Bitcoin Halving 2025: What Time Is The Bitcoin Halving 2025

The Bitcoin halving, a pre-programmed event in the Bitcoin protocol, is anticipated to occur in 2025, significantly impacting the cryptocurrency’s supply and, potentially, its price. Understanding the mechanics of this event and its historical context is crucial for navigating the evolving cryptocurrency market.

Bitcoin Halving Mechanics

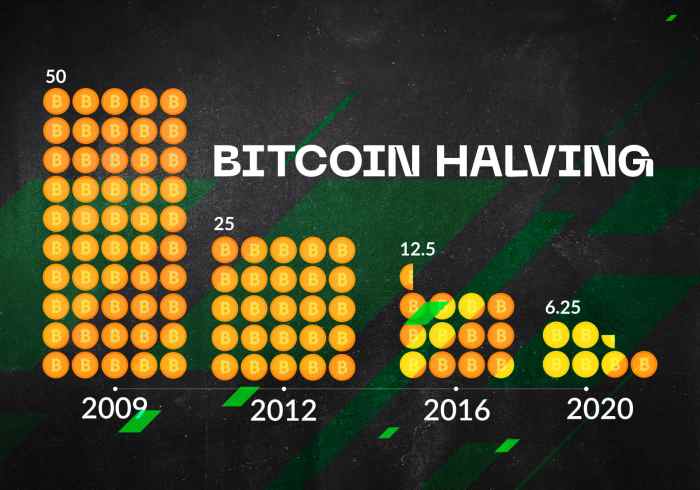

The Bitcoin halving reduces the rate at which new Bitcoins are created and added to the circulating supply. This occurs approximately every four years, or every 210,000 blocks mined. The reward miners receive for verifying transactions and adding new blocks to the blockchain is cut in half. For example, the reward started at 50 BTC per block and has been halved three times, currently standing at 6.25 BTC. The 2025 halving will reduce this reward to 3.125 BTC per block. This controlled reduction in supply is a core component of Bitcoin’s deflationary model.

Historical Impact of Bitcoin Halvings

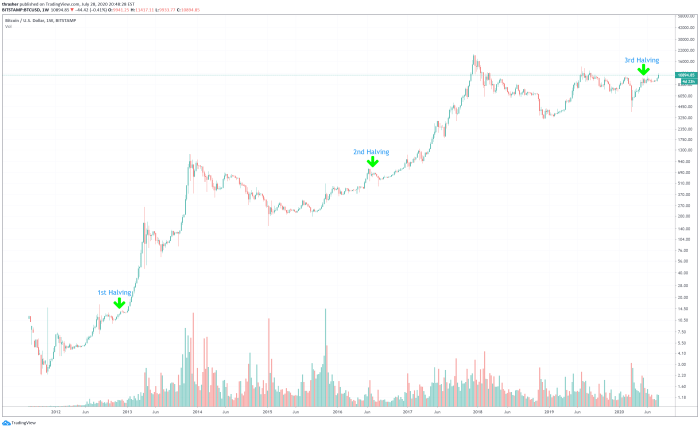

Previous halvings have generally been followed by periods of increased Bitcoin price appreciation. The first halving in 2012 saw a gradual price increase in the following year. The second halving in 2016 preceded a significant bull run that peaked in late 2017. The third halving in 2020 was followed by another bull market that reached its peak in late 2021. However, it’s crucial to note that other factors, such as market sentiment, regulatory changes, and macroeconomic conditions, also significantly influence Bitcoin’s price. Attributing price movements solely to halvings would be an oversimplification.

Anticipated Effects of the 2025 Halving

The 2025 halving is expected to reduce the inflation rate of Bitcoin, potentially increasing its scarcity and value. With a reduced supply of newly mined coins, demand could outpace supply, driving up the price. However, the extent of this price increase is highly uncertain and dependent on various factors including global economic conditions, investor sentiment, and the overall adoption rate of Bitcoin. Similar to previous cycles, we can anticipate increased speculation and volatility leading up to and following the event.

Comparison with Previous Halvings

While the 2025 halving shares the fundamental mechanism of reducing the block reward with previous events, there are key differences. The overall market maturity and regulatory landscape have evolved significantly since the first halving. The level of institutional investment and public awareness are considerably higher now. Therefore, the market reaction to the 2025 halving might differ from previous cycles, making accurate prediction challenging. Similarities include the core principle of reduced supply and the potential for increased price volatility.

Timeline of Significant Events

What Time Is The Bitcoin Halving 2025 – The following timeline Artikels key events leading up to and following the 2025 halving. This is an approximation, and precise dates may vary slightly.

- Pre-2025: Increasing anticipation and speculation about the halving’s impact on price. Potential price increases driven by this anticipation.

- Mid-2024 to Early 2025: The halving date approaches, leading to increased trading volume and price volatility.

- Q2 2025 (Approximate): The Bitcoin halving occurs. The block reward is reduced to 3.125 BTC.

- Post-2025: Initial period of price uncertainty followed by a potential bull market, though this is not guaranteed. The impact of the halving will gradually unfold over time.

Predicting the Bitcoin Price After the 2025 Halving

Predicting the price of Bitcoin after any halving event is inherently speculative, as numerous interconnected factors influence its trajectory. While the halving itself reduces the rate of new Bitcoin entering circulation, thereby potentially increasing scarcity and driving up price, other market forces can significantly impact the outcome. This analysis explores various scenarios and influencing factors to provide a nuanced perspective on potential post-halving price movements.

Potential Price Scenarios Post-Halving

Several price scenarios are plausible following the 2025 halving, ranging from modest increases to substantial price surges. A conservative estimate might see a gradual price appreciation, mirroring the post-halving trends of previous cycles, but with potentially less dramatic gains due to increased market maturity and regulatory scrutiny. Conversely, a bullish scenario could involve a significant price increase driven by sustained institutional adoption, positive regulatory developments, and broader macroeconomic factors. A bearish scenario, however, might see limited price movement or even a price decline due to macroeconomic headwinds or negative regulatory actions. These scenarios are not mutually exclusive and the actual outcome will likely be a complex interplay of these forces. For example, a moderate increase in price might occur initially, followed by a period of consolidation before further upward momentum, contingent on various market conditions.

Macroeconomic Conditions and Bitcoin’s Price

Macroeconomic conditions play a crucial role in shaping Bitcoin’s price trajectory. Periods of high inflation or economic uncertainty often see investors seeking alternative assets, potentially boosting Bitcoin’s demand. Conversely, periods of economic stability or rising interest rates could lead to capital flowing out of riskier assets like Bitcoin, impacting its price negatively. For example, the 2022 bear market coincided with rising inflation and interest rate hikes by central banks globally, negatively impacting Bitcoin’s price. Conversely, periods of significant economic downturn have historically seen Bitcoin prices rise as investors seek hedges against inflation and currency devaluation.

Adoption Rates and Regulatory Changes

The rate of Bitcoin adoption, both among individuals and institutions, is a key determinant of its price. Increased institutional investment, coupled with growing retail adoption, can significantly drive up demand and price. Conversely, low adoption rates can lead to price stagnation or even decline. Regulatory changes also exert considerable influence. Favorable regulatory frameworks, such as those seen in some jurisdictions that treat Bitcoin as a recognized asset class, can encourage investment and adoption, positively impacting price. Conversely, restrictive or unclear regulations can deter investment and negatively affect price. For instance, the increased regulatory scrutiny in some countries has contributed to price volatility and uncertainty.

Hypothetical Model of Post-Halving Price Impact

A hypothetical model illustrating the interplay of various factors could be constructed. This model could incorporate variables such as the halving effect (reduced supply), macroeconomic conditions (inflation, interest rates), adoption rates (institutional and retail), regulatory developments (positive or negative), and overall market sentiment. Each variable could be assigned a weight reflecting its relative influence, and the model could then generate a range of potential price outcomes based on different combinations of these variables. For instance, a scenario with high adoption, favorable regulation, and moderate inflation might predict a significant price increase, whereas a scenario with low adoption, negative regulation, and high interest rates might predict a price decline. The complexity of such a model would necessitate advanced statistical techniques and would still only provide a probabilistic forecast, not a definitive prediction.

Expert Opinions and Predictions

While predicting the exact price is impossible, several experts have offered their insights. PlanB, a well-known on-chain analyst, has historically used stock-to-flow models to predict Bitcoin’s price, although these predictions haven’t always been accurate. Other analysts, such as those at firms like Bloomberg or CoinDesk, offer price forecasts based on various technical and fundamental analyses, often providing a range of potential outcomes rather than a single point prediction. It’s crucial to note that these predictions should be considered opinions and not financial advice, and their accuracy is not guaranteed. The diversity of opinions underscores the inherent uncertainty in predicting Bitcoin’s future price.

The Impact of the 2025 Halving on Bitcoin Mining

The Bitcoin halving, scheduled for 2025, will significantly impact the profitability and sustainability of Bitcoin mining operations. This event, which reduces the block reward miners receive for validating transactions, will create a ripple effect across the entire mining ecosystem, forcing miners to adapt and innovate to remain competitive.

The halving will directly decrease the revenue generated per block mined. Currently, miners receive 6.25 BTC per block. After the halving, this reward will be cut in half to 3.125 BTC. This reduction in reward will directly impact the profitability of mining operations, particularly those operating on slim margins. The profitability of a mining operation is determined by the interplay of several factors including the Bitcoin price, electricity costs, mining hardware efficiency, and the difficulty of mining. A lower block reward necessitates either a rise in the Bitcoin price or a decrease in operational costs to maintain profitability.

Miner Adjustments to Reduced Block Rewards

Miners will likely implement various strategies to offset the reduced block rewards. These adjustments may include: upgrading to more energy-efficient mining hardware, negotiating lower electricity rates with energy providers, optimizing mining operations to improve efficiency, consolidating mining operations to leverage economies of scale, or diversifying revenue streams by engaging in activities like providing mining-as-a-service. For example, large-scale mining operations might invest in next-generation Application-Specific Integrated Circuits (ASICs) that consume less energy while maintaining high hash rates. Smaller operations might explore collaborations or mergers to improve their competitiveness.

Environmental Implications of the Halving

The halving’s environmental impact is complex. While reduced profitability might lead some less-efficient miners to exit the market, potentially reducing overall energy consumption, others might seek to offset reduced revenue by increasing their hash rate, potentially leading to increased energy usage. The long-term environmental sustainability of Bitcoin mining hinges on the adoption of renewable energy sources and the continued development of more energy-efficient mining hardware. The success of this transition will be crucial in determining the overall environmental footprint of the Bitcoin network post-halving.

Technological Advancements Mitigating Halving’s Impact

Technological advancements in mining hardware and software will play a vital role in mitigating the halving’s impact. The development of more energy-efficient ASICs, improved cooling systems, and advancements in mining algorithms could significantly reduce operational costs and enhance profitability. Furthermore, the exploration of alternative consensus mechanisms, while not directly impacting the 2025 halving, could offer long-term solutions for reducing the energy consumption associated with Bitcoin mining. For instance, the development and implementation of more efficient proof-of-work algorithms could decrease energy requirements.

Challenges Faced by Bitcoin Miners: Before and After the Halving

Before the halving, the primary challenges for Bitcoin miners were maintaining profitability in the face of fluctuating Bitcoin prices and increasing mining difficulty. Competition was intense, requiring constant upgrades to hardware and optimization of operational efficiency. After the halving, these challenges will be amplified by the reduced block reward. Miners will face intensified pressure to reduce operational costs, adopt new technologies, and potentially consolidate or exit the market if they cannot adapt to the changed economic landscape. The ability to secure low-cost, sustainable energy will become a crucial differentiator between successful and unsuccessful mining operations. The post-halving environment will favor those miners who can efficiently adapt to the new economic reality.

Bitcoin Halving and Investor Sentiment

The Bitcoin halving, a programmed event reducing the rate of new Bitcoin creation, significantly impacts investor sentiment. Anticipation builds months before the event, influencing trading activity and price volatility. Post-halving, the market reacts to the actual outcome, often exhibiting a period of consolidation before potentially resuming a price trend.

Investor sentiment surrounding Bitcoin halvings is typically characterized by a mixture of optimism and uncertainty. The reduction in supply is often viewed as bullish, driving increased demand and potentially pushing prices higher. However, the impact is not always immediate or guaranteed, and various factors can influence the market’s response.

Investor Strategies Surrounding the Halving

Investors employ diverse strategies before and after a Bitcoin halving. Some adopt a “buy-and-hold” approach, believing the long-term value proposition remains strong regardless of short-term price fluctuations. Others engage in more active trading strategies, attempting to profit from price volatility. This might include leveraging derivatives like futures contracts to speculate on price movements, or employing technical analysis to identify optimal entry and exit points. Some investors may also choose to dollar-cost average (DCA) into Bitcoin over a period of time, mitigating risk by spreading their investment across multiple purchases.

Risks and Rewards of Investing Around the Halving

Investing in Bitcoin around a halving event presents both significant risks and potential rewards. The primary reward is the potential for substantial price appreciation due to the reduced supply. However, the market can remain volatile, and unexpected events – regulatory changes, macroeconomic shifts, or security breaches – could negatively impact Bitcoin’s price regardless of the halving. The risk of significant losses is ever-present, particularly for investors leveraging borrowed funds or employing high-risk trading strategies. It’s crucial to remember that past performance is not indicative of future results.

Past Investor Behavior During Halvings

Previous Bitcoin halvings offer valuable insights into potential investor behavior in 2025. The 2012 halving saw a relatively muted price response in the short term, followed by a significant price increase over the subsequent year. The 2016 halving led to a more pronounced price surge in the months following the event. The 2020 halving saw a period of consolidation, followed by a significant bull run in 2021. Analyzing these past events helps contextualize expectations, though it’s important to remember that each halving occurs within a unique macroeconomic and market environment.

Investor Profiles and Responses to the 2025 Halving

The following table Artikels potential responses from different investor profiles to the 2025 halving:

| Investor Profile | Pre-Halving Strategy | Post-Halving Strategy | Potential Outcome |

|---|---|---|---|

| Long-term HODLer | Accumulate Bitcoin, ignoring short-term price fluctuations | Continue holding, potentially averaging down if prices dip | Potential for significant long-term gains |

| Short-term Trader | Attempt to profit from price volatility using derivatives or technical analysis | Adjust strategy based on market conditions, potentially taking profits or adding to positions | High risk/high reward, potential for significant gains or losses |

| Risk-averse Investor | Dollar-cost average into Bitcoin, gradually increasing holdings | Continue DCA approach, or hold existing position | Lower risk, potential for moderate gains |

| Speculator | Leverage high amounts of capital to bet on a significant price increase | Liquidate positions quickly based on market conditions | Extremely high risk/high reward, potential for substantial gains or complete loss of capital |

Frequently Asked Questions about the Bitcoin Halving 2025

The Bitcoin halving, a programmed event reducing the rate of new Bitcoin creation, is a significant event impacting the cryptocurrency’s price, mining profitability, and investor sentiment. Understanding the mechanics and potential consequences is crucial for anyone involved in the Bitcoin ecosystem. This section addresses common questions surrounding the 2025 halving.

The Exact Date and Time of the Bitcoin Halving in 2025, What Time Is The Bitcoin Halving 2025

Pinpointing the precise date and time of the 2025 Bitcoin halving requires understanding the Bitcoin protocol. The halving occurs after every 210,000 blocks are mined. Miners compete to solve complex cryptographic puzzles; the first to solve a puzzle adds a block to the blockchain and receives a reward. The block reward is currently 6.25 BTC, and this will be halved to 3.125 BTC. While the average block time is approximately 10 minutes, it can fluctuate, making precise prediction challenging. Therefore, we can only estimate the halving date based on the current block generation rate. Small variations in block times accumulate over many blocks, creating uncertainty in the exact date and time. Observing the blockchain’s progress in the months leading up to the projected halving provides a more refined estimate.

The Halving’s Effect on the Price of Bitcoin

The halving’s impact on Bitcoin’s price is a subject of much debate. Historically, halvings have preceded periods of price appreciation. The reduced supply of newly mined Bitcoin, combined with continued or increased demand, can lead to price increases due to basic supply and demand economics. However, other factors, such as overall market sentiment, regulatory changes, macroeconomic conditions, and technological developments, significantly influence Bitcoin’s price. For example, the 2012 and 2016 halvings were followed by substantial price rallies, but the market conditions and investor behaviour surrounding those events were significantly different from the current landscape. Predicting the exact price movement is impossible, but historically, halvings have been bullish events.

Risks Associated with Investing in Bitcoin Around the Halving

Investing in Bitcoin, especially around a halving, carries inherent risks. The cryptocurrency market is notoriously volatile, and price swings can be dramatic. The anticipation of a halving can lead to speculative bubbles, resulting in rapid price increases followed by equally rapid corrections. Furthermore, external factors unrelated to the halving can significantly impact the price. Regulatory uncertainty, security breaches, or negative news can trigger sell-offs, regardless of the halving. Therefore, investors should exercise caution, diversify their portfolios, and only invest what they can afford to lose. Consider that the price action after previous halvings has not been uniform, highlighting the unpredictability of the market.

The Halving’s Impact on Bitcoin Miners

The halving directly affects Bitcoin miners’ profitability. The reduced block reward means miners earn less Bitcoin per block mined. This can lead to some miners becoming unprofitable, potentially causing them to shut down their operations or adapt. Miners might respond by upgrading their hardware to increase efficiency, consolidating operations to reduce overhead, or switching to more profitable altcoins. The overall effect on the mining landscape is likely to be a consolidation of the industry, with only the most efficient and well-capitalized miners remaining. This could also lead to an increase in the hashrate as miners compete to maintain profitability despite the reduced reward.

Is the Bitcoin Halving a Guaranteed Event?

The Bitcoin halving is a programmed event within the Bitcoin protocol, making it a highly predictable event. The code dictates the halving mechanism, reducing the block reward at predetermined intervals. However, unforeseen circumstances could theoretically disrupt this. A significant software bug or a 51% attack could theoretically alter the block reward schedule, though such scenarios are highly improbable due to the decentralized nature of Bitcoin and the vast computational power securing the network. While unlikely, unexpected disruptions remain a theoretical possibility.

Beyond the 2025 Halving

The 2025 Bitcoin halving marks a significant milestone, but it’s not the end of the story. Understanding the long-term implications of this event requires looking beyond the immediate price fluctuations and considering the broader trajectory of Bitcoin’s adoption and the evolving technological landscape. The years following the halving will be crucial in determining Bitcoin’s ultimate role in the global financial system.

Long-Term Implications for Bitcoin’s Adoption and Growth

The reduced inflation rate resulting from the halving is expected to contribute to Bitcoin’s perceived scarcity and potentially increase its value as a store of value. However, broader adoption hinges on factors beyond the halving, such as regulatory clarity, improved usability, and the development of robust infrastructure. Increased institutional investment and wider public acceptance will be vital for sustained growth. Similar to the periods following previous halvings, we can expect increased interest and potentially volatile price movements in the short term. The long-term impact will depend heavily on global economic conditions and the evolution of the cryptocurrency market as a whole.

Potential Technological Developments Influencing Bitcoin’s Future

Several technological advancements could significantly shape Bitcoin’s future. The Lightning Network, for example, aims to improve scalability and transaction speed, addressing a key limitation of the Bitcoin blockchain. Layer-2 solutions like the Lightning Network are vital for widespread adoption, enabling faster and cheaper transactions. Furthermore, advancements in privacy-enhancing technologies could enhance Bitcoin’s appeal to a broader user base concerned about data security and anonymity. Research and development into more energy-efficient mining techniques are also crucial for the long-term sustainability of the Bitcoin network.

Key Challenges and Opportunities Facing Bitcoin

Bitcoin faces challenges such as regulatory uncertainty in various jurisdictions, ongoing debates surrounding its energy consumption, and the constant threat of security vulnerabilities. However, opportunities abound. The growing demand for decentralized finance (DeFi) applications and the increasing interest in digital assets present a fertile ground for Bitcoin’s expansion. Strategic partnerships with established financial institutions could also accelerate mainstream adoption. Successfully navigating these challenges and capitalizing on emerging opportunities will be essential for Bitcoin’s continued growth.

Comparison with Other Cryptocurrencies

Bitcoin’s position as the first and most established cryptocurrency provides a significant advantage. Its market capitalization and brand recognition are unmatched. However, newer cryptocurrencies often offer enhanced features, such as faster transaction speeds or more sophisticated smart contract functionalities. The competition will likely intensify, with altcoins vying for market share. Bitcoin’s future success will depend on its ability to adapt and innovate while maintaining its core principles of decentralization and security. The evolution of the cryptocurrency ecosystem will be characterized by competition and collaboration, with Bitcoin’s longevity depending on its adaptability and continued relevance.

Potential Future Trajectories of Bitcoin’s Price and Adoption

A visual representation could show two diverging lines on a graph. One line, representing price, could initially exhibit a sharp upward trend following the halving, potentially leveling off or even experiencing corrections before resuming a longer-term upward trajectory, influenced by factors like adoption rate and market sentiment. The second line, representing adoption, would show a gradual but steady increase, potentially accelerating as the technology matures and use cases expand. The graph would illustrate the possibility of periods of volatility in price, but a generally positive long-term trend, mirroring the historical pattern observed after previous halvings, though the scale and speed of growth would be uncertain. The image would also show the potential for significant price fluctuations depending on global economic events and market sentiment.