Bitcoin Halving 2025

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created. This occurs approximately every four years, or every 210,000 blocks mined. It’s a crucial mechanism designed to control Bitcoin’s inflation and maintain its scarcity over time. Understanding the halving’s impact is key to comprehending Bitcoin’s long-term value proposition.

Bitcoin Halving: A Detailed Explanation

The Bitcoin halving process directly affects the block reward miners receive for successfully adding a new block of transactions to the blockchain. Before the first halving, miners received 50 BTC per block. After the first halving, this reward was cut in half to 25 BTC. Subsequent halvings followed this pattern, reducing the reward to 12.5 BTC, then 6.25 BTC, and the upcoming 2025 halving will reduce it to 3.125 BTC. This controlled reduction in the rate of new Bitcoin creation is fundamental to the cryptocurrency’s deflationary nature. The total number of Bitcoins that can ever exist is capped at 21 million. The halving ensures that this limit is gradually approached, contributing to the asset’s perceived scarcity.

Historical Significance of Past Bitcoin Halvings and Their Effects

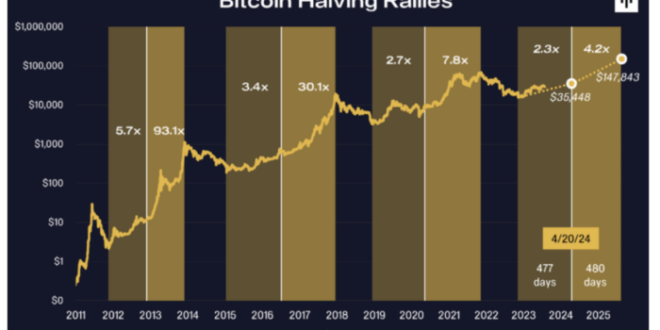

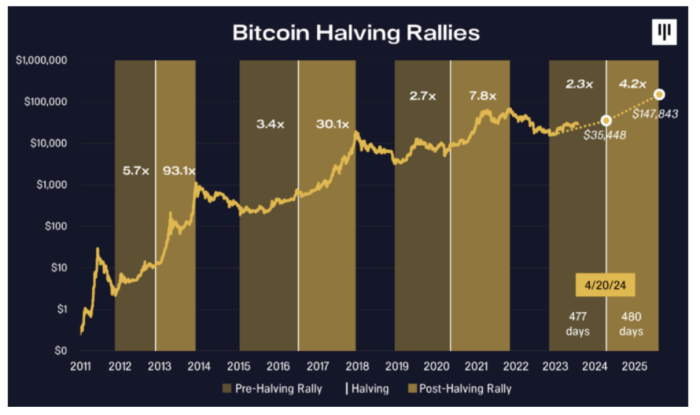

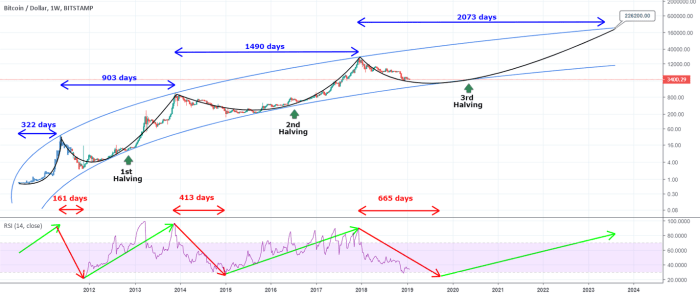

The past three Bitcoin halvings have shown a noticeable correlation between the halving event and subsequent price increases. While correlation doesn’t equal causation, the halvings have consistently coincided with periods of increased market interest and price appreciation. The first halving in November 2012, saw Bitcoin’s price relatively stable in the following months, but a significant bull run occurred in the following years. The second halving in July 2016, preceded a considerable price surge in late 2017. Similarly, the third halving in May 2020, was followed by a significant price rally that peaked in late 2021. These historical trends have led many to anticipate a similar positive impact following the 2025 halving, although the extent of this impact remains uncertain and subject to various market factors. It is important to note that other economic and geopolitical events also significantly influence Bitcoin’s price.

Expected Changes in Bitcoin Mining Profitability After the 2025 Halving

The 2025 halving will undoubtedly impact the profitability of Bitcoin mining. The reduced block reward will directly lower the revenue generated per block mined. Miners will need to adjust their operations to remain profitable. This might involve increasing mining efficiency through upgrades to hardware, seeking lower electricity costs, or consolidating mining operations. Those miners who cannot adapt to the reduced profitability might be forced to shut down their operations. This could lead to a reduction in the overall hash rate (the computational power securing the network) in the short term, but could also result in a more efficient and sustainable mining ecosystem in the long run. The price of Bitcoin will play a crucial role in determining the overall profitability. A significant price increase following the halving could offset the reduced block reward, ensuring continued profitability for many miners. Conversely, a price decline could exacerbate the challenges faced by miners, potentially leading to a more significant consolidation of the mining industry. The interplay between the halving, Bitcoin’s price, and the adaptability of miners will determine the long-term effects on the Bitcoin network’s security and stability.

Predicting the 2025 Halving Date

Predicting the precise date of the 2025 Bitcoin halving requires understanding the Bitcoin network’s block generation time and the halving mechanism. While a precise date can be estimated, several factors influence its accuracy.

The Bitcoin halving occurs approximately every four years, reducing the block reward paid to miners by half. This reward currently stands at 6.25 BTC per block. The halving is triggered when a specific number of blocks are mined, currently set at 210,000 blocks between each halving event. This means the next halving will take place after approximately 210,000 blocks are mined after the last halving which occurred in 2020.

Calculating the Halving Date and its Accuracy

The most common method for estimating the halving date involves calculating the average block time and extrapolating that to the next 210,000 blocks. However, the block time is not constant; it fluctuates due to various factors influencing the computational power dedicated to mining. A longer average block time will delay the halving, while a shorter average time will accelerate it. The average block time is approximately 10 minutes, though this can vary. Using a 10-minute average block time and the 210,000 block requirement, a simple calculation yields an estimated date. However, this is merely an approximation, and the actual date could differ due to the inherent variability of the block generation time. For example, periods of increased mining difficulty or decreased hashrate can significantly impact the average block time, leading to deviations from the estimated date. The accuracy of the calculation is therefore limited by the inherent unpredictability of the network’s dynamic behavior. Historical data shows that the halving dates have not perfectly aligned with initial predictions due to these fluctuations. More sophisticated models incorporating historical block time data and network parameters can offer more accurate predictions, though complete precision remains elusive. These models often utilize statistical methods to account for the inherent variability in block generation time, providing a probability distribution rather than a single point estimate for the halving date.

Factors Affecting the Halving Date, When Does Bitcoin Halving 2025

Several factors can influence the timing of the Bitcoin halving. Changes in the network’s hashrate, for instance, directly impact block generation time. A significant increase in hashrate leads to faster block creation, potentially bringing the halving forward, while a decrease has the opposite effect. Similarly, changes in mining difficulty adjustments, a mechanism designed to maintain a consistent block time, can also influence the halving date. Network congestion or upgrades also have the potential to temporarily disrupt block generation, thus impacting the overall timeline. Unexpected events, such as major regulatory changes or significant shifts in market sentiment, can indirectly affect the hashrate and subsequently influence the halving date. Finally, the precise calculation relies on the assumption of a consistent average block time over the period leading up to the halving. Any deviation from this assumption will lead to a difference between the predicted and actual halving date. Therefore, while we can make an educated guess based on current trends, the exact date remains subject to the inherent variability of the Bitcoin network.

Market Impact of the 2025 Halving: When Does Bitcoin Halving 2025

The Bitcoin halving, a programmed event reducing the rate of new Bitcoin creation, is anticipated to have significant effects on the cryptocurrency market in 2025. Understanding the potential short-term and long-term consequences requires analyzing past halving cycles and considering diverse expert perspectives. While predicting precise price movements is impossible, examining historical trends and current market conditions can offer valuable insights.

The halving’s impact stems from its effect on Bitcoin’s inflation rate. By reducing the supply of newly mined Bitcoin, the halving creates a dynamic where demand potentially outpaces supply, potentially leading to price appreciation. This effect, however, is not immediate and is often influenced by other market factors such as regulatory changes, macroeconomic conditions, and overall investor sentiment.

Short-Term Price Effects

Historically, the period immediately following a halving has shown mixed results. While some have witnessed a gradual price increase leading up to and immediately after the event, others have experienced a period of consolidation or even a temporary price dip before a subsequent rally. The 2012 and 2016 halvings, for example, were followed by periods of significant price appreciation, but the timing and magnitude of these increases varied considerably. The 2020 halving saw a less dramatic immediate price increase, highlighting the influence of external factors. These variations emphasize the complexity of predicting short-term price movements following a halving. Short-term effects are influenced by a multitude of factors beyond just the halving itself.

Long-Term Price Effects

The long-term impact of Bitcoin halvings is generally considered more significant. The reduced inflation rate contributes to a scarcity narrative, potentially increasing Bitcoin’s value as a store of value over time. The historical data supports this assertion, with both the 2012 and 2016 halvings being followed by substantial long-term price increases, although the timing of these increases varied significantly. However, it’s crucial to remember that other factors, such as technological advancements, adoption rates, and regulatory frameworks, also play a crucial role in determining Bitcoin’s long-term price trajectory. The long-term effect is a more gradual process influenced by a combination of factors.

Comparison with Previous Halvings

Analyzing previous halvings provides valuable context. The 2012 halving saw Bitcoin’s price increase from approximately $12 to over $1,000 within a few years. The 2016 halving led to a price surge from around $650 to nearly $20,000 within a similar timeframe. However, the 2020 halving, while also leading to price increases, showed a less immediate and dramatic response. These differences highlight the interplay between the halving’s impact and external market forces. Comparing these events demonstrates that while the halving creates a foundational shift in supply dynamics, other market factors significantly shape the ultimate price outcome.

Expert Opinions on Market Reaction

Expert opinions on the 2025 halving are diverse. Some analysts predict a significant price surge driven by the decreased supply and increased scarcity. Others emphasize the impact of macroeconomic conditions, regulatory uncertainty, and the overall cryptocurrency market sentiment, suggesting a more moderate or even unpredictable response. The range of opinions highlights the complexity of forecasting market reactions, emphasizing the importance of considering various factors beyond the halving itself. The wide range of predictions underscores the inherent uncertainties associated with market forecasting.

Mining and the 2025 Halving

The Bitcoin halving event, scheduled for 2025, will significantly impact the profitability and landscape of Bitcoin mining. This reduction in the block reward, from 6.25 BTC to 3.125 BTC, will inevitably trigger adjustments within the mining ecosystem, affecting both individual miners and large mining operations. The subsequent changes will ripple through the entire Bitcoin network.

The halving directly affects miner revenue. With fewer newly minted bitcoins awarded per block, the profitability of mining operations will decrease. This reduction in profitability will likely lead to a consolidation within the mining industry, with less profitable miners being forced to shut down or merge with larger entities. The overall number of active miners could decrease, potentially impacting the network’s hash rate and security. However, it’s important to note that the market price of Bitcoin plays a crucial role here; a significant price increase could offset the reduced block reward and maintain or even increase mining profitability. Conversely, a price decline could exacerbate the challenges faced by miners.

Mining Hardware and Energy Consumption Changes

The halving often prompts innovation and adaptation within the mining hardware sector. Miners are constantly seeking more energy-efficient and powerful hardware to maintain profitability. The reduced block reward will incentivize the development and adoption of more efficient ASICs (Application-Specific Integrated Circuits) and potentially new mining technologies. This drive for efficiency will also influence energy consumption patterns. While the overall energy consumption of the Bitcoin network might initially decrease due to some miners shutting down, the adoption of more powerful hardware could partially offset this reduction. The long-term impact on energy consumption will depend on a complex interplay of factors, including the price of Bitcoin, the efficiency of new hardware, and the regulatory landscape surrounding energy usage in mining. For example, the shift towards renewable energy sources in some mining operations could potentially mitigate the environmental concerns associated with Bitcoin mining.

Historical Halving and Mining Difficulty Adjustments

The Bitcoin protocol incorporates a difficulty adjustment mechanism to maintain a consistent block generation time of approximately 10 minutes. This mechanism automatically adjusts the mining difficulty every 2016 blocks, approximately every two weeks, based on the network’s hash rate. After a halving, the reduced block reward initially lowers the profitability of mining, causing a temporary decrease in the network’s hash rate. This decline in hash rate triggers a downward adjustment in mining difficulty, making it slightly easier to mine blocks and mitigating the immediate impact of the halving on the network’s security. The table below illustrates the historical relationship between halving events and subsequent mining difficulty adjustments. Note that the precise timing and magnitude of these adjustments can vary due to the dynamic nature of the Bitcoin network.

| Halving Date | Approximate Time to Difficulty Adjustment (days) | Percentage Change in Difficulty (approx.) |

|---|---|---|

| November 28, 2012 | ~14 | -16% |

| July 9, 2016 | ~14 | -20% |

| May 11, 2020 | ~14 | -28% |

Bitcoin’s Long-Term Outlook After 2025

The 2025 Bitcoin halving is a significant event, but its long-term impact on Bitcoin’s dominance within the cryptocurrency market remains a subject of ongoing discussion and speculation. While the halving undeniably reduces the rate of new Bitcoin creation, its effect on price and market position is intertwined with broader macroeconomic factors, technological advancements, and regulatory developments.

The halving’s primary effect is a reduction in the inflation rate of Bitcoin. This deflationary pressure, coupled with increasing demand, is often cited as a potential catalyst for price appreciation. However, this effect is not guaranteed and depends on a multitude of interacting forces. Historically, Bitcoin’s price has experienced periods of significant volatility both before and after previous halvings. Understanding the interplay of these factors is crucial for assessing Bitcoin’s long-term prospects.

Bitcoin’s Scarcity Compared to Other Cryptocurrencies

Bitcoin’s inherent scarcity, capped at 21 million coins, is a key differentiator compared to many other cryptocurrencies. Unlike Bitcoin, many altcoins have either no fixed supply or vastly larger maximum supplies. This difference in scarcity directly impacts the potential for long-term value appreciation. While some altcoins may offer innovative functionalities or faster transaction speeds, Bitcoin’s established network effect and scarcity provide a compelling argument for its continued dominance as a store of value. The limited supply creates a deflationary pressure that is not replicated to the same extent in other cryptocurrencies. This deflationary pressure, in theory, should drive up the value of each Bitcoin over time, assuming demand continues to increase.

A Hypothetical Bitcoin Price Trajectory Post-2025 Halving

Predicting future price movements with certainty is impossible. However, we can construct a plausible scenario based on historical data and current market trends. Assume a successful 2025 halving, leading to a period of increased price volatility followed by a gradual upward trend. This upward trend could be punctuated by periods of correction, mirroring past halving cycles. For instance, imagine a scenario where the price rises steadily from, say, $50,000 to $100,000 within two years post-halving, then experiences a correction to around $70,000 before resuming its upward trajectory, potentially reaching $200,000 by 2030. This scenario, while speculative, reflects the potential for significant price appreciation alongside periods of market adjustment. This trajectory is, however, contingent upon factors like widespread adoption, regulatory clarity, and the overall macroeconomic environment. It is crucial to remember that this is just one possible scenario, and the actual price could vary significantly. The influence of external factors, such as global economic downturns or increased regulatory scrutiny, could significantly alter this predicted trajectory. Past performance is not indicative of future results, and investing in cryptocurrencies involves significant risk.

Investing and the 2025 Halving

The Bitcoin halving event, scheduled for 2025, is anticipated to significantly impact the cryptocurrency market. Understanding this impact is crucial for investors looking to navigate the potential volatility and capitalize on opportunities. This section explores investment strategies, risk management techniques, and the potential benefits and risks associated with investing in Bitcoin around the halving.

The 2025 halving will reduce the rate at which new Bitcoins are created, decreasing the supply entering the market. Historically, halvings have been followed by periods of price appreciation, though this is not guaranteed. Investors should carefully consider their risk tolerance and investment horizon before making any decisions. A diversified portfolio is always recommended, mitigating the risk associated with any single asset, including Bitcoin.

Investment Strategies Around the 2025 Halving

Several investment strategies can be considered in anticipation of and following the 2025 Bitcoin halving. These strategies range from long-term holding to more active trading approaches. For example, a long-term “hodling” strategy involves buying and holding Bitcoin for an extended period, aiming to benefit from long-term price appreciation. Alternatively, a dollar-cost averaging (DCA) approach involves investing a fixed amount of money at regular intervals, regardless of price fluctuations, reducing the impact of market volatility. More active strategies might involve short-term trading based on price predictions, but these carry significantly higher risk. It is important to remember that past performance is not indicative of future results.

Risk Management Techniques for Bitcoin Investment

Market volatility is inherent to cryptocurrency investing. Effective risk management is paramount. Diversification across different asset classes is a key strategy to mitigate risk. Investors should only invest what they can afford to lose, avoiding over-leveraging or using borrowed funds. Setting stop-loss orders can limit potential losses by automatically selling Bitcoin if the price falls below a predetermined level. Regularly reviewing your investment portfolio and adjusting your strategy based on market conditions is also crucial. Finally, staying informed about market trends and news related to Bitcoin is essential for making informed decisions.

Benefits and Risks of Investing in Bitcoin Before and After the Halving

The potential benefits and risks of investing in Bitcoin around the halving are significant.

When Does Bitcoin Halving 2025 – Potential Benefits:

- Price Appreciation: Historically, halvings have been followed by periods of price increases, although this is not guaranteed.

- Reduced Inflationary Pressure: The reduced supply of new Bitcoins could lead to decreased inflationary pressure.

- Increased Scarcity: The halving further reduces the total supply of Bitcoin, potentially increasing its value due to scarcity.

Potential Risks:

- Market Volatility: The cryptocurrency market is known for its extreme volatility, and price fluctuations can be significant.

- Regulatory Uncertainty: Government regulations concerning cryptocurrencies can impact Bitcoin’s price and accessibility.

- Technological Risks: Security breaches or technological advancements could negatively impact Bitcoin’s value.

- Economic Downturns: Broader economic factors can influence the price of Bitcoin, potentially leading to significant price drops.

Frequently Asked Questions (FAQ)

This section addresses common queries regarding the 2025 Bitcoin halving, its impact on the market, and investment strategies. Understanding these points is crucial for navigating the potential volatility surrounding this significant event in the Bitcoin lifecycle.

Bitcoin Halving Date in 2025

The exact date of the Bitcoin halving in 2025 is dependent on the block generation time. Bitcoin’s protocol dictates a halving approximately every four years, reducing the block reward for miners by half. While predicting the precise date requires monitoring the blockchain’s block generation rate, estimations currently point to a halving sometime in the spring or early summer of 2025. Slight variations are possible due to fluctuations in mining difficulty.

Bitcoin Halving’s Price Impact

Historically, Bitcoin halvings have been followed by periods of price appreciation. The reduced supply of newly mined Bitcoin, coupled with consistent demand, can create upward pressure on the price. However, it’s crucial to remember that this is not a guaranteed outcome. Other market factors, including macroeconomic conditions, regulatory changes, and overall investor sentiment, significantly influence Bitcoin’s price. The 2012 and 2016 halvings saw subsequent price increases, but the market’s response is never identical, and other factors often play a more significant role than the halving itself.

Risks and Rewards of Investing Around the Halving

Investing in Bitcoin around a halving presents both significant risks and potential rewards. The potential for price appreciation is a major draw, but the cryptocurrency market is inherently volatile. Prices can fluctuate dramatically, leading to substantial losses. Therefore, thorough research, risk assessment, and a well-defined investment strategy are essential. Diversification of one’s portfolio is also strongly recommended to mitigate potential losses. For example, an investor might allocate only a small percentage of their total investment portfolio to Bitcoin, hedging against potential losses.

Halving’s Impact on Bitcoin Mining

The halving directly impacts Bitcoin miners by reducing their block rewards. This can lead to increased mining difficulty as miners compete for the smaller reward. Less profitable miners might be forced to shut down operations, leading to a consolidation within the mining industry. This can also lead to increased hash rate centralization, depending on the resilience of smaller mining operations. The long-term effect on mining profitability is a complex interplay between the reduced reward and the potential for increased Bitcoin price.

Alternative Investment Strategies Around the Halving

While investing directly in Bitcoin is an option, alternative strategies exist. These could include investing in Bitcoin mining companies (though this carries its own risks), diversifying into other cryptocurrencies, or focusing on investments less correlated with the cryptocurrency market. For instance, an investor might consider allocating funds to stablecoins or other asset classes, like gold or real estate, to balance their portfolio and reduce overall risk. The choice of strategy depends heavily on individual risk tolerance and investment goals.

Illustrative Examples

Understanding the impact of Bitcoin halvings requires examining historical data and considering potential future scenarios. Analyzing past price movements around halving events provides valuable insights, while exploring hypothetical market conditions helps us prepare for the 2025 halving’s potential outcomes.

Bitcoin Halving Price Action: A Historical Overview

A chart depicting Bitcoin’s price action surrounding the previous three halving events (2012, 2016, and 2020) would show a clear pattern. The x-axis would represent time, showing the period leading up to and following each halving. The y-axis would display Bitcoin’s price in USD. Each halving event would be marked with a vertical line. Before each halving, the chart would likely show a period of price buildup, followed by a significant price increase in the months and years after the event. However, the magnitude and duration of these increases varied across each halving. The chart would also illustrate periods of price volatility both before and after each halving, highlighting the inherent risk associated with Bitcoin investment. Importantly, the chart would visually demonstrate that while a price increase typically follows a halving, the timing and extent of this increase are not guaranteed.

Hypothetical Scenarios for the 2025 Halving

Different market conditions could significantly influence the outcome of the 2025 halving. Let’s explore two contrasting scenarios.

Scenario 1: Strong Bull Market Leading Up to the Halving

In this scenario, a robust bull market precedes the 2025 halving. Bitcoin’s price would be significantly higher than its price at the time of the previous halving. The anticipation of the reduced inflation rate caused by the halving could further fuel the bull run, leading to a potentially explosive price increase after the event. This scenario mirrors the price action observed after the 2016 and 2020 halvings, albeit on a potentially larger scale, given the increased adoption and institutional interest in Bitcoin since then. The increased demand driven by scarcity could exacerbate the price increase, potentially exceeding the price increases observed in previous cycles.

Scenario 2: Bear Market or Stagnant Market Leading Up to the Halving

Alternatively, a bear market or a period of stagnant price action could precede the 2025 halving. In this case, the halving’s impact on price might be less pronounced, or even delayed. The reduced supply might not be enough to overcome bearish sentiment or general market uncertainty. The price increase post-halving might be more gradual and less dramatic compared to previous cycles. This scenario could be similar to the situation observed in the months leading up to the 2012 halving, where the price increase post-halving was less dramatic than in subsequent cycles. A prolonged period of low prices might dampen investor enthusiasm, potentially reducing the price surge expected after the halving. Regulatory uncertainty or a broader economic downturn could further contribute to this subdued market response.

Determining the precise date for the When Does Bitcoin Halving 2025 event requires careful consideration of block generation times. However, a comprehensive resource detailing this significant event is available at 2025 Bitcoin Halving , providing insights into the expected timeline. Understanding this helps clarify When Does Bitcoin Halving 2025 and its potential impact on the cryptocurrency market.

The Bitcoin halving in 2025 is anticipated to occur in April, significantly impacting the cryptocurrency’s supply. Understanding the potential price movements following this event is crucial, and for insightful analysis on this, you can check out this resource on Bitcoin Halving 2025 Price Prediction. Ultimately, the exact timing of the halving in 2025 will depend on the Bitcoin network’s block generation time.

Pinpointing the exact date for the Bitcoin halving in 2025 requires close monitoring of the blockchain, but it’s anticipated to occur sometime in the spring. Naturally, speculation abounds regarding the subsequent price action, and understanding potential market movements is key. For insights into this, check out this analysis on the Bitcoin Price After Halving 2025 to better inform your perspective on the When Does Bitcoin Halving 2025 question.

Ultimately, the timing of the halving significantly influences the future trajectory of Bitcoin’s value.