What is Bitcoin Halving?: Que Es Halving Bitcoin 2025

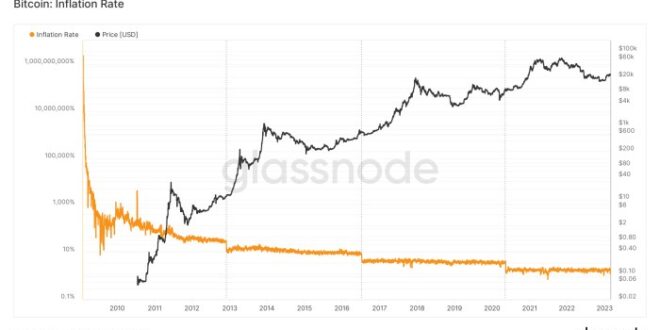

Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created. This occurs approximately every four years, or every 210,000 blocks mined. It’s a crucial part of Bitcoin’s design, intended to control inflation and maintain the scarcity of the cryptocurrency.

Bitcoin Halving Mechanism

The halving mechanism is hard-coded into the Bitcoin software. It dictates that the reward miners receive for successfully adding a block of transactions to the blockchain is cut in half. Initially, miners received 50 BTC per block. After the first halving, this dropped to 25 BTC, then to 12.5 BTC, and currently stands at 6.25 BTC. The next halving in 2025 will reduce this reward to 3.125 BTC. This controlled reduction in the supply of newly minted Bitcoins is designed to mimic the scarcity of precious metals like gold.

Historical Bitcoin Halvings and Their Effects

The Bitcoin halving has historically been associated with significant price increases in the months following the event. This is largely attributed to the reduced supply of new Bitcoins entering the market, increasing scarcity and potentially driving up demand. While correlation doesn’t equal causation, the past two halvings provide interesting data points. The first halving in November 2012 saw a relatively modest price increase, partly due to the nascent stage of the cryptocurrency market. The second halving in July 2016 preceded a significant bull market, and the third halving in May 2020 also triggered a notable price surge, though the market dynamics were influenced by other factors as well. It is important to note that various market conditions and external influences play a role in Bitcoin’s price movements.

Expected Consequences of the 2025 Bitcoin Halving

Predicting the precise impact of the 2025 halving is challenging, as numerous variables influence Bitcoin’s price. However, based on historical trends and market analysis, several potential consequences are anticipated. The reduced supply of new Bitcoins is likely to exert upward pressure on price, especially if demand remains strong or increases. However, macroeconomic conditions, regulatory changes, and overall market sentiment will significantly impact the actual outcome. The 2025 halving could potentially lead to a price increase similar to or even exceeding previous halving cycles, but it’s equally plausible that the effect might be less pronounced due to market maturity and evolving investor behavior. Past performance is not indicative of future results. Considering the increased institutional investment in Bitcoin since the last halving, the impact might differ significantly from previous cycles.

Bitcoin Halving Schedule and Circulating Supply

The following table illustrates the Bitcoin halving schedule and its impact on the circulating supply. Note that these figures are approximate, as the actual block time can vary slightly.

| Halving Date | Block Reward (BTC) | Approximate Circulating Supply (BTC) |

|---|---|---|

| November 28, 2012 | 25 | 10,500,000 |

| July 9, 2016 | 12.5 | 15,750,000 |

| May 11, 2020 | 6.25 | 18,375,000 |

| Approximately April 2024 | 3.125 | ~19,187,500 (projected) |

Bitcoin Halving 2025

The Bitcoin halving, scheduled for approximately 2025, is a significant event in the cryptocurrency’s lifecycle. This event, where the reward for Bitcoin miners is cut in half, has historically been followed by periods of price volatility and market adjustments. Understanding the potential impacts of the 2025 halving is crucial for investors, miners, and users alike.

Bitcoin Price Volatility After the 2025 Halving

The halving mechanism, by reducing the supply of newly minted Bitcoin, is expected to create upward pressure on the price. Previous halvings have demonstrated a correlation between reduced supply and subsequent price increases, though the timing and magnitude of these increases vary. However, it’s important to note that price volatility is inherent to Bitcoin, and other market factors, such as regulatory changes, macroeconomic conditions, and overall investor sentiment, will significantly influence the price reaction. The 2025 halving’s impact on price might be amplified or dampened by these external factors. For example, the 2012 halving saw a gradual price increase, while the 2016 halving led to a more pronounced surge after a period of consolidation. The 2020 halving saw a significant price increase following the halving event. The interplay between these events and external market pressures will likely dictate the price volatility around the 2025 halving.

Impact on Bitcoin Mining Profitability and Operations

A halving directly reduces the reward miners receive for validating transactions and adding new blocks to the blockchain. This reduction in revenue necessitates adjustments within the mining industry. Miners with high operational costs might find it challenging to remain profitable, leading to a potential consolidation within the sector. Some miners might choose to shut down operations, while others might optimize their operations to reduce energy consumption and improve efficiency. The hashrate, a measure of the total computational power dedicated to mining, could experience a temporary dip before stabilizing at a new level. This could lead to increased centralization of mining power if smaller, less efficient operations are forced to exit the market. The adaptation of more energy-efficient mining equipment and exploration of alternative energy sources will be crucial for miners to maintain profitability.

Comparison of Market Reactions to Previous Halvings, Que Es Halving Bitcoin 2025

While each halving presents unique circumstances, historical data provides insights into potential market reactions. The 2012 halving resulted in a gradual price increase, the 2016 halving led to a more pronounced price surge after a period of consolidation, and the 2020 halving saw a substantial price increase in the months following the event. However, it is crucial to consider the broader market conditions surrounding each halving. Factors like the overall state of the global economy, regulatory changes, and technological advancements played significant roles in shaping the market responses. The 2025 halving’s impact will likely be influenced by similar external factors, making direct comparisons with previous events challenging, but nonetheless informative.

Implications for Bitcoin Adoption and Mainstream Acceptance

The 2025 halving’s impact on Bitcoin’s adoption and mainstream acceptance is less direct than its influence on price and mining. However, a sustained price increase following the halving could contribute positively to increased public awareness and interest in Bitcoin. This increased visibility might attract new investors and users, accelerating adoption. Conversely, a significant price drop could temporarily hinder mainstream acceptance. The overall narrative surrounding Bitcoin, including regulatory developments and media coverage, will also play a crucial role in shaping public perception and adoption rates.

Predicted Effects of the 2025 Halving on Different Market Segments

| Market Segment | Predicted Effect | Example/Real-life Case |

|---|---|---|

| Miners | Reduced profitability, potential consolidation, increased focus on efficiency | Similar to the 2020 halving, where some smaller mining operations were forced to shut down due to reduced profitability. |

| Investors | Potential for price increase, increased volatility, opportunity for long-term gains or losses | The price surge following the 2016 halving provided significant gains for long-term investors, while short-term traders faced significant volatility. |

| Users | Potentially increased transaction fees (due to increased network congestion), potential increase in Bitcoin’s value | Increased transaction fees were observed following previous halvings due to higher network usage. |

Factors Influencing the 2025 Halving

The Bitcoin halving in 2025, like previous events, will be a significant moment impacting the cryptocurrency’s price and overall market dynamics. However, the actual effect is not predetermined and depends on a complex interplay of macroeconomic conditions, regulatory landscapes, technological advancements, and prevailing market sentiment. Understanding these interwoven factors is crucial for navigating the potential volatility surrounding this event.

Macroeconomic Factors

Broad economic conditions significantly influence investor behavior and risk appetite, directly affecting Bitcoin’s price. For example, high inflation could drive investors towards Bitcoin as a hedge against inflation, potentially increasing demand and price. Conversely, a global recession might lead to risk-aversion, causing investors to sell assets like Bitcoin to secure capital, resulting in price drops. The strength of the US dollar, a primary benchmark currency, also plays a role; a stronger dollar could suppress Bitcoin’s price denominated in USD, while a weaker dollar could have the opposite effect. These macroeconomic variables are inherently unpredictable, making accurate forecasting challenging but undeniably important.

Regulatory Changes and Governmental Policies

Governmental regulations and policies regarding cryptocurrencies are constantly evolving. Stringent regulations, such as increased Know Your Customer (KYC) requirements or outright bans, could dampen investor enthusiasm and limit market participation, potentially mitigating the upward pressure typically associated with a halving. Conversely, favorable regulatory frameworks, such as clear guidelines for cryptocurrency taxation or the establishment of regulated exchanges, could bolster investor confidence and increase demand, amplifying the halving’s impact. The regulatory landscape varies significantly across countries, further complicating predictions. For instance, a supportive regulatory environment in a major market like the EU could offset negative impacts from stricter regulations elsewhere.

Technological Advancements in Bitcoin Mining

Technological advancements in Bitcoin mining hardware and efficiency play a crucial role. Improvements in mining hardware, such as more powerful ASICs (Application-Specific Integrated Circuits), reduce the cost of mining, potentially increasing the number of miners and the overall hash rate. This could influence the network’s security and stability. Conversely, if mining becomes significantly less profitable due to increased energy costs or stricter environmental regulations, some miners might exit the network, potentially impacting the hash rate and network security. The development of more energy-efficient mining solutions could also play a critical role in making Bitcoin mining more sustainable and potentially less susceptible to price fluctuations.

Overall Cryptocurrency Market Sentiment

The overall sentiment within the broader cryptocurrency market significantly impacts Bitcoin’s price. A positive market sentiment, driven by factors such as successful projects, technological breakthroughs, or increased institutional adoption, could amplify the positive price effects of the halving. Conversely, negative sentiment, stemming from events like major security breaches, regulatory crackdowns, or significant market corrections, could overshadow the halving’s impact and lead to price stagnation or even decline. The interconnectedness of cryptocurrencies means that the performance of other prominent cryptocurrencies can influence investor confidence in Bitcoin. For example, a major bull run in altcoins might draw investors away from Bitcoin, even during a halving event.

Interconnectedness of Factors Influencing the 2025 Halving

Que Es Halving Bitcoin 2025 – The following flowchart illustrates the complex interplay of factors influencing the outcome of the 2025 Bitcoin halving:

(Imagine a flowchart here. The flowchart would start with a central box labeled “2025 Bitcoin Halving.” Arrows would branch out to boxes representing Macroeconomic Factors (Inflation, Recession, USD Strength), Regulatory Changes & Policies (KYC, Taxation, Bans), Technological Advancements (Mining Hardware, Energy Costs, Efficiency), and Overall Crypto Market Sentiment (Investor Confidence, Altcoin Performance). Each of these boxes would then have smaller arrows pointing to a final box labeled “Bitcoin Price Impact,” illustrating how each factor contributes to the overall effect.)