Macroeconomic Factors and Global Events

Bitcoin’s price, while often touted as decentralized and independent, is significantly influenced by broader macroeconomic trends and global events. Understanding these influences is crucial for predicting its potential trajectory. The interplay between factors like inflation, interest rates, and geopolitical instability creates a complex environment that shapes investor sentiment and, consequently, Bitcoin’s value.

Bitcoin’s price often exhibits an inverse relationship with inflation. High inflation erodes the purchasing power of fiat currencies, potentially driving investors towards alternative assets like Bitcoin, perceived as a hedge against inflation. Conversely, periods of low inflation may reduce the demand for Bitcoin as investors find less incentive to seek refuge in alternative assets. Interest rate hikes, a common response to inflation, can impact Bitcoin’s price by reducing the attractiveness of riskier assets, including cryptocurrencies. Higher interest rates typically lead to increased returns on less volatile investments, diverting capital away from Bitcoin. Economic recessions, characterized by reduced economic activity and decreased investor confidence, can also negatively affect Bitcoin’s price, as investors tend to liquidate assets to mitigate losses during such periods.

Inflation’s Impact on Bitcoin

High inflation, like that experienced in many countries in 2022, often leads to increased Bitcoin adoption as individuals seek to preserve their wealth. The purchasing power of fiat currencies diminishes, making Bitcoin, with its fixed supply, a more attractive store of value. Conversely, periods of low inflation might lessen the appeal of Bitcoin as a hedge against inflation, potentially leading to price stagnation or even decline. For example, during periods of relatively low inflation in the early 2010s, Bitcoin’s price was considerably less volatile than during periods of high inflation.

Geopolitical Events and Global Crises

Geopolitical instability and global crises often create uncertainty in financial markets, driving investors towards safe-haven assets, including gold and, to a certain extent, Bitcoin. Major events such as wars, political upheavals, or global pandemics can trigger significant price fluctuations in Bitcoin as investors react to the perceived risk. The 2020 COVID-19 pandemic, for instance, initially caused a sharp drop in Bitcoin’s price before a subsequent recovery as investors sought alternative assets. Similarly, the ongoing war in Ukraine has caused market volatility, impacting Bitcoin’s price alongside other assets.

Bitcoin’s Performance During Past Economic Downturns

Historically, Bitcoin’s performance during economic downturns has been mixed. While it has shown periods of resilience and even growth during some recessions, it has also experienced significant price drops alongside traditional markets. Comparing Bitcoin’s performance to other asset classes during past recessions reveals that its correlation with traditional markets isn’t always consistent. Sometimes it acts as a safe haven, other times it mirrors the downward trends of stocks and bonds. This lack of consistent correlation highlights the complexity of its relationship with the broader economy.

Potential Macroeconomic Scenarios and Their Impact on Bitcoin in 2025

Predicting Bitcoin’s price is inherently speculative, but considering potential macroeconomic scenarios can offer insights.

- Scenario 1: Persistent Inflation and Rising Interest Rates: This scenario could lead to decreased Bitcoin demand, potentially resulting in a price decline or stagnation. Investors might prioritize safer, higher-yielding assets.

- Scenario 2: Global Economic Recession: A severe global recession could negatively impact Bitcoin’s price, as investors liquidate assets to mitigate losses. However, it could also lead to increased demand as a hedge against economic uncertainty.

- Scenario 3: Controlled Inflation and Stable Interest Rates: This relatively stable environment could foster investor confidence and potentially lead to Bitcoin price appreciation, as investors allocate funds to riskier assets with higher growth potential.

- Scenario 4: Geopolitical Crisis: A significant geopolitical event could cause substantial volatility in Bitcoin’s price, depending on the nature and severity of the crisis. It could act as a safe haven or suffer alongside traditional markets.

Bitcoin’s Role in the Global Financial System

Bitcoin’s potential impact on the global financial system is a subject of considerable debate. Its decentralized nature and cryptographic security offer a stark contrast to traditional, centralized systems, raising questions about its future role as both a payment method and a store of value. The following sections explore these facets in detail.

Bitcoin’s Potential as Mainstream Payment and Store of Value

Bitcoin’s adoption as a mainstream payment method faces significant hurdles. While its peer-to-peer transaction capabilities are attractive, volatility remains a major deterrent for widespread use in everyday transactions. Businesses are hesitant to accept a currency whose value fluctuates dramatically, risking losses on sales. However, Bitcoin’s potential as a store of value is more compelling. Its limited supply of 21 million coins and its resistance to inflation appeal to investors seeking a hedge against traditional fiat currencies. The growing acceptance of Bitcoin by institutional investors suggests a growing confidence in its long-term value, though this confidence is not universally shared. For example, the price fluctuations experienced in 2022 highlighted the inherent risks associated with holding Bitcoin as a long-term investment.

Bitcoin’s Disruptive Potential to Traditional Finance

Bitcoin’s decentralized nature poses a direct challenge to traditional financial institutions. By removing intermediaries like banks and payment processors, Bitcoin transactions can be faster, cheaper, and more transparent. This disintermediation has the potential to reshape the financial landscape, potentially reducing reliance on traditional banking systems and enabling cross-border payments without significant fees or delays. However, the lack of regulatory oversight and the potential for illicit activities remain significant concerns. For instance, the use of Bitcoin in ransomware attacks has raised concerns about its potential for criminal activity, prompting increased regulatory scrutiny globally.

Comparison with Gold and Other Stores of Value

Bitcoin’s characteristics as a store of value are often compared to those of gold. Both are considered scarce assets with limited supply. Gold, however, has a long history as a store of value, backed by centuries of tradition and widespread acceptance. Bitcoin’s relative youth and volatility make it a riskier proposition compared to gold. Other traditional stores of value, such as real estate or government bonds, also offer different risk-reward profiles. While real estate offers tangible assets and potential rental income, its liquidity is limited. Government bonds, on the other hand, offer relatively low risk but lower potential returns compared to Bitcoin’s potentially high volatility. The choice between these different assets depends heavily on individual risk tolerance and investment goals.

Impact of Decentralization on the Future of Finance

Bitcoin’s decentralized nature is its most transformative characteristic. The absence of a central authority controlling the Bitcoin network fosters transparency and resilience. It makes the system resistant to censorship and single points of failure, unlike traditional financial systems vulnerable to government intervention or hacking. This decentralization could lead to the emergence of new financial services and models, potentially empowering individuals and reducing the power of established institutions. However, the lack of a central authority also presents challenges in terms of regulation and consumer protection. The ongoing debate surrounding Bitcoin’s regulatory framework highlights the complexity of balancing innovation with the need for responsible financial practices.

Predictive Models and Forecasting Techniques

Predicting Bitcoin’s future price is a complex undertaking, fraught with challenges. Numerous methods exist, each with its strengths and weaknesses, and none offer foolproof accuracy. Understanding these methods, their limitations, and their historical performance is crucial for navigating the volatile cryptocurrency market.

Predicting the price of Bitcoin relies heavily on two primary analytical approaches: technical analysis and fundamental analysis. Both offer valuable insights, but neither provides definitive predictions. Their combined application, however, can offer a more nuanced perspective.

Technical Analysis Methods

Technical analysis focuses on historical price and volume data to identify patterns and predict future price movements. This approach assumes that past market behavior can indicate future trends. Common technical indicators include moving averages (e.g., simple moving average, exponential moving average), relative strength index (RSI), and Bollinger Bands. For example, a sustained upward trend in a moving average might suggest a bullish outlook, while RSI exceeding 70 might signal an overbought condition, potentially leading to a price correction. However, relying solely on technical indicators can be misleading, as market sentiment and unforeseen events can significantly impact price movements.

Fundamental Analysis Methods

Fundamental analysis assesses the intrinsic value of Bitcoin by considering factors such as adoption rates, regulatory changes, technological advancements, and macroeconomic conditions. For example, widespread institutional adoption could drive up demand and increase price, while stringent regulatory crackdowns could have the opposite effect. This approach attempts to determine whether the current market price accurately reflects Bitcoin’s underlying value. However, accurately quantifying these factors and their impact on price remains challenging, making precise predictions difficult.

Limitations and Challenges in Bitcoin Price Prediction

Predicting Bitcoin’s price is inherently challenging due to its high volatility and susceptibility to speculative trading. External factors, such as regulatory announcements, major market events, and even social media trends, can dramatically influence its price. Furthermore, the relatively young age of Bitcoin and the lack of a long historical dataset limit the effectiveness of certain predictive models. The decentralized nature of Bitcoin and the anonymity surrounding some transactions also pose challenges for accurate data collection and analysis. The lack of a direct correlation between Bitcoin’s price and traditional market indicators further complicates predictive modeling. For example, a global economic downturn might not necessarily lead to a corresponding decrease in Bitcoin’s value, as investors might view it as a hedge against inflation.

Accuracy of Predictive Models

The accuracy of various predictive models in forecasting past Bitcoin price movements has been mixed. While some models have shown some degree of success in short-term predictions, their long-term accuracy remains questionable. The inherent volatility of the market and the influence of unpredictable events make it difficult to consistently outperform a simple “buy and hold” strategy. Studies comparing different models often reveal inconsistencies, highlighting the limitations of relying solely on any single predictive method. Past performance, therefore, should not be considered indicative of future results. For example, a model that accurately predicted a price surge in 2021 might have completely failed to predict the subsequent market correction.

Reliability of Price Predictions and Market Volatility

The reliability of Bitcoin price predictions is inherently low. The cryptocurrency market is exceptionally volatile, driven by speculation, hype, and unpredictable events. Claims of precise price predictions should be treated with extreme skepticism. While analytical methods can offer insights into potential price movements, they cannot definitively predict future prices. Investors should always approach predictions with caution and consider the significant risks involved in investing in cryptocurrencies. A diversified investment strategy and a thorough understanding of the market’s inherent volatility are crucial for mitigating risk.

Potential Scenarios for Bitcoin in 2025

Predicting Bitcoin’s future is inherently speculative, but by considering macroeconomic trends, technological advancements, and regulatory developments, we can Artikel plausible scenarios for its price and market position in 2025. These scenarios are not exhaustive, and the actual outcome may differ significantly. The following analysis considers a range of possibilities, from bullish to bearish, highlighting the factors influencing each.

Scenario 1: Continued Growth and Mainstream Adoption

This scenario envisions Bitcoin experiencing significant growth driven by increased institutional adoption, positive regulatory developments in key markets, and growing public awareness. Widespread acceptance as a store of value and a hedge against inflation could push Bitcoin’s price significantly higher. Factors such as the continued maturation of the Bitcoin ecosystem, the development of robust infrastructure for institutional investment, and a generally positive global economic climate would all contribute to this outcome. This scenario would likely see Bitcoin integrated into more financial services and accepted by a broader range of businesses.

Scenario 2: Stagnation and Consolidation

In this scenario, Bitcoin’s price experiences limited growth or even a period of consolidation. This could be due to several factors, including increased regulatory scrutiny, macroeconomic uncertainty, or competition from alternative cryptocurrencies. A lack of significant technological advancements or a major market-moving event could also contribute to a period of relative stagnation. Investor sentiment might be muted, leading to a sideways market with moderate price fluctuations. This scenario would likely see a more cautious approach from investors, with less significant price volatility compared to the bullish scenario.

Scenario 3: Bearish Market and Price Decline

This scenario Artikels a potential decline in Bitcoin’s price, potentially driven by negative macroeconomic events, such as a significant global recession or a major regulatory crackdown. A loss of investor confidence, coupled with technological setbacks or security breaches within the Bitcoin network, could lead to a substantial price correction. This scenario also considers the possibility of increased competition from other cryptocurrencies or the emergence of alternative financial technologies. The implications for investors would be significant losses, while users might face challenges in using Bitcoin as a transactional currency.

Scenario Comparison

| Scenario | Price Range (USD) | Market Conditions | Investor/User Implications |

|---|---|---|---|

| Continued Growth and Mainstream Adoption | $100,000 – $250,000+ | High volatility, increasing institutional investment, widespread adoption | High potential returns for early investors; increased ease of use and accessibility for users. |

| Stagnation and Consolidation | $30,000 – $60,000 | Low volatility, moderate institutional investment, limited adoption growth | Limited returns for investors; stable but potentially less exciting market for users. |

| Bearish Market and Price Decline | Below $20,000 | High volatility, decreased institutional investment, potential regulatory uncertainty | Significant losses for investors; reduced usability and accessibility for users. |

Frequently Asked Questions (FAQ): Prediction Of Bitcoin In 2025

This section addresses some common questions regarding Bitcoin’s potential future and investment considerations. Understanding these points is crucial before making any investment decisions, as the cryptocurrency market is inherently volatile.

Potential Bitcoin Price in 2025, Prediction Of Bitcoin In 2025

Predicting the precise price of Bitcoin in 2025 is impossible. Numerous factors, including macroeconomic conditions, regulatory changes, and technological advancements, influence its value. However, based on various forecasting models and considering different scenarios, potential price ranges can be explored. For instance, a conservative scenario might predict a price between $50,000 and $100,000, assuming moderate growth and adoption. A more bullish scenario, factoring in widespread adoption and technological breakthroughs, could see prices exceeding $200,000 or even higher. Conversely, a bearish scenario, considering significant regulatory hurdles or market downturns, could result in prices significantly lower than current levels. These are merely speculative ranges, and the actual price will likely fall somewhere within this broad spectrum or potentially outside it entirely. It’s vital to remember that past performance is not indicative of future results.

Bitcoin as an Investment

Bitcoin presents both significant opportunities and considerable risks. The potential for high returns is undeniable, given its history of substantial price appreciation. However, its volatility is equally noteworthy. Bitcoin’s price can fluctuate dramatically in short periods, leading to substantial gains or losses. Investors should be prepared for significant price swings and only invest what they can afford to lose. Furthermore, the regulatory landscape surrounding Bitcoin is still evolving, and changes in regulations could significantly impact its value. Due diligence and a thorough understanding of the risks are paramount before investing in Bitcoin. Consider diversification as part of a broader investment strategy rather than relying solely on Bitcoin.

Factors Influencing Bitcoin’s Price in 2025

Several key factors will likely influence Bitcoin’s price in 2025. These include macroeconomic conditions (such as inflation and interest rates), global geopolitical events (which can impact investor sentiment), the adoption of Bitcoin by institutional investors and governments, technological advancements in the Bitcoin ecosystem, and regulatory developments worldwide. The interplay of these factors will determine the trajectory of Bitcoin’s price. For example, increased regulatory clarity could boost investor confidence and drive price appreciation, while a global economic downturn might lead to a decrease in Bitcoin’s value as investors seek safer assets.

Safe Buying and Storage of Bitcoin

Buying and storing Bitcoin securely requires careful planning. Reputable cryptocurrency exchanges are the most common method for purchasing Bitcoin. Choosing a well-established exchange with strong security measures is crucial. Once purchased, storing Bitcoin securely is paramount. Hardware wallets, which are physical devices designed to store cryptocurrency offline, are considered the most secure option. Software wallets, which are applications on your computer or smartphone, offer convenience but carry a higher risk of hacking. Never share your private keys with anyone, and be wary of phishing scams. Regularly backing up your wallet and practicing good security hygiene are essential to protecting your Bitcoin investment.

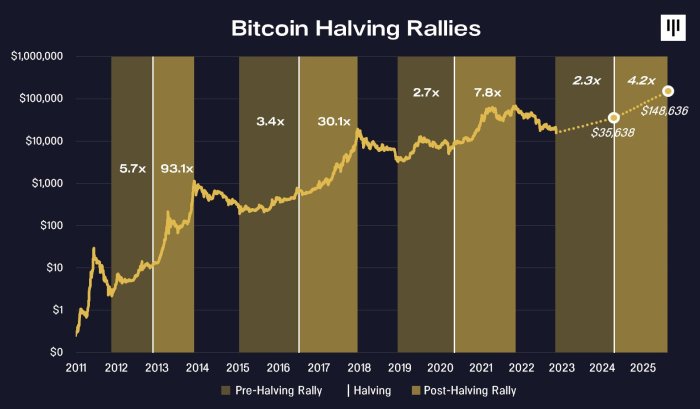

Prediction Of Bitcoin In 2025 – Predicting Bitcoin’s price in 2025 is challenging, with various factors influencing its trajectory. A key event to consider is the upcoming Bitcoin halving, which will significantly impact the rate of new Bitcoin entering circulation. To understand its potential effects, refer to this insightful article on Bitcoin Halving 2025: What Does It Mean? This understanding is crucial for forming a more informed prediction about Bitcoin’s value by 2025.

Predicting Bitcoin’s price in 2025 is challenging, with various factors influencing its trajectory. A key event to consider is the upcoming Bitcoin halving, which will significantly impact the rate of new Bitcoin entering circulation. To understand its potential effects, refer to this insightful article on Bitcoin Halving 2025: What Does It Mean? This understanding is crucial for forming a more informed prediction about Bitcoin’s value by 2025.

Predicting Bitcoin’s price in 2025 is challenging, with various factors influencing its trajectory. A key event to consider is the upcoming Bitcoin halving, which will significantly impact the rate of new Bitcoin entering circulation. To understand its potential effects, refer to this insightful article on Bitcoin Halving 2025: What Does It Mean? This understanding is crucial for forming a more informed prediction about Bitcoin’s value by 2025.

Predicting Bitcoin’s price in 2025 is challenging, influenced by various factors including macroeconomic conditions and technological advancements. A key event to consider when forecasting is the next Bitcoin halving, which significantly impacts the cryptocurrency’s supply. To understand its potential effect, it’s crucial to know precisely when this halving will occur; you can find out more by checking this resource: When In 2025 Is The Next Bitcoin Halving?

. This date is a pivotal element in shaping future price predictions for Bitcoin in 2025.

Predicting Bitcoin’s price in 2025 is challenging, influenced by various factors including macroeconomic conditions and technological advancements. A key event to consider when forecasting is the next Bitcoin halving, which significantly impacts the cryptocurrency’s supply. To understand its potential effect, it’s crucial to know precisely when this halving will occur; you can find out more by checking this resource: When In 2025 Is The Next Bitcoin Halving?

. This date is a pivotal element in shaping future price predictions for Bitcoin in 2025.

Predicting Bitcoin’s price in 2025 is challenging, influenced by various factors including macroeconomic conditions and technological advancements. A key event to consider when forecasting is the next Bitcoin halving, which significantly impacts the cryptocurrency’s supply. To understand its potential effect, it’s crucial to know precisely when this halving will occur; you can find out more by checking this resource: When In 2025 Is The Next Bitcoin Halving?

. This date is a pivotal element in shaping future price predictions for Bitcoin in 2025.