Bitcoin Halving 2025

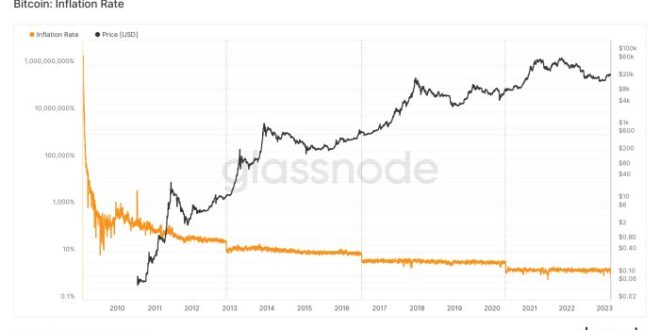

The Bitcoin halving, a programmed event occurring approximately every four years, reduces the rate at which new Bitcoins are created. This reduction in supply is a core component of Bitcoin’s deflationary monetary policy, intended to control inflation and potentially influence its price. Understanding the mechanics and historical impact is crucial for navigating the market leading up to and following the 2025 halving.

Bitcoin Halving Mechanics and Historical Price Impact, When Halving Bitcoin 2025

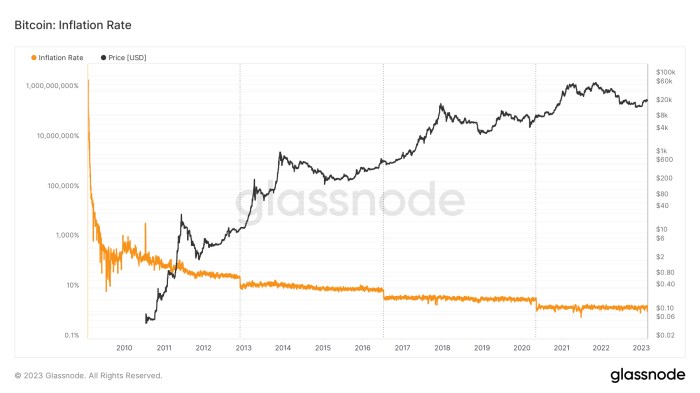

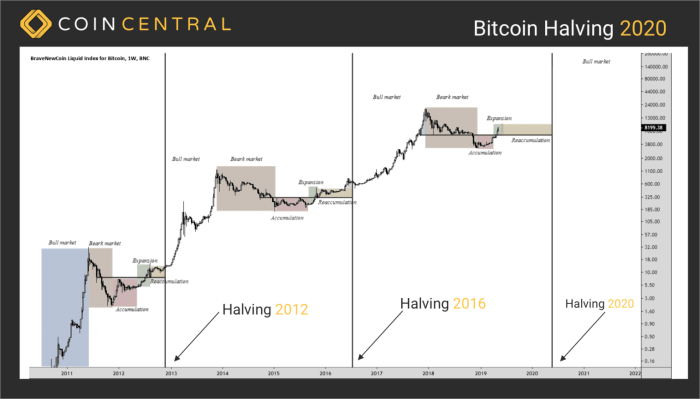

The Bitcoin halving mechanism is embedded in the Bitcoin protocol. Every 210,000 blocks mined, the reward given to miners for successfully adding a block to the blockchain is halved. This began with a 50 BTC reward, reduced to 25 BTC, then 12.5 BTC, and will be reduced to 6.25 BTC in 2025. Historically, halving events have been followed by periods of significant price appreciation, although the timing and magnitude of these increases have varied. The 2012 and 2016 halvings were followed by substantial bull runs, although other market factors also played significant roles. The 2020 halving saw a price increase, but the market dynamics were more complex, influenced by increased institutional interest and global macroeconomic events.

Potential Price Scenarios Following the 2025 Halving

Predicting Bitcoin’s price after the 2025 halving is inherently speculative. A bullish scenario anticipates a surge in price driven by the reduced supply, increased scarcity, and continued institutional adoption. This could lead to a new all-time high, mirroring (though not necessarily replicating) the price increases seen after previous halvings. Conversely, a bearish scenario suggests that macroeconomic factors, regulatory uncertainty, or a general market downturn could dampen the impact of the halving, potentially leading to a period of price stagnation or even a decline. The degree of price movement will depend on the interplay of these factors. For example, a global recession could significantly impact investor sentiment and risk appetite, potentially overshadowing the impact of the halving.

Comparison with Previous Halving Events

The 2025 halving differs from previous events in several key aspects. The overall market maturity is significantly higher, with greater institutional involvement and regulatory scrutiny. The cryptocurrency market itself is far more diverse, with a multitude of altcoins competing for investor attention. While previous halvings occurred in a relatively nascent market, the 2025 halving will take place within a more established, yet still volatile, ecosystem. Investor sentiment also plays a crucial role; the level of anticipation and speculation surrounding the halving will impact its immediate aftermath. For instance, the hype surrounding the 2020 halving was significant, but the subsequent price action was influenced by factors beyond the halving itself.

Impact of Macroeconomic Factors

Macroeconomic factors, such as inflation and recessionary pressures, can significantly influence Bitcoin’s price. High inflation could drive investors towards Bitcoin as a hedge against inflation, potentially boosting its price. However, a recessionary environment could lead to risk-aversion, causing investors to liquidate assets, including Bitcoin, impacting its price negatively. The interplay between these macroeconomic forces and the halving’s impact on supply will determine the net effect on Bitcoin’s price. The 2008 financial crisis, for example, showed how macroeconomic events can profoundly influence even seemingly unrelated markets.

Timeline of Key Events

A timeline leading up to and following the 2025 halving would include:

- Pre-Halving (2024-2025): Increased anticipation and speculation, potential price volatility driven by market sentiment and macroeconomic factors.

- Halving Event (2025): The actual halving event itself, likely accompanied by increased media attention and short-term price fluctuations.

- Post-Halving (2025-2026): Potential price appreciation driven by reduced supply, but also influenced by macroeconomic conditions and overall market sentiment. This period could see continued volatility, with potential price corrections.

This timeline is a general projection and the actual timing and impact of events could vary significantly.

Mining and the 2025 Halving

The Bitcoin halving in 2025, scheduled to reduce the block reward from 6.25 BTC to 3.125 BTC, will significantly impact Bitcoin mining profitability and the overall network. This reduction in newly minted coins directly affects miners’ revenue, forcing them to adapt their operations to remain viable. The consequences will ripple through the entire ecosystem, influencing the network’s security and the price of Bitcoin itself.

Miner Profitability and Responses to the Halving

The halving directly cuts miners’ revenue by half. To maintain profitability, miners will need to adjust their operations. This could involve increasing efficiency through upgrades to mining hardware, negotiating lower energy costs, or consolidating operations to achieve economies of scale. Less profitable miners, particularly those with older equipment or high energy costs, may be forced to shut down, leading to a redistribution of mining power amongst the more efficient operators. Some miners might also diversify their revenue streams by exploring alternative cryptocurrencies or engaging in other blockchain-related activities. The overall effect will be a more competitive and potentially more centralized mining landscape.

Impact on Hashrate and Network Security

The reduction in miner profitability could lead to a decrease in the Bitcoin hashrate, which represents the total computational power securing the network. A lower hashrate could, theoretically, make the network more vulnerable to attacks, such as 51% attacks. However, this effect is mitigated by several factors. Firstly, the price of Bitcoin could increase following the halving, offsetting the reduced block reward. Secondly, technological advancements in mining hardware continuously improve efficiency, allowing miners to maintain or even increase their profitability despite the reduced reward. Historically, Bitcoin’s hashrate has shown resilience after previous halvings, demonstrating the adaptability of the mining industry.

Bitcoin Mining Cost Structure and Halving Impact

The cost of Bitcoin mining comprises several key components: hardware costs (ASIC miners), electricity costs, maintenance and repair costs, cooling costs, and internet connectivity costs. The halving directly impacts the revenue side of the equation, squeezing profit margins. Miners with high electricity costs or outdated hardware will be disproportionately affected. Those who can secure cheaper energy contracts or upgrade to more efficient ASICs will have a competitive advantage. The cost of electricity, often the largest expense, is highly variable depending on location and energy source. For instance, miners located in regions with abundant hydroelectric power may experience lower operating costs compared to those reliant on fossil fuels.

Profitability Comparison: Before and After the Halving

Comparing profitability before and after the halving requires considering different mining hardware and energy costs. For example, a miner using older generation ASICs with high energy consumption might become unprofitable after the halving, while a miner using the latest, highly efficient ASICs might still maintain profitability even with the reduced block reward, provided the Bitcoin price remains stable or increases. This highlights the importance of technological innovation and strategic cost management in the mining industry. A simple calculation comparing revenue (block reward x Bitcoin price) against total operating costs will reveal the profitability for each scenario.

Hypothetical Scenario: Price Drop After Halving

Let’s consider a scenario where the Bitcoin price drops significantly after the 2025 halving. Assume the price falls by 50% from its pre-halving level. This would halve the revenue miners receive from each block, compounding the impact of the halving itself. Many miners, particularly those already operating on thin margins, would likely become unprofitable and be forced to shut down. This could lead to a substantial drop in the hashrate, potentially increasing the network’s vulnerability to attacks. The extent of this impact would depend on the duration and severity of the price drop, as well as the resilience and adaptability of the remaining miners. A similar situation was observed during the 2018 bear market, where many miners ceased operations due to the combination of a halving and a significant price decline.

Investor Sentiment and Market Predictions

The 2025 Bitcoin halving is a significant event anticipated to impact Bitcoin’s price, and consequently, investor sentiment is highly varied and complex. While historical precedent suggests a positive correlation between halvings and price increases, the current macroeconomic climate and regulatory uncertainty introduce significant variables that complicate predictions. Understanding the prevailing investor sentiment and various market predictions is crucial for navigating the potential opportunities and risks.

Investor Sentiment Regarding the 2025 Halving and its Anticipated Effects

Current investor sentiment is a mixture of optimism and caution. Many long-term holders remain bullish, believing the halving will reduce Bitcoin’s inflation rate and increase its scarcity, leading to price appreciation. However, concerns remain regarding broader economic conditions, including inflation, potential interest rate hikes, and geopolitical instability. These factors could dampen the positive impact of the halving, leading to a more muted price response or even a temporary decline. Some investors are taking a wait-and-see approach, preferring to observe the market’s reaction before committing significant capital. Others are actively hedging their positions to mitigate potential losses.

Market Predictions Surrounding Bitcoin’s Price Trajectory Post-Halving

Various analysts and firms have offered price predictions for Bitcoin following the 2025 halving. These predictions vary significantly, reflecting the inherent uncertainty in the cryptocurrency market. For example, some analysts, based on historical halving cycles and increasing institutional adoption, predict prices well above $100,000 per Bitcoin by the end of 2025 or shortly thereafter. Others, taking a more conservative stance, point to potential macroeconomic headwinds and regulatory challenges, forecasting a more moderate price increase or even a temporary price correction following the halving. Credible sources for these predictions include research reports from companies like CoinShares, Arcane Research, and individual analysts with established track records in the cryptocurrency space. It is important to note that these are predictions, not guarantees, and the actual price movement will depend on numerous interacting factors.

Investment Strategies in Anticipation of the 2025 Halving

Several investment strategies are being employed by investors in anticipation of the 2025 halving. Some investors are adopting a “dollar-cost averaging” (DCA) strategy, gradually accumulating Bitcoin over time, regardless of short-term price fluctuations. This mitigates the risk of investing a lump sum at a market peak. Others are employing a more active trading strategy, attempting to buy low and sell high, capitalizing on price volatility. Some are utilizing derivatives, such as futures contracts, to speculate on price movements and hedge against potential losses. Finally, a significant portion of long-term holders are employing a “HODL” strategy, holding onto their Bitcoin regardless of short-term price fluctuations, believing in its long-term value proposition.

Potential Risks and Opportunities for Investors Based on Various Price Scenarios

The post-halving price trajectory will present both risks and opportunities for investors. In a bullish scenario, where Bitcoin’s price significantly increases, investors holding Bitcoin will experience substantial gains. However, those who are short Bitcoin or have taken leveraged positions against it will face significant losses. Conversely, in a bearish scenario, where the price remains stagnant or declines, investors holding Bitcoin will experience losses, while those who have short positions will profit. A moderate price increase would represent a less dramatic scenario, offering moderate gains for holders and limiting losses for those with opposing positions. The potential for regulatory changes and unforeseen market events further complicates these scenarios and adds additional risk.

Comparison of Bullish and Bearish Market Predictions

| Prediction Type | Price Target (USD) | Rationale | Source/Analyst (Illustrative) |

|---|---|---|---|

| Bullish | $150,000+ | Historical halving cycles, increased institutional adoption, scarcity | Analyst X, Research Firm Y |

| Bullish | $100,000 – $150,000 | Halving effect combined with moderate economic growth | CoinShares Research Report |

| Bearish | $50,000 – $75,000 | Macroeconomic headwinds, regulatory uncertainty | Analyst Z, independent analysis |

| Bearish | Below $50,000 | Severe economic downturn, significant regulatory crackdown | Pessimistic market forecast, hypothetical scenario |

Long-Term Implications of the 2025 Halving: When Halving Bitcoin 2025

The 2025 Bitcoin halving, reducing the block reward for miners by half, presents a pivotal moment with far-reaching consequences for Bitcoin’s trajectory and the broader cryptocurrency landscape. Its impact will ripple across adoption rates, market valuation, technological advancements, and regulatory frameworks, potentially reshaping the financial ecosystem as we know it.

Bitcoin’s Adoption and Market Capitalization

The halving’s primary impact is expected to be a reduction in the supply of newly mined Bitcoin. This scarcity, coupled with sustained or increased demand, could lead to a significant increase in Bitcoin’s price. Historically, halvings have been followed by periods of price appreciation, although the magnitude varies. A substantial price increase would naturally inflate Bitcoin’s market capitalization, solidifying its position as a prominent asset class and potentially attracting further institutional investment. However, this outcome is not guaranteed and depends on various market factors, including macroeconomic conditions and investor sentiment. For instance, the 2016 halving led to a substantial price increase, while the 2020 halving saw a more gradual rise, highlighting the complexity of predicting market behavior.

Impact on the Broader Cryptocurrency Market and Traditional Finance

The 2025 halving’s effects extend beyond Bitcoin. A significant price surge in Bitcoin could trigger a positive sentiment ripple across the broader cryptocurrency market, potentially boosting the prices of other cryptocurrencies. Conversely, a negative reaction to the halving could have a dampening effect. Moreover, increased Bitcoin adoption and market capitalization could strengthen the cryptocurrency market’s overall relationship with traditional finance, potentially leading to greater integration and acceptance by institutional investors and regulatory bodies. This could involve increased participation of traditional financial institutions in cryptocurrency markets and the development of new financial products based on Bitcoin and other cryptocurrencies.

Influence on Bitcoin-Related Technologies

The anticipated price increase following the halving could incentivize further development and adoption of Bitcoin-related technologies. This includes advancements in scaling solutions (like the Lightning Network), improved security protocols, and the creation of new applications built on the Bitcoin blockchain. Increased demand for Bitcoin could also lead to innovation in areas such as Bitcoin mining hardware and energy-efficient mining techniques. The potential for increased transaction fees following the halving might also drive the adoption of layer-2 solutions to mitigate high transaction costs.

Potential Regulatory Changes

The halving’s impact could significantly influence regulatory responses globally. A substantial price increase and heightened adoption could prompt governments to either tighten or loosen regulations surrounding Bitcoin and cryptocurrencies. Increased regulatory clarity could foster greater institutional investment, while overly restrictive regulations could stifle innovation and adoption. The regulatory landscape will likely vary across jurisdictions, with some countries embracing a more progressive approach and others adopting a more cautious stance. The example of El Salvador’s adoption of Bitcoin as legal tender illustrates the potential for both significant positive and negative consequences, depending on the specifics of the regulatory framework.

Projected Growth of Bitcoin’s Market Cap

A visual representation of Bitcoin’s projected market cap post-halving would show three scenarios: a conservative scenario, projecting modest growth based on historical trends; a moderate scenario, assuming a significant price increase following the halving; and an optimistic scenario, reflecting a substantial price surge and widespread adoption. The conservative scenario would show a gradual upward trend, while the moderate scenario would depict a steeper incline, and the optimistic scenario would illustrate an exponential increase. The exact figures for each scenario would depend on various factors and would be represented by different curves on the graph, with the x-axis representing time and the y-axis representing market capitalization. The graph would highlight the uncertainty inherent in market predictions and emphasize the dependence on numerous factors.

Frequently Asked Questions (FAQs)

This section addresses common queries regarding the upcoming Bitcoin halving in 2025, providing clarity on its mechanics, potential market impact, and associated risks. Understanding these aspects is crucial for informed decision-making, especially for those considering investments in Bitcoin.

Bitcoin Halving Explained

A Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created (mined) by half. This occurs approximately every four years, or every 210,000 blocks mined. The halving mechanism is designed to control inflation and maintain the scarcity of Bitcoin over time. Essentially, it’s a built-in deflationary pressure on the Bitcoin supply.

The Halving’s Impact on Bitcoin’s Price

Historically, Bitcoin halving events have been followed by periods of significant price appreciation. The previous halvings in 2012, 2016, and 2020 all saw substantial price increases in the months and years following the event. However, it’s crucial to remember that correlation doesn’t equal causation. Other factors, such as increased adoption, regulatory changes, and macroeconomic conditions, also play a substantial role in Bitcoin’s price. The price surge after a halving might be attributed to anticipation and speculation rather than a direct cause-and-effect relationship. For example, the 2020 halving was followed by a significant bull run, but this was also influenced by broader factors like institutional investment and growing interest in decentralized finance.

Projected Date of the 2025 Halving

The 2025 Bitcoin halving is projected to occur around April 2025. However, this date is an estimate based on the average block time. Slight variations in block times can cause the actual date to shift by a few days or even weeks. The exact date will only be known once the 210,000th block after the previous halving is mined.

Potential Risks of Investing Before the Halving

Investing in Bitcoin before a halving carries inherent risks. The price may not necessarily increase as anticipated; in fact, it could potentially decline due to various market factors. Volatility is a significant risk, with prices potentially experiencing sharp fluctuations in either direction. Furthermore, the cryptocurrency market is highly susceptible to regulatory changes and unforeseen events, which could negatively impact Bitcoin’s price. Finally, there’s always the risk of losing your entire investment.

Strategies for Navigating Market Volatility

Managing risk around the 2025 halving requires a cautious approach. Diversification is key – don’t invest all your funds in Bitcoin. Dollar-cost averaging (DCA) can help mitigate risk by spreading investments over time rather than making a large lump-sum purchase. Thorough research and understanding of the market are essential. Only invest what you can afford to lose. Considering the historical price volatility of Bitcoin, setting realistic profit targets and stop-loss orders can help manage potential losses. Staying informed about market trends and news related to Bitcoin and the broader cryptocurrency market is crucial for informed decision-making.