What is Bitcoin Halving?: What Is Bitcoin Halving 2025 Prediction

Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created. This occurs approximately every four years, or every 210,000 blocks mined. It’s a crucial mechanism designed to control inflation and maintain the scarcity of Bitcoin over time.

Bitcoin Halving Mechanics: The core mechanic involves reducing the block reward paid to miners for successfully adding new transactions to the blockchain. Initially, the reward was 50 BTC per block. With each halving, this reward is cut in half. Therefore, after the first halving, it became 25 BTC, then 12.5 BTC, and the next halving in 2024 will reduce it to 6.25 BTC. This controlled reduction in new Bitcoin supply is a key feature distinguishing Bitcoin from traditional fiat currencies.

Historical Impact of Bitcoin Halvings

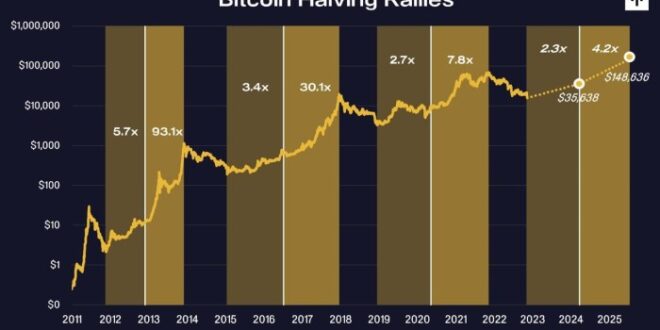

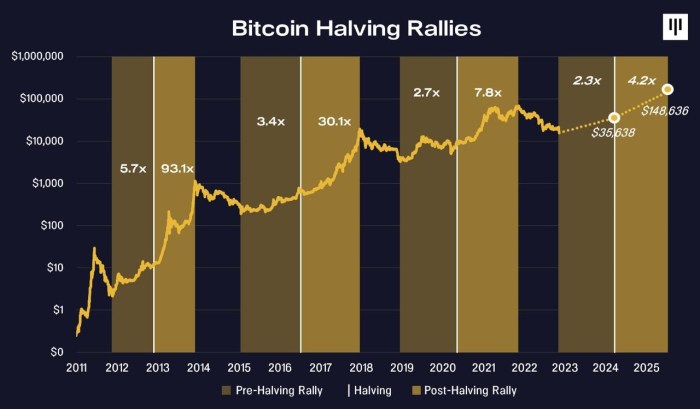

Previous Bitcoin halvings have demonstrably impacted both price and network activity. While correlation doesn’t equal causation, a noticeable price increase has followed each halving, albeit with varying degrees of intensity and timing. The increased scarcity of newly mined Bitcoin, coupled with often-increased demand, is generally cited as a primary driver of these price movements. Furthermore, network activity, measured by metrics such as hash rate (a measure of computational power securing the network) and transaction volume, has generally shown an upward trend following halvings, indicating increased participation and interest in the Bitcoin ecosystem.

Timeline of Past Halvings and Market Effects

| Halving Date | Block Reward Before | Block Reward After | Subsequent Price Movement (Approximate) | Notes |

|---|---|---|---|---|

| November 28, 2012 | 50 BTC | 25 BTC | Significant price increase over the following year | Early stages of Bitcoin adoption; market still relatively small. |

| July 9, 2016 | 25 BTC | 12.5 BTC | Gradual price increase leading up to the 2017 bull run | Growing institutional interest and increased media coverage. |

| May 11, 2020 | 12.5 BTC | 6.25 BTC | Significant price increase in the months following, culminating in a major bull market | Increased adoption by institutional investors and growing global awareness. |

Expected Impact of the 2025 Halving

Predicting the precise impact of the 2025 halving is inherently speculative. However, based on historical trends and current market conditions, several factors could influence the outcome. The reduced supply of newly mined Bitcoin will likely continue to exert upward pressure on price. However, macroeconomic conditions, regulatory developments, and overall market sentiment will also play significant roles. The 2025 halving might not mirror the previous events precisely, as the Bitcoin market is far more mature and complex now than it was in 2012, 2016, or 2020. The level of institutional investment and the broader adoption of Bitcoin will be key determinants of the post-halving price action. For example, if institutional adoption continues to grow, the impact could be amplified compared to previous halvings. Conversely, significant negative macroeconomic events could dampen the positive price effect.

Factors Influencing the 2025 Bitcoin Halving Prediction

Predicting Bitcoin’s price after the 2025 halving is inherently complex, involving a confluence of macroeconomic conditions, regulatory landscapes, technological advancements, and the behavior of miners themselves. While no one can definitively state the price, understanding these influencing factors allows for a more nuanced perspective on potential outcomes.

Macroeconomic Factors

Broad economic trends significantly impact Bitcoin’s price. Periods of high inflation, for example, can drive investors towards Bitcoin as a hedge against inflation, increasing demand and potentially pushing the price upwards. Conversely, periods of economic stability or contraction could lead to decreased demand and price volatility. The Federal Reserve’s monetary policy, global inflation rates, and overall economic growth are key indicators to monitor. For instance, the 2022 inflation surge saw a corresponding increase in Bitcoin’s price, though this correlation isn’t always direct or predictable. Other factors like geopolitical instability and major global events can also introduce considerable uncertainty.

Regulatory Changes

Government regulations play a crucial role in shaping Bitcoin’s trajectory. Clearer, more consistent regulatory frameworks could boost institutional investment and increase mainstream adoption, leading to higher prices. Conversely, overly restrictive or uncertain regulations can stifle growth and negatively impact price. The varying approaches taken by different countries, from outright bans to embracing Bitcoin as a legitimate asset class, highlight the significant impact of regulatory decisions. For example, El Salvador’s adoption of Bitcoin as legal tender initially boosted its price, although long-term effects are still unfolding.

Technological Advancements

Advancements in blockchain technology and related infrastructure can significantly influence Bitcoin’s adoption and price. Improvements in scalability, transaction speed, and energy efficiency could attract more users and institutional investors. The development of the Lightning Network, for example, aims to improve Bitcoin’s scalability, potentially increasing its usability for everyday transactions and driving up demand. Conversely, technological setbacks or security breaches could negatively impact investor confidence and lead to price drops.

Miner Behavior and Hash Rate

The behavior of Bitcoin miners and changes in the network’s hash rate are closely tied to the price. Miners’ profitability is directly influenced by the Bitcoin price and the cost of electricity. If the price falls below the cost of mining, some miners might choose to shut down their operations, reducing the hash rate and potentially impacting network security. Conversely, a rising price incentivizes more miners to join the network, increasing the hash rate and strengthening network security. This dynamic creates a feedback loop between price and mining activity. For example, periods of low Bitcoin prices in the past have resulted in miners temporarily halting operations or switching to more profitable cryptocurrencies.

Supply and Demand Dynamics

The halving event directly impacts the supply of new Bitcoins entering circulation. The reduced supply, coupled with consistent or increased demand, is often cited as a key driver for price increases post-halving. However, the extent of this price increase depends heavily on the prevailing market sentiment and overall demand. Historical data shows a price surge following previous halvings, but the magnitude of the increase has varied considerably. Therefore, accurately predicting the supply and demand dynamics around the 2025 halving requires careful consideration of all the other factors discussed above. For instance, while the 2016 and 2020 halvings were followed by significant price increases, the market conditions and investor sentiment were significantly different in each case.

Potential Price Scenarios for Bitcoin in 2025

Predicting Bitcoin’s price is inherently speculative, but analyzing historical trends, market sentiment, and the upcoming halving event allows us to formulate plausible scenarios for Bitcoin’s price post-2025. These scenarios represent a range of possibilities, from highly optimistic to pessimistic, and a more neutral middle ground. It’s crucial to remember that these are just potential outcomes, and the actual price could deviate significantly.

The following three scenarios explore potential price movements after the 2025 Bitcoin halving, considering various factors influencing the cryptocurrency market. Each scenario presents a different outlook, highlighting the inherent uncertainty in predicting future price movements. Remember that these are illustrative examples and not financial advice.

Bitcoin Price Scenarios Post-2025 Halving

| Scenario | Price Prediction (USD) | Supporting Factors | Risks |

|---|---|---|---|

| Bullish | $150,000 – $200,000 |

|

|

| Bearish | $30,000 – $50,000 |

|

|

| Neutral | $75,000 – $100,000 |

|

|

The Role of Market Sentiment and Speculation

Market sentiment and speculation play a significant role in Bitcoin’s price volatility, particularly around halving events. The anticipation surrounding reduced supply often fuels speculative trading, leading to price increases before the halving and subsequent price corrections afterward. Understanding the interplay between these factors is crucial for navigating the market during this period.

The influence of market sentiment on Bitcoin’s price is undeniable. This sentiment, a collective feeling of investors and traders about the future price direction, is shaped by numerous factors, including news coverage, social media trends, regulatory developments, and overall macroeconomic conditions. A positive sentiment, characterized by widespread optimism and belief in Bitcoin’s future, can drive prices higher, while negative sentiment, fueled by fear, uncertainty, and doubt, can lead to price drops. The halving, being a predictable event with significant implications for Bitcoin’s supply, naturally amplifies these existing market dynamics.

Comparison of Current and Past Market Sentiments

The current market sentiment towards the 2025 Bitcoin halving is a complex mix of optimism and caution. While some analysts predict significant price increases, others express concerns about macroeconomic factors and regulatory uncertainty. Comparing this to past halvings reveals interesting patterns. Before the 2012 halving, the market was relatively small and less mature, resulting in a less pronounced price reaction. The 2016 halving saw a more significant price increase leading up to the event, followed by a period of consolidation. The 2020 halving was preceded by considerable hype and speculation, leading to a substantial price surge. The 2025 halving’s anticipatory market sentiment appears to be more nuanced, reflecting a greater awareness of macroeconomic risks and regulatory pressures compared to previous cycles.

Examples of Speculation’s Influence on Bitcoin’s Price

Several instances demonstrate how speculation dramatically impacted Bitcoin’s price. The rapid price increase in late 2017, driven largely by speculative trading and media hype, is a prime example. Similarly, the price surge in 2020–2021, fueled by institutional investment and retail investor enthusiasm, highlighted the power of speculation. Conversely, periods of negative sentiment, often triggered by regulatory crackdowns or market crashes, have resulted in significant price corrections. These examples underscore the significant influence of speculative forces on Bitcoin’s price trajectory, particularly around major events like halvings.

Analyzing Social Media and News Sentiment

Analyzing social media and news sentiment can provide valuable insights into market expectations for the 2025 halving. Tools and techniques exist to gauge the overall sentiment expressed on platforms like Twitter, Reddit, and other relevant news sources. By tracking s related to Bitcoin, the halving, and related topics, and by analyzing the tone of the associated posts and articles, one can gain a better understanding of prevailing market sentiment. For example, a surge in positive sentiment expressed on social media platforms, alongside bullish predictions from prominent analysts, might indicate a positive price outlook for Bitcoin leading up to the halving. Conversely, a preponderance of negative news coverage and bearish commentary could signal a potential price decline. This type of sentiment analysis, while not foolproof, offers a valuable supplementary tool for assessing market expectations.

Long-Term Implications of the 2025 Halving

The 2025 Bitcoin halving, reducing the rate of new Bitcoin creation by half, is expected to have profound and lasting effects on the cryptocurrency’s trajectory and the broader financial landscape. While predicting the precise impact is impossible, analyzing historical trends and current market conditions allows us to explore potential long-term consequences. The reduced supply, coupled with anticipated continued demand, will likely exert significant pressure on Bitcoin’s price, but the ultimate effect will depend on a complex interplay of factors.

The decreased inflation rate resulting from the halving could increase Bitcoin’s appeal as a store of value. This could attract institutional investors and high-net-worth individuals seeking inflation hedges, potentially leading to increased adoption and a higher market capitalization. Conversely, the halving’s impact on price is not guaranteed; past halvings have been followed by periods of both significant price increases and subsequent corrections. The actual outcome hinges on various external factors such as macroeconomic conditions, regulatory changes, and overall market sentiment.

Bitcoin Adoption and Financial Landscape Position, What Is Bitcoin Halving 2025 Prediction

The 2025 halving could significantly influence Bitcoin’s adoption. A sustained price increase following the halving could further legitimize Bitcoin as a viable asset class, attracting mainstream investors and driving greater integration into traditional financial systems. Conversely, a price stagnation or downturn could dampen adoption, potentially hindering the widespread acceptance of Bitcoin as a medium of exchange or a store of value. The event’s impact on Bitcoin’s position within the financial landscape is directly linked to its success in attracting both institutional and individual investors. For example, a scenario where major financial institutions begin offering Bitcoin-related services could significantly boost its mainstream appeal.

Challenges and Opportunities Post-Halving

The period following the 2025 halving presents both challenges and opportunities for Bitcoin. A potential challenge is the increased volatility that might accompany the price fluctuations. This volatility could deter some investors, particularly those with a lower risk tolerance. Opportunities include the potential for increased innovation within the Bitcoin ecosystem, such as the development of new applications and services built on the Bitcoin blockchain. Furthermore, a higher price could incentivize further development of layer-2 scaling solutions, addressing issues like transaction fees and network congestion. The successful navigation of these challenges and the exploitation of these opportunities will be crucial for Bitcoin’s long-term success.

Impact on Bitcoin Ecosystem Development

The halving is likely to influence the development of the Bitcoin ecosystem in several ways. The reduced block reward could incentivize miners to focus on improving efficiency and reducing energy consumption. This could lead to advancements in mining hardware and techniques, potentially making Bitcoin mining more sustainable and environmentally friendly. Furthermore, a higher Bitcoin price could encourage further development of Lightning Network and other layer-2 scaling solutions, enhancing the network’s capacity to handle a larger volume of transactions. This increased scalability would improve the user experience and make Bitcoin more suitable for everyday transactions. For instance, the development of more user-friendly wallets and payment gateways could significantly improve Bitcoin’s accessibility.

Impact on the Broader Cryptocurrency Market

The 2025 Bitcoin halving is unlikely to be isolated; its impact will likely ripple through the broader cryptocurrency market. A significant price increase in Bitcoin could trigger a “bull market” across the cryptocurrency space, boosting the prices of altcoins. Conversely, a Bitcoin price downturn could negatively impact the entire market. The correlation between Bitcoin’s price and the performance of other cryptocurrencies is well-established, making Bitcoin’s trajectory a key driver of overall market sentiment. The strength of this correlation will likely vary depending on the overall market conditions and the relative maturity of other cryptocurrencies. A positive impact on Bitcoin could lead to increased investment in the entire sector, while a negative impact could trigger a broader sell-off.

What Is Bitcoin Halving 2025 Prediction – Predicting the Bitcoin halving in 2025 involves analyzing various factors influencing its price. A key element in these predictions is the timing of the event itself; according to many sources, the Bitcoin Halving Is Expected To Occur In April 2025, as detailed in this article: Bitcoin Halving Is Expected To Occur In April 2025. This date significantly impacts predictions on Bitcoin’s value post-halving, influencing market speculation and investor strategies.

Predicting the Bitcoin halving in 2025 involves considering various factors impacting its price. A key element in these predictions is the analysis offered by prominent figures in the crypto space, such as the insights provided by Plan B, whose detailed forecast can be found here: Plan B Bitcoin Halving 2025 Prediction. Understanding his model helps contextualize broader predictions surrounding the 2025 Bitcoin halving and its potential consequences for the market.

Predicting the Bitcoin halving in 2025 involves considering its impact on scarcity and price. A key element in these predictions is knowing the precise date of the halving event, which you can find by checking this resource: Date Of Bitcoin Halving In 2025. Understanding this date is crucial for accurately forecasting the potential market reaction to the reduced Bitcoin supply post-halving and its subsequent effect on price predictions.

Predicting the Bitcoin halving in 2025 is a complex endeavor, with various factors influencing potential price movements. To understand these predictions, it’s crucial to first grasp the mechanics of the halving itself; for a comprehensive explanation, refer to this informative resource: Bitcoin Halving 2025 What Is It. Understanding the halving’s impact on Bitcoin’s supply is key to forming accurate predictions about its future price.

Predicting the Bitcoin halving in 2025 involves analyzing various factors influencing its price. Understanding past halving cycles is crucial, and a helpful resource for this is the detailed analysis provided at Bitcoin Prognose Halving 2025. This site offers valuable insights into potential price movements following the 2025 halving, ultimately contributing to a more informed prediction of Bitcoin’s future value.

Predicting the Bitcoin halving in 2025 involves analyzing various factors influencing its price. Understanding the precise timing is crucial, and a helpful resource for this is the Bitcoin Halving Countdown 2025 which provides a clear visual representation of the time remaining. This countdown helps contextualize predictions about the halving’s impact on Bitcoin’s future value and market behavior.