Bitcoin Halving 2025: What Will Happen After Bitcoin Halving In 2025

The Bitcoin halving is a programmed event in the Bitcoin protocol that occurs approximately every four years. It’s a crucial part of Bitcoin’s design, intended to control inflation and maintain the scarcity of Bitcoin. This event significantly impacts the rate at which new Bitcoins are created, influencing various aspects of the cryptocurrency’s ecosystem.

Bitcoin Halving: The Mechanism and Impact on Supply

The halving mechanism is built into the Bitcoin code. Every 210,000 blocks mined, the reward given to miners for verifying transactions is cut in half. Initially, the reward was 50 BTC per block. After the first halving, it became 25 BTC, then 12.5 BTC, and currently stands at 6.25 BTC. The 2025 halving will reduce this reward to 3.125 BTC. This controlled reduction in the rate of new Bitcoin creation is designed to mimic the scarcity of precious metals like gold, ultimately limiting the total supply of Bitcoin to 21 million coins.

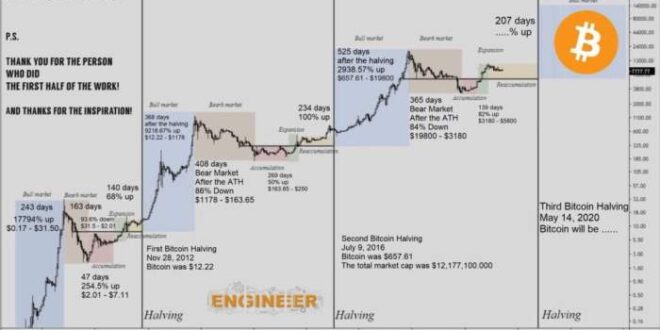

Historical Impact of Bitcoin Halvings, What Will Happen After Bitcoin Halving In 2025

Previous halvings have demonstrated a notable correlation with price increases, although the exact relationship is complex and influenced by various market factors. The first halving in 2012 saw a gradual price increase over the following year. The second halving in 2016 was followed by a significant bull run, leading to substantial price appreciation. The third halving in 2020 also witnessed a period of increased price volatility and eventually a substantial bull market. It’s important to note that while past performance doesn’t guarantee future results, the halving events have historically been significant catalysts for market excitement and price fluctuations. Other factors such as adoption rate, regulatory changes, and macroeconomic conditions also play a significant role in shaping Bitcoin’s price. For example, the 2020 halving coincided with a growing institutional interest in Bitcoin, which contributed to the subsequent price surge. However, the 2012 and 2016 halvings occurred in different market conditions, highlighting the interplay of multiple factors influencing Bitcoin’s price trajectory.

What Will Happen After Bitcoin Halving In 2025 – Predicting the precise market reaction to the 2025 Bitcoin halving is challenging, but many anticipate increased price volatility. To effectively reach potential investors during this period of market fluctuation, a robust online advertising strategy is crucial; consider setting up a Google Ads Account to target interested parties. This proactive approach will help you capitalize on the heightened interest surrounding Bitcoin after the halving event.