Bitcoin Halving Explained

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created. This occurs approximately every four years, or every 210,000 blocks mined. Understanding this mechanism is crucial to grasping Bitcoin’s long-term economic model and its potential price fluctuations.

The halving directly impacts Bitcoin’s supply. By cutting the block reward in half, the rate of new Bitcoin entering circulation decreases significantly. This reduction in supply, coupled with generally consistent or increasing demand, is often theorized to lead to price appreciation. The basic principle is simple: if demand remains the same but supply shrinks, the price tends to rise to reflect the scarcity. This is a fundamental principle of economics.

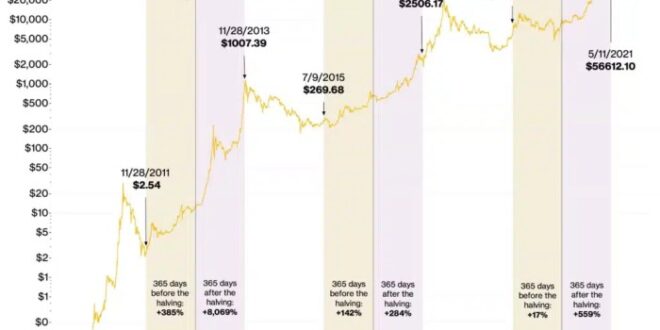

Historical Bitcoin Halvings and Price Movements

Bitcoin has undergone two previous halvings. The first halving occurred in November 2012, reducing the block reward from 50 BTC to 25 BTC. The price of Bitcoin subsequently rose significantly over the following year. The second halving took place in July 2016, cutting the block reward from 25 BTC to 12.5 BTC. Again, a substantial price increase followed, albeit with periods of volatility. While correlation doesn’t equal causation, these historical trends have fueled the anticipation surrounding future halvings. It’s important to remember that numerous other factors – technological advancements, regulatory changes, market sentiment – also influence Bitcoin’s price, making it impossible to predict the exact outcome with certainty.

Factors Influencing Bitcoin’s Price After a Halving

Several factors interact to shape Bitcoin’s price trajectory after a halving. Miner behavior is a key element. A reduced block reward means miners need a higher Bitcoin price to maintain profitability. This can create upward pressure on the price as miners are incentivized to hold onto their Bitcoin rather than sell it immediately. However, the level of miner capitulation (selling Bitcoin to cover costs) also influences the price. Furthermore, market sentiment plays a crucial role. Anticipation of the halving often leads to increased buying pressure in the months leading up to the event, while uncertainty can cause price corrections afterwards. Broader macroeconomic conditions and the overall state of the cryptocurrency market also have significant impacts. For instance, the 2018 bear market impacted Bitcoin’s price even after the 2016 halving.

Expected Changes in Bitcoin Mining Profitability

The next halving will reduce the block reward from 6.25 BTC to 3.125 BTC. This will inevitably affect mining profitability. Miners will need to adjust their operations to remain profitable, potentially by improving efficiency, consolidating mining operations, or seeking cheaper energy sources. Some less efficient miners might be forced to shut down, leading to a reduction in the overall hashrate (the computational power securing the Bitcoin network). This could, paradoxically, increase the security of the network in the long run by eliminating less-secure operations. However, the extent of this impact depends on the prevailing Bitcoin price and the cost of electricity, hardware, and other operational expenses. The price of Bitcoin would need to rise to compensate for the reduced block reward to ensure profitability for the average miner. A sustained lower price could lead to a period of reduced mining activity and consolidation within the industry.

Predicting the 2025 Halving Date: When In 2025 Is The Next Bitcoin Halving?

Predicting the exact date of the Bitcoin halving in 2025 requires understanding the core mechanics of Bitcoin’s blockchain. The halving is a programmed event, occurring approximately every four years, reducing the block reward miners receive for validating transactions. This reward reduction, built into the Bitcoin protocol, aims to control inflation and maintain the scarcity of Bitcoin.

The Bitcoin network generates new blocks roughly every ten minutes. Each block contains a limited number of transactions and is added to the blockchain after successful mining. Miners compete to solve complex cryptographic puzzles, and the first to solve the puzzle adds the block and receives the block reward. The difficulty of these puzzles automatically adjusts to maintain the approximate ten-minute block time, regardless of the overall mining power on the network. This dynamic difficulty adjustment is crucial for the consistent operation of the Bitcoin network.

Bitcoin Block Creation and Mining Difficulty

The halving is directly tied to the block height, not a specific calendar date. The Bitcoin protocol dictates that the block reward is halved after every 210,000 blocks are mined. Therefore, predicting the halving date depends on accurately estimating the average block time. While the target is ten minutes, variations occur due to fluctuations in mining hash rate and network congestion. Historically, the average block time has been close to the ten-minute target, but slight deviations can accumulate over time. For example, if the average block time is consistently slightly slower than ten minutes, the halving will be slightly delayed. Conversely, faster-than-average block times would bring it forward.

Potential Delays or Advancements in the Halving Schedule

While the halving is a deterministic event based on block height, unexpected events could theoretically influence the timing. A significant increase in mining hash rate could lead to faster block generation and an earlier-than-expected halving. Conversely, a substantial decrease in mining hash rate (e.g., due to a major regulatory crackdown or a significant drop in Bitcoin’s price) could cause a delay. However, the self-adjusting difficulty mechanism is designed to mitigate these effects, ensuring the long-term stability of the ten-minute block time target. The impact of these variations is usually minor and unlikely to significantly shift the halving date by more than a few days.

Timeline Illustrating Events Leading Up to and Following the 2025 Halving

A simplified timeline, based on a consistent ten-minute block time, could look like this:

When In 2025 Is The Next Bitcoin Halving? – The approximate date of the halving can be estimated by tracking the current block height and extrapolating based on the average block time. Many online resources provide real-time tracking of block heights and countdown timers to the next halving. However, it’s important to remember that these are estimates and subject to the slight variations mentioned earlier. For instance, a slight deviation of even a few seconds per block, compounded over hundreds of thousands of blocks, can result in a small shift in the final halving date. It is advisable to rely on multiple independent sources for the most accurate prediction.

The 2025 Bitcoin halving is projected to occur sometime in the Spring or early Summer of 2025. Precise predictions will become increasingly accurate as the halving approaches and more data on the average block time becomes available.

Market Impact and Price Predictions

The Bitcoin halving, a programmed event reducing the rate of newly mined Bitcoin, has historically shown a strong correlation with subsequent price increases. However, the extent of this impact varies, influenced by broader macroeconomic factors and market sentiment. Analyzing past halvings provides valuable insights into potential price movements surrounding the 2025 event.

Past Halving Market Reactions

The Bitcoin halving events of 2012, 2016, and 2020 each triggered distinct market responses. The 2012 halving saw a gradual price increase over the following year. The 2016 halving was followed by a significant bull run, culminating in the 2017 price peak. The 2020 halving, occurring amidst the COVID-19 pandemic, initially experienced a period of consolidation before a substantial price surge in late 2020 and early 2021. These varied responses highlight the complexity of predicting precise price movements, emphasizing the influence of external market forces.

Price Volatility Surrounding the 2025 Halving

Increased price volatility is anticipated in the lead-up to and following the 2025 halving. The anticipation of the event itself can create speculative buying pressure, driving prices upward. However, this increased speculation can also lead to sharp corrections if expectations are not met. Post-halving, the reduced supply of newly mined Bitcoin can contribute to price appreciation, but this effect is often not immediate and can be influenced by other market dynamics, such as regulatory changes or broader economic trends. The degree of volatility will depend on various factors including overall market sentiment, regulatory developments, and the adoption rate of Bitcoin.

Expert Opinions and Market Analyses

Numerous market analysts and experts offer varying predictions regarding Bitcoin’s price in 2025. Some analysts suggest a significant price surge following the halving, citing the reduced supply as a primary driver. Others are more cautious, highlighting the potential for market corrections and the impact of macroeconomic factors such as inflation and interest rates. For example, some analysts have predicted prices ranging from $100,000 to well over $1 million, while others remain significantly more conservative in their estimates. These divergent opinions underscore the inherent uncertainty in predicting future price movements. It’s crucial to remember that these are predictions, not guarantees.

Bitcoin Price Before and After Halvings

| Halving Date | Price Before (USD) (approx.) | Price After (USD) (approx.) (peak within 1-2 years) | Price Change (%) (approx.) |

|---|---|---|---|

| November 2012 | $13 | $1,147 | +8715% |

| July 2016 | $650 | $20,000 | +3000% |

| May 2020 | $8,700 | $69,000 | +700% |

Mining and Network Security

The Bitcoin halving, a programmed event reducing the block reward paid to miners, significantly impacts the profitability of Bitcoin mining and, consequently, the security and decentralization of the Bitcoin network. Understanding these impacts is crucial to assessing the long-term health and stability of the cryptocurrency.

The halving directly affects miners’ revenue. A reduced block reward means miners earn less Bitcoin for each block they successfully mine. This decrease in profitability incentivizes less efficient miners to exit the network, as their operational costs may exceed their earnings. Conversely, it encourages more efficient miners to improve their operations, adopt more energy-efficient hardware, and optimize their mining processes to remain profitable. This dynamic plays a crucial role in the overall health of the Bitcoin network.

Miner Profitability and Network Security Incentives

The halving creates a pressure point for miners. Those with high operational costs or less efficient equipment may find it economically unviable to continue mining. This can lead to a decrease in the overall hashrate—the computational power securing the network—in the short term. However, the long-term effect is often an increase in the efficiency and security of the network as less efficient miners are replaced by more efficient ones. This process contributes to a more robust and resilient network, as only the most efficient and cost-effective miners remain. The incentive structure remains: secure the network and earn Bitcoin, albeit a smaller amount per block. The higher the security, the more valuable Bitcoin becomes, potentially offsetting the reduced reward.

Impact on Decentralization, When In 2025 Is The Next Bitcoin Halving?

The halving’s effect on decentralization is complex and debated. While a decrease in the number of miners could theoretically lead to greater centralization, with fewer, larger mining pools dominating the network, the increased barrier to entry might also strengthen decentralization in a different way. Only the most sophisticated and well-funded operations will be able to profitably mine. This could prevent the emergence of many small, easily influenced mining pools, promoting instead a more stable and diverse landscape of larger, more resilient operations. The long-term outcome depends on various factors, including the technological advancements in mining hardware and the global distribution of mining operations.

Anticipated Changes in Hashrate

Historically, Bitcoin’s hashrate has experienced temporary dips following a halving, as less profitable miners leave the network. However, the hashrate usually recovers and surpasses previous levels within a relatively short period. This recovery is driven by several factors: the increasing price of Bitcoin (often seen post-halving), the adoption of more efficient mining hardware, and the entry of new, more efficient miners. Predicting the precise impact on the hashrate is difficult, but a temporary dip followed by a long-term increase is a common pattern.

Energy Consumption Before and After Previous Halvings

The energy consumption of Bitcoin mining is a frequently discussed topic. While it’s challenging to obtain precise figures for energy consumption across all mining operations, analyzing trends from past halvings provides some insights. Note that these figures are estimates and vary widely depending on the source and methodology.

| Halving | Approximate Hashrate Before (EH/s) | Approximate Hashrate After (EH/s) | Estimated Energy Consumption Trend |

|---|---|---|---|

| 2012 | ~1 | ~2 (approx. 1 year post-halving) | Increased, but efficiency improvements offset some growth. |

| 2016 | ~10 | ~30 (approx. 1 year post-halving) | Significant increase, but technological advancements in hardware efficiency played a role. |

| 2020 | ~100 | ~180 (approx. 1 year post-halving) | Continued increase, but debate persists regarding the overall sustainability. |

Investor Sentiment and Market Speculation

Investor sentiment and market speculation play a significant role in shaping Bitcoin’s price trajectory, particularly around halving events. The anticipation of reduced supply often fuels bullish sentiment, leading to price increases before the halving. Conversely, post-halving price movements are influenced by whether the increased scarcity translates into actual increased demand. The interplay between these factors creates a complex and dynamic market environment.

The influence of investor sentiment is multifaceted. Positive news, technological advancements, and regulatory clarity can bolster investor confidence, driving up demand and price. Conversely, negative news, regulatory uncertainty, or security breaches can trigger sell-offs and price declines. The period leading up to a halving often sees heightened volatility as investors weigh the potential for price appreciation against the inherent risks associated with Bitcoin’s price fluctuations.

Institutional Investor Influence

Institutional investors, including large hedge funds, asset management firms, and corporations, exert considerable influence on Bitcoin’s price. Their participation in the market brings significant capital inflows, potentially pushing prices higher. However, their actions can also amplify market volatility, as large-scale buying or selling can significantly impact price movements. For example, the entry of MicroStrategy and Tesla into the Bitcoin market caused significant price increases in 2020 and 2021. Conversely, institutional sell-offs can contribute to sharp price corrections. The involvement of institutional investors adds a layer of complexity to the already volatile nature of the cryptocurrency market.

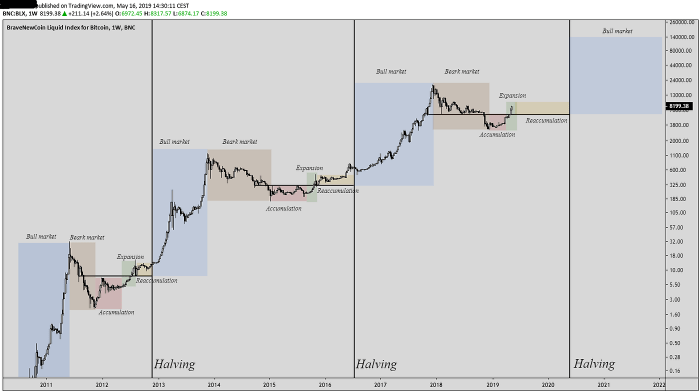

Historical Market Reactions to Halving Events

Historical data reveals distinct patterns in Bitcoin’s price behavior around halving events. Prior to the halving, anticipation often leads to a price increase, reflecting the expectation of future scarcity. The 2012 and 2016 halvings saw substantial price increases in the periods leading up to the event. However, the post-halving price movements have been more varied. While some halvings were followed by significant price appreciation, others were followed by periods of consolidation or even price corrections. The 2020 halving, for instance, was followed by a significant bull run, while the subsequent period saw substantial price volatility. These varied responses highlight the complexity of predicting price movements solely based on the halving event.

Visual Representation of Market Cycles Surrounding a Bitcoin Halving

Imagine a graph charting Bitcoin’s price over time. The x-axis represents time, and the y-axis represents price. The halving event is marked by a vertical line on the x-axis. Before the halving line, you see a gradual upward trend, representing the increasing anticipation and speculation. This upward trend may be somewhat volatile, with peaks and troughs reflecting market sentiment. The closer it gets to the halving, the steeper the incline may become, reaching a peak sometime before or shortly after the halving event itself. After the halving line, the graph’s trajectory is less predictable. It could continue upward, reflecting a sustained bull market fueled by the reduced supply. Alternatively, it might experience a period of consolidation, with the price fluctuating within a certain range before eventually resuming an upward trend. In some cases, a post-halving period might even show a temporary price decline before eventually recovering and moving higher. The overall shape would resemble a somewhat asymmetrical wave, with a sharper incline before the halving and a more gradual and less predictable movement afterward. The exact shape and magnitude of the wave vary with each halving event.

Frequently Asked Questions

This section addresses some common questions regarding the Bitcoin halving, its expected timing, and its potential impact on the cryptocurrency market. Understanding these aspects is crucial for anyone considering investing in or otherwise engaging with Bitcoin.

Bitcoin Halving Explained

A Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created. This occurs approximately every four years, or every 210,000 blocks mined. The halving cuts the reward miners receive for successfully adding a new block of transactions to the blockchain in half. For example, before the 2020 halving, miners received 12.5 BTC per block; after the halving, this reward dropped to 6.25 BTC. This controlled reduction in the supply of new Bitcoins is a fundamental aspect of Bitcoin’s design, intended to manage inflation and maintain its long-term value.

Bitcoin Halving Expected Date

The next Bitcoin halving is expected to occur in April 2025. The precise date depends on the time it takes to mine the 210,000 blocks, which can fluctuate slightly due to variations in mining difficulty. However, April 2025 remains the strongly projected timeframe based on current block generation rates.

Bitcoin Halving’s Effect on Price

Historically, Bitcoin halvings have been followed by periods of significant price appreciation. This is largely attributed to the reduced supply of newly mined Bitcoins, which can increase scarcity and potentially drive up demand. The 2012 and 2016 halvings, for instance, were followed by substantial price increases, though the timing and magnitude of these increases varied. However, it’s crucial to remember that numerous other factors influence Bitcoin’s price, and past performance is not indicative of future results. External economic conditions, regulatory changes, and overall market sentiment all play a role.

Risks Associated with Investing Around a Halving Event

Investing in Bitcoin around a halving event carries several risks. The price increase anticipated by many may not materialize, or the increase may be followed by a significant correction. The heightened market volatility leading up to and following a halving presents a considerable risk to investors. Furthermore, the cryptocurrency market is highly speculative, and the price of Bitcoin is susceptible to dramatic swings driven by news events, technological developments, and overall investor sentiment. Therefore, it’s essential to conduct thorough research, understand the risks involved, and only invest what you can afford to lose.