Bitcoin’s Price History and Market Trends

Bitcoin’s price history is a rollercoaster ride reflecting both its technological innovation and its susceptibility to market forces. Since its inception, Bitcoin has experienced periods of explosive growth followed by significant corrections, shaping its volatile nature and attracting both fervent supporters and skeptical critics. Understanding these fluctuations is crucial for navigating the cryptocurrency landscape.

Bitcoin’s price has been influenced by a complex interplay of factors, making accurate prediction challenging. However, by analyzing these factors, we can gain a better understanding of the historical trends and potential future trajectories.

Major Bull and Bear Markets

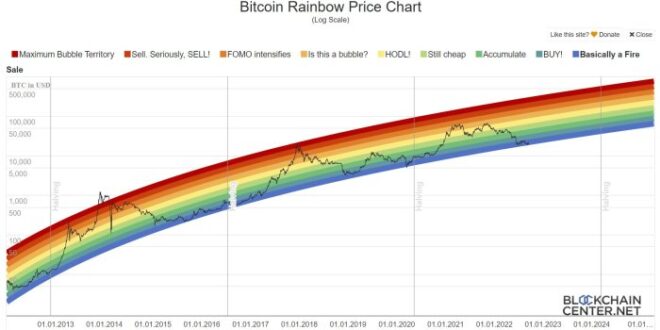

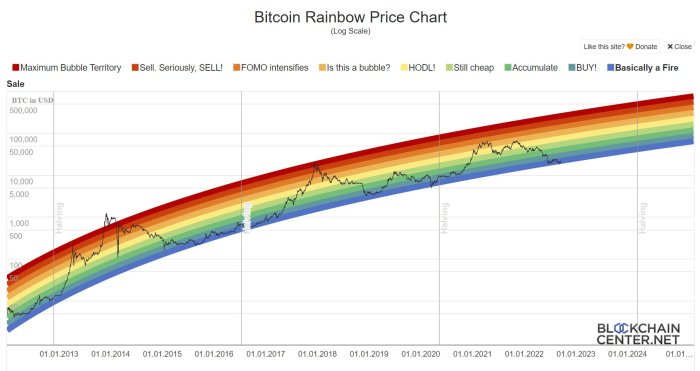

Bitcoin’s journey can be broadly categorized into distinct bull and bear markets. The initial years saw gradual price appreciation, culminating in the first major bull run in 2013, pushing the price above $1,000. This was followed by a substantial correction, typical of nascent markets. The next significant bull market began in late 2016 and peaked in late 2017, reaching almost $20,000, driven by increased media attention and institutional interest. Subsequent bear markets saw significant price drops, with the market bottoming out around $3,000 in 2018 and again in 2020. The most recent bull run began in 2020, reaching a high of over $60,000 in late 2021, before another substantial correction. These cycles highlight the inherent volatility of Bitcoin and the importance of understanding market sentiment.

Factors Influencing Bitcoin’s Price

Several factors contribute to Bitcoin’s price fluctuations. Regulatory changes, both positive and negative, significantly impact investor confidence and market liquidity. For example, positive regulatory frameworks in some jurisdictions have boosted Bitcoin’s adoption, while negative pronouncements or outright bans have led to price declines. Technological advancements, such as the implementation of the Lightning Network, which improves transaction speed and scalability, can also positively influence price. Conversely, significant network issues or security breaches can negatively affect price. Macroeconomic conditions, including inflation, interest rates, and global economic uncertainty, also play a crucial role. During periods of economic instability, investors often turn to Bitcoin as a hedge against inflation, driving demand and price increases.

Comparative Price Performance

A comparative chart illustrating Bitcoin’s price performance against other major cryptocurrencies (e.g., Ethereum, Ripple) and traditional assets (e.g., gold, the S&P 500) would reveal interesting dynamics. Such a chart would visually demonstrate periods of outperformance and underperformance relative to these assets, highlighting Bitcoin’s unique risk-return profile. For example, during periods of high inflation, Bitcoin might outperform traditional assets, while during periods of economic growth, traditional assets may show stronger returns. The chart would need to be dynamically updated, as cryptocurrency and traditional asset prices constantly fluctuate.

Key Events and Their Impact on Bitcoin’s Price

A timeline showcasing key events in Bitcoin’s history and their corresponding price impact would provide a valuable historical context. Key events could include the launch of Bitcoin, major price rallies and crashes, significant regulatory announcements, technological upgrades, and notable partnerships or integrations. For instance, the 2010 Pizza transaction, while seemingly insignificant, marked an early adoption milestone. Similarly, the Mt. Gox hack in 2014 caused a significant price drop due to the loss of a large number of Bitcoins. This timeline would illustrate how specific events, both positive and negative, have directly and indirectly affected Bitcoin’s price trajectory over time.

Technological Factors Affecting Bitcoin’s Future: What’s The Prediction For Bitcoin 2025

Bitcoin’s future price isn’t solely determined by market sentiment; underlying technological advancements and adoption rates play a crucial role. Understanding these factors is key to forming a realistic prediction for 2025 and beyond. This section will explore the significant technological influences shaping Bitcoin’s trajectory.

The Impact of Scaling Solutions

The Lightning Network (LN) is a layer-2 scaling solution designed to address Bitcoin’s transaction speed limitations. By enabling off-chain transactions, LN significantly reduces congestion on the main Bitcoin blockchain, allowing for faster and cheaper payments. Increased adoption of LN could lead to a wider acceptance of Bitcoin for everyday transactions, potentially boosting its price through increased utility and demand. For example, imagine a future where LN allows for instant, low-fee microtransactions, facilitating seamless peer-to-peer payments for goods and services. This enhanced functionality would make Bitcoin a more attractive alternative to traditional payment systems. Successful widespread LN adoption could significantly impact Bitcoin’s transaction volume and overall usability.

Bitcoin’s Technological Development, What’s The Prediction For Bitcoin 2025

Ongoing development of Bitcoin’s underlying technology is crucial for its long-term viability. Improvements in areas such as privacy, security, and efficiency are constantly being explored and implemented. Taproot, for example, is a significant upgrade that improves transaction privacy and efficiency. Future developments could focus on further enhancing scalability, potentially through alternative consensus mechanisms or layer-2 solutions beyond the Lightning Network. These advancements will contribute to Bitcoin’s robustness and appeal, potentially driving increased adoption and consequently, price appreciation. Consider the potential for a future where Bitcoin’s transaction processing speed rivals that of centralized payment systems, thereby solidifying its position as a dominant digital currency.

Institutional Adoption and its Influence

The growing involvement of institutional investors, such as large corporations and investment firms, significantly impacts Bitcoin’s price. Increased institutional adoption brings substantial capital inflows, leading to higher demand and potentially driving price increases. This is evident in past instances where large-scale institutional investments have correlated with periods of significant price growth. The increased legitimacy and perceived stability associated with institutional backing can also attract more individual investors, further contributing to price appreciation. For example, the entry of MicroStrategy and Tesla into the Bitcoin market spurred significant price increases. Continued institutional adoption in the coming years could lead to a similar, or even more pronounced, effect.

Bitcoin Price Prediction Models

Various models attempt to predict Bitcoin’s future price, each with its own set of assumptions and limitations. These models often incorporate factors like historical price data, market capitalization, adoption rates, and technological advancements. Some models utilize statistical analysis, while others incorporate more complex algorithms and machine learning techniques. However, it’s crucial to remember that these are just predictions, and their accuracy is limited by the inherent volatility of the cryptocurrency market and the difficulty of accurately forecasting future events. The range of predictions for 2025 varies significantly, depending on the underlying assumptions of each model, highlighting the inherent uncertainty involved in such forecasts. For example, some models predict a price well above $100,000, while others suggest a much lower figure, demonstrating the wide spectrum of possible outcomes.

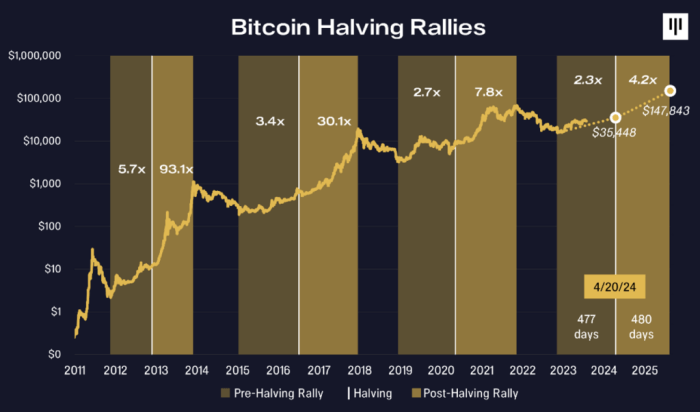

What’s The Prediction For Bitcoin 2025 – Predicting Bitcoin’s price in 2025 is challenging, with various factors influencing its trajectory. A key event impacting this prediction is the Bitcoin halving in 2024, which will significantly reduce the rate of new Bitcoin creation. For insightful analysis on this pivotal event, check out this resource on Predictions For Bitcoin Halving 2025. Understanding the halving’s potential consequences is crucial for formulating a comprehensive 2025 Bitcoin price forecast.

Predicting Bitcoin’s price in 2025 is challenging, with various factors influencing its trajectory. A key element to consider is the upcoming Bitcoin halving, which will significantly impact the supply of new Bitcoins. For a detailed analysis of this event’s market consequences, check out this insightful report: Bitcoin Halving:Impact On The Market 2025 En.Jmoanews.Com. Understanding the halving’s effects is crucial for any prediction about Bitcoin’s value by 2025.

Predicting Bitcoin’s price in 2025 is challenging, with various factors influencing its trajectory. A key element to consider is the upcoming halving event, significantly impacting Bitcoin’s supply. For insights into this crucial event, check out this comprehensive analysis on the 2025 Bitcoin Halving Prediction. Understanding the halving’s potential effects is vital for any 2025 Bitcoin price prediction.

Predicting Bitcoin’s 2025 price is challenging, with various factors influencing its trajectory. A key event to consider is the Bitcoin Halving, which significantly impacts the supply of new Bitcoins. To understand the potential timing of this crucial event, check out the precise dates on this resource: Bitcoin Halving 2025 Dates. This information is vital for forming a more accurate forecast for Bitcoin’s value in 2025.

Predicting Bitcoin’s price in 2025 is challenging, with various factors influencing its trajectory. A key event to consider is the Bitcoin halving, scheduled for that year; understanding its impact is crucial for any forecast. To learn more about this significant event, check out this resource on Bitcoin Halving 2025 Là Gì , which will help you better grasp the potential implications for Bitcoin’s future price.

Ultimately, the 2025 price will depend on the interplay of numerous economic and technological factors.

Predicting Bitcoin’s 2025 price is challenging, with various factors influencing its trajectory. A key event to consider is the Bitcoin Halving in 2024, which will significantly impact the supply of new Bitcoins. To understand its potential consequences, it’s helpful to review the analysis provided in this article: Bitcoin Halving 2025 What To Expect. Ultimately, the halving’s effect on Bitcoin’s price in 2025 remains a subject of ongoing debate and speculation.