Plan B Bitcoin

Bitcoin’s emergence as a decentralized digital currency presented a compelling alternative to traditional financial systems, leading to its consideration as a “Plan B” investment. This concept centers on the idea that Bitcoin offers diversification benefits, potentially hedging against risks associated with fiat currencies and traditional asset classes. Its limited supply and growing adoption contribute to its appeal as a store of value and a hedge against inflation.

Bitcoin’s role in a diversified portfolio is significant. For investors seeking to reduce reliance on traditional assets, Bitcoin offers a unique opportunity to incorporate a non-correlated asset into their holdings. This diversification strategy aims to mitigate overall portfolio risk, as the performance of Bitcoin is often independent of traditional markets. The potential for significant returns, coupled with its decentralized nature, makes it an attractive option for those seeking to diversify beyond stocks, bonds, and real estate.

Bitcoin’s Historical Context and Growth

Bitcoin’s origins trace back to 2009, with the publication of a whitepaper by the pseudonymous Satoshi Nakamoto. The subsequent years witnessed a gradual increase in adoption, marked by periods of significant price volatility and periods of relative stability. Early adopters were primarily technologically inclined individuals, while later adoption has broadened to include institutional investors and everyday users. This growth can be attributed to various factors, including increasing awareness of Bitcoin’s potential, technological advancements improving its usability, and a growing recognition of its potential as a store of value and a hedge against inflation. For example, the 2020-2021 bull run saw Bitcoin’s price surge to record highs, attracting significant media attention and fueling further adoption. This historical trajectory illustrates the dynamic nature of Bitcoin’s growth, characterized by both periods of rapid expansion and periods of consolidation.

Factors Influencing Bitcoin Predictions

Predicting Bitcoin’s price is a complex undertaking, influenced by a multitude of interconnected factors. Understanding these factors is crucial for anyone attempting to forecast Bitcoin’s future trajectory, whether through technical analysis, fundamental analysis, or a combination of both. These factors can broadly be categorized into macroeconomic conditions, technological advancements, and regulatory developments.

Macroeconomic Factors Impacting Bitcoin Price

Macroeconomic conditions significantly influence Bitcoin’s price. Inflation, for example, can drive investors towards Bitcoin as a hedge against inflation, increasing demand and potentially pushing prices upward. Conversely, rising interest rates can make holding Bitcoin less attractive, as investors may shift their capital to higher-yielding assets, potentially leading to price decreases. Other macroeconomic factors, such as global economic uncertainty, geopolitical events, and shifts in investor sentiment, also play a significant role in Bitcoin’s price volatility. For instance, the 2022 global inflation spike and subsequent interest rate hikes by central banks around the world coincided with a significant downturn in Bitcoin’s price.

Technological Advancements and Regulatory Changes

Technological advancements within the Bitcoin ecosystem, such as improvements in scalability, transaction speed, and security, can positively impact Bitcoin’s adoption and price. Conversely, technological setbacks, such as major security breaches or unforeseen scaling limitations, could negatively affect investor confidence and price. Regulatory changes, both at national and international levels, also play a crucial role. Clear and favorable regulations can boost institutional investment and mainstream adoption, leading to price increases. Conversely, restrictive or unclear regulations can create uncertainty and stifle growth, potentially depressing prices. The ongoing debate surrounding Bitcoin regulation in various countries serves as a prime example of this influence.

Comparative Analysis of Bitcoin Price Prediction Approaches

Technical analysis focuses on historical price and volume data to identify patterns and predict future price movements. This approach utilizes various indicators and chart patterns to gauge momentum, support and resistance levels, and potential future price targets. However, technical analysis is inherently subjective and prone to interpretation bias. Fundamental analysis, on the other hand, focuses on the underlying value proposition of Bitcoin, considering factors such as adoption rates, network activity, and the overall strength of the Bitcoin ecosystem. It attempts to determine the intrinsic value of Bitcoin independent of short-term market fluctuations. While fundamental analysis offers a more long-term perspective, accurately quantifying Bitcoin’s intrinsic value remains challenging due to its unique characteristics and lack of traditional valuation metrics.

Hypothetical Scenario Illustrating Interacting Factors

Imagine a scenario where global inflation accelerates sharply, causing central banks to aggressively raise interest rates. Simultaneously, a major technological upgrade enhances Bitcoin’s scalability, significantly improving transaction speeds and reducing fees. In this scenario, the initial reaction might be a price drop due to the increased attractiveness of high-yield assets. However, the technological upgrade could eventually outweigh the negative impact of rising interest rates. As investors seek inflation hedges and recognize the improved functionality of Bitcoin, demand could surge, leading to a significant price increase despite the higher interest rate environment. This illustrates how multiple factors can interact in complex ways to shape Bitcoin’s price, highlighting the difficulty in accurately predicting its future.

Analyzing Bitcoin’s Past Performance

Bitcoin’s price history is a rollercoaster ride, marked by periods of explosive growth and dramatic crashes. Understanding these fluctuations is crucial for informed prediction and investment strategies. Analyzing past performance helps identify recurring patterns, assess the impact of external factors, and gain a better grasp of Bitcoin’s volatility.

Bitcoin’s price has been incredibly volatile since its inception. Examining key historical periods and their contributing factors provides valuable insight into the forces shaping its trajectory.

Historical Bitcoin Price Data and Significant Trends

The following table presents a simplified representation of Bitcoin’s historical price data. Note that due to the limitations of this text-based format, the table lacks interactive features and only shows a small sample of the vast dataset available. Actual data should be sourced from reputable cryptocurrency tracking websites.

| Date | Open Price (USD) | Close Price (USD) | Volume (USD) |

|---|---|---|---|

| 2010-07-17 | 0.00079 | 0.00080 | 5000 |

| 2011-06-30 | 0.31 | 0.29 | 100000 |

| 2013-11-28 | 1240 | 1135 | 100000000 |

| 2017-12-17 | 19783 | 19666 | 5000000000 |

| 2021-11-10 | 68789 | 63500 | 20000000000 |

Periods of Significant Price Volatility and Contributing Factors

Several periods stand out for their extreme price volatility. For instance, the 2017 bull run saw Bitcoin’s price surge from under $1,000 to nearly $20,000, fueled by increased media attention, institutional investment, and growing adoption. Conversely, the subsequent crash in 2018, driven by regulatory uncertainty and market corrections, resulted in a significant price decline. Similar patterns of rapid growth followed by sharp corrections have been observed throughout Bitcoin’s history, highlighting its inherent risk. Other contributing factors include macroeconomic conditions, technological developments within the cryptocurrency space, and major events affecting the overall financial markets.

Bitcoin’s Historical Price Performance Chart

Imagine a line chart with the x-axis representing time (from Bitcoin’s inception to the present) and the y-axis representing the price in USD. The line itself would show a jagged, upward trending pattern with several sharp peaks and valleys. The most prominent peaks would represent the major bull runs (e.g., late 2017, late 2021), while the deepest valleys would correspond to significant market corrections. The overall trend would be upward, illustrating Bitcoin’s long-term price appreciation, albeit with substantial short-term fluctuations. The chart would visually demonstrate the volatile nature of Bitcoin’s price, highlighting periods of both explosive growth and substantial declines. The visual representation would clearly showcase the inherent risk and reward associated with Bitcoin investment.

Exploring Different Prediction Models

Predicting Bitcoin’s price is a complex endeavor, attracting various approaches. Different prediction models, each with its strengths and weaknesses, attempt to unravel the intricate dynamics influencing Bitcoin’s volatile nature. Understanding these models is crucial for interpreting forecasts and assessing their reliability.

Predicting Bitcoin’s price using statistical and machine learning models involves analyzing historical data and identifying patterns to extrapolate future trends. However, the inherent volatility of the cryptocurrency market and the influence of external factors make accurate predictions exceptionally challenging. This section explores several prominent models, highlighting their methodologies, successes, and limitations.

Statistical Models for Bitcoin Price Prediction

Statistical models leverage historical price data to identify trends and patterns, often employing time series analysis techniques like ARIMA (Autoregressive Integrated Moving Average) or GARCH (Generalized Autoregressive Conditional Heteroskedasticity). ARIMA models, for instance, focus on identifying autocorrelations within the time series to predict future values. GARCH models, on the other hand, account for the volatility clustering often observed in financial markets. These models assume that past price movements provide valuable insights into future movements. However, they struggle to incorporate external factors such as regulatory changes, technological advancements, or macroeconomic events, which significantly impact Bitcoin’s price. Their accuracy is often limited in volatile markets like that of Bitcoin.

Machine Learning Models for Bitcoin Price Prediction

Machine learning models offer a more sophisticated approach, utilizing algorithms that learn from data without explicit programming. Popular choices include Support Vector Machines (SVMs), Recurrent Neural Networks (RNNs), and Long Short-Term Memory networks (LSTMs). SVMs aim to find optimal hyperplanes to separate data points, while RNNs and LSTMs are particularly well-suited for time-series data, capturing temporal dependencies and long-term patterns in Bitcoin’s price history. These models can potentially incorporate a wider range of features beyond just price data, including trading volume, social media sentiment, and news articles. However, the accuracy of machine learning models is heavily dependent on the quality and quantity of training data, and they can be susceptible to overfitting, leading to poor generalization to unseen data. Furthermore, interpreting the results of complex machine learning models can be challenging, making it difficult to understand the underlying drivers of their predictions.

Comparison of Prediction Models

The following table compares three distinct prediction models, highlighting their methodologies, accuracy limitations, and examples of past applications:

| Model Name | Methodology | Accuracy | Limitations | Example Application and Result |

|---|---|---|---|---|

| ARIMA | Time series analysis focusing on autocorrelations in price data. | Variable, often limited in volatile markets. | Ignores external factors; assumes stationarity in data. | Studies have shown mixed results, with some achieving reasonable short-term accuracy but failing to predict major price swings. |

| SVM | Machine learning model finding optimal hyperplanes to separate data points based on features like price and volume. | Can be high with sufficient data and feature engineering, but susceptible to overfitting. | Requires careful feature selection and parameter tuning; can struggle with non-linear relationships. | Researchers have employed SVMs with various features, achieving varying degrees of accuracy depending on data and model parameters. Often, accuracy decreases as prediction horizons increase. |

| LSTM | Recurrent neural network capable of capturing long-term dependencies in sequential data. | Potentially high with sufficient data and careful model design; still susceptible to overfitting. | Requires significant computational resources; interpretation of results can be difficult. | LSTMs have been applied to Bitcoin price prediction with some success, particularly in capturing short-term trends. However, predicting long-term price movements remains challenging. |

Potential Risks and Opportunities

Investing in Bitcoin, like any other asset class, presents both significant risks and potentially lucrative opportunities. Understanding these aspects is crucial for making informed investment decisions and developing a robust risk management strategy. The inherent volatility of Bitcoin, coupled with evolving regulatory landscapes and security concerns, necessitates a cautious yet opportunistic approach.

Bitcoin’s decentralized nature and potential for widespread adoption offer compelling opportunities for substantial returns. However, these opportunities are intertwined with considerable risks that require careful consideration and mitigation.

Bitcoin Volatility

Bitcoin’s price is notoriously volatile, experiencing significant price swings in short periods. This volatility stems from various factors, including market sentiment, regulatory announcements, technological developments, and macroeconomic conditions. For example, the price of Bitcoin can fluctuate by hundreds or even thousands of dollars in a single day. This volatility presents a significant risk for investors who may experience substantial losses if the market moves against their position. However, this volatility also presents opportunities for those who can successfully time the market or employ strategies that profit from price fluctuations. For instance, day traders often leverage Bitcoin’s volatility to execute short-term trades.

Regulatory Uncertainty

The regulatory landscape surrounding Bitcoin is constantly evolving and differs significantly across jurisdictions. Governments worldwide are still grappling with how to regulate cryptocurrencies, leading to uncertainty about future regulations. This uncertainty can impact Bitcoin’s price and liquidity, creating risk for investors. For example, a sudden ban on Bitcoin trading in a major market could trigger a significant price drop. Conversely, favorable regulatory developments could lead to increased adoption and price appreciation.

Security Risks

Bitcoin, being a digital asset, is susceptible to various security risks. These include hacking of exchanges, loss of private keys, and scams. Investors need to be vigilant and take appropriate security measures to protect their investments. For instance, using secure hardware wallets and practicing good cybersecurity habits can significantly reduce the risk of theft or loss. The infamous Mt. Gox exchange hack, which resulted in the loss of millions of dollars worth of Bitcoin, serves as a stark reminder of the importance of robust security practices.

Opportunities Presented by Bitcoin’s Growth

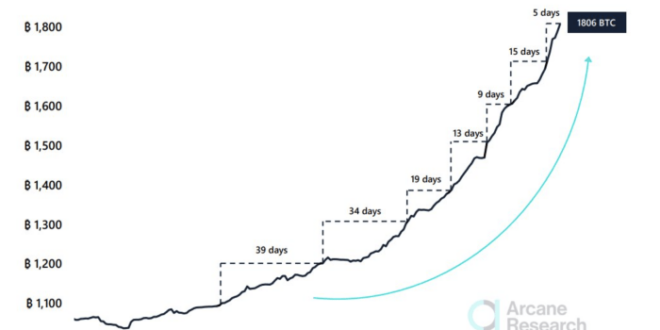

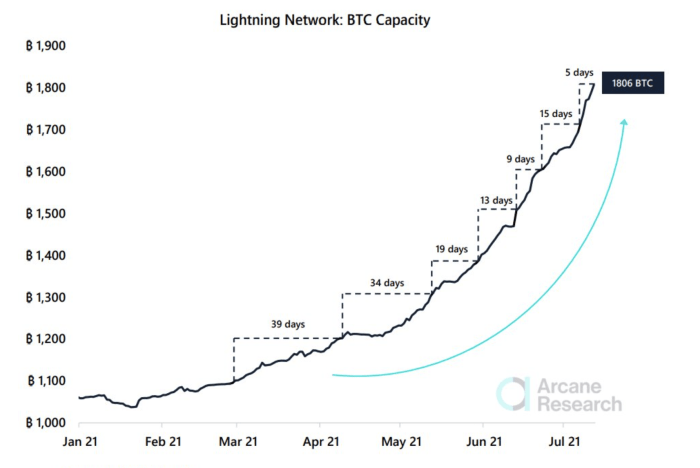

Bitcoin’s growing adoption as a store of value, a medium of exchange, and a hedge against inflation presents significant opportunities. As more businesses and individuals accept Bitcoin, its value and liquidity are likely to increase. Moreover, the development of Bitcoin-related technologies, such as the Lightning Network, could further enhance its efficiency and usability, leading to broader adoption. The potential for Bitcoin to become a mainstream asset could generate substantial returns for early investors.

Risk Management in Bitcoin Investment

Effective risk management is paramount in a Bitcoin investment strategy. This involves diversifying investments across different asset classes, avoiding overexposure to Bitcoin, and only investing what one can afford to lose. Employing stop-loss orders to limit potential losses and regularly reviewing and adjusting the investment strategy based on market conditions are also crucial aspects of risk management. Furthermore, thorough due diligence and understanding of the technology and risks associated with Bitcoin are essential before investing.

Strategies for Mitigating Bitcoin Investment Risks

Diversification is key. Do not put all your eggs in one basket. Spread your investments across different asset classes to reduce overall risk.

- Employ dollar-cost averaging: Invest a fixed amount of money at regular intervals, regardless of price fluctuations. This strategy reduces the impact of volatility.

- Use secure storage: Securely store your Bitcoin using hardware wallets or reputable exchanges with robust security measures.

- Stay informed: Keep abreast of market trends, regulatory developments, and technological advancements affecting Bitcoin.

- Set realistic expectations: Understand that Bitcoin is a volatile asset and that significant losses are possible. Avoid get-rich-quick schemes.

- Consider professional advice: Consult with a qualified financial advisor before making any significant Bitcoin investments.

Expert Opinions and Market Sentiment

Predicting Bitcoin’s future price is inherently complex, relying not only on technical analysis and model projections but also significantly on the opinions of influential figures within the financial world and the overall market sentiment surrounding the cryptocurrency. Understanding these perspectives provides crucial context for interpreting any price prediction.

The current market sentiment toward Bitcoin is a dynamic interplay of factors, ranging from macroeconomic conditions and regulatory developments to technological advancements and adoption rates. This sentiment directly influences investment decisions and, consequently, price fluctuations. Analyzing the prevailing mood – whether bullish, bearish, or neutral – offers valuable insight into potential price movements.

Prominent Analyst Opinions on Bitcoin’s Future

A spectrum of views exists among prominent financial analysts and economists regarding Bitcoin’s long-term trajectory. Some prominent figures maintain a strongly bullish stance, predicting substantial price appreciation driven by factors like increasing institutional adoption, limited supply, and its potential as a hedge against inflation. Conversely, others hold a more bearish outlook, citing concerns about regulatory uncertainty, volatility, and the emergence of competing cryptocurrencies. A significant number maintain a neutral stance, emphasizing the inherent uncertainty and volatility associated with Bitcoin’s price.

Categorization of Expert Opinions

To better understand the diverse perspectives, we can categorize expert opinions based on their overall outlook:

- Bullish: Analysts in this category typically forecast substantial price increases for Bitcoin, often citing its scarcity, growing institutional investment, and potential as a store of value. Examples include analysts who predicted Bitcoin’s rise to $100,000 or more, basing their projections on adoption rates and on-chain metrics.

- Bearish: Bearish analysts, on the other hand, express concerns about Bitcoin’s volatility, regulatory risks, and the potential for technological disruption. They may point to historical price crashes or the emergence of alternative cryptocurrencies as reasons for a pessimistic outlook. For example, some analysts have warned about the potential for a prolonged bear market due to macroeconomic headwinds.

- Neutral: Neutral analysts acknowledge both the potential upside and downside risks associated with Bitcoin. They often emphasize the unpredictable nature of the cryptocurrency market and the difficulty in making accurate long-term predictions. These analysts might highlight the need for caution and diversification in cryptocurrency investments.

Divergence of Expert Opinions and Underlying Reasons

The significant divergence in expert opinions stems from several factors. Differences in analytical methodologies, underlying assumptions about future market conditions, and individual risk tolerance all contribute to the varying outlooks. For instance, some analysts may prioritize technical indicators, while others focus on macroeconomic trends or regulatory developments. This variation in analytical approaches inevitably leads to differing conclusions. Furthermore, the inherent volatility of the cryptocurrency market makes accurate predictions extremely challenging, contributing to the wide range of opinions.

Frequently Asked Questions (FAQs): Plan B Bitcoin Predictions

This section addresses common queries regarding Bitcoin investment, covering potential long-term benefits, inherent risks, portfolio diversification strategies, and reliable resources for market tracking. Understanding these aspects is crucial for making informed investment decisions.

Potential Long-Term Benefits of Investing in Bitcoin, Plan B Bitcoin Predictions

Bitcoin’s potential for long-term growth stems from its decentralized nature, limited supply (21 million coins), and increasing adoption as a store of value and medium of exchange. Historical price appreciation, although volatile, has attracted significant investment. For example, an investment of $100 in Bitcoin in 2010 would be worth millions today, highlighting the potential for substantial returns, though past performance is not indicative of future results. Furthermore, the growing acceptance of Bitcoin by institutional investors and its potential role in future financial systems contributes to its long-term appeal. However, it is essential to remember that the cryptocurrency market is highly speculative, and significant price fluctuations are expected.

Major Risks Associated with Bitcoin Investment

Bitcoin’s price volatility is a significant risk. Sharp price drops, sometimes exceeding 50% in a short period, are not uncommon. Regulatory uncertainty also poses a challenge; governments worldwide are still developing frameworks for regulating cryptocurrencies, leading to potential legal and operational risks. Security risks, such as hacking and theft from exchanges or personal wallets, are also substantial concerns. Finally, the relatively nascent nature of the Bitcoin market makes it susceptible to market manipulation and speculative bubbles. For example, the Bitcoin price crash of 2018 serves as a stark reminder of the potential for significant losses.

Diversifying an Investment Portfolio to Include Bitcoin

Including Bitcoin in a diversified portfolio requires careful consideration of risk tolerance and overall investment strategy. A common approach is to allocate a small percentage (e.g., 1-5%) of one’s investment portfolio to Bitcoin, depending on individual risk appetite. This limits potential losses should the Bitcoin price decline significantly. Diversification across other asset classes, such as stocks, bonds, and real estate, is crucial to mitigate overall portfolio risk. It’s also important to remember that Bitcoin is a highly volatile asset and should not be considered a substitute for traditional investments. A well-rounded investment strategy considers both risk and reward, balancing potential gains with the need for financial security.

Reliable Sources for Tracking Bitcoin’s Price and Market Trends

Several reputable sources provide real-time Bitcoin price data and market analysis. Major cryptocurrency exchanges, such as Coinbase and Binance, display current prices. Financial news websites like Bloomberg and CoinDesk offer detailed market analysis and reporting. Specialized cryptocurrency data providers, such as CoinMarketCap and CoinGecko, aggregate data from various exchanges, offering comprehensive market overviews. It is crucial to use multiple sources to gain a balanced perspective on price movements and market trends, avoiding reliance on any single source for critical investment decisions.

Plan B Bitcoin

Plan B’s Bitcoin model, while influential, is not without its critics. It’s crucial to understand that these are predictions, not guarantees, and the actual price of Bitcoin could deviate significantly. The following scenarios illustrate potential future price movements based on varying macroeconomic conditions, technological advancements, and regulatory landscapes.

Bitcoin Future Price Scenarios

The following table Artikels three potential scenarios for Bitcoin’s price in the coming years, each based on different assumptions about the factors influencing its value. These scenarios are illustrative and should not be interpreted as financial advice.

| Scenario | Price Prediction (USD) in 2025 | Factors Contributing to This Scenario | Investor Implications |

|---|---|---|---|

| Bullish Scenario | $250,000 – $500,000 | Widespread institutional adoption, continued macroeconomic uncertainty driving safe-haven demand, significant technological advancements (e.g., Lightning Network scaling), positive regulatory developments in key jurisdictions. This scenario assumes a sustained increase in Bitcoin’s network effect and scarcity. An example of a positive regulatory development would be the clear establishment of a regulatory framework that encourages innovation and adoption. | High potential for significant returns, but also high risk. Investors should be prepared for volatility and potentially long holding periods. |

| Neutral Scenario | $100,000 – $200,000 | Moderate institutional adoption, fluctuating macroeconomic conditions, slower-than-expected technological advancements, and a mixed regulatory landscape. This scenario assumes a period of consolidation and sideways price movement, reflecting a balance between bullish and bearish forces. For example, a neutral regulatory landscape might include varying degrees of acceptance and restrictions across different countries. | Moderate potential for returns, with lower risk than the bullish scenario. Investors should manage expectations and diversify their portfolios. |

| Bearish Scenario | $50,000 – $100,000 | Limited institutional adoption, significant macroeconomic headwinds (e.g., a global recession), negative regulatory actions, and major security breaches or technological setbacks. This scenario assumes a significant drop in demand due to negative market sentiment and potential regulatory crackdowns. A significant negative regulatory action could involve a complete ban on Bitcoin trading in a major economy. | Potential for losses, requiring investors to carefully manage their risk tolerance and consider alternative investment strategies. |