Market Predictions and Investor Sentiment

The Bitcoin halving in 2025, anticipated to occur around April, is a significant event expected to influence the cryptocurrency’s price trajectory. The halving, which reduces the rate at which new Bitcoins are created, is often viewed as a deflationary event that could increase scarcity and, consequently, price. However, the actual impact remains a subject of ongoing debate among market analysts and investors. Several factors beyond the halving itself will play a crucial role in shaping the market’s response.

Predicting Bitcoin’s price movement is inherently challenging due to its volatility and the influence of numerous intertwined factors. While the halving is a predictable event, its market impact is far from certain. The following sections explore various perspectives on the 2025 halving’s potential effects, considering both bullish and bearish scenarios.

Bullish and Bearish Market Predictions

The Bitcoin halving often sparks significant speculation about its impact on price. Bullish predictions anticipate a substantial price increase following the halving, while bearish predictions suggest a less dramatic or even negative impact. These predictions are based on historical data, supply and demand dynamics, and macroeconomic factors.

| Prediction Type | Price Movement Expectation | Reasoning | Example/Real-Life Case |

|---|---|---|---|

| Bullish | Significant price increase post-halving | Reduced supply, increased scarcity, anticipation of future price appreciation, potential institutional investment. Historical precedent suggests a price increase following previous halvings. | The halvings in 2012 and 2016 were followed by significant bull runs, although the time lag between the halving and price surge varied. This historical precedent fuels the bullish sentiment. |

| Bearish | Limited or no significant price increase, potential price correction | Macroeconomic uncertainty, regulatory pressures, potential saturation of the market, existing supply already exceeding demand, investor fatigue. The 2020 halving, for instance, was followed by a period of consolidation before the subsequent bull run. | The crypto market’s correlation with traditional markets means negative macroeconomic events like recessions or high inflation can negatively impact Bitcoin’s price regardless of the halving. The 2022 bear market, despite the upcoming 2024 halving, exemplifies this. |

| Neutral | Moderate price increase, or sideways movement | Balance between bullish and bearish factors; the market’s response may be muted due to various conflicting pressures. | This scenario acknowledges that the halving’s impact is not solely deterministic, and other market forces can significantly moderate its effects. |

Investor Sentiment and Macroeconomic Factors

Investor sentiment plays a crucial role in shaping Bitcoin’s price. Leading up to the halving, anticipation and speculation can drive price increases. However, if investor confidence wanes due to macroeconomic instability or regulatory uncertainty, the positive impact of the halving might be diminished. Conversely, a positive macroeconomic environment, coupled with strong investor confidence, could amplify the halving’s effect on price.

Macroeconomic factors, such as inflation rates, interest rates, and global economic growth, significantly influence Bitcoin’s price. For instance, high inflation could drive investors towards Bitcoin as a hedge against inflation, potentially boosting its price. Conversely, rising interest rates might divert investment away from riskier assets like Bitcoin, leading to price corrections. The interaction between these macroeconomic factors and the halving event will be crucial in determining the overall market response. A strong global economy might lead to increased investment in Bitcoin, amplifying the halving’s positive impact, while a recessionary environment could dampen its effects.

Long-Term Implications for Bitcoin

The Bitcoin halving, a programmed event reducing the rate of new Bitcoin creation, has profound and lasting effects on the cryptocurrency’s long-term trajectory. Understanding these implications is crucial for investors and anyone interested in the future of decentralized finance. The halving’s impact extends beyond immediate price fluctuations, shaping Bitcoin’s scarcity, adoption, and overall narrative as a digital store of value.

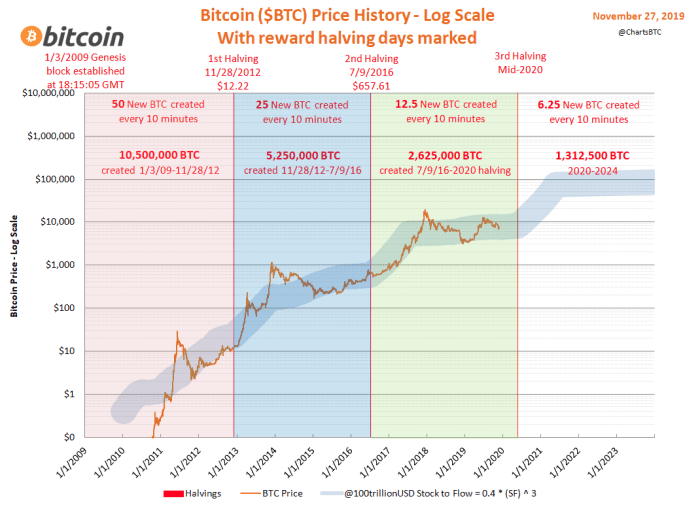

Bitcoin’s Halving Mechanism and Scarcity

The Bitcoin halving mechanism, coded into its core protocol, cuts the block reward paid to miners in half approximately every four years. This deliberate deflationary policy directly impacts the rate at which new Bitcoin enters circulation. The predictable nature of these halvings contributes significantly to Bitcoin’s scarcity. As the supply becomes increasingly constrained, while demand potentially remains robust or increases, the fundamental value proposition of Bitcoin as a limited resource is reinforced. This inherent scarcity is a key driver of its perceived value and a differentiating factor compared to fiat currencies. The decreasing rate of Bitcoin creation mimics the scarcity of precious metals like gold, bolstering its appeal as a digital gold alternative.

Increased Institutional Adoption

Halving events often precede periods of increased institutional interest in Bitcoin. The anticipation of scarcity, coupled with the potential for price appreciation, makes Bitcoin an attractive asset for large investors seeking diversification and inflation hedges. Following previous halvings, we’ve seen a notable increase in the participation of institutional investors, including hedge funds, asset management firms, and even publicly traded companies adding Bitcoin to their balance sheets. This institutional adoption provides a significant boost to Bitcoin’s legitimacy and market capitalization, further solidifying its position in the global financial landscape. For example, MicroStrategy’s substantial Bitcoin purchases demonstrate the growing confidence of institutional players in Bitcoin’s long-term potential.

Bitcoin’s Narrative as a Decentralized Store of Value

The halving events play a crucial role in reinforcing Bitcoin’s narrative as a decentralized store of value. The predictable and transparent nature of the halving mechanism strengthens the trust and confidence in the system. The fact that this scarcity is programmed into the Bitcoin protocol, independent of any central authority, further underscores its decentralized nature. This contrasts sharply with traditional financial systems, where monetary policy is subject to political influence and potential manipulation. The halving, therefore, acts as a powerful symbol of Bitcoin’s resilience and its commitment to its original principles.

Comparison with Other Cryptocurrencies

While other cryptocurrencies have implemented similar mechanisms to control their token supply, Bitcoin’s halving remains unique due to its established track record and network effect. Many altcoins have employed token burning mechanisms or other deflationary strategies, but none have the same level of market maturity and widespread adoption as Bitcoin. Furthermore, the predictability and transparency of Bitcoin’s halving are crucial differentiators. The lack of a central authority controlling the halving schedule contributes to Bitcoin’s decentralized and trustless nature. The impact of these mechanisms on price and adoption varies significantly depending on the specific cryptocurrency and its overall market dynamics.

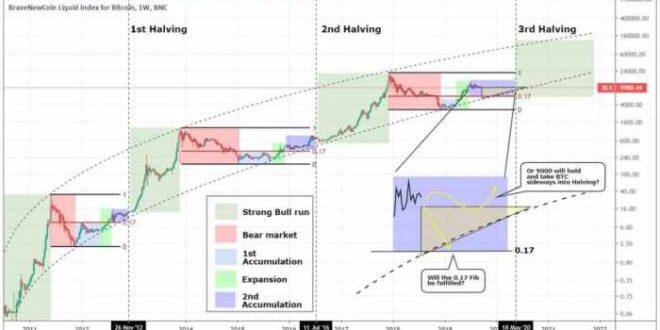

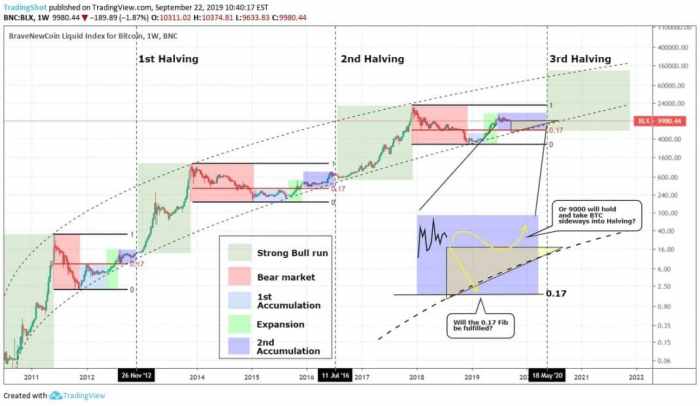

Historical Impact of Bitcoin Halvings, What Day Is Bitcoin Halving 2025

The following timeline illustrates the historical impact of Bitcoin halvings on its price and adoption:

| Halving Date | Approximate Price Before Halving (USD) | Approximate Price After Halving (USD) | Notable Observations |

|---|---|---|---|

| November 28, 2012 | ~13 USD | ~1000 USD (approx. 1 year later) | Significant price increase following the first halving, accompanied by growing adoption. |

| July 9, 2016 | ~650 USD | ~20000 USD (approx. 2 years later) | Another substantial price surge, reflecting increased institutional and public interest. |

| May 11, 2020 | ~8700 USD | ~64000 USD (approx. 1 year later) | The third halving saw a similar trend of price appreciation, although market dynamics were more complex. |

Note: These price points are approximate and represent a snapshot in time. The actual price movements are complex and influenced by numerous factors beyond the halving itself. Furthermore, the time lag between the halving and the subsequent price surge varies.

Frequently Asked Questions (FAQs): What Day Is Bitcoin Halving 2025

This section addresses common questions surrounding the upcoming Bitcoin halving in 2025, clarifying the process, its historical impact, and associated risks. Understanding these points is crucial for anyone considering Bitcoin investment, especially in the lead-up to this significant event.

Bitcoin Halving Explained

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created (mined) by 50%. This occurs approximately every four years, or more precisely, every 210,000 blocks mined. The halving mechanism is designed to control inflation and maintain the scarcity of Bitcoin over time. Essentially, it cuts the reward miners receive for verifying transactions on the blockchain.

Bitcoin Halving Date in 2025

The estimated date for the next Bitcoin halving is sometime in April 2025. The precise date depends on the time it takes to mine the 210,000 blocks leading up to the event. While various sources offer specific dates, these are projections and subject to minor fluctuations based on the network’s mining difficulty. For a precise date, it’s essential to monitor the Bitcoin blockchain in the weeks leading up to the event. Several cryptocurrency news sites and blockchain explorers provide real-time block count data.

Halving’s Effect on Bitcoin’s Price

Historically, Bitcoin halvings have been followed by periods of significant price increases. The reduced supply of newly minted Bitcoins, coupled with consistent demand, has often created upward pressure on the price. However, it’s crucial to note that this correlation doesn’t guarantee future price movements. Other factors, such as macroeconomic conditions, regulatory changes, and overall market sentiment, significantly influence Bitcoin’s price. The 2012 and 2016 halvings were followed by substantial bull runs, but this is not a certainty for the 2025 halving.

Risks of Investing Around a Halving

Investing in Bitcoin, particularly around a halving event, carries significant risk. The price volatility associated with Bitcoin is well-documented, and this volatility can be amplified around halvings due to heightened market speculation. There’s no guarantee of price increases; the market could react negatively, leading to potential losses. Investors should carefully assess their risk tolerance and only invest what they can afford to lose.

Uniqueness of the 2025 Halving

Whether the 2025 halving will be significantly different from previous ones remains to be seen. However, several potential factors could influence its impact. The increasing institutional adoption of Bitcoin, the maturation of the cryptocurrency market, and the evolving regulatory landscape could all play a role in shaping the market’s response. Additionally, the ongoing debate surrounding environmental concerns related to Bitcoin mining might also affect investor sentiment and, consequently, the price.

Illustrative Example: Bitcoin Price Chart

This section provides a hypothetical illustration of Bitcoin’s price action surrounding a previous halving event, to better understand potential price movements in the lead-up to and aftermath of the 2025 halving. It’s crucial to remember that this is a simplified representation and actual price movements are significantly more complex and influenced by numerous unpredictable factors.

The chart would depict a period roughly two years before and two years after a hypothetical halving event. In the two years leading up to the halving, we would see an initial period of relatively stable, albeit volatile, price action. This initial phase might be characterized by a gradual upward trend punctuated by several significant corrections. The anticipation of the halving would gradually build, leading to increasing volatility and price fluctuations as investors speculate on the event’s impact. As the halving approaches, the chart might show a period of intense price action, with sharp increases and decreases, reflecting the heightened uncertainty and speculative trading.

Price Action Leading Up to the Halving

The price leading up to the halving could be visualized as a series of upward-sloping waves, each wave representing a period of price increase followed by a correction. The amplitude of these waves (the distance between the peaks and troughs) would likely increase as the halving date draws closer, reflecting the growing market excitement and speculation. The overall trend, however, would likely be upward, suggesting a gradual accumulation of Bitcoin in anticipation of the halving. Imagine the peaks getting progressively higher, while the troughs still remain above the previous cycle’s peaks, demonstrating a bullish trend despite the corrections.

Price Action Following the Halving

Post-halving, the chart might initially show a period of consolidation or even a slight dip, as the immediate impact of the halving is digested by the market. This is often followed by a period of gradual price appreciation. The rate of this appreciation could be initially slower than the price increase leading up to the halving, before potentially accelerating significantly as the scarcity of newly mined Bitcoin becomes more apparent. The chart would display a gradual upward trend, punctuated by less severe corrections than those seen in the pre-halving period. The overall trend, however, would continue to be upward, indicating a positive long-term outlook for Bitcoin’s price. This post-halving appreciation could be represented by a less volatile upward trend compared to the pre-halving period, showcasing a steadier growth pattern.

Illustrative Price Ranges

For illustrative purposes, let’s consider a hypothetical scenario. In the two years leading up to the halving, the price might fluctuate between $20,000 and $50,000, culminating in a price around $45,000 at the halving event. Following the halving, the price could initially dip to $40,000 before gradually increasing to $60,000 within the next year and potentially reaching $100,000 or more over the subsequent year. These figures are purely hypothetical and for illustrative purposes only. The actual price movements would be significantly influenced by numerous market factors.

What Day Is Bitcoin Halving 2025 – Pinpointing the exact day of the Bitcoin halving in 2025 requires close monitoring of the blockchain, but it’s a significant event for cryptocurrency investors. Planning your marketing strategy around this event could be highly beneficial, and for that, consider setting up a robust Google Ads Account to reach a wider audience. Effective advertising could capitalize on the increased interest surrounding the Bitcoin halving in 2025, making it a key date for your campaign calendar.