Bitcoin Cash Halving 2025

The Bitcoin Cash halving, anticipated for sometime in 2025, is a significant event that will reduce the rate at which new BCH is created. This process, programmed into the Bitcoin Cash protocol, is designed to control inflation and mimic the scarcity of traditional precious metals. Understanding the mechanics and historical impact of previous halvings is crucial for predicting its effects on price and network activity in 2025.

Bitcoin Cash Halving Mechanics

The Bitcoin Cash halving mechanism is straightforward. Every 210,000 blocks mined, the reward given to miners for successfully adding a new block to the blockchain is cut in half. This directly impacts the rate of new Bitcoin Cash entering circulation. For example, if the current block reward is 6.25 BCH, after the halving, it will be reduced to 3.125 BCH. This halving event is a predetermined, algorithmic function within the Bitcoin Cash protocol, not subject to change or external influence.

Historical Impact of Previous Bitcoin Cash Halvings

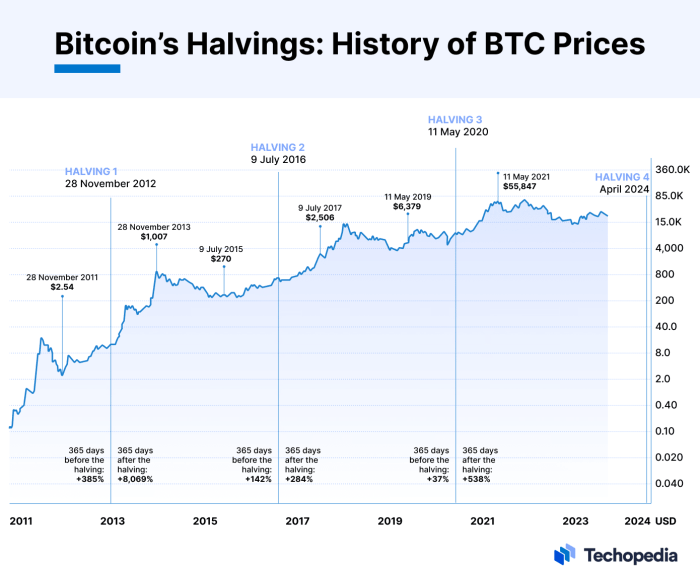

Bitcoin Cash has experienced previous halvings. These events have generally been followed by periods of increased price volatility. While not all halvings have resulted in immediate price surges, they often mark a significant turning point in the cryptocurrency’s market trajectory. The reduced supply of newly mined BCH can lead to increased scarcity and, consequently, potential upward pressure on price. Network activity, measured by metrics such as transaction volume and hash rate, often shows fluctuations around halving events, although the direction and magnitude of these changes vary. A detailed analysis of these historical fluctuations can help inform predictions for the 2025 halving.

Anticipated Effects of the 2025 Halving

Predicting the precise impact of the 2025 halving is challenging. However, based on past halvings and current market conditions, we can anticipate certain effects. The reduction in block reward will likely lead to increased competition among miners, potentially impacting the network’s security and stability. The effect on price is uncertain and will depend on various factors, including overall market sentiment, adoption rates, and regulatory developments. The 2025 halving might not lead to the same dramatic price increase seen in previous halvings due to factors like increased market maturity and greater regulatory scrutiny. It’s crucial to consider that macroeconomic conditions and broader cryptocurrency market trends will play a significant role in shaping the outcome.

Timeline of Significant Events Leading to the 2025 Halving

Several key events will shape the landscape leading up to the 2025 Bitcoin Cash halving. These include ongoing developments in the cryptocurrency regulatory environment, advancements in Bitcoin Cash’s underlying technology, and broader shifts in the global financial system. The months preceding the halving will likely see increased speculation and volatility in the BCH market. Analyzing these events in their context is crucial for informed decision-making.

Key Metrics: Before and After the 2025 Halving

| Metric | Before Halving | After Halving |

|---|---|---|

| Block Reward (BCH) | 6.25 | 3.125 |

| Circulating Supply (BCH) | [Approximate value prior to halving – requires real-time data] | [Approximate value post halving – requires real-time data and calculation based on mining rate] |

| Estimated Hashrate (TH/s) | [Approximate value prior to halving – requires real-time data] | [Prediction based on historical trends and miner behavior – requires expert analysis] |

Predicting Bitcoin Cash’s Price After the Halving

Predicting the price of Bitcoin Cash (BCH) after its 2025 halving is inherently speculative, as numerous interconnected factors influence cryptocurrency markets. While no one can definitively state the price, analyzing various contributing elements allows for a range of potential scenarios. This analysis explores key factors impacting BCH’s price and examines different prediction models.

Factors Influencing Bitcoin Cash’s Price Post-Halving

Several key factors will significantly influence Bitcoin Cash’s price following the halving. These factors interact in complex ways, making accurate prediction challenging. Market sentiment, adoption rates, regulatory landscapes, and macroeconomic conditions all play a crucial role. For example, a positive market sentiment driven by widespread adoption and favorable regulatory developments could propel BCH’s price upward. Conversely, negative sentiment coupled with restrictive regulations could lead to price stagnation or decline.

Price Prediction Models and Methodologies

Various models attempt to forecast cryptocurrency prices, each with its strengths and weaknesses. Simple moving averages (SMA) and exponential moving averages (EMA) are technical indicators often used to identify trends. However, these are primarily based on historical price data and may not accurately capture the impact of significant events like a halving. More sophisticated models incorporate additional factors, such as on-chain metrics (transaction volume, hash rate), social sentiment analysis, and even machine learning algorithms. These complex models aim to account for a broader range of influences but still carry inherent uncertainty. For example, a model incorporating on-chain data might predict a price surge based on increased transaction activity after the halving, but this prediction is contingent on maintaining positive market sentiment and continued adoption.

Impact of Macroeconomic Factors

Macroeconomic conditions significantly impact cryptocurrency markets. Factors such as inflation rates, interest rates, and overall economic growth influence investor sentiment and risk appetite. For example, during periods of high inflation, investors might seek refuge in cryptocurrencies like BCH as a hedge against inflation, potentially driving up demand and price. Conversely, rising interest rates can decrease the attractiveness of riskier assets like cryptocurrencies, leading to potential price declines. A global recession, for instance, could negatively affect the price of BCH, as investors may liquidate their holdings to cover losses in other investments.

Comparison of Analyst Predictions

Analysts and experts offer a range of Bitcoin Cash price predictions, reflecting differing methodologies and perspectives. Some analysts may be bullish, projecting substantial price increases based on the halving’s deflationary effect and increased scarcity. Others might adopt a more cautious approach, highlighting the volatility of the cryptocurrency market and the potential for unforeseen events to impact price. It’s crucial to consider the source’s credibility and underlying assumptions when evaluating these predictions. A comparison of these predictions might show a range from, say, $100 to $1000 per BCH, reflecting the significant uncertainty involved. However, relying solely on any single prediction is risky.

Potential Price Scenarios

The following chart illustrates potential price scenarios for Bitcoin Cash post-halving, based on different assumptions about market sentiment, adoption, and macroeconomic conditions. [Note: A visual representation of a chart would be inserted here. The chart would show three lines representing different scenarios: a bullish scenario (significant price increase), a neutral scenario (moderate price increase or stagnation), and a bearish scenario (price decrease). Each line would be labeled clearly, and the y-axis would represent the price of BCH, while the x-axis would represent time after the halving. Specific price points would not be given due to the inherent uncertainty, but the general trends would be visually represented.] This chart should not be interpreted as a definitive forecast but rather as a visualization of the range of possible outcomes.

The Impact on Bitcoin Cash Mining

The Bitcoin Cash halving in 2025 will significantly alter the mining landscape, primarily by reducing the block reward miners receive for successfully adding blocks to the blockchain. This reduction directly impacts the profitability of Bitcoin Cash mining operations, forcing miners to adapt and potentially reshaping the industry’s competitive dynamics. The extent of this impact will depend on several factors, including the price of Bitcoin Cash, the cost of electricity, and the efficiency of mining hardware.

The halving’s effect on mining profitability is straightforward: reduced block rewards mean less revenue for miners. This necessitates a careful evaluation of operational costs, particularly electricity expenses, which often constitute a substantial portion of mining expenditures. Profitability will hinge on the balance between the reduced reward and the prevailing Bitcoin Cash price. If the price remains relatively stable or increases, the impact might be less severe. Conversely, a price decline could render many mining operations unprofitable, leading to significant changes in the industry.

Changes in the Mining Landscape

The halving will likely trigger a consolidation within the Bitcoin Cash mining sector. Smaller mining operations, with higher operational costs per unit of hash power, may find themselves squeezed out of the market. This could lead to a shift in mining pool dominance, with larger, more efficient pools gaining market share. This concentration of hash power in fewer hands raises concerns about network centralization and security, although the degree of impact will depend on the resilience of the overall network. We might see increased competition among the remaining miners, potentially leading to innovative strategies for cost reduction and efficiency gains. The history of Bitcoin mining offers a parallel: previous halvings have resulted in periods of intense competition and consolidation, with the most efficient miners surviving.

Emergence of New Mining Hardware or Techniques

The drive to maintain profitability in the face of reduced rewards will likely spur innovation in mining hardware and techniques. Miners will seek more energy-efficient ASICs (Application-Specific Integrated Circuits) to lower operational costs. Advances in cooling technology and more efficient power supplies could also play a crucial role. Furthermore, research into alternative consensus mechanisms, while not directly impacting the halving’s immediate consequences, could gain momentum as miners explore ways to maintain profitability and potentially reduce reliance on Proof-of-Work. The development of more sophisticated mining software and strategies to optimize hash rate and energy consumption will also be key. For example, the transition from older, less efficient ASICs to newer, more powerful models following previous halvings demonstrates this pattern of technological advancement.

Implications for Smaller Miners

Smaller Bitcoin Cash miners face the most significant challenges following the halving. Their relatively higher operational costs per unit of hash power make them particularly vulnerable to the reduced block rewards. Many smaller operations may be forced to shut down or merge with larger entities to remain competitive. This could lead to a decline in the decentralization of the Bitcoin Cash network, as the hash rate becomes increasingly concentrated in the hands of fewer, larger players. This scenario echoes similar trends observed in other cryptocurrencies after halving events. The impact on smaller miners also raises concerns about the overall health and resilience of the network, as a more centralized mining landscape may be more susceptible to attacks or manipulation.

Potential Miner Responses to Reduced Rewards

Miners will likely adopt several strategies to adapt to the reduced rewards. These may include:

- Improving energy efficiency: Upgrading to more energy-efficient hardware and optimizing data center operations to reduce electricity consumption.

- Consolidation and mergers: Smaller mining operations may merge to achieve economies of scale and reduce operational costs per unit of hash power.

- Diversification: Miners may diversify their operations by mining other cryptocurrencies alongside Bitcoin Cash to mitigate the risk associated with reduced rewards.

- Seeking alternative revenue streams: Exploring options like offering mining services or participating in staking activities to supplement mining income.

- Advocating for higher transaction fees: Miners might advocate for increasing transaction fees on the Bitcoin Cash network to offset the reduced block rewards.

The success of these strategies will depend on various factors, including the Bitcoin Cash price, the level of competition, and the overall state of the cryptocurrency market.

Bitcoin Cash’s Long-Term Outlook After 2025: When Is Bitcoin Cash Halving 2025

Bitcoin Cash, since its inception, has aimed to be a faster, cheaper, and more scalable alternative to Bitcoin. Looking beyond the 2025 halving, its long-term success hinges on continued development, community support, and its ability to adapt to the evolving cryptocurrency landscape. Several factors will significantly influence its future trajectory.

Technological Advancements Planned for Bitcoin Cash

The Bitcoin Cash development team consistently works on improving the network’s efficiency and functionality. Future upgrades may focus on enhancing privacy features, improving transaction speed through advancements in scaling solutions, and potentially exploring integration with other blockchain technologies. Examples of potential improvements include the implementation of privacy-enhancing protocols like Confidential Transactions, or further development of sidechain technologies to offload transaction processing from the main chain, thereby increasing scalability and reducing transaction fees. These technological improvements are crucial for attracting and retaining users and developers.

Bitcoin Cash’s Role in the Broader Cryptocurrency Ecosystem

Bitcoin Cash aims to serve as a peer-to-peer electronic cash system, focusing on providing a readily usable and accessible cryptocurrency for everyday transactions. Its potential role within the broader ecosystem depends on its success in achieving this goal. If Bitcoin Cash gains widespread adoption for everyday payments, it could become a significant competitor to existing payment systems and other cryptocurrencies with similar goals. Conversely, if it fails to gain significant traction, it may remain a niche cryptocurrency with a dedicated but relatively small user base. Its success hinges on its ability to compete effectively with other cryptocurrencies in terms of speed, cost, and usability.

Bitcoin Cash’s Advantages and Disadvantages Compared to Other Cryptocurrencies

Compared to Bitcoin, Bitcoin Cash boasts faster transaction speeds and lower fees. However, Bitcoin benefits from a significantly larger market capitalization and brand recognition. Compared to other altcoins focusing on speed and scalability, like Litecoin or Solana, Bitcoin Cash’s advantages might lie in its established history and relatively larger community. However, its disadvantages include potentially less innovation in terms of smart contract functionality compared to Ethereum or newer platforms. A key advantage of Bitcoin Cash is its relative simplicity; it focuses primarily on its core functionality as a payment system, avoiding the complexities of some other cryptocurrencies. A disadvantage, however, could be the perceived lack of significant development in other areas beyond its primary function.

A Potential Future Scenario for Bitcoin Cash in 5 Years

In a positive scenario, five years from now, Bitcoin Cash could be a widely adopted payment system in specific regions or industries, particularly those where fast and low-cost transactions are prioritized. Imagine a scenario where small businesses in developing countries utilize Bitcoin Cash for everyday transactions due to its accessibility and low fees. This would lead to increased adoption and a higher market capitalization. Conversely, in a less optimistic scenario, Bitcoin Cash might struggle to compete with newer, faster, and more innovative cryptocurrencies, resulting in a relatively stagnant market share and price. This scenario would be analogous to other cryptocurrencies that, despite early promise, have failed to maintain relevance due to technological limitations or a lack of community engagement. The reality will likely fall somewhere between these two extremes, depending on technological advancements, market conditions, and overall adoption rates.

Frequently Asked Questions (FAQ)

This section addresses common queries regarding the upcoming Bitcoin Cash halving event in 2025. Understanding these key aspects can help you navigate the potential market shifts and make informed decisions.

Bitcoin Cash Halving Explained

A Bitcoin Cash halving is a programmed event that reduces the rate at which new Bitcoin Cash (BCH) is created. This happens approximately every four years, when the block reward – the amount of BCH miners receive for verifying transactions – is cut in half. This mechanism is designed to control inflation and maintain the scarcity of BCH over time, similar to the halving mechanism in Bitcoin. For example, if the block reward is currently 12.5 BCH, after the halving it will become 6.25 BCH.

Bitcoin Cash Halving Date in 2025

The estimated date for the Bitcoin Cash halving in 2025 is around the middle of the year. The precise date will depend on the exact block height at which the halving is triggered, and minor variations are possible due to network conditions. However, the general timeframe remains consistent with the four-year cycle established by the Bitcoin Cash protocol. Predicting the precise day requires monitoring the blockchain’s block generation rate leading up to the event.

The Halving’s Effect on Bitcoin Cash Price, When Is Bitcoin Cash Halving 2025

Historically, cryptocurrency halving events have often been associated with price increases in the preceding months and following the event itself. The reduced supply of newly mined BCH, combined with potentially sustained or increased demand, can create upward pressure on the price. However, it’s crucial to remember that price movements are influenced by numerous factors beyond the halving, including market sentiment, regulatory developments, and overall economic conditions. The price impact can be significant, but the extent is highly unpredictable. For example, the Bitcoin halving in 2020 led to a substantial price increase, but the subsequent market behavior was complex and influenced by various other factors.

Risks of Investing in Bitcoin Cash Around the Halving

Investing in cryptocurrencies like Bitcoin Cash carries significant risk. The market is highly volatile, meaning prices can fluctuate dramatically in short periods. Investing before a halving involves the risk of a price correction or a failure to see the expected price increase. Similarly, investing after the halving carries the risk that the anticipated price surge might not materialize, or that a subsequent market downturn could occur. Thorough research, risk assessment, and diversification are essential for any cryptocurrency investment strategy. It’s important to only invest what you can afford to lose.

Reliable Information Sources for Bitcoin Cash Halving

For reliable information about the Bitcoin Cash halving, consult official sources such as the Bitcoin Cash website, reputable cryptocurrency news outlets, and blockchain explorers that track BCH network data. Always be critical of information found on less established websites or social media platforms, as misinformation is prevalent in the cryptocurrency space. Examining data from multiple reputable sources helps mitigate the risk of relying on biased or inaccurate information. Consider exploring the technical documentation of the Bitcoin Cash protocol for a deeper understanding of the halving mechanism itself.

Illustrative Examples

Understanding the Bitcoin Cash halving’s impact requires concrete examples. The following scenarios illustrate how the halving affects block rewards and mining profitability. These are hypothetical examples, but they demonstrate the fundamental principles at play.

Halving’s Impact on Block Reward

The Bitcoin Cash halving reduces the Bitcoin Cash rewarded to miners for successfully adding a block to the blockchain. Before the halving, let’s assume a hypothetical block reward of 12.5 BCH. After the halving, this reward is cut in half to 6.25 BCH. This reduction directly impacts the revenue miners receive for their computational efforts.

| Event | Block Reward (BCH) |

|---|---|

| Before Halving | 12.5 |

| After Halving | 6.25 |

This simple table clearly shows the immediate effect of the halving on the miner’s income per block. The halving event is a programmed, predictable reduction, built into the Bitcoin Cash protocol.

Halving’s Impact on Mining Profitability

Mining profitability depends on several factors beyond the block reward, including the price of Bitcoin Cash (BCH), electricity costs, and the hash rate (the computational power dedicated to mining). Let’s consider three hypothetical mining operations with varying levels of efficiency.

| Mining Operation | Hashrate (TH/s) | Electricity Cost ($/kWh) | Monthly Revenue (Before Halving) | Monthly Revenue (After Halving) | Profitability Change (%) |

|---|---|---|---|---|---|

| Small-Scale Miner | 10 | 0.15 | $5000 | $2500 | -50% |

| Medium-Scale Miner | 1000 | 0.10 | $500,000 | $250,000 | -50% |

| Large-Scale Miner | 100,000 | 0.08 | $50,000,000 | $25,000,000 | -50% |

This table illustrates that while the percentage change in profitability is the same (a 50% reduction) across all operations, the absolute impact varies greatly depending on the scale of the operation. Large-scale miners, while experiencing the same percentage drop, face a significantly larger monetary loss. This highlights the importance of economies of scale in mining and the potential for smaller operations to be disproportionately affected. Note that these figures are purely hypothetical and do not reflect any real-world mining operation. Actual profitability is influenced by many more variables.

When Is Bitcoin Cash Halving 2025 – Determining the exact date for the Bitcoin Cash halving in 2025 requires careful consideration of its block reward schedule. Understanding the timing of Bitcoin halvings is crucial for making accurate predictions, and a helpful resource for this is the comprehensive guide on Bitcoin Halving 2025 Time. This information, while focused on Bitcoin, provides a framework for understanding the halving process which can then be applied to analyzing the Bitcoin Cash halving schedule for 2025.

Determining the exact date for the Bitcoin Cash halving in 2025 requires careful consideration of its block reward schedule. However, to understand the timing of such events, it’s helpful to compare it to Bitcoin’s halving schedule; you can find the projected date for the Bitcoin halving on this helpful resource: What Date Is The Bitcoin Halving 2025.

This comparison can offer insights into potential timing for the Bitcoin Cash halving, though the specific date remains dependent on its own network parameters.

Determining the exact date for the Bitcoin Cash halving in 2025 requires careful consideration of the blockchain’s schedule. However, to understand the timing precision involved, it’s helpful to also consider the Bitcoin halving; you can find details on the precise time at What Time Is Bitcoin Halving 2025. This helps contextualize the complexities involved in predicting the Bitcoin Cash halving date, as both events are related but distinct occurrences on separate blockchains.

Ultimately, pinpointing the Bitcoin Cash halving date necessitates close monitoring of the network’s block generation rate.

Determining the precise date for the Bitcoin Cash halving in 2025 requires careful consideration of its block reward schedule. To better understand the mechanics behind these halvings and potentially project future Bitcoin halvings, you might find the Bitcoin Halving 2025 Calculator helpful. This tool can provide insights that may aid in indirectly estimating the timing of future Bitcoin Cash halvings, although it won’t give a direct answer regarding the Bitcoin Cash event itself.

Determining the Bitcoin Cash halving in 2025 requires careful consideration of its independent schedule. This is unlike Bitcoin’s halving, which you can research further by checking this helpful resource on When Was The Bitcoin Halving In 2025. Understanding Bitcoin’s halving timeline helps contextualize the separate Bitcoin Cash event, allowing for a clearer comparison between the two cryptocurrencies’ reward schedules.

Therefore, focusing solely on Bitcoin Cash’s internal mechanisms is key to accurately predicting its 2025 halving date.

Determining the precise date for the Bitcoin Cash halving in 2025 requires careful consideration of its block reward schedule. Understanding the mechanics of halving events is crucial, and a helpful resource for understanding this process is the comprehensive guide on Halving Bitcoin 2025. This knowledge helps contextualize the Bitcoin Cash halving, allowing for a more informed prediction of its timing within 2025.