Bitcoin Halving 2025

The Bitcoin halving, a programmed event reducing the rate of new Bitcoin creation, is a significant occurrence in the cryptocurrency’s lifecycle. Understanding its mechanics and historical impact is crucial for predicting its potential influence on the market in 2025. This event fundamentally alters the rate of Bitcoin inflation, potentially impacting its scarcity and, consequently, its price.

Bitcoin Halving Mechanics and Historical Price Impact

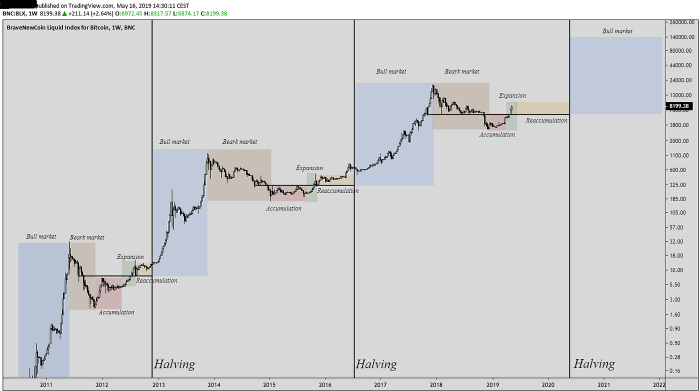

The Bitcoin halving mechanism is embedded within the Bitcoin protocol. Approximately every four years, the reward given to Bitcoin miners for verifying transactions and adding new blocks to the blockchain is cut in half. This reduces the supply of newly minted Bitcoin entering circulation. Historically, halvings have been followed by periods of significant price appreciation, though the timing and magnitude of these increases have varied. The reduced supply, coupled with sustained or increased demand, often leads to upward price pressure. However, it’s crucial to remember that other market factors, such as regulatory changes, macroeconomic conditions, and overall investor sentiment, also play a substantial role in price movements.

Timeline of Past Bitcoin Halvings and Price Movements

The Bitcoin network has undergone two previous halvings:

| Halving Date | Price Before Halving (USD) | Price Around Halving (USD) | Price 1 Year After Halving (USD) |

|---|---|---|---|

| November 28, 2012 | ~ $12 | ~ $12 | ~ $100 |

| July 9, 2016 | ~ $650 | ~ $650 | ~ $20,000 |

Note: These are approximate figures and reflect the price at various points around the halving date. The actual price fluctuations are much more complex and involve considerable volatility.

Predictions for the 2025 Bitcoin Halving

Several reputable cryptocurrency analysts have offered predictions regarding the 2025 halving’s price impact. These predictions vary widely, reflecting the inherent uncertainty in the cryptocurrency market. Some analysts suggest a significant price surge following the halving, potentially mirroring the patterns observed after previous halvings, while others are more cautious, emphasizing the influence of macroeconomic factors and regulatory landscapes. For instance, some analysts predict a price increase to levels significantly higher than the previous bull market peak, while others suggest a more moderate rise. The actual outcome will depend on a complex interplay of factors.

Comparison of Past Halving Cycles and Anticipated 2025 Halving

| Factor | 2012 Halving | 2016 Halving | Anticipated 2025 Halving |

|---|---|---|---|

| Market Maturity | Early stage, limited adoption | Growing adoption, increased institutional interest | Mature market, significant institutional and retail adoption |

| Regulatory Landscape | Minimal regulation | Increasing regulatory scrutiny | Likely more established and potentially stricter regulations |

| Macroeconomic Conditions | Relatively stable global economy | Period of economic uncertainty | Potentially uncertain global economic conditions |

| Price Before Halving | ~$12 | ~$650 | Currently ~$30,000 (this is a dynamic figure) |

Factors Influencing Bitcoin’s Price Post-Halving

The 2025 Bitcoin halving, reducing the rate of new Bitcoin creation, is a significant event expected to impact the cryptocurrency’s price. However, the actual price trajectory will depend on a complex interplay of factors extending beyond the halving itself. Predicting the future price with certainty is impossible, but analyzing potential influences provides a clearer understanding of the possibilities.

Macroeconomic Factors

Macroeconomic conditions significantly influence Bitcoin’s price, often acting as a counter-cyclical asset. High inflation, for example, can drive investors towards Bitcoin as a hedge against inflation, increasing demand and potentially pushing the price upwards. Conversely, rising interest rates, making traditional investments more attractive, could lead to capital flowing out of cryptocurrencies, potentially depressing Bitcoin’s price. The overall health of the global economy, including factors like recessionary fears or geopolitical instability, also plays a substantial role. For instance, the 2022 bear market was partly attributed to rising interest rates and concerns about global economic slowdown.

Bitcoin Adoption and Institutional Investment

Increased adoption of Bitcoin by individuals and businesses is a key driver of price appreciation. Widespread acceptance as a payment method, growing usage in decentralized finance (DeFi) applications, and the expansion of Bitcoin ATMs all contribute to increased demand. Simultaneously, institutional investment, particularly from large corporations and hedge funds, injects significant capital into the market, boosting liquidity and potentially driving prices higher. The growing acceptance of Bitcoin as a store of value by institutional investors is a positive sign for future price growth, mirroring the early adoption of gold by central banks.

Regulatory Changes and Governmental Policies

Governmental regulations and policies significantly impact Bitcoin’s price volatility. Favorable regulations, such as clear guidelines on taxation and licensing, can increase investor confidence and attract more capital. Conversely, stricter regulations, including outright bans or excessive restrictions, can create uncertainty and lead to price declines. The regulatory landscape varies considerably across different jurisdictions, and shifts in policy can cause significant market fluctuations. The ongoing debate surrounding Bitcoin regulation in various countries illustrates the impact of governmental actions on price volatility. For example, a sudden crackdown on crypto exchanges in a major market could trigger a sharp price drop.

Potential Bullish and Bearish Scenarios, When Is Bitcoin 2025 Halving

The interplay of the factors discussed above creates a range of potential scenarios for Bitcoin’s price after the 2025 halving.

- Bullish Scenario: Strong macroeconomic headwinds (high inflation, geopolitical uncertainty), coupled with continued institutional adoption and positive regulatory developments, could lead to a significant price surge post-halving. Increased demand driven by scarcity (due to the halving) could further amplify this effect, potentially exceeding previous bull market highs.

- Bearish Scenario: A strong global economy with low inflation, coupled with negative regulatory changes or a major security breach affecting the Bitcoin network, could create a bearish environment. Reduced investor interest and capital outflows could result in a prolonged period of price stagnation or even a significant decline.

Mining Difficulty and Hash Rate Adjustments

The Bitcoin halving, occurring approximately every four years, significantly impacts the mining landscape by reducing the block reward miners receive for successfully adding transactions to the blockchain. This, in turn, triggers adjustments in mining difficulty and hash rate, the collective computational power dedicated to securing the network. Understanding these adjustments is crucial for predicting Bitcoin’s price and network stability.

The halving directly influences mining profitability. A reduced block reward necessitates miners maintaining profitability by either increasing efficiency or reducing operational costs. This often leads to a temporary decrease in the hash rate as less profitable miners are forced to leave the network. However, the subsequent increase in Bitcoin’s price, typically anticipated after a halving, often counteracts this effect, attracting new miners and eventually leading to a surge in the hash rate. The Bitcoin network dynamically adjusts its mining difficulty to maintain a consistent block generation time of approximately 10 minutes. This self-regulating mechanism ensures the network’s security and stability despite fluctuations in the hash rate.

Historical Analysis of Difficulty and Hash Rate Adjustments

Historically, Bitcoin halvings have been followed by periods of hash rate decline, followed by substantial recovery and growth. The 2012 halving saw a temporary dip in hash rate, quickly followed by a significant increase. Similarly, the 2016 halving experienced a similar pattern, albeit with a more prolonged period of adjustment. The 2020 halving showed a more immediate recovery, potentially due to increased institutional investment and technological advancements in mining hardware. This historical data demonstrates the resilience of the Bitcoin network and its ability to adapt to changing economic conditions. Analyzing these past events provides valuable insight into potential scenarios following the 2025 halving.

Expected Changes in Mining Difficulty and Hash Rate for 2025

Leading up to the 2025 halving, we can expect a gradual increase in mining difficulty as miners compete for the existing block reward. This increase will likely plateau before the halving, as miners anticipate the reward reduction. Immediately following the halving, a temporary decrease in the hash rate is anticipated, as some less-efficient miners may become unprofitable. However, given the anticipation of the halving and the historical precedent of price increases following halvings, a strong rebound in the hash rate is likely. This rebound is expected to be driven by increased miner adoption of more efficient hardware and the attraction of new miners seeking to capitalize on the potential price appreciation. The speed and magnitude of this recovery will depend on various factors, including the actual price of Bitcoin post-halving, the availability and cost of mining hardware, and the overall regulatory landscape.

Relationship Between Halving, Difficulty, and Hash Rate

| Halving Event | Mining Difficulty Adjustment | Hash Rate Adjustment |

|---|---|---|

| 2012 | Gradual increase leading up to halving, followed by adjustments to maintain 10-minute block time. | Initial dip, followed by significant growth. |

| 2016 | Similar pattern to 2012, with adjustments to maintain block time. | Initial dip, followed by substantial growth, though recovery took longer than in 2012. |

| 2020 | Gradual increase leading up to halving, followed by adjustments. | Relatively quick recovery and continued growth post-halving. |

| 2025 (Projected) | Expected gradual increase before halving, followed by adjustments to maintain block time. | Anticipated initial dip, followed by strong recovery and growth, potentially faster than in 2020 due to technological advancements. |

The Bitcoin Halving’s Impact on Miners: When Is Bitcoin 2025 Halving

The Bitcoin halving, a pre-programmed event that reduces the block reward miners receive for verifying transactions, significantly impacts the profitability and operational viability of the Bitcoin mining industry. This event creates a period of adjustment and reshuffling within the ecosystem, favoring larger, more efficient operations while potentially squeezing out smaller players.

The reduced block reward directly affects miners’ revenue streams. With half the Bitcoin earned per block, miners face a critical challenge in maintaining profitability, especially considering the ongoing operational costs associated with electricity consumption, hardware maintenance, and facility upkeep. The profitability equation, which balances the revenue from block rewards and transaction fees against these operational costs, becomes severely strained post-halving.

Challenges Faced by Bitcoin Miners Post-Halving

Miners face a dual challenge after a halving: maintaining profitability in the face of reduced block rewards and managing escalating operational costs. Electricity prices, a major expense for miners, can fluctuate significantly, impacting profitability margins. Furthermore, the continuous need for hardware upgrades to maintain competitiveness within the mining landscape adds to the financial pressure. The cost of acquiring and maintaining specialized ASIC (Application-Specific Integrated Circuit) miners is substantial, and their lifespan is limited, requiring regular replacements. These pressures can force miners to make difficult choices regarding their operations.

Adaptation Strategies Employed by Bitcoin Miners

To mitigate the impact of reduced block rewards, miners typically adopt several strategies. These include optimizing their mining operations for maximum efficiency, negotiating lower electricity rates with providers, diversifying revenue streams by participating in other blockchain networks or offering mining-as-a-service, and consolidating operations to achieve economies of scale. Some miners might also explore more energy-efficient mining hardware or alternative energy sources to reduce operational costs. For example, a large-scale mining operation might invest in renewable energy sources like solar or hydro power to lower their electricity expenses and improve their environmental footprint, thereby enhancing long-term profitability.

Consolidation within the Bitcoin Mining Industry

The post-halving period often witnesses a significant wave of consolidation within the Bitcoin mining industry. Smaller, less efficient mining operations, struggling to maintain profitability under the reduced block reward, may be forced to shut down or merge with larger entities. This consolidation leads to a more centralized mining landscape, with fewer, larger players dominating the network’s hash rate. This can lead to discussions surrounding the potential implications for network decentralization. Historically, we have seen examples of smaller mining pools merging or being acquired by larger players after halving events.

Impact on Smaller vs. Larger Mining Operations

Smaller mining operations, typically characterized by limited capital reserves and less negotiating power with electricity providers, are disproportionately affected by the halving. Their smaller scale prevents them from achieving the same economies of scale as larger operations, making it more challenging to offset the reduced profitability. In contrast, larger, established miners, with greater financial resources and established infrastructure, are better positioned to weather the storm. They can leverage their economies of scale, negotiate better electricity rates, and absorb the short-term impact of reduced rewards. A realistic scenario could see many smaller miners forced to cease operations while larger companies acquire their assets, further consolidating the industry. This could potentially lead to a more concentrated hash rate distribution and raise concerns about network centralization.

Long-Term Implications of the 2025 Halving

The 2025 Bitcoin halving, reducing the rate of new Bitcoin creation by half, will have profound and lasting effects on the cryptocurrency’s scarcity, value proposition, and its potential role within the global financial system. Understanding these long-term implications requires considering various factors, including adoption rates, regulatory landscapes, and technological advancements. The interplay of these factors will ultimately shape Bitcoin’s future price trajectory and its overall influence on finance.

Bitcoin’s Scarcity and Store-of-Value Proposition

The halving mechanism directly contributes to Bitcoin’s deflationary nature, making it inherently scarce. This scarcity is a core component of its value proposition as a store of value, similar to precious metals like gold. As the supply of new Bitcoin diminishes, its value is expected to increase, especially if demand continues to grow. This increased scarcity could attract investors seeking inflation hedges and long-term value preservation, potentially driving further price appreciation. The limited supply, coupled with growing institutional adoption, positions Bitcoin to compete with traditional assets as a preferred store of value over the long term.

Bitcoin’s Role in the Global Financial System

The 2025 halving could accelerate Bitcoin’s integration into the global financial system. Increased scarcity and potential price appreciation may encourage broader institutional adoption, leading to greater liquidity and accessibility. This increased acceptance could lead to Bitcoin playing a more significant role in international payments, cross-border transactions, and potentially even as a reserve asset for central banks or large financial institutions. However, regulatory hurdles and geopolitical uncertainties remain significant factors influencing the pace and extent of this integration. For example, the success of El Salvador’s adoption of Bitcoin as legal tender, while facing challenges, demonstrates a possible path for other nations.

Potential Future Price Scenarios for Bitcoin

The future price of Bitcoin post-halving is highly speculative and depends on a confluence of factors. However, we can Artikel a few plausible scenarios:

When Is Bitcoin 2025 Halving – Several factors, including regulatory changes, technological innovations, and macroeconomic conditions, will significantly impact Bitcoin’s price. Below are three possible scenarios illustrating different potential outcomes.

- Scenario 1: Bullish Scenario – High Adoption and Positive Regulation: This scenario assumes widespread institutional adoption, positive regulatory developments in key markets (like the US and EU), and continued technological advancements improving Bitcoin’s scalability and usability. In this case, increased demand coupled with decreasing supply could lead to a substantial price increase, potentially exceeding previous all-time highs significantly. This could be fueled by further institutional investment, increased retail adoption, and the growing perception of Bitcoin as a safe-haven asset during times of economic uncertainty. For example, a similar level of institutional adoption seen in gold markets could significantly drive up Bitcoin’s price.

- Scenario 2: Neutral Scenario – Moderate Adoption and Mixed Regulation: This scenario assumes moderate institutional and retail adoption, with a mixed regulatory landscape characterized by both supportive and restrictive measures across different jurisdictions. Technological advancements continue, but at a slower pace than in the bullish scenario. This balanced scenario could result in a gradual price appreciation, potentially outpacing inflation but not reaching exponential growth. The price may consolidate around a certain range, reflecting the ongoing tension between bullish and bearish market forces. This scenario mirrors the gradual growth seen in some established technology companies after initial hype subsides.

- Scenario 3: Bearish Scenario – Low Adoption and Negative Regulation: This scenario considers a pessimistic outlook with limited institutional adoption, negative or overly restrictive regulations globally, and potential technological setbacks hindering Bitcoin’s scalability or security. Under these circumstances, the price could stagnate or even decline, potentially failing to significantly surpass previous all-time highs. This outcome would likely reflect a lack of confidence from investors and a failure to overcome regulatory and technological challenges. A significant security breach affecting the Bitcoin network could also contribute to a bearish outcome.

Frequently Asked Questions about the Bitcoin 2025 Halving

The Bitcoin halving is a significant event in the cryptocurrency’s lifecycle, impacting its price, mining dynamics, and long-term prospects. Understanding this event requires addressing several key questions and concerns. This section clarifies common queries regarding the 2025 halving.

Bitcoin Halving Explained

A Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created and added to the circulating supply. This occurs approximately every four years, or every 210,000 blocks mined. The halving cuts the block reward in half, meaning miners receive fewer Bitcoins for successfully verifying and adding transactions to the blockchain. This mechanism is crucial for maintaining Bitcoin’s deflationary nature and controlling its supply.

Expected Date of the 2025 Bitcoin Halving

While the exact date of the 2025 halving isn’t known with absolute certainty until the block is mined, predictions based on the current block generation rate point to a timeframe around the spring or summer of 2025. The precise date depends on the time it takes to mine the 210,000 blocks leading up to the halving event. Slight variations are possible due to fluctuations in mining difficulty.

Bitcoin Price Impact of a Halving

Historically, Bitcoin halvings have been followed by periods of significant price appreciation. This is largely attributed to the reduced supply of new Bitcoins entering the market, potentially increasing scarcity and driving demand. However, it’s crucial to remember that other market factors, such as regulatory changes, macroeconomic conditions, and investor sentiment, also heavily influence Bitcoin’s price. The 2012 and 2016 halvings were followed by substantial price increases, though the timing and magnitude varied.

Risks Associated with Bitcoin Investment Around a Halving

Investing in Bitcoin, especially around a halving, carries inherent risks. Price volatility is a defining characteristic of cryptocurrencies, and the period surrounding a halving can be particularly turbulent. The expectation of price increases can lead to speculative bubbles, while unforeseen events or changes in market sentiment can result in sharp price corrections. Furthermore, regulatory uncertainty and the overall volatility of the cryptocurrency market remain significant factors to consider. Investing only what one can afford to lose is paramount.

Halving’s Impact on Bitcoin Miners

The halving directly impacts Bitcoin miners’ profitability. A reduced block reward means miners earn less Bitcoin for each block they mine. This can lead to increased competition, forcing less efficient miners to shut down or consolidate operations. Miners may need to adjust their strategies, potentially focusing on more energy-efficient mining equipment or exploring alternative revenue streams to remain profitable. The 2012 and 2016 halvings resulted in some miners exiting the market, while others adapted and persevered.

Long-Term Implications of the 2025 Halving for Bitcoin

The long-term implications of the 2025 halving are subject to speculation, but the general consensus suggests a potential increase in Bitcoin’s scarcity and value. The reduced supply, coupled with continued adoption and increasing institutional investment, could contribute to a long-term upward trend in price. However, unforeseen technological advancements, competing cryptocurrencies, or changes in regulatory landscapes could impact this outlook. The halving is a significant event, but it is not the sole determinant of Bitcoin’s future price trajectory.

Determining the precise date for the Bitcoin 2025 halving requires careful consideration of the blockchain’s block time. To understand the specifics of this event, you should consult a reliable resource dedicated to tracking these crucial dates, such as the detailed analysis provided at Bitcoin Halving Time 2025. This resource offers valuable insights into when we can expect the Bitcoin 2025 halving to occur.

Determining the precise date for the Bitcoin 2025 halving requires careful consideration of the blockchain’s block time. To understand the specifics of this event, you should consult a reliable resource dedicated to tracking these crucial dates, such as the detailed analysis provided at Bitcoin Halving Time 2025. This resource offers valuable insights into when we can expect the Bitcoin 2025 halving to occur.

Determining the precise date for the Bitcoin 2025 halving requires careful consideration of the blockchain’s block time. To understand the specifics of this event, you should consult a reliable resource dedicated to tracking these crucial dates, such as the detailed analysis provided at Bitcoin Halving Time 2025. This resource offers valuable insights into when we can expect the Bitcoin 2025 halving to occur.

Determining the precise date for the Bitcoin 2025 halving requires careful consideration of the blockchain’s block time. To understand the specifics of this event, you should consult a reliable resource dedicated to tracking these crucial dates, such as the detailed analysis provided at Bitcoin Halving Time 2025. This resource offers valuable insights into when we can expect the Bitcoin 2025 halving to occur.

Determining the precise date for the Bitcoin 2025 halving requires careful consideration of the blockchain’s block time. To understand the specifics of this event, you should consult a reliable resource dedicated to tracking these crucial dates, such as the detailed analysis provided at Bitcoin Halving Time 2025. This resource offers valuable insights into when we can expect the Bitcoin 2025 halving to occur.

Determining the precise date for the Bitcoin 2025 halving requires careful consideration of the blockchain’s block time. To understand the specifics of this event, you should consult a reliable resource dedicated to tracking these crucial dates, such as the detailed analysis provided at Bitcoin Halving Time 2025. This resource offers valuable insights into when we can expect the Bitcoin 2025 halving to occur.