Bitcoin Halving 2025

The Bitcoin halving, a programmed event reducing the rate at which new Bitcoins are mined, is a significant occurrence in the cryptocurrency’s lifecycle. This reduction in supply, coupled with generally increasing demand, has historically led to substantial price increases in the months and years following each halving. The 2025 halving, anticipated around April, is generating considerable speculation within the crypto community.

Bitcoin Halving Mechanics and Historical Impact

The Bitcoin halving mechanism is embedded within the Bitcoin protocol. Approximately every four years, the reward given to miners for successfully verifying and adding new blocks to the blockchain is cut in half. This process, designed to control inflation, reduces the influx of new Bitcoins into circulation. Historically, these halvings have been followed by periods of significant price appreciation, though the timing and magnitude of these price increases vary. The reduced supply, combined with continued (and often increasing) demand, creates upward pressure on the price.

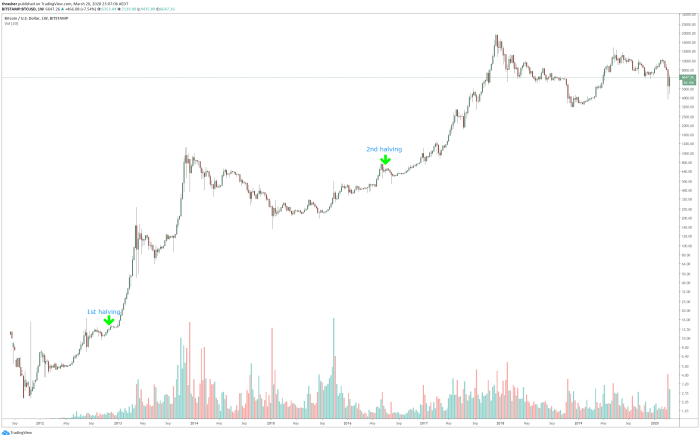

Timeline of Past Bitcoin Halvings and Subsequent Price Movements

The first Bitcoin halving occurred in November 2012, reducing the block reward from 50 BTC to 25 BTC. This was followed by a gradual price increase over the subsequent years. The second halving in July 2016, cutting the reward to 12.5 BTC, preceded a significant bull market culminating in late 2017. The third halving in May 2020, reducing the reward to 6.25 BTC, was followed by a substantial price surge in late 2020 and early 2021. It’s important to note that while halvings have historically correlated with price increases, other market factors also significantly influence Bitcoin’s price.

Predictions from Reputable Crypto Analysts Regarding the 2025 Halving

Several reputable crypto analysts predict a positive impact from the 2025 halving. Some forecasts suggest a significant price increase, citing the reduced supply as a key driver. However, these predictions vary widely, depending on assumptions about overall market sentiment, macroeconomic conditions, and regulatory developments. For example, some analysts project a price increase exceeding previous cycles, while others offer more conservative estimates, emphasizing the unpredictable nature of the market. It’s crucial to remember that these are predictions, not guarantees.

Factors Influencing Bitcoin Price After the 2025 Halving

Numerous factors beyond the halving itself will influence Bitcoin’s price trajectory after 2025. These include macroeconomic conditions (e.g., inflation, interest rates), regulatory changes, technological advancements within the cryptocurrency space, and overall investor sentiment. Geopolitical events and adoption rates in emerging markets also play significant roles. The interplay of these factors makes precise price prediction exceptionally challenging. For instance, a global recession could negatively impact Bitcoin’s price, irrespective of the halving. Conversely, widespread institutional adoption could lead to a surge in price, even in the face of macroeconomic headwinds.

Comparison of Previous Bitcoin Halvings

| Halving Date | Block Height (approx.) | Subsequent Price Change (approx. percentage change over 1-2 years) |

|---|---|---|

| November 2012 | 210,000 | +8000% (over 2 years) |

| July 2016 | 420,000 | +2000% (over 1 year) |

| May 2020 | 630,000 | +1000% (over 1 year) |

Understanding the “Wann Ist Das Bitcoin Halving 2025” Search Query

The German phrase “Wann ist das Bitcoin Halving 2025?” translates to “When is the Bitcoin halving 2025?” This seemingly simple query reveals a user’s significant interest in a specific event within the cryptocurrency world – the Bitcoin halving. Understanding the user’s intent requires examining the context and implications of this event for Bitcoin investors and enthusiasts.

The key information users seeking this phrase desire centers around the precise timing of the next Bitcoin halving. They are not merely curious; they are likely actively involved in the Bitcoin market and need this date for various strategic planning purposes.

Comparison with Similar Queries

This German query has direct equivalents in other languages, such as “When is the Bitcoin halving 2025?” in English, “Cuándo será la reducción a la mitad de Bitcoin 2025?” in Spanish, and “Quand aura lieu le halving Bitcoin 2025 ?” in French. The consistency across languages underscores the global interest in this event. The specific phrasing might vary slightly depending on the language’s grammatical structure and common terminology, but the underlying intent remains the same: to determine the exact date or timeframe of the halving.

Aspects of the Halving Event of Interest to Users

Users searching for this information are interested in more than just the date. They likely need to understand the halving’s implications for Bitcoin’s price, mining profitability, and the overall market sentiment. The halving is a significant event that often triggers volatility and speculation.

Categorization of User Needs

The various needs of users performing this search can be categorized as follows:

- Precise Timing: Users need the exact date or a very narrow timeframe for the halving event. This is crucial for investment strategies and market predictions.

- Price Prediction: Many users are interested in understanding how the halving might affect Bitcoin’s price in the short-term and long-term. Historical data from previous halvings often informs these predictions, although the outcome is never certain.

- Mining Impact: The halving reduces the reward for Bitcoin miners. Users want to know how this will impact mining profitability and the potential for changes in mining difficulty.

- Market Sentiment Analysis: Understanding the anticipated market reaction to the halving is critical. Users want to gauge the general feeling of optimism or pessimism surrounding the event and its potential impact on trading.

- Investment Strategy Planning: The halving is a key factor in investment decisions. Users need the date to plan their buying, selling, or holding strategies.

The Impact of the Halving on Bitcoin Miners: Wann Ist Das Bitcoin Halving 2025

The Bitcoin halving, a programmed event that reduces the block reward miners receive for validating transactions, significantly impacts the profitability and operational strategies of the Bitcoin mining industry. This reduction in reward necessitates adjustments to maintain profitability and can lead to industry consolidation and innovation.

The halving directly affects miners’ revenue. As the reward is cut in half, their income from newly minted Bitcoin decreases. This reduction forces miners to re-evaluate their operational costs, including electricity consumption, hardware maintenance, and personnel expenses. Miners who cannot operate profitably at the reduced reward are forced to either adapt or shut down their operations.

Reduced Block Rewards and Miner Profitability

The halving’s impact on miner profitability is a direct consequence of the halved block reward. Before the halving, miners receive a certain amount of Bitcoin for each block they successfully mine. After the halving, this reward is halved. For example, if the reward was 6.25 BTC before a halving, it becomes 3.125 BTC afterward. This immediately reduces revenue unless the price of Bitcoin increases sufficiently to compensate for the lower reward. Profitability is directly tied to the relationship between the block reward (in Bitcoin), the Bitcoin price (in USD or other fiat currency), and the operational costs (in USD or other fiat currency). If the operational cost per block exceeds the revenue generated from the halved block reward, miners will face losses.

Mining Difficulty Adjustments Before and After Previous Halvings

Bitcoin’s mining difficulty adjusts approximately every two weeks to maintain a consistent block generation time of roughly 10 minutes. Before a halving, the mining difficulty generally increases as more miners join the network in anticipation of the relatively higher profitability associated with the pre-halving block reward. After a halving, the difficulty may initially remain high, but it typically experiences a period of adjustment, potentially decreasing as less profitable miners exit the network. This dynamic reflects the network’s self-regulating mechanism, which balances the computational power available with the desired block generation time. Analyzing past halvings reveals this pattern: a surge in difficulty before, followed by a period of adjustment and potential decrease after.

Miner Adaptation Strategies in Response to the Halving

Miners employ several strategies to navigate the challenges posed by the halving. These include: increasing mining efficiency through technological upgrades (e.g., adopting more energy-efficient ASICs), consolidating operations to achieve economies of scale, diversifying revenue streams (e.g., exploring Bitcoin mining pools or offering other services), and focusing on regions with lower electricity costs. Some miners may also choose to temporarily suspend operations or even permanently exit the market if they cannot adapt to the new economic realities.

Potential for Consolidation within the Bitcoin Mining Industry

The halving often accelerates consolidation within the Bitcoin mining industry. Less efficient or financially weaker miners may be forced to shut down or merge with larger operations. This leads to a more concentrated mining landscape, with fewer, larger players dominating the network’s hash rate. This consolidation can have both positive and negative consequences. While it can enhance network security by centralizing hash power amongst more robust operators, it also raises concerns about potential centralization of control.

Mining Profitability and Halving Events, Wann Ist Das Bitcoin Halving 2025

The following text-based visual representation illustrates the general relationship between mining profitability and halving events:

“`

Profitability

^

| /——-\

| / \

| / \

| / \

Halving Event –/—————\—- Halving Event

| |

| |

| |

| |

+—————–+—> Time

Low High

“`

This simplified representation shows that profitability tends to be higher before a halving and decreases immediately afterward, before potentially recovering over time due to factors like price appreciation and network adjustments. The exact shape of the curve is influenced by several factors, including the Bitcoin price, mining difficulty, and operational costs.

The Halving’s Influence on Bitcoin’s Long-Term Price

The Bitcoin halving, a programmed event reducing the rate of new Bitcoin creation, has historically coincided with periods of significant price appreciation. However, the relationship isn’t solely causal; various market forces interact to shape Bitcoin’s price trajectory after a halving. Understanding these forces is crucial for assessing the long-term impact of the 2025 halving.

Historical Price Performance Following Past Halvings

Bitcoin has experienced three previous halvings (2012, 2016, and 2020). Following each event, the price exhibited a period of growth, although the timing and magnitude varied considerably. The 2012 halving was followed by a gradual price increase, culminating in the 2013 bull run. The 2016 halving preceded the 2017 bull market, which saw a dramatic surge in price. The 2020 halving, while initially showing modest price movement, eventually contributed to the 2021 bull market. It’s important to note that other factors, such as increased adoption, regulatory changes, and macroeconomic conditions, also influenced these price movements. Attributing price changes solely to the halving would be an oversimplification.

The Role of Supply and Demand in Shaping Bitcoin’s Price

The halving directly impacts the supply side of the Bitcoin equation. By reducing the rate of new Bitcoin entering circulation, the halving creates a deflationary pressure on the asset. This reduced supply, coupled with sustained or increased demand, can lead to price appreciation. However, demand is equally, if not more, crucial. Strong investor sentiment, institutional adoption, and broader market interest are all key drivers of demand, ultimately determining the extent to which the reduced supply translates into price increases. If demand remains weak or declines, the impact of the reduced supply on price may be minimal or even negated.

Expert Opinions on Potential Long-Term Price Increase or Decrease

Experts hold differing views on the long-term price impact of the 2025 halving. Some analysts predict a significant price surge, citing the historical precedent and the anticipated increase in scarcity. Others are more cautious, emphasizing the unpredictable nature of the cryptocurrency market and the influence of external factors such as regulatory uncertainty and macroeconomic trends. Predicting the future price of Bitcoin with certainty is impossible, and expert opinions should be viewed as informed speculation rather than guaranteed outcomes. For example, some analysts point to the potential for a prolonged bear market following the 2025 halving, while others maintain that the halving is a key catalyst for a new bull cycle.

Factors Affecting Price Beyond the Immediate Impact of the Halving

The halving’s influence on Bitcoin’s price is not isolated; numerous other factors contribute to the long-term price trajectory. These include:

- Regulatory landscape: Favorable regulations can boost investor confidence and increase adoption.

- Technological advancements: Improvements in Bitcoin’s technology or the emergence of competing cryptocurrencies can influence its value.

- Macroeconomic conditions: Global economic events, such as inflation or recession, can impact investor appetite for risky assets like Bitcoin.

- Adoption rate: Widespread adoption by individuals and institutions is a crucial driver of demand and price.

- Market sentiment: Investor confidence and overall market sentiment play a significant role in price fluctuations.

These factors can either amplify or mitigate the halving’s impact, making it challenging to predict the exact outcome.

Potential Price Scenarios Based on Various Market Conditions

The following table illustrates potential price scenarios for Bitcoin after the 2025 halving, based on different market conditions. These are hypothetical scenarios and should not be considered financial advice.

| Market Condition | Price Scenario (USD) | Rationale |

|---|---|---|

| Strong Bull Market (High Demand, Positive Sentiment) | $100,000 – $200,000+ | Increased demand driven by strong adoption and positive market sentiment overcomes reduced supply. This scenario mirrors the post-2016 and 2020 halving bull runs, albeit potentially on a larger scale. |

| Neutral Market (Moderate Demand, Stable Sentiment) | $50,000 – $100,000 | The reduced supply partially offsets any potential decrease in demand, leading to a sideways or moderately upward price trend. This is a less extreme outcome compared to the previous two. |

| Bear Market (Low Demand, Negative Sentiment) | <$50,000 | Low demand outweighs the impact of the reduced supply, leading to a prolonged period of price decline. This scenario is less likely given the historical data, but still possible under significant negative market conditions. |

Frequently Asked Questions (FAQ) about the 2025 Bitcoin Halving

The Bitcoin halving is a significant event in the cryptocurrency world, generating considerable interest and speculation. Understanding this event is crucial for anyone involved in or considering involvement with Bitcoin. This section addresses common questions surrounding the 2025 halving.

Bitcoin Halving Explained

A Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the reward given to Bitcoin miners for successfully validating transactions and adding new blocks to the blockchain. This reward, initially 50 BTC per block, is cut in half approximately every four years. The halving mechanism is designed to control the rate at which new Bitcoins are created, aiming for a controlled inflation rate and maintaining the scarcity of the cryptocurrency.

Expected Date of the 2025 Bitcoin Halving

While the exact date depends on the block time and mining difficulty, the 2025 Bitcoin halving is anticipated to occur sometime in April 2025. The precise date will be determined as the blocks are mined leading up to the event. It’s important to note that this is an approximation, and minor variations are possible.

The Halving’s Effect on Bitcoin Price

The impact of a halving on Bitcoin’s price is complex and not fully predictable. Historically, halvings have been followed by periods of price appreciation, likely due to the reduced supply of newly minted Bitcoins. This decreased supply can increase demand, pushing the price upwards. However, other market factors, such as regulatory changes, macroeconomic conditions, and overall investor sentiment, also significantly influence Bitcoin’s price. Short-term price volatility is expected around the halving event, with potential for both sharp increases and decreases. Long-term price effects are harder to predict and depend on a variety of economic and market conditions. For example, the 2012 and 2016 halvings were followed by significant price increases, but the timeframe and magnitude varied.

Risks Associated with Investing Around the Halving

Investing in Bitcoin, especially around a halving event, carries inherent risks. Price volatility is a major concern; the price could drop significantly despite the anticipated scarcity effect. Market manipulation and speculative bubbles are also potential risks. Furthermore, the regulatory landscape surrounding cryptocurrencies is constantly evolving, and changes could negatively impact the value of Bitcoin. It’s crucial to remember that past performance is not indicative of future results, and no investment is guaranteed to be profitable. Therefore, careful risk assessment and diversification are essential before investing any significant amount.

Reliable Information Sources on the Bitcoin Halving

Reliable information about the Bitcoin halving can be found from several reputable sources. These include:

- The official Bitcoin Core website and documentation.

- Reputable cryptocurrency news outlets such as CoinDesk, Cointelegraph, and Bloomberg.

- Blockchain explorers, which provide real-time data on Bitcoin’s blockchain.

- Peer-reviewed academic research on cryptocurrencies and blockchain technology.

It’s crucial to critically evaluate information from any source and cross-reference data before making any investment decisions. Avoid relying solely on social media or less credible websites for financial advice.

Determining the precise date for the Wann Ist Das Bitcoin Halving 2025 requires understanding the Bitcoin halving mechanism. To find out the exact day, you’ll need to consult a reliable resource, such as this helpful page: What Day Is The Bitcoin Halving 2025. Once you have that date, you can easily convert it to understand Wann Ist Das Bitcoin Halving 2025 in German.

Determining the exact date for the Wann Ist Das Bitcoin Halving 2025 requires careful consideration of block times. Predicting the subsequent price action, however, is inherently speculative. To explore potential price movements after the halving, you might find this resource helpful: Bitcoin Price Next Halving 2025. Ultimately, understanding the halving’s impact on the Wann Ist Das Bitcoin Halving 2025 remains a key area of interest for Bitcoin investors.

Determining the precise date for the Bitcoin halving in 2025, or “Wann ist das Bitcoin Halving 2025,” requires careful consideration of the Bitcoin network’s block generation time. To find out the projected date, a helpful resource is this website: When Is Bitcoin Halving Date 2025. Using this information, we can then accurately predict the “Wann ist das Bitcoin Halving 2025” timeframe more precisely.

Determining the precise date for “Wann Ist Das Bitcoin Halving 2025” requires understanding the halving mechanism. This involves pinpointing the exact block height at which the reward is cut in half. To find out when this occurs in 2025, a helpful resource is available: When In 2025 Is The Next Bitcoin Halving?. Using this information, we can then accurately predict the “Wann Ist Das Bitcoin Halving 2025” date with greater precision.

Determining the exact date for the “Wann ist das Bitcoin Halving 2025?” requires understanding the halving mechanism. For insightful predictions and analysis on this event, check out this resource on Bitcoin Halving Prediction 2025 which helps clarify the timeline. Ultimately, pinpointing the precise “Wann ist das Bitcoin Halving 2025?” hinges on the block generation rate.

Determining the precise date for the 2025 Bitcoin halving requires careful analysis of the blockchain’s transaction history. Understanding the halving’s impact on Bitcoin’s future value is crucial, and a helpful resource for predicting this is available here: Bitcoin Price After Halving 2025. Ultimately, pinpointing the exact “Wann Ist Das Bitcoin Halving 2025” remains dependent on ongoing network activity.