Investor Sentiment and Market Speculation: Next Halving Bitcoin After 2025

Investor sentiment surrounding Bitcoin halvings is a complex interplay of anticipation, speculation, and past performance. The reduction in new Bitcoin supply acts as a fundamental catalyst, often driving narratives of scarcity and future price appreciation. However, the actual impact is significantly influenced by broader macroeconomic conditions, regulatory developments, and the overall risk appetite of investors. Understanding these factors is crucial for navigating the market volatility surrounding these events.

The period leading up to a halving typically sees a surge in bullish sentiment. Investors anticipate a potential price increase due to the decreased supply, leading to increased buying pressure and speculation. This positive sentiment can be amplified by media coverage and social media discussions, creating a self-reinforcing cycle. Conversely, the period immediately following the halving can witness a temporary correction as investors who bought in anticipation of the event take profits. The subsequent price trajectory depends on whether the anticipated scarcity narrative outweighs other market forces.

The Role of Speculation and Market Manipulation

Speculation plays a significant role in shaping Bitcoin’s price, particularly around halvings. Large investors and market makers can leverage the heightened anticipation to manipulate prices through coordinated buying or selling. This can lead to artificial price inflation or deflation, creating opportunities for profit but also increasing the risk of significant losses for less sophisticated investors. For instance, during the 2020 halving, the price did not immediately skyrocket, instead consolidating for several months before a substantial upward trend. This period of consolidation could be interpreted as a period of manipulation or a simple market correction, highlighting the complexities involved. The lack of transparency and regulation in the cryptocurrency market exacerbates this issue.

Price Volatility Surrounding Halvings, Next Halving Bitcoin After 2025

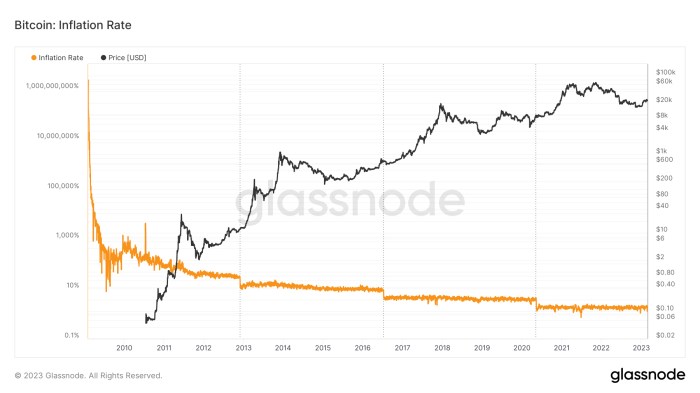

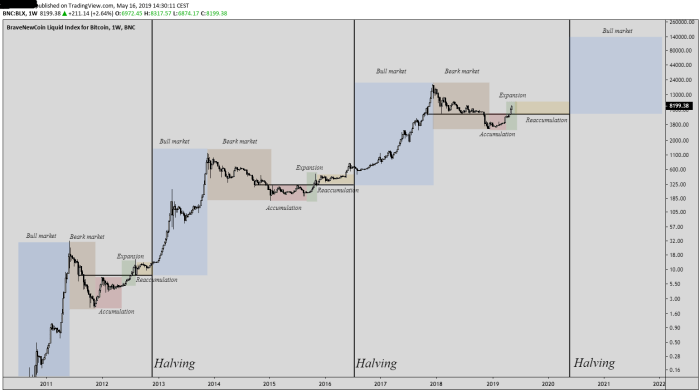

Bitcoin’s price is inherently volatile, and this volatility is amplified during the periods surrounding halvings. The uncertainty surrounding the actual impact of the reduced supply, coupled with the speculative trading activity, contributes to significant price swings. Historically, we have seen both sharp price increases and significant corrections in the months leading up to and following halvings. This volatility presents both opportunities and risks for investors. A disciplined approach with a well-defined risk management strategy is crucial for navigating this turbulent period. For example, the 2012 halving saw a gradual price increase following the event, while the 2016 halving experienced a more dramatic surge after a period of relative stability.

Historical Market Reactions to Previous Halvings

Analyzing past halvings provides valuable insights into potential future market behavior. The 2012 halving saw a gradual price increase following the event, while the 2016 halving experienced a more dramatic surge after a period of relative stability. The 2020 halving presented a more complex picture, with a period of consolidation following the event before a substantial price increase. These varied responses highlight the influence of external factors beyond the halving itself, including macroeconomic conditions, regulatory changes, and overall market sentiment. Investor behavior in each instance differed, with some opting for long-term holding strategies while others engaged in more speculative short-term trading. Understanding these historical patterns can help inform expectations, but it’s crucial to remember that past performance is not necessarily indicative of future results.

Long-Term Implications for Bitcoin’s Value

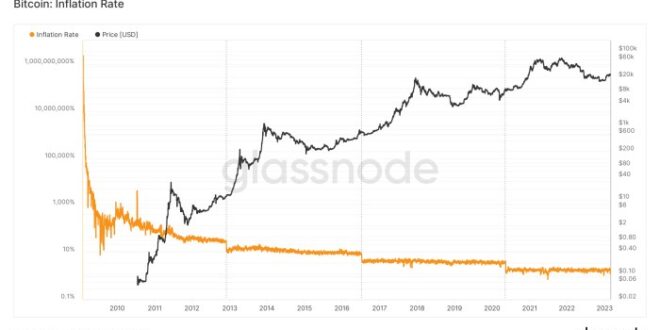

The Bitcoin halving, a programmed reduction in the rate of new Bitcoin creation, has historically been associated with significant price increases in the following months and years. However, predicting the long-term impact of the next halving, expected after 2025, requires a nuanced understanding of various interacting factors beyond simply the reduced supply. The long-term value of Bitcoin is a complex interplay of technological advancements, regulatory landscapes, and evolving market sentiment.

Bitcoin Adoption and Value

The halving event, by reducing the supply of new Bitcoins entering circulation, creates a potential scarcity effect. This scarcity, coupled with increasing adoption and demand, could theoretically drive up Bitcoin’s price. However, widespread adoption is not guaranteed. Factors like regulatory clarity, ease of use, and the development of scalable solutions are crucial for mainstream acceptance. Increased adoption, regardless of the halving, would likely be a significant positive factor in the long-term price appreciation of Bitcoin. Conversely, a lack of mainstream adoption could limit its price growth, regardless of the halving’s effect on supply. The history of previous halvings shows a correlation between increased price and increased adoption, but not a direct causation.

Bitcoin’s Value Compared to Other Assets

Comparing Bitcoin’s potential long-term value against other assets requires considering its unique characteristics. Unlike traditional currencies or commodities, Bitcoin has a fixed supply, making it potentially less susceptible to inflationary pressures. However, its volatility remains a significant concern. Compared to gold, often viewed as a safe haven asset, Bitcoin’s price is far more volatile, though it shares a similar narrative of scarcity. Against other cryptocurrencies, Bitcoin’s position as the first and most established cryptocurrency gives it a significant first-mover advantage, but this doesn’t guarantee sustained dominance. Ultimately, Bitcoin’s long-term value relative to other assets will depend on its ability to maintain its position as a store of value and a medium of exchange in a rapidly evolving financial landscape.

Factors Driving Bitcoin’s Long-Term Price

Beyond the halving, several factors will significantly influence Bitcoin’s long-term price. These include technological advancements (such as the Lightning Network improving transaction speeds), regulatory developments (positive regulations could boost adoption), macroeconomic conditions (global economic uncertainty could drive investors to Bitcoin), and the overall sentiment of the cryptocurrency market. Institutional adoption, while growing, remains a crucial factor. Increased participation by institutional investors could inject significant capital into the market, potentially driving up prices. Conversely, a major regulatory crackdown or a significant security breach could severely impact investor confidence and price.

Potential Price Scenarios After the Next Halving

The following scenarios represent potential outcomes for Bitcoin’s price in the years following the next halving. These are speculative and should not be considered financial advice. It’s crucial to remember that past performance is not indicative of future results.

Next Halving Bitcoin After 2025 – It is important to note that these scenarios are highly speculative and influenced by numerous unpredictable factors. The actual price movement could deviate significantly from these estimations.

Speculation around the next Bitcoin halving after 2025 is already underway, focusing on its potential impact on price and mining profitability. To understand the foundation for these predictions, we first need to establish the timing of the next event; a crucial question answered by this resource: When Does Bitcoin Halving 2025. Knowing this date allows for more accurate forecasting of the post-2025 halving market dynamics and the long-term implications for Bitcoin’s trajectory.

- Optimistic: Widespread adoption, positive regulatory developments, and continued institutional investment could drive Bitcoin’s price to significantly higher levels, potentially reaching six-figures or more within a few years of the halving. This scenario is comparable to the rapid growth seen in the years following previous halvings, but on a potentially larger scale due to increased global adoption and institutional involvement.

- Neutral: A moderate increase in adoption, coupled with a stable regulatory environment, could lead to a gradual increase in Bitcoin’s price, outpacing inflation but without the explosive growth seen in optimistic scenarios. This scenario aligns with a more cautious approach to cryptocurrency investment, reflecting a moderate level of market sentiment and adoption.

- Pessimistic: Negative regulatory actions, significant security breaches, or a broader cryptocurrency market downturn could lead to a decrease or stagnation in Bitcoin’s price, potentially reversing some of the gains from the halving. This scenario mirrors historical periods of bearish market sentiment within the cryptocurrency space, highlighting the potential risks associated with volatile assets.

Alternative Cryptocurrencies and Market Dynamics

The Bitcoin halving, a significant event in the cryptocurrency world, doesn’t exist in a vacuum. Its impact ripples across the broader crypto market, influencing the performance and market share of alternative cryptocurrencies (altcoins). Understanding these dynamics is crucial for navigating the post-halving landscape.

The reduced supply of newly mined Bitcoin, a direct consequence of the halving, can create several effects on altcoins. These effects are complex and interconnected, influenced by factors such as investor sentiment, technological advancements within specific altcoin projects, and the overall macroeconomic environment.

Altcoin Performance Following Bitcoin Halvings

Historically, Bitcoin halvings have often been followed by periods of increased volatility and price appreciation for Bitcoin. This can lead to a “flight to safety” effect, where investors move funds from altcoins into Bitcoin, resulting in decreased altcoin prices. However, this isn’t always the case. Sometimes, the increased attention and overall market excitement surrounding Bitcoin can positively influence the entire crypto market, leading to gains for altcoins as well. The 2012 and 2016 halvings offer examples of both scenarios, with some altcoins experiencing significant gains alongside Bitcoin, while others suffered losses. The outcome is highly dependent on individual altcoin fundamentals and market sentiment.

Altcoin Market Share After Bitcoin Halving

The potential for altcoins to gain market share after a Bitcoin halving is a complex issue. While Bitcoin’s dominance often increases in the short term following a halving, long-term market share shifts are less predictable. Innovations within specific altcoin projects, such as improved scalability solutions or the introduction of novel functionalities, can attract investors and lead to market share gains. Conversely, a lack of development or negative news surrounding a particular altcoin can lead to a loss of market share, regardless of the Bitcoin halving. The Ethereum network’s growth, despite Bitcoin’s dominance, serves as a prime example of an altcoin expanding its market share.

Impact of Halving on Overall Cryptocurrency Market Capitalization

The impact of a Bitcoin halving on the overall cryptocurrency market capitalization is multifaceted. While Bitcoin’s market capitalization tends to increase following a halving due to price appreciation, the overall effect on the total market cap is less clear-cut. The aforementioned “flight to safety” can reduce the market capitalization of altcoins, potentially offsetting Bitcoin’s gains. However, if the halving generates broader market enthusiasm, the total market capitalization could increase despite relative shifts in market share between Bitcoin and altcoins. The net effect depends on the interplay of investor sentiment, the performance of altcoins, and Bitcoin’s price movement.

Bitcoin and Altcoin Market Capitalization Comparison Across Halvings

The following table offers a simplified comparison of Bitcoin’s market capitalization against a selection of top altcoins before and after previous halvings. Note that obtaining precise figures for all altcoins across all halvings is difficult due to data availability and the constantly evolving cryptocurrency landscape. The table uses approximate figures to illustrate the general trend.

| Halving Date | Bitcoin Market Cap (Approximate, USD Billion) – Before | Bitcoin Market Cap (Approximate, USD Billion) – After | Altcoin (Example: Ethereum) Market Cap (Approximate, USD Billion) – Before | Altcoin (Example: Ethereum) Market Cap (Approximate, USD Billion) – After |

|---|---|---|---|---|

| November 2012 | ~1 | ~10 | ~0.01 | ~0.1 |

| July 2016 | ~10 | ~150 | ~0.1 | ~20 |

Frequently Asked Questions

This section addresses common queries regarding Bitcoin halving events, focusing on their mechanics, historical impact, and future implications for investors. Understanding these events is crucial for navigating the cryptocurrency market effectively.

Bitcoin Halving Explained

A Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created. This occurs approximately every four years, or every 210,000 blocks mined. The halving mechanism is designed to control Bitcoin’s inflation and maintain its scarcity. Before the first halving in 2012, miners received 50 BTC for each block they successfully mined. After the halving, this reward was cut in half to 25 BTC. Subsequent halvings have further reduced the reward to 12.5 BTC (2016) and 6.25 BTC (2020). The next halving will reduce the reward to 3.125 BTC. This controlled reduction in the supply of newly minted Bitcoin is a core feature of Bitcoin’s deflationary model.

Next Bitcoin Halving’s Expected Date

While the exact date is dependent on the time it takes to mine blocks, which can fluctuate slightly, the next Bitcoin halving is currently estimated to occur in early 2025. This prediction is based on the consistent four-year cycle and the ongoing rate of block mining. However, it’s important to note that this is an approximation, and minor variations are possible due to factors influencing block mining times. For example, increased mining difficulty or changes in the overall hash rate of the Bitcoin network could slightly alter the halving date.

Halving’s Impact on Bitcoin’s Price

Historically, Bitcoin halvings have been followed by periods of significant price appreciation. This is often attributed to the reduced supply of newly minted coins creating upward pressure on price, especially when coupled with sustained or increased demand. The 2012 and 2016 halvings were followed by substantial price increases, although other market factors undoubtedly contributed to these price movements. It’s important to remember that past performance is not indicative of future results, and other economic and market forces play a significant role in Bitcoin’s price. The 2020 halving saw a period of price increase, though the timing and extent of the price rise were not as immediately apparent as in previous cycles.

Risks Associated with Investing After a Halving

Investing in Bitcoin after a halving carries inherent risks. While historically, halvings have been followed by price increases, there’s no guarantee this will always be the case. Market volatility remains a significant risk, with the potential for substantial price drops. Regulatory uncertainty in various jurisdictions also poses a considerable risk. Furthermore, the cryptocurrency market is susceptible to speculative bubbles and market manipulation, leading to unpredictable price swings. Finally, the inherent technological risks associated with blockchain technology, such as security vulnerabilities or scaling issues, should also be considered.

Alternative Cryptocurrencies Less Affected by Halving Events

Several alternative cryptocurrencies (altcoins) employ different consensus mechanisms and reward structures, making them less directly affected by halving events similar to Bitcoin’s. For example, some altcoins utilize Proof-of-Stake (PoS) instead of Proof-of-Work (PoW), eliminating the need for block rewards tied to mining. Others may have different inflation models that aren’t subject to periodic halvings. However, it’s crucial to remember that altcoins often carry their own unique risks and are subject to their own market dynamics. Thorough research and understanding of the specific cryptocurrency’s characteristics are essential before investing.

Speculation regarding the next Bitcoin halving after 2025 is already underway, with many analysts focusing on the long-term implications of this significant event. To accurately predict future halvings, understanding the precise timing of the 2025 halving is crucial, and you can find detailed information on this at Bitcoin Halving 2025 Time. This knowledge will help in better forecasting the potential impact on Bitcoin’s price and overall market dynamics for subsequent halvings.

Predicting the next Bitcoin halving after 2025 requires careful consideration of various factors. Understanding the previous halvings is crucial, and a useful resource for tracking the 2025 event is the Halving Bitcoin 2025 Reloj which provides a countdown and relevant data. This detailed information helps contextualize the impact of halvings and allows for better informed speculation regarding future halvings beyond 2025.

Speculation around the next Bitcoin halving after 2025 is already beginning, with many anticipating significant price movements. To understand the foundation for these predictions, it’s crucial to first examine the upcoming halving event, detailed on this helpful resource: Halving Bitcoin 2025 Fecha. Understanding the 2025 halving’s impact will better inform analyses of subsequent halvings and their potential effects on Bitcoin’s value and market dynamics.

Speculation around the next Bitcoin halving after 2025 is already beginning, with many analysts focusing on the potential impact of reduced supply. Understanding the predicted price movements following the 2025 halving is crucial for forecasting future trends, and you can find insightful analysis on this at Bitcoin Halving 2025 Price. This analysis will inform better predictions for the subsequent halving and its effect on the overall Bitcoin market.

Speculation around the next Bitcoin halving after 2025 is already beginning, with many anticipating another significant price surge. Understanding the mechanics of these events is crucial, and a great starting point is learning about the upcoming Bitcoin Halving 2025. This will provide valuable context for predicting the long-term implications for the cryptocurrency market and the subsequent halving events.