Investment Strategies for Bitcoin in 2025

Predicting Bitcoin’s price in 2025 remains speculative, but understanding various investment strategies can help navigate the market’s volatility. This section Artikels several approaches, categorized by risk tolerance, emphasizing the crucial role of diversification and risk mitigation.

Risk Tolerance and Investment Strategies

Investors should tailor their Bitcoin investment strategy to their individual risk tolerance. A conservative investor might favor lower-risk options, while a more aggressive investor might accept higher risk for potentially greater returns. The following table illustrates different strategies with varying risk profiles.

| Strategy | Risk Level | Potential Returns |

|---|---|---|

| Dollar-Cost Averaging (DCA) | Low to Moderate | Consistent, potentially lower overall returns compared to lump-sum investing if the price significantly increases. |

| Hodling (Long-Term Holding) | Moderate to High | High potential returns if the price appreciates significantly over the long term; significant losses possible if the price decreases. |

| Short-Term Trading | High | Potential for high returns in short periods; also high risk of significant losses due to price volatility. |

| Leveraged Trading | Extremely High | Potential for amplified returns; also extremely high risk of significant losses, potentially exceeding initial investment. |

Diversification in a Bitcoin Portfolio

Diversification is crucial to mitigate risk. Investing solely in Bitcoin exposes your portfolio to significant volatility. A diversified portfolio might include other cryptocurrencies (e.g., Ethereum, Solana), traditional assets (e.g., stocks, bonds), and alternative investments (e.g., real estate). This reduces the impact of any single asset’s price fluctuations on your overall investment. For example, an investor could allocate 20% of their portfolio to Bitcoin, 30% to other cryptocurrencies, and 50% to traditional assets.

Risks Associated with Bitcoin Investment and Mitigation

Bitcoin’s price is notoriously volatile, influenced by regulatory changes, market sentiment, and technological developments. Security risks, such as hacking and theft from exchanges or personal wallets, are also significant concerns. To mitigate these risks:

- Secure Storage: Use hardware wallets for increased security compared to software wallets or exchanges.

- Diversification: Spread your investments across various asset classes to reduce overall portfolio risk.

- Risk Management: Set stop-loss orders to limit potential losses during volatile periods.

- Due Diligence: Thoroughly research any exchange or platform before investing.

- Stay Informed: Keep up-to-date on Bitcoin news and market trends.

Examples of Successful and Unsuccessful Bitcoin Investment Strategies

A successful strategy would involve buying Bitcoin early (e.g., in 2010) and holding it long-term, benefiting from its substantial price appreciation. An unsuccessful strategy might involve investing a large sum in Bitcoin at its peak price and then selling it during a significant market downturn, resulting in substantial losses. Another example of an unsuccessful strategy would be engaging in leveraged trading without proper risk management, leading to liquidation of the position and substantial losses. Conversely, a successful strategy could involve consistently using dollar-cost averaging to accumulate Bitcoin over a prolonged period, mitigating the risk of investing a large sum at an unfavorable price point.

Frequently Asked Questions (FAQs) about Bitcoin in 2025: Prediction On Bitcoin 2025

Predicting the future of Bitcoin is inherently speculative, but by analyzing current trends and considering potential future events, we can form reasonable expectations regarding its performance and associated risks in 2025. This section addresses some frequently asked questions to provide a clearer picture.

Bitcoin’s Price Target in 2025, Prediction On Bitcoin 2025

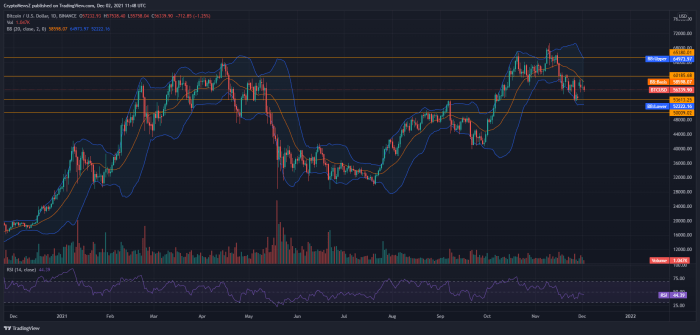

Reaching $100,000 by 2025 is a significant price target for Bitcoin. Several factors could contribute to such growth, including increased adoption by institutional investors, further development of Bitcoin’s underlying technology, and continued global economic uncertainty driving demand for alternative assets. However, equally significant factors could hinder this, such as increased regulatory scrutiny, market corrections, or the emergence of competing cryptocurrencies. While the potential exists, the likelihood is uncertain and dependent on numerous unpredictable variables. For instance, the 2021 bull run saw Bitcoin reach nearly $69,000, demonstrating its potential for rapid growth, but subsequent market corrections highlight its volatility. Predicting a specific price point with certainty is impossible.

Risks Associated with Bitcoin Investment in 2025

Investing in Bitcoin in 2025 carries inherent risks. Volatility remains a primary concern, as Bitcoin’s price can fluctuate dramatically in short periods. Regulatory uncertainty poses another risk, with governments worldwide still grappling with how to regulate cryptocurrencies. Security breaches, both on exchanges and in personal wallets, represent a significant threat to investors’ funds. Furthermore, the decentralized nature of Bitcoin, while a strength, also means there is no central authority to protect investors in case of fraud or loss. Finally, the speculative nature of the market makes it susceptible to market manipulation and pump-and-dump schemes. The 2018 bear market, which saw Bitcoin’s price plummet by over 80%, serves as a stark reminder of these risks.

Safe Bitcoin Investment Practices

Safe Bitcoin investment involves careful consideration of storage and exchange choices. Hardware wallets, such as Ledger or Trezor, provide the most secure method of storing Bitcoin offline, minimizing the risk of hacking. Choosing reputable and regulated cryptocurrency exchanges is crucial; research is essential to avoid scams or exchanges with weak security. Diversification is also key; avoid investing your entire portfolio in Bitcoin. Regularly backing up your private keys and using strong, unique passwords are paramount. Finally, staying informed about security best practices and emerging threats is an ongoing necessity. Consider using multi-signature wallets for added security.

Potential Regulatory Hurdles for Bitcoin in 2025

Regulatory changes concerning Bitcoin in 2025 could significantly impact its price and accessibility. Governments worldwide are actively exploring regulatory frameworks for cryptocurrencies, ranging from outright bans to comprehensive regulatory structures. Increased KYC/AML (Know Your Customer/Anti-Money Laundering) compliance requirements could impact accessibility, particularly for smaller investors. Taxation policies related to Bitcoin transactions also remain a significant uncertainty. The varying approaches taken by different countries create a complex and ever-evolving regulatory landscape. For example, El Salvador’s adoption of Bitcoin as legal tender contrasts sharply with China’s ban on cryptocurrency trading.

Bitcoin as a Long-Term Investment

Bitcoin’s long-term potential as an investment is a subject of ongoing debate. Proponents point to its limited supply (21 million coins), its decentralized nature, and its potential to disrupt traditional financial systems. However, the long-term risks remain substantial. Technological advancements could render Bitcoin obsolete, while regulatory changes could severely limit its utility. Moreover, the long-term price prediction remains highly speculative. Investing in Bitcoin for the long term requires a high tolerance for risk and a deep understanding of the underlying technology and market forces. The historical performance of Bitcoin, which has shown both periods of explosive growth and significant decline, highlights the inherent uncertainties involved in a long-term investment strategy.

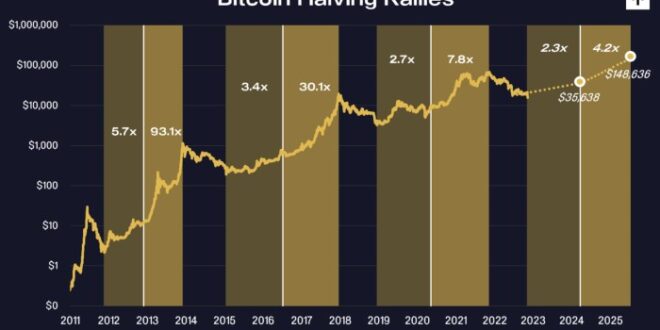

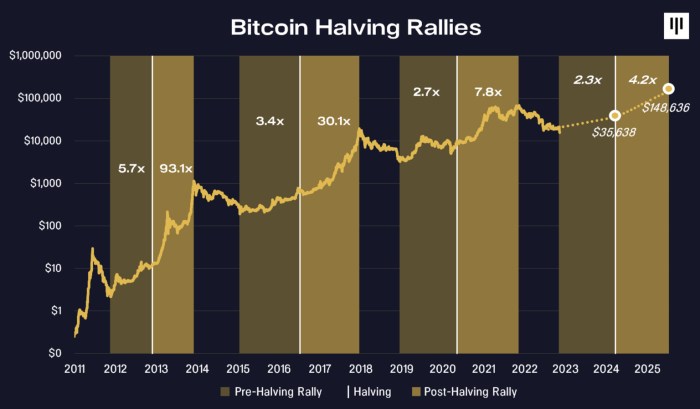

Prediction On Bitcoin 2025 – Predicting Bitcoin’s price in 2025 is challenging, with various factors influencing its trajectory. A key element to consider is the impact of the next Bitcoin halving, which will significantly reduce the rate of new Bitcoin creation. For insightful analysis on this, check out this resource: Bitcoin Halving:Impact On The Market 2025 En.Jmoanews.Com. Understanding the halving’s effects is crucial for any accurate prediction on Bitcoin’s 2025 value.

Predicting Bitcoin’s value in 2025 is a complex endeavor, influenced by numerous factors. A key element to consider is the impact of the upcoming halving event, which will significantly alter the rate of new Bitcoin creation. For a detailed analysis on this crucial aspect, check out this insightful resource on the Bitcoin Prediction 2025 Halving. Understanding the halving’s potential effects is vital for any comprehensive prediction of Bitcoin’s price in 2025.

Predicting Bitcoin’s value in 2025 is a complex endeavor, influenced by numerous factors. A key element to consider is the impact of the upcoming halving event, which will significantly alter the rate of new Bitcoin creation. For a detailed analysis on this crucial aspect, check out this insightful resource on the Bitcoin Prediction 2025 Halving. Understanding the halving’s potential effects is vital for any comprehensive prediction of Bitcoin’s price in 2025.

Predicting Bitcoin’s value in 2025 is a complex endeavor, influenced by numerous factors. A key element to consider is the impact of the upcoming halving event, which will significantly alter the rate of new Bitcoin creation. For a detailed analysis on this crucial aspect, check out this insightful resource on the Bitcoin Prediction 2025 Halving. Understanding the halving’s potential effects is vital for any comprehensive prediction of Bitcoin’s price in 2025.

Predicting Bitcoin’s value in 2025 is a complex endeavor, influenced by numerous factors. A key element to consider is the impact of the upcoming halving event, which will significantly alter the rate of new Bitcoin creation. For a detailed analysis on this crucial aspect, check out this insightful resource on the Bitcoin Prediction 2025 Halving. Understanding the halving’s potential effects is vital for any comprehensive prediction of Bitcoin’s price in 2025.

Predicting Bitcoin’s value in 2025 is a complex endeavor, influenced by numerous factors. A key element to consider is the impact of the upcoming halving event, which will significantly alter the rate of new Bitcoin creation. For a detailed analysis on this crucial aspect, check out this insightful resource on the Bitcoin Prediction 2025 Halving. Understanding the halving’s potential effects is vital for any comprehensive prediction of Bitcoin’s price in 2025.