Mining and the 2025 Halving

The Bitcoin halving, scheduled for 2025, is a significant event that fundamentally alters the economics of Bitcoin mining. This event, occurring approximately every four years, reduces the block reward miners receive for validating transactions and adding new blocks to the blockchain by half. This reduction directly impacts mining profitability, network security, and energy consumption.

Impact on Mining Profitability and Hash Rate

The halving directly reduces the revenue generated by Bitcoin miners. With fewer newly minted bitcoins awarded per block, miners must rely more heavily on transaction fees to remain profitable. This often leads to a temporary decrease in mining profitability, potentially causing some less efficient miners to shut down their operations. This reduction in mining activity can result in a temporary drop in the hash rate – the total computational power dedicated to securing the Bitcoin network. However, historically, the Bitcoin price has tended to increase following halving events, offsetting the reduced block reward and often leading to increased profitability in the long run. The 2012 and 2016 halvings provide strong examples of this pattern. While profitability initially dipped, the subsequent price appreciation ultimately benefited the remaining miners.

Impact on Energy Consumption

The Bitcoin network’s energy consumption is closely tied to the hash rate. A decrease in the hash rate, potentially resulting from the halving, could lead to a reduction in energy consumption. However, this effect is complex. Miners might respond to reduced profitability by upgrading to more energy-efficient hardware, thus potentially offsetting some of the energy savings from a reduced hash rate. Conversely, a price increase following the halving might incentivize new miners to enter the market, potentially increasing energy consumption. The net effect on energy consumption is therefore uncertain and depends on several interacting factors, including the Bitcoin price, the efficiency of new mining hardware, and the overall regulatory landscape.

Miner Responses to Reduced Profitability

Faced with reduced profitability, miners typically adopt several strategies. One common response is consolidation: smaller, less efficient mining operations may merge with larger ones to achieve economies of scale and improve profitability. Another strategy involves the adoption of more energy-efficient mining hardware, such as newer ASICs (Application-Specific Integrated Circuits) designed for optimal performance and lower energy consumption. Some miners might also choose to temporarily suspend operations until profitability improves, waiting for a price increase or a reduction in energy costs. Finally, some miners may shift their focus to mining alternative cryptocurrencies with higher profitability.

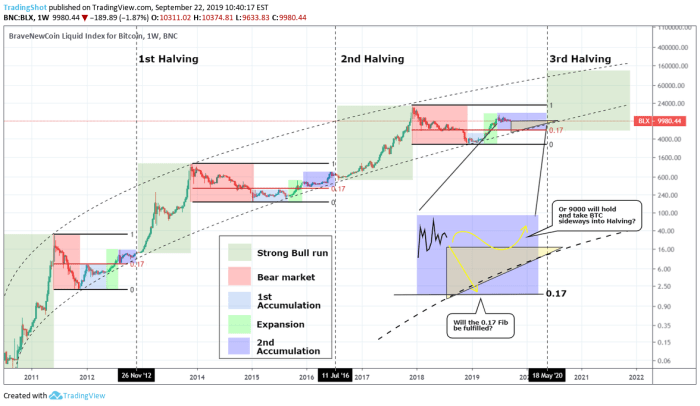

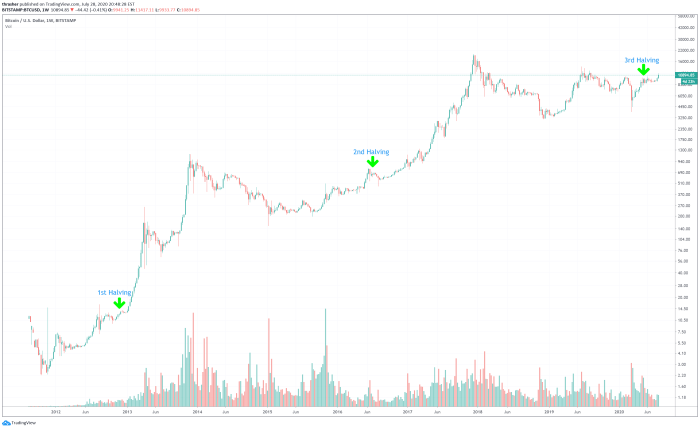

Comparison of Mining Landscapes Before and After Previous Halvings

Before the previous halvings, the mining landscape often featured a more fragmented distribution of mining power, with numerous smaller players competing. After the halving, a trend toward consolidation usually emerged, with larger, more well-capitalized mining operations gaining market share. The technological landscape also shifted, with the adoption of more efficient mining hardware becoming increasingly prevalent. For example, the period following the 2016 halving saw a significant increase in the adoption of advanced ASICs, leading to a substantial increase in the network’s hash rate despite the reduced block reward.

Relationship Between Mining Difficulty, Block Reward, and Bitcoin Price, What Date Is Bitcoin Halving 2025

A graph illustrating the relationship between mining difficulty, block reward, and Bitcoin price would show three distinct lines. The block reward line would be a step function, decreasing by half at each halving event. The mining difficulty line would generally trend upwards over time, reflecting the increasing computational power on the network. This increase is an inherent mechanism of the Bitcoin protocol, adjusting the difficulty to maintain a consistent block generation time of approximately 10 minutes. The Bitcoin price line would fluctuate considerably, but would likely show an overall upward trend over the long term, especially following halving events. The relationship isn’t perfectly linear, but there’s a clear correlation: Increased Bitcoin price often leads to increased mining difficulty as more miners join the network, seeking to capitalize on the higher profitability. Conversely, a decrease in the Bitcoin price can lead to a drop in mining difficulty as less-profitable miners leave the network. The halving event acts as a significant exogenous shock to the system, initially reducing profitability, but potentially setting the stage for long-term price appreciation and subsequent increased profitability.

Investor Sentiment and the 2025 Halving

Investor sentiment plays a crucial role in shaping Bitcoin’s price trajectory, particularly around major events like the halving. Understanding past investor behavior and anticipating future reactions is vital for navigating the market’s potential volatility. Analyzing historical data and current market indicators allows for a more informed assessment of the likely price movements leading up to and following the 2025 halving.

Historical Investor Behavior Around Previous Halvings

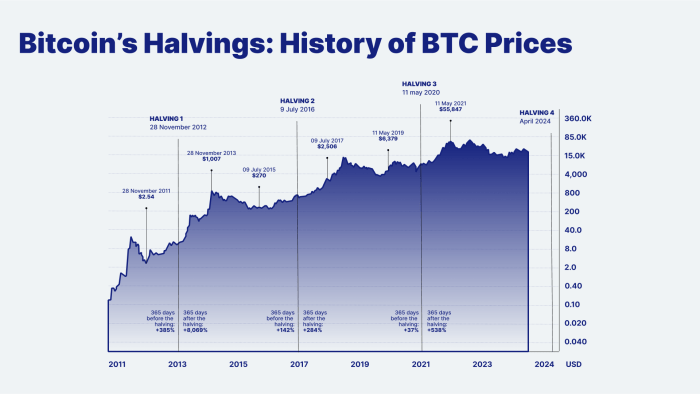

Previous Bitcoin halvings have exhibited distinct patterns in investor behavior. The 2012 and 2016 halvings were followed by significant price increases, although the timing and magnitude varied. In both instances, anticipation of the reduced supply fueled bullish sentiment, driving up trading volume and attracting new investors. However, the price increase wasn’t immediate; it unfolded over a period of months, sometimes even years, highlighting the complexity of predicting short-term price movements. The 2020 halving showed a different pattern, with a period of consolidation followed by a significant price surge in late 2020 and early 2021. This demonstrates the unpredictable nature of market reactions and the influence of factors beyond the halving itself, such as macroeconomic conditions and regulatory changes.

Key Indicators of Investor Sentiment

Several indicators provide insights into prevailing investor sentiment. Trading volume reflects the level of market activity; high volume often indicates strong conviction, either bullish or bearish. Social media sentiment, gauged through analysis of posts and discussions on platforms like Twitter and Reddit, offers a real-time pulse of public opinion. On-chain metrics, such as the number of active addresses and the miner’s revenue, can also provide valuable insights into the underlying strength of the network and investor confidence. Furthermore, Google Trends data, showing search interest in “Bitcoin,” can act as a proxy for public awareness and interest in the cryptocurrency.

Investor Expectations and Bitcoin’s Price

Investor expectations play a significant role in shaping Bitcoin’s price. The anticipation of scarcity due to the halving often creates a bullish narrative, leading to price increases. However, if the halving is already priced in – meaning the expected price increase is already reflected in the current market price – the actual event may not result in a dramatic price surge. Conversely, negative news or unexpected market events could dampen investor enthusiasm, potentially leading to price corrections even in the lead-up to the halving. The interplay between expectations and reality is a critical factor determining the actual price impact.

Potential for Increased Volatility

The period surrounding the halving is typically characterized by increased market volatility. As investors position themselves for anticipated price movements, trading activity intensifies, leading to larger price swings. Uncertainty about the market’s reaction to the halving itself, coupled with external factors like macroeconomic conditions and regulatory developments, can further amplify volatility. This increased volatility presents both opportunities and risks for investors.

Hypothetical Scenario: Divergent Investor Reactions

Consider two scenarios. In Scenario A, investors overwhelmingly anticipate a significant price increase post-halving. This leads to a strong buying pressure in the months leading up to the event, driving the price significantly higher. After the halving, the price might consolidate or even experience a short-term correction before resuming its upward trajectory, driven by continued buying pressure. In contrast, Scenario B depicts a more cautious investor sentiment. Despite the halving, the price remains relatively flat or even declines due to factors like broader market downturn or regulatory uncertainty. This scenario highlights the importance of considering diverse investor reactions and not solely relying on the halving as a price driver.

Frequently Asked Questions about the 2025 Bitcoin Halving: What Date Is Bitcoin Halving 2025

The Bitcoin halving is a significant event in the cryptocurrency world, generating considerable interest and speculation. Understanding the mechanics, implications, and potential outcomes is crucial for both seasoned investors and newcomers alike. This section addresses common questions surrounding the 2025 halving.

Bitcoin Halving Explained

A Bitcoin halving is a programmed reduction in the rate at which new Bitcoins are created and added to the circulating supply. This occurs approximately every four years, or every 210,000 blocks mined. The halving mechanism is integral to Bitcoin’s deflationary nature, limiting the total number of Bitcoins to 21 million. Essentially, it cuts the reward miners receive for verifying transactions in half.

Expected Date of the 2025 Bitcoin Halving

While the exact date remains subject to minor fluctuations depending on the block mining time, the 2025 Bitcoin halving is currently estimated to occur around April 2025. This prediction is based on the consistent average block time of approximately 10 minutes and the pre-programmed halving algorithm. However, variations in mining difficulty can slightly affect the precise timing. For example, if mining difficulty increases significantly, the block time might increase slightly and thus delay the halving. Conversely, a decrease in difficulty could speed up the process.

Impact of the Halving on Bitcoin Supply

The halving directly impacts Bitcoin’s circulating supply. Each halving reduces the rate of new Bitcoin creation by 50%. Before the halving, miners receive a certain number of Bitcoins as a reward for successfully mining a block. After the halving, this reward is halved, leading to a slower increase in the total supply of Bitcoins. This controlled reduction contributes to Bitcoin’s scarcity and potential for long-term value appreciation. The 2025 halving will reduce the block reward from 6.25 BTC to 3.125 BTC per block.

Potential Risks and Opportunities of the 2025 Halving

The 2025 halving presents both risks and opportunities. A potential opportunity lies in the anticipated increase in Bitcoin’s price due to decreased supply. Historically, halvings have been followed by periods of price appreciation, though this is not guaranteed. However, the market’s reaction can be unpredictable, influenced by various macroeconomic factors and investor sentiment. Risks include potential price volatility in the lead-up to and following the halving, and the possibility that the expected price surge may not materialize due to unforeseen circumstances, such as a broader economic downturn or regulatory changes.

Reliable Sources of Information on the Bitcoin Halving

Reliable information on the Bitcoin halving can be found from several reputable sources. These include blockchain explorers (such as Blockchain.com or Blockstream Explorer) that provide real-time data on block creation and mining rewards. Reputable cryptocurrency news outlets, academic research papers focusing on Bitcoin economics, and official Bitcoin Core documentation also offer valuable insights. Always critically evaluate information from various sources to ensure accuracy and avoid misinformation.

The Long-Term Implications of the 2025 Halving

The 2025 Bitcoin halving, reducing the rate of new Bitcoin creation by half, is a significant event with potentially profound long-term consequences for Bitcoin’s adoption, market position, and role in the future of finance. Its impact will likely ripple across the broader cryptocurrency landscape and influence technological advancements within the Bitcoin ecosystem. Understanding these potential implications is crucial for navigating the evolving digital asset landscape.

The halving’s impact on Bitcoin’s long-term adoption and market dominance hinges on several factors. Reduced supply, theoretically, should increase scarcity and potentially drive up demand, bolstering Bitcoin’s price and reinforcing its position as a store of value. This could attract further institutional and individual investment, leading to wider adoption. However, macroeconomic factors, regulatory changes, and the emergence of competing cryptocurrencies will all play a significant role in determining the actual outcome. A successful halving cycle, characterized by price appreciation and increased adoption, could further cement Bitcoin’s dominance within the cryptocurrency market. Conversely, a less impactful halving could allow alternative cryptocurrencies to gain more traction.

Bitcoin’s Role in the Future of Finance

The 2025 halving could significantly influence Bitcoin’s role in the future of finance. A sustained price increase following the halving could enhance Bitcoin’s credibility as a viable alternative to traditional financial systems. Increased adoption might lead to greater integration into existing financial infrastructure, potentially facilitating cross-border payments, decentralized finance (DeFi) applications, and other innovative financial services. The halving’s impact on Bitcoin’s price and adoption could accelerate or hinder this integration, influencing the pace of financial innovation built upon the Bitcoin blockchain. For example, if Bitcoin’s price significantly increases after the halving, it could lead to more businesses accepting Bitcoin as a form of payment, thus increasing its integration into everyday transactions.

Comparison with Previous Halvings

Analyzing the long-term effects of previous Bitcoin halvings provides valuable insights into the potential outcomes of the 2025 event. The halvings of 2012 and 2016 were followed by significant price increases, although the timing and magnitude varied. The 2012 halving saw a gradual price appreciation, while the 2016 halving led to a more pronounced bull market. However, it’s important to note that numerous other factors influenced these price movements, including market sentiment, technological advancements, and regulatory developments. Comparing the 2025 halving to these previous events requires considering the unique macroeconomic context and the evolving cryptocurrency landscape. While past performance is not indicative of future results, the historical data provides a framework for potential scenarios.

Impact on Bitcoin’s Technological Development

The 2025 halving could indirectly influence the development of Bitcoin’s underlying technology. A price increase following the halving might attract more developers and researchers to the Bitcoin ecosystem, leading to innovations in areas such as scalability, privacy, and security. Increased funding and community engagement could accelerate the development and adoption of Layer-2 scaling solutions, such as the Lightning Network, improving transaction speed and reducing fees. Conversely, a less successful halving might lead to a decrease in development activity, potentially slowing down technological advancements. The correlation between Bitcoin’s price and its technological development is complex and not always directly proportional, but a positive price trend often fosters a more vibrant and active development community.