Bitcoin Halving 2025

The Bitcoin halving, a pre-programmed event in the Bitcoin protocol, is anticipated to occur in 2025, marking a significant moment in the cryptocurrency’s history. This event, which reduces the rate at which new Bitcoins are mined by 50%, has historically been followed by periods of increased price volatility and, in some cases, substantial price appreciation. Understanding the mechanics of this event and its potential impact is crucial for anyone invested in or interested in the cryptocurrency market.

Bitcoin Halving Mechanics and Historical Impact, Reloj Halving Bitcoin 2025

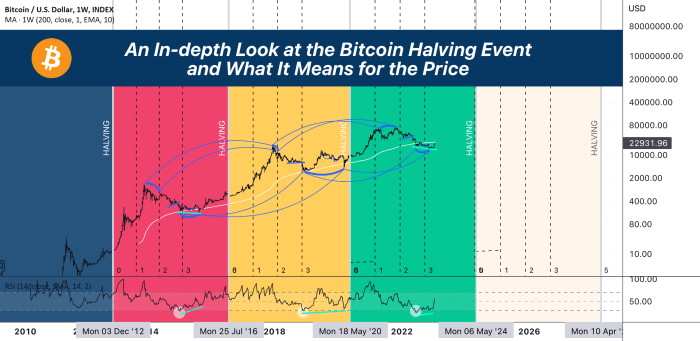

The Bitcoin halving is a key feature of Bitcoin’s design intended to control inflation. Every 210,000 blocks mined (approximately every four years), the reward given to Bitcoin miners for verifying transactions is halved. This reduces the influx of new Bitcoins into circulation, making them potentially more scarce and valuable. Historically, the previous halvings in 2012, 2016, and 2020 have been followed by periods of significant price increases, though the timing and magnitude of these increases have varied. The 2012 halving saw a gradual price increase, while the 2016 and 2020 halvings were followed by more pronounced, though ultimately uneven, bull runs. However, it’s important to note correlation does not equal causation; other market factors also play significant roles.

Anticipated Effects of the 2025 Halving on Supply and Demand

The 2025 halving will reduce the block reward from 6.25 BTC to 3.125 BTC per block. This decrease in the rate of new Bitcoin creation will directly impact the supply side of the market. With a reduced supply, assuming demand remains consistent or increases, the price of Bitcoin is expected to experience upward pressure. The extent of this pressure will depend on several factors, including overall market sentiment, macroeconomic conditions, regulatory developments, and the adoption rate of Bitcoin. A higher demand coupled with a lower supply typically results in price appreciation.

Comparison of the 2025 Halving to Previous Events

While the mechanism of the halving remains consistent across all events, the surrounding market conditions differ significantly. The 2012 halving occurred in a relatively nascent cryptocurrency market with limited awareness and adoption. The 2016 and 2020 halvings took place in a more mature market with greater institutional involvement and regulatory scrutiny. The 2025 halving is expected to occur in a market shaped by significant technological advancements, increased regulatory scrutiny, and a broader understanding of cryptocurrencies. This makes direct comparisons challenging, highlighting the need for nuanced analysis rather than simple extrapolation from past events.

Timeline of Key Events Leading to and Following the 2025 Halving

The precise date of the 2025 halving is difficult to predict with certainty due to the unpredictable nature of Bitcoin’s block time. However, we can expect a period of increased anticipation leading up to the event, likely starting several months prior. Immediately following the halving, the market may experience increased volatility as investors react to the actual event and its short-term effects. The long-term impact will likely unfold over several months or even years, influenced by a variety of factors including macroeconomic trends and overall market sentiment.

Hypothetical Market Reaction Scenario

Let’s consider a scenario where positive macroeconomic conditions prevail leading up to the 2025 halving, fostering a generally bullish sentiment in the cryptocurrency market. Increased institutional adoption and growing retail investor interest could combine with the reduced supply of new Bitcoins to create a significant surge in demand. In this hypothetical scenario, the price of Bitcoin could experience a substantial increase in the months following the halving, potentially exceeding previous price highs. However, it is crucial to remember this is just one potential outcome; other scenarios, including a less bullish or even bearish market reaction, are certainly possible. This illustrates the inherent uncertainty associated with predicting market reactions to major events like the Bitcoin halving.

Reloj Halving Bitcoin 2025

The Bitcoin halving event, scheduled for 2025, is a significant occurrence in the cryptocurrency world, anticipated to impact Bitcoin’s price. This event, where the reward for Bitcoin miners is cut in half, historically has been followed by periods of significant price appreciation. However, predicting the precise market reaction remains a complex undertaking.

Market Predictions and Analysis of the 2025 Halving

Diverse expert opinions exist regarding the potential price impact of the 2025 Bitcoin halving. Some analysts predict a substantial price surge, while others hold more conservative or even bearish views. The ultimate outcome will depend on a complex interplay of factors, including the prevailing macroeconomic climate, regulatory developments, and overall market sentiment.

Bullish, Bearish, and Neutral Market Scenarios

A bullish scenario anticipates a significant price increase following the halving, driven by reduced supply and increased demand. This is supported by the historical precedent of previous halvings, where price appreciation followed. However, the magnitude of this increase is subject to debate, with some projecting a modest rise and others forecasting exponential growth. Conversely, a bearish scenario suggests that macroeconomic headwinds, regulatory uncertainty, or a general lack of investor confidence could negate the positive impact of the halving, leading to stagnant or even declining prices. A neutral scenario proposes a more moderate price movement, neither significantly bullish nor bearish, with the halving’s impact being largely offset by other market forces.

The Influence of Macroeconomic Factors

Macroeconomic conditions play a crucial role in shaping Bitcoin’s price trajectory after the halving. Factors such as inflation rates, interest rate policies, and global economic growth can significantly influence investor sentiment and risk appetite. For instance, high inflation might drive investors towards Bitcoin as a hedge against inflation, boosting its price. Conversely, a global recession could lead to risk-averse behavior, potentially suppressing Bitcoin’s price regardless of the halving.

Risks and Uncertainties in Predicting Halving Effects

Predicting the precise impact of the halving is inherently uncertain. Unforeseen events, such as major regulatory changes, security breaches, or unexpected technological advancements, could significantly alter the market’s reaction. Furthermore, the increasing institutional involvement in the cryptocurrency market adds another layer of complexity, making it difficult to accurately model future price movements. The influence of social media trends and market manipulation further contribute to the inherent unpredictability.

Comparative Table of Prediction Models

The following table summarizes various prediction models, highlighting their assumptions and projected price ranges. It is important to note that these are merely estimates and should not be considered financial advice.

| Model | Assumptions | Projected Price Range (USD) | Source/Analyst |

|---|---|---|---|

| PlanB’s Stock-to-Flow Model | Based on historical Bitcoin supply and price data. | $100,000 – $1,000,000+ | PlanB (On-chain analyst) |

| Quantitative Analysis Model | Uses statistical methods to analyze historical price data and market trends. | $50,000 – $150,000 | (Example: Research firm X) |

| Fundamental Analysis Model | Focuses on Bitcoin’s underlying technology, adoption rate, and network effects. | $30,000 – $80,000 | (Example: Analyst Y) |

| Market Sentiment-Based Model | Considers investor sentiment, news events, and social media trends. | $20,000 – $60,000 | (Example: News outlet Z) |

Investing in Bitcoin Before and After the 2025 Halving

The Bitcoin halving, scheduled for 2025, is a significant event expected to impact Bitcoin’s price and overall market dynamics. Understanding the potential implications and implementing sound risk management strategies are crucial for investors considering exposure to Bitcoin before and after this event. This section explores various investment approaches, risk mitigation techniques, and potential opportunities surrounding the 2025 halving.

Risk Management Strategies for Bitcoin Investments Around the Halving

The Bitcoin halving historically has been followed by periods of price volatility. Investors should adopt a robust risk management approach to navigate this potential instability. This includes understanding your risk tolerance, diversifying your portfolio, and employing strategies like dollar-cost averaging to mitigate the impact of price fluctuations. A well-defined exit strategy, based on predetermined price targets or market indicators, is also essential. For example, an investor might set a stop-loss order at a certain percentage below their purchase price to limit potential losses. Another approach is to diversify holdings across various asset classes, reducing the overall impact of any single investment’s performance.

A Step-by-Step Guide on Safely Buying and Storing Bitcoin

Purchasing and securing Bitcoin requires careful planning and execution. First, research and select a reputable cryptocurrency exchange that offers robust security measures and a user-friendly interface. Verify the exchange’s licensing and security protocols before proceeding. Next, complete the account registration process, providing accurate and verified personal information. After funding your account via a secure method (bank transfer or debit/credit card), initiate a Bitcoin purchase order, specifying the desired quantity. Once acquired, transfer your Bitcoin to a secure hardware wallet. Hardware wallets, like Ledger or Trezor, offer offline storage, significantly reducing the risk of hacking or theft. Regularly back up your wallet’s seed phrase and keep it in a safe place, away from digital access.

Comparing Long-Term Holding and Short-Term Trading Strategies

Long-term holding (HODLing) is a popular strategy among Bitcoin investors, based on the belief in Bitcoin’s long-term value appreciation. This approach minimizes the impact of short-term price volatility and requires less active management. Conversely, short-term trading involves frequent buying and selling to capitalize on price fluctuations. This requires more active market monitoring and understanding of technical analysis, increasing the potential for both profits and losses. The optimal strategy depends on individual risk tolerance and investment goals. For example, a risk-averse investor with a long-term horizon might prefer HODLing, while a more risk-tolerant investor might pursue short-term trading.

Diversifying Investment Portfolios to Mitigate Risk

Diversification is a cornerstone of effective risk management. Investing solely in Bitcoin exposes your portfolio to significant volatility. Diversifying across different asset classes, such as stocks, bonds, real estate, and other cryptocurrencies, can reduce overall portfolio risk. Allocating a portion of your investment to stablecoins or other less volatile assets can further cushion against Bitcoin’s price fluctuations. For example, an investor might allocate 5% of their portfolio to Bitcoin, 15% to other cryptocurrencies, 40% to stocks, and 40% to bonds. This strategy reduces the impact of a potential Bitcoin price decline.

Potential Investment Opportunities Related to Bitcoin Mining and Infrastructure

The Bitcoin mining industry presents investment opportunities beyond directly holding Bitcoin. Investing in publicly traded mining companies or through private equity can provide exposure to the growth of the mining sector. Furthermore, companies providing infrastructure services, such as specialized hardware manufacturers or data center operators, could also offer significant growth potential. However, it’s crucial to thoroughly research these companies, assessing their financial health, operational efficiency, and regulatory compliance before investing. Investing in these areas carries inherent risks associated with technological advancements, regulatory changes, and energy costs. Consider these risks when making your investment decisions.

The Impact of the 2025 Halving on Bitcoin Mining

The Bitcoin halving event, scheduled for 2025, will significantly impact the profitability and operational landscape of Bitcoin mining. This reduction in the block reward, halved every four years, creates a ripple effect across the entire ecosystem, influencing everything from miner revenue to energy consumption and environmental concerns. Understanding these impacts is crucial for anyone involved in or observing the Bitcoin market.

The halving directly affects the profitability of Bitcoin mining by reducing the reward miners receive for successfully validating transactions and adding new blocks to the blockchain. This reduction in revenue necessitates adjustments within the mining industry to maintain profitability. Historically, halvings have been followed by periods of increased mining difficulty and a subsequent consolidation within the mining sector, with less efficient miners exiting the market. This process, though initially disruptive, often leads to a more efficient and resilient network in the long term.

Changes in Bitcoin Mining Profitability

The 2025 halving will likely lead to a decrease in mining profitability in the short term. Miners will need to adapt by increasing efficiency, potentially through upgrading their hardware, optimizing their operations, or seeking access to cheaper energy sources. The profitability of mining depends on several factors including the Bitcoin price, mining difficulty, energy costs, and the efficiency of mining hardware. A decline in Bitcoin price alongside the halving could significantly impact the viability of less efficient mining operations. Conversely, a sustained or increased Bitcoin price could offset the impact of the reduced block reward. For example, the 2016 halving saw a significant increase in Bitcoin’s price following the event, ultimately offsetting the reduced block reward for many miners.

Implications for Bitcoin Mining Energy Consumption

The Bitcoin network’s energy consumption is a subject of ongoing debate. The halving, while not directly reducing the network’s computational power, might indirectly influence energy consumption. With reduced profitability, less efficient miners may be forced to shut down, potentially leading to a slight decrease in overall energy usage. However, this effect might be offset by more efficient miners increasing their hashing power to maintain their market share. Furthermore, the continuous innovation in mining hardware aims for increased efficiency, potentially mitigating the overall energy consumption increase associated with the increased mining difficulty following a halving.

Environmental Concerns and Potential Solutions

The environmental impact of Bitcoin mining is a significant concern. The high energy consumption of the network raises questions about its sustainability. Solutions include transitioning to renewable energy sources for mining operations, improving mining hardware efficiency, and developing more energy-efficient consensus mechanisms. Several mining operations are already transitioning to renewable energy sources like hydropower and solar power. This shift towards sustainable practices is vital for addressing the environmental concerns associated with Bitcoin mining. Furthermore, research into more efficient mining hardware and alternative consensus mechanisms could significantly reduce the network’s overall energy footprint.

Comparison of Mining Landscapes Before and After Previous Halvings

Previous halvings have demonstrated a pattern of short-term profitability challenges followed by periods of consolidation and adaptation within the mining sector. The 2012 and 2016 halvings saw initial drops in mining profitability, but the subsequent price increases largely offset these losses. The mining landscape evolved, with more efficient miners gaining market share and less efficient operations shutting down. This led to a more centralized mining landscape in the following years. The 2025 halving is expected to follow a similar pattern, with adjustments in mining strategies and a potential shift in market dominance among mining pools.

Potential for Technological Advancements to Offset the Halving’s Impact

Technological advancements in mining hardware play a crucial role in offsetting the negative impact of the halving on miners. The development of more energy-efficient ASICs (Application-Specific Integrated Circuits) and improved cooling systems allows miners to maintain profitability even with a reduced block reward. Furthermore, innovations in mining software and pool management strategies can optimize efficiency and reduce operational costs. The ongoing development of quantum-resistant cryptography is also relevant, as it ensures the long-term viability of Bitcoin mining in the face of potential technological disruptions.

Understanding the Reloj Halving Bitcoin 2025 requires careful consideration of the halving event’s impact. A key aspect to analyze is the anticipated effects leading up to the event, which are extensively covered in this insightful resource on the Bitcoin April 2025 Halving. Ultimately, this analysis informs our projections for the Reloj Halving Bitcoin 2025 and its potential consequences for the market.

Understanding the Reloj Halving Bitcoin 2025 requires examining past trends. To gain valuable insight into the anticipated impact, it’s helpful to review the historical data; a comprehensive look at the Bitcoin Halving History 2025 provides a strong foundation. This historical context allows for a more informed prediction regarding the potential effects of the upcoming Reloj Halving Bitcoin 2025 event on the cryptocurrency market.

The Bitcoin 2025 halving, often visualized with a “Reloj Halving Bitcoin 2025” countdown, is a significant event impacting the cryptocurrency’s future. Understanding its potential consequences requires examining various predictions; for insightful analysis, check out this resource on Bitcoin Price Prediction After 2025 Halving. Ultimately, the Reloj Halving Bitcoin 2025 serves as a marker for anticipating future price fluctuations and market trends.

Understanding the Reloj Halving Bitcoin 2025 requires knowing the precise date of the halving event. To determine this crucial date, you’ll want to consult a reliable resource like this one: When Is Bitcoin Halving In 2025. This information is key to accurately predicting the potential impact of the halving on the Bitcoin price and the overall market, thus providing a more complete picture of Reloj Halving Bitcoin 2025.

Understanding the Reloj Halving Bitcoin 2025 requires knowing the precise date of the halving event. To clarify this crucial point, you should consult a reliable resource like this article on When Is Bitcoin 2025 Halving , which provides a detailed analysis. This date is fundamental to predicting the potential impact on the Bitcoin price and the overall market, making accurate information on the Reloj Halving Bitcoin 2025 essential for informed decision-making.

Understanding the “Reloj Halving Bitcoin 2025” requires considering the anticipated impact on price. A key factor in predicting future Bitcoin value is the upcoming halving event, and to gain insights into potential price movements, you might find the analysis at Bitcoin Halving 2025 Price helpful. This information is crucial for anyone interested in the long-term trajectory of Reloj Halving Bitcoin 2025 and its market implications.