Bitcoin Halving 2025

The Bitcoin halving is a significant event in the cryptocurrency’s lifecycle, occurring approximately every four years. It’s a programmed reduction in the rate at which new Bitcoins are created, impacting the supply and potentially influencing its price. Understanding this event is crucial for anyone invested in or interested in Bitcoin’s future.

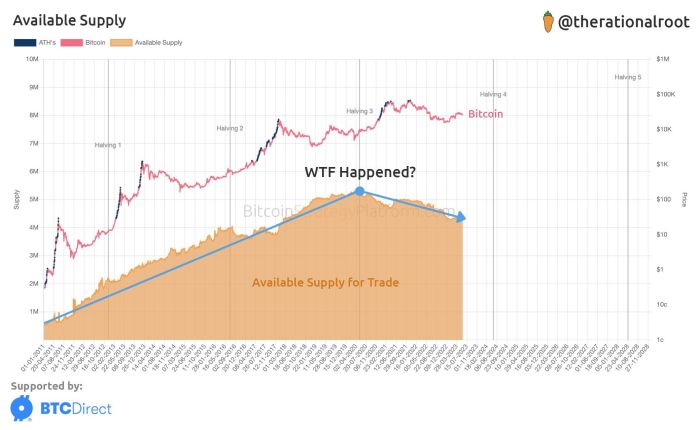

Bitcoin Halving Mechanics and Impact on Supply

The Bitcoin halving mechanism is embedded within the Bitcoin protocol. Every 210,000 blocks mined, the reward given to miners for verifying transactions is cut in half. Initially, the reward was 50 BTC per block. After the first halving, it became 25 BTC, then 12.5 BTC, and the next halving in 2024 will reduce it to 6.25 BTC. This halving process continues until all 21 million Bitcoins are mined, which is projected to occur around the year 2140. The halving directly impacts the inflation rate of Bitcoin, making it a progressively scarcer asset over time. Historically, halving events have been followed by periods of significant price appreciation, although the extent of this price increase varies.

Bitcoin Halving Historical Impact on Price

Historically, the Bitcoin halving events have been followed by periods of price increases. The first halving in late 2012 saw a gradual price increase over the following year. The second halving in mid-2016 was followed by a more dramatic surge in price, leading to the bull market of 2017. The third halving in May 2020 was followed by a price increase that culminated in late 2021. It’s important to note that while halvings have often preceded bull runs, other factors also contribute to price movements, and a price increase is not guaranteed. These past instances serve as data points, demonstrating a correlation but not establishing a direct causal relationship. External factors such as macroeconomic conditions, regulatory changes, and market sentiment all play significant roles.

Timeline Leading Up To The 2025 Halving

The anticipated timeline for the 2025 Bitcoin halving is based on the consistent block time of approximately 10 minutes. Mining difficulty adjusts to maintain this block time, accounting for changes in the overall network’s computing power. Therefore, precise predictions of the halving date are challenging, but it is expected to occur sometime in the spring or summer of 2024. The period leading up to the halving often witnesses increased speculation and volatility in the market as investors anticipate the potential price impact. This period might see increased on-chain activity and potentially higher transaction fees. The months following the halving are typically when the effects on price become more apparent, though the exact timing and magnitude are uncertain. Analyzing on-chain metrics, market sentiment, and macroeconomic conditions during this period can offer insights into the potential price trajectory.

Historical Price Performance After Halvings

Bitcoin’s price history following its halving events reveals a complex interplay of factors influencing its value. While each halving has been followed by a period of significant price appreciation, the timing and magnitude of these increases have varied considerably. Understanding these past performances offers valuable insights, albeit not necessarily predictive, for potential future movements.

Analyzing the price movements after each halving requires considering the broader macroeconomic climate, technological advancements within the Bitcoin ecosystem, and evolving investor sentiment. Simply extrapolating past performance to predict future outcomes is an oversimplification, yet examining historical trends provides a valuable contextual framework.

Price Movements After Previous Halvings

The first Bitcoin halving in November 2012 saw the price rise from roughly $12 to approximately $1,100 within a year. The second halving in July 2016 resulted in a price increase from around $650 to nearly $20,000 by December 2017. The third halving in May 2020 saw a price increase from approximately $9,000 to a high of over $64,000 in April 2021. While each halving was followed by substantial price appreciation, the timing and peak price reached varied significantly. The duration of the bull market following each halving also differed substantially.

Factors Influencing Price Changes Post-Halving

Several key factors have consistently played a significant role in shaping Bitcoin’s price trajectory after each halving. These include the reduction in the rate of new Bitcoin creation, increasing scarcity, market speculation, regulatory developments, and macroeconomic conditions. The reduced supply of newly mined Bitcoin, a direct consequence of the halving, often fuels increased demand, particularly amongst investors viewing Bitcoin as a scarce digital asset. Simultaneously, broader market sentiment, driven by factors such as global economic uncertainty or technological breakthroughs in the cryptocurrency space, can significantly impact price fluctuations. Regulatory changes, both positive and negative, can also influence investor confidence and market liquidity.

Market Sentiment and Investor Behavior

Investor behavior surrounding past halvings has been characterized by a mixture of anticipation, speculation, and volatility. In the lead-up to each halving, the market often experiences a period of heightened anticipation, with investors positioning themselves for potential price appreciation. Following the halving, this anticipation frequently translates into increased buying pressure, driving prices upward. However, this upward trend is not always linear. Periods of significant price corrections and market corrections have occurred in the aftermath of previous halvings, highlighting the inherent volatility of the cryptocurrency market. The level of investor sophistication and understanding of Bitcoin’s underlying technology also plays a significant role in shaping market sentiment and influencing price movements. Increased institutional investment, for example, can significantly affect market liquidity and price stability.

Factors Influencing Bitcoin’s Price in 2025

Predicting Bitcoin’s price in 2025 is inherently complex, depending on a confluence of economic, regulatory, and technological factors. While the halving event significantly impacts the rate of new Bitcoin creation, its effect on price is intertwined with broader market forces. Understanding these contributing factors is crucial for a more nuanced perspective on potential price movements.

Macroeconomic Conditions

Global macroeconomic conditions will play a significant role in Bitcoin’s price trajectory in 2025. Periods of economic uncertainty, such as high inflation or recessionary pressures, often see investors seeking safe haven assets, potentially driving demand for Bitcoin. Conversely, strong economic growth might divert investment away from alternative assets like Bitcoin towards more traditional markets. For example, the 2020 COVID-19 pandemic initially caused market volatility, but later saw Bitcoin’s price surge as investors sought diversification and inflation hedges. The prevailing interest rate environment will also significantly influence Bitcoin’s appeal; higher interest rates may reduce the attractiveness of Bitcoin as a speculative investment.

Regulatory Developments

Regulatory clarity and acceptance of Bitcoin by governments worldwide will be a major determinant of its price. Stringent regulations could stifle adoption and potentially suppress prices, while a more favorable regulatory landscape could boost investor confidence and increase demand. The ongoing debate surrounding Bitcoin’s classification as a security, commodity, or currency in different jurisdictions illustrates this uncertainty. Increased regulatory scrutiny in certain regions, coupled with more progressive policies in others, could lead to significant price fluctuations. The example of China’s crackdown on cryptocurrency mining in 2021 significantly impacted Bitcoin’s price, highlighting the influence of regulatory actions.

Technological Advancements and Adoption Rates

Technological advancements within the Bitcoin ecosystem and wider adoption of cryptocurrencies will influence price. Improvements in scalability, transaction speeds, and the development of second-layer solutions like the Lightning Network could increase Bitcoin’s usability and appeal to a broader audience. Conversely, a lack of significant technological progress might hinder wider adoption. Increased institutional investment, driven by the growing acceptance of Bitcoin as a legitimate asset class, is also a key factor. The growing integration of Bitcoin into mainstream financial services, such as payment processors and investment platforms, could fuel price appreciation.

Influential Factors and Potential Price Impact

| Factor | Potential Positive Impact | Potential Negative Impact | Example/Real-life Case |

|---|---|---|---|

| Macroeconomic Conditions (Inflation, Recession) | Increased demand as a safe haven asset during economic uncertainty. | Reduced demand during periods of strong economic growth. | Bitcoin’s price surge during the initial stages of the COVID-19 pandemic. |

| Regulatory Developments (Clarity, Acceptance) | Increased investor confidence and wider adoption. | Suppressed adoption and price volatility due to uncertainty or restrictions. | China’s ban on cryptocurrency mining in 2021 negatively impacting Bitcoin’s price. |

| Technological Advancements (Scalability, Adoption) | Improved usability and wider appeal, increased institutional investment. | Limited adoption due to technological limitations. | The development of the Lightning Network aiming to improve Bitcoin’s scalability. |

Price Prediction Models and Approaches

Predicting Bitcoin’s price, especially around a halving event, is a complex undertaking. Numerous models exist, each with its own strengths and weaknesses, relying on different data and analytical approaches. Understanding these models and their limitations is crucial for interpreting any price prediction.

Predicting the future price of Bitcoin involves navigating a landscape of uncertainty. Two primary approaches dominate the field: technical analysis and fundamental analysis. Each offers a distinct perspective, and a balanced approach often incorporates elements of both.

Technical Analysis

Technical analysis focuses on historical price and volume data to identify patterns and trends, predicting future price movements. It uses various indicators like moving averages, relative strength index (RSI), and candlestick patterns to generate buy and sell signals. For example, a bullish crossover of a 50-day and 200-day moving average might be interpreted as a signal of an upcoming price increase.

- Strengths: Relatively easy to understand and implement, readily available data, focuses on market sentiment reflected in price action.

- Weaknesses: Relies heavily on past performance, which isn’t always indicative of future results; susceptible to manipulation; subjective interpretation of indicators.

Fundamental Analysis

Fundamental analysis assesses the intrinsic value of Bitcoin based on factors like adoption rate, network security, regulatory landscape, and macroeconomic conditions. It attempts to determine whether the current market price accurately reflects Bitcoin’s underlying value. For instance, a significant increase in institutional adoption could be considered a bullish fundamental factor.

- Strengths: Provides a long-term perspective on value; less susceptible to short-term market noise; considers factors beyond price action.

- Weaknesses: Difficult to quantify some factors (e.g., regulatory uncertainty); requires extensive research and expertise; long-term predictions are inherently uncertain.

Hypothetical Price Prediction Model

A robust prediction model could integrate both technical and fundamental analysis. It might use a weighted average of technical indicators (e.g., moving averages, RSI) and fundamental factors (e.g., network hash rate, transaction volume, regulatory developments, and macroeconomic indicators like inflation). The weights assigned to each factor would be determined based on their historical correlation with Bitcoin’s price and expert judgment.

For example, a model might assign 40% weight to technical indicators (averaging several indicators to reduce subjectivity), 30% to network security metrics (hash rate, difficulty), 20% to adoption rate (number of users and wallets), and 10% to macroeconomic conditions (inflation, interest rates). This model would then generate a price prediction based on the combined weighted score of these factors. The model’s accuracy would be regularly evaluated and adjusted based on its performance against actual price movements. Such a model would still be inherently probabilistic, reflecting the inherent volatility of the cryptocurrency market. A real-world example of this approach might involve using historical data to train a machine learning model, incorporating these various factors as input variables to predict future prices. However, even sophisticated models cannot perfectly predict future price movements.

Range of Potential Price Outcomes: What Is The Price Prediction For Bitcoin Halving 2025

Predicting Bitcoin’s price after the 2025 halving is inherently speculative, but by considering various factors and historical trends, we can Artikel a range of potential scenarios. These scenarios are based on varying degrees of market adoption, macroeconomic conditions, and regulatory developments. It’s crucial to remember that these are possibilities, not guarantees.

Considering the historical impact of previous halvings, coupled with current market sentiment and technological advancements, several price trajectories are plausible. We can categorize these scenarios based on levels of market adoption and broader economic stability.

Bearish Scenario: Stagnant Adoption and Economic Downturn

A bearish scenario envisions a relatively flat or slightly declining Bitcoin price in 2025. This outcome is predicated on low levels of institutional and retail adoption, coupled with a global economic downturn or prolonged period of uncertainty. Similar to the period following the 2012 halving, where Bitcoin’s price experienced a period of consolidation before a significant subsequent rally, this scenario anticipates a less dramatic price increase. Factors contributing to this scenario include increased regulatory scrutiny, a lack of significant technological breakthroughs impacting Bitcoin’s utility, and a general risk-off sentiment in the broader financial markets. For example, a significant global recession could trigger a widespread sell-off across asset classes, including Bitcoin. In this scenario, Bitcoin’s price might remain within a range of $30,000 to $50,000 throughout 2025.

Neutral Scenario: Moderate Adoption and Stable Economic Growth

A neutral scenario assumes moderate growth in Bitcoin adoption and relatively stable global economic conditions. This is a middle-ground scenario, reflecting a balanced outlook on various factors influencing Bitcoin’s price. In this case, the price increase following the halving is less pronounced than in a bullish scenario but still demonstrates positive growth. This scenario is analogous to the period after the 2016 halving, where the price saw a gradual increase leading up to the bull market of 2017. The price could potentially range from $50,000 to $100,000 by the end of 2025, reflecting a moderate increase driven by steady adoption and a generally stable macroeconomic environment. This scenario assumes no major geopolitical events or unexpected regulatory shifts that significantly impact investor sentiment.

Bullish Scenario: High Adoption and Economic Recovery, What Is The Price Prediction For Bitcoin Halving 2025

A bullish scenario assumes widespread adoption of Bitcoin by both institutional and retail investors, combined with a robust global economic recovery. This scenario mirrors the post-2020 halving period, where Bitcoin experienced a significant price surge. Several factors could contribute to this outcome, including significant institutional investment, increasing regulatory clarity (or lack of significant negative regulation), and the development of new Bitcoin-related financial products and services. This scenario anticipates a much more pronounced price increase post-halving, potentially exceeding previous price highs. For instance, a major technological advancement, such as widespread adoption of the Lightning Network significantly improving transaction speed and scalability, could further fuel this bullish sentiment. In this optimistic scenario, Bitcoin’s price could potentially reach $100,000 to $200,000 or even higher by the end of 2025.

Risks and Uncertainties Associated with Predictions

Predicting Bitcoin’s price, particularly around significant events like the 2025 halving, is inherently fraught with uncertainty. Numerous factors, both internal and external to the cryptocurrency market, can significantly impact its trajectory, making precise forecasting extremely challenging, if not impossible. Any prediction should be viewed with a healthy dose of skepticism and considered just one possible outcome among many.

The limitations of price prediction models are substantial. Many models rely on historical data and extrapolations, assuming past trends will continue. However, the cryptocurrency market is known for its volatility and unpredictable nature, frequently defying historical patterns. Models often fail to account for unforeseen events – regulatory changes, technological breakthroughs, or significant shifts in market sentiment – which can dramatically alter Bitcoin’s price. Furthermore, the inherent complexity of the market, influenced by factors ranging from macroeconomic conditions to individual investor behavior, makes it difficult to create a truly comprehensive predictive model.

Model Limitations and Market Volatility

Bitcoin’s price is notoriously volatile. Sharp price swings, both upward and downward, are commonplace. This volatility stems from various factors including speculative trading, regulatory uncertainty, and the relatively small market capitalization compared to traditional asset classes. For example, the price of Bitcoin has experienced significant drops of over 50% in the past, demonstrating the potential for substantial losses. Price prediction models, even sophisticated ones, often struggle to accurately capture this volatility, leading to inaccurate forecasts. The inherent limitations of relying on past performance to predict future outcomes in such a dynamic market are considerable. The 2017-2018 bear market, for instance, significantly deviated from many predictions based on previous cycles.

Regulatory Uncertainty and Geopolitical Events

Government regulations and geopolitical events pose significant risks. Changes in regulatory frameworks, whether favorable or unfavorable, can significantly impact Bitcoin’s price and adoption. A sudden crackdown on cryptocurrency exchanges or a ban on Bitcoin trading in a major market could trigger a substantial price drop. Similarly, global geopolitical instability, such as wars or economic crises, can also lead to significant market fluctuations, impacting investor confidence and potentially causing Bitcoin’s price to fall. The impact of the recent regulatory scrutiny in various jurisdictions serves as a clear example of this risk.

Responsible Investing and Risk Management

Given the inherent risks and uncertainties, responsible investing and risk management are paramount. Investors should thoroughly research Bitcoin and the cryptocurrency market before investing any funds. Diversification across different asset classes is crucial to mitigate risk, and investors should only invest an amount they can afford to lose entirely. Understanding the potential for significant price fluctuations and the lack of regulatory protection in many jurisdictions is essential. Setting realistic expectations and avoiding emotional decision-making are crucial components of a sound investment strategy. The “buy the dip” mentality, while sometimes profitable, can also lead to substantial losses if the market continues to decline. A disciplined approach to risk management is key to navigating the volatile cryptocurrency landscape.

What Is The Price Prediction For Bitcoin Halving 2025 – Predicting Bitcoin’s price after the 2025 halving is challenging, with various analysts offering diverse forecasts. To understand potential price movements, it’s helpful to consider what might happen following the halving event; for insightful perspectives on this, check out this analysis on Bitcoin Prediction After Halving 2025. Ultimately, accurately predicting the Bitcoin price after the 2025 halving remains speculative, dependent on numerous market factors.

Predicting Bitcoin’s price after the 2025 halving is a complex undertaking, with various analysts offering widely differing forecasts. Understanding the precise timing is crucial for these predictions, and to that end, you might find the schedule helpful; check out the definitive list of Bitcoin Halving Dates 2025 to better inform your own assessment of potential price movements following the halving event.

Ultimately, the actual price will depend on numerous market factors.

Predicting Bitcoin’s price after the 2025 halving is challenging, with various analysts offering diverse forecasts. Understanding the mechanics of the halving is crucial for informed speculation, and a good resource for this is the comprehensive guide on Halving 2025 Bitcoin. Ultimately, the actual price will depend on numerous market factors beyond the halving itself, making accurate prediction difficult.

Predicting Bitcoin’s price after the 2025 halving is a complex undertaking, with various analysts offering widely differing forecasts. A key factor influencing these predictions is the precise timing of the event, which you can find confirmed at Next Bitcoin Halving Date 2025. Understanding this date is crucial for accurately modeling the subsequent market reaction and potential price fluctuations in the Bitcoin market.

Predicting the Bitcoin price after the 2025 halving is a complex undertaking, influenced by numerous factors. To gain insight into potential price movements, understanding historical trends is crucial. For a detailed analysis of what experts foresee, check out this comprehensive resource on Bitcoin Price At Halving 2025 , which helps contextualize the broader question of what the price prediction for Bitcoin Halving 2025 might be.

Ultimately, any prediction remains speculative, dependent on market dynamics and unforeseen events.

Predicting the Bitcoin price after the 2025 halving is a complex undertaking, influenced by numerous factors. To gain insight into potential price movements, understanding historical trends is crucial. For a detailed analysis of what experts foresee, check out this comprehensive resource on Bitcoin Price At Halving 2025 , which helps contextualize the broader question of what the price prediction for Bitcoin Halving 2025 might be.

Ultimately, any prediction remains speculative, dependent on market dynamics and unforeseen events.