Bitcoin Halving 2025

The Bitcoin halving is a significant event in the cryptocurrency’s lifecycle, occurring approximately every four years. It involves a reduction in the rate at which new Bitcoins are created, impacting the overall supply and potentially influencing its price. Historically, halvings have been followed by periods of price appreciation, although the extent and duration vary.

Bitcoin Halving Mechanics and Impact on Supply

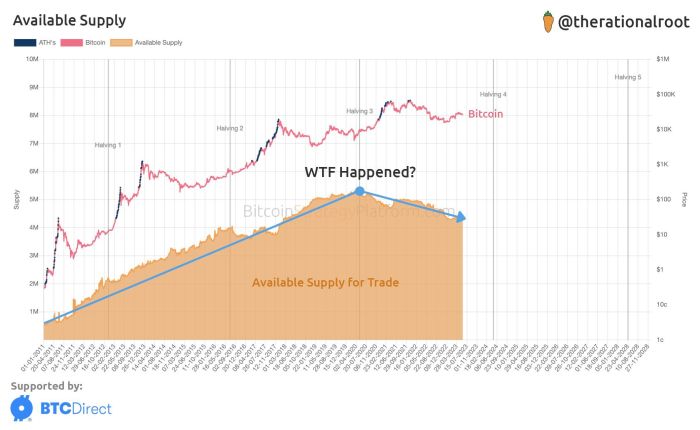

The Bitcoin halving is a programmed event hardcoded into the Bitcoin protocol. It dictates that the reward given to miners for successfully validating and adding new blocks to the blockchain is cut in half. Initially, the reward was 50 BTC per block. After the first halving, it became 25 BTC, then 12.5 BTC, and the next halving in 2025 will reduce it to 6.25 BTC. This controlled reduction in the rate of new Bitcoin creation is designed to create a deflationary pressure on the supply. The halving doesn’t directly increase demand, but it reduces the rate of new Bitcoin entering circulation, potentially leading to increased scarcity and price appreciation if demand remains consistent or increases. The precise effect is difficult to predict definitively, as market dynamics are complex and influenced by many factors beyond the halving itself.

Expected Date and Significance of the 2025 Halving

The 2025 Bitcoin halving is expected to occur around the spring of that year. The exact date depends on the time it takes miners to solve the cryptographic puzzles required to add blocks to the blockchain, a process that can fluctuate slightly. The significance lies in its potential impact on the Bitcoin price. Previous halvings have been followed by periods of substantial price increases, though it is crucial to remember that other factors like regulatory changes, market sentiment, and technological advancements also significantly influence the price. For instance, the halving in 2012 saw a price increase from around $10 to approximately $1,000 over the subsequent years, and the 2020 halving was followed by a price surge to over $60,000 in 2021. However, these are past performances, and future price movements are not guaranteed to follow a similar pattern. It’s essential to approach any predictions with caution.

Historical Impact of Bitcoin Halvings on Price

Analyzing the historical impact of Bitcoin halvings on its price reveals a complex relationship. While both previous halvings were followed by substantial price increases, attributing this solely to the halving itself is an oversimplification. The price surge post-halving is often a confluence of factors, including increased scarcity, anticipation leading up to the event, and broader market trends. Other factors such as adoption rates, technological innovations, regulatory developments, and macroeconomic conditions all play a significant role in determining Bitcoin’s price. Therefore, while the halving is a noteworthy event, it’s just one piece of a larger puzzle when considering Bitcoin’s price trajectory.

Historical Price Analysis of Bitcoin After Previous Halvings

Bitcoin’s price has historically shown interesting patterns following its halving events, where the rate of new Bitcoin creation is cut in half. Analyzing these patterns can offer insights, though it’s crucial to remember that past performance is not indicative of future results. Numerous factors beyond the halving itself influence Bitcoin’s price.

The price movements after each halving have been significantly different, highlighting the complexity of predicting future price behavior. While a general upward trend is often observed, the magnitude and timing of these price increases vary considerably. This variability underscores the importance of considering a multitude of market forces alongside the halving event itself.

Price Movements After Previous Halvings

The following table summarizes Bitcoin’s price performance around its previous halving events. Note that these figures represent approximate values at specific points in time and may vary slightly depending on the data source used. The selection of dates focuses on periods around the halving event itself to highlight the immediate impact. Long-term price movements extend well beyond the timeframe shown here.

| Halving Date | Approximate Price 3 Months Before | Approximate Price at Halving | Approximate Price 3 Months After | Approximate Price 12 Months After | Approximate Price 24 Months After |

|---|---|---|---|---|---|

| November 2012 | ~$12 | ~$13 | ~$100 | ~$1000 | ~$200 |

| July 2016 | ~$650 | ~$650 | ~$750 | ~$10000 | ~$4000 |

| May 2020 | ~$8700 | ~$8700 | ~$11500 | ~$29000 | ~$40000 |

*Note: These prices are approximate and based on various market data sources. Precise figures may vary depending on the exchange and data aggregation methods.*

Factors Influencing Price Changes After Halvings

Several interconnected factors influence Bitcoin’s price trajectory after a halving. These include shifts in market sentiment, regulatory developments, and technological advancements.

Market sentiment plays a significant role. The anticipation of a halving often leads to increased buying pressure as investors speculate on future price appreciation. However, this positive sentiment can be countered by broader market trends or negative news impacting the cryptocurrency space.

Regulatory changes, both favorable and unfavorable, can significantly impact Bitcoin’s price. Clearer regulatory frameworks can increase investor confidence and attract institutional investment, while stricter regulations can dampen price growth.

Technological advancements, such as improved scalability solutions or the development of new applications built on the Bitcoin blockchain, can also affect the price. Positive developments often boost investor confidence and increase demand. Conversely, significant technological setbacks or security vulnerabilities could negatively affect the price.

Factors Influencing Bitcoin’s Price in 2025

Predicting Bitcoin’s price is inherently challenging, given the volatile nature of the cryptocurrency market. However, by analyzing several key factors, we can gain a better understanding of the potential forces shaping its value in 2025. These factors encompass macroeconomic conditions, regulatory landscapes, technological advancements, and the competitive cryptocurrency ecosystem.

Macroeconomic Factors, Price Of Bitcoin At Halving 2025

Global economic conditions significantly influence Bitcoin’s price. High inflation, for instance, can drive investors towards Bitcoin as a hedge against inflation, potentially increasing demand and price. Conversely, rising interest rates, often implemented to combat inflation, can divert investment away from riskier assets like Bitcoin, leading to price decreases. The overall health of the global economy, including factors like recessionary fears or periods of strong economic growth, will also play a crucial role. For example, the 2022 economic downturn saw a significant correction in Bitcoin’s price, mirroring the broader market sentiment.

Regulatory Developments

Regulatory clarity and acceptance are vital for Bitcoin’s mainstream adoption. Favorable regulatory frameworks in major economies could boost investor confidence and increase institutional investment, driving up the price. Conversely, stricter regulations or outright bans could negatively impact Bitcoin’s price by limiting accessibility and hindering its growth. The differing regulatory approaches taken by countries like El Salvador (which adopted Bitcoin as legal tender) and China (which banned Bitcoin trading) illustrate the wide-ranging impact of government policies.

Technological Advancements and Adoption Rates

Technological improvements within the Bitcoin network, such as scaling solutions (Layer-2 technologies) that increase transaction speed and reduce fees, can enhance its usability and attract more users. Widespread adoption by businesses and individuals, fueled by increased ease of use and greater acceptance as a payment method, will directly influence price. The increasing integration of Bitcoin into financial systems, such as the development of Bitcoin ETFs, also contributes to its broader acceptance and potential price appreciation.

Competition from Other Cryptocurrencies

The emergence and growth of competing cryptocurrencies pose a challenge to Bitcoin’s market dominance. The success of alternative cryptocurrencies with innovative features or superior scalability could potentially divert investment away from Bitcoin, affecting its price. However, Bitcoin’s established first-mover advantage, brand recognition, and strong network effect continue to provide it with a significant competitive edge. The relative performance of altcoins compared to Bitcoin in the preceding years will provide insight into future market share dynamics.

Predicting the Price of Bitcoin at the 2025 Halving

Predicting the price of Bitcoin, or any cryptocurrency for that matter, is inherently speculative. While historical data and market analysis can offer valuable insights, numerous unforeseen events can significantly impact price movements. The following scenarios attempt to Artikel potential price ranges around the 2025 halving, acknowledging the inherent limitations of such predictions.

Potential Bitcoin Price Scenarios at the 2025 Halving

The following table presents three distinct price scenarios for Bitcoin around the 2025 halving, encompassing bullish, neutral, and bearish perspectives. These scenarios consider factors such as the halving’s historical impact, macroeconomic conditions, regulatory developments, and overall market sentiment.

| Scenario | Price Range (USD) | Supporting Factors | Potential Risks |

|---|---|---|---|

| Bullish | $150,000 – $250,000 | Strong institutional adoption, continued technological advancements, positive regulatory developments, a generally positive macroeconomic environment, and the historical price increase following previous halvings. This scenario assumes a significant increase in demand exceeding the reduced supply created by the halving. Similar to the price surge after the 2020 halving, though this assumes a more significant jump. | Regulatory crackdowns, unexpected macroeconomic downturns, a major security breach impacting Bitcoin’s reputation, or a significant shift in investor sentiment could dampen the bullish outlook. The high price range represents a significant increase from current levels, and the speed of such an increase carries inherent volatility risks. |

| Neutral | $75,000 – $125,000 | This scenario assumes a more moderate increase in price, reflecting a balance between the positive effects of the halving and potential headwinds. It incorporates a degree of uncertainty regarding macroeconomic factors and regulatory developments. This scenario assumes a continuation of current trends, albeit with the halving’s positive effect being less dramatic than in a bullish scenario. | Uncertain macroeconomic conditions, regulatory uncertainty, and a lack of substantial new adoption could limit price appreciation. This scenario also acknowledges the possibility of sideways price movement for an extended period following the halving. |

| Bearish | $30,000 – $60,000 | This scenario considers the possibility of negative macroeconomic conditions, significant regulatory challenges, or a loss of investor confidence leading to a less pronounced price increase following the halving, or even a price decline. This scenario is based on a more pessimistic outlook, considering the potential for negative global events impacting investor risk appetite. | A severe global recession, significant regulatory setbacks, a major security vulnerability, or a loss of investor confidence could all contribute to a bearish scenario. This scenario considers the potential for a significant correction in the cryptocurrency market as a whole. |

Limitations of Price Predictions

Predicting the price of Bitcoin with certainty is impossible. The cryptocurrency market is highly volatile and influenced by a multitude of factors, including global economic conditions, technological advancements, regulatory changes, and investor sentiment. Historical data can provide valuable context, but past performance is not indicative of future results. Unexpected events, such as a major security breach or a sudden shift in regulatory landscape, can dramatically alter price trajectories. Therefore, the scenarios presented above should be viewed as potential outcomes, not definitive predictions.

Investment Strategies and Risk Management

Investing in Bitcoin, especially around a halving event, presents both significant opportunities and substantial risks. Understanding various investment strategies and implementing robust risk management techniques are crucial for navigating this volatile market. The following sections detail different approaches, their inherent risks, and strategies for mitigating potential losses.

Investment Strategies Before and After the 2025 Halving

Investors can employ several strategies before and after the 2025 Bitcoin halving, each carrying its own risk profile. A crucial aspect is aligning the strategy with individual risk tolerance and investment goals. Some popular approaches include dollar-cost averaging (DCA), lump-sum investment, and tactical asset allocation. DCA involves investing a fixed amount of money at regular intervals, regardless of price fluctuations, reducing the impact of market volatility. A lump-sum investment, on the other hand, involves investing a large sum of money at once, potentially benefiting from lower average purchase prices if the market subsequently rises. Tactical asset allocation involves adjusting the portfolio’s allocation to Bitcoin based on market predictions and analysis. Post-halving, investors may choose to hold (HODL), sell some or all holdings for profit-taking, or rebalance their portfolio to maintain a desired risk level.

Risks Associated with Bitcoin Investment Around the Halving

The Bitcoin halving, while historically correlated with price increases, does not guarantee future price appreciation. Several risks are inherent in Bitcoin investments, particularly around the halving. Volatility remains a primary concern; Bitcoin’s price can experience sharp and unpredictable swings, potentially leading to significant losses. Regulatory uncertainty poses another risk, with governments worldwide grappling with how to regulate cryptocurrencies. Changes in regulations could negatively impact Bitcoin’s price and liquidity. Furthermore, technological risks, such as security breaches or scaling issues within the Bitcoin network, could also affect the price. Finally, market manipulation and speculative bubbles remain potential threats, capable of causing sudden and dramatic price drops. The 2017 bull market, followed by a significant correction, serves as a cautionary tale.

Risk Management Strategies

Effective risk management is paramount when investing in Bitcoin. Diversification is a crucial strategy, spreading investments across different asset classes (stocks, bonds, real estate) to reduce the impact of losses in any single asset. Dollar-cost averaging (DCA), as mentioned earlier, helps mitigate the risk of investing a large sum at a market peak. Setting stop-loss orders can limit potential losses by automatically selling Bitcoin if the price falls below a predetermined level. Thorough research and due diligence are essential before investing, understanding the technology, market dynamics, and associated risks. Finally, only investing what one can afford to lose is a fundamental principle of responsible investing. Avoid using borrowed funds or investing money needed for essential expenses.

Investment Approaches, Risks, and Rewards

| Investment Approach | Risks | Potential Rewards |

|---|---|---|

| Dollar-Cost Averaging (DCA) | Lower potential returns compared to lump-sum investing if the price significantly increases | Reduced risk of investing at market peaks, smoother entry into the market |

| Lump-Sum Investment | High risk of significant losses if the price falls after investment | Higher potential returns if the price significantly increases |

| Tactical Asset Allocation | Requires significant market knowledge and analysis, potential for mistiming the market | Opportunity to maximize returns by adjusting allocation based on market predictions |

| HODLing | Exposure to prolonged periods of price stagnation or decline | Potential for significant long-term gains if the price increases substantially |

Frequently Asked Questions (FAQs)

This section addresses common queries regarding the Bitcoin halving event, its impact on price, and associated investment considerations. Understanding these factors is crucial for navigating the complexities of Bitcoin investment.

Bitcoin Halving and its Price Impact

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created. This occurs approximately every four years, and it halves the block reward miners receive for verifying transactions and adding new blocks to the blockchain. Historically, halvings have been followed by periods of significant price appreciation, though this is not guaranteed. The reduced supply of newly mined Bitcoin, coupled with potentially increasing demand, can create upward pressure on price. However, other market forces, such as regulatory changes or macroeconomic conditions, also play a significant role.

Timing of the Next Bitcoin Halving

The next Bitcoin halving is expected to occur in 2025, around the month of April or May. The exact date depends on the time it takes for miners to solve complex cryptographic puzzles and add new blocks to the blockchain. This date is not fixed and can fluctuate slightly based on network hash rate. Predicting the precise date with certainty is challenging, but the approximate timeframe is widely anticipated within the cryptocurrency community.

Potential Bitcoin Price Scenarios After the 2025 Halving

Predicting the precise price of Bitcoin after the 2025 halving is impossible. Various scenarios are possible, ranging from substantial price increases to more moderate gains or even potential price corrections. Past halvings have been followed by periods of both significant price appreciation and subsequent price drops, demonstrating the volatility inherent in the cryptocurrency market. For example, the 2012 halving was followed by a period of significant growth, while the 2016 halving saw a more gradual increase. The 2020 halving saw a period of significant growth, followed by a substantial correction in 2021. These diverse outcomes highlight the unpredictable nature of Bitcoin’s price trajectory. The price will be heavily influenced by adoption rates, regulatory landscape, and overall market sentiment.

Risks Involved in Investing in Bitcoin

Investing in Bitcoin carries substantial risks. Bitcoin’s price is highly volatile, subject to dramatic swings in short periods. Market manipulation, regulatory uncertainty, security breaches, and technological advancements can all significantly impact its price. Furthermore, Bitcoin is a relatively new asset class, and its long-term viability remains uncertain. The decentralized nature of Bitcoin, while a strength for many, also means there is less regulatory oversight and protection for investors compared to traditional financial markets. Loss of private keys can lead to irreversible loss of funds.

Managing Risk When Investing in Bitcoin

Risk management is crucial for Bitcoin investors. Diversification across various asset classes, including traditional investments, is a key strategy to mitigate losses. Only investing what one can afford to lose is paramount. Thorough research and understanding of the technology and market dynamics are also essential. Using secure storage methods for Bitcoin, such as hardware wallets, is recommended to protect against theft or loss. Staying informed about market trends and regulatory developments is crucial for making informed investment decisions. Consider employing dollar-cost averaging, investing a fixed amount at regular intervals, to mitigate the impact of volatility.

Illustrative Examples: Price Of Bitcoin At Halving 2025

Visual representations are crucial for understanding complex price prediction models and historical Bitcoin price trends. The following examples offer a clearer picture of potential price scenarios and past market behavior.

Chart of Bitcoin Price Prediction Models

This chart displays various price prediction models for Bitcoin’s price at the 2025 halving. The x-axis represents time, specifically leading up to and including the 2025 halving event. The y-axis represents the predicted Bitcoin price in USD. Each line on the chart represents a different prediction model, differentiated by color and legend.

For instance, one line might represent a model based solely on historical price action after previous halvings, assuming a similar percentage increase post-halving. Another line could incorporate on-chain metrics such as the circulating supply and transaction volume, along with macroeconomic factors like inflation rates and regulatory changes. A third model might use a more sophisticated approach, incorporating machine learning algorithms trained on historical Bitcoin price data and other relevant market indicators. The legend clearly identifies each model and its underlying assumptions. The data used for each model would be clearly cited in the chart’s accompanying documentation, referencing sources like historical Bitcoin price data from reputable exchanges (e.g., Coinbase, Binance), on-chain data from sources like Glassnode, and macroeconomic data from sources such as the World Bank or Federal Reserve. Differences in predicted prices stem from the varying weights assigned to different data points and the differing methodologies employed. For example, a model heavily weighted on past halving performance might predict a more conservative price increase compared to a model that incorporates optimistic projections for broader cryptocurrency adoption.

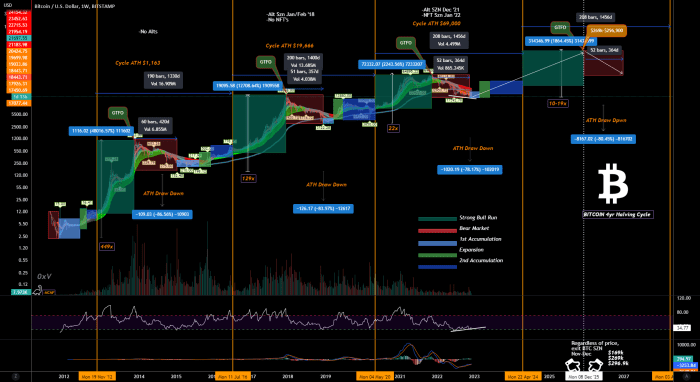

Image Depicting Historical Bitcoin Price Action After Previous Halvings

This image would be a line graph showing the historical price of Bitcoin in USD over time, focusing on the periods immediately following each previous halving event (2012, 2016, 2020). The x-axis would represent time, and the y-axis would represent the Bitcoin price in USD. Key price movements, such as significant peaks (all-time highs) and troughs (market bottoms), would be clearly marked and labeled on the graph. For example, the 2012 halving could be shown to be followed by a significant price increase, reaching a peak before a subsequent correction. Similarly, the 2016 halving would illustrate a period of relatively slower growth initially, followed by a substantial price surge culminating in a new all-time high. The 2020 halving could be depicted with a sharp price increase, followed by a period of consolidation and another significant price rally. The graph would visually highlight the general trend of price appreciation following each halving, while also acknowledging the volatility and periods of correction within these upward trends. The visual representation would allow for a clear comparison of the price action following each halving, providing context for potential price movements following the 2025 halving. The graph would use clear visual cues (e.g., different colors or shading) to delineate the period after each halving event, making it easy to compare the timelines and price trajectories.

Price Of Bitcoin At Halving 2025 – Predicting the Bitcoin price at the 2025 halving is challenging, with various factors influencing the outcome. To keep track of the crucial date itself, you can use a countdown timer like the Bitcoin Halving 2025 Time Clock , which helps monitor the approach of this significant event. Ultimately, the price at the halving will depend on market sentiment and broader economic conditions, making precise forecasting difficult.

Predicting the price of Bitcoin at the 2025 halving is a complex undertaking, influenced by numerous market factors. A key event leading up to this is the Bitcoin Halving in April 2025, as detailed in this informative article: Bitcoin Halving April 2025. This halving will undoubtedly impact the supply dynamics of Bitcoin, and subsequently influence its price in the months and years that follow.

Therefore, understanding the implications of the April 2025 halving is crucial for any analysis of the Bitcoin price at that time.

Predicting the Bitcoin price at the 2025 halving is challenging, with various factors influencing the outcome. Understanding the long-term implications requires considering future halvings; for a detailed look at the events following the 2025 halving, check out this insightful article on Bitcoin Halving After 2025. Ultimately, the price at the 2025 halving will depend on market sentiment and broader economic conditions in the years leading up to it.

Predicting the Bitcoin price at the 2025 halving is a complex undertaking, influenced by numerous factors. To accurately assess potential price movements, understanding the precise timing is crucial; you can find that information by checking this resource on When Was The Bitcoin Halving In 2025. Knowing the exact date allows for more refined price estimations based on historical halving patterns and market sentiment leading up to the event.

Therefore, the date of the halving directly impacts any price prediction for 2025.

Predicting the Bitcoin price at the 2025 halving is challenging, with various factors influencing its trajectory. It’s important to consider related events, such as the impact of the upcoming Bitcoin Cash Halving 2025 , which could indirectly affect Bitcoin’s market dynamics and overall investor sentiment. Ultimately, the price of Bitcoin at its own halving will depend on a complex interplay of market forces and broader economic conditions.

Predicting the price of Bitcoin at the 2025 halving is a complex undertaking, influenced by numerous factors. To gain a better understanding of potential scenarios, exploring various prediction models is crucial. For insightful analysis, check out this comprehensive resource on Bitcoin 2025 Halving Prediction , which helps contextualize the expected price changes around the halving event. Ultimately, the actual Bitcoin price at the 2025 halving remains uncertain but informed speculation is possible.