Bitcoin Halving 2025

The Bitcoin halving, a programmed event occurring approximately every four years, is a significant event in the cryptocurrency’s lifecycle. It directly impacts the rate at which new Bitcoins are introduced into circulation, influencing supply and, historically, price. Understanding the mechanics of this event and its historical impact is crucial for navigating the potential market shifts in 2025.

Bitcoin Halving Mechanics and Supply Impact

The Bitcoin halving reduces the reward miners receive for successfully adding new blocks to the blockchain by 50%. This process, hardcoded into the Bitcoin protocol, limits the total number of Bitcoins to 21 million. Before the first halving, miners received 50 BTC per block. Each halving cuts this reward in half, gradually slowing the rate of new Bitcoin creation. This controlled inflation mechanism is designed to maintain Bitcoin’s scarcity and potentially increase its value over time. The reduced supply, coupled with potentially increasing demand, is the primary driver of the anticipated price increase following a halving.

Historical Impact of Bitcoin Halvings

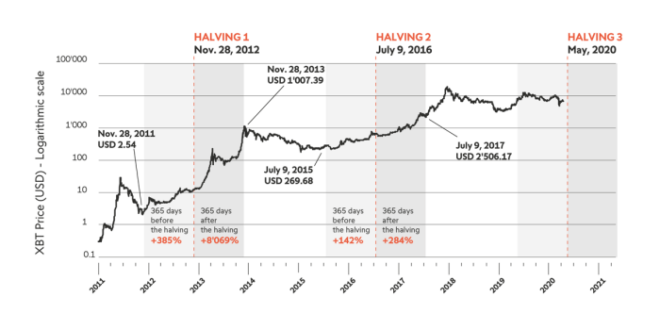

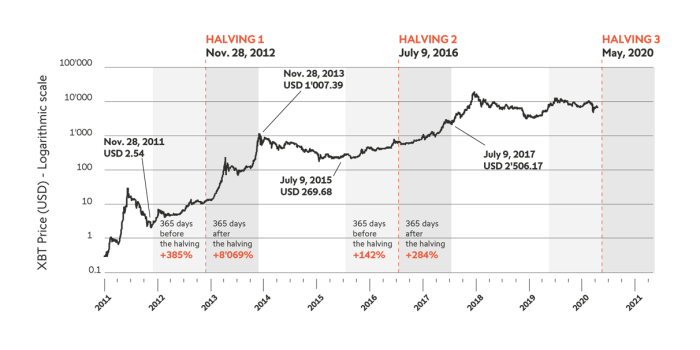

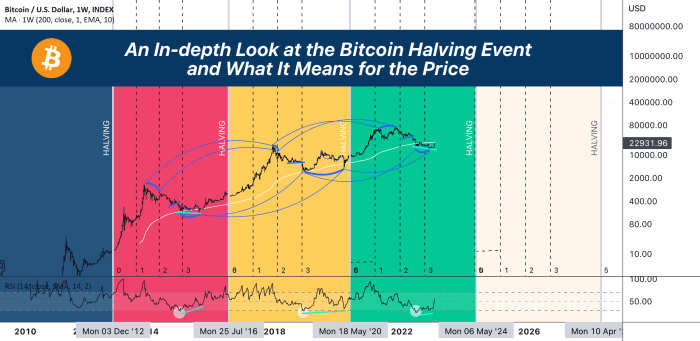

The previous three Bitcoin halvings have demonstrably influenced both price and market sentiment. The first halving, in November 2012, saw a relatively modest price increase in the following months. The second halving, in July 2016, preceded a significant bull market, with Bitcoin’s price surging dramatically. The third halving, in May 2020, was followed by another substantial price increase, though the market conditions were significantly different than in 2016. While correlation doesn’t equal causation, the historical data suggests a strong link between halvings and subsequent price appreciation.

Anticipated Effects of the 2025 Halving

Predicting the precise impact of the 2025 halving is inherently challenging. However, several factors suggest a potential for significant price movement. The market’s maturity since the 2020 halving is one key difference. Increased institutional adoption, regulatory developments, and macroeconomic conditions will all play a role. Unlike previous halvings, the 2025 event will occur in a more regulated and scrutinized environment, potentially influencing investor behavior and price volatility. The interplay between supply reduction and prevailing market sentiment will be crucial in determining the outcome.

Timeline of Key Events Surrounding the 2025 Halving

The lead-up to the 2025 halving will likely involve increased speculation and volatility. Months before the event, we can anticipate a surge in discussions and analysis regarding its potential impact. The halving itself will be a highly anticipated event, potentially followed by a period of increased price volatility. In the months following the halving, the market will adjust to the new block reward, and the price will likely be influenced by broader macroeconomic trends and market sentiment.

Comparison of Bitcoin Halving Events

| Block Reward (BTC) | Estimated Date | Market Conditions | Notable Events/Observations |

|---|---|---|---|

| 50 | November 2012 | Early market, low adoption | Relatively modest price increase following the event. |

| 25 | July 2016 | Growing adoption, increasing institutional interest | Significant price surge following the event, marking the start of a major bull market. |

| 12.5 | May 2020 | Increased institutional investment, global pandemic | Substantial price increase, although market volatility remained high due to external factors. |

| 6.25 | ~March/April 2025 (estimated) | High regulatory scrutiny, uncertain macroeconomic climate | Outcome uncertain, influenced by various market forces. |

Predicting Bitcoin’s Price After the 2025 Halving

Predicting Bitcoin’s price after any event, especially a halving, is inherently speculative. However, by analyzing historical data, considering influencing factors, and examining various prediction models, we can form a more informed perspective on potential price trajectories. While no model guarantees accuracy, understanding these approaches helps navigate the complexities of the cryptocurrency market.

Historical Correlation Between Halvings and Price Movements

The Bitcoin halving, which reduces the rate of new Bitcoin creation, has historically been followed by periods of significant price appreciation. The 2012 and 2016 halvings were both followed by substantial bull runs, although the timing and magnitude varied. Analyzing the price charts from these periods reveals a general upward trend following each halving, although other market forces significantly impacted the price. The time lag between the halving and the peak price also varied, highlighting the influence of factors beyond the halving itself. For example, the 2012 halving saw a more gradual price increase, while the 2016 halving led to a more rapid surge. This difference underscores the limitations of relying solely on historical correlation for prediction.

Factors Influencing Bitcoin’s Price Post-Halving

Several factors beyond the halving itself significantly influence Bitcoin’s price. Macroeconomic conditions, such as inflation rates, interest rates, and overall economic growth, play a crucial role. Regulatory changes, both favorable and unfavorable, can dramatically impact investor sentiment and market liquidity. Technological advancements, such as the development of layer-2 scaling solutions or improvements in mining efficiency, can also affect the price. Finally, broader market sentiment and adoption rates significantly influence Bitcoin’s price. A surge in institutional investment or widespread adoption by retail investors can fuel price increases. Conversely, negative news or regulatory crackdowns can lead to price drops.

Price Prediction Models and Their Limitations, What Day Is The Bitcoin Halving 2025

Various models attempt to predict Bitcoin’s price. One common approach is the stock-to-flow model, which uses the ratio of existing Bitcoin to newly mined Bitcoin to estimate future scarcity and price. While this model has shown some correlation with historical data, it has limitations, as it doesn’t account for the influence of external factors mentioned above. Other models use technical analysis, examining chart patterns and indicators to predict future price movements. These models can be subjective and prone to biases. Finally, some models use fundamental analysis, evaluating the underlying value proposition of Bitcoin based on factors such as adoption rates and network effects. All models are inherently limited by their inability to perfectly predict the complex interplay of market forces. For example, the stock-to-flow model’s accuracy significantly decreased after the 2021 bull run.

Expert Opinions and Market Analyses

Expert opinions on Bitcoin’s price after the 2025 halving vary widely. Some analysts predict significant price increases, potentially reaching six-figure values, citing the historical correlation between halvings and bull runs, alongside growing institutional adoption. Others express more cautious optimism, acknowledging the potential for price increases but highlighting the risks associated with macroeconomic uncertainty and regulatory challenges. Still, others remain bearish, citing concerns about the sustainability of the current market hype and potential regulatory crackdowns. These diverse viewpoints highlight the inherent uncertainty in making price predictions. For example, PlanB, the creator of the stock-to-flow model, has revised his predictions multiple times based on changing market conditions.

Hypothetical Bullish and Bearish Market Scenarios

A bullish scenario could see Bitcoin’s price surge significantly following the 2025 halving, driven by a combination of factors, including increasing institutional adoption, favorable regulatory developments, and sustained macroeconomic growth. In this scenario, the price could potentially reach and surpass previous all-time highs, fueled by strong investor demand and limited supply. Conversely, a bearish scenario could see the price remain relatively flat or even decline, hampered by macroeconomic headwinds, negative regulatory changes, or a loss of investor confidence. This scenario could be exacerbated by increased selling pressure from miners seeking to offset reduced block rewards. The actual outcome will likely depend on the interplay of these various factors. For instance, a significant global recession could significantly dampen even a bullish halving cycle.

The Impact of the 2025 Halving on Bitcoin Mining

The Bitcoin halving, a programmed event occurring approximately every four years, significantly impacts the Bitcoin mining ecosystem. This event reduces the block reward miners receive for successfully adding new blocks to the blockchain, directly affecting their profitability and potentially influencing the network’s overall security and stability. The 2025 halving, reducing the block reward by half, will be no exception, presenting both challenges and opportunities for miners.

The reduced block reward directly affects the profitability of Bitcoin mining. Miners earn Bitcoin for solving complex cryptographic puzzles, and the block reward forms a crucial part of their revenue. A halving cuts this revenue stream in half, making it harder for miners to cover their operational costs, which include electricity, hardware maintenance, and potentially labor. Profitability becomes heavily dependent on the price of Bitcoin; a higher Bitcoin price can offset the reduced reward, while a lower price could force less profitable miners to shut down their operations. This dynamic interplay between Bitcoin’s price and mining profitability is a key factor influencing the post-halving landscape.

The Impact on Hash Rate and Network Security

The halving’s impact on the hash rate – a measure of the total computational power securing the Bitcoin network – is a crucial consideration. A drop in profitability could lead some miners to become unprofitable and shut down their operations, resulting in a decreased hash rate. This reduced hash rate could, in theory, make the network more vulnerable to 51% attacks, where a malicious actor controls more than half of the network’s hash rate to manipulate the blockchain. However, historically, halvings have often been followed by periods of increased hash rate due to technological advancements, such as the introduction of more efficient mining hardware and the entry of new, larger mining operations. The long-term effect on network security remains to be seen, as it depends on several factors including the price of Bitcoin and technological innovations.

Miner Adaptation Strategies

Faced with reduced profitability, miners will likely employ various strategies to adapt. These strategies could include: upgrading to more energy-efficient mining hardware, negotiating lower electricity costs with providers, diversifying revenue streams by offering hosting services or engaging in other crypto-related activities, and focusing on larger-scale operations to benefit from economies of scale. Some miners might also choose to consolidate their operations, merging with other mining pools to improve efficiency and profitability. The success of these strategies will depend on individual circumstances and market conditions.

Comparison with Previous Halvings

The 2025 halving will not be the first. Previous halvings have shown varied effects on the mining landscape. The 2012 and 2016 halvings were followed by periods of price increases, which ultimately boosted profitability and offset the reduced block reward. However, the impact varied among miners, with some adapting successfully and others exiting the market. The 2020 halving saw a period of price consolidation followed by a significant bull run. The overall impact of halvings is complex and influenced by factors beyond the halving itself, including macroeconomic conditions, regulatory changes, and technological advancements.

Challenges and Opportunities for Miners Post-2025 Halving

The following points summarize the key challenges and opportunities miners will face after the 2025 halving:

- Challenges: Reduced profitability, potential decrease in hash rate, increased competition, and the need for significant capital investment in new hardware or infrastructure.

- Opportunities: Potential for increased Bitcoin price leading to higher profitability, technological advancements leading to improved efficiency, consolidation of the mining industry, and the emergence of new, more efficient mining technologies.

The 2025 Halving and Bitcoin’s Long-Term Prospects

The 2025 Bitcoin halving is a significant event with potentially profound implications for Bitcoin’s long-term trajectory. Reducing the rate of new Bitcoin entering circulation will directly impact its scarcity, a key factor influencing its value proposition as a store of value and potentially driving price appreciation. The event’s impact extends beyond price, affecting adoption, mining dynamics, and the broader cryptocurrency ecosystem.

Bitcoin’s Scarcity and Store-of-Value Proposition

The halving mechanism is integral to Bitcoin’s deflationary nature. By reducing the supply of newly minted Bitcoin, each halving reinforces its scarcity. This inherent scarcity is a central argument for Bitcoin’s value as a store of value, similar to gold, where limited supply contributes to its long-term price stability and appreciation. The 2025 halving will further solidify this scarcity, potentially making Bitcoin even more attractive to investors seeking inflation hedges and long-term wealth preservation. Historically, previous halvings have been followed by periods of significant price appreciation, although this is not guaranteed to repeat. For example, the 2012 and 2016 halvings were followed by substantial bull runs.

Implications for Bitcoin Adoption and Mainstream Acceptance

The 2025 halving could act as a catalyst for increased Bitcoin adoption and mainstream acceptance. As the scarcity narrative strengthens, institutional investors and individual users might be drawn to Bitcoin as a safe haven asset and a potential hedge against inflation. Increased media attention surrounding the halving often boosts public awareness, potentially leading to wider adoption. However, factors beyond the halving, such as regulatory clarity and technological advancements, also play crucial roles in determining mainstream acceptance. The halving’s impact on adoption will likely be a gradual process, influenced by various market conditions and broader economic trends.

Long-Term Effects on the Broader Cryptocurrency Market

The 2025 halving’s impact extends beyond Bitcoin. Altcoins, cryptocurrencies other than Bitcoin, could experience price fluctuations correlated with Bitcoin’s performance. A significant Bitcoin price surge post-halving might attract investment away from altcoins, while a period of stagnation could lead to relative altcoin outperformance. However, the overall impact on the broader cryptocurrency market is complex and depends on numerous interacting factors, including the overall market sentiment, regulatory developments, and the performance of other asset classes. The interconnectivity between Bitcoin and the altcoin market means the halving’s effects are not isolated to Bitcoin alone.

Potential Future Price and Market Dominance

Predicting Bitcoin’s future price is inherently speculative. Various market scenarios exist, each leading to different outcomes. Some analysts predict a significant price increase following the halving due to increased scarcity and investor demand. Others are more cautious, citing potential regulatory risks and macroeconomic uncertainties. Bitcoin’s market dominance, its share of the total cryptocurrency market capitalization, is also subject to change. Increased Bitcoin adoption could strengthen its dominance, while the emergence of innovative altcoins could potentially challenge it. The interplay of these factors makes accurate long-term predictions difficult.

Potential Long-Term Price Trajectory

This text-based illustration depicts potential Bitcoin price trajectories post-2025 halving.

Scenario A (Bullish): A sharp price increase following the halving, driven by strong investor demand and increased scarcity. The price steadily climbs, potentially reaching new all-time highs within a few years. This scenario assumes positive macroeconomic conditions and continued institutional adoption.

Scenario B (Neutral): A moderate price increase followed by periods of consolidation. The price fluctuates within a defined range, reflecting a balance between supply and demand. This scenario assumes a more moderate level of investor enthusiasm and potential macroeconomic headwinds.

Scenario C (Bearish): A relatively flat or even slightly declining price after the halving. This scenario assumes negative macroeconomic conditions, regulatory uncertainty, or a significant shift in investor sentiment towards alternative assets.

| Scenario | Description | Potential Price Trajectory (Illustrative) |

| ——– | ———————————————– | ————————————– |

| A | Strong Bull Run | Steep upward curve, reaching new highs |

| B | Moderate Growth and Consolidation | Gentle upward trend with fluctuations |

| C | Flat or Slightly Declining | Horizontal or slightly downward trend |

Note: This is a simplified representation and does not account for all possible market variables. Actual price movements will depend on numerous interconnected factors.

Frequently Asked Questions (FAQs) about the Bitcoin Halving 2025: What Day Is The Bitcoin Halving 2025

The Bitcoin halving is a significant event in the cryptocurrency’s lifecycle, impacting its price, mining profitability, and overall network security. Understanding this event is crucial for anyone involved in or interested in the Bitcoin ecosystem. This section addresses some of the most frequently asked questions surrounding the 2025 halving.

Bitcoin Halving Mechanism

The Bitcoin halving is a programmed event embedded in the Bitcoin protocol. It occurs approximately every four years, reducing the rate at which new Bitcoins are created (mined) by half. This reduction in the block reward, the incentive for miners to secure the network, is designed to control Bitcoin’s inflation rate and maintain its scarcity over time. Initially, the block reward was 50 BTC. After the first halving, it became 25 BTC, then 12.5 BTC, and the next halving in 2025 will reduce it to 6.25 BTC. This controlled reduction ensures a predictable and finite supply of Bitcoin, ultimately capped at 21 million coins.

Expected Date of the 2025 Bitcoin Halving

While the halving is approximately every four years, the precise date depends on the time it takes to mine a block. Bitcoin’s block time target is 10 minutes, but this fluctuates slightly. Based on current mining difficulty and block times, the 2025 halving is currently estimated to occur around the Spring of 2025. However, the exact date will only be known closer to the event as the mining difficulty adjusts. Minor variations of a few days are entirely possible. For instance, the 2020 halving was slightly delayed compared to some initial predictions.

Impact of the Halving on Bitcoin’s Price

Historically, Bitcoin’s price has tended to increase in the period leading up to and following a halving event. This is often attributed to the reduced supply of newly mined Bitcoin, potentially creating upward pressure on demand. The 2012 and 2016 halvings were followed by significant price increases, although other market factors were also at play. It’s important to note that past performance is not indicative of future results. The price after the 2025 halving is uncertain and subject to various market forces, including macroeconomic conditions, regulatory changes, and overall investor sentiment. The 2012 and 2016 halvings were followed by bull markets, but the market dynamics are complex and not solely driven by the halving.

Risks Associated with Investing in Bitcoin Around the Halving

Investing in Bitcoin, particularly around a halving event, carries significant risk. The price of Bitcoin is notoriously volatile, subject to sharp price swings in either direction. The anticipation surrounding a halving can lead to speculative bubbles, potentially resulting in significant price increases followed by substantial corrections. Investors should be prepared for both large gains and losses. Furthermore, regulatory uncertainty and technological developments can also significantly impact Bitcoin’s price. It is essential to conduct thorough research and only invest what one can afford to lose. Remember the dramatic price drops seen in previous crypto winters, even after halvings.

Impact of the Halving on Bitcoin Miners

The halving directly impacts Bitcoin miners’ profitability. With a reduced block reward, miners’ revenue per block decreases. This can force less efficient miners out of the market, increasing the network’s overall hash rate concentration among larger, more efficient operations. To maintain profitability, miners may need to increase their mining efficiency, potentially through upgrades to their hardware or by securing cheaper energy sources. Some miners might choose to temporarily halt operations or even shut down permanently if the reduced reward fails to cover their operational costs. This dynamic, however, also contributes to a more secure and decentralized network in the long run.