Plan B Bitcoin Price

Bitcoin’s price has experienced dramatic fluctuations since its inception in 2009. Initially trading at negligible values, it saw its first major surge in 2011, reaching over $30 before plummeting. Subsequent years witnessed periods of both explosive growth and significant corrections, punctuated by events like the Mt. Gox exchange collapse in 2014 and the 2017 bull run that propelled Bitcoin to nearly $20,000. More recently, the market has shown continued volatility, influenced by macroeconomic factors and evolving regulatory landscapes.

Plan B, a pseudonym for an influential analyst, is known for developing Bitcoin price prediction models based on stock-to-flow (S2F) analysis. This model posits a correlation between Bitcoin’s scarcity (its limited supply of 21 million coins) and its price. The model has gained significant attention, although it’s important to note that it’s not without its critics, with some arguing that it oversimplifies the complex factors influencing Bitcoin’s price. Plan B’s predictions have generated considerable discussion within the cryptocurrency community, shaping market sentiment and influencing investment strategies.

Factors Influencing Bitcoin’s Price

Several interconnected factors significantly impact Bitcoin’s price. These factors are dynamic and often interact in unpredictable ways, making accurate price prediction challenging. Market sentiment, driven by news, social media trends, and overall investor confidence, plays a crucial role. Positive news, such as institutional adoption or regulatory clarity, tends to drive prices upward, while negative news, like security breaches or regulatory crackdowns, can lead to sharp declines.

Regulatory changes across different jurisdictions also have a profound impact. Government policies regarding cryptocurrency trading, taxation, and legal recognition directly affect investor confidence and market liquidity. For example, countries that embrace Bitcoin as a legitimate asset class tend to see increased trading volume and price appreciation, while those with restrictive regulations often experience the opposite.

Technological advancements within the Bitcoin ecosystem also contribute to price fluctuations. Upgrades to the Bitcoin network, such as the implementation of SegWit or the Lightning Network, can enhance scalability and efficiency, potentially boosting investor confidence and driving price increases. Conversely, delays or failures in technological development can negatively impact market sentiment. The introduction of new competing cryptocurrencies also influences Bitcoin’s price, as investors may allocate funds to alternative projects perceived as offering superior features or potential returns.

Plan B’s Model and Predictions

Plan B, a pseudonymous analyst, gained significant attention for his Bitcoin price prediction models, primarily based on stock-to-flow (S2F) analysis. These models attempt to forecast Bitcoin’s price based on its scarcity, comparing its newly mined supply to its existing circulating supply. While initially met with considerable enthusiasm, the accuracy and limitations of these models have been a subject of ongoing debate within the cryptocurrency community.

Plan B’s methodology primarily centers around the stock-to-flow ratio. The S2F ratio is calculated by dividing the existing stock of Bitcoin (the total number of coins in circulation) by the newly mined Bitcoin (the number of coins added to the supply annually). The model posits a strong correlation between this ratio and Bitcoin’s price, suggesting that as the S2F ratio increases (due to a decreasing rate of new Bitcoin creation), the price should also rise. This is based on the economic principle that scarcity tends to drive up value. Plan B further refined his model with the inclusion of additional factors, creating variations such as the S2FX model which attempted to account for halving events and other market dynamics. These models often involve logarithmic regression analysis to fit historical price data and project future price movements.

Comparison of Plan B’s Predictions with Actual Bitcoin Price Movements

Plan B’s models, particularly his initial S2F model, generated significant predictions for Bitcoin’s price. For instance, the model predicted a Bitcoin price of approximately $100,000 by the end of 2021. However, the actual price at the end of 2021 fell considerably short of this prediction. While Bitcoin did reach all-time highs during that period, it subsequently experienced a significant correction. Similarly, subsequent predictions made using updated versions of the model, such as the S2FX model, have also faced discrepancies between projected prices and actual market performance. The model’s accuracy, therefore, has been demonstrably limited, highlighting the complexity and volatility of the cryptocurrency market. These discrepancies underscore the challenge of applying economic models to a nascent and highly speculative asset class.

Accuracy and Limitations of Plan B’s Model

While Plan B’s models offered a compelling narrative based on scarcity, their limitations are significant. The primary limitation stems from the model’s reliance on historical correlations. The assumption that past relationships between the S2F ratio and Bitcoin’s price will continue to hold in the future is a crucial vulnerability. Furthermore, the model doesn’t adequately incorporate several factors that significantly influence Bitcoin’s price, including regulatory changes, technological developments, macroeconomic conditions, and overall market sentiment. These are all exogenous factors that can dramatically impact the price regardless of the S2F ratio. Unforeseen events, such as significant market crashes or regulatory crackdowns, can also severely disrupt the predicted price trajectory. The inherent volatility of the cryptocurrency market itself makes accurate long-term price predictions exceptionally challenging. Therefore, while the S2F model provided a framework for considering Bitcoin’s scarcity, its predictive power is significantly limited by its simplistic nature and inability to account for the multifaceted forces driving Bitcoin’s price. It’s crucial to understand that Plan B’s models are not foolproof predictions but rather represent a specific perspective on Bitcoin’s price dynamics.

Criticisms and Alternative Perspectives

Plan B’s stock-to-flow (S2F) model, while influential, has faced significant criticism regarding its methodology, assumptions, and predictive power. Several alternative models exist, each offering different perspectives on Bitcoin’s price trajectory and incorporating varying degrees of macroeconomic influence. Understanding these criticisms and alternatives provides a more nuanced view of Bitcoin price prediction.

Major Criticisms of Plan B’s S2F Model

The S2F model’s simplicity, while initially appealing, has drawn criticism. The model primarily focuses on Bitcoin’s scarcity, represented by the stock-to-flow ratio, and assumes a direct correlation between scarcity and price. Critics argue this oversimplifies the complex interplay of factors influencing Bitcoin’s price. For example, the model doesn’t explicitly account for market sentiment, regulatory changes, technological advancements, or the adoption rate by institutions and individuals. The model’s historical accuracy, while initially impressive, has also been questioned as Bitcoin’s price deviated from the model’s predictions, particularly after the 2021 bull run. Furthermore, the extrapolation of the S2F model to predict future prices relies heavily on the assumption that past trends will continue, which is not always a reliable predictor of future market behavior. The model’s lack of incorporation of fundamental analysis and macroeconomic factors also weakens its predictive capabilities.

Alternative Models for Bitcoin Price Prediction

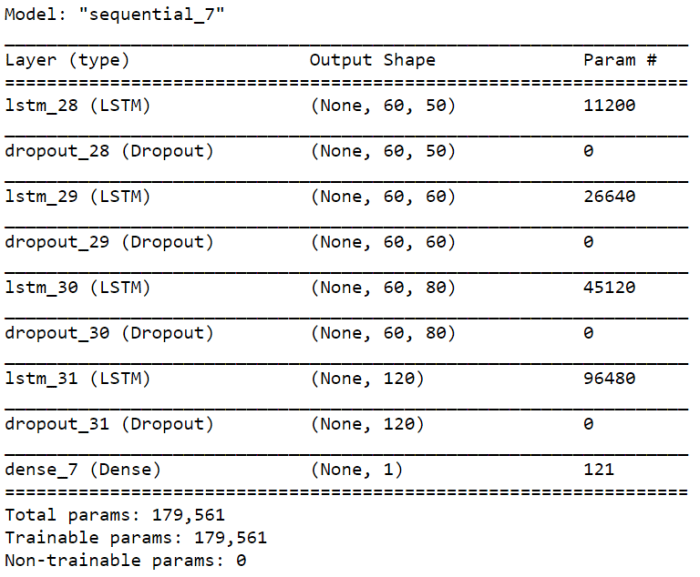

Several alternative models attempt to predict Bitcoin’s price by incorporating a wider range of factors than the S2F model. These models often use econometric techniques, incorporating variables like transaction volume, network activity, market capitalization, and macroeconomic indicators. For instance, some models utilize machine learning algorithms to analyze historical price data and identify patterns that might predict future price movements. Other approaches focus on fundamental analysis, evaluating factors such as adoption rates, technological improvements, and regulatory developments to assess Bitcoin’s intrinsic value. These alternative models acknowledge the limitations of solely relying on scarcity as a predictor of price and strive for a more comprehensive understanding of the complex market dynamics at play. For example, a model might incorporate factors like the adoption rate of Lightning Network, a second-layer scaling solution, which could increase Bitcoin’s utility and potentially drive up demand.

Impact of Macroeconomic Factors on Bitcoin’s Price

Macroeconomic factors, such as inflation and interest rates, significantly influence Bitcoin’s price. High inflation often drives investors to seek alternative assets, including Bitcoin, as a hedge against inflation. Conversely, rising interest rates can reduce the attractiveness of Bitcoin as investors may prefer higher returns from traditional assets. Plan B’s S2F model largely ignores these macroeconomic considerations, focusing primarily on Bitcoin’s inherent properties. The model’s failure to incorporate these factors is a significant limitation, as macroeconomic shifts can dramatically impact investor sentiment and, consequently, Bitcoin’s price. For instance, the 2022 cryptocurrency market downturn was partly attributed to rising interest rates and increased regulatory scrutiny, factors not directly addressed in the S2F model. The model’s predictive accuracy could be improved by integrating macroeconomic indicators and analyzing their impact on Bitcoin’s price.

Impact of Market Events on Plan B’s Predictions

Plan B’s stock-to-flow (S2F) model, while influential, isn’t immune to the volatility inherent in the cryptocurrency market. Significant events can significantly impact Bitcoin’s price, thereby affecting the accuracy of Plan B’s predictions. Understanding these influences is crucial for a balanced perspective on the model’s limitations and strengths.

Plan B’s model primarily focuses on Bitcoin’s scarcity, arguing that its price is driven by its decreasing supply rate (halving events) and increasing demand. However, real-world events often introduce complexities not fully captured by the model’s simplified assumptions. These external factors can either bolster or undermine the model’s predictive power.

Halving Events and Their Impact

Bitcoin’s halving events, which reduce the rate of new Bitcoin creation by half, are central to Plan B’s S2F model. The model posits that these events, by reducing supply, should drive up price. The 2012 and 2016 halvings were followed by significant price increases, seemingly supporting the model. However, the 2020 halving, while resulting in a price increase, did not follow the model’s projected trajectory as precisely. This discrepancy highlights the influence of other market forces beyond the simple supply-demand dynamics emphasized by the S2F model. The post-halving price movements are complex and influenced by a multitude of factors, including market sentiment, regulatory changes, and macroeconomic conditions.

Regulatory Announcements and Market Sentiment

Regulatory announcements, both positive and negative, exert considerable influence on Bitcoin’s price. Positive news, such as regulatory clarity or adoption by major financial institutions, can lead to significant price rallies. Conversely, negative news, like regulatory crackdowns or warnings from government agencies, can trigger sharp price drops. These events, often unpredictable, can significantly deviate Bitcoin’s price from Plan B’s projections. For example, China’s crackdown on cryptocurrency mining in 2021 caused a notable price correction, underscoring the model’s sensitivity to external regulatory factors.

Unexpected Events and Black Swan Events

Unexpected events, or “black swan” events – highly improbable occurrences with significant consequences – can drastically alter Bitcoin’s price trajectory and render any prediction inaccurate. The collapse of FTX in late 2022 serves as a prime example. This event, unforeseen by most market analysts, including Plan B, caused a significant market downturn that temporarily undermined the S2F model’s predictions. The impact of such unpredictable events highlights the inherent limitations of any predictive model in a highly volatile and rapidly evolving market.

Timeline of Key Events and Their Impact

The following table illustrates key events and their subsequent impact on Bitcoin’s price and Plan B’s predictions. Note that the impact is subjective and interpretations may vary.

| Date | Event | Bitcoin Price Impact | Impact on Plan B’s Predictions |

|---|---|---|---|

| November 2012 | First Bitcoin Halving | Substantial price increase over the following year | Initial support for the S2F model |

| July 2016 | Second Bitcoin Halving | Significant price increase leading up to the 2017 bull run | Further validation of the S2F model |

| May 2020 | Third Bitcoin Halving | Price increase, but less dramatic than previous halvings, followed by a period of consolidation | Deviation from predicted price trajectory |

| May 2021 | Increased Institutional Adoption and Tesla’s Bitcoin Purchase | Significant price increase | Short-term alignment, but long-term effects uncertain |

| November 2021 – May 2022 | China’s Mining Crackdown, Macroeconomic Uncertainty | Significant price decrease | Temporary deviation, but long-term implications unclear |

| November 2022 | FTX Collapse | Sharp price decrease | Significant deviation from predictions |

Plan B and Long-Term Bitcoin Price Outlook

Plan B’s stock-to-flow (S2F) model, while controversial, has significantly impacted the long-term Bitcoin price outlook. Its core premise, linking Bitcoin’s scarcity to its price, has resonated with many investors, shaping their expectations and influencing market sentiment. However, it’s crucial to understand both the potential benefits and inherent risks associated with basing investment decisions solely on this model.

Plan B’s model suggests a strong positive correlation between Bitcoin’s scarcity (represented by the S2F ratio) and its price. The model’s predictions, while not always accurate, have at times aligned with market trends, contributing to its popularity. The model’s simplicity and the perceived clarity of its projections have attracted a considerable following, leading to significant investment activity based on its anticipated price targets. However, the model’s limitations, discussed previously, must be carefully considered.

Implications of Plan B’s Model for Bitcoin’s Long-Term Price Trajectory, Plan B Bitcoin Price

Plan B’s model, by its very nature, predicts a significant increase in Bitcoin’s price over the long term. The model extrapolates from historical data and the fixed supply of Bitcoin (21 million coins), suggesting a progressively steeper price appreciation as Bitcoin becomes scarcer. This projection has fueled considerable optimism among long-term Bitcoin holders, leading many to believe in a potential future where Bitcoin’s value surpasses that of gold or other established assets. However, it’s crucial to acknowledge that this projection is based on a specific set of assumptions, and deviations from these assumptions could significantly alter the predicted trajectory. For example, widespread adoption of alternative cryptocurrencies or unforeseen regulatory changes could influence Bitcoin’s price in ways not accounted for by the S2F model.

Influence of Plan B’s Predictions on Investor Behavior and Market Sentiment

Plan B’s predictions have demonstrably influenced investor behavior. The release of his model’s predictions often coincides with periods of increased market volatility and trading activity. Investors, particularly those with a longer-term investment horizon, have frequently used Plan B’s projections to justify their “buy and hold” strategies, viewing any dips as buying opportunities aligned with the model’s long-term price targets. Conversely, periods where the model’s predictions are not met can lead to market corrections as investors reassess their positions and adjust their expectations. This demonstrates a clear link between Plan B’s model and the psychological factors driving Bitcoin’s market dynamics. For example, the anticipation of the “S2F halving price predictions” has historically led to significant price rallies, although these rallies have not always matched the predicted magnitude.

Risks and Opportunities Associated with Investing in Bitcoin Based on Plan B’s Model

Investing in Bitcoin based solely on Plan B’s model presents both significant opportunities and considerable risks. The potential for substantial returns, as predicted by the model, is a major draw for investors. However, the inherent volatility of the cryptocurrency market, coupled with the limitations of the S2F model itself, introduces substantial risk. The model does not account for external factors such as regulatory changes, macroeconomic conditions, or technological advancements that could significantly impact Bitcoin’s price. Moreover, the model’s reliance on historical data might not accurately predict future price movements, especially in a rapidly evolving market like cryptocurrencies. Therefore, while Plan B’s model can provide a framework for long-term thinking, it should not be the sole basis for investment decisions. Diversification and thorough due diligence remain crucial aspects of any sound investment strategy.

Illustrative Examples of Bitcoin Price Movements: Plan B Bitcoin Price

Analyzing Bitcoin’s price history through the lens of Plan B’s stock-to-flow (S2F) model offers valuable insights, though it’s crucial to remember that the model is not a perfect predictor and relies on several assumptions. The following examples highlight instances where the model’s predictions aligned with market behavior and others where they diverged, illustrating its strengths and limitations. It is important to note that the accuracy of the model’s predictions is subject to interpretation and the ever-changing nature of the cryptocurrency market.

Plan B’s S2F Model and the 2021 Bitcoin Bull Run

Plan B’s S2F model predicted a significant Bitcoin price increase in 2021, based on the halving events and the decreasing rate of new Bitcoin entering circulation. The model projected prices substantially higher than the then-current market price. While Bitcoin did experience a significant bull run during this period, reaching an all-time high exceeding $60,000, it ultimately fell short of some of the most optimistic predictions made using the S2F model. This discrepancy can be attributed to several factors, including macroeconomic conditions, regulatory uncertainty, and overall market sentiment.

Bitcoin Price Performance in Late 2022 and Early 2023

In late 2022 and early 2023, Bitcoin experienced a period of significant price decline, falling to below $16,000. This period saw a divergence between Plan B’s model predictions and the actual market price. The model, while acknowledging the potential for volatility, had anticipated a higher floor price. Several factors contributed to this discrepancy, including the broader cryptocurrency market downturn, the collapse of FTX, and the impact of rising interest rates globally. These events exerted significant downward pressure on Bitcoin’s price, exceeding the model’s anticipated range.

| Date | Event | Predicted Price (Plan B’s Model) | Actual Price (Approximate) |

|---|---|---|---|

| December 2020 | Halving-related prediction | >$100,000 (various predictions existed) | ~$29,000 (at the time) |

| November 2021 | Peak of the 2021 bull run | ||

| November 2022 | FTX collapse and market downturn | ||

| April 2023 | Post-market downturn recovery |

Frequently Asked Questions (FAQs)

This section addresses common queries regarding Plan B’s Bitcoin price prediction model, its accuracy, criticisms, and implications for investment decisions. Understanding these points is crucial for anyone considering using Plan B’s model as a guide for Bitcoin investment strategies.

Plan B’s Bitcoin Price Prediction Model

Plan B’s model primarily utilizes on-chain data, specifically focusing on the stock-to-flow (S2F) ratio of Bitcoin. The S2F ratio is calculated by dividing the existing supply of Bitcoin by the newly mined Bitcoin in a given period. The model posits a correlation between the S2F ratio and Bitcoin’s price, suggesting that a higher S2F ratio leads to a higher price. This is based on the principle of scarcity; as the rate of new Bitcoin creation slows down, its value should theoretically increase due to increased demand and limited supply. Plan B further developed this into S2F cross-asset models, incorporating data from other assets to refine predictions. The core concept, however, remains centered on the scarcity principle inherent in Bitcoin’s design.

Accuracy of Plan B’s Predictions

Plan B’s predictions, particularly those based on the initial S2F model, have shown a mixed record of accuracy. While some predictions aligned with the actual Bitcoin price movements in the timeframe they covered, others have significantly deviated. For example, the model’s prediction for Bitcoin’s price at the end of 2021 fell considerably short of the actual price. Several factors, including unforeseen market events and the inherent limitations of any predictive model, contribute to this inaccuracy. It’s important to remember that correlation does not equal causation, and other market forces can heavily influence Bitcoin’s price beyond the S2F ratio. The model’s accuracy should not be considered definitive or guaranteed.

Criticisms of Plan B’s Model

Several criticisms have been leveled against Plan B’s model. One common critique is its reliance on a single metric (S2F ratio) to predict a complex asset’s price. Bitcoin’s price is influenced by numerous factors, including regulatory changes, technological advancements, adoption rates, macroeconomic conditions, and market sentiment – none of which are directly incorporated into the basic S2F model. Furthermore, the model’s predictive power has been questioned, especially given its deviation from actual prices in certain periods. Counterarguments often point to the model’s success in predicting broad trends rather than precise price points, emphasizing the importance of understanding its limitations. Others argue that the model serves as a useful framework for understanding the long-term value proposition of Bitcoin based on its scarcity.

Investing in Bitcoin Based on Plan B’s Predictions

Investing in Bitcoin based solely on Plan B’s predictions would be highly risky. While the model offers a compelling narrative around Bitcoin’s scarcity and potential price appreciation, it’s crucial to remember that it’s just one factor among many that influence the market. Bitcoin is a highly volatile asset, and its price can fluctuate dramatically in short periods. Any investment decision should be based on thorough research, risk tolerance, and a diversified investment strategy. Relying on a single predictive model, regardless of its apparent accuracy, can lead to significant financial losses. Therefore, considering other factors and seeking professional financial advice before investing in Bitcoin is strongly recommended.

Disclaimer and Conclusion Summary

This section provides a concise summary of the key findings regarding Plan B’s Bitcoin price model and predictions, along with a crucial disclaimer to ensure responsible interpretation of the presented information. Understanding the limitations and potential inaccuracies is vital before applying this information to any personal financial decisions.

The analysis of Plan B’s model has explored its strengths, weaknesses, and the impact of various market events on its predictive accuracy. While the model has shown some correlation with historical Bitcoin price movements, it’s crucial to remember that no model can perfectly predict future price action.

Key Takeaways

- Plan B’s stock-to-flow (S2F) model, while influential, is not a perfect predictor of Bitcoin’s price. Its accuracy has varied over time, demonstrating that other factors significantly impact Bitcoin’s price.

- Several criticisms have been leveled against the S2F model, including its reliance on historical data and its failure to account for technological advancements, regulatory changes, and broader macroeconomic conditions.

- Market events, such as regulatory crackdowns, significant technological upgrades, or major macroeconomic shifts, can significantly impact Bitcoin’s price and invalidate short-term predictions based on the S2F model.

- While Plan B’s model offers a long-term perspective, it’s crucial to approach such long-term predictions with caution, acknowledging the inherent uncertainty in any long-term market forecast.

- Alternative models and perspectives exist, suggesting that a multitude of factors contribute to Bitcoin’s price volatility, beyond the simple S2F metric.

Disclaimer

The information presented in this article is for educational purposes only and should not be considered financial advice. Investing in Bitcoin or any cryptocurrency carries significant risk, and you could lose some or all of your investment. This analysis does not constitute a recommendation to buy, sell, or hold any cryptocurrency. Conduct thorough research and seek advice from a qualified financial advisor before making any investment decisions.