Next Bitcoin Halving Date 2025

Bitcoin halvings are pivotal events in the cryptocurrency’s lifecycle, significantly impacting its supply and often its price. These events, programmed into Bitcoin’s code, reduce the rate at which new Bitcoins are created, effectively creating a scarcity effect similar to that of precious metals. Understanding these events is crucial for anyone interested in Bitcoin’s long-term trajectory.

The halving mechanism is a core element of Bitcoin’s deflationary design. Every 210,000 blocks mined, approximately every four years, the reward given to miners for verifying transactions is cut in half. This halving reduces the rate of Bitcoin inflation, making each Bitcoin theoretically more valuable over time due to reduced supply.

Bitcoin Halving History and Price Impact

The Bitcoin network has undergone two previous halvings. The first occurred in November 2012, reducing the block reward from 50 BTC to 25 BTC. Following this halving, Bitcoin’s price experienced a significant increase over the subsequent year. The second halving took place in July 2016, reducing the block reward further to 12.5 BTC. Again, this event was followed by a substantial price appreciation, albeit with periods of volatility. While correlation doesn’t equal causation, these past events have fueled speculation about the potential impact of the upcoming halving. It’s important to note that various market factors beyond the halving itself influence Bitcoin’s price, including regulatory changes, technological advancements, and overall market sentiment.

Bitcoin Halving Mechanism and Supply Effect, Next Bitcoin Halving Date 2025

The halving mechanism is hard-coded into Bitcoin’s protocol, ensuring its predictability. The reward for miners starts at 50 BTC per block and is halved repeatedly until the maximum supply of 21 million Bitcoins is reached, approximately in the year 2140. Each halving effectively slows the rate at which new Bitcoins enter circulation. This controlled supply, combined with increasing demand, is a key factor driving the argument for Bitcoin’s long-term value appreciation. The reduction in new Bitcoin supply doesn’t immediately impact the existing supply, but it changes the rate at which the total supply grows, leading to a slower increase in the circulating supply over time. This mechanism is designed to mimic the scarcity of precious metals like gold, making Bitcoin a potentially attractive store of value.

Predicting the 2025 Halving Date

The Bitcoin halving, a significant event in the cryptocurrency’s lifecycle, occurs approximately every four years. It’s a programmed reduction in the rate at which new Bitcoins are created, impacting the inflation rate and potentially influencing the price. Predicting the precise date of the next halving, scheduled for 2025, requires understanding the underlying mechanics of the Bitcoin blockchain.

The halving process is determined by a specific block height, not a calendar date. Bitcoin’s code dictates that a new block of transactions is added to the blockchain roughly every 10 minutes. The halving event is triggered when a predetermined number of blocks has been mined since the genesis block. Each halving divides the block reward in half. Therefore, calculating the precise date requires estimating the average block time and extrapolating that to the block height of the next halving. While the target block time is 10 minutes, variations due to network hashrate fluctuations exist, creating some uncertainty.

Calculating the Halving Date

The calculation involves determining the block height at which the next halving will occur. This height is fixed in the Bitcoin protocol. Knowing this block height, we can then estimate the time until the halving based on the average block generation time. However, this is only an approximation. The actual date may vary slightly due to changes in the mining difficulty and network activity. For instance, the third halving, initially predicted for July 2020, occurred slightly earlier due to variations in block generation time. This illustrates the inherent difficulty in pinpointing an exact date. A precise prediction requires constant monitoring of the block generation rate leading up to the event.

Factors Influencing the Halving Date

While the core halving mechanism is deterministic, several factors could subtly influence the actual date. A significant factor is the blockchain’s hashrate. A higher hashrate leads to faster block creation, potentially accelerating the halving. Conversely, a lower hashrate could delay it. Furthermore, major blockchain forks or significant network upgrades could temporarily disrupt the block generation rate, creating minor deviations from the predicted timeline. Unexpected events, like major security breaches or regulatory changes, are also impossible to predict but could indirectly affect mining activity and consequently the halving date.

Timeline to the 2025 Halving

While a precise date remains elusive until closer to the event, we can illustrate a simplified countdown based on the historical average block time. Assuming an average block time of approximately 10 minutes, and knowing the target block height for the next halving, a preliminary estimate can be generated. This estimate would provide a reasonable approximation, subject to the aforementioned uncertainties. A dynamic countdown, constantly updated based on real-time blockchain data, would offer a more accurate, albeit still approximate, projection. Note that this is a simplified illustration and should not be considered a definitive prediction. For a precise timeline, continuous monitoring of the Bitcoin network is essential.

The Impact of the Halving on Mining

The Bitcoin halving, a programmed event that reduces the block reward miners receive for validating transactions, significantly impacts the profitability and landscape of Bitcoin mining. This reduction forces miners to adapt their operations, leading to potential shifts in the industry’s structure and energy consumption. Understanding these impacts is crucial for anyone involved in or interested in the Bitcoin ecosystem.

The halving directly affects Bitcoin mining profitability by decreasing the revenue miners generate per block. Before the halving, miners receive a certain number of newly minted Bitcoins for each block they successfully mine. After the halving, this reward is cut in half. To maintain profitability, miners must either reduce their operating costs (e.g., energy consumption, hardware maintenance) or see a corresponding increase in the price of Bitcoin. If the Bitcoin price remains stagnant or falls, less profitable mining operations will likely become unsustainable, leading to some miners shutting down. This process of less efficient miners exiting the market is often referred to as a “mining shakeout.”

Changes in the Mining Landscape Post-Halving

The halving typically triggers a period of consolidation within the Bitcoin mining industry. Less efficient miners, those with higher operating costs or older, less energy-efficient hardware, are often the first to be affected. This leads to a decrease in the overall number of miners, and an increase in the market share held by larger, more efficient operations. These larger operations often benefit from economies of scale, allowing them to operate more profitably even with reduced block rewards. This can result in increased centralization of the Bitcoin mining network, although the degree of centralization is a subject of ongoing debate and depends on various factors, including the availability of cheap energy and technological advancements. For example, the 2021 halving saw a significant shift towards large-scale mining operations in regions with abundant and cheap hydropower, like some parts of China (before the government crackdown) and Kazakhstan.

Implications for Energy Consumption in Bitcoin Mining

The halving’s impact on energy consumption is complex. While the reduction in mining profitability could lead to some miners shutting down, thus lowering overall energy use, it could also incentivize miners to adopt more energy-efficient technologies and strategies. The increased competition and pressure to maintain profitability could accelerate the adoption of more energy-efficient mining hardware (ASICs) and renewable energy sources. However, the overall effect is difficult to predict precisely. The increase in the price of Bitcoin following previous halvings has often offset the reduced block reward, leading to a continued (though not necessarily proportional) increase in total energy consumption as more miners enter the market attracted by the higher profits. This makes accurate forecasting challenging. It’s important to consider that energy consumption is also influenced by factors beyond the halving, such as the price of Bitcoin, regulatory changes, and technological advancements in mining hardware.

Long-Term Implications of the 2025 Halving

The 2025 Bitcoin halving, reducing the block reward for miners by half, is a significant event with far-reaching consequences for Bitcoin’s long-term trajectory. Its impact extends beyond the immediate price fluctuations, influencing the network’s security, the incentives for miners, and ultimately, Bitcoin’s position as a store of value and a medium of exchange. Understanding these long-term implications requires considering the interplay of scarcity, adoption, and market dynamics.

The halving directly impacts Bitcoin’s scarcity, a core tenet of its value proposition. By reducing the rate of new Bitcoin entering circulation, the halving intensifies the existing scarcity. This, in theory, should increase its value over time, assuming demand remains consistent or increases. However, the actual price response is complex and depends on various factors, including macroeconomic conditions, regulatory developments, and overall market sentiment. Historical precedent suggests a period of price volatility following a halving, often followed by a longer-term upward trend, but this is not guaranteed.

Bitcoin’s Price and Adoption Scenarios

Several potential scenarios exist for Bitcoin’s price and adoption in the years following the 2025 halving. A positive scenario could see increased institutional adoption, coupled with growing mainstream awareness, driving significant price appreciation. This would be fueled by the reduced supply and increased demand, potentially mirroring the price increases seen after previous halvings, albeit potentially at a different scale depending on market conditions. Conversely, a less optimistic scenario might see subdued price growth or even a period of stagnation, perhaps due to macroeconomic headwinds or increased regulatory scrutiny. This scenario could still see increased adoption, but at a slower pace, leading to a less dramatic price increase. A third, more extreme scenario could involve unforeseen events impacting the entire cryptocurrency market, impacting Bitcoin’s price regardless of the halving. The 2008 financial crisis, for example, demonstrates how unforeseen macroeconomic events can dramatically impact asset prices regardless of underlying fundamentals.

Impact on the Broader Cryptocurrency Market

The 2025 Bitcoin halving’s impact will likely extend beyond Bitcoin itself, influencing the broader cryptocurrency market. The halving’s effect on Bitcoin’s price could trigger ripple effects across other cryptocurrencies, potentially boosting the entire market’s value if Bitcoin’s price increases significantly. However, a negative impact on Bitcoin’s price could also lead to a downturn in the broader market, as Bitcoin often acts as a bellwether for the entire space. Furthermore, the halving could potentially shift the dynamics within the cryptocurrency market, with altcoins experiencing varying degrees of correlation to Bitcoin’s price movement. The relative performance of different cryptocurrencies will depend on their individual characteristics, market capitalization, and adoption rates.

Risks and Uncertainties: Next Bitcoin Halving Date 2025

Predicting Bitcoin’s price, especially around a halving event, is inherently risky. Numerous interconnected factors influence its value, making accurate forecasting exceptionally challenging. While the halving reduces the rate of new Bitcoin entering circulation, it’s not a guaranteed catalyst for price appreciation. Several unpredictable events could significantly impact the market, both positively and negatively.

Unforeseen events and market sentiment can drastically alter Bitcoin’s trajectory. For example, regulatory changes in major economies, unexpected technological advancements, or significant geopolitical events can all cause substantial price volatility. Furthermore, the inherently speculative nature of Bitcoin, coupled with its susceptibility to manipulation, adds another layer of uncertainty. It’s crucial to understand these risks before making any investment decisions.

Regulatory Uncertainty

Government regulations worldwide significantly impact Bitcoin’s price. Changes in tax laws, trading restrictions, or outright bans in key markets can trigger sharp price movements. For instance, a sudden crackdown on cryptocurrency exchanges in a major jurisdiction could lead to a significant sell-off, irrespective of the halving’s impact. Conversely, supportive regulations in large economies could drive substantial price increases. The lack of a globally unified regulatory framework contributes to this inherent uncertainty.

Technological Risks

Technological advancements or vulnerabilities pose significant risks. The emergence of a superior cryptocurrency, a major security breach affecting a significant exchange, or the discovery of a critical flaw in the Bitcoin protocol could negatively impact its price. The 2010 Mt. Gox hack, for example, which resulted in the loss of millions of dollars worth of Bitcoin, demonstrates the potential impact of technological vulnerabilities. Constant technological evolution is inherent to the cryptocurrency space and can create unforeseen challenges.

Market Sentiment and Speculation

Market sentiment, driven by media coverage, social media trends, and overall investor confidence, plays a crucial role. Fear, uncertainty, and doubt (FUD) can trigger significant sell-offs, while positive news and hype can fuel speculative bubbles. The 2017 Bitcoin bubble, followed by a significant crash, exemplifies the impact of irrational exuberance and subsequent market corrections. These periods of intense speculation can make accurate price predictions almost impossible.

Responsible Investment and Risk Management

Given the inherent volatility and uncertainty surrounding Bitcoin, responsible investment and risk management are paramount. Investors should only allocate capital they can afford to lose and diversify their portfolios to mitigate risk. Thorough research, understanding the underlying technology, and a long-term perspective are essential. Avoid making investment decisions based solely on short-term price fluctuations or speculative hype. Consider consulting with a qualified financial advisor before making any significant investments in cryptocurrencies.

Frequently Asked Questions (FAQ)

Understanding the Bitcoin halving in 2025 requires addressing common queries surrounding this significant event. The following table clarifies key aspects of the upcoming halving, providing answers, sources, and links for further research.

| Question | Answer | Source | Related Links |

|---|---|---|---|

| What is the Bitcoin halving? | The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created by 50%. This occurs approximately every four years. The next halving is expected in 2025. | Bitcoin Whitepaper | Bitcoin Whitepaper |

| When exactly will the 2025 Bitcoin halving occur? | The precise date depends on the block generation time, which can fluctuate slightly. While predictions point to a date in 2025, the exact date is only known once the block containing the halving event is mined. | Blockchain Explorers (e.g., Blockchain.com) | Blockchain.com |

| How will the 2025 halving impact Bitcoin’s price? | Historically, Bitcoin’s price has tended to increase in the periods following a halving event. This is due to the reduced supply of newly mined Bitcoin, potentially increasing scarcity and demand. However, this is not guaranteed, and other market factors play a significant role. | CoinMarketCap, various market analyses | CoinMarketCap |

| What is the impact of the halving on Bitcoin miners? | The halving reduces the reward miners receive for validating transactions. This can lead to increased competition, potential consolidation within the mining industry, and adjustments in mining profitability, potentially requiring miners to increase efficiency or cease operations. | Cambridge Bitcoin Electricity Consumption Index | Cambridge Bitcoin Electricity Consumption Index |

| What are the long-term implications of the 2025 halving? | The long-term effects are uncertain but could include increased Bitcoin scarcity, potential price appreciation over time, and further adoption of Bitcoin as a store of value and a medium of exchange. However, regulatory changes and broader economic conditions could significantly influence these outcomes. | Various economic and financial forecasts | (Note: Numerous research papers and articles discuss long-term implications; a specific link is not provided due to the broad nature of the question.) |

Illustrative Data Visualization

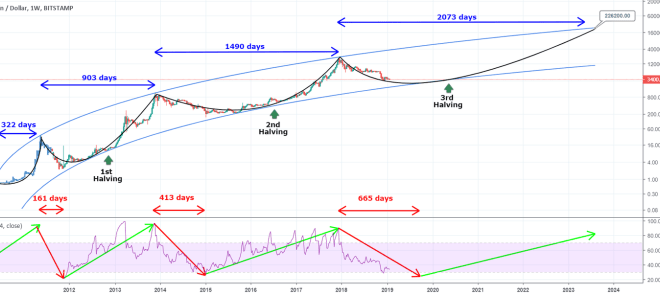

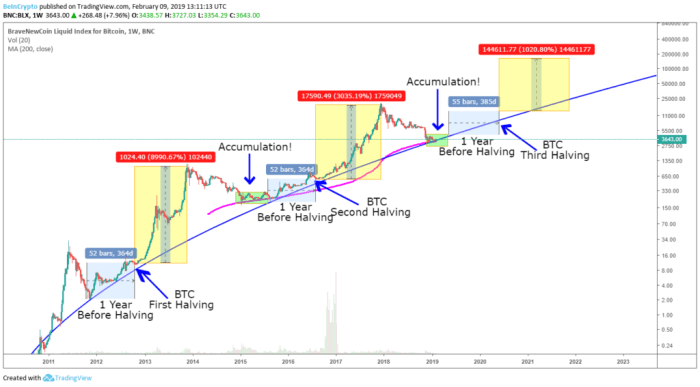

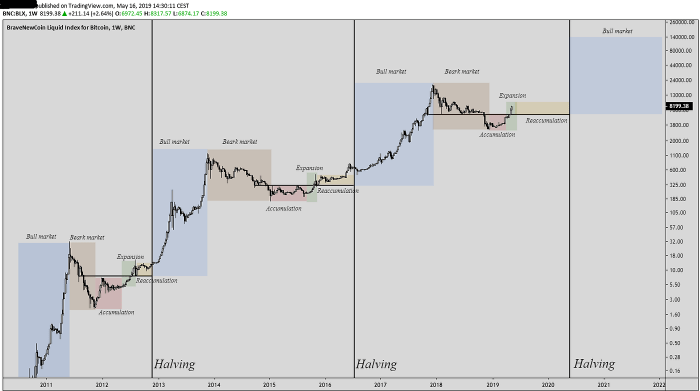

Visual representations are crucial for understanding the complex relationship between Bitcoin’s halving events and its price. Analyzing historical data allows us to identify trends and potentially inform expectations for the 2025 halving, although it’s important to remember that past performance is not necessarily indicative of future results. The following charts offer a visual summary of key data points.

Bitcoin Price Performance Before and After Past Halvings

This chart would display Bitcoin’s price over time, clearly marking the dates of previous halving events (2012, 2016, and 2020). The x-axis would represent time, and the y-axis would represent Bitcoin’s price in USD. Each halving event would be marked with a vertical line. The chart would show price movements in the periods leading up to each halving (e.g., 12 months prior) and the subsequent periods (e.g., 12, 24, and 36 months after). Data points would include the price at the time of each halving and key price highs and lows within the chosen timeframes. The significance lies in observing whether a consistent pattern emerges—for example, a period of price increase following each halving, though the magnitude of the increase may vary. The chart would highlight the variability in price response after each halving, emphasizing the complexity of predicting future price movements based solely on historical data. It would also include shaded regions to highlight periods of significant bullish or bearish market sentiment, providing context for price fluctuations. For example, the 2020 halving coincided with a period of increasing institutional interest in Bitcoin, potentially contributing to the subsequent price surge.

Projected Bitcoin Supply Over the Next Few Years

This chart would depict the total supply of Bitcoin over time, projecting into the future. The x-axis would represent time (years), and the y-axis would represent the total number of Bitcoins in circulation. A clear line would show the steady increase in Bitcoin supply, with a noticeable step-down at the 2025 halving date. The data points would include the total Bitcoin supply before and after each halving, as well as projections for future years based on the known block reward reduction schedule. The significance of this chart is to visually demonstrate the impact of the halving on the rate of new Bitcoin entering circulation. The chart would clearly show the halving’s effect on the inflation rate of Bitcoin, illustrating how the reduced issuance rate contributes to the scarcity of Bitcoin over time. A comparison could be drawn between the pre- and post-halving supply growth rates to highlight the significant reduction in new Bitcoin entering circulation. For instance, the chart could show that the rate of new Bitcoin entering circulation is halved after the 2025 event, resulting in a slower increase in the overall supply. This visualization emphasizes the long-term implications of the halving on the overall supply and demand dynamics of Bitcoin.

Additional Resources

Understanding the intricacies of the Bitcoin halving and its potential consequences requires consulting a variety of sources. The following list provides access to credible information from reputable organizations and researchers in the cryptocurrency space. These resources offer diverse perspectives and data points, contributing to a more comprehensive understanding of this significant event.

Reputable Websites and Publications

This section compiles links to websites and publications known for their accurate and in-depth coverage of Bitcoin and the cryptocurrency market. These sources provide ongoing analysis and commentary on the halving’s potential impact.

- CoinMetrics: CoinMetrics offers detailed on-chain data and analysis of Bitcoin, providing valuable insights into network activity and potential market reactions to the halving. Their data visualizations are particularly helpful for understanding trends.

- Glassnode: Similar to CoinMetrics, Glassnode provides on-chain analytics, offering a different perspective on Bitcoin’s network health and the potential effects of the halving. Their studies often focus on miner behavior and network security.

- Cointelegraph: Cointelegraph is a well-known cryptocurrency news outlet that regularly publishes articles and analyses on the Bitcoin halving, offering a broad range of viewpoints from industry experts.

- The Block: The Block provides in-depth reporting and analysis on the cryptocurrency industry, including frequent updates and expert opinions on the upcoming halving and its market implications.

Research Papers and Academic Publications

While readily available academic papers specifically dedicated to *predicting* the precise market impact of each halving are scarce due to the inherent volatility and complexity of the cryptocurrency market, several research papers explore related topics such as the impact of block reward reductions on miner behavior and network security. These studies provide a foundation for understanding the underlying mechanisms at play. Finding specific papers requires using s such as “Bitcoin halving,” “block reward reduction,” and “cryptocurrency mining economics” in academic search engines like Google Scholar.

Relevant Blogs and Forums

While caution is advised when using information from blogs and forums, some established and reputable sources in the cryptocurrency community offer insightful discussions and analysis. However, always critically evaluate the information presented and cross-reference it with data from more established sources. Note that this information is often less formal and may not undergo the same rigorous fact-checking as academic publications or established news outlets.

The Next Bitcoin Halving Date in 2025 is anticipated to significantly impact the cryptocurrency market. For businesses looking to capitalize on this event, a robust online marketing strategy is crucial; consider setting up a Google Ads Account to reach potential investors and traders interested in the halving’s effects. Effective advertising could be key to success during this period of market volatility surrounding the Next Bitcoin Halving Date 2025.