Bitcoin Halving

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created. This occurs approximately every four years, or every 210,000 blocks mined, and is a crucial mechanism designed to control inflation and maintain the scarcity of Bitcoin.

Bitcoin Halving Mechanism

The Bitcoin halving mechanism is hardcoded into the Bitcoin blockchain. It dictates that the reward given to Bitcoin miners for successfully adding a block of transactions to the blockchain is cut in half. Initially, the reward was 50 BTC per block. After the first halving, it became 25 BTC, then 12.5 BTC, and currently stands at 6.25 BTC. This reduction in block reward directly impacts the supply of new Bitcoins entering circulation, making them inherently more scarce over time. The halving events are predictable and transparent, adding to the system’s reliability and predictability.

Historical Halvings and Price Effects

Three Bitcoin halvings have already occurred: in November 2012, July 2016, and May 2020. Following each halving, the price of Bitcoin has experienced a significant increase, although the timing and magnitude of these price increases have varied. The 2012 halving saw a gradual price increase over the following year. The 2016 halving was followed by a more pronounced price surge in 2017. The 2020 halving led to a price rally that continued into late 2021. It’s important to note that while a price increase often follows a halving, other market factors like adoption rate, regulatory changes, and overall economic conditions also play a significant role in Bitcoin’s price movements. Correlation does not equal causation. Therefore, while historical data suggests a positive correlation between halvings and price increases, it does not guarantee a similar outcome in the future.

Economic Principles Underlying the Halving

The Bitcoin halving is fundamentally rooted in the principles of supply and demand. By reducing the rate of new Bitcoin creation, the halving decreases the supply of Bitcoin entering the market. This reduced supply, combined with relatively stable or increasing demand, can lead to an increase in price, assuming all other market conditions remain constant. This is a basic economic principle: scarcity drives value. The predictable nature of the halving further contributes to this effect, as it allows market participants to anticipate the potential impact on supply and adjust their strategies accordingly. This predictability is a key differentiating factor compared to traditional fiat currencies, where the supply can be manipulated by central banks. The halving is a crucial component in Bitcoin’s design, aiming to create a deflationary monetary policy and maintain the long-term value of the cryptocurrency.

Market Sentiment and the 2025 Halving

The 2025 Bitcoin halving, a significant event reducing the rate of new Bitcoin creation, is already influencing market sentiment. Understanding this sentiment is crucial for predicting price movements and overall market behavior leading up to and following the event. Various factors contribute to the overall market mood, and analyzing these factors allows for a more nuanced perspective on potential outcomes.

Market sentiment surrounding the 2025 halving is a complex interplay of several key indicators. These indicators, ranging from on-chain metrics to social media activity, offer insights into the collective belief and expectations of the market participants. News events and regulatory actions further shape this sentiment, sometimes dramatically altering predictions.

Key Indicators of Market Sentiment

Several key indicators provide insights into market sentiment. On-chain data, such as the number of active addresses and transaction volume, can reveal the level of participation and engagement in the Bitcoin network. Increased activity often suggests growing interest and potential price increases. Conversely, declining metrics may indicate waning interest and potential downward pressure. Social media sentiment analysis, tracking the tone of discussions on platforms like Twitter and Reddit, offers another perspective. A predominantly positive sentiment can indicate bullish expectations, while a negative sentiment might signal bearishness. Finally, the volume of Bitcoin held on exchanges provides an indication of potential selling pressure. High exchange balances might suggest a willingness to sell, while lower balances might indicate a holding strategy. The interplay of these indicators paints a more comprehensive picture of prevailing market sentiment.

Influence of News Events and Regulatory Changes

News events and regulatory changes significantly influence market expectations surrounding the halving. Positive news, such as institutional adoption or favorable regulatory developments, can boost investor confidence and drive up prices. For example, announcements from large companies about Bitcoin investments or the approval of Bitcoin ETFs in major markets can significantly shift market sentiment. Conversely, negative news, such as government crackdowns or security breaches, can create uncertainty and lead to price drops. The regulatory landscape is particularly important; strict regulations can dampen investor enthusiasm, while supportive policies can foster growth. The 2021 bull run, for instance, coincided with increasing institutional interest and positive media coverage, while the subsequent downturn partially stemmed from regulatory uncertainty and market corrections.

Investor Behavior and Speculation, When Is Bitcoin Halving 2025 Prediction

Investor behavior and speculation play a crucial role in shaping price predictions for the 2025 halving. Historically, the halving events have been followed by periods of price appreciation, leading many investors to anticipate a similar pattern in 2025. This anticipation fuels speculative buying, potentially driving prices higher even before the halving occurs. However, this speculative behavior can also lead to significant price volatility, with potential for sharp corrections if expectations are not met. The level of investor confidence and risk appetite are crucial factors; periods of high risk aversion can lead to a more cautious approach, potentially dampening the price impact of the halving. Conversely, a risk-on environment might amplify the price increase. The interplay of long-term investors (“hodlers”) and short-term traders further influences price dynamics. The actions of “whales” – individuals or entities holding large amounts of Bitcoin – can also significantly impact market sentiment and price movements.

Technological Factors and the Halving

The Bitcoin halving, a pre-programmed event reducing the rate of new Bitcoin creation, doesn’t exist in a vacuum. Its impact is significantly shaped by concurrent technological advancements within the Bitcoin ecosystem. These advancements, encompassing scaling solutions and mining infrastructure improvements, can either amplify or mitigate the halving’s effects on price and network stability.

Technological advancements play a crucial role in shaping Bitcoin’s price trajectory, influencing both supply and demand. Increased adoption driven by improved usability and transaction speeds can boost demand, potentially offsetting the deflationary pressure from the halving. Conversely, significant technological setbacks or security vulnerabilities could negatively impact market sentiment and price. The interplay between technological progress and the halving’s inherent supply shock creates a complex dynamic that is difficult to predict with certainty.

Scaling Solutions and Network Upgrades

The Bitcoin network’s capacity to handle transactions is a critical factor influencing its usability and adoption. Scaling solutions like the Lightning Network, which allows for faster and cheaper off-chain transactions, aim to alleviate congestion and improve the overall user experience. Successful implementation and widespread adoption of such solutions could lead to increased demand for Bitcoin, potentially mitigating the price dip often associated with the post-halving period. For example, if the Lightning Network becomes significantly more user-friendly and widely adopted before the 2025 halving, it could stimulate a surge in demand that counteracts the reduced supply. Conversely, failure to achieve significant scaling improvements could limit Bitcoin’s growth potential and dampen the positive effects of the halving.

Mining Difficulty Adjustments

The Bitcoin network adjusts its mining difficulty every 2016 blocks (approximately every two weeks) to maintain a consistent block generation time of around 10 minutes. This adjustment mechanism is crucial in the post-halving landscape. Following a halving, the reward for mining a block is reduced, leading to potentially lower profitability for miners. If the difficulty doesn’t adjust appropriately, it could result in a significant drop in hash rate (the computational power securing the network), potentially making the network more vulnerable. Conversely, a swift and accurate difficulty adjustment could help stabilize the mining ecosystem and prevent a dramatic downturn in the post-halving period. Historically, the difficulty adjustment mechanism has proven robust, successfully adapting to various changes in the mining landscape. However, the 2025 halving will be different because of the increased influence of institutional investors and the potential for significant technological shifts. The speed and efficiency of these adjustments will therefore be crucial in determining the stability of the network and its overall health.

Macroeconomic Factors and Bitcoin: When Is Bitcoin Halving 2025 Prediction

Bitcoin’s price, while influenced by its own internal dynamics, is significantly impacted by broader macroeconomic trends. Understanding these global economic forces is crucial for predicting Bitcoin’s future price movements, especially in the context of the 2025 halving. The interplay between global economic conditions, investor sentiment, and Bitcoin’s inherent characteristics creates a complex but analyzable system.

Global economic conditions exert a considerable influence on Bitcoin’s price. Periods of economic uncertainty, such as recessions or geopolitical instability, often see investors seeking safe haven assets, which can drive demand for Bitcoin as a store of value, potentially pushing its price upwards. Conversely, periods of robust economic growth might see investors shifting funds into more traditional assets, potentially leading to a decrease in Bitcoin’s price. The strength of the US dollar, a global reserve currency, also plays a role; a strengthening dollar can sometimes negatively impact the price of Bitcoin, as many investors transact in dollars.

Inflation’s Impact on Bitcoin Value

High inflation erodes the purchasing power of fiat currencies. This can drive investors towards alternative assets, like Bitcoin, perceived as a hedge against inflation. The limited supply of Bitcoin (21 million coins) is a key argument in its favor as an inflation hedge. For example, during periods of high inflation in various countries, such as Argentina or Venezuela, Bitcoin adoption has seen a surge, reflecting a flight from devaluing local currencies. However, the correlation isn’t always direct; Bitcoin’s price can be influenced by numerous other factors, and its behavior during inflationary periods is subject to ongoing debate and research.

Interest Rates and Bitcoin’s Price

Interest rate hikes by central banks, often implemented to combat inflation, can impact Bitcoin’s price in several ways. Higher interest rates generally increase the attractiveness of traditional savings and investments, potentially drawing funds away from riskier assets like Bitcoin. This can lead to a decrease in Bitcoin’s price. Conversely, extremely low or negative interest rates in some countries can make Bitcoin a more attractive investment, as it offers a potential return that surpasses traditional low-yield instruments. The 2022 interest rate hikes by the Federal Reserve, for instance, coincided with a period of decreased Bitcoin value, although other factors were undoubtedly at play.

Geopolitical Events and Investor Sentiment

Geopolitical events, such as wars, political instability, or major international crises, can significantly impact investor sentiment and, consequently, Bitcoin’s price. Uncertainty and fear often drive investors towards perceived safe haven assets, including Bitcoin, resulting in increased demand and potentially higher prices. Conversely, periods of relative geopolitical calm might lead to a decrease in demand as investors shift their focus to other assets. The Russian invasion of Ukraine in 2022, for example, led to increased volatility in the cryptocurrency market, as investors reacted to the uncertainty and sought refuge in various assets, including Bitcoin.

Risks and Uncertainties of Predictions

Predicting Bitcoin’s price, especially around a halving event, is inherently fraught with uncertainty. Numerous factors influence the cryptocurrency’s value, making precise forecasting extremely difficult, if not impossible. While historical data and analysis can offer insights, they cannot account for the unpredictable nature of the market or unforeseen external events.

The inherent volatility of Bitcoin makes any prediction inherently risky. Forecasts often rely on assumptions about future market sentiment, technological advancements, and macroeconomic conditions, all of which are subject to change. A slight shift in any of these factors can significantly impact the price, potentially rendering even the most sophisticated predictions inaccurate. For example, unexpected regulatory changes, major security breaches, or significant shifts in global economic conditions could dramatically alter Bitcoin’s trajectory.

Limitations of Predictive Models

Predictive models, while helpful for understanding potential trends, are not crystal balls. They rely on historical data and algorithms, which assume past performance is indicative of future results – a flawed assumption in the highly dynamic cryptocurrency market. These models often fail to account for “black swan” events – highly improbable but potentially impactful occurrences that can dramatically shift market sentiment and prices. The 2020 COVID-19 pandemic, for instance, serves as a prime example of a black swan event that drastically impacted global markets, including Bitcoin’s price. Models that didn’t account for such a large-scale, unforeseen event would have produced inaccurate predictions.

Impact of Unexpected Events

Unexpected events, both positive and negative, can significantly impact Bitcoin’s price. A sudden surge in institutional adoption, for example, could drive prices higher, while a major security flaw or regulatory crackdown could lead to a sharp decline. Geopolitical instability, shifts in investor sentiment, and technological breakthroughs all hold the potential to drastically alter the predicted price trajectory. Consider the 2021 bull run, fueled by increased institutional investment and mainstream media attention, or the subsequent “crypto winter” characterized by a significant market correction. These events highlight the unpredictable nature of the market and the limitations of any predictive model.

Importance of Risk Management

Given the inherent risks and uncertainties, robust risk management is crucial for anyone investing in Bitcoin. This involves diversifying investments across different asset classes, avoiding over-leveraging, and only investing capital one can afford to lose. Thorough due diligence, understanding personal risk tolerance, and regularly reviewing one’s investment strategy are all vital aspects of responsible Bitcoin investment. For example, an investor might allocate only a small percentage of their overall portfolio to Bitcoin to mitigate potential losses in case of a significant market downturn. Furthermore, understanding technical analysis and market trends can help inform investment decisions, but should not be considered a guarantee of success.

Alternative Perspectives on the 2025 Halving

The impact of the 2025 Bitcoin halving is a subject of considerable debate within the cryptocurrency community. While many anticipate a bullish price surge following the event, a significant number hold more cautious or even bearish views. Understanding these diverse perspectives is crucial for navigating the complexities of Bitcoin’s price prediction. This section will explore contrasting opinions and their underlying rationales, offering a balanced view of the potential outcomes.

Predicting the precise market reaction to a halving is inherently challenging, influenced by a multitude of interconnected factors. While the reduced supply of newly mined Bitcoin is a key driver, broader macroeconomic conditions, regulatory developments, and overall market sentiment play equally important, if not more significant roles. Analyzing these contrasting viewpoints provides a more nuanced understanding of the potential scenarios.

Contrasting Bullish and Bearish Predictions

The cryptocurrency community is divided on the 2025 halving’s impact. Bullish predictions often center on the scarcity of Bitcoin and its potential to drive increased demand. Conversely, bearish predictions highlight potential macroeconomic headwinds or a market already saturated with Bitcoin.

| Prediction | Source/Analyst | Reasoning | Example/Real-life Case |

|---|---|---|---|

| Significant price increase post-halving | PlanB (Stock-to-Flow model) | Historically, Bitcoin’s price has increased following previous halvings due to reduced supply. The Stock-to-Flow model suggests a strong correlation between Bitcoin’s price and its scarcity. | The price surge following the 2016 and 2020 halvings serves as evidence supporting this view, although other factors also contributed. |

| Moderate price increase or sideways movement | Bloomberg analysts | Macroeconomic factors, such as inflation and interest rates, could outweigh the impact of the halving. Increased regulatory scrutiny and market saturation could also limit price appreciation. | The lack of significant price increase after the 2020 halving for an extended period can be partially attributed to broader market downturns and regulatory uncertainties. |

| Price stagnation or even a decline | Some independent analysts | Concerns around Bitcoin’s energy consumption, environmental impact, and the emergence of competing cryptocurrencies could dampen investor enthusiasm. A prolonged bear market could also precede the halving, negating its bullish effect. | The prolonged bear market from 2018-2020, which preceded the 2020 halving, highlights the influence of broader market sentiment and macroeconomic factors. |

| Significant price increase but delayed impact | Various crypto commentators | The impact of the halving may not be immediately apparent, with price increases potentially occurring several months or even a year after the event. This is due to the time it takes for market dynamics to adjust to the reduced supply. | While past halvings have shown price increases, the timing of these increases has varied, suggesting that the effect isn’t instantaneous. |

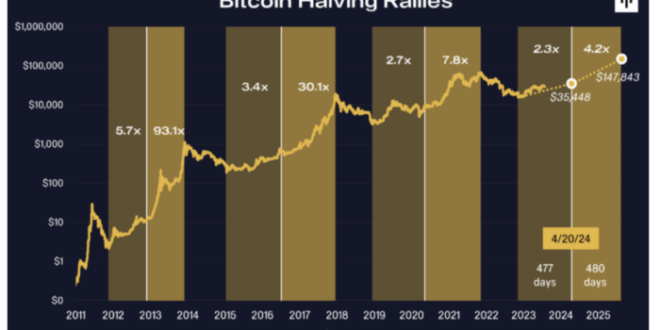

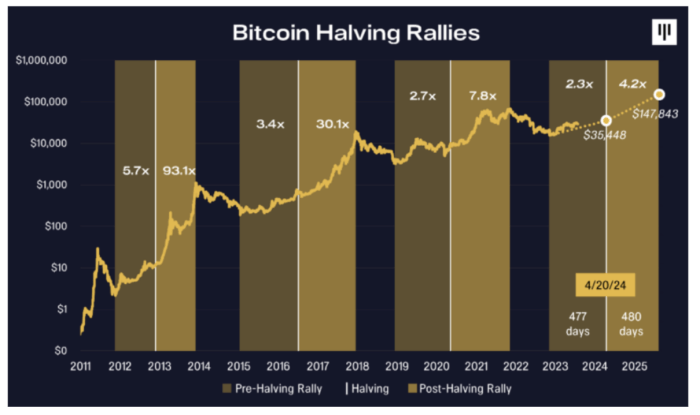

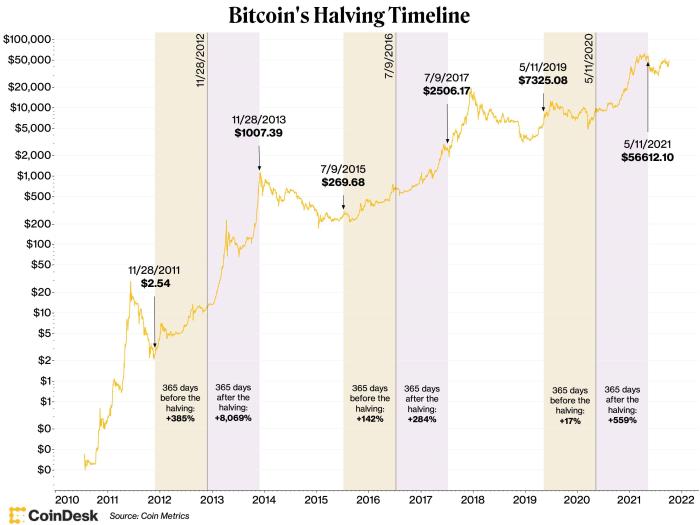

Historical Data and Future Implications

Analyzing Bitcoin’s price behavior around previous halving events offers valuable insights, though it’s crucial to understand the limitations of extrapolating past performance to predict future outcomes. While historical data provides a context, numerous other factors influence Bitcoin’s price, making precise predictions inherently challenging.

Past halving events have generally been followed by periods of significant price appreciation, but the timing and magnitude of these increases have varied considerably. This variability highlights the complexity of the market and the multitude of interacting factors at play. Simple extrapolation from past halvings risks overlooking crucial contextual differences between market cycles.

Bitcoin Price Behavior Around Past Halvings

The following table summarizes Bitcoin’s price around its previous halving events. Note that these figures represent approximate values at specific points in time and can vary depending on the source and the exact timeframe considered. The table also illustrates the significant price volatility experienced in the periods following each halving.

| Halving Date | Price Before Halving (USD) | Price After Halving (USD, approximate peak) | Approximate Time to Peak (Months) | Approximate Peak Increase (%) |

|---|---|---|---|---|

| November 28, 2012 | ~12 | ~1,147 | ~18 | ~9,558% |

| July 9, 2016 | ~650 | ~20,000 | ~18 | ~3,077% |

| May 11, 2020 | ~8,700 | ~64,800 | ~12 | ~745% |

Interpreting Historical Data for 2025 Predictions

While the data above suggests a positive correlation between halving events and subsequent price increases, directly applying these past percentages to predict the 2025 halving’s impact is risky. The cryptocurrency market has matured significantly since the first halving. Increased regulatory scrutiny, broader adoption, and the emergence of competing cryptocurrencies all introduce variables not fully reflected in past price movements. For example, the percentage increase from the 2020 halving was significantly lower than previous halvings, highlighting the changing market dynamics. Any prediction needs to account for these evolving circumstances.

Visual Representation of Halving Events and Price Movements

Imagine a line graph with the x-axis representing time and the y-axis representing Bitcoin’s price in USD. Three distinct peaks would be visible, corresponding to the price surges following each halving. The height of each peak would visually represent the magnitude of the price increase. The graph would also show the significant price fluctuations before and after each halving, highlighting the volatility inherent in the market. Connecting the halving events with lines to their respective price peaks would illustrate the temporal relationship, though it is crucial to remember that correlation does not equal causation. The graph would not show a perfectly linear or predictable relationship, emphasizing the inherent uncertainty in predicting future price movements based solely on historical data.

Frequently Asked Questions (FAQs)

This section addresses common queries regarding the Bitcoin halving, its impact on price, and the inherent uncertainties involved in making predictions based on this event. Understanding these aspects is crucial for anyone considering investment strategies related to the Bitcoin halving.

Bitcoin Halving Explained

The Bitcoin halving is a programmed event in the Bitcoin protocol that reduces the rate at which new Bitcoins are created. This occurs approximately every four years, halving the reward paid to Bitcoin miners for verifying transactions and adding new blocks to the blockchain. For example, the reward was initially 50 BTC per block, reduced to 25 BTC, then 12.5 BTC, and currently stands at 6.25 BTC. This controlled inflation mechanism is a core element of Bitcoin’s design, intended to limit the total supply to 21 million coins.

Timing of the Next Bitcoin Halving

The next Bitcoin halving is projected to occur in the spring of 2024. The precise date depends on the block generation time, which can fluctuate slightly. While predictions point towards a specific date, slight variations are possible due to the decentralized nature of the Bitcoin network and the unpredictable computational power dedicated to mining. This uncertainty underscores the need for caution when relying on exact dates for investment decisions.

Halving’s Effect on Bitcoin Price

Historically, Bitcoin’s price has tended to increase in the period leading up to and following previous halvings. This is attributed to the reduced supply of new Bitcoins entering the market, potentially creating upward pressure on demand. However, it’s crucial to note that other market factors, such as overall economic conditions, regulatory changes, and investor sentiment, significantly influence the price. The 2012 and 2016 halvings were followed by substantial price increases, but the market dynamics are complex and past performance is not indicative of future results. The 2020 halving saw a period of price appreciation, followed by a considerable correction later in the year.

Price Guarantees After Halving

There are absolutely no guarantees regarding Bitcoin’s price after a halving. While historical data suggests a correlation between halvings and subsequent price increases, this is not a deterministic relationship. Numerous other factors influence Bitcoin’s price, making any prediction inherently uncertain. Treating any prediction as a guarantee would be a significant risk. For instance, unforeseen events such as a major security breach or a drastic shift in regulatory landscape could negatively impact the price regardless of the halving.

Risks of Investing Based on Halving Predictions

Investing based solely on halving predictions carries substantial risk. The cryptocurrency market is highly volatile, and predictions are often speculative. Relying on such predictions without considering other market factors can lead to significant financial losses. Investors should conduct thorough due diligence, diversify their portfolios, and only invest what they can afford to lose. The 2012 and 2016 halvings showed price increases, but the 2020 halving, while initially positive, was followed by a substantial correction, highlighting the unpredictable nature of the market.

When Is Bitcoin Halving 2025 Prediction – Predicting the exact date of the Bitcoin halving in 2025 remains challenging, with various estimations circulating. However, effective marketing strategies can help businesses capitalize on this event. For instance, setting up a robust Google Ads Account allows targeted advertising to reach potential investors interested in the Bitcoin halving and its predicted market impact. Ultimately, understanding the Bitcoin halving’s timeline is crucial for informed decision-making.