Next Bitcoin Halving 2025

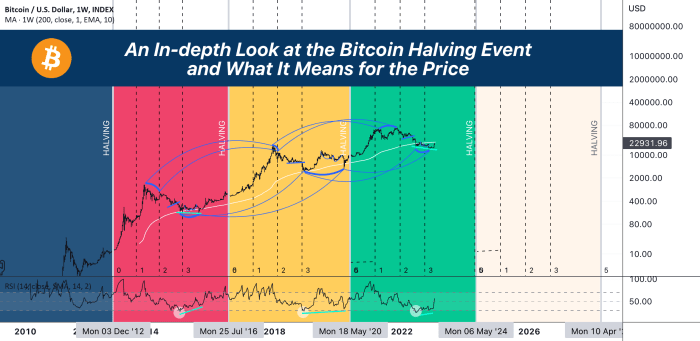

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created. This occurs approximately every four years, cutting the block reward in half. This reduction in supply is intended to maintain Bitcoin’s scarcity and potentially influence its price. While not a guaranteed price driver, historical data suggests a correlation between halving events and subsequent price increases, although the timing and magnitude of these increases vary significantly.

The halving mechanism directly impacts the inflation rate of Bitcoin. By reducing the newly minted coins entering circulation, the halving theoretically decreases the supply, potentially increasing its value based on the principles of supply and demand. However, other market factors, including regulatory changes, technological advancements, and overall macroeconomic conditions, also play crucial roles in determining Bitcoin’s price.

Historical Impact of Bitcoin Halvings

Previous Bitcoin halvings have shown varied impacts on market trends. The first halving in 2012 saw a gradual price increase in the following year. The second halving in 2016 was followed by a significant bull run in 2017, culminating in an all-time high price. The third halving in 2020 also led to a substantial price surge in late 2020 and early 2021. It is important to note that while these halvings were followed by price increases, the timing and extent of the price movements were influenced by multiple other factors beyond just the halving itself. These factors include investor sentiment, broader market conditions, and technological developments within the cryptocurrency space. Therefore, while historical data provides some insight, it does not guarantee a similar outcome for the 2025 halving.

Timeline Leading to the 2025 Halving

The Bitcoin halving occurs approximately every 210,000 blocks mined. Based on the current block mining rate, the next halving is projected to occur sometime in the spring of 2025. While the precise date remains uncertain due to fluctuations in mining difficulty, we can highlight key events leading up to it. These include continued development and adoption of Bitcoin, evolving regulatory landscapes across different jurisdictions, and the ongoing competition among cryptocurrencies. Market speculation and anticipation of the halving itself will also be significant factors in the lead-up to the event. For example, increased institutional investment and the growth of Bitcoin’s underlying technology could influence the price trajectory in the run-up to the halving. Conversely, negative regulatory news or a broader market downturn could temper the anticipated price effects. The period leading up to the halving will be marked by intense speculation and volatility in the market, making it crucial for investors to remain informed and manage risk appropriately.

Predicting Bitcoin’s Price After the 2025 Halving: Next Halving Bitcoin 2025

Predicting the price of Bitcoin after the 2025 halving is a complex undertaking, fraught with uncertainty. Numerous factors influence Bitcoin’s price, making accurate forecasting exceptionally challenging. While no model guarantees precise predictions, several approaches attempt to quantify the impact of the halving and other market dynamics.

Price Prediction Models and Methodologies

Several models attempt to forecast Bitcoin’s price post-halving. These range from simple stock-to-flow models, which focus on the relationship between Bitcoin’s scarcity and its price, to more sophisticated models incorporating macroeconomic indicators, adoption rates, and sentiment analysis. Stock-to-flow models, for example, historically correlated Bitcoin’s price with its scarcity, suggesting a price increase following each halving. However, these models often fail to account for unexpected events like regulatory changes or market manipulation. Other models incorporate machine learning algorithms, analyzing vast datasets to identify patterns and predict future price movements. These machine learning approaches, while potentially powerful, are also susceptible to biases in the data and may not accurately capture unforeseen market shifts. Finally, some analysts use a combination of quantitative and qualitative methods, integrating technical analysis with fundamental analysis and expert opinions to arrive at a price forecast.

Bullish and Bearish Market Predictions

Bullish predictions for the 2025 halving often center on the historical precedent of price increases following previous halvings. Proponents of this view argue that the reduced supply of newly mined Bitcoin, combined with sustained demand, will inevitably drive up the price. They may point to the increasing adoption of Bitcoin as a store of value and a hedge against inflation as further supporting arguments. In contrast, bearish predictions highlight the potential for regulatory uncertainty, macroeconomic instability, and the emergence of competing cryptocurrencies to dampen the price impact of the halving. Bearish analysts may cite previous instances where the halving’s effect on price was less pronounced than anticipated, emphasizing the unpredictable nature of the cryptocurrency market. The interplay of these opposing viewpoints creates a wide range of price predictions.

Comparison of Price Predictions from Reputable Sources, Next Halving Bitcoin 2025

The following table compares price predictions from several sources, noting their underlying assumptions and methodologies. It is crucial to remember that these are merely predictions, and the actual price may differ significantly.

| Source | Predicted Price (USD) | Methodology | Assumptions |

|---|---|---|---|

| PlanB (Stock-to-Flow Model) *Example* | $100,000 – $150,000 | Stock-to-flow analysis | Continued adoption, limited supply |

| CoinDesk *Example* | $50,000 – $100,000 | Combination of technical and fundamental analysis | Moderate adoption, macroeconomic stability |

| Bloomberg *Example* | $30,000 – $70,000 | Expert opinions and market sentiment analysis | Potential regulatory headwinds, competitive landscape |

| CryptoQuant *Example* | $60,000 – $120,000 | On-chain metrics and market behavior analysis | High institutional adoption, stable market sentiment |

*Note: These are illustrative examples, and actual predictions from these sources may vary. Always consult the original sources for the most up-to-date information.*

Factors Influencing Bitcoin’s Price Post-Halving

The 2025 Bitcoin halving, reducing the block reward for miners by half, is a significant event anticipated to impact Bitcoin’s price. However, the price movement isn’t solely determined by this event; numerous macroeconomic factors, regulatory landscapes, and technological advancements play crucial roles. Understanding these interconnected influences is key to forming a comprehensive perspective on Bitcoin’s potential price trajectory after the halving.

Macroeconomic Factors and Their Influence on Bitcoin’s Price

Global macroeconomic conditions significantly influence Bitcoin’s price. High inflation, for instance, can drive investors towards Bitcoin as a hedge against inflation, increasing demand and potentially pushing prices higher. Conversely, rising interest rates, making traditional investments more attractive, could lead to a decrease in Bitcoin’s appeal and potentially lower its price. Major global economic events, such as recessions or geopolitical instability, also introduce considerable uncertainty and volatility into the cryptocurrency market. For example, the 2008 financial crisis led many to explore alternative assets, and Bitcoin, being a relatively new asset at that time, saw increased interest. The ongoing war in Ukraine has also shown how geopolitical events can impact the value of various assets, including Bitcoin.

Regulatory Changes and Government Policies

Government regulations and policies significantly shape the Bitcoin market. Favorable regulations, such as clear guidelines for cryptocurrency exchanges and taxation, can foster greater institutional investment and wider adoption, potentially increasing Bitcoin’s price. Conversely, restrictive regulations, such as outright bans or stringent KYC/AML requirements, can stifle growth and reduce price. The contrasting regulatory approaches of different countries highlight this influence; for example, El Salvador’s adoption of Bitcoin as legal tender boosted its price temporarily, while China’s ban had a negative impact. The ongoing debate surrounding Bitcoin regulation in various jurisdictions reflects the continuous evolution of its regulatory landscape and its impact on the price.

Technological Advancements and Bitcoin Adoption Rates

Technological advancements within the Bitcoin ecosystem and its increasing adoption rates also influence its price. Improvements in scalability, such as the Lightning Network, can enhance Bitcoin’s usability and potentially increase demand. Wider adoption by businesses and institutions, signaling increased legitimacy and trust, can also drive price appreciation. Conversely, significant technological setbacks or security breaches could negatively impact investor confidence and lead to price drops. The development of second-layer solutions like the Lightning Network aims to improve transaction speed and reduce fees, which are often cited as limitations of Bitcoin. Increased adoption by payment processors and major corporations further enhances the credibility and use cases of Bitcoin.

Next Halving Bitcoin 2025 – The next Bitcoin halving in 2025 is a significant event anticipated to impact the cryptocurrency’s price. Understanding the precise timing is crucial for investors, and to clarify this, you might find it helpful to consult this resource: When Was Bitcoin Halving In 2025. This information helps to accurately predict the market effects surrounding the next halving and allows for better preparation.

The next Bitcoin halving in 2025 is a significant event for the cryptocurrency’s future price. Understanding potential price movements requires careful analysis, and a helpful resource for this is the detailed Bitcoin Halving Chart 2025 Prediction which offers various scenarios. By studying these predictions, we can better anticipate the impact of the 2025 halving on the Bitcoin market and its overall trajectory.

The next Bitcoin halving in 2025 is a significant event for the cryptocurrency’s future price. Understanding potential price movements requires careful analysis, and a helpful resource for this is the detailed Bitcoin Halving Chart 2025 Prediction which offers various scenarios. By studying these predictions, we can better anticipate the impact of the 2025 halving on the Bitcoin market and its overall trajectory.

The next Bitcoin halving in 2025 is a significant event for the cryptocurrency’s future price. Understanding potential price movements requires careful analysis, and a helpful resource for this is the detailed Bitcoin Halving Chart 2025 Prediction which offers various scenarios. By studying these predictions, we can better anticipate the impact of the 2025 halving on the Bitcoin market and its overall trajectory.

The next Bitcoin halving in 2025 is a significant event for the cryptocurrency’s future price. Understanding potential price movements requires careful analysis, and a helpful resource for this is the detailed Bitcoin Halving Chart 2025 Prediction which offers various scenarios. By studying these predictions, we can better anticipate the impact of the 2025 halving on the Bitcoin market and its overall trajectory.

The next Bitcoin halving in 2025 is a significant event for the cryptocurrency’s future price. Understanding potential price movements requires careful analysis, and a helpful resource for this is the detailed Bitcoin Halving Chart 2025 Prediction which offers various scenarios. By studying these predictions, we can better anticipate the impact of the 2025 halving on the Bitcoin market and its overall trajectory.