Bitcoin Price Prediction 2025

Predicting the price of Bitcoin in 2025 is inherently speculative, given the cryptocurrency’s volatile nature and the influence of numerous unpredictable factors. However, by analyzing current market conditions, historical trends, and potential future developments, we can explore plausible scenarios. This analysis will consider both optimistic and pessimistic outlooks to provide a comprehensive overview.

Bitcoin Market State and Influencing Factors

Currently, the Bitcoin market exhibits a complex interplay of factors impacting its price. Adoption by institutional investors continues to grow, alongside increasing regulatory scrutiny globally. Technological advancements, such as the Lightning Network improving transaction speeds and scalability, also play a role. Conversely, macroeconomic conditions, such as inflation and interest rate changes, significantly influence investor sentiment and risk appetite, affecting Bitcoin’s price. The overall level of public interest and media coverage also contributes to market volatility. For example, a major positive news story could trigger a price surge, while negative news could cause a sharp drop.

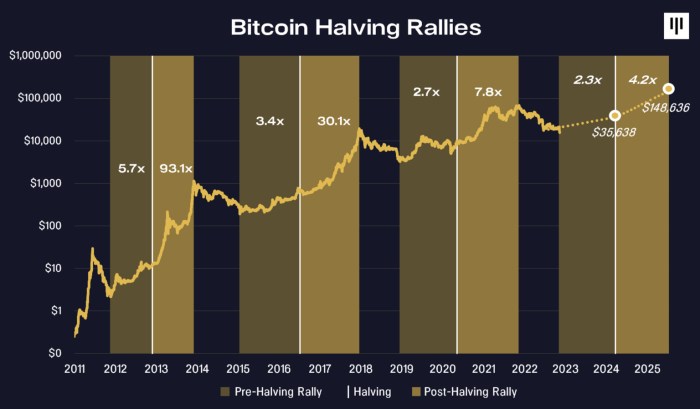

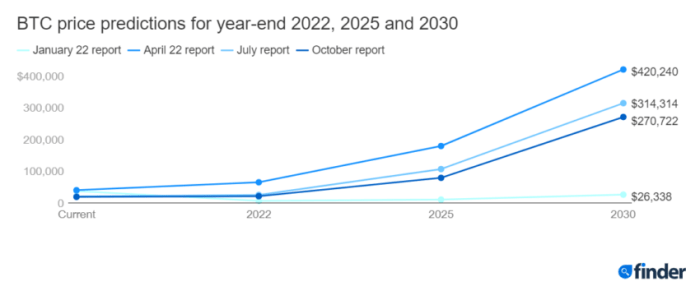

Potential Price Scenarios for Bitcoin in 2025

Several scenarios are possible for Bitcoin’s price by 2025. A bullish scenario could see Bitcoin’s price exceeding $100,000, driven by widespread institutional adoption, increased regulatory clarity leading to greater investor confidence, and continued technological advancements. This scenario assumes sustained global economic growth and a continued shift towards decentralized finance. Conversely, a bearish scenario might see Bitcoin’s price fall below $20,000. This could result from increased regulatory pressure leading to stricter limitations, a major security breach eroding trust, or a significant macroeconomic downturn impacting investor confidence. A more moderate scenario could see Bitcoin trading somewhere between $30,000 and $70,000, reflecting a balance between positive and negative factors. The price would likely fluctuate significantly within this range, reflecting the inherent volatility of the cryptocurrency market.

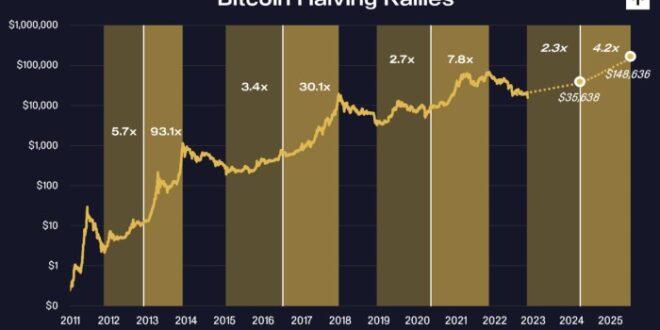

Historical Price Trends and Recurring Patterns

Bitcoin’s price history reveals a pattern of significant price increases followed by substantial corrections. Since its inception, Bitcoin has experienced several bull and bear markets, with each cycle generally lasting several years. For example, the 2017 bull market saw Bitcoin reach an all-time high of nearly $20,000, followed by a prolonged bear market that lasted into 2020. While past performance is not indicative of future results, analyzing these cycles can help identify potential patterns and inform predictions. Identifying the length and intensity of these cycles is crucial in predicting potential future price movements. However, it’s important to remember that external factors can significantly disrupt these patterns, making precise prediction difficult. The emergence of new cryptocurrencies and technological advancements also introduces significant uncertainties into the long-term price forecasting.

Factors Influencing Bitcoin’s Future Price: Prediction Bitcoin 2025

Predicting Bitcoin’s price in 2025, or any future date, is inherently complex. Numerous intertwined factors contribute to its volatility and long-term trajectory. Understanding these influences is crucial for navigating the cryptocurrency market. This section explores key elements shaping Bitcoin’s potential future price.

Regulatory Changes and Bitcoin’s Price

Government regulations significantly impact Bitcoin’s price. Increased regulatory clarity, such as the establishment of clear legal frameworks for cryptocurrency trading and taxation, could boost investor confidence and lead to price appreciation. Conversely, stringent regulations, including outright bans or excessive restrictions, can negatively impact Bitcoin’s price by limiting its accessibility and hindering its adoption. The regulatory landscape varies widely across jurisdictions, creating uncertainty and impacting price fluctuations. For example, a sudden crackdown on cryptocurrency exchanges in a major market could trigger a price drop, while the adoption of clear regulatory frameworks in another could lead to a price increase.

Technological Advancements and Bitcoin Adoption

Technological advancements play a crucial role in shaping Bitcoin’s future. The Lightning Network, for instance, aims to improve Bitcoin’s scalability and transaction speed by processing payments off-chain. Successful implementation and widespread adoption of the Lightning Network could enhance Bitcoin’s usability for everyday transactions, potentially driving increased demand and price appreciation. Other technological advancements, such as improved mining hardware or new consensus mechanisms, could also impact Bitcoin’s price by influencing its security, efficiency, and overall appeal. A significant technological breakthrough could lead to a surge in adoption, resulting in a price increase. Conversely, failure to overcome scalability challenges could hinder widespread adoption and limit price growth.

Macroeconomic Factors and Bitcoin’s Value

Macroeconomic conditions exert considerable influence on Bitcoin’s price. Periods of high inflation often see investors seeking alternative assets to preserve their purchasing power. Bitcoin, often viewed as a hedge against inflation, might experience increased demand and price appreciation during such times. Conversely, rising interest rates can make other investment options more attractive, potentially diverting capital away from Bitcoin and causing its price to fall. Economic downturns or geopolitical instability can also trigger volatility in Bitcoin’s price as investors react to uncertainty. For instance, the 2022 market downturn was partly driven by macroeconomic factors such as rising inflation and interest rate hikes.

Bitcoin’s Price Performance Compared to Other Assets

Comparing Bitcoin’s price performance to other major assets, such as gold and the US dollar, provides valuable context. While Bitcoin is often touted as “digital gold,” its price volatility is significantly higher than that of gold. This difference highlights the inherent risk associated with Bitcoin investment. Bitcoin’s price correlation with the US dollar can also be variable, depending on prevailing market sentiment and macroeconomic factors. During periods of US dollar weakness, Bitcoin might appreciate, while periods of US dollar strength might lead to a decline in Bitcoin’s price. The long-term performance of Bitcoin compared to these assets remains a subject of ongoing debate and analysis.

Potential Disruptive Events and Bitcoin’s Price

Several potential disruptive events could significantly impact Bitcoin’s price. These include major security breaches, regulatory crackdowns in key markets, the emergence of competing cryptocurrencies with superior technology, or unforeseen technological disruptions. A large-scale security breach compromising the Bitcoin network could erode investor confidence and cause a sharp price decline. Similarly, a coordinated global regulatory crackdown could significantly limit Bitcoin’s use and adoption, leading to a substantial price drop. The introduction of a significantly superior cryptocurrency could also divert investment and market share away from Bitcoin, impacting its price negatively. These are just some examples, and the potential for unforeseen events to impact Bitcoin’s price is always present.

Bitcoin Adoption and Market Sentiment

Bitcoin’s journey from a niche cryptocurrency to a globally recognized asset has been marked by fluctuating adoption rates and evolving market sentiment. Understanding these dynamics is crucial for predicting its future price trajectory. This section delves into the current state of Bitcoin adoption, analyzes prevailing market sentiment, and explores the influential roles of institutional investors and media coverage.

Global Bitcoin Adoption and Demographics

Bitcoin adoption varies significantly across the globe and within different demographic groups. While countries like El Salvador have embraced Bitcoin as legal tender, others maintain stricter regulatory frameworks, hindering widespread adoption. Younger generations, generally more tech-savvy and open to digital innovation, show higher rates of Bitcoin ownership compared to older generations. Geographic location also plays a significant role; regions with greater access to technology and financial infrastructure tend to exhibit higher adoption rates. For example, developed nations in North America and Europe generally have higher Bitcoin adoption rates than many developing nations in Africa or South America, though this is changing rapidly in certain regions. This disparity is largely due to factors such as internet access, financial literacy, and regulatory clarity.

Market Sentiment Analysis: Investor Confidence and Public Perception

Market sentiment towards Bitcoin is a complex interplay of investor confidence and public perception. Periods of high price volatility often correlate with heightened market sentiment, both positive and negative. News events, regulatory changes, and technological advancements all influence investor sentiment. For instance, positive news regarding institutional adoption can trigger a surge in investor confidence, leading to price increases. Conversely, negative news, such as a major security breach or regulatory crackdown, can trigger a sell-off and decreased confidence. Public perception, often shaped by media coverage and word-of-mouth, also significantly impacts overall market sentiment. Positive media portrayals can increase public interest and drive adoption, while negative portrayals can fuel skepticism and fear, potentially hindering growth.

Institutional Investors’ Influence on Bitcoin’s Price, Prediction Bitcoin 2025

The involvement of institutional investors, such as large hedge funds and investment firms, has become increasingly significant in shaping Bitcoin’s price. Their substantial capital inflows can significantly impact market liquidity and price stability. For example, MicroStrategy’s significant Bitcoin purchases have been cited as a catalyst for price increases in the past. Conversely, large-scale sell-offs by institutional investors can lead to significant price corrections. The actions of these institutional players often signal market trends and influence the decisions of smaller investors. Their involvement adds a layer of legitimacy and stability to the Bitcoin market, though their actions are not always predictable or beneficial to all market participants.

Social Media and News Coverage Impact on Price Volatility

Social media platforms and traditional news outlets play a crucial role in influencing Bitcoin’s price volatility. Viral social media trends, particularly those fueled by influential figures or communities, can rapidly shift market sentiment and drive significant price swings. Similarly, positive or negative news coverage can dramatically impact investor confidence and trading activity. A single negative headline about a security breach or regulatory uncertainty can trigger a sell-off, while positive news about technological advancements or widespread adoption can fuel price increases. This highlights the importance of discerning reliable information sources from speculation and misinformation, particularly in a volatile market like Bitcoin’s.

Future Bitcoin Adoption Rate Projections

Projecting future Bitcoin adoption rates requires careful consideration of several factors, including technological advancements, regulatory changes, and evolving market sentiment. While predicting precise figures is challenging, several indicators suggest continued growth. The increasing integration of Bitcoin into mainstream financial systems, along with the growing adoption of blockchain technology in various sectors, points towards a potential increase in Bitcoin’s usage and acceptance. However, regulatory uncertainty and potential technological disruptions could hinder widespread adoption. Considering past adoption trends and current developments, a conservative estimate might be a gradual increase in global adoption, with significant variations across different regions and demographics. Real-world examples, like the growing use of Bitcoin for remittances in certain regions, suggest a positive trajectory, but the pace of adoption will depend on various unpredictable external factors.

Technical Analysis of Bitcoin

Technical analysis offers a framework for predicting Bitcoin’s price movements by studying historical price and volume data. While not foolproof, it provides valuable insights that, when combined with fundamental analysis, can inform trading strategies. However, it’s crucial to remember that Bitcoin’s volatility and the influence of external factors can significantly impact its accuracy, particularly in long-term predictions.

Potential Price Movements Until 2025

A hypothetical technical analysis chart might show Bitcoin’s price fluctuating within a range, influenced by support and resistance levels. For instance, a previous high of $69,000 could act as a significant resistance level, while a previous low, say $20,000, might serve as support. The chart would illustrate potential price trajectories based on various scenarios, such as a bullish trend breaking through resistance, leading to higher prices, or a bearish trend pushing the price towards support levels. The chart would also incorporate trendlines, identifying the general direction of the price movement. Important to note, this is a hypothetical illustration; real-world charts would reflect actual market data and be far more complex. A significant event, such as widespread adoption by institutional investors, could drastically alter the predicted trajectory.

Using Technical Indicators to Predict Bitcoin’s Price

Moving averages, such as the 50-day and 200-day simple moving averages (SMA), can identify trends. A bullish crossover (50-day SMA crossing above the 200-day SMA) might signal a potential upward trend, while a bearish crossover would suggest the opposite. The Relative Strength Index (RSI) is a momentum indicator; readings above 70 suggest overbought conditions (potential price correction), while readings below 30 suggest oversold conditions (potential price rebound). For example, if the RSI shows Bitcoin is overbought after a significant price surge, a technical analyst might predict a short-term price correction. However, these indicators should be used in conjunction with other analysis tools and not as standalone predictors.

Limitations of Technical Analysis for Long-Term Predictions

Technical analysis primarily focuses on past price action and patterns. It struggles to account for unpredictable events like regulatory changes, significant technological advancements, or unexpected macroeconomic shifts that can dramatically impact Bitcoin’s price. The longer the timeframe, the greater the influence of unforeseen circumstances, rendering long-term predictions based solely on technical analysis less reliable. For example, the unforeseen 2022 cryptocurrency market crash, largely driven by macroeconomic factors and regulatory uncertainty, demonstrated the limitations of solely relying on technical indicators for accurate long-term predictions. The inherent volatility of Bitcoin also makes it challenging to accurately predict long-term price movements with any single method.

Comparison of Technical Analysis Methods

| Method | Accuracy (Qualitative Assessment) | Pros | Cons |

| Moving Averages | Moderate, better for short-term trends | Easy to understand and implement, identifies trends | Lagging indicator, susceptible to false signals |

| RSI | Moderate, useful for identifying overbought/oversold conditions | Helps identify potential price reversals, easy to interpret | Can generate false signals, less effective in sideways markets |

| Support/Resistance Levels | Variable, depends on the accuracy of identification | Provides potential price targets, useful for risk management | Subjective identification, can be easily broken |

| Fibonacci Retracements | Variable, depends on the accuracy of swing high/low identification | Provides potential price targets, useful for identifying potential reversal points | Subjective identification, can be inaccurate in volatile markets |

Prediction Bitcoin 2025 – Predicting Bitcoin’s price in 2025 is challenging, with various factors influencing its trajectory. A key event impacting this prediction is the next Bitcoin halving, which significantly affects the rate of new Bitcoin entering circulation. To understand the timeline for this crucial event, check out this resource: When Will Bitcoin Halving Happen In 2025. The timing of the halving will undoubtedly play a major role in shaping Bitcoin’s price throughout 2025 and beyond.

Predicting Bitcoin’s price in 2025 is a complex endeavor, influenced by numerous factors. A key event to consider is the next Bitcoin halving, which significantly impacts the cryptocurrency’s inflation rate. To understand the timing and potential effects of this event, refer to this informative resource on Bitcoin Halving When 2025. Ultimately, the halving’s impact will be a significant factor in any accurate prediction of Bitcoin’s value by 2025.

Predicting Bitcoin’s price in 2025 is a complex undertaking, influenced by numerous factors. A key element to consider is the impact of the 2024 halving, which will reduce the rate of new Bitcoin creation. To understand the potential price trajectory post-halving, you might find this resource helpful: Bitcoin Price After Halving 2025 Usd. Ultimately, while this analysis offers valuable insight, the actual Bitcoin price in 2025 remains speculative and dependent on market forces.

Predicting Bitcoin’s price in 2025 is a complex undertaking, influenced by numerous factors. A key element to consider is the impact of the 2024 halving, which will reduce the rate of new Bitcoin creation. To understand the potential price trajectory post-halving, you might find this resource helpful: Bitcoin Price After Halving 2025 Usd. Ultimately, while this analysis offers valuable insight, the actual Bitcoin price in 2025 remains speculative and dependent on market forces.

Predicting Bitcoin’s price in 2025 is a complex undertaking, influenced by numerous factors. A key element to consider is the impact of the 2024 halving, which will reduce the rate of new Bitcoin creation. To understand the potential price trajectory post-halving, you might find this resource helpful: Bitcoin Price After Halving 2025 Usd. Ultimately, while this analysis offers valuable insight, the actual Bitcoin price in 2025 remains speculative and dependent on market forces.

Predicting Bitcoin’s price in 2025 is challenging, influenced by numerous factors including market sentiment and technological advancements. A key event impacting these predictions is the upcoming halving, which significantly alters Bitcoin’s inflation rate. To understand its potential effect, it’s helpful to learn more about What Is The 2025 Bitcoin Halving. This event’s influence on supply and demand will undoubtedly play a major role in shaping Bitcoin’s price trajectory heading into 2025 and beyond.