Bitcoin Halving 2025

The Bitcoin halving, a programmed event reducing the rate of newly minted Bitcoin by half, is anticipated in 2025. This event has historically been associated with significant price increases in the following periods, leading to considerable speculation about its impact on the market this time around. Understanding the historical context and considering potential influencing factors is crucial for navigating this significant event in the cryptocurrency landscape.

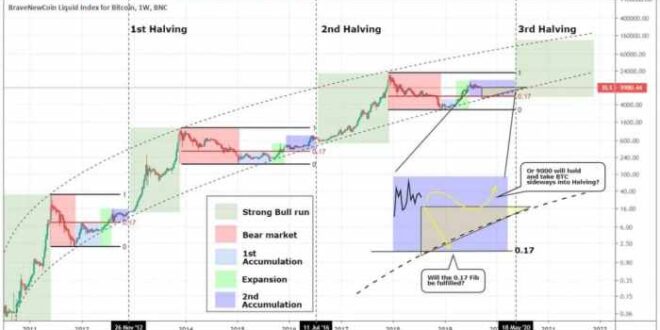

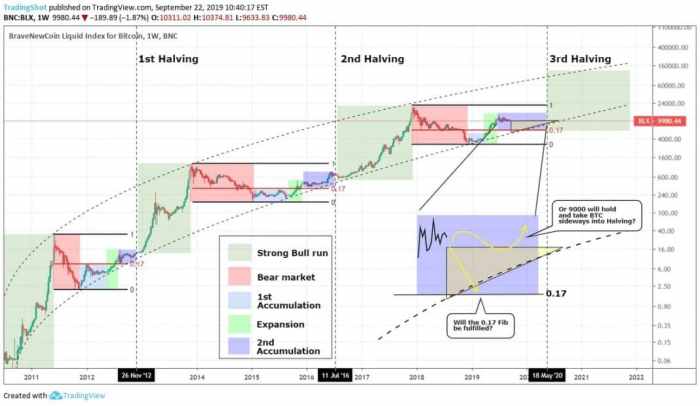

Historical Impact of Bitcoin Halvings on Price

Previous Bitcoin halvings have demonstrably influenced price trends. The first halving in 2012 saw a relatively gradual price increase following the event. The second halving in 2016 was followed by a more substantial price surge, culminating in the 2017 bull market. The third halving in 2020, although initially showing a less immediate price reaction, eventually contributed to the significant price appreciation seen in late 2020 and early 2021. While correlation doesn’t equal causation, the historical pattern suggests a potential link between halvings and subsequent price appreciation. It’s important to note, however, that other market forces significantly influenced these price movements.

Factors Influencing the 2025 Halving’s Effect

Several factors beyond the halving itself will likely shape the market reaction in 2025. Macroeconomic conditions, including inflation rates, interest rate policies, and overall economic growth, will play a significant role. Regulatory changes at both national and international levels will also influence investor sentiment and market liquidity. The level of institutional adoption and the overall maturation of the cryptocurrency market will further impact the price response to the halving. For instance, the increased regulatory scrutiny seen in 2022-2023 significantly impacted market sentiment and price action. The state of the overall global economy in 2025 will likely be a primary driver of price movements, regardless of the halving.

Comparison of Anticipated Market Reactions

Predicting the market’s reaction to the 2025 halving requires comparing it to previous events while acknowledging crucial differences. While past halvings have generally been followed by price increases, the magnitude and timing of these increases varied significantly. The 2025 halving occurs in a much more mature and regulated market than previous events, potentially leading to a less volatile, more measured price response. The increased institutional involvement might also dampen the speculative exuberance seen in previous bull runs. A more measured, longer-term price increase is a possible outcome, contrasting with the more rapid and intense price surges observed after previous halvings.

Increased Bitcoin Scarcity and its Influence on Value

The halving directly impacts Bitcoin’s scarcity by reducing the rate of new coin issuance. This reduction in supply, coupled with potentially sustained or increasing demand, could contribute to a higher price. The principle of supply and demand is fundamental here. A reduction in supply, all else being equal, tends to increase price. However, demand also plays a crucial role; if demand weakens, the price impact of the halving might be muted. The ongoing narrative of Bitcoin as a deflationary asset could further support price appreciation, attracting investors seeking protection against inflation.

Diverse Perspectives within the Crypto Community

Opinions within the crypto community regarding the 2025 halving are diverse. Some analysts predict a significant price surge mirroring previous cycles, emphasizing the historical correlation and the increasing scarcity of Bitcoin. Others are more cautious, highlighting the potential impact of macroeconomic factors and regulatory uncertainties. Some even suggest that the halving’s price impact might be less pronounced than in the past due to market maturity and the increased sophistication of investors. The range of opinions reflects the inherent uncertainty in predicting future market behavior.

Predicting Bitcoin’s Price After the 2025 Halving: Prediccion Bitcoin Halving 2025

Predicting the price of Bitcoin after the 2025 halving is inherently challenging, given the cryptocurrency’s volatile nature and the influence of numerous interconnected factors. However, by analyzing historical trends, employing various predictive models, and considering macroeconomic conditions, we can formulate a range of plausible scenarios. It’s crucial to remember that these are estimations, not guarantees.

Plausible Price Scenarios Post-Halving, Prediccion Bitcoin Halving 2025

Several scenarios are possible following the 2025 halving, each dependent on a confluence of factors. A conservative estimate might see Bitcoin reaching $100,000-$150,000 within a year or two post-halving, assuming moderate adoption and stable macroeconomic conditions. This scenario aligns with historical halving cycles, where price increases have followed, albeit with varying degrees of intensity and timeframes. A more bullish scenario, factoring in increased institutional adoption and a generally positive global economic outlook, could push Bitcoin to $250,000 or even higher. Conversely, a bearish scenario, considering negative regulatory actions or a broader cryptocurrency market downturn, might see prices stagnate or even decline temporarily before resuming an upward trajectory. The price range ultimately depends on the interplay of numerous variables.

Analytical Models for Bitcoin Price Prediction

Several analytical models attempt to forecast Bitcoin’s price. Stock-to-flow (S2F) models, for example, correlate Bitcoin’s scarcity (its limited supply) with its price. While historically somewhat accurate, S2F models are simplistic and don’t account for market sentiment, regulatory changes, or technological advancements. On-chain analysis examines data from the Bitcoin blockchain, such as transaction volumes and network activity, to infer market sentiment and potential price movements. This method offers a more nuanced perspective than S2F but requires sophisticated interpretation and is susceptible to manipulation. Finally, econometric models incorporate macroeconomic factors like inflation and interest rates to predict price changes. These models offer a broader context but struggle to accurately capture the unique characteristics of the cryptocurrency market.

Impact of Institutional Investment and Adoption

Institutional investment has played a significant role in Bitcoin’s price appreciation in the past. Increased participation from large financial institutions, hedge funds, and corporations can significantly impact price by injecting large sums of capital into the market, increasing demand and pushing prices higher. However, this influx of capital is not guaranteed and can be influenced by regulatory uncertainty and macroeconomic conditions. Increased adoption by mainstream businesses, as payment methods or store of value, further enhances its legitimacy and potential for growth. The level of institutional and mainstream adoption will be a key determinant of Bitcoin’s price trajectory after the halving.

Hypothetical Investment Strategy

A diversified investment strategy is advisable, given the inherent volatility of Bitcoin. One approach would be to allocate a portion of one’s investment portfolio to Bitcoin, based on risk tolerance and financial goals. A phased approach, investing smaller amounts over time rather than a single large investment, can mitigate risk. For example, one might allocate 5% of their portfolio to Bitcoin, purchasing a predetermined amount each month regardless of the price. This strategy reduces the impact of market volatility and allows for accumulation over time. A more aggressive strategy might involve allocating a larger percentage, but this carries a higher risk of significant losses. The strategy should be adjusted based on the predicted scenarios Artikeld above and one’s personal risk tolerance.

Hierarchical Structure of Factors Influencing Bitcoin Price

The factors influencing Bitcoin’s price can be organized hierarchically. At the top level are macroeconomic factors (global economic conditions, inflation, interest rates). The second level includes market dynamics (supply and demand, institutional investment, regulatory landscape). The third level comprises technical factors (blockchain activity, hash rate, mining difficulty). Finally, at the base level are psychological factors (market sentiment, FOMO (fear of missing out), fear). This hierarchical structure illustrates the complex interplay of factors affecting Bitcoin’s price, highlighting the interconnectedness of macroeconomic, market, technical, and psychological elements.

Prediccion Bitcoin Halving 2025 – Predicting the Bitcoin Halving in 2025 involves careful analysis of various factors. A key element in these predictions is knowing the precise date of the halving, which you can find by checking the definitive resource for this information: Halving Bitcoin Date 2025. Understanding this date is crucial for accurate predictions about the subsequent price action and market volatility surrounding the Bitcoin Halving 2025 event.

Predicting the Bitcoin Halving 2025 event involves considering various factors, including mining difficulty adjustments and overall market sentiment. A key element in these predictions is understanding the potential price impact, which is thoroughly discussed in this insightful analysis on Bitcoin Halving 2025 Price. Ultimately, accurate prediction of the Bitcoin Halving 2025 remains challenging, but resources like this provide valuable context for informed speculation.

Predicting the Bitcoin Halving 2025 impact requires understanding the precise date of the event, which significantly influences market speculation. To accurately gauge this, confirming the exact date is crucial; you can find this information by checking the definitive resource on the Bitcoin Halving 2025 Date. This precise date then allows for more refined predictions regarding the subsequent Bitcoin price movements following the halving in 2025.

Prediccion Bitcoin Halving 2025 is a topic generating significant interest, with many speculating on the cryptocurrency’s price trajectory following the event. Understanding historical trends is crucial, and for a visual representation of potential scenarios, check out this insightful resource: Bitcoin Halving Chart 2025 Prediction. This chart helps contextualize the Prediccion Bitcoin Halving 2025, offering a clearer perspective on possible outcomes.

Predicting the Bitcoin Halving in 2025 involves analyzing various factors, including mining difficulty and network hash rate. A key aspect of this prediction is knowing the precise date of the halving, and you can find that information by checking this resource: When Is Bitcoin Halving 2025. Understanding the exact timing is crucial for accurate predictions regarding Bitcoin’s price and overall market behavior following the 2025 halving event.

Predicting the Bitcoin Halving in 2025 involves considering numerous factors, including miner behavior and market sentiment. Understanding the historical impact of previous halvings is crucial, and a great resource for this is the comprehensive analysis available at 2025 Halving Bitcoin. This in-depth look at the 2025 event helps refine predictions for the Bitcoin Halving 2025, providing valuable context for informed speculation.