Key Factors Influencing Bitcoin’s Future Price

Predicting Bitcoin’s price in 2025 is inherently complex, involving a confluence of macroeconomic trends, technological advancements, and regulatory landscapes. Several key factors will significantly shape its trajectory, creating both opportunities and challenges for investors. Understanding these factors is crucial for navigating the volatility inherent in the cryptocurrency market.

Macroeconomic Factors and Bitcoin’s Price

Global economic conditions, inflation rates, and prevailing interest rates will significantly influence Bitcoin’s price in 2025. High inflation, for instance, can drive investors towards alternative assets like Bitcoin as a hedge against currency devaluation. Conversely, rising interest rates can make holding Bitcoin less attractive, as investors may shift towards higher-yielding traditional investments. The overall health of the global economy will also play a crucial role; a recessionary environment might see investors move towards safer assets, potentially depressing Bitcoin’s price, while strong economic growth could fuel further investment. For example, the 2022 bear market saw a significant correlation between rising interest rates and Bitcoin’s price decline, illustrating the sensitivity of the cryptocurrency to macroeconomic shifts.

Technological Advancements and Bitcoin’s Future

Technological advancements within the Bitcoin ecosystem will significantly impact its future price. The development and adoption of layer-2 scaling solutions, such as the Lightning Network, are vital. These solutions aim to improve transaction speed and reduce fees, making Bitcoin more practical for everyday use. Increased institutional adoption, involving larger financial institutions and corporations incorporating Bitcoin into their investment strategies, will also contribute to price appreciation. The ongoing development of more user-friendly wallets and improved infrastructure will also broaden Bitcoin’s appeal and potentially drive up demand. For instance, the growing use of Lightning Network for microtransactions showcases the potential of layer-2 solutions to enhance Bitcoin’s usability and appeal to a wider audience.

Regulatory Frameworks and Government Policies

Government regulations and policies will play a pivotal role in shaping Bitcoin’s price. Clearer regulatory frameworks, providing legal certainty and investor protection, could encourage greater institutional investment and broader market participation, leading to price increases. Conversely, overly restrictive or uncertain regulations could stifle growth and depress prices. Different jurisdictions adopting varying approaches to Bitcoin regulation will create a complex and dynamic environment. For example, El Salvador’s adoption of Bitcoin as legal tender, despite initial volatility, demonstrates the potential impact of government policies on the cryptocurrency’s price. Conversely, China’s crackdown on cryptocurrency mining significantly impacted Bitcoin’s price in the short term, highlighting the considerable influence of governmental actions.

Exploring Different Price Prediction Models

Predicting Bitcoin’s future price is inherently complex, relying on a confluence of factors and employing various analytical approaches. No single model guarantees accuracy, and each possesses strengths and limitations that must be considered. The following explores three prominent methodologies: technical analysis, fundamental analysis, and quantitative models, illustrating their application with examples.

Technical Analysis

Technical analysis focuses on historical price and volume data to identify patterns and predict future price movements. It assumes that market sentiment and price trends are reflected in chart patterns. Technical analysts use various indicators, such as moving averages, relative strength index (RSI), and candlestick patterns, to generate buy and sell signals.

Strengths: Relatively simple to understand and implement; provides visual representations of market trends; can be used to identify potential support and resistance levels.

Limitations: Relies heavily on past performance, which is not necessarily indicative of future results; susceptible to manipulation; subjective interpretation of chart patterns can lead to inconsistencies.

Example: A simple moving average (SMA) calculation could involve averaging the closing prices of Bitcoin over a specific period (e.g., 200 days). If the 200-day SMA is trending upwards, a technical analyst might interpret this as a bullish signal, suggesting a potential price increase. However, this signal alone is insufficient for a robust prediction and needs to be considered alongside other indicators and market context.

Fundamental Analysis

Fundamental analysis evaluates the intrinsic value of Bitcoin based on underlying factors influencing its demand and supply. This includes assessing factors like adoption rate, regulatory developments, technological advancements, macroeconomic conditions, and network security. A higher intrinsic value suggests a potential for price appreciation.

Strengths: Considers the underlying drivers of Bitcoin’s value; provides a more holistic perspective than technical analysis; less susceptible to short-term market noise.

Limitations: Requires in-depth knowledge of the cryptocurrency ecosystem and broader macroeconomic factors; difficult to quantify certain qualitative factors; predictions can be sensitive to assumptions and estimations.

Example: A fundamental analyst might project Bitcoin’s price based on its adoption as a store of value, considering factors like increasing institutional investment and growing global awareness. If they estimate that Bitcoin’s market capitalization will reach a certain level by 2025, based on projected adoption rates, they can then derive a corresponding price prediction. This would, however, depend on assumptions about the total number of Bitcoins in circulation and the overall market sentiment.

Quantitative Models

Quantitative models utilize statistical and mathematical techniques to forecast Bitcoin’s price. These models can incorporate various factors, including historical price data, macroeconomic indicators, and social media sentiment, to generate price predictions. Examples include time series models (like ARIMA) and machine learning algorithms.

Strengths: Can incorporate a large amount of data; can identify complex relationships between variables; potentially more objective than technical or fundamental analysis.

Limitations: Requires advanced statistical and programming skills; model accuracy depends heavily on data quality and model selection; prone to overfitting, where the model performs well on historical data but poorly on future data. Furthermore, unpredictable events (e.g., regulatory crackdowns, major security breaches) can significantly impact accuracy.

Example: A simple linear regression model could be used to predict Bitcoin’s price based on its historical price and other relevant factors. The model would estimate a linear relationship between these variables and project the price based on projected values of the independent variables in 2025. However, the accuracy of this prediction depends heavily on the accuracy of the projections of the independent variables and the assumption that the linear relationship will continue to hold. A more sophisticated model, such as a neural network, could capture more complex non-linear relationships, but would also require more data and expertise.

Potential Price Scenarios for Bitcoin in 2025

Predicting Bitcoin’s price five years out is inherently speculative, relying on extrapolations from current trends and educated guesses about future developments. However, by considering various economic and technological factors, we can construct plausible scenarios to illustrate potential price ranges. These scenarios are not predictions, but rather thought experiments to highlight the range of possibilities.

Bullish Scenario: Bitcoin as Digital Gold

This scenario assumes widespread adoption of Bitcoin as a store of value, similar to gold. Increased institutional investment, coupled with a growing understanding of Bitcoin’s scarcity and decentralized nature, drives demand significantly. Government regulations become more favorable, clarifying its legal status and facilitating broader usage. Technological advancements improve transaction speeds and scalability, addressing some of Bitcoin’s current limitations.

The economic factors driving this scenario include a potential flight to safety from traditional assets during times of economic uncertainty, and increased demand from investors seeking diversification and inflation hedging. Technological factors involve improvements in layer-2 scaling solutions, such as the Lightning Network, enhancing Bitcoin’s usability for everyday transactions. This increased adoption and utility could propel Bitcoin’s price significantly higher.

Bearish Scenario: Regulatory Crackdown and Market Correction

This scenario envisions a more pessimistic outlook, driven by increased regulatory scrutiny and a broader cryptocurrency market correction. Governments worldwide might implement stricter regulations, hindering Bitcoin’s adoption and potentially leading to a decline in market capitalization. A major security breach or unforeseen technological flaw could also erode investor confidence. Furthermore, a prolonged period of economic stability might reduce the demand for Bitcoin as a safe haven asset.

Economically, this scenario assumes a period of relative global economic stability, reducing the need for alternative assets. Technological setbacks, such as a significant security vulnerability, could trigger a significant price drop. This scenario highlights the inherent risks associated with investing in cryptocurrencies, especially in the face of uncertain regulatory environments.

Neutral Scenario: Gradual Growth and Consolidation

This scenario represents a more moderate outlook, where Bitcoin experiences gradual price appreciation alongside broader market growth. Technological advancements continue to improve the network’s efficiency, but regulatory uncertainty persists, limiting mass adoption. The market stabilizes, with price fluctuations remaining within a relatively predictable range. Institutional investment continues at a moderate pace, without a significant surge or decline.

Economically, this scenario anticipates a steady global economic growth, with Bitcoin maintaining its position as a niche asset rather than a mainstream investment. Technologically, improvements are made, but they do not drastically alter the overall landscape. This scenario represents a more balanced perspective, acknowledging both the potential for growth and the inherent risks and uncertainties in the cryptocurrency market.

| Scenario Name | Price Range (USD) | Supporting Factors |

|---|---|---|

| Bullish: Digital Gold | $150,000 – $250,000 | Widespread adoption, institutional investment, favorable regulations, technological improvements |

| Bearish: Regulatory Crackdown | $10,000 – $30,000 | Increased regulation, market correction, security breaches, economic stability |

| Neutral: Gradual Growth | $50,000 – $100,000 | Moderate adoption, steady technological improvements, persistent regulatory uncertainty |

Risks and Uncertainties Associated with Price Predictions

Predicting Bitcoin’s price in 2025, or any future date, is inherently fraught with uncertainty. Numerous factors influence its value, many of which are unpredictable and interconnected, making accurate forecasting exceptionally challenging. While various models attempt to quantify these influences, the inherent volatility of the cryptocurrency market renders even the most sophisticated predictions unreliable.

The inherent limitations of price prediction models stem from the novelty of Bitcoin and the cryptocurrency market itself. Unlike traditional assets with long historical data sets, Bitcoin’s relatively short lifespan limits the accuracy of statistical analysis and predictive algorithms. Furthermore, the cryptocurrency market is susceptible to rapid and significant shifts driven by factors outside the scope of typical financial modeling, making it difficult to account for all variables influencing price.

Impact of Unexpected Events

Unexpected events, often referred to as “black swan” events, can dramatically impact Bitcoin’s price. These are unforeseen occurrences with significant consequences, defying conventional probability assessments. For example, the collapse of FTX in 2022 sent shockwaves through the entire cryptocurrency market, causing a significant drop in Bitcoin’s price. Similarly, a major security breach targeting a major cryptocurrency exchange or a significant regulatory crackdown could trigger substantial price volatility. These events are, by definition, difficult to predict, highlighting the inherent risk in any price forecast. The 2010 Mt. Gox hack, for instance, although smaller in scale than the FTX collapse, also resulted in significant price fluctuations and demonstrated the vulnerability of the ecosystem to such events.

Importance of Risk Management

Given the inherent uncertainties, effective risk management is paramount for investors in the cryptocurrency market. This involves diversifying investments across different asset classes, not just concentrating solely on Bitcoin. It also requires setting realistic expectations, understanding that significant losses are possible, and only investing capital one can afford to lose. Sophisticated investors might employ hedging strategies to mitigate potential losses. For example, they might use derivatives or other instruments to offset potential price declines. Furthermore, staying informed about market developments, technological advancements, and regulatory changes is crucial for navigating the inherent risks associated with Bitcoin investment. Regularly reviewing one’s investment strategy and adjusting it in response to changing market conditions is a key aspect of effective risk management in this volatile space.

Investment Strategies and Considerations

Investing in Bitcoin, like any other volatile asset, requires careful consideration of your risk tolerance and a well-defined investment strategy. The potential for high returns is matched by the potential for significant losses, making a thorough understanding of various approaches crucial before committing any capital. This section Artikels several strategies and highlights the importance of due diligence.

Dollar-Cost Averaging

Dollar-cost averaging (DCA) is a strategy where you invest a fixed amount of money at regular intervals, regardless of the price. This mitigates the risk of investing a lump sum at a market peak. For example, if you invest $100 per week into Bitcoin, you’ll buy more Bitcoin when the price is low and fewer when the price is high, averaging out your purchase price over time. This reduces the impact of short-term price volatility on your overall investment. While it doesn’t guarantee profits, it can help to reduce the emotional impact of market fluctuations and potentially lower your average purchase cost.

Diversification

Diversification is a fundamental principle of investing. It involves spreading your investments across different asset classes to reduce overall portfolio risk. Investing solely in Bitcoin exposes you to significant volatility. A diversified portfolio might include a mix of Bitcoin, other cryptocurrencies (like Ethereum), traditional assets (stocks, bonds), and potentially real estate. The specific allocation depends on your risk tolerance and financial goals. For instance, a risk-averse investor might allocate a smaller percentage of their portfolio to Bitcoin, while a more risk-tolerant investor might allocate a larger percentage. This approach helps to cushion potential losses in one asset class with gains in another.

Thorough Due Diligence, Price Prediction For Bitcoin 2025

Before investing in Bitcoin, conducting thorough due diligence is paramount. This involves understanding the underlying technology (blockchain), the regulatory landscape (which varies significantly by country), and the potential risks associated with cryptocurrency investments. Researching the history of Bitcoin’s price movements, understanding market sentiment, and analyzing the technological advancements within the Bitcoin ecosystem are all critical components of due diligence. It’s also important to understand the security risks involved, such as the potential for hacking or loss of private keys.

Risks Associated with Volatile Assets

Investing in volatile assets like Bitcoin carries inherent risks. Price fluctuations can be dramatic, leading to substantial losses in short periods. Market manipulation, regulatory changes, and technological disruptions can all significantly impact Bitcoin’s price. It’s crucial to only invest what you can afford to lose and to be prepared for the possibility of significant losses. For example, the Bitcoin price experienced a significant drop in 2022, highlighting the potential for substantial losses. Investors should understand and accept these risks before entering the market. Furthermore, the lack of regulatory oversight in some jurisdictions adds another layer of complexity and risk.

Frequently Asked Questions (FAQ): Price Prediction For Bitcoin 2025

This section addresses common questions regarding Bitcoin’s price prediction for 2025 and investing in cryptocurrencies. Understanding these aspects is crucial for making informed decisions.

Main Factors Influencing Bitcoin’s Price

Bitcoin’s price is influenced by a complex interplay of factors. Supply and demand dynamics are paramount, with adoption rates, regulatory changes, macroeconomic conditions (inflation, interest rates), and technological developments playing significant roles. Media sentiment and large-scale investor activity (institutional and retail) also exert considerable influence. For example, positive news about Bitcoin adoption by major corporations can drive prices up, while negative regulatory announcements can lead to price drops.

Accuracy of Bitcoin Price Predictions

Bitcoin price predictions are inherently uncertain. The cryptocurrency market is highly volatile and influenced by numerous unpredictable factors. Models, while helpful, rely on historical data and assumptions that may not hold true in the future. Therefore, any prediction should be viewed with caution, acknowledging the significant margin of error involved. Past performance is not indicative of future results, and unexpected events can drastically alter price trajectories. For instance, the unforeseen collapse of a major cryptocurrency exchange could trigger a significant market downturn, regardless of any prior prediction.

Safety of Investing in Bitcoin

Investing in Bitcoin carries significant risk. Its price volatility is substantial, meaning substantial gains can be offset by equally substantial losses. The cryptocurrency market is relatively unregulated in many jurisdictions, exposing investors to fraud and scams. Furthermore, Bitcoin’s value is entirely dependent on market sentiment and technological developments, factors outside of individual investor control. However, potential rewards can be substantial for those willing to tolerate the risk, as Bitcoin’s price has historically demonstrated periods of significant growth. Diversification of investments is essential to mitigate risk.

Alternative Investment Options

Diversifying your investment portfolio is crucial to mitigate risk. Alternative options include traditional assets like stocks, bonds, and real estate, which generally exhibit lower volatility than Bitcoin. Precious metals like gold can also act as a hedge against inflation and market uncertainty. Other cryptocurrencies offer diversification within the digital asset space, but each carries its own unique set of risks. Investing in index funds or exchange-traded funds (ETFs) can provide exposure to a broader range of assets, reducing reliance on any single investment’s performance. For example, investing in a diversified S&P 500 index fund offers exposure to a wide range of large-cap US companies, reducing the risk associated with investing in a single stock.

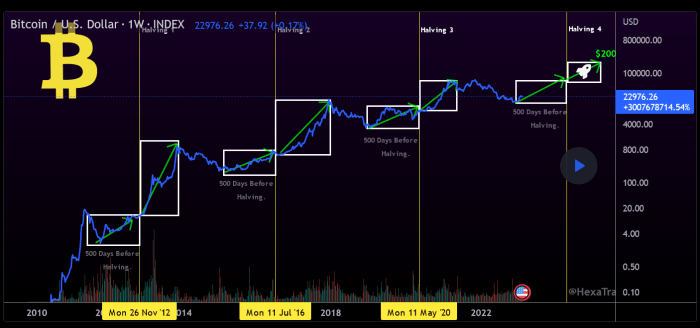

Price Prediction For Bitcoin 2025 – Predicting Bitcoin’s price in 2025 is challenging, influenced by numerous factors. A key event impacting these predictions is the Bitcoin Halving, significantly altering the rate of new Bitcoin entering circulation. To understand the timing of this crucial event, check the confirmed date on this resource: Bitcoin Halving Event 2025 Date. This halving will likely have a substantial effect on the price prediction for Bitcoin in 2025, making it a focal point for analysts.

Predicting Bitcoin’s price in 2025 is challenging, heavily influenced by various factors including the halving events. Understanding the impact of these events is crucial; for instance, to accurately gauge future price movements, one must know precisely when the next halving occurred, which you can find out by checking this resource: When Did The Bitcoin Halving Happen 2025.

This information then allows for a more informed prediction of Bitcoin’s price trajectory in 2025, considering the reduced supply post-halving.

Predicting Bitcoin’s price in 2025 is challenging, influenced by various factors including technological advancements and market sentiment. A key event impacting these predictions is the Bitcoin halving, significantly altering the rate of new Bitcoin entering circulation. To understand the timing of this crucial event, check out this resource on ¿Cuándo Es El Halving De Bitcoin 2025? which will help you better contextualize potential price movements for Bitcoin in 2025.

Ultimately, the halving’s impact on scarcity and demand will play a major role in future price forecasts.

Predicting Bitcoin’s price in 2025 is challenging, influenced by various factors including technological advancements and market sentiment. A key event impacting these predictions is the Bitcoin halving, significantly altering the rate of new Bitcoin entering circulation. To understand the timing of this crucial event, check out this resource on ¿Cuándo Es El Halving De Bitcoin 2025? which will help you better contextualize potential price movements for Bitcoin in 2025.

Ultimately, the halving’s impact on scarcity and demand will play a major role in future price forecasts.

Predicting Bitcoin’s price in 2025 is challenging, influenced by various factors including technological advancements and market sentiment. A key event impacting these predictions is the Bitcoin halving, significantly altering the rate of new Bitcoin entering circulation. To understand the timing of this crucial event, check out this resource on ¿Cuándo Es El Halving De Bitcoin 2025? which will help you better contextualize potential price movements for Bitcoin in 2025.

Ultimately, the halving’s impact on scarcity and demand will play a major role in future price forecasts.

Predicting Bitcoin’s price in 2025 is challenging, influenced by various factors including technological advancements and market sentiment. A key event impacting these predictions is the Bitcoin halving, significantly altering the rate of new Bitcoin entering circulation. To understand the timing of this crucial event, check out this resource on ¿Cuándo Es El Halving De Bitcoin 2025? which will help you better contextualize potential price movements for Bitcoin in 2025.

Ultimately, the halving’s impact on scarcity and demand will play a major role in future price forecasts.