of selling. The algorithms that govern newsfeeds and suggested content on these platforms can further amplify this effect, exposing users to information that reinforces pre-existing biases or introduces new perspectives. The sheer scale of Meta’s user base means that even a relatively small percentage shift in sentiment can translate into substantial market movement.

Examples of Social Media Trends Affecting Cryptocurrency Prices

The 2017 Bitcoin bull run, for instance, was accompanied by a surge in positive social media chatter. Numerous memes, influencer endorsements, and news articles circulated widely across platforms like Facebook and Twitter, fueling a speculative frenzy that drove prices to record highs. Conversely, periods of regulatory uncertainty or negative news reports have often triggered drops in price, with social media acting as a rapid conduit for disseminating such information and fostering fear among investors. For example, Elon Musk’s tweets about Dogecoin and Bitcoin have repeatedly caused significant price swings, demonstrating the power of influential social media personalities.

Utilizing Social Media Data to Predict Bitcoin Price Movements

Analyzing social media data, particularly from Meta’s platforms, offers a potential avenue for predicting Bitcoin price movements. By employing natural language processing (NLP) techniques, one can gauge the overall sentiment expressed towards Bitcoin across various platforms. This sentiment analysis, combined with other market indicators, can help construct more accurate predictive models. However, challenges remain, such as filtering out noise, identifying genuine sentiment shifts from random fluctuations, and accounting for the influence of bots and coordinated campaigns designed to manipulate market sentiment.

Meta’s AI and Social Media Sentiment Analysis

Meta’s advanced AI capabilities could significantly enhance the analysis of social media sentiment. Its AI algorithms can process vast amounts of data from Facebook, Instagram, and other platforms far more efficiently than human analysts. By identifying patterns and correlations between social media sentiment and Bitcoin price changes, Meta’s AI could potentially generate more accurate and timely predictions. However, ethical considerations regarding data privacy and the potential for algorithmic bias need to be carefully addressed. The accuracy of such predictions would also depend heavily on the quality and comprehensiveness of the data used, as well as the sophistication of the AI models employed.

Risks and Uncertainties Associated with Bitcoin Price Predictions

Predicting the future price of Bitcoin, or any cryptocurrency for that matter, is inherently fraught with risk and uncertainty. Numerous factors, both internal and external to the cryptocurrency market, can significantly impact price movements, making accurate forecasting exceptionally challenging. The inherent volatility of Bitcoin, coupled with the complexities of the global financial system, renders any prediction a probabilistic estimate rather than a definitive statement.

The limitations of using AI and other predictive models for Bitcoin price forecasting are substantial. While these tools can identify trends and patterns in historical data, they struggle to account for unforeseen events, unpredictable shifts in market sentiment, and the influence of external factors such as regulatory changes or technological advancements. These models are, at best, sophisticated extrapolations of past data, and their accuracy diminishes significantly when applied to long-term forecasting. Over-reliance on these models without considering the inherent limitations can lead to inaccurate assessments and potentially disastrous investment decisions.

Limitations of Predictive Models

AI and other quantitative models rely heavily on historical data. However, the cryptocurrency market, especially Bitcoin’s, is relatively young and characterized by periods of extreme volatility and rapid shifts in market dynamics. Past performance, therefore, may not be indicative of future results. Moreover, these models often struggle to incorporate qualitative factors such as regulatory announcements, significant technological breakthroughs, or major geopolitical events that can dramatically alter the market landscape. For instance, a sudden regulatory crackdown in a major market could cause a significant price drop that wouldn’t be reflected in a model solely based on historical trading data. Furthermore, the models themselves can be subject to biases in the data used to train them, leading to skewed predictions. The inherent complexity of the market and the interaction of various factors often defy simple mathematical modeling.

Unforeseen Events and Their Impact

Unforeseen events pose a significant threat to the accuracy of Bitcoin price predictions. A sudden regulatory crackdown in a major jurisdiction, for example, could trigger a sharp price decline. Similarly, a major security breach impacting a major exchange or a significant technological flaw in the Bitcoin network could lead to widespread uncertainty and price volatility. Unexpected macroeconomic events, such as global recessions or significant shifts in monetary policy, can also have a profound impact on Bitcoin’s price, making long-term predictions particularly unreliable. The 2022 crypto winter, triggered by a combination of factors including rising interest rates and the collapse of TerraUSD, serves as a stark reminder of the potential for unpredictable events to severely impact market valuations.

Comparison of Prediction Methods

Various methods exist for predicting Bitcoin’s price, ranging from fundamental analysis (assessing factors like adoption rate and technological developments) to technical analysis (studying price charts and trading volume) and AI-powered predictive models. Fundamental analysis offers a longer-term perspective, but it’s subjective and susceptible to bias. Technical analysis relies on identifying patterns in price movements, but these patterns can be unreliable and prone to false signals. AI models, as discussed, are limited by their dependence on historical data and inability to fully account for unforeseen events. Ultimately, no single method guarantees accurate predictions, and a diversified approach, combining insights from multiple sources, is often recommended.

Responsible Investing Practices

Responsible Bitcoin investment necessitates a thorough understanding of the inherent risks and a robust risk management strategy. Diversification is crucial; avoiding the concentration of investments solely in Bitcoin is paramount. Thorough research and due diligence are essential before investing, including understanding the underlying technology, market dynamics, and potential regulatory risks. Investors should only invest what they can afford to lose and avoid making emotional investment decisions based on short-term price fluctuations or hype. Setting realistic expectations and maintaining a long-term perspective are key components of responsible Bitcoin investing. Regularly reviewing and adjusting the investment strategy based on market conditions and personal financial circumstances is also vital.

Frequently Asked Questions (FAQ)

This section addresses common queries regarding the potential influence of Meta’s AI initiatives on Bitcoin’s price in 2025 and the broader factors impacting the cryptocurrency market. We will explore the reliability of predictions, key influencing factors beyond Meta’s AI, and the inherent risks associated with Bitcoin investment.

Meta’s AI Impact on Bitcoin Price in 2025

Meta’s AI advancements could indirectly affect Bitcoin’s price. For example, improved AI-driven trading algorithms might increase market efficiency or lead to more sophisticated prediction models. However, the direct impact is difficult to quantify. A significant positive influence might stem from Meta’s integration of cryptocurrency into its platforms, potentially increasing adoption and demand. Conversely, negative impacts could arise from AI-powered regulatory tools or negative sentiment generated by AI-driven news and analysis. The actual effect remains speculative and dependent on various market forces.

Reliability of Bitcoin Price Predictions Considering Meta’s AI

Bitcoin price predictions, even those considering Meta’s AI influence, are inherently unreliable. The cryptocurrency market is highly volatile and influenced by numerous unpredictable factors, including regulatory changes, technological developments, and overall market sentiment. While AI can analyze historical data and identify trends, it cannot accurately predict unforeseen events like a major security breach or a sudden shift in government policy. Therefore, any prediction, even one incorporating Meta’s AI, should be treated with considerable caution. For instance, predictions made in 2020 for Bitcoin’s price in 2022 were widely inaccurate due to the unforeseen events that transpired.

Major Factors Influencing Bitcoin’s Price Besides Meta’s AI, Meta Ai Bitcoin Price 2025

Bitcoin’s price is shaped by a complex interplay of macroeconomic and technological factors. Macroeconomic factors include global inflation rates, interest rate adjustments by central banks (like the Federal Reserve), and overall economic growth. Technological factors include the development of new cryptocurrencies, improvements in blockchain technology, and the adoption of Bitcoin by major corporations or institutions. Regulatory changes, both domestically and internationally, play a significant role, as do events such as large-scale adoption by institutional investors or significant security breaches.

Risks Involved in Investing in Bitcoin Based on Predictions

Investing in Bitcoin based on any prediction, regardless of its source, carries substantial risk. Bitcoin’s price is notoriously volatile, subject to dramatic swings in short periods. Market manipulation, regulatory uncertainty, and technological vulnerabilities all contribute to this volatility. Furthermore, the speculative nature of the cryptocurrency market means that significant losses are possible. Investors should only allocate funds they can afford to lose and thoroughly research the risks before investing. The collapse of FTX in 2022 serves as a stark reminder of the potential for substantial and rapid losses in the cryptocurrency market.