What is Bitcoin Halving?

Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created. This occurs approximately every four years, or every 210,000 blocks mined. It’s a crucial mechanism designed to control Bitcoin’s inflation and maintain its scarcity over time.

Bitcoin Halving Mechanics and Impact on Supply

The halving event directly affects the reward miners receive for successfully adding new blocks to the blockchain. Before the first halving, miners received 50 BTC per block. After each halving, this reward is cut in half. This means that the rate at which new Bitcoins enter circulation is halved, impacting the overall supply. The ultimate goal is to limit the total number of Bitcoins to 21 million. This controlled supply is a key factor in Bitcoin’s value proposition as a deflationary asset.

Historical Bitcoin Halvings and Price Effects

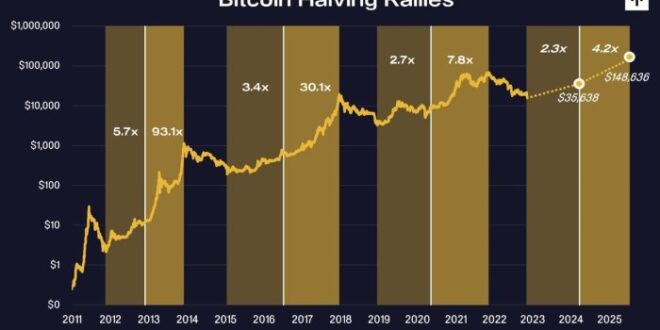

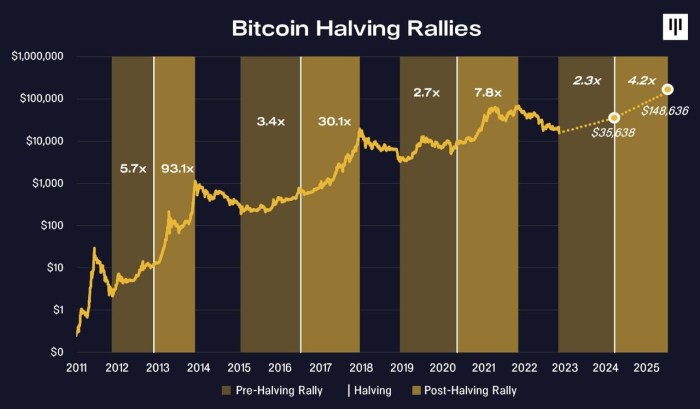

Bitcoin has experienced three halvings to date. The first occurred in November 2012, the second in July 2016, and the third in May 2020. While there’s no guarantee of price increases following a halving, historically, the price has shown significant upward trends in the periods following each event. For example, following the 2012 halving, Bitcoin’s price experienced a gradual but substantial increase over the next year. Similarly, the 2016 halving was followed by a period of price growth, culminating in the 2017 bull market. The 2020 halving was also followed by a considerable price surge, although market conditions and other factors undoubtedly played a role in these price movements. It’s important to note that correlation does not equal causation; other market factors significantly influence Bitcoin’s price.

Theories Surrounding Bitcoin Halving’s Impact on Price

Several theories attempt to explain the relationship between Bitcoin halvings and price increases. One prominent theory suggests that the reduced supply of new Bitcoins creates a scarcity effect, increasing demand and driving up the price. This is based on fundamental economic principles of supply and demand. Another theory focuses on the anticipation surrounding the halving. Traders often buy Bitcoin in advance of the event, anticipating future price increases, creating a self-fulfilling prophecy. Conversely, some argue that the halving’s impact on price is overstated, highlighting the influence of broader market trends, regulatory changes, and technological advancements. The actual effect is likely a complex interplay of these various factors.

Bitcoin Halving Schedule and Inflation Rate

The following table illustrates the Bitcoin halving schedule and its impact on the inflation rate. Note that the inflation rate is calculated based on the newly minted Bitcoin relative to the circulating supply at the time of the halving. The numbers are approximate due to the variability of block times.

| Halving Event | Year | Block Reward (BTC) | Approximate Annual Inflation Rate |

|---|---|---|---|

| Genesis Block | 2009 | 50 | ~9% |

| First Halving | 2012 | 25 | ~4.5% |

| Second Halving | 2016 | 12.5 | ~2.25% |

| Third Halving | 2020 | 6.25 | ~1.125% |

| Fourth Halving (Predicted) | 2024 | 3.125 | ~0.5625% |

Bitcoin Halving 2025

The Bitcoin halving, a programmed event reducing the rate at which new Bitcoins are mined, is a significant factor influencing the cryptocurrency’s price and overall market dynamics. Understanding the projected date and potential impact of the 2025 halving is crucial for anyone involved in or observing the cryptocurrency market.

Bitcoin Halving 2025: Projected Date and Anticipated Effects

The next Bitcoin halving is projected to occur around April 2025. This prediction is based on the Bitcoin protocol’s inherent design, which dictates a halving approximately every four years. While the exact date can vary slightly depending on the block mining time, April 2025 remains the most widely accepted estimate within the cryptocurrency community. Historically, halvings have been followed by periods of significant price appreciation, though the extent of the price increase varies. The 2012 and 2016 halvings were followed by substantial bull runs, although external market factors played a significant role in these price movements. The 2020 halving, while leading to a price increase, was followed by a period of volatility before a major price surge in late 2020 and early 2021. Predicting the exact price impact of the 2025 halving remains challenging, as it depends on a confluence of factors.

Macroeconomic Factors and Bitcoin Price After the 2025 Halving

Macroeconomic conditions significantly influence Bitcoin’s price, irrespective of halving events. Factors such as inflation rates, interest rate policies implemented by central banks, global economic growth, and geopolitical events all play a crucial role. For instance, the 2020 halving coincided with a period of economic uncertainty due to the COVID-19 pandemic and subsequent government stimulus packages. This created a complex interplay between the halving’s impact and broader macroeconomic shifts, influencing Bitcoin’s price trajectory. Similarly, rising inflation in 2021-2022 led to increased interest in Bitcoin as a hedge against inflation, driving price increases. The economic climate leading up to and following the 2025 halving will therefore be a critical determinant of its ultimate effect on Bitcoin’s price. A strong global economy might lessen the impact of the halving, while a recessionary environment could amplify it.

Timeline of Key Events Surrounding the 2025 Bitcoin Halving

The period surrounding the 2025 halving will likely be marked by significant market activity. Understanding the potential timeline can help investors and observers better navigate the anticipated volatility.

What Is Bitcoin Halving 2025 Prediction – The following timeline illustrates key events and anticipated market reactions:

- Pre-Halving (2024-Early 2025): Increased speculation and price volatility as the halving date approaches. Potential for a “buy-the-dip” strategy by investors anticipating the price increase post-halving.

- Halving Event (April 2025): The halving occurs, reducing the block reward for miners. Initial market reaction could be mixed, depending on the prevailing macroeconomic conditions.

- Post-Halving (Late 2025 – 2026): A potential bull run, similar to previous cycles, driven by decreased supply and increased demand. However, the extent and duration of this bull run will be influenced by macroeconomic factors and overall market sentiment.

- Long-Term (Beyond 2026): The long-term price trajectory will depend on factors such as Bitcoin adoption, regulatory developments, and technological advancements within the cryptocurrency space.

Factors Influencing Bitcoin Halving Predictions

Predicting the price of Bitcoin after a halving event is notoriously difficult, as it involves a complex interplay of various economic, technological, and psychological factors. While past halvings have shown a general upward trend in price following the event, the magnitude and timing of this price increase are far from certain. Numerous variables contribute to the uncertainty surrounding these predictions.

Miner Behavior’s Impact on Bitcoin Price Volatility

Miner behavior significantly influences Bitcoin’s price volatility. Before a halving, miners face reduced profitability due to the impending decrease in block rewards. This can lead to increased selling pressure as miners attempt to offset the reduced income. Conversely, after the halving, if the price remains sufficiently high, miners are incentivized to hold onto their Bitcoin, reducing selling pressure and potentially contributing to price appreciation. The 2016 and 2020 halvings illustrate this dynamic, although the extent of the impact varied considerably. For example, the 2020 halving saw a period of price consolidation followed by a significant bull run, while the 2016 halving’s price impact was less dramatic and took longer to manifest. The miners’ collective response, including their hash rate adjustments and selling strategies, directly impacts the network’s security and the overall market sentiment.

Regulatory Changes and Technological Advancements

Regulatory changes and technological advancements also play crucial roles in shaping Bitcoin’s price trajectory. Stringent regulations in key markets can dampen investor enthusiasm, while supportive regulatory frameworks can boost confidence and attract new investment. Simultaneously, technological advancements, such as the development of layer-2 scaling solutions or improvements in mining efficiency, can affect the network’s capacity and transaction costs, indirectly influencing its appeal and market value. The regulatory landscape varies widely across jurisdictions, and any significant shifts in policy can have immediate and substantial consequences for Bitcoin’s price. Similarly, breakthroughs in mining technology could alter the cost of production and subsequently the overall profitability of mining operations.

Market Speculation and Investor Sentiment

Market speculation and investor sentiment are arguably the most dominant factors influencing Bitcoin’s price around halving events. The anticipation of a halving often creates a self-fulfilling prophecy, as investors buy Bitcoin in expectation of future price appreciation. This increased demand can drive up the price even before the halving takes place. Conversely, if negative news or unforeseen events occur, investor sentiment can quickly shift, leading to price corrections regardless of the halving. The narratives surrounding the halving – whether it’s focused on scarcity, deflationary pressures, or the potential for increased institutional adoption – heavily influence the level of speculation and overall investor confidence. The media’s portrayal of the event also plays a significant role in shaping public perception and influencing investment decisions. The 2017 bull run, largely fueled by speculation and hype surrounding the upcoming halving, serves as a prime example of the potent influence of market sentiment.

Interaction of Factors and Price After the 2025 Halving

Different perspectives exist on how these factors might interact to influence the Bitcoin price after the 2025 halving. Some analysts believe that the combination of reduced miner selling pressure, increased institutional adoption, and positive regulatory developments could lead to a significant price surge. Others are more cautious, pointing to the potential for regulatory uncertainty, macroeconomic headwinds, or a general market correction to temper any price increase. The actual outcome will likely depend on the relative strength of these competing forces and the overall state of the global economy. For example, a global recession could significantly dampen investor enthusiasm, irrespective of the halving’s impact on Bitcoin’s supply dynamics. Therefore, any prediction requires careful consideration of the interplay between these diverse factors and a realistic assessment of the prevailing macroeconomic conditions.

Alternative Predictions and Scenarios

Predicting Bitcoin’s price after the 2025 halving is inherently speculative, as numerous factors can influence the market. While historical trends offer some guidance, unforeseen events can dramatically alter the trajectory. The following explores a range of possible outcomes, considering both optimistic and pessimistic scenarios, and highlighting the impact of potential game-changers.

Price Movement Scenarios Following the 2025 Halving

The halving typically leads to a period of reduced supply, potentially creating upward price pressure. However, the extent of this pressure is debatable. Several scenarios are plausible, ranging from a modest price increase to a significant bull run, or even a continued bear market. The actual outcome will depend on the interplay of various macroeconomic and market-specific factors.

| Scenario | Probability (Estimate) | Potential Price Impact | Rationale |

|---|---|---|---|

| Bullish Run | 30% | Significant price increase (e.g., exceeding $100,000) | Increased scarcity coupled with sustained institutional and retail investor demand. This scenario mirrors the price surges seen after previous halvings, albeit potentially amplified by broader adoption. |

| Moderate Price Increase | 40% | Moderate price increase (e.g., $50,000 – $100,000) | Reduced supply contributes to price appreciation, but other factors like regulatory uncertainty or macroeconomic headwinds limit the extent of the increase. This scenario reflects a more balanced outlook, considering both positive and negative influences. |

| Stagnant Price or Mild Correction | 20% | Little to no price change or a slight decrease | Various factors, such as macroeconomic instability, regulatory crackdowns, or a lack of significant new adoption, offset the effects of reduced supply. This scenario highlights the potential for external forces to override the typical halving effect. |

| Bearish Market Continuation | 10% | Continued price decline | Negative macroeconomic conditions or a major market crash could overwhelm the positive effects of the halving. This reflects a pessimistic outlook, where broader economic trends overshadow the impact of reduced Bitcoin supply. |

Impact of Unexpected Events

Unforeseen events can significantly alter Bitcoin’s price trajectory. A major technological breakthrough, such as the widespread adoption of a layer-2 scaling solution that drastically improves transaction speeds and reduces fees, could lead to a surge in adoption and price appreciation. Conversely, a significant regulatory crackdown in a major market could trigger a sharp price drop.

Historical Events and Their Relevance

Past events provide valuable insights. The 2017 bull run, fueled by increased institutional interest and retail speculation, saw Bitcoin’s price reach nearly $20,000. Conversely, the 2018 bear market, triggered by regulatory uncertainty and concerns about market manipulation, led to a significant price correction. These events highlight the importance of considering both technological advancements and regulatory developments when forecasting Bitcoin’s future price. The 2020 halving, while initially showing a delayed price increase, eventually contributed to the 2021 bull run. Analyzing the timelines and contributing factors of these events can offer valuable insights into potential price movements after the 2025 halving.

The Role of Mining in Post-Halving Bitcoin Price: What Is Bitcoin Halving 2025 Prediction

Bitcoin miners are the backbone of the Bitcoin network, securing transactions and adding new blocks to the blockchain through a computationally intensive process. Their profitability is directly tied to the block reward, the amount of Bitcoin they receive for successfully mining a block, and the price of Bitcoin itself. The halving event, which cuts the block reward in half, significantly impacts miner profitability and, consequently, the overall Bitcoin ecosystem.

The halving’s effect on miner profitability is straightforward: reduced rewards mean less revenue per block mined. This directly influences the overall supply of Bitcoin, as less profitable mining could lead to some miners exiting the network, potentially slowing down block creation. Conversely, a price increase following a halving can offset the reduced block reward, maintaining or even boosting miner profitability. This dynamic interplay between block reward, Bitcoin price, and mining activity is crucial in understanding the post-halving price trajectory.

Miner Adaptation Strategies

Miners are not passive actors; they actively adapt to changing market conditions. Faced with reduced block rewards, miners typically employ several strategies to maintain profitability. These include upgrading to more energy-efficient mining hardware to lower operational costs, consolidating mining operations to benefit from economies of scale, and diversifying revenue streams, potentially exploring activities like Bitcoin mining pool operations or offering other services related to blockchain technology. Some might choose to temporarily halt operations or switch to mining altcoins, which offer potentially higher rewards, waiting for a price increase in Bitcoin to resume.

Hypothetical Scenario: Significant Shift in Mining Activity

Let’s imagine a scenario where, following the 2025 halving, the Bitcoin price remains stagnant or even declines slightly. This could lead to a significant portion of less efficient miners becoming unprofitable and shutting down their operations.

- Reduced Hash Rate: The overall computational power (hash rate) securing the Bitcoin network decreases, potentially making the network more vulnerable to attacks, at least temporarily.

- Increased Block Times: With fewer miners participating, the time it takes to mine a block could increase, potentially leading to slower transaction confirmation times.

- Short-Term Price Volatility: The market could react negatively to the reduced hash rate and slower transaction speeds, causing short-term price volatility and potentially a further price drop.

- Long-Term Price Adjustment: However, the reduced supply of newly mined Bitcoin, due to miners leaving the network, could eventually lead to a scarcity effect, driving the price back up in the long term. This would attract new miners back into the network, restoring the hash rate and stabilizing transaction speeds.

This hypothetical scenario highlights the complex interplay between mining profitability, network security, and Bitcoin’s price. While a temporary decrease in mining activity could create short-term instability, the inherent scarcity of Bitcoin could ultimately drive long-term price appreciation. The resilience of the Bitcoin network and its ability to adapt to these changes will be crucial in determining the actual outcome.

Frequently Asked Questions (FAQs)

This section addresses some common questions regarding the Bitcoin halving in 2025, focusing on the expected date, price impact, influencing factors, and the reliability of predictions. Understanding these aspects is crucial for navigating the complexities of the cryptocurrency market.

Expected Date of the Bitcoin Halving in 2025

The Bitcoin halving is expected to occur around April 2025. This date is an approximation based on the Bitcoin network’s block generation time, which averages around 10 minutes. The exact date depends on the actual time it takes to mine the blocks leading up to the halving event. Slight variations are possible, but April 2025 remains the most likely timeframe.

Impact of the Bitcoin Halving on Bitcoin Price

Historically, Bitcoin halvings have been followed by significant price increases. The halving reduces the rate of new Bitcoin entering circulation, potentially creating scarcity and driving up demand. For example, the halving in 2012 was followed by a period of price appreciation, and the 2016 halving similarly preceded a substantial price surge. However, it’s crucial to note that other market factors also influence price, and a direct causal link isn’t guaranteed. The 2020 halving saw a price increase, but the timing and magnitude of the increase were not immediately apparent, demonstrating the complex interplay of factors at play. Future scenarios could vary significantly depending on the prevailing market conditions.

Factors Influencing Bitcoin Price After the 2025 Halving, What Is Bitcoin Halving 2025 Prediction

Several factors beyond the halving itself could influence Bitcoin’s price trajectory. These include:

- Market Sentiment: Investor confidence and overall market trends significantly impact Bitcoin’s price. Positive sentiment can lead to increased demand and higher prices, while negative sentiment can cause price drops.

- Regulations: Government regulations and policies concerning cryptocurrencies can dramatically affect market dynamics and investor behavior. Favorable regulations could boost adoption and price, while restrictive measures could stifle growth.

- Technological Advancements: Developments in Bitcoin’s underlying technology, such as improvements in scalability or security, could positively influence its price. Conversely, significant technological setbacks could negatively impact investor confidence.

- Macroeconomic Conditions: Global economic events, such as inflation or recession, can influence investor risk appetite and subsequently affect Bitcoin’s price. Periods of economic uncertainty might lead investors to seek refuge in Bitcoin as a hedge against inflation, potentially driving up its value.

- Adoption Rate: Wider adoption by businesses and individuals increases demand and can contribute to price appreciation. Conversely, slower-than-expected adoption might limit price growth.

Reliability of Bitcoin Halving Predictions

While historical data suggests a correlation between Bitcoin halvings and subsequent price increases, it’s crucial to understand that these are not guaranteed outcomes. Predicting the cryptocurrency market with certainty is inherently difficult due to its volatility and the numerous interconnected factors at play. Past performance is not indicative of future results. Therefore, while halvings can be considered a significant event influencing the supply dynamics of Bitcoin, they are only one factor among many determining its price. Any prediction should be treated with caution, and relying solely on halving predictions for investment decisions is risky.

Predicting the Bitcoin Halving 2025 impact is a complex task, involving analysis of various market factors. A crucial element in these predictions is knowing the precise date of the halving, which significantly influences miner profitability and subsequent price action. To understand the timing, you can check the precise dates on this resource: Bitcoin Halving Dates 2025. Ultimately, accurate Bitcoin Halving 2025 predictions rely on a thorough understanding of this key date and its historical implications.

Predicting the Bitcoin halving in 2025 involves analyzing various factors influencing its price. A key aspect of this prediction hinges on understanding precisely when the halving will occur; to clarify this, you might find this resource helpful: When Was Bitcoin Halving In 2025. Knowing the exact date allows for more accurate modeling of the potential impact on Bitcoin’s scarcity and, consequently, its predicted price after the event.

Predicting the Bitcoin halving in 2025 involves analyzing various factors influencing its price. A key element in these predictions is knowing the exact date of the event, which is crucial for market analysis. To find out precisely when this will occur, you should check this resource: What Day Is The Bitcoin Halving 2025. Understanding the specific date allows for more accurate predictions about the potential impact of the halving on Bitcoin’s value and market behavior in the following months.

Predicting the Bitcoin halving in 2025 involves considering various factors influencing its price. A key element in these predictions is understanding the impact of the reduced Bitcoin supply, a phenomenon that will significantly affect the market. For detailed information on this pivotal event, check out this resource on the Bitcoin April 2025 Halving , which provides valuable insights into the upcoming halving.

Ultimately, these analyses help shape predictions for Bitcoin’s value post-halving in 2025.

Understanding Bitcoin Halving 2025 predictions involves analyzing the impact of reduced Bitcoin supply on market dynamics. A key aspect of this analysis is forecasting the potential price changes, which is where understanding the specifics of Bitcoin Halving 2025 Price Prediction becomes crucial. Ultimately, these price predictions help shape the overall picture of what the 2025 Bitcoin Halving might entail for investors and the cryptocurrency market.

Predicting the Bitcoin halving in 2025 involves analyzing various factors influencing its price. A key element in these predictions is understanding the potential impact on price, which is explored in detail at this helpful resource: Halving Bitcoin 2025 Precio. Ultimately, What Is Bitcoin Halving 2025 Prediction remains a complex question with many contributing variables to consider.