Bitcoin Halving 2025

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created. This occurs approximately every four years, and significantly impacts the inflation rate of Bitcoin, influencing its overall supply and potentially its market price. Understanding this event is crucial for anyone interested in Bitcoin’s long-term trajectory.

Bitcoin Halving: A Simplified Explanation

The Bitcoin halving cuts the reward given to Bitcoin miners who verify transactions and add new blocks to the blockchain in half. Before the first halving, miners received 50 BTC for each block mined. Each halving reduces this reward. This controlled reduction in new Bitcoin supply is a core feature designed to make Bitcoin a deflationary asset in the long run. The halving directly affects the rate at which new Bitcoins enter circulation, impacting the overall supply available.

Historical Halvings and Price Effects

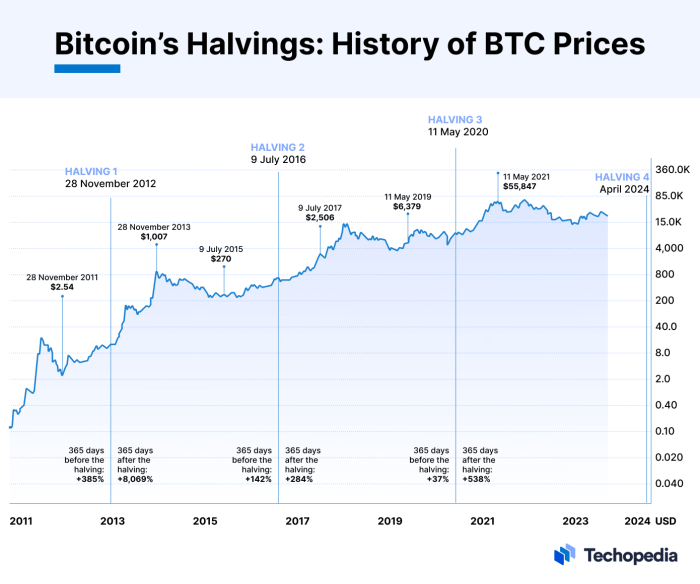

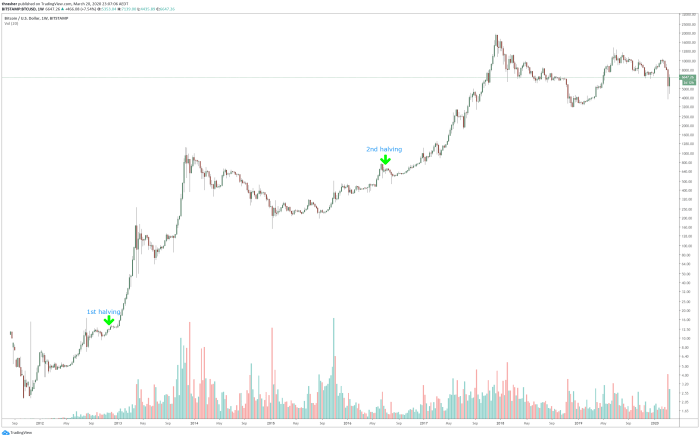

Historically, Bitcoin halvings have been followed by periods of significant price appreciation. While correlation doesn’t equal causation, and other factors influence Bitcoin’s price, the halvings have consistently coincided with bullish market trends. It’s important to note that the price increase isn’t immediate; it often takes time for the market to fully react to the reduced supply. Several factors, including overall market sentiment, regulatory changes, and technological advancements, also play a crucial role.

Timeline of Past Halvings and Price Movements

The following table summarizes the key dates and approximate price movements around past Bitcoin halvings. Note that these are approximations, and the precise price movements are subject to interpretation depending on the timeframe considered.

| Halving Date | Approximate Bitcoin Price (USD) Before Halving | Approximate Bitcoin Price (USD) After Halving (Peak) | Time to Peak (Approximate) |

|---|---|---|---|

| November 28, 2012 | ~$13 | ~$1,147 | ~1 year |

| July 9, 2016 | ~$650 | ~$20,000 | ~1.5 years |

| May 11, 2020 | ~$8,700 | ~$69,000 | ~1 year |

Comparison of Past Halvings

The following bullet points compare key metrics from the past halvings. It is important to remember that each halving occurs in a different macroeconomic and technological environment, making direct comparisons challenging.

- Block Reward Reduction: Each halving consistently reduces the block reward by 50%.

- Time to Peak Price After Halving: While there’s a general upward trend in price following each halving, the time it takes to reach a peak varies significantly.

- Magnitude of Price Increase: The percentage increase in Bitcoin’s price following each halving has differed considerably, influenced by numerous market factors beyond the halving itself.

- Pre-Halving Price Volatility: The level of price volatility leading up to each halving has also varied.

The Mechanics of the Halving

The Bitcoin halving is a programmed event that occurs approximately every four years, reducing the rate at which new Bitcoins are created. This mechanism is fundamental to Bitcoin’s deflationary nature and is designed to control its supply. Understanding its mechanics is crucial to grasping its impact on the cryptocurrency’s value and network security.

The halving process directly affects the block reward miners receive for successfully adding new blocks to the blockchain. This reward, initially set at 50 BTC per block, is halved with each halving event. For instance, after the 2012 halving, the reward became 25 BTC, then 12.5 BTC after the 2016 halving, and currently stands at 6.25 BTC. The 2025 halving will further reduce this to 3.125 BTC. This reduction in reward is hardcoded into the Bitcoin protocol and cannot be altered.

Impact on Mining Difficulty and Security

The reduction in block rewards directly influences the economics of Bitcoin mining. Miners must constantly compete to solve complex cryptographic puzzles to validate transactions and add new blocks to the blockchain. The difficulty of these puzzles dynamically adjusts to maintain a consistent block generation time of approximately ten minutes. As the block reward decreases, less profitable mining operations become unsustainable, leading to a natural attrition of less efficient miners. This, however, doesn’t necessarily compromise network security, as the remaining miners tend to be those with more efficient equipment and lower operational costs. The halving can therefore lead to a consolidation of mining power in the hands of larger, more established players, strengthening the network’s overall security against attacks. However, it’s important to note that this increased centralization could raise concerns regarding network resilience and potential vulnerabilities.

Comparison with Previous Halvings

The 2025 halving will differ from previous halvings in several ways. The mining landscape has significantly changed since the first halving in 2012. The early days saw a relatively decentralized mining environment with individual miners using readily available hardware. Subsequently, large-scale, specialized mining operations (often utilizing ASICs – Application-Specific Integrated Circuits) have emerged, dominating the mining landscape. The increasing dominance of large mining pools might exacerbate the centralization concerns mentioned earlier. Furthermore, the overall cost of electricity and the regulatory environment surrounding Bitcoin mining have also significantly evolved, impacting the profitability and feasibility of mining operations. While previous halvings saw price increases following the event, the magnitude and timing of such price movements are uncertain for 2025, given the evolved market dynamics.

Impact on the Bitcoin Ecosystem

The halving’s impact extends beyond the realm of mining. The reduced supply of newly minted Bitcoins can influence its scarcity and potentially drive up its price. This price increase can stimulate further adoption and investment, creating a positive feedback loop. However, it’s important to note that other factors, such as regulatory changes, macroeconomic conditions, and market sentiment, also play a crucial role in determining Bitcoin’s price. Furthermore, the halving can affect the broader cryptocurrency market, influencing the prices and activity of altcoins. The reduced miner revenue could also potentially impact the development and innovation within the Bitcoin ecosystem, as miners’ incentives to support the network might be affected. The long-term effects will depend on the interplay of these various factors.

Predicting the Impact of the 2025 Halving: Que Es El Halving Bitcoin 2025

Predicting Bitcoin’s price after a halving is notoriously difficult, as numerous interconnected factors influence the market. While the halving itself reduces the rate of new Bitcoin entering circulation, thereby potentially increasing scarcity and driving up demand, other market forces can significantly impact the outcome. Understanding these forces is crucial for forming a reasoned prediction.

Factors Influencing Bitcoin’s Price Post-Halving

Several key factors will play a crucial role in determining Bitcoin’s price trajectory following the 2025 halving. These include macroeconomic conditions (global inflation, recessionary fears, interest rate hikes), regulatory developments (new laws impacting cryptocurrency trading or mining), technological advancements (layer-2 scaling solutions, improved security), and overall investor sentiment (fear, uncertainty, and doubt, or FUD, versus greed and excitement). The interplay of these factors will ultimately shape the market’s response to the reduced Bitcoin supply.

Potential Price Increase Scenarios

A bullish scenario following the 2025 halving could see a significant price increase. This would likely be driven by a combination of factors: increased scarcity of Bitcoin due to the halving, strong institutional adoption, continued growth in the overall cryptocurrency market, and positive macroeconomic conditions. For example, if global inflation remains high and traditional financial assets underperform, investors may seek refuge in Bitcoin as a hedge against inflation, pushing prices higher. This is similar to what happened in previous halving cycles, albeit with varying degrees of success.

Potential Price Decrease Scenarios

Conversely, a bearish scenario is also possible. A prolonged period of macroeconomic uncertainty, stringent regulations, a major security breach affecting the Bitcoin network, or a significant loss of investor confidence could all contribute to a price decrease despite the halving. For instance, if a major cryptocurrency exchange experiences a catastrophic failure, it could trigger a sell-off across the market, including Bitcoin, regardless of the halving’s impact on supply. Such a scenario could outweigh the scarcity effect of the halving.

Comparison of Market Analyses and Predictions

Various market analysts and prediction models offer differing perspectives on the 2025 halving’s impact. Some analysts, basing their predictions on historical price action following previous halvings, anticipate a substantial price increase. Others are more cautious, emphasizing the influence of macroeconomic conditions and regulatory risks. There is no single consensus view; the range of predictions reflects the inherent uncertainty of the cryptocurrency market. It’s important to note that past performance is not necessarily indicative of future results.

Potential Price Movement Summary

| Scenario | Price Movement | Contributing Factors |

|---|---|---|

| Bullish | Significant Price Increase | Increased scarcity, strong institutional adoption, positive macroeconomic conditions, positive investor sentiment. |

| Bearish | Price Decrease or Stagnation | Macroeconomic uncertainty, stringent regulations, negative investor sentiment, major market events (e.g., exchange failures). |

| Neutral | Moderate Price Increase or Sideways Movement | Balanced interplay of bullish and bearish factors. |

Investing and Trading Strategies Around the Halving

The Bitcoin halving, a significant event in the cryptocurrency’s lifecycle, presents both opportunities and challenges for investors and traders. Understanding the potential impact and employing suitable strategies is crucial for navigating the market volatility that often accompanies this event. The following Artikels several approaches, highlighting their associated risks and rewards.

Potential Investment Strategies

Investors considering the 2025 halving have several strategic options. The choice depends largely on individual risk tolerance and investment horizon. A diversified approach is generally recommended to mitigate potential losses.

- Dollar-Cost Averaging (DCA): This strategy involves investing a fixed amount of money at regular intervals, regardless of price fluctuations. DCA reduces the risk of investing a large sum at a market peak. For example, an investor might choose to invest $100 per week into Bitcoin leading up to and following the halving.

- Buy and Hold: This long-term strategy focuses on acquiring Bitcoin and holding it for an extended period, irrespective of short-term price movements. The belief is that the halving’s deflationary pressure will drive long-term price appreciation. This strategy is suitable for investors with a high risk tolerance and a long-term investment horizon.

- Value Investing: This approach involves identifying undervalued assets based on fundamental analysis. In the context of Bitcoin, this could involve assessing its network effects, adoption rate, and overall utility to determine if its current price accurately reflects its intrinsic value. This approach requires significant market research and understanding.

Risks and Rewards of Trading Strategies

Trading strategies around the halving offer higher potential returns but also carry significantly increased risk. Successful execution requires a deep understanding of market dynamics and technical analysis.

- Short-Term Trading: This involves attempting to profit from short-term price fluctuations before and after the halving. This strategy is highly risky due to the inherent volatility of Bitcoin. Successful short-term trading often relies on precise timing and accurate prediction of market movements, which is difficult even for experienced traders. Significant losses are possible.

- Swing Trading: This involves holding Bitcoin for a few days or weeks, capitalizing on medium-term price swings. This approach is less risky than short-term trading but still requires careful analysis and risk management. Swing trading might involve identifying support and resistance levels to enter and exit trades strategically.

- Options Trading: Options contracts allow investors to buy or sell Bitcoin at a predetermined price within a specific timeframe. This offers leverage and potential for higher returns but also carries the risk of significant losses if the market moves against the investor’s position. Options trading requires a sophisticated understanding of derivatives markets.

Risk Management in Bitcoin Halving Volatility

Effective risk management is paramount when navigating the volatility surrounding the halving. Losses can be substantial if proper precautions aren’t taken.

Que Es El Halving Bitcoin 2025 – Diversification across different asset classes is crucial to reduce overall portfolio risk. Never invest more than you can afford to lose. Setting stop-loss orders to limit potential losses on individual trades is a vital risk management tool. Regularly reviewing and adjusting your investment strategy based on market conditions is also essential. Finally, thorough research and understanding of the market are paramount before making any investment decisions.

Understanding “Que Es El Halving Bitcoin 2025” involves grasping the core concept of Bitcoin’s reward halving. This event, which significantly impacts the cryptocurrency’s inflation rate, is scheduled for 2025. To pinpoint the precise date, a helpful resource is available at Bitcoin Halving 2025 Time. Knowing this date allows for better predictions regarding Bitcoin’s future price and market behavior, furthering our understanding of Que Es El Halving Bitcoin 2025.

Hypothetical Investment Plan

The following Artikels a hypothetical investment plan, catering to different risk tolerances:

| Risk Tolerance | Strategy | Allocation | Rationale |

|---|---|---|---|

| Low | DCA into Bitcoin and stablecoins | 60% stablecoins, 40% Bitcoin | Minimizes risk while gaining exposure to Bitcoin’s potential appreciation. |

| Medium | DCA into Bitcoin, Ethereum, and a diversified portfolio of other assets | 30% Bitcoin, 20% Ethereum, 50% other assets | Diversifies risk across multiple assets while maintaining exposure to cryptocurrencies. |

| High | Swing trading and short-term Bitcoin trading with a portion in a long-term buy-and-hold strategy | 70% active trading, 30% long-term hold | High potential returns but significant risk; requires expertise and careful risk management. |

Long-Term Implications of the Halving

The Bitcoin halving, a pre-programmed event reducing the rate of new Bitcoin creation, has significant long-term implications extending far beyond the immediate price volatility often observed around the event itself. Understanding these long-term effects is crucial for investors, developers, and anyone interested in the future of Bitcoin and the broader cryptocurrency landscape. The halving’s impact on scarcity, adoption, and value proposition will shape Bitcoin’s trajectory for years to come.

The halving directly affects Bitcoin’s scarcity, a core tenet of its value proposition. By reducing the supply of newly minted Bitcoin, each existing Bitcoin becomes proportionally more valuable. This inherent scarcity, coupled with increasing demand, is predicted to exert upward pressure on price over the long term. However, the magnitude of this price increase is subject to various market factors, including overall economic conditions, regulatory changes, and the adoption rate of Bitcoin as a store of value and medium of exchange. Historical data from previous halvings suggests a correlation between the halving events and subsequent price increases, although the timing and extent of these increases have varied.

Bitcoin’s Role as a Store of Value

The halving reinforces Bitcoin’s potential as a store of value. By reducing inflation inherent in its issuance mechanism, Bitcoin aims to mirror the properties of precious metals like gold, which have historically served as reliable stores of value due to their scarcity and limited supply. Increased scarcity, driven by the halving, could further enhance Bitcoin’s appeal to investors seeking to hedge against inflation or diversify their portfolios. The long-term success of Bitcoin in this role depends on its ability to maintain its security, network stability, and adoption among institutional and individual investors. The growing institutional interest in Bitcoin suggests a positive trend in this direction.

Bitcoin’s Adoption and Market Position, Que Es El Halving Bitcoin 2025

The long-term effects of the halving on Bitcoin’s adoption are complex and intertwined with broader technological and societal trends. A higher price, potentially driven by the halving-induced scarcity, could either accelerate or hinder adoption depending on the overall market sentiment and economic conditions. Increased price could make Bitcoin less accessible to a broader audience, potentially slowing adoption. Conversely, the perception of scarcity and the potential for future price appreciation could attract new users and investors. The halving’s impact on Bitcoin’s market position relative to other cryptocurrencies will also depend on the innovation and adoption rates within the broader cryptocurrency market. The success of competing cryptocurrencies with different mechanisms and features could influence Bitcoin’s dominance in the long term.

Comparison with Other Assets

Comparing Bitcoin’s long-term potential with other cryptocurrencies and traditional assets reveals a nuanced picture. While some altcoins aim to offer enhanced functionality or scalability, Bitcoin’s first-mover advantage, established network effect, and proven track record contribute to its unique position. Its comparison to traditional assets like gold involves examining its characteristics as a store of value, considering factors such as volatility, liquidity, and regulatory oversight. Unlike gold, Bitcoin is a digital asset with unique properties, such as programmability and transparency, that could offer advantages in the long term. However, its volatility remains a significant factor differentiating it from more stable traditional assets.

Broader Implications for the Cryptocurrency Market

The Bitcoin halving’s impact extends beyond Bitcoin itself, influencing the broader cryptocurrency market. The event often triggers increased attention and investment in the cryptocurrency space as a whole, potentially boosting the prices of other cryptocurrencies alongside Bitcoin. However, this effect is not guaranteed, and the impact on other cryptocurrencies can vary depending on their correlation with Bitcoin and their individual market dynamics. A significant price increase in Bitcoin could lead to a “bull market” effect, attracting new investors and driving overall market capitalization higher. Conversely, a lack of significant price movement following the halving could lead to a period of consolidation or even a bearish market sentiment. The halving acts as a significant catalyst for market dynamics, but its ultimate impact is shaped by numerous interacting factors.

Frequently Asked Questions (FAQs)

This section addresses common queries regarding the Bitcoin halving, providing clarity on its mechanics, impact, and long-term implications. Understanding these aspects is crucial for anyone interested in navigating the cryptocurrency market.

Bitcoin Halving Explained

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created. This occurs approximately every four years, halving the block reward that miners receive for verifying transactions and adding new blocks to the blockchain. For example, the reward started at 50 BTC per block and has been halved three times already, currently standing at 6.25 BTC per block.

Date of the Next Bitcoin Halving

The next Bitcoin halving is projected to occur around April 2024. The precise date depends on the time it takes for miners to solve complex cryptographic puzzles and add new blocks to the blockchain, a process that naturally fluctuates.

The Halving’s Effect on Bitcoin’s Price

Historically, Bitcoin’s price has tended to increase following a halving event. This is largely attributed to the reduced supply of new Bitcoins entering the market, potentially increasing scarcity and driving up demand. However, it’s crucial to note that this is not guaranteed, and other market factors can significantly influence price movements. For instance, the 2012 halving saw a gradual price increase, while the 2016 halving resulted in a more pronounced surge, followed by a period of consolidation. The 2020 halving exhibited a similar pattern, with a significant price increase leading up to and following the event, followed by market corrections. Predicting the precise impact of the 2024 halving is therefore challenging and speculative.

Risks and Rewards of Investing During a Halving Cycle

Investing in Bitcoin during a halving cycle presents both significant risks and potential rewards. The reduced supply can create upward price pressure, potentially leading to substantial gains. However, the cryptocurrency market is inherently volatile, and external factors such as regulatory changes, macroeconomic conditions, and market sentiment can significantly impact Bitcoin’s price regardless of the halving. Therefore, investors should proceed with caution, carefully assess their risk tolerance, and diversify their portfolios. Investing only what one can afford to lose is paramount.

Long-Term Implications of Bitcoin Halvings

The long-term implications of Bitcoin halvings center on the decreasing rate of inflation for the cryptocurrency. As the supply of new Bitcoins diminishes, the scarcity of the asset increases, potentially making it more valuable over time. This deflationary characteristic is a key element of Bitcoin’s design, intended to maintain its value and act as a hedge against inflation in traditional fiat currencies. However, the actual long-term impact is subject to various factors, including widespread adoption, technological advancements, and overall market dynamics. The historical performance suggests a positive correlation between halving events and long-term price appreciation, but it’s not a certainty.

Illustrative Example: Bitcoin Halving Price History

Analyzing Bitcoin’s price action surrounding previous halving events offers valuable insights into potential future price movements. While past performance doesn’t guarantee future results, observing historical trends can inform expectations and risk assessments. The following analysis uses data primarily sourced from reputable cryptocurrency tracking websites like CoinMarketCap and CoinGecko, which aggregate data from various exchanges.

The visual representation would ideally be a line graph charting Bitcoin’s price over several years, encompassing the periods leading up to and following each halving event. The x-axis would represent time (in years), and the y-axis would display Bitcoin’s price in USD. Three distinct halving events would be clearly marked on the graph with vertical lines and corresponding dates: November 2012, July 2016, and May 2020.

Bitcoin Price Movements Around Halving Events

The graph would visually demonstrate the price fluctuations surrounding each halving. For instance, in the period leading up to the 2012 halving, Bitcoin’s price exhibited a relatively slow and steady increase. Following the halving, a significant price surge occurred, although this was followed by a period of consolidation and subsequent volatility. Similarly, the 2016 halving was preceded by a period of price consolidation, followed by a substantial price increase after the event, reaching an all-time high before experiencing a significant correction. The 2020 halving showed a similar pattern: a period of price appreciation leading up to the halving, followed by a considerable price rise, eventually reaching another all-time high before a market correction. The graph would clearly illustrate the general trend of price appreciation post-halving, though the magnitude and duration of these increases have varied considerably. It is crucial to remember that external factors, such as regulatory changes, market sentiment, and macroeconomic conditions, also significantly influence Bitcoin’s price. The graph would help visualize the interplay between the halving events and these broader market forces.

Understanding the “Que Es El Halving Bitcoin 2025” requires knowing the precise timing of the event. To clarify this, you should check out this resource on When Bitcoin Halving 2025 which details the scheduled date. This date is crucial because the halving significantly impacts Bitcoin’s inflation rate, a key element of understanding the “Que Es El Halving Bitcoin 2025” phenomenon and its predicted market effects.

Understanding “Que Es El Halving Bitcoin 2025” requires grasping the core concept of Bitcoin’s halving mechanism. This process, where the reward for mining new blocks is cut in half, significantly impacts Bitcoin’s inflation rate. For a deeper dive into the specifics of this upcoming event, you can consult this excellent resource on the 2025 Bitcoin Halving.

Ultimately, understanding this halving is crucial to predicting the future trajectory of Bitcoin’s value and overall market dynamics related to “Que Es El Halving Bitcoin 2025”.

Understanding the “Que Es El Halving Bitcoin 2025” involves grasping the halving’s impact on Bitcoin’s supply. This reduction in newly mined Bitcoin often leads to increased scarcity and potential price fluctuations. To explore potential price movements, check out this insightful resource on Bitcoin Halving 2025 Price Prediction which offers predictions and analysis. Ultimately, the “Que Es El Halving Bitcoin 2025” question is intricately tied to the resulting market dynamics.

Understanding the “Que Es El Halving Bitcoin 2025” involves grasping the halving’s impact on Bitcoin’s supply. This reduction in newly mined Bitcoin often leads to increased scarcity and potential price fluctuations. To explore potential price movements, check out this insightful resource on Bitcoin Halving 2025 Price Prediction which offers predictions and analysis. Ultimately, the “Que Es El Halving Bitcoin 2025” question is intricately tied to the resulting market dynamics.

Understanding the “Que Es El Halving Bitcoin 2025” involves grasping the halving’s impact on Bitcoin’s supply. This reduction in newly mined Bitcoin often leads to increased scarcity and potential price fluctuations. To explore potential price movements, check out this insightful resource on Bitcoin Halving 2025 Price Prediction which offers predictions and analysis. Ultimately, the “Que Es El Halving Bitcoin 2025” question is intricately tied to the resulting market dynamics.